Interactive Kiosk Market Size:

Interactive kiosk Market size is estimated to reach over USD 51,611.19 Million by 2031 from a value of USD 29,909.76 Million in 2023 and is projected to grow by USD 31,487.80 Million in 2024, growing at a CAGR of 7.1% from 2024 to 2031.

Interactive Kiosk Market Scope & Overview:

An interactive kiosk refers to a computer terminal featuring specialized hardware and software that allows access to information and applications for communication, commerce, entertainment, or education. The primary types include self-service kiosk machines, payment kiosk machines, ticket kiosk machines, and information among others. They offer a range of benefits including improved customer service, cost savings, personalized experience, data-driven insights, and others. The aforementioned benefits are major determinants for increasing their deployment in banks, retail, travel & tourism, and other industries.

For instance, in May 2023, Samsung Electronics globally launched the KMC-W, an updated Windows version of the award-winning Samsung Kiosk. An interactive 24-inch display highlights this new version which improves self-service display technology using extensive software compatibility. This makes it useful in industries like food and beverage, retail, travel, and healthcare.

How is AI Transforming the Interactive Kiosk Market?

AI is being utilized in the interactive kiosk market, primarily for facilitating personalized user experiences through AI for tailored recommendations and offers. AI integration enhances user engagement with more intuitive, natural interfaces and computer vision for features such as virtual try-ons. Moreover, the integration of AI also improves operational efficiency by automating tasks, providing real-time data analytics, and allowing remote management. This contributes to greater customer satisfaction, increased sales, and smarter business operations across sectors such as retail, healthcare, transportation, and others. Thus, the above factors are expected to create lucrative prospects for market growth in upcoming years.

Interactive Kiosk Market Insights:

