Silver Sintering Paste Market Size:

Silver Sintering Paste Market size is growing with a CAGR of 6.3% during the forecast period (2025-2032), and the market is projected to be valued at USD 156.85 Million by 2032 from USD 96.71 Million in 2024. Additionally, the market value for the 2025 attributes to USD 102.44 Million.

Silver Sintering Paste Market Scope & Overview:

Silver sintering paste, also known as Ag sintering paste, is a special glue-like material made from tiny silver particles. It is used to join parts in electronic devices without using regular solder. When heated, the silver particles bond together and form a strong, highly conductive layer. There are two main types, pressure sintering and pressure-less sintering. Pressure sintering needs heat and pressure, while pressure-less sintering only needs heat. It offers superior electrical and thermal conductivity when compared to traditional solders. This paste is used in power devices and high-performance LEDs. It is also used in semiconductor devices and solar cells, amongst others. It helps these devices handle heat better and last longer. This makes it very useful in modern electronics, where strong and reliable connections are needed.

How is AI Transforming the Silver Sintering Paste Market?

AI is increasingly being used in the silver sintering paste market, particularly for optimizing material formulation, improving quality control, and streamlining manufacturing processes. AI-powered solutions can accelerate research and development (R&D) by reducing trial-and-error in paste composition, which enables faster prediction of performance and properties such as thermal conductivity and adhesion. Moreover, during its manufacturing process, AI-powered machine vision systems provide real-time quality assurance, detecting defects, and adjusting sintering parameters for improved uniformity and reduced material waste. Additionally, AI integration to facilitate automation in manufacturing processes can reduce manual labor, minimize errors, and improve production efficiency. Therefore, the aforementioned factors are expected to positively impact the market growth in upcoming years.

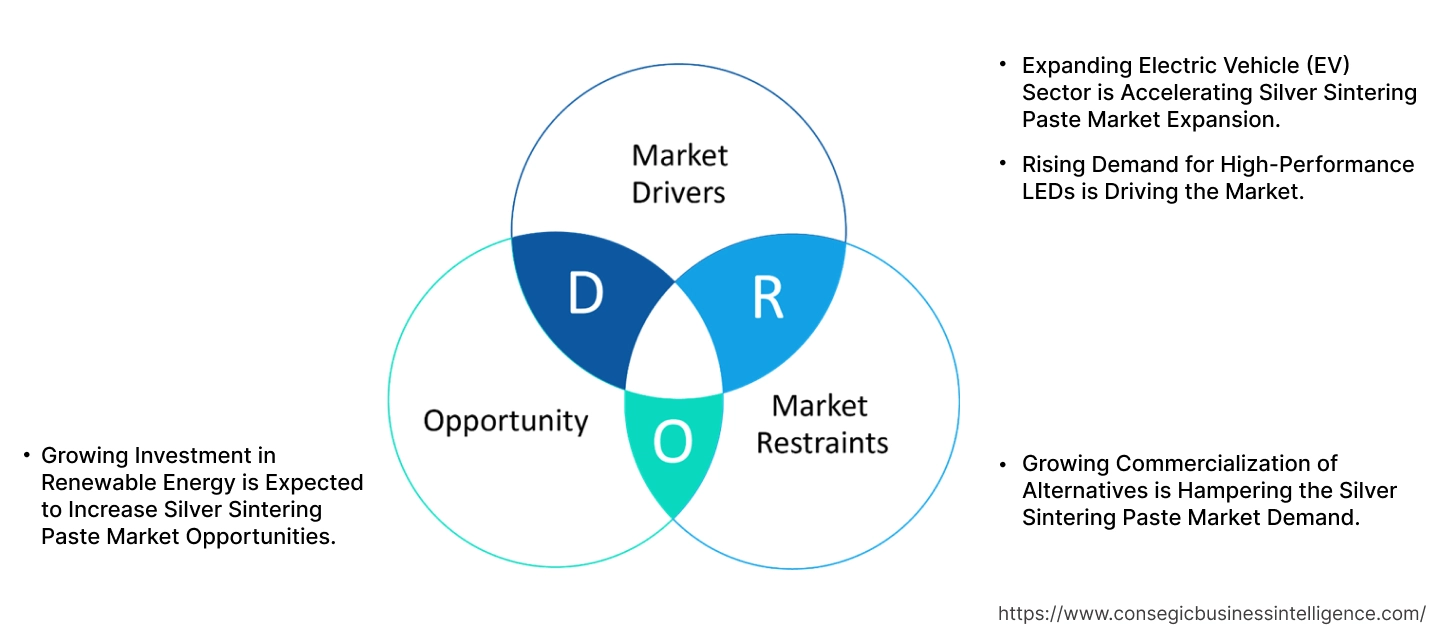

Key Drivers:

Expanding Electric Vehicle (EV) Sector is Accelerating Silver Sintering Paste Market Expansion.

