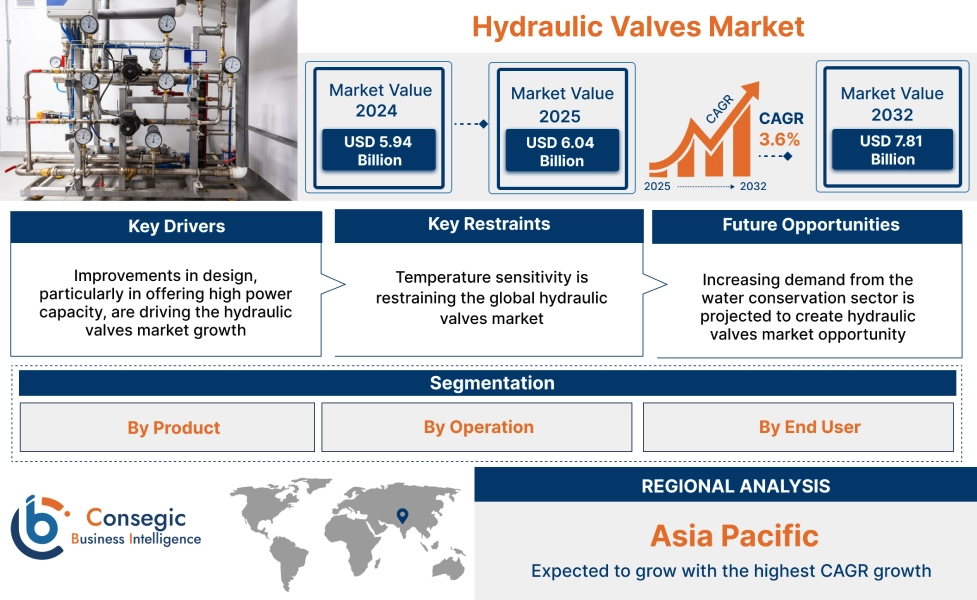

Hydraulic Valves Market Size:

Hydraulic Valves Market Size is estimated to reach over USD 7.81 Billion by 2032 from a value of USD 5.94 Billion in 2024 and is projected to grow by USD 6.04 Billion in 2025, growing at a CAGR of 3.6% from 2025 to 2032.

Hydraulic Valves Market Scope & Overview:

Hydraulic valves are crucial mechanical components within a hydraulic system that serve to control and manage the flow of hydraulic fluid. These valves act as regulators, directing the fluid's movement, adjusting its pressure, and controlling its rate of flow to various actuators like cylinders and motors. By manipulating the hydraulic fluid, these valves enable the controlled operation and functionality of a wide range of machinery, operating under significant pressures.

Hydraulic Valves Market Dynamics - (DRO) :