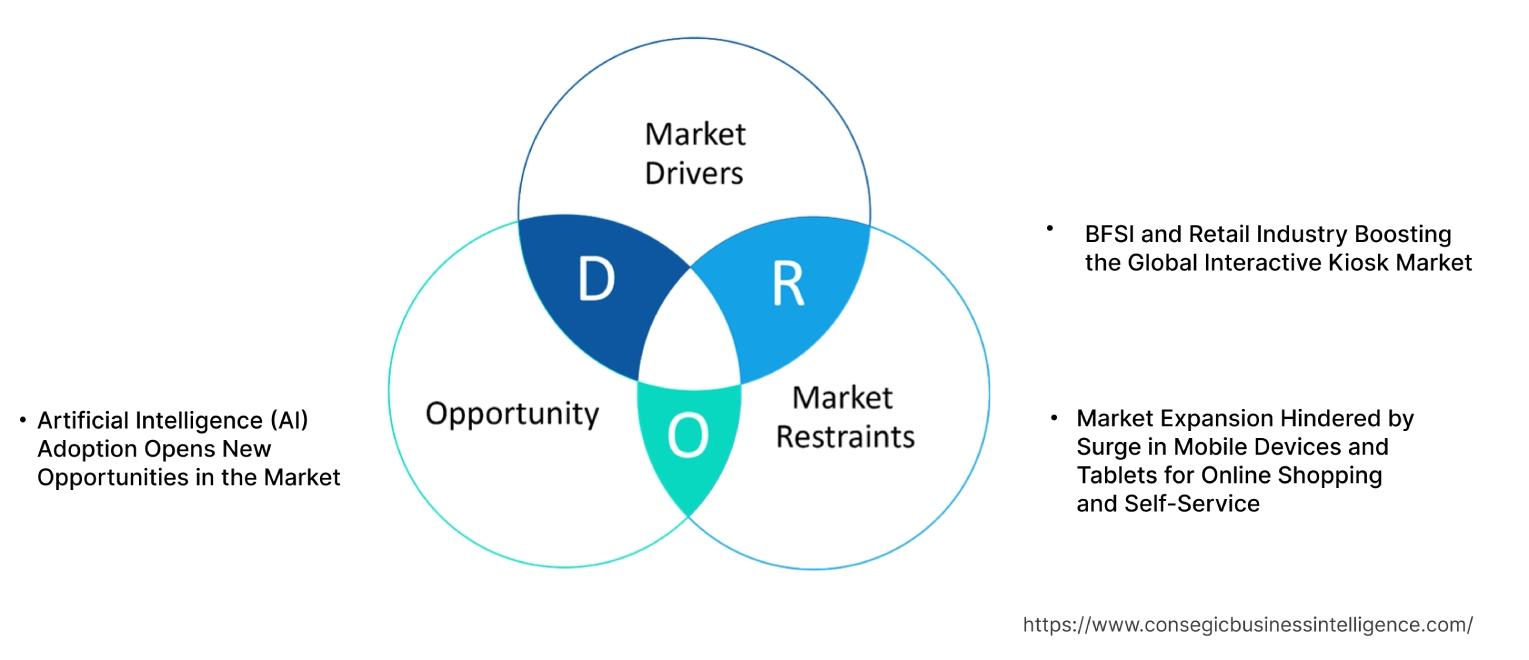

Key Drivers:

BFSI and Retail Industry Boosting the Global Interactive Kiosk Market

Interactive kiosks are primarily utilized in the BFSI (Banking, Financial Services, and Insurance) and retail industry for applications in making appointments, paying bills, printing ID cards, and badges, task recording, deposits and withdrawals, and others. They can be employed for several tasks including self-checkout, wayfinding, vending, ticketing, ordering, attendance marking, and others are key prospects for increasing their utilization.

- In September 2021, Montreal's Artitalia Group Inc.. in collaboration with Denim Society, introduced a phygital (physical + digital) experience at Carrefour Laval. This innovative approach combines traditional in-person shopping with online retail to provide customers with a unique experience. They've created the first-ever unmanned kiosk for Denim Society, integrating online and offline shopping.

Therefore, the growing BFSI and retail sector is driving the, in turn proliferating the interactive kiosk market growth.

Key Restraints :

Market Expansion Hindered by Surge in Mobile Devices and Tablets for Online Shopping and Self-Service

The rise in the use of mobile devices and tablets for online shopping and self-service tasks is posing a challenge to the market. Many of the services offered by these kiosks are now readily available on smartphones and tablets such as self-checkout, wayfinding, ticketing, ordering, and others.

- In December 2022, according to Waitrr, kiosks typically are found in high-traffic areas, offering self-service ordering, menu customization, and card payment options. However, they don't solve the queuing problem. Waitrr, a mobile ordering service, allows customers to order anytime, anywhere. It includes features like push notifications and order history. It's cost-effective for restaurateurs, eliminating the need for large screens and reducing customer wait times.

Therefore, the market analysis depicts that this shift to mobile devices for shopping is impacting consumer preference and impeding the interactive kiosk market growth.

Future Opportunities :

Artificial Intelligence (AI) Adoption Opens New Opportunities in the Market

Artificial intelligence-based interactive kiosk refers to a computer terminal that can provide tailored recommendations based on user preferences, past activities, or real-time data, enhancing the overall user experience. AI-based kiosks are transforming the self-service technology landscape. Factors such as the use of natural language processing and conversational AI enable intuitive communication through voice commands or input in everyday language.

- In August 2023, SiteKiosk Online developed its first AI-based feature, a product advisor prototype. This AI tool uses machine learning to present relevant item recommendations and descriptions inspired by customer queries, which enhances the shopping experience. It analyzes the client's input to discover fitting goods and services before informing customers in detail.

Hence, the rising adoption of artificial intelligence is anticipated to increase the utilization of these kiosks, in turn promoting interactive kiosk market opportunities during the forecast period.

Interactive Kiosk Market Segmental Analysis :

By Type:

Based on the type, the market is segmented into self-service kiosk machines, payment kiosk machine, ticket kiosk machine, information kiosk machine, wayfinding kiosk machine, and others.

Trends in the type:

- The growing trend of cashless payment initiatives is influencing the payment kiosk segment.

- Self-service kiosks are integrated with augmented reality (AR) for virtual try-ons and product customization in the fashion sector.

The self-service kiosk machine accounted for the largest revenue share in 2023 and is anticipated to register the fastest CAGR during the forecast period.