Silver sintering paste is used in electric vehicles (EVs) to connect parts in semiconductors, inverters, and power modules. These parts handle high heat and need a strong, long-lasting bond. This paste helps cool the parts and makes them work better. It provides these parts with high thermal & electrical conductivity and low resistivity. It is also used in battery systems and control units. This makes the EVs more reliable and safer. A combination of environmental concerns and government incentives has led to growth in the EV sector, driving the need for Ag sintering paste.

For instance,

- According to the International Energy Agency, global electric car sales surged by 35% in 2023, exceeding 2022 figures by 3.5 million units, thus positively impacting silver sintering paste market trends.

Overall, the expanding EV sector is significantly boosting the silver sintering paste market expansion.

Rising Demand for High-Performance LEDs is Driving the Market.

High-performance LEDs are bright and energy-saving light sources. Silver sintering paste is used to fix LED chips to their base. It helps carry heat away quickly, so the LED stays cool and works longer. The paste also improves electrical flow. This makes LED brighter and more efficient. It creates a strong bond that does not break under heat. This is very useful in streetlights and industrial lighting. It also helps LEDs survive in tough environments such as high temperatures. There is rising demand for energy-saving lights, leading manufacturers to launch more products, thus requiring Ag sintering paste.

For instance,

- In 2023, Luminus Devices launched MP-7070 high-performance LEDs, delivering exceptional optical performance in outdoor and industrial environments, thus positively impacting the silver sintering paste market trends.

Thus, the rising need for high-performance LEDs is accelerating the global silver sintering paste market growth.

Key Restraints:

Growing Commercialization of Alternatives is Hampering the Silver Sintering Paste Market Demand.

The market faces competition from other substitutes available in the market. This is because while silver offers great performance, it is expensive and not always needed for applications. Many manufacturers now prefer materials that cost less but still work well enough for their needs. Some common substitutes include copper sintering paste, conductive epoxy, solder paste, and non-silver ink. Copper paste has good thermal properties, and conductive epoxy is easy to use. Moreover, solder paste is widely used in many industries as it allows for mass soldering of multiple components at once. Additionally, nano-silver ink is also gaining importance in flexible electronics. Hence, the growing commercialization of substitutes is hampering the silver sintering paste market demand.

Future Opportunities :

Growing Investment in Renewable Energy is Expected to Increase Silver Sintering Paste Market Opportunities.

Silver sintering paste is used in solar panels, where it helps joint parts such as solar cells and metal plates. The paste makes strong and heat-resistant connections. It improves the flow of electricity, so more power is produced from sunlight. Moreover, in wind power systems, it is used in power electronics that control the turbines. The paste contributes to the stable and highly efficient operation of both solar panels and wind power systems.

For instance,

- In 2024, the U.S. Department of Energy invested USD 149.87 million in clean energy projectsacross 28 U.S. states. This creates potential for the market.

Overall, growing investment in renewable energy is expected to increase the silver sintering paste market opportunities.

Silver Sintering Paste Market Segmental Analysis :

By Type:

Based on type, the market is categorized into pressure sintering and pressure-less sintering.

Trends in Type:

- Advancements in pressure sintering techniques to achieve higher density in challenging applications such as power devices amongst others.

- Focus on improving the cost-effectiveness of both pressure and pressure-less sintering materials.

The pressure sintering segment accounted for the largest market share in 2024.

- Pressure sintering is a process where an Ag sintering paste is heated and pressed at the same time to join two parts together.

- Moreover, the pressure helps the silver particles to stick better and form a strong, solid connection.

- This method is used in electronics that handle high heat and power, such as inverters, power modules, and solar cells, among others.

- The rapid rise in the solar industry and increased production of the above-mentioned electronics for the sector are driving the segment for high thermal/electrical needs.

- For instance, according to PV Tech, China's solar cell exports saw a significant year-on-year increase of 38.2% in 2024, reaching 7.79 billion units.

- Overall, as per the market analysis, the increased power electronics manufacturing is driving a segment in the silver sintering paste market growth.

The pressure-less sintering segment is expected to grow at the fastest CAGR over the forecast period.

- Pressure-less sintering is a method where Ag sintering paste is heated without using any pressure.

- This process is easier and cheaper because it does not need special machines to press the parts.

