Hydrogenated MDI Market Size :

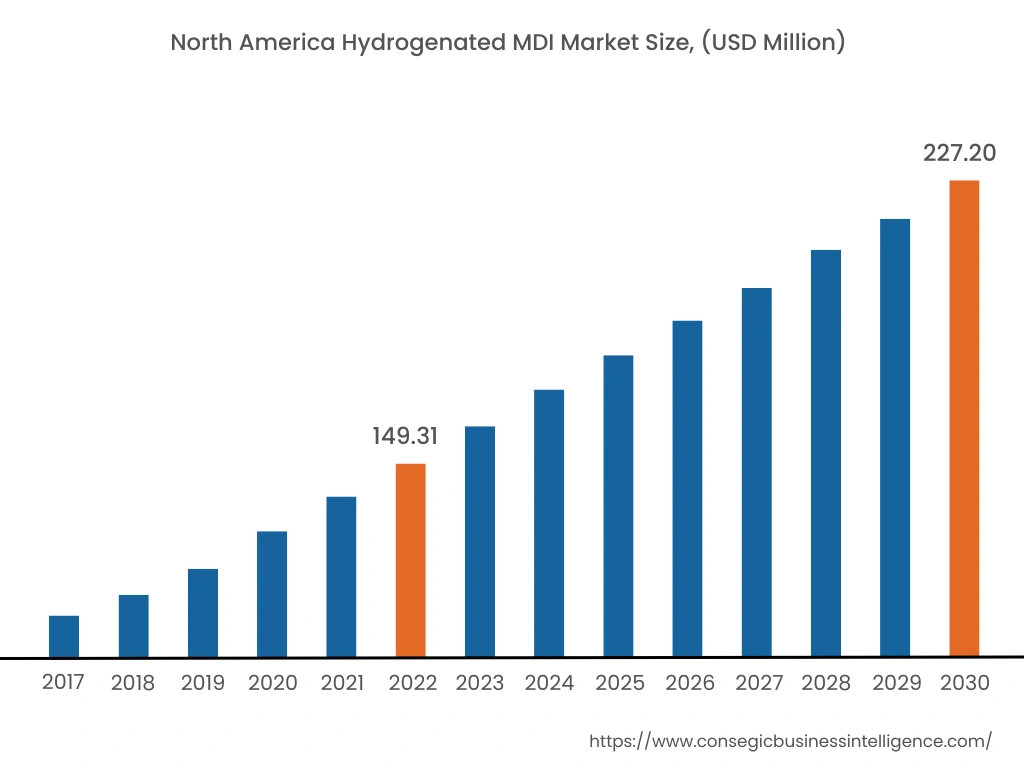

Consegic Business Intelligence analyzes that the hydrogenated MDI market size is growing with a healthy CAGR of 5.4% during the forecast period (2023-2030), and the market is projected to be valued at USD 655.69 Million by 2030 from USD 432.77 Million in 2022.

Hydrogenated MDI Market Scope & Overview:

Hydrogenated MDI, also known as H12MDI, is an organic compound belonging to the class of isocyanates. It has a chemical formula C15H22N2O2, CAS number 5124-30-1, and a molecular weight of 262.34738 g/mol. Hydrogenated MDI is an aromatic diisocyanate comprising good mechanical properties, resistant to hydrolysis, and is majorly used in the synthesis of polyurethane. Hydrogenated MDI is equipped with various beneficial properties such as excellent weather ability, superior hydrolysis & chemical resistance in end products.

These properties of hydrogenated MDI ensure superior protection from resistance against abrasion in end products. As a result of the above-mentioned properties, hydrogenated MDI is an ideal solution for various applications, including polyurethane elastomer, fabric coating, polyurethane dispersions, adhesives, sealants, elastomers, and others. Moreover, Hydrogenated MDI is a key chemical used as a reactive building block to produce chemical products, reactive intermediates, and polymers.

Hydrogenated MDI Market Insights :

Key Drivers :

Booming building and construction activities are benefiting the market growth

Hydrogenated MDI is utilized in applications, including adhesives, sealants, and elastomers to undergo addition reactions at room temperature. Adhesives, sealants, and elastomers are employed in various construction projects, including residential, commercial, industrial, and infrastructure. For instance, according to the recent 2022 statistics published by the European Construction Industry Federation (FIEC), in 2020, the investment in residential construction projects in the Netherlands was Euro 34,917.95 million (USD 39,883.15 million), and in 2021, it was EURO 36,175.00 million (USD 42,785.62 million). In 2021, the year-on-year growth rate of the Netherlands' residential construction industry was 3.6% as compared with the year 2020. Therefore, the growth in building and construction activities is accelerating the demand for adhesives, sealants, and elastomers. Hence, the increase in the demand for the above products is boosting the demand for hydrogenated MDI to ensure superior purity of construction products. This, in turn, is benefiting the market growth.

