Kidney Stone Management Devices Market Size :

Consegic Business Intelligence analyzes that the Kidney Stone Management Devices Market size is growing with a healthy CAGR of 4.8% during the forecast period (2023-2030), and the market is projected to be valued at USD 2,505.11 Million by 2030 from USD 1,724.51 Million in 2022.

Kidney Stone Management Devices Market Scope & Overview:

Kidney stone management devices are specialized medical tools and equipment designed to aid in the diagnosis, treatment, and removal of kidney stones. These devices are used by healthcare professionals including urologists and nephrologists, to effectively manage kidney stones and provide relief to patients.

These devices encompass a range of tools and technologies including lithotripters, stone retrieval devices, urinary stents, and others. These devices are designed to be minimally invasive, enabling healthcare professionals to perform procedures with reduced patient discomfort, shorter recovery time, and fewer complications than traditional surgical methods. Kidney stone devices play a crucial role in the management of kidney stones, allowing for effective stone fragmentation, removal, and prevention of recurrent stone formation.

Kidney Stone Management Devices Market Insights :

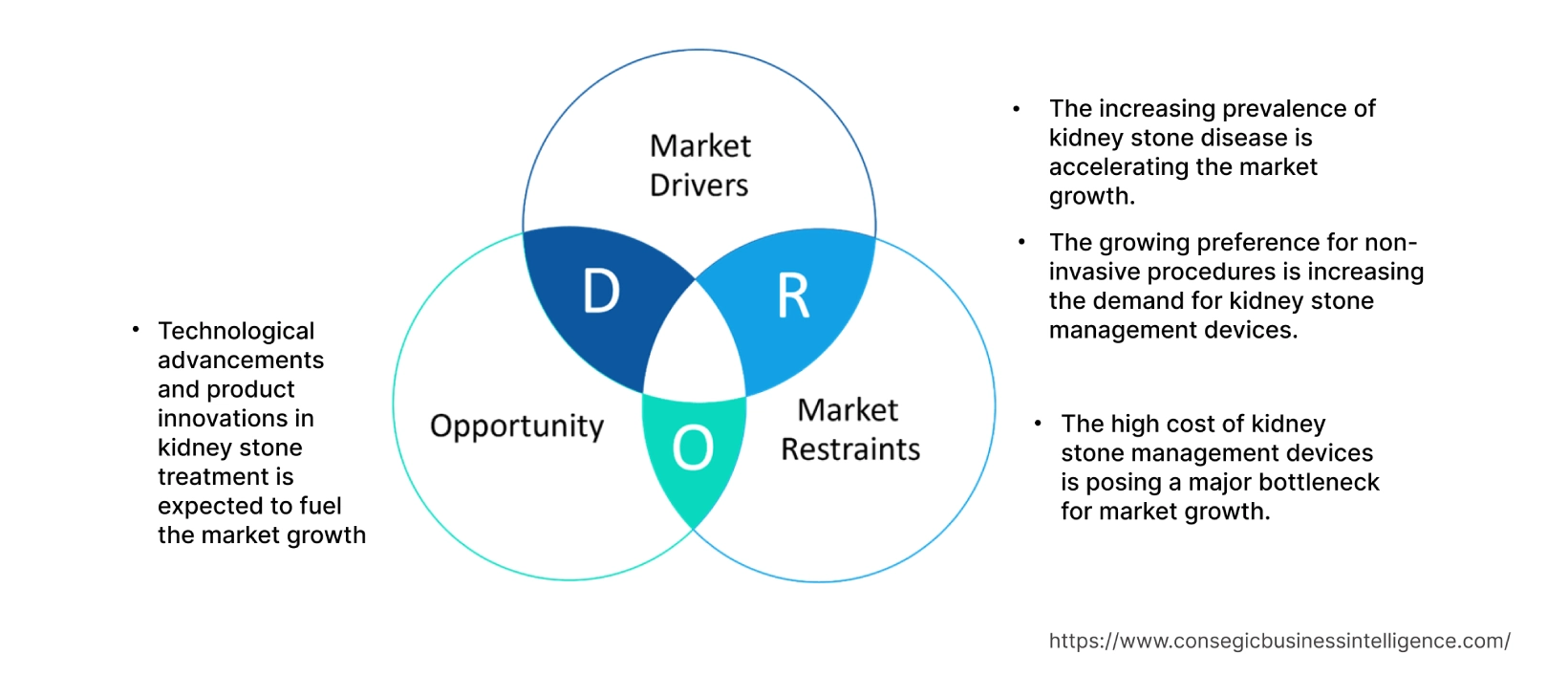

Kidney Stone Management Devices Market Dynamics - (DRO) :

Key Drivers :

The increasing prevalence of kidney stone disease is accelerating the kidney stone management devices market

The increasing prevalence of kidney stone disease is accelerating the kidney stone management devices market

The rising incidence of kidney stones globally is one of the prime factors driving the demand for kidney stone management devices. Factors such as unhealthy dietary habits and increasing obesity rates contribute to the growing number of kidney stone cases.