- It is becoming popular because companies want faster and simpler ways to make strong bonds in electronics.

- Pressure-less sintering works well for delicate parts that cannot handle force. It is used in small semiconductor devices and speed sensors, among others.

- Rising semiconductor miniaturization for increased performance and efficiency will drive the demand for this paste.

- According to market analysis, pressure-less sintering, being a cheaper bonding material for delicate and miniaturized electronics, will drive the segmental share for the upcoming years.

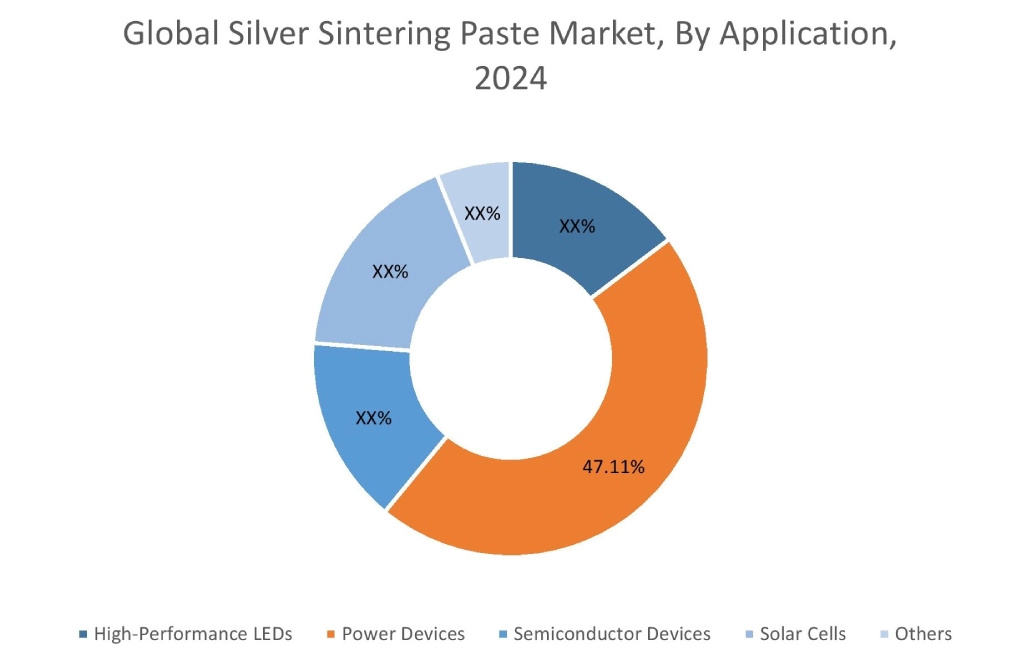

By Application:

Based on application, the market is categorized into high-performance LEDs, power devices, semiconductor devices, solar cells, and others.

Trends in the Application

- Ag sintering paste remains the preferred choice for die attachment in high-power LEDs due to its superior thermal management.

- Ag sintering paste is gaining traction for creating conductive contacts in solar cells. It offers improved efficiency and long-term reliability.

The power devices segment accounted for the largest market share of 47.11% in 2024.

- Silver sintering paste is used in power devices such as IGBTs, MOSFETs, and power modules.

- These devices control and switch large amounts of electricity in trains, EVs, and machines. This paste is placed between the chip and the base to create a strong bond.

- Moreover, it prevents cracks and damage over time. Additionally, it keeps the connection stable even under high stress and temperature.

- Expanding manufacturing of smart machines, EVs, and trains is driving the paste demand for superior thermal management and enhanced electrical conductivity between power devices.

- For instance, according to the Press Information Bureau,in 2024, Indian Railways manufactured 7,134 coaches, a 9% rise compared to the previous year.

- Overall, as per the silver sintering paste market analysis, the growing transport and smart machines sector is driving the segment in the silver sintering paste industry.

The solar cells segment is expected to grow at the fastest CAGR over the forecast period.

- Silver sintering paste is used in solar cells to connect the solar cell chip to its base. It creates a long-lasting bond which handles stress and heat.

- It helps in removing heat, which keeps the solar panel cool. The paste allows smooth electricity flow, which improves the cell’s performance.

- The paste is also excellent for thin and flexible cells. It is especially useful in high-efficiency solar cells where stable connections are required.

- It reduces power loss and improves reliability. There is growing consumer awareness regarding the environment. In understanding, they are seeking cleaner energy, leading to increased solar cell manufacturing, thus driving the segment.

- Moreover, governments are also providing incentives and tax benefits for solar programs, further boosting the segment share.

