Interposer Market Introduction :

Interposer Market size is estimated to reach over USD 1,334.25 Million by 2030 from a value of USD 322.04 Million in 2022, growing at a CAGR of 19.7% from 2023 to 2030.

Interposer Market Definition & Overview :

An interposer is a physical component used in electronic systems to provide connectivity or signal translation between two different interfaces or technologies. They act as an intermediary to provide electrical connections between the Integrated Circuit (IC) and the circuit board to address electrical, mechanical, or thermal differences by allowing an electrical signal to efficiently pass through the board. Additionally, as per the analysis, they also facilitate signal routing, power distribution, and thermal dissipation for the IC, thus enhancing the system's performance and reliability.

Interposer Market Insights :

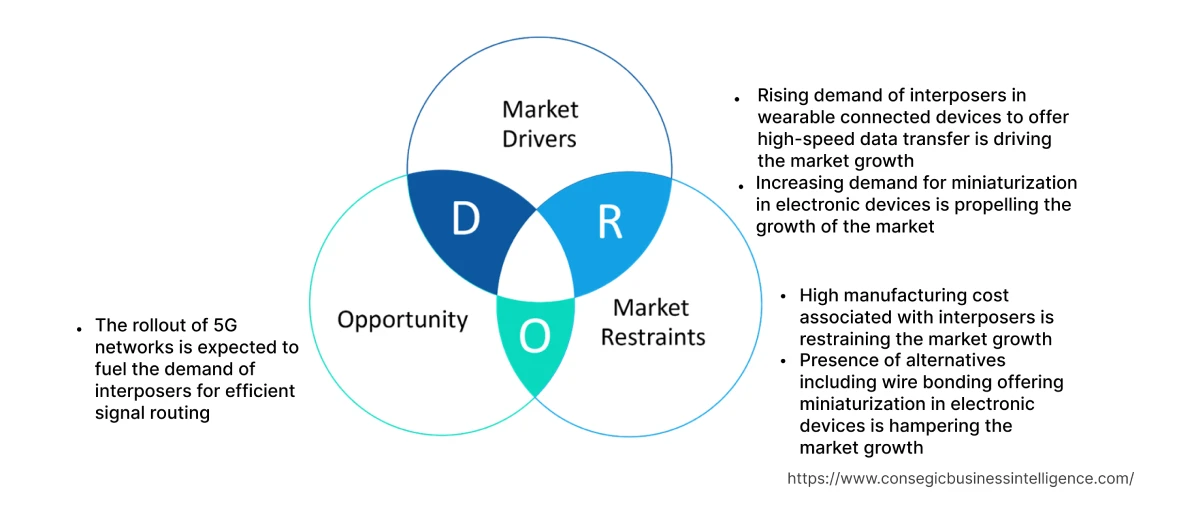

Interposer Market Dynamics- (DRO) :

Key Drivers :

Rising demand of interposers in wearable connected devices to offer high-speed data transfer is driving the market

Wearable devices including smartwatches, fitness trackers, and augmented reality (AR) glasses rely heavily on sensors such as accelerometers, gyroscopes, heart rate monitors, and environmental sensors to gather data and provide accurate measurements. They facilitate the integration of sensors with other components, enabling seamless connectivity, signal routing, and power distribution within the device. Additionally, wearable devices require fast and reliable data transfer for performing tasks including transmitting health data and receiving notifications. These components are considered ideal for supporting high-speed signaling between different chips ensuring efficient data transmission and reducing latency issues.

Furthermore, wearable devices operate on limited power sources including small batteries. These device aid in optimizing power delivery within the device, enabling efficient power management, and reduced power loss, thus enhancing overall power efficiency. Consequently, the ability of these devices to provide high-speed transfer at low power contributes significantly in driving the market. For instance, in November 2021, according to International Data Corporation (IDC), in India the wearable market grew by 93.8% in the third quarter of 2021, shipping approximately 23.8 million units of devices.

Increasing demand for miniaturization in electronic devices is propelling the market

Interposers enable the stacking and integration of various chips including processors, memory, sensors, and communication modules, allowing greater functionality and performance in miniaturized devices. Miniaturization leads to higher input/output (I/O) ratio within a limited space and these device provide a means to accommodate higher I/O density by offering additional layers for signal routing and electrical connections. Furthermore, with miniaturization, the distance between components and the length of interconnects decreases, leading to difficulty in maintaining signal integrity and delivering power efficiently. These devices address such issues by providing shorter signal paths and optimizing power distribution within the device, thus contributing significantly in driving the interposer market growth. For instance, in June 2021, researchers at the Tokyo Institute of Technology developed a 3D functional interposer that contains an embedded capacitor to offer miniaturization. The device consumes less power and reduces the wire length between the capacitor and chips, hence contributing notably in accelerating the market trend.