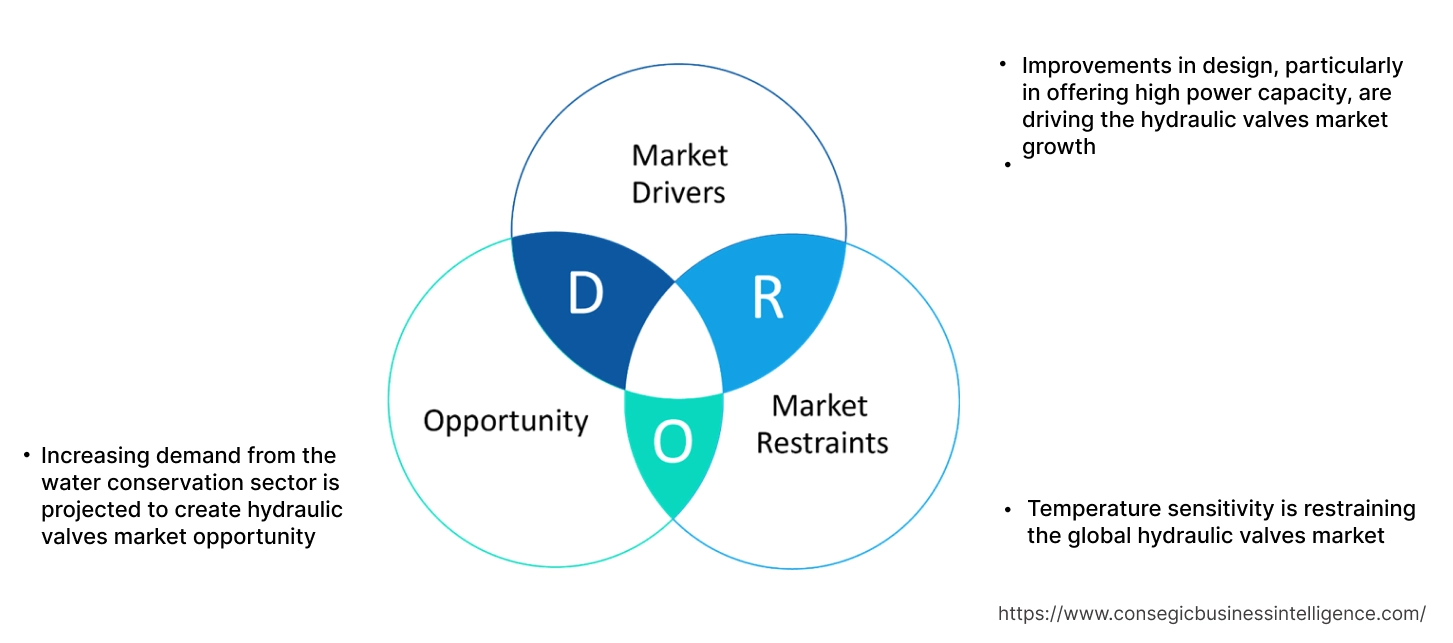

Key Drivers:

Improvements in design, particularly in offering high power capacity, are driving the hydraulic valves market growth

High power capacity valves enable hydraulic systems to operate larger and more demanding machinery in construction, mining, and agriculture. Valves with higher flow rates and pressure handling capabilities allow hydraulic to operate at faster speeds, increasing the productivity of machinery. High power capacity translates to greater force in linear actuators and higher torque in rotary actuators. This enables machinery to handle heavier loads and perform more demanding tasks, improving overall efficiency, consequently driving the hydraulic valves market size.

- For instance, in October 2024, Danfoss Power Solutions expanded its Vickers portfolio with the launch of the KBFRG4-5 proportional valve. This single-stage, four-way hydraulic valve features a round solenoid design, offering high power capacity (up to 350 bar and 290 liters per minute flow) and durability for various industrial applications like wind turbines, machine tools, and metal forming. It also boasts a fast step response and robust design with IP67 protection.

Consequently, improvements in design, particularly in offering high power capacity, are driving the hydraulic valves market growth.

Key Restraints:

Temperature sensitivity is restraining the global hydraulic valves market

Increased temperatures cause hydraulic fluid to become thinner, which leads to increased internal leakage, reduced lubrication, and decreased response time. Also, decreased temperatures cause hydraulic fluid to become thicker, which results in sluggish operation, increased energy consumption, and potential for cavitation. Additionally, temperature extremes degrade the elastomeric materials used in seals and hoses. High temperatures can cause them to harden and crack, leading to leaks, while low temperatures can make them brittle and prone to failure. Moreover, temperature-induced viscosity changes directly affect the flow rate through the valve for a given opening, leading to inconsistencies in the speed and force of hydraulic actuators.

Therefore, as per the analysis, these combined factors are significantly hindering the hydraulic valves market share.

Future Opportunities :

Increasing demand from the water conservation sector is projected to create hydraulic valves market opportunity

Modern agriculture adopts efficient irrigation techniques like drip irrigation and micro-sprinklers to minimize water wastage. Hydraulic valves, especially proportional and servo valves, offer the precise flow control necessary for these systems, delivering water directly to the plant roots and reducing evaporation and runoff. Additionally, hydraulic valves enable the creation of zone irrigation systems, where water can be supplied to different areas, which optimizes water usage and prevents over-watering. Moreover, integrating hydraulic valves with sensors and automated control systems allows for real-time adjustments based on soil moisture levels and weather conditions, hence boosting hydraulic valves market demand.

Hence, based on the analysis, increasing need from the water conservation sector is expected to create hydraulic valves market opportunities.