- For instance, in the British Journal of Nursing, it is estimated that the incidence of kidney stone disease rose from 10% in 2019 to 15% in 2020. Kidney stones are one of the most common kidney diseases, and their prevalence is increasing across the globe.

Therefore, it is evident from the above data that the rising prevalence of kidney stone cases is propelling the demand for devices for accurate and timely diagnosis. This prime factor is boosting the kidney stone management devices market growth.

The growing preference for non-invasive procedures is increasing the demand for kidney stone management devices.

Patients and healthcare professionals are increasingly opting for non-invasive or minimally invasive procedures for kidney stone management. This preference is driving the demand for devices such as lithotripters and ureteroscopy devices, which offer effective stone management and removal without the need for open surgery. Further, non-invasive procedures are generally less painful and carry a low risk of complications compared to invasive surgeries. Hence, the growing desire for improved patient comfort, reduced risk, and shorter recovery time is contributing to the kidney stone management devices market demand.

Key Restraints :

The high cost of kidney stone management devices is posing a major bottleneck for market growth.

Kidney stone management devices, especially technically advanced ones are costly. The cost of these devices can limit their adoption, particularly in developing countries with limited healthcare budgets and affordability constraints. In these regions, healthcare providers face challenges in accessing and affording these devices, leading to suboptimal treatment options or delayed interventions. Furthermore, compliance with regulations, testing costs, and other factors are inducing kidney stone management device manufacturers to increase their product prices.

Overall, the high cost of devices presents challenges in ensuring equitable access to effective treatment options. Therefore, analysis of market trends depicts that the aforementioned factors are anticipated to hamper the kidney stone management devices market trends in the following years.

Future Opportunities :

Technological advancements and product innovations in kidney stone treatment are expected to fuel the market growth.

Technological advancements and product innovations in kidney stone treatment are expected to fuel the market growth.

Continuous advancements in medical technology and product innovations offer opportunities for the development of new and improved kidney stone management devices. This includes the introduction of devices with enhanced imaging capabilities, improved stone fragmentation techniques, and better patient comfort features. The key players operating in these devices are substantially investing in the technological innovations of these devices.

- For instance, in 2020, Dornier MedTech GmbH announced the launch of the Dornier Delta III Lithotripter. The device is designed to provide urologists with a high-performance lithotripsy solution for the treatment of kidney stones.

Thus, the market trends analysis shows that the launch of new products with nanotechnology technology will create a potential kidney stone management devices market opportunity in the forecast years.

Kidney Stone Management Devices Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 2,505.11 Million |

| CAGR (2023-2030) | 4.8% |

| By Stone Type | Calcium oxalate, Uric acid, Struvite, and Cystine |

| By Product Type | Lithotripters (Ultrasonic, Ballistic, Combination lithotripters, Electrohydraulic lithotripters), Stone retrieval devices, Urinary stents, and Others |

| By Treatment | Shock wave lithotripsy (SWL), Ureteroscopy (URS), Percutaneous nephrolithotomy (PNL), and Others |

| By End User | Hospitals, Specialty Clinics, Ambulatory surgery centers, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Boston Scientific Corporation, Becton, Dickinson and Company, Cook Medical, Olympus, STORZ MEDICAL AG, Coloplast Corp, DirexGroup., EDAP TMS, Inceler Medikal Co. Ltd., and Dornier MedTech |

Kidney Stone Management Devices Market Segmental Analysis :

By Stone Type :

The stone-type segment is categorized into calcium oxalate, uric acid, struvite, and cystine. In 2022, the calcium oxalate segment accounted for the highest market in the overall kidney stone management devices market share.

Calcium oxalate is the most common type of kidney stone that is created when calcium combines with oxalate in the urine. Inadequate calcium and fluid intake, as well as other conditions, contribute to their formation. Additionally, dehydration from not drinking enough fluid, and a diet with high protein, oxalate, and sodium are some of the factors increasing the risk of calcium oxalate kidney stones.

However, the uric acid segment is expected to grow at the fastest CAGR in the market during the forecast period. Uric acid stone is associated with metabolic syndrome. Increasing high purine diets such as red meat, organ meats, beer/alcoholic beverages, and meat-based gravies increases the risk of uric acid formation. Furthermore, the analysis of segmental trends shows that increasing cases of obesity and diabetes among the population are expected to kidney stone management devices market demand.

By Product Type :

The product type segment is categorized into lithotripters, stone retrieval devices, urinary stents, and others.

In 2022, the lithotripters segment accounted for the highest market share in the market. Lithotripters are further categorized into ultrasonic, ballistic, combination lithotripters, and electrohydraulic lithotripters. Lithotripters are devices used to break down kidney stones into smaller fragments through the application of shock waves or laser energy. Additionally, technological advancements and new product launches by market players have increased the effectiveness and safety of lithotripter devices.

- For instance, in 2021, Olympus Corporation announced the launch of the LithoVue Empower Retrieval Deployment Device. The device is designed to facilitate the removal of kidney stones and improve the efficiency of lithotripsy procedures.