Key Restraints :

High manufacturing cost associated with interposers is restraining the market

The high cost of production of these devices is the key factor responsible for hampering the expansion of the market. The components utilized in the manufacturing of these devices including a through-silicon via (TSV) and through glass vias (TGVs) are expensive. The high cost prevents small enterprises from investing in interposer-based solutions and compels the user to seek alternatives. Consequently, the high production cost limits the adoption of these devices by small and medium organizations, which in turn, restraints the market.

Future Opportunities :

Presence of alternatives including wire bonding offering miniaturization in electronic devices is hampering the market

The roll out of 5G network is expected to fuel the demand of these devices and create lucrative opportunities and trends in the future. 5G networks offer higher data transfer rates compared to previous generations with increased bandwidth that requires advanced chipsets, processors, and communication modules for handling the higher data throughput. These devices play a crucial role in integrating high-performance components, ensuring efficient signal routing and power delivery within the device. Additionally, 5G networks utilize higher frequency bands, including millimeter-wave (mm-wave) frequencies, for increased data capacity and faster communication. The mmWave components require specific design considerations and integration techniques due to the higher frequencies. These devices provide the necessary connectivity solutions and support the integration of mmWave chips and antennas, thus projected to create potential interposer market opportunities and trends in the upcoming years.

Interposer Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 1,334.25 Million |

| CAGR (2023-2030) | 19.7% |

| Based on the Product Type | 2D interposer, 2.5D interposer, and 3D interposer |

| Based on the Application | ASIC/FPGA, CIS, CPU/GPU, Logic SoC, MEMS 3D Capping Interposer, RF Devices, and Others |

| Based on the End User | Telecommunication, Consumer Electronics, Automotive, Military & Aerospace, and Others |

| Based on the Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Key Players | Amkor Technology, Inc., Murata Manufacturing Co., Ltd., Intel Corporation, Black Box Limited, ALLVIA Inc., Plan Optik AG, Nvidia Corporation, TEZZARON, SerialTek, Taiwan Semiconductor Manufacturing Company Limited, Xilinx, Inc., Qualcomm Technologies, Inc., NHanced Semiconductors Inc., DuPont, Teledyne Technologies Incorporated |

Interposer Market Segmental Analysis :

Based on the Product Type :

The product type segment is trifurcated into 2D interposer, 2.5D interposer, and 3D interposer. 3D interposers accounted for the largest global interposer market share in 2022 and are also projected to witness the fastest CAGR during the forecast period. 3D interposers offer superior performance and functionality in comparison to 2D and 2.5D interposers. 3D interposers enable shorter interconnect lengths, higher interconnect density, and increased bandwidth by vertically stacking multiple chips through-silicon vias (TSVs). According to the analysis, shorter interconnect lengths results in improved system performance, reduced power consumption, and enhanced functionality, thus contributing significantly in driving the expansion of this segment. In addition, as per the analysis the increasing adoption of 3D interposers in advanced packaging solutions to fit multiple processors and memory in a single package is also bolstering the market trend. For instance, in April 2023, Taiwan Semiconductor Manufacturing Company Limited (TSMC) launched the 2nm technology, RF technology with N4PRF, N3P, N3X, and N3AE processors, and 3DFabric system for advanced packaging and silicon stacking. The system employs 3D interposers to meet the growing demand for High-Performance Computing (HPC) applications to fit multiple processors and memory in a single package. The advanced TSMC, Chip on Wafer on Substrate solution is capable of accommodating 12 stacks of HBM memory, thus contributing remarkably in boosting the interposer market trend.

Based on the Application :

The application segment is classified into ASIC/FPGA, CIS, CPU/GPU, Logic SoC, MEMS 3D capping interposer, RF devices, and others. Logic SoC accounted for the largest market share in 2022 as these devices enable high-speed interconnects between various components to create a system on a chip (SoC) that provides low-loss signal transmission paths. Additionally, as per the analysis, these devices also allow efficient power distribution and reduced electromagnetic interference, optimizing the overall performance of the system.

Moreover, these devices are capable of maintaining optimal operating temperatures in an electrical pathway to prevent thermal throttling, thus ensuring consistent performance of the system. Furthermore, these devices also connect the chips across various signals at low latency and high bandwidth, hence contributing significantly in accelerating the growth of the Logic SoC segment. For instance, in March 2022, Apple launched M1 Ultra by using these devices for advanced packaging that connects the die of two M1 Max chips to form a system on a chip (SoC) offering improved levels of capabilities and performance. The device operates by utilizing a silicon interposer that connects the chip across 10000 signals, offering an 2.5TB/s of low latency and 4 times increased bandwidth to provide enhanced functionality and performance.