- Self-service kiosk machines refer to automated standalone structures that provide specific services to users. They are designed for convenience, efficiency, and quick service.

- They offer a range of benefits including customer convenience, time efficiency, labor cost reduction, and the ability to capture valuable customer data.

- They are utilized in retail, banking, hospitality, and other industrial applications that require ticket vending, bill payments, check-in, and information dissemination solutions.

- From July 2024, IKEA is bettering their customer experience with self-service kiosks called Upptäcka kiosks in their stores to enhance the shopping experience by giving customers more options and the ability to shop independently.

- Therefore, self-service kiosk machines are driving the interactive kiosk market trends.

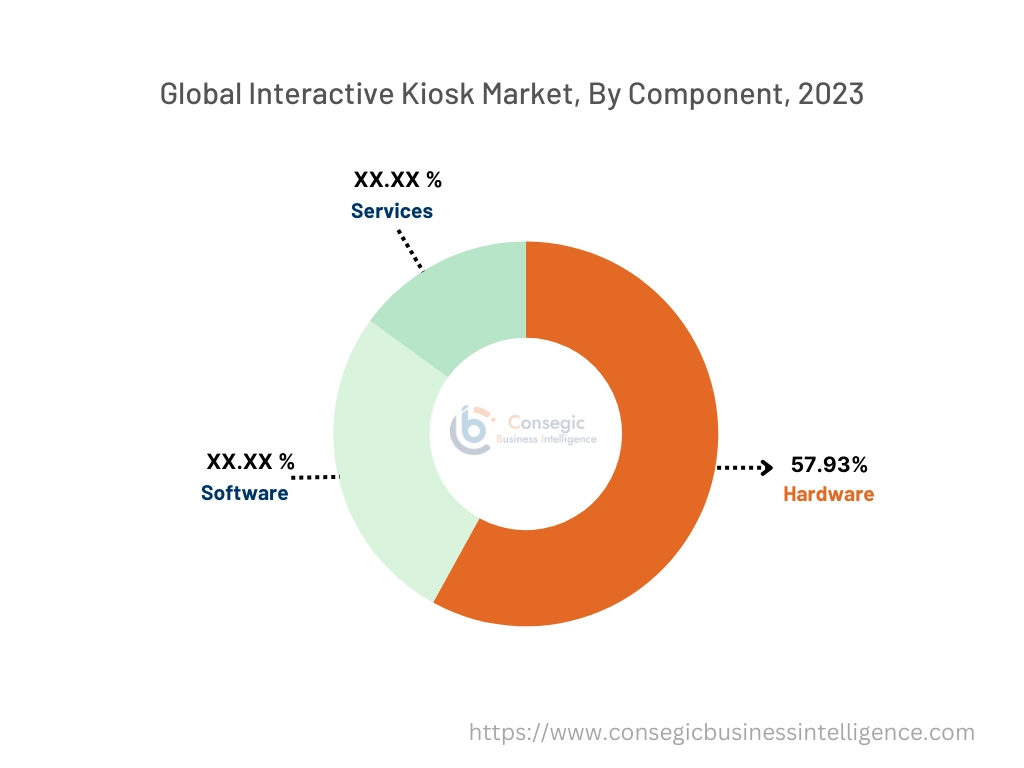

By Component:

Based on the component, the market is trifurcated into hardware, software, and service.

Trends in the component:

- Key players are shifting from non-interactive kiosks to interactive kiosks with updated hardware components such as keyboards, barcode scanners, card readers, printers, trackballs, video cameras, touch screens, and others.

- In the aftermath of the pandemic, interactive kiosks are equipped with touch-free interfaces, voice recognition, and hand gesture capabilities.

The hardware accounted for the largest revenue of 57.93% in 2023.

- Hardware components in kiosks refer to physical elements like touch screens, keyboards, printers, card readers, barcode scanners, video cameras, and other peripherals. They are designed to ensure efficient operation, seamless user experience, and others.

- They offer a range of benefits including improved customer satisfaction due to flawless performance, reduced operating time compared to manual services, lower labor costs, shorter wait times, and enhanced customer interactions.