However, the stone retrieval devices segment is expected to grow at the fastest CAGR in the market during the forecast period. Stone retrieval devices are useful for extracting the whole stone during the kidney stone treatment. Due to the advanced technology of stone retrieval devices, it is widely used in urology. Furthermore, the analysis of segmental trends depicts that the benefits associated with stone retrieval devices including the ease of use, noninvasive nature, and high efficiency in the treatment of stones are boosting the kidney stone management devices market trends.

By Treatment Type :

The treatment type segment is categorized into shock wave lithotripsy (SWL), ureteroscopy (URS), percutaneous nephrolithotomy (PNL), and others.

In 2022, the shock wave lithotripsy (SWL) segment accounted for the highest market in the kidney stone management devices market share. SWL is a nonsurgical technique for treating stones in the kidney using high-energy shock waves. Stones are broken into stone dust or fragments that are small enough to pass in the urine. The main advantage of this treatment is that it treats kidney stones without an incision. As per the kidney stone management devices market analysis, the hospital stays and recovery time are reduced.

- For instance, a study by the National Centre for Biotechnology Information (NCBI), the study has shown that SWL can achieve a stone clearance rate of 82% to 90% and 58% to 67% for proximal/mid and distal ureteral stones, respectively.

However, the ureteroscopy (URS) segment is expected to grow at the fastest CAGR in the market during the forecast period. Ureteroscopy is a preferred method for the treatment of small- to medium-sized kidney stones located in any part of the urinary tract. Due to advanced technology and a higher accuracy rate for identification and estimation of kidney stone location in patients, there is wide adoption of ureteroscopy in kidney stone treatments. Furthermore, as per the segmental trends analysis the high success rate of the ureteroscopy (URS) procedure is likely to surge the kidney stone management devices market growth over the forecast period.

By End-User :

The end user segment is categorized into hospitals, specialty clinics, ambulatory surgery centers, and others.

In 2022, the hospitals segment accounted for the highest market share of 43.25% in the overall market. Hospitals are a major end-user of kidney stone management devices. These devices are used in the various departments within the hospitals including urology, nephrology, and surgery. Hospitals typically have specialized equipment and skilled healthcare professionals to diagnose and treat kidney stones effectively.

However, the specialty clinics segment is expected to grow at the fastest CAGR in the market during the forecast period. Specialty clinics have advanced equipment and specialized care dedicated to urological procedures. As per the kidney stone management devices market analysis, the above-mentioned factors contribute to the growth of the specialty clinic segment in the market in the forecasted period.

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2022, North America accounted for the highest market share at 35.15% and was valued at USD 606.16 million, and is expected to reach USD 884.05 million in 2030. Owing to factors such as the adoption of minimally invasive techniques, advanced healthcare infrastructure, and favorable reimbursement policy. In North America, the U.S. accounted for the highest market share of 66.05% during the base year of 2022. This is due to the high prevalence of kidney stone diseases in the region.

- For instance, in 2021, according to an article published by the National Institute of Health (NIH), it is estimated that every year about 600,000 Americans suffer from kidney stones in the U.S.

Furthermore, Asia Pacific is expected to witness significant growth over the forecast period, growing at a CAGR of 5.3% during 2023-2030. This is attributed to the large population base, increasing awareness about these devices, and rising disposable income levels contributing to the market growth. The regional trends analysis shows that countries such as China, India, and Japan are major contributors to the kidney stone management devices market expansion in the region.

Top Key Players & Market Share Insights:

The global Kidney Stone Management Devices market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the kidney stone management devices industry include-

- Boston Scientific Corporation

- Becton, Dickinson and Company

- EDAP TMS

- Inceler Medikal Co. Ltd.

- Dornier MedTech.

- Olympus

- Cook Medical

- STORZ MEDICAL AG

- Coloplast Corp

- DirexGroup

Recent Industry Developments :

- In March 2021, Boston Scientific announced an agreement to acquire Lumenis LTD. This acquisition will help Lumenis LTD expand its urology laser portfolio in the U.S. and Japan through a distribution arrangement.

- In June 2020, Olympus, a global technology leader in medical and surgical procedure devices announced the launch of a Soltive Laser System (Soltive SuperPulsed Laser System), the application of thulium fiber laser technology designed for stone lithotripsy and soft tissue applications.

Key Questions Answered in the Report

What was the market size of the kidney stone management devices industry in 2022? +

In 2022, the market size of kidney stone management devices was USD 1,724.51 million

What will be the potential market valuation for the kidney stone management devices industry by 2030? +

In 2030, the market size of kidney stone management devices is expected to reach USD 2,505.11 million.

What are the key factors driving the growth of the kidney stone management Devices market? +

Increasing prevalence of kidney stones and growing preference for non-invasive procedures are driving the global kidney stone management devices market growth.

What is the dominating segment in the kidney stone management devices market by the end user? +

In 2022, the hospital segment accounted for the highest market share of 43.25% in the overall kidney stone management devices market.

Based on current market trends and future predictions, which geographical region is the dominating region in the kidney stone management devices market? +

North America accounted for the highest market share in the overall kidney stone management devices market.