The ASIC/FPGA (Application-Specific Integrated Circuit/Field-Programmable Gate Array) segment is expected to register the fastest CAGR during the forecast period. ASICs and FPGAs are extensively employed in high-performance computing applications including data centers, artificial intelligence, machine learning, and scientific research. Based on the analysis, the applications require advanced processing capabilities, high-speed data transfer, and efficient power management capabilities. These devices enable the integration of ASICs and FPGAs with other components, optimizing the performance and enabling higher computational efficiency. Additionally, advanced packaging technologies, namely 2.5D and 3D packaging, offer higher levels of integration, improved performance, and reduced form factors. ASICs and FPGAs leverage these devices to achieve the benefits of such advanced packaging technologies, further driving the adoption of these devices and fueling the growth of the market.

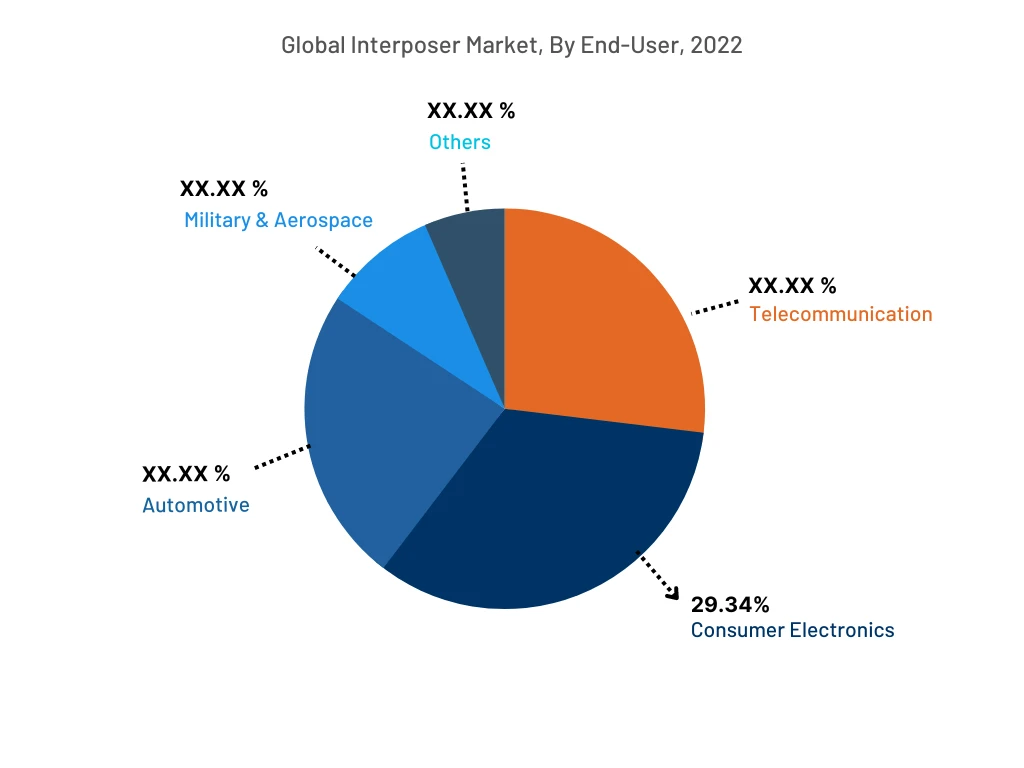

Based on the End-user :

The end-user segment is divided into telecommunication, consumer electronics, automotive, military & aerospace, and others. Consumer electronics accounted for the largest market share of 29.34% in 2022 as these devices are equipped with mobile devices to facilitate the integration of components including application processors, memory modules, and Radio Frequency (RF) modules, allowing for compact and efficient designs. Additionally, as per the interposer market analysis, these devices enable signal routing, power delivery, and thermal management, thus contributing in enhancing the performance and functionality of mobile devices. For instance, in May 2021, Samsung launched Interposer Cube4 with next-generation 2.5D packaging technology. The advancements in thses devices offers High Bandwidth Memory (HBM) allowing multiple modules to operate as a single chip in one package. Additionally, based on the analysis Cube4 also provides faster communication and improved power efficiency between memory and logic through heterogeneous integration.