- Various factors promoting these kiosks including increased demand for automated and self-service kiosks, advancements in wireless connectivity, and the ability for remote management.

- In July 2021, imageHOLDERS launched its first touchless kiosk, utilizing Ultraleap hand tracking technology. It has been created using an Ultraleap hand-tracking camera and TouchFree software. It captures finger and hand motions so people can interact with the screen content without touching anything, using midair gestures.

- Therefore, as per the segmental analysis the aforementioned reasons contribute to the hardware segment.

The software is anticipated to register the fastest CAGR during the forecast period.

- Software components in kiosks refer to operating systems, application software, and user interfaces. They are utilized in managing the kiosk's operations, processing user inputs, displaying information, and facilitating user interaction.

- Factors influencing the software segment include technological advancements like artificial intelligence, machine learning, near-field communication, radio frequency identification, and more in security and digital payment solutions.

- In August 2023, ID TECH launched the Kiosk V contactless payment reader as part of the NEO 3 Platform of Products. Retailers can integrate it into any payment environment using the latest contactless kernels for major credit card companies and mobile payments. It is a standalone NFC payment reader that allows integration with loyalty and rewards programs.

- Therefore, the software segment is anticipated to boost the interactive kiosk market demand during the forecast period.

By Panel Size:

Based on the panel size, the market is segmented into trifurcated below 17-inch display, 17-inch to 32-inch display, and above 32-inch display.

Trends in the Panel Size:

- The increase in commercial infrastructure such as shopping centers, airports, and others has led to an increase in the use of large-size panels for advertisements, wayfinding, and others.

The 17-inch to 32-inch panel accounted for the largest revenue share in 2023 and is anticipated to register the fastest CAGR during the forecast period.

- They offer a range of benefits including better user experience due to a larger display, suitability for interactive content, and adaptability to both indoor and outdoor settings.

- Factors influencing this segment include optimal viewing distance, versatility in various environments, and balance between cost and performance.

- In December 2022, Delphi Display Systems, Inc. unveiled Endura 32X, specifically engineered to cater to autonomous voice ordering applications in the quick service restaurant (QSR) sector. This new 32-inch outdoor display and speaker post system are equipped with a broad range of sensors to enable seamless integration with third-party loyalty programs, payment systems, and kiosk applications.

- Therefore, the 17-inch to 32-inch display are anticipated to boost the growth of the market during the forecast period.

By Location:

Based on the location, the market is bifurcated into outdoor and indoor.

Trends in the location:

- Kiosks are designed to aesthetically blend into various environments such as retail stores, airports, hotels, and hospitals and be flexible for customizations to enhance their appeal.

- New kiosks for mobile charging and electric vehicle battery charging have been launched.

The indoor segment accounted for the largest revenue share of the interactive kiosk market share in 2023.

- Factors influencing the indoor segment include the controlled environment indoors leading to less wear and tear and the ability to offer more complex services due to reliable power and internet connectivity.

- They offer a range of benefits including enhanced customer service, efficient space utilization, and the ability to provide detailed information and services to customers.

- They are utilized in high-footfall indoor locations like malls, airports, and retail stores and other.

- In January 2024, Meridian deployed the innovative iHealthAssist solution, by PRSONAS at The Princess Alexandra Hospital NHS Trust. The goal was to enhance patient satisfaction, provide 24/7 hospital information, and assist in wayfinding. Alex, an intelligent agent avatar, was introduced at the main entrance of the hospital. It can carry out conversations in five languages, one of which is British Sign Language.

- Thus, analysis of the segment shows that indoor kiosks are driving the interactive kiosk market trends.

The outdoor kiosks are anticipated to register the fastest CAGR during the forecast period.

- Factors influencing the outdoor segment include advancements in weatherproofing, increased demand for self-service in public spaces, and the development of solar-powered and energy-efficient kiosks.

- They offer a range of benefits including services to users around the clock and enhancing user engagement in public spaces. It also offers convenient access to information and services in outdoor settings.

- They offer a range of benefits including enhanced customer service, efficient space utilization, and the ability to provide detailed information and services to customers.