Hydraulic Valves Market Segmental Analysis :

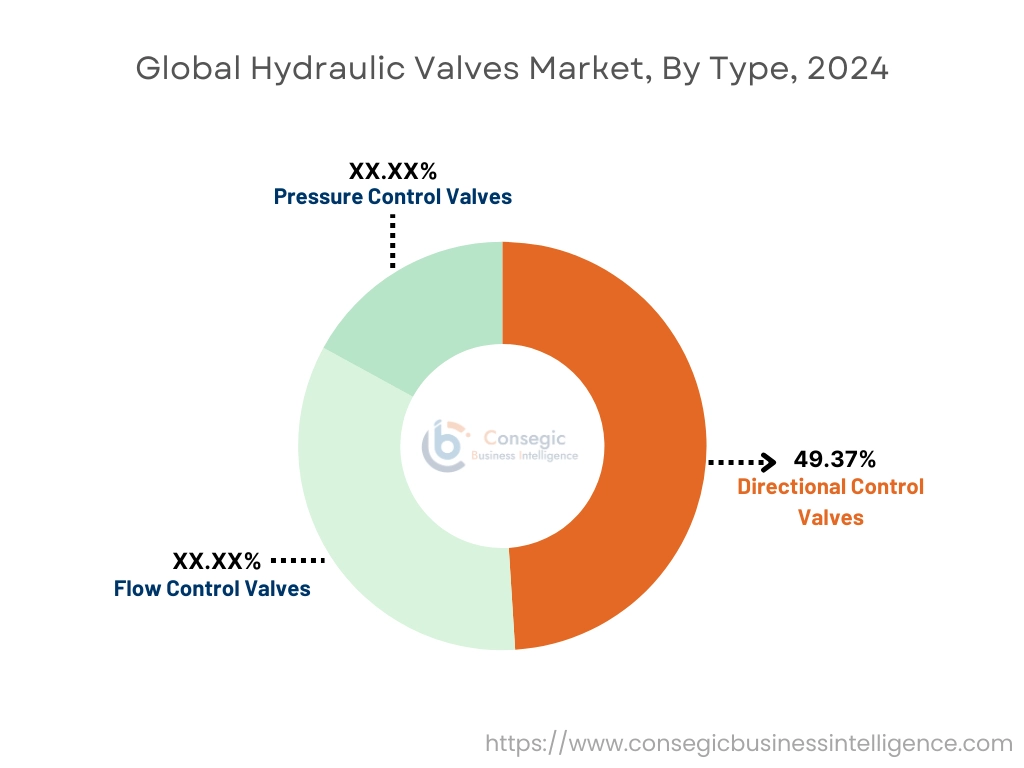

By Type:

Based on the Type, the market is categorized into Directional Control Valves, Flow Control Valves, and Pressure Control Valves.

Trends in the Type:

- Integration of sensors and automation capabilities in pressure control valves for real-time pressure monitoring and system optimization.

- Growing trend towards the development of valves that minimize pressure losses and maintain stable pressure with minimal energy waste.

Directional Control Valves accounted for the largest revenue share of 49.37% in 2024.

- Incorporation of sensors for remote monitoring, predictive maintenance, and real-time data analytics.

- Growing use of electronics for precise control, faster response times, and seamless integration with sophisticated control systems.

- Moreover, the design of more compact valves for applications with limited space, particularly in mobile hydraulics and robotics, is further boosting the hydraulic valves market size.

- Utilizing durable and corrosion-resistant materials to extend valve lifespan and reliability in harsh environments.

- For instance, Oceaneering International launched a new high-pressure Hydraulic Directional Control Valve (HCV) designed for subsea environments. This robust and contamination-tolerant valve can handle pressures up to 20,000 psi (1380 bar) and operate at depths of 13,120 ft (4000 m).

- Thus, as per the hydraulic valves market analysis, the aforementioned factors are driving directional control valves segment expansion.

Flow Control Valves are predicted to register the fastest CAGR during the forecast period.

- Advanced designs that maintain consistent flow rates despite fluctuations in system pressure and fluid viscosity due to temperature changes.

- Integration with electronic systems for precise and dynamic flow rate adjustments, often in closed-loop control systems.

- Adoption of IoT-enabled "smart" valves for real-time monitoring, control, and diagnostics, improving operational efficiency.

- Ongoing research into using fast switching on/off valves for precise flow regulation and potential energy savings.

