Optical Position Sensor Market Size :