- In March 2024, an interactive outdoor kiosk is being introduced in Covington to assist residents and visitors in finding businesses, landmarks, and services. This initiative is a collaboration between City officials, Southbank Partners, a regional nonprofit, and RoveIQ, a Covington-based digital signage company. The wayfinding signage will be installed by Southbank Partners along the constructed section of Riverfront Commons. Currently, 1.5 miles of Riverfront Commons are complete in Covington.

- Therefore, the outdoor kiosks are anticipated to boost the growth of the market during the forecast period.

By End-User:

Based on the end user, the market is segmented into bank, retail, travel & tourism, corporate, healthcare, hospitality and others.

Trends in the end-user:

- Kiosks are improving the guest experience in hotels and other hospitality environments with functionalities such as check-in/out, concierge services, and entertainment options.

- The healthcare sector has begun utilizing interactive kiosks to assist patients with language barriers, by incorporating multiple languages into these kiosks. These kiosks also have features such as appointments, wayfinding, and others.

The retail sector accounted for the largest revenue of the overall interactive kiosk market share in 2023.

- Factors including the increasing adoption of self-service technologies, the demand for efficient customer service, and the rising trend of digitization are key aspects driving the retail segment.

- In June 2024, Samsung announced the introduction of Samsung Kiosks powered by GRUBBRR in partnership with PDQ Chicken branches in multiple states, including New Jersey, New York, Florida, and North Carolina. This technology aims to assist PDQ restaurants in improving operational efficiencies, streamlining the ordering process, enhancing the customer experience, and potentially increasing revenue.

- Thus, the retail industry is driving the interactive kiosk market demand.

The BFSI is anticipated to register the fastest CAGR during the forecast period.

- The growing BFSI segment is attributed to several factors including the increasing adoption of digital banking and the rising trend of self-service technologies in the financial sector.

- Using kiosks enhances the customer experience, as it reduces queuing, and provides guidelines and information.

- In May 2024, QualityKiosk Technologies is expanding its partnership with the Commercial Bank of Dubai (CBD) to improve the bank's digital customer experiences. This partnership aims to minimize predictive risk, increase quality engineering efficiencies, and boost productivity, aligning with CBD's goal of advancing digital banking services.

- Therefore, as per the segmental analysis, the BFSI sector is anticipated to boost the interactive kiosk market opportunities during the forecast period.