Growth of the chemical sector is boosting the growth of the market

The chemicals industry frequently deploys hydrogenated MDI to ensure a high degree of flexibility and superior mechanical strength. The rising investments in the chemical sector, expansion of chemical manufacturing units, and rising production of industrial chemicals are key factors driving the growth of the chemical industry. For instance, according to the recent statistics published by the European Chemical Industry Council (CEFIC), in the year 2021, the European Union region was the second largest manufacturer of chemicals at the global level valued at EURO 4,026 billion. Also, the average growth product growth rate of chemicals in the European Union region was 0.4% between 2011-2021. Hence, the bolstering chemical industry is accelerating the demand for hydrogenated MDI as the chemical is utilized as a base material in adhesives, sealants, and others. This, in turn, is driving the growth of the market.

Key Restraints :

Health hazards associated with hydrogenated MDI are restraining the market growth

Hydrogenated MDI has various beneficial properties such as a high degree of flexibility, excellent mechanical strength, and resistance to abrasion, among others. Hence, hydrogenated MDI is utilized in various end-use industries such as building & construction, and chemicals, among others. On the contrary, the health hazards associated with the hydrogenated MDI chemical is posing a bottleneck for market growth. For instance, according to the New Jersey Department of Health and Senior Services, hydrogenated MDI is considered a hazardous chemical. Frequent exposure to hydrogenated MDI can cause skin and eye irritation. Furthermore, the more serious implication of hydrogenated MDI on health includes cancer hazards. Thus, the health hazards associated with hydrogenated MDI are posing a major roadblock to the revenue growth of the market.

Future Opportunities :

The development of new textile manufacturing facilities will favor the market growth

Hydrogenated MDI is an ideal solution for the textile industry to ensure superior fabric gloss and shine. The growth of the textile industry at the global level is attributed due to factors such as the introduction of a sustainable textile range, the expansion of textile manufacturing plants, government schemes, and others. For instance, in June 2021, Perennials and Sutherland LLC expanded its textile manufacturing plant production capacity in Mexico. Moreover, the full-scale operation of the textile plant was completed in the first quarter of 2022. Hence, the expansion strategies for increasing the production of textile products at the global level are spurring the demand for hydrogenated MDI as it is utilized in textile coating applications. This prominent factor is supplementing the hydrogenated MDI market.

Hydrogenated MDI Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 655.69 Million |

| CAGR (2023-2030) | 5.4% |

| By Application | Polyurethane Elastomers, Radiation Curable Urethane Acrylates, Polyurethane Dispersions (PUDs), Thermoplastic Polyurethanes (TPUs), Resins, and Others |

| By End-use Industry | Building & Construction, Textile, Chemicals, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Covestro AG, Merck KGaA, Evonik Industries AG, MITSUI CHEMICALS, Ashland, Wanhua Chemical, and BASF SE |

Hydrogenated MDI Market Segmental Analysis :