- For instance, SPX FLOW introduced a new Bolting Flow Control Valve (BFCV), a safety-focused design that prevents accidental torque wrench operation during setup. This lightweight and user-friendly valve completely isolates the wrench from the hydraulic pump, significantly reducing the risk of hand injuries while the operator is positioning the tool.

- Subsequently, the above-mentioned factors are contributing notably to spurring the market expansion.

By Operation:

Based on the Operation, the market is classified into Automated and Manual.

Trends in the Operation:

- Manual processes are sometimes essential for collecting the initial data needed to train and implement effective automation systems.

- Modern automation incorporates Artificial Intelligence (AI), Machine Learning (ML), the Internet of Things (IoT), robotics, and cloud computing to create more intelligent and adaptive systems.

Automated accounted for the largest revenue share in 2024 and is predicted to register the fastest CAGR during the forecast period.

- The hyperautomation trend involves automating complex, end-to-end processes by orchestrating multiple technologies, including Robotic Process Automation (RPA) and process mining.

- Low-code and no-code platforms are making automation tools accessible to non-technical users, driving the hydraulic valves market demand.

- Growing trend towards collaborative robots (cobots) that work alongside humans, enhancing safety and efficiency by handling repetitive or dangerous tasks.

- For instance, Flomatic Corporation released its C1001-HYDRAULIC CHECK VALVE, designed to prevent backflow in pipelines. This valve features adjustable controls for both opening and closing speeds and is available in sizes ranging from 1 ¼" to 12".

- Thus, as per the hydraulic valves market analysis, the aforementioned factors are driving automated segment growth.

By End User:

Based on the End User, the market is categorized into Industrial Machinery, Automotive, Construction Machinery, Material Handling, Metal & Mining, Oil & Gas, Power Generation, and Others.

Trends in the End User:

- Increasing trend towards renewable energy sources like solar and wind power creates the need for hydraulic valves in systems that control the pitch and yaw of wind turbines and the tracking systems of solar panels.

- The oil and gas industry relies heavily on hydraulic systems for various applications in exploration, drilling, and production, including control of wellhead equipment, pipeline operations, and offshore platforms.

Industrial Machinery accounted for the largest revenue share in 2024.

- Hydraulic valves are crucial for controlling the precise movements and power of automated machinery, leading to an increased need for advanced and reliable valves, hence driving the market trend.

- Industrial applications increasingly require hydraulic systems that offer high levels of precision and efficiency, which necessitates the use of sophisticated hydraulic valves.

- Continuous advancements in hydraulic valves are improving the performance, efficiency, and durability of industrial machinery.

- In conclusion, the above-mentioned reasons are contributing notably to spurring the market.

Automotive is projected to register the fastest growth during the forecast period.

- Hydraulic systems are playing a role in improving fuel efficiency and reducing emissions in vehicles, particularly in electric and hybrid vehicles, through optimized energy usage in braking and suspension.

- Innovations in electromechanical hydraulic actuators capable of withstanding higher pressures, particularly in steering, braking, and suspension systems of high-performance and luxury vehicles.

- Hydraulic valves, especially in variable valve timing (VVT) systems, are in high demand for their accuracy and efficiency in optimizing engine valve timing and delivery, leading to reduced fuel consumption, improved performance, and minimized emissions in internal combustion engines.

- In conclusion, as per the analysis, the aforementioned factors are predicted to witness the automotive segment growth.