Telecommunication industry is anticipated to witness the fastest CAGR as these devies are deployed in network equipment namely routers, switches, and base stations to facilitate the integration of high-speed processors, memory modules, interface circuits, and power management components. Furthermore, in optical communication systems, these devices play a role in integrating optical transceivers, signal processing units, and interface circuits. These devices provide the necessary interconnects for efficient transmission of optical signals, enabling high-speed data transfer and low latency in optical networks. In conclusion, the increasing adoption of these devices in network equipment and optical communication systems in the telecommunication sector is expected to drive market trend in the upcoming years.

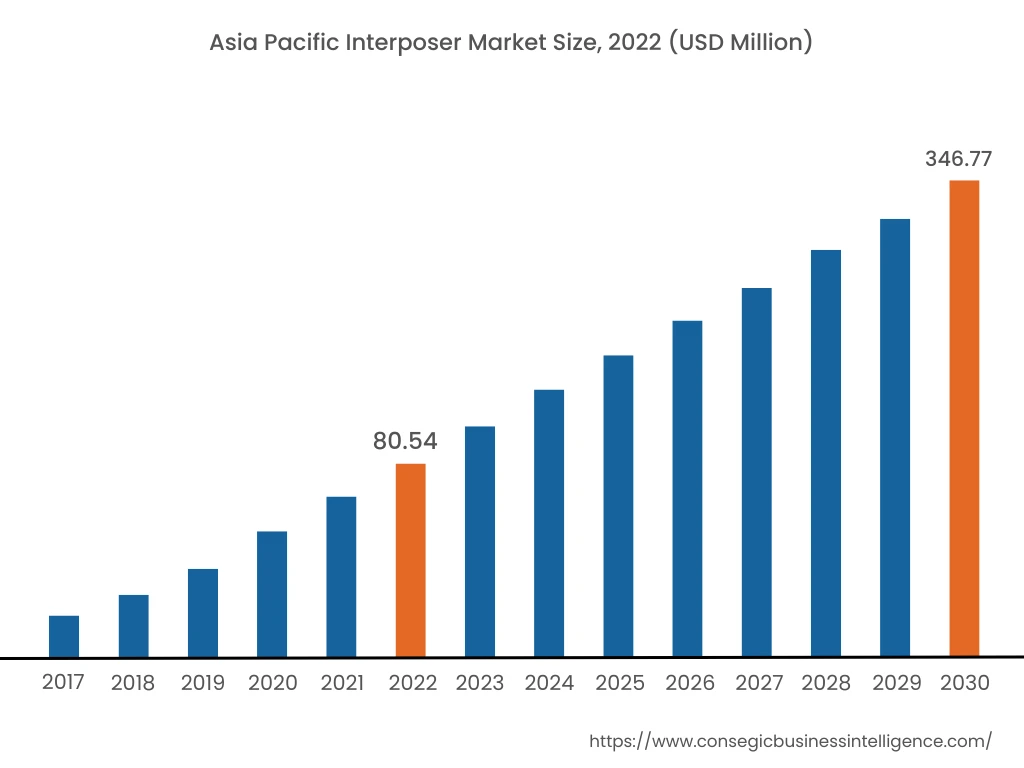

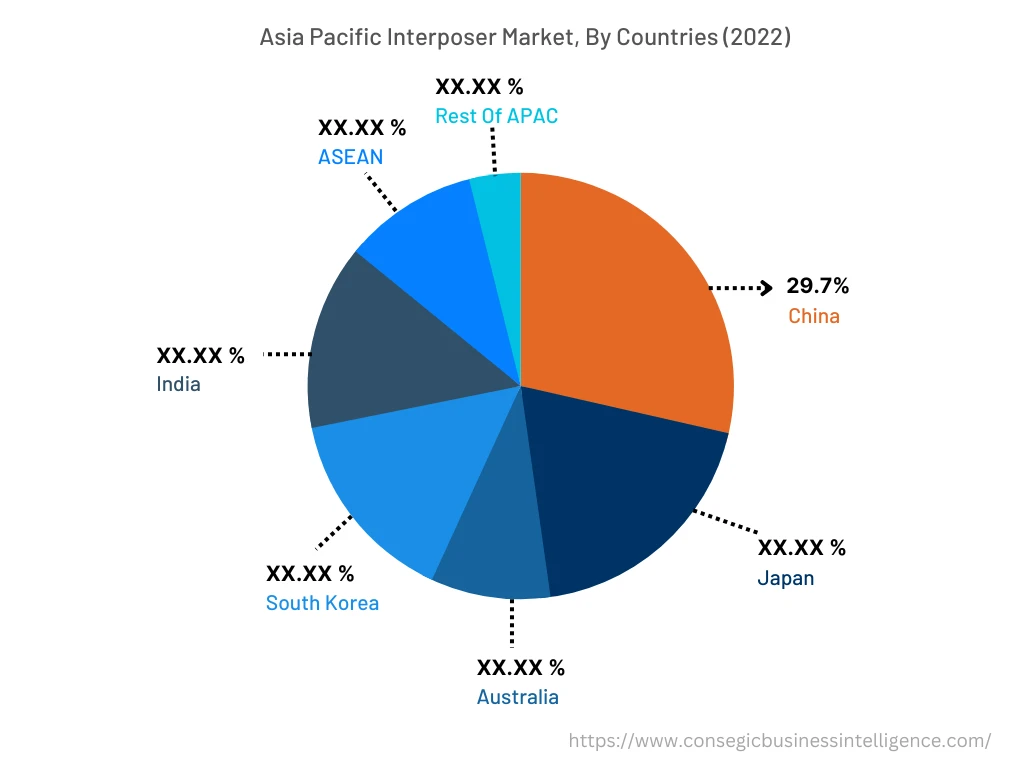

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2022, North America accounted for the highest market share of 38.73% valued at USD 3,526.85 Million in 2022 and USD 3,695.42 Million in 2023 and is expected to reach USD 5,537.22 Million in 2031. In the North American region, the U.S. accounted for the highest Interposer Market share of 65.52% in 2022. The growth of this region is majorly attributed to increased healthcare and laboratory labels market demand in North American countries, owing to dominant presence of manufacturers of healthcare and pharmaceutical products. In addition to this, the phenomenal escalation in the production of pharmaceutical sector is another major sector promoting the development of the market in the region. For instance, according to the report published by the European Federation of Pharmaceutical Industries and Associations (EFPIA) in May 2022, North America accounted for 49.1% of world pharmaceutical sales in 2021, compared to 23.4% in Europe, while U.S. had 64.4% of sales of newly launched medicines during the period 2016-2021, compared to 16.8% in the European market. Thus, contributing to increased requirement for these labels to further propel the market in the region.

However, Asia Pacific is expected to grow at the fastest CAGR of 5.8% during the forecast period. The expansion of this region is majorly attributed to increasing demand for labels in the steadily growing healthcare and pharmaceutical sectors in the region. Similarly, the rising awareness about communicating information about products to their users is another influential factor expected to create opportunities and Interposer Market trends over the forecast period.

Top Key Players & Market Share Insights :