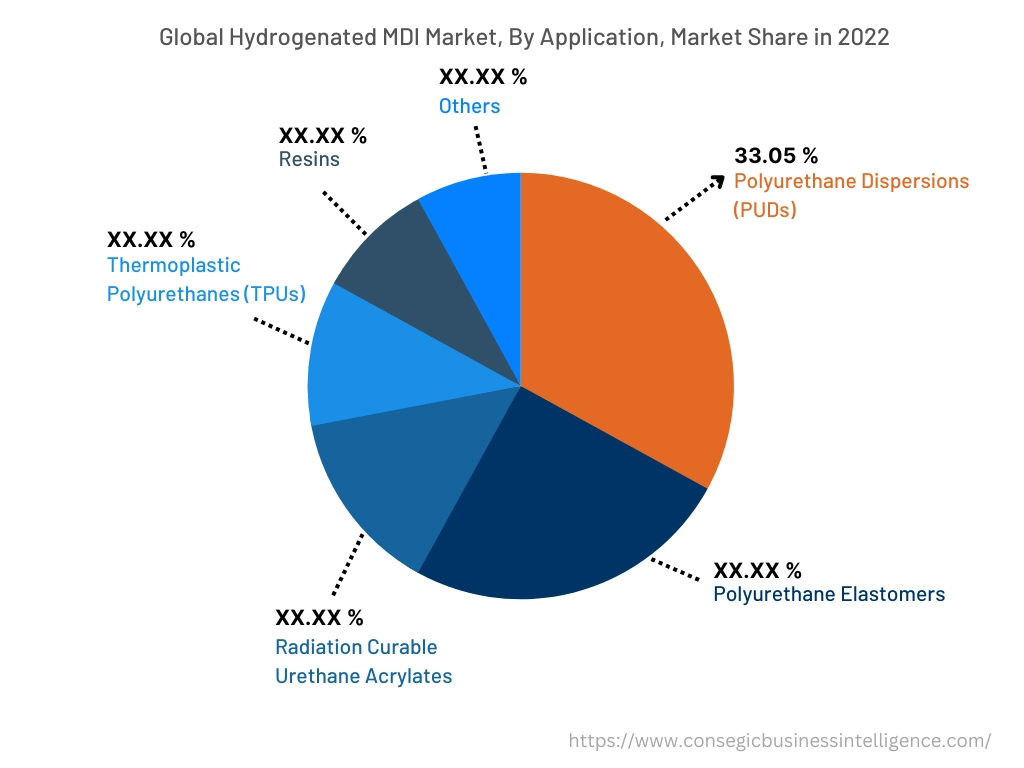

By Application :

The application segment is categorized into polyurethane elastomers, radiation curable urethane acrylates, polyurethane dispersions (PUDs), thermoplastic polyurethanes (TPUs), resins, and others. In 2022, the polyurethane dispersions (PUDs) segment accounted for the highest market share of 33.05% in the overall hydrogenated MDI market. Hydrogenated MDI is utilized in the manufacturing of polyurethane dispersions (PUDs) to offer unparalleled versatility. Hydrogenated MDI can undergo additional reactions at room temperature with sustenance that contains active hydrogens. Thus, the hydrogenated MDI enables the efficient preparation of polyurethane products such as polyurethane dispersions (PUDs) which have a distinctive set of properties. Furthermore, the unique feature of hydrogenated MDI results in the formulation of optically clear polyurethane dispersions (PUDs) when combined with suitable polyol reactants. Thus, due to the above beneficial properties, the deployment of hydrogenated MDI is increasing for polyurethane dispersions (PUDs) to ensure superior performance benefits, which, in turn, is benefiting the market growth.

However, the resins segment is expected to be the fastest-growing segment during the forecast period. This is due to the increasing adoption of resins in the textile industry. For instance, according to the recent statistics published by the Italian Federation of Textiles, Fashion, and Accessories, in 2021, the Italian textiles industry showcased a positive trend over 2020. Furthermore, the Italian textiles market was valued at more than Euro 5.8 billion (USD 6.9 billion) in 2021, registering a year-on-year growth rate of 9.6% as compared with 2020.

By End-Use-Industry :

The end-use industry segment is categorized into building & construction, textile, chemicals, and others. In 2022, the building & construction segment accounted for the highest market share in the hydrogenated MDI market. Hydrogenated MDI is employed in various building and construction applications, including flooring, roofing, and others to provide superior mechanical protection. Furthermore, hydrogenated MDI is deployed as a building block in various building and construction products such as adhesives, sealants, and elastomers to ensure superior protection from chemicals and abrasion. For instance, as of June 2023, various commercial projects are under the development phase in the Asia Pacific region, including USD 900 million Commerz III Commercial Office Complex in India (the completion year 2027), USD 500 million Shibaura 1-Chome Mixed-Use Complex in Japan (the completion year 2030), USD 92 million Cangnan County People's Hospital Phase II in China (the completion year 2024), and others. Hence, the ongoing building and construction projects will create a lucrative opportunity for hydrogenated MDI demand growth to ensure protection from chemicals. This, in turn, will boost the segment growth in the upcoming years.

However, the textile segment is expected to be the fastest-growing segment during the forecast period because of the development of new textile manufacturing facilities, increasing government investments, and others.