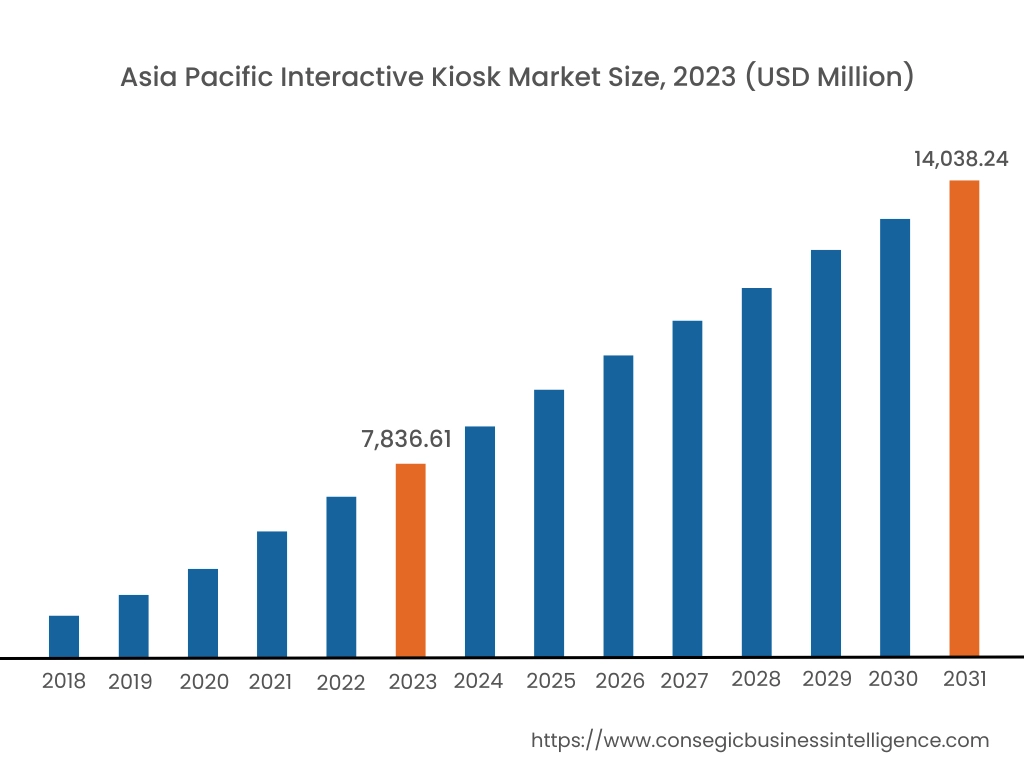

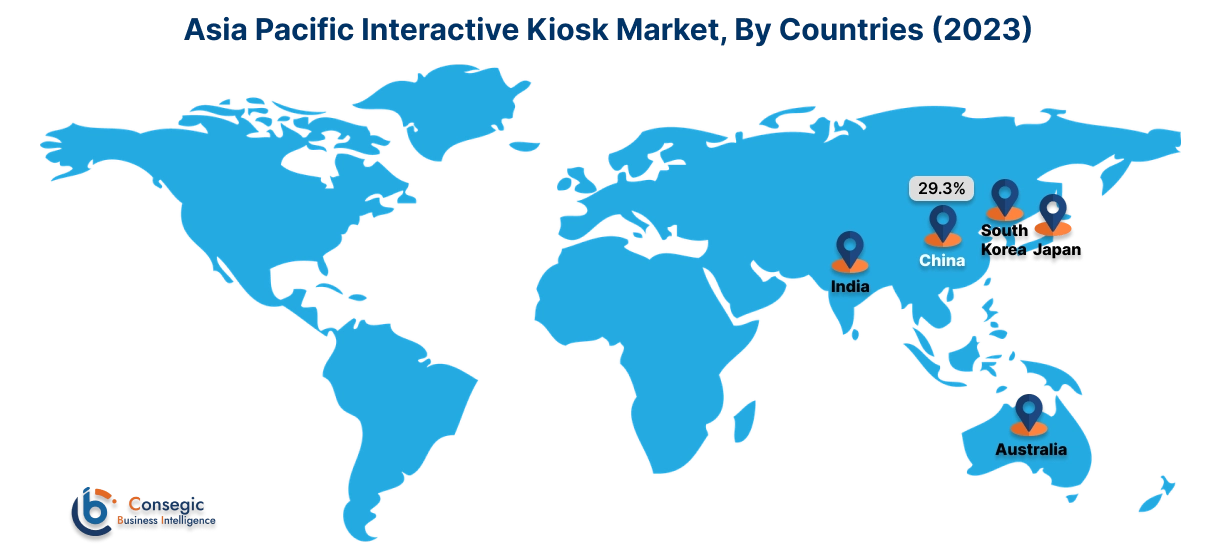

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 7,836.61 Million in 2023. Moreover, it is projected to grow by USD 8,276.28 Million in 2024 and reach over USD 14,038.24 Million by 2031. Out of this, China accounted for the maximum revenue share of 29.3%.

The Asia Pacific region's growing retail and tourism sectors offer lucrative growth prospects for the market. Additionally, the growing digitalization and self-service technologies are driving the interactive kiosk market expansion. Automation in industrial sectors such as electronics, automotive, and robotics is rising in regions such as China, Japan, South Korea, and India.

- In May 2024, MEASAT, a provider of broadband in rural communities, partnered up with Mudah Healthtech to introduce telehealth services at remote medical facilities within Malaysia within the next 24 months. With the signing of a Memorandum of Understanding (MoU), the two companies have planned to deploy approximately 2,000 Mudah HealthTech Sihat Xpress telehealth kiosks. These kiosks will be used by at least 1,000 rural physicians operating within MEASAT's satellite broadband service coverage under CONNECTme NOW.