The Interposer Market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market trend through mergers, acquisitions, and partnerships. The key players in the market include -

- CILS

- Avery Dennison Corporation

- inotec Barcode Security Ltd.

- Etisoft.com.pl

- Ga International

- Cab Produkttechnik GmbH & Co KG

- Leland Company

- Brady

- Schreiner Group

- Robinson Tape and Label, Inc.

- Shamrock Labels

- General Data Company, Inc.

- Watson Label Products

- Xinxing Label

Recent Industry Developments :

- In May 2020, CILS offered durable label material, which can create social distancing signage and zones and customise messaging specific to certain environment and requirements and can easily print signs using current laser or thermal transfer printer.

- In October 2023, Weifang Xinxiang Label Products Co., Ltd. introduced a full set of DuPont Cyrel FAST Plate Equipment, marking a revolutionary transformation in our printing capabilities. This innovative addition is set to redefine their approach to printing, achieving higher print quality, superior process control, enhanced consistency, improved prepress production efficiency, and the ability to produce flexo plates in less than an hour.

Key Questions Answered in the Report

What is an interposer? +

An interposer is a physical component used in electronic systems to provide connectivity or signal translation between two different interfaces or technologies.

What specific segmentation details are covered in the interposer market report, and how is the dominating segment impacting the market growth? +

The application segment has registered Logic SoC as the dominating segment owing to the ability of interposers to enable high-speed interconnects between various components to create a system on a chip (SoC) that provides low-loss signal transmission paths.

What specific segmentation details are covered in the interposer market report, and how is the fastest segment anticipated to impact the market growth? +

In the end-user segment, the telecommunication industry witnesses the fastest CAGR as interposers are deployed in network equipment namely routers, switches, and base stations to facilitate the integration of high-speed processors, memory modules, interface circuits, and power management components.

What specific segmentation details are covered in the interposer market report, and how does each dominating segment is influencing the demand globally? +

As mentioned above, each dominating segment is prompting the demand globally due to rising industrial needs. Moreover, fluctuation in demand being witnessed from several sectors is responsible for driving the interposer market.