By Region :

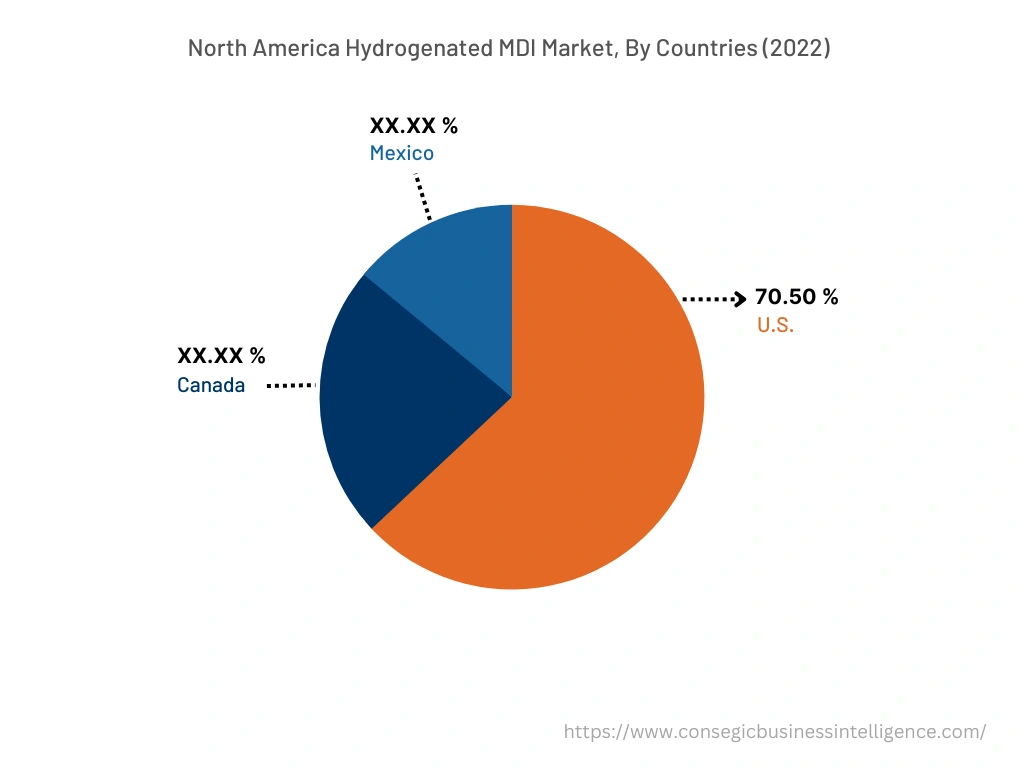

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

In 2022, North America accounted for the highest market share at 34.50% and was valued at USD 149.31 million, and is expected to reach USD 227.20 million in 2030. In North America, the U.S. accounted for the highest market share of 70.50% during the base year of 2022. This is due to the growth of the various end-use industries, including building & construction, textile, and others. For instance, in 2022, various office building projects were started in the United States such as USD 476 million for The Eight Office Tower project (completion year 2024), USD 400 million for 1900 Lawrence Street Office Tower (completion year 2024), USD 276 million El Segundo Headquarters and Training Facility (completion year 2024), and others. Henceforth, the increase in the above end-use industries in the North America region is proliferating the growth of the market.

Furthermore, Asia Pacific is expected to witness significant growth over the forecast period, growing at a CAGR of 6.1% during 2023-20230. This is due to the increasing development of new buildings & construction projects in the region.

Top Key Players & Market Share Insights:

The hydrogenated MDI market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Covestro AG

- Merck KGaA

- Wanhua Chemical

- BASF SE

- Evonik Industries AG

- MITSUI CHEMICALS

- Ashland

Recent Industry Developments :

- In November 2022, Covestro announced the development of a new USD 1.5 billion methylene diphenyl diisocyanate (MDI) plant that will be completed by the end of 2026 in the United States.

- In May 2021, Wanhua Chemical announced an expansion in the production capacity of the MDI product portfolio with the addition of 600,000 tons to its existing production capacity. The prime aim of the company was to increase the market share in the global hydrogenated MDI industry.

- In April 2021, Kumho Mitsui Chemicals invested USD 358.1 million for the expansion of its chemical manufacturing plant in South Korea. In addition, the production of the MDI portfolio will increase from 400,000 tons per annum to 610,000 tons per annum. The project is expected to be completed by the end of 2024.

Key Questions Answered in the Report

What was the market size of the hydrogenated MDI industry in 2022? +

In 2022, the market size of hydrogenated MDI was USD 432.77 million

What will be the potential market valuation for the hydrogenated MDI industry by 2030? +

In 2030, the market size of hydrogenated MDI will be expected to reach USD 655.69 million.

What are the key factors driving the growth of the hydrogenated MDI market? +

Booming building and construction activities are benefiting the market growth.

What is the dominating segment in the hydrogenated MDI market by application? +

In 2022, the polyurethane dispersions (PUDs) segment accounted for the highest market share of 33.05% in the overall hydrogenated MDI market.

Based on current market trends and future predictions, which geographical region is the dominating region in the hydrogenated MDI market? +

North America accounted for the highest market share in the overall hydrogenated MDI market.