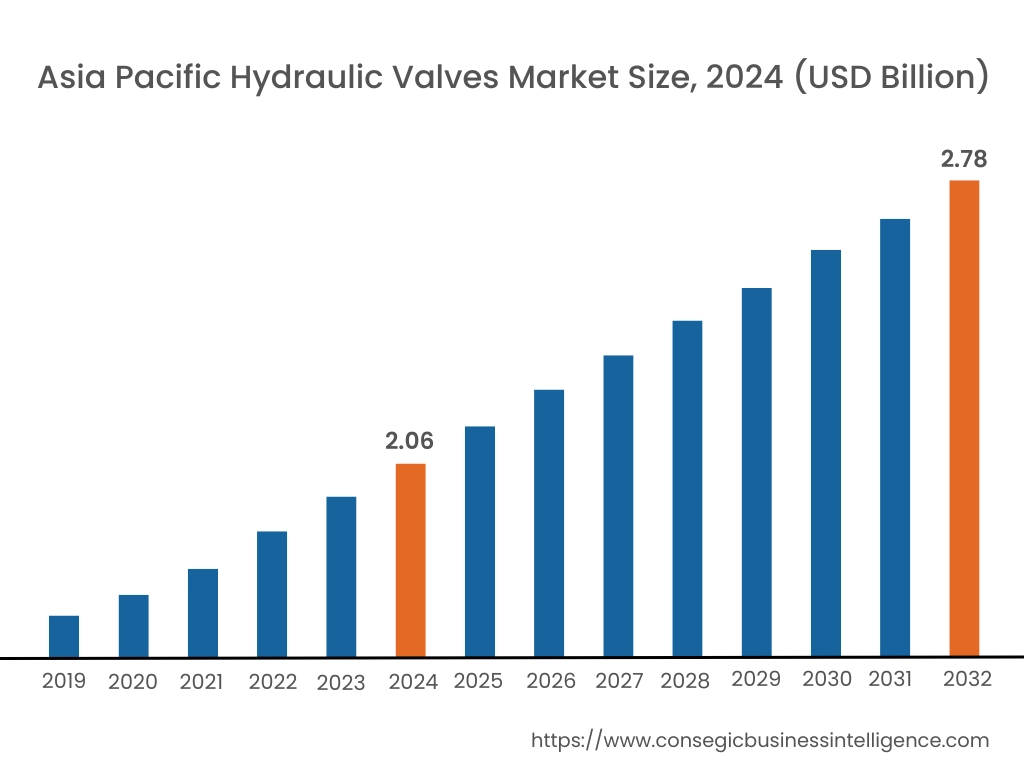

Regional Analysis:

The global hydraulic valves market has been classified by region into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America.

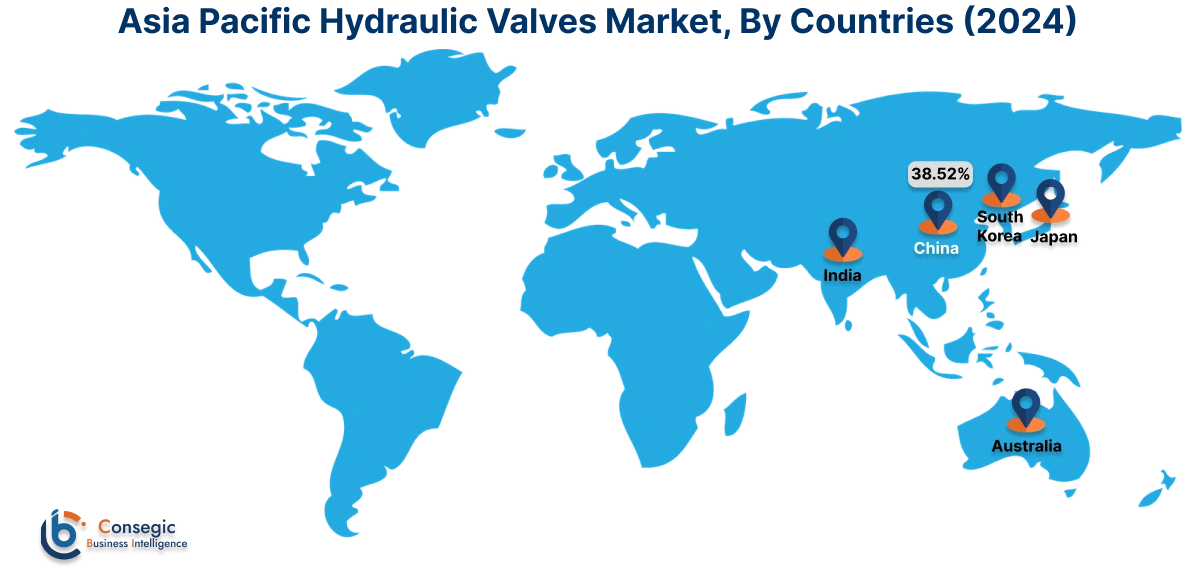

Asia Pacific was valued at USD 2.06 Billion in 2024. Moreover, it is projected to grow by USD 2.10 Billion in 2025 and reach over USD 2.78 Billion by 2032. Out of these, China accounted for the largest revenue share of 38.52% in 2024. Industries across the Asia Pacific are increasingly adopting automation and advanced machinery to enhance productivity, efficiency, and safety. Hydraulic valves are integral components in these automated systems, providing the necessary force and control for various operations in manufacturing, agriculture, and mining. Supportive government regulations and increasing investments in the manufacturing and infrastructure sectors across the Asia Pacific region are creating a conducive environment for market growth.