North America is estimated to reach over USD 17,031.69 Million by 2031 from a value of USD 9,999.08 Million in 2023 and is projected to grow by USD 10,515.33 Million in 2024. The North American region is dominated by a robust retail sector and high consumer adoption of self-service solutions. The growth of various end-use sectors is mainly driven by its deployment in banks, retail, and other industries.

- In Feb 2022, Houston is embracing digital navigation with the introduction of interactive wayfinding kiosks. The first of these kiosks, part of the citywide Interactive Kiosk Experience (IKE) Smart City initiative, was unveiled near the George R. Brown Convention Center. The project aims to enhance pedestrian navigation in Houston. Over time, the city plans to gradually install 25 IKE kiosks in different regions such as Midtown, Uptown, and Downtown.

Furthermore, as per the interactive kiosk market analysis, factors including technological advancements and rising focus on customer experience are projected to drive interactive kiosk market expansion in North America during the forecast period.

As per the regional analysis, the European region is anticipated to witness substantial growth that is backed by a healthy economy and technological advancement. Companies invest in innovative technologies to cater to the surging demand for these kiosks across the region.

The Middle East, Africa, and Latin America are expected to grow at a considerable rate owing to the rising disposable income levels and increasing consumption of smartphones, portable devices, and others across Brazil, UAE, and others.

Top Key Players & Market Share Insights:

The interactive kiosk market is highly competitive with major players providing kiosks to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-use launches to hold a strong position in the market. Key players in the interactive kiosk industry include-

- Advantech Co., Ltd. (Taiwan)

- Samsung (South Korea)

- KIOSK Information Systems, Inc. (U.S.)

- Meridian Kiosks (U.S.)

- Diebold Nixdorf, Incorporated. (U.S.)

- Olea Kiosks Inc. (US)

- Embross. (Canada)

- NCR Voyix Corporation. (Georgia)

- REDYREF (U.S.)

- Aila Technologies Inc. (U.S.)

Recent Industry Developments :

Product Launches:

- In June 2024, Partner Tech USA Inc., a worldwide pioneer in smart POS and self-service solutions, announced the launch of its latest version of self-checkout software, equipped with AI features. This inventive and user-friendly software improves the self-checkout process by accelerating transactions, deterring fraud, and reducing the need for customer interventions.

- In May 2024, NCR Voyix launched the Aloha Kiosk, powered by GRUBBRR, to provide restaurant operators with self-ordering technology as a response to the challenges posed by COVID-19, such as labor retention and increasing costs. This collaborative effort between NCR Voyix and GRUBBRR offers a fully integrated kiosk solution, aiming to assist restaurants in overcoming these challenges by facilitating smooth data flow and enabling the creation of unique omnichannel ordering experiences for customers.

Mergers and Acquisitions:

- In April 2024, Kiosk Operators, a provider of kiosk and locker solutions based in Dallas, purchased Wellmation, a company that specializes in pharmaceutical kiosks. The acquisition encompasses Wellmation's patents, software, hardware, and overall intellectual property.

Partnership & Collaboration:

- In April 2024, Fiserv, Inc., partnered with Clover Kiosk to introduce the upgraded 24" Clover Kitchen Display System to help restaurants optimize operations and improve customer experience. These solutions, designed to be integrated with other Clover software and hardware, facilitate comprehensive order management. They offer up to 40% reduction in total cost of ownership compared to similar products.

Interactive Kiosk Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 51,611.19 Million |

| CAGR (2024-2031) | 7.1% |

| By Type |

|

| By Component |

|

| By Panel Size |

|

| By Panel Size |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

What is an interactive kiosk? +

An interactive kiosk refers to a computer terminal featuring specialized hardware and software that allows access to information and applications for communication, commerce, entertainment, or education.

What specific segmentation details are covered in the type report, and how is the dominating segment impacting the market growth? +

For instance, by type segment has witnessed transistors as the dominating segment in the year 2023, owing to the increasing adoption of interactive kiosks in banks, retail, travel & tourism, and other industrial applications.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2024-2031? +

Asia Pacific is anticipated to register the fastest CAGR during the forecast period.