- Thus, according to market analysis, eco-conscious consumers and government support for solar cells are driving segmental growth for the forecasted years.

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, North America accounted for the highest silver sintering paste market share at 41.91% and was valued at USD 40.53 Million and is expected to reach USD 60.29 Million in 2032. In North America, the U.S. accounted for the silver sintering paste market share of 72.15% during the base year of 2024. The fast growth of electric vehicles is a major driver for the rising use of ag sintering paste. This paste is helpful in connecting parts in EV systems, such as inverters. It provides them with superior electrical performance. The increasing awareness of consumers regarding the increasing consumer awareness of the benefits of electric vehicles is driving industry expansion, driving the need for this paste.

For instance,

- According to Cox Automotive Inc., EV sales reached 1,212,758 units in 2023, showing a 49% increase from the previous year.

Thus, rising consumer awareness demanding electric vehicles is driving the market in the region.

In Asia Pacific, the silver sintering paste market is experiencing the fastest growth with a CAGR of 8.4% over the forecast period. In this region, more companies manufacturing semiconductors are a significant driver of the market. Countries such as China, Taiwan, Japan, and South Korea leads the market as they are building more factories to make chips for phones, computers, and other electronics. Ag sintering paste is better than normal solder because it lasts longer and works efficiently under more stress. It forms strong bonds that resist cracking. This helps devices perform better even if they are under high pressure. As the APAC region is increasing chip production, the requirements for ag sintering paste are growing.

Europe's silver sintering paste market analysis indicates that several key trends are contributing to its growth in the region. There is growing use of solar cells in the region. Many countries are building more solar power systems to use clean energy. Solar cells need parts that carry electricity well and last a long time. Ag sintering paste is used to make strong and heat-resistant connections in these parts. It is helpful in improving the power and lifespan of solar cells. More solar farms and rooftop systems are installed across Europe, thus requiring this paste. This trend is expected to continue as Europe supports green energy solutions.

Middle East and Africa (MEA) market analysis indicates that there is a rising need for high-performance LED lighting in the region. Businesses are using LED lights to save energy and reduce costs. LED lights are also used in smart homes and streetlights. These LEDs need strong materials to handle heat, in which Ag sintering paste is excellent. This paste is useful in bonding LED components and creating electrical connections. It also helps LEDs with efficient performance even at high temperatures. This makes LEDs more reliable and safer.

Latin America's region creates potential for the market. New technologies are helping Ag sintering paste become more useful. Companies are now manufacturing silver pastes for sintering, which work at lower temperatures and give stronger connections. This makes the process easier and cheaper to use in factories. It is also helpful in industries such as automotive and consumer electronics. These new pastes can form robust and stable bonds, which contribute to improved reliability. Moreover, manufacturers are continuously developing new paste formulations with improved adhesion properties, positively driving trends. All these advancements are expanding the application of paste, driving the market in the region.

Top Key Players and Market Share Insights:

The Silver Sintering Paste market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Silver Sintering Paste market. Key players in The Silver Sintering Paste industry include-

- Indium Corporation (United States)

- Heraeus Electronics (Germany)

- Nihon Superior Co., Ltd. (Japan)

- Henkel AG & Co. KGaA (Germany)

- MacDermid Alpha (United States)

- Bando Chemical Industries, Ltd. (Japan)

- Shenzhen Jufeng Solder Co., Ltd. (China)

- KYOCERA Corporation (Japan)

- Dycotec Materials Ltd. (United Kingdom)

- Namics Corporation (Japan)

Recent Industry Developments :

Product Launch:

- In 2023, MacDermid Alpha recently introduced ALPHA Argomax 2047, a silver paste for sintering, utilizing nanotechnology. This new paste is specifically formulated for bonding large surfaces, such as attaching modules to baseplates and securing heat sinks.

Silver Sintering Paste Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 156.85 Million |

| CAGR (2025-2032) | 6.3% |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

Who are the major players in the Silver Sintering Paste market? +

Indium Corporation (United States), Bando Chemical Industries, Ltd. (Japan), Shenzhen Jufeng Solder Co., Ltd. (China), KYOCERA Corporation (Japan), and Dycotec Materials Ltd. (United Kingdom) are some major players in the market.

What specific segmentation details are covered in the Silver Sintering Paste market? +

Type and Application segmentation details are covered in the Silver Sintering Paste market.

How big is the Silver Sintering Paste market? +

In 2024, the Silver Sintering Paste market is USD 96.71 Million.

Which is the fastest-growing region in the Silver Sintering Paste market? +

Asia Pacific is the fastest-growing region in the Silver Sintering Paste market.