- For instance, the Union Budget 2025-26 has allocated USS 128.64 billion, equivalent to 3.1% of GDP, for capital infrastructure investment. Additionally, between April 2000 and September 2024, India attracted significant Foreign Direct Investment (FDI) in the construction sector, with USD 26.76 billion in construction development and USD 35.24 billion in construction (infrastructure) activities.

North America region was valued at USD 1.70 Billion in 2024. Moreover, it is projected to grow by USD 1.73 Billion in 2025 and reach over USD 2.21 Billion by 2032. The ongoing trend of automation across various industries fuels the need for sophisticated hydraulic valves, particularly electric control and servo valves, which offer enhanced precision and integration capabilities with digital control systems. Additionally, there is an increasing emphasis on developing and adopting energy-efficient hydraulic systems with low-leakage rates and improved control capabilities, contributing to the growth of advanced valve designs.

As per the hydraulic valves market analysis, European regulations emphasizing energy efficiency and reduced emissions are driving the need for advanced hydraulic systems with lower leakage and optimized power consumption. Additionally, several Latin American countries are witnessing increasing industrial activity, particularly in manufacturing, mining, and agriculture, leading to higher demand for hydraulic systems. Moreover, countries in the Middle East, particularly the GCC nations, are undertaking large-scale infrastructure projects, including transportation networks, urban development, and utilities, driving the need for hydraulic machinery.

Top Key Players and Market Share Insights:

The market is highly competitive, with major players providing hydraulic valves to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the hydraulic valves industry include-

- Parker Hannifin (USA)

- Bosch Rexroth (Germany)

- Eaton Corporation (USA)

- Danfoss Power Solutions (Denmark)

- Moog Inc. (USA)

- Kawasaki Heavy Industries (Japan)

- Yuken Kogyo Co. Ltd. (Japan)

- Atos Hydraulics (Italy)

- HAWE Hydraulik (Germany)

- Hydac International (Germany)

- Flowserve (USA)

- Emerson Electric Co. (USA)

- Veljan Hydrair Limited (India)

- Rekith Hydraulics (China)

- KYB Corporation (Japan)

Recent Industry Developments :

Product Launch:

- In Apr 2025, Helios Technologies expanded its electro-proportional hydraulics cartridge valve family with the RPEP and RPEN valves.1 The RPEP is designed for industrial applications needing precise pressure regulation, while the RPEN supports mobile equipment, particularly in fan drive applications.2 They also released the DNDU directional blocking valve, DFUA & DFUB directional poppet valves, and the RBUA bi-directional relief valve earlier in 2025.3

Hydraulic Valves Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 7.81 Billion |

| CAGR (2025-2032) | 3.6% |

| By Type |

|

| By Operation |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the hydraulic valves market? +

The hydraulic valves market size is estimated to reach over USD 7.81 Billion by 2032 from a value of USD 5.94 Billion in 2024 and is projected to grow by USD 6.04 Billion in 2025, growing at a CAGR of 3.6% from 2025 to 2032.

What specific segmentation details are covered in the hydraulic valves report? +

The hydraulic valves report includes specific segmentation details for type, operation, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the hydraulic valves market, the automotive segment is the fastest-growing segment during the forecast period.

Who are the major players in the hydraulic valves market? +

The key participants in the hydraulic valves market are Parker Hannifin (USA), Bosch Rexroth (Germany), Eaton Corporation (USA), Danfoss Power Solutions (Denmark), Moog Inc. (USA), Kawasaki Heavy Industries (Japan), Yuken Kogyo Co. Ltd. (Japan), Atos Hydraulics (Italy), HAWE Hydraulik (Germany), Hydac International (Germany), Flowserve (USA), Emerson Electric Co. (USA), Veljan Hydrair Limited (India), Rekith Hydraulics (China), KYB Corporation (Japan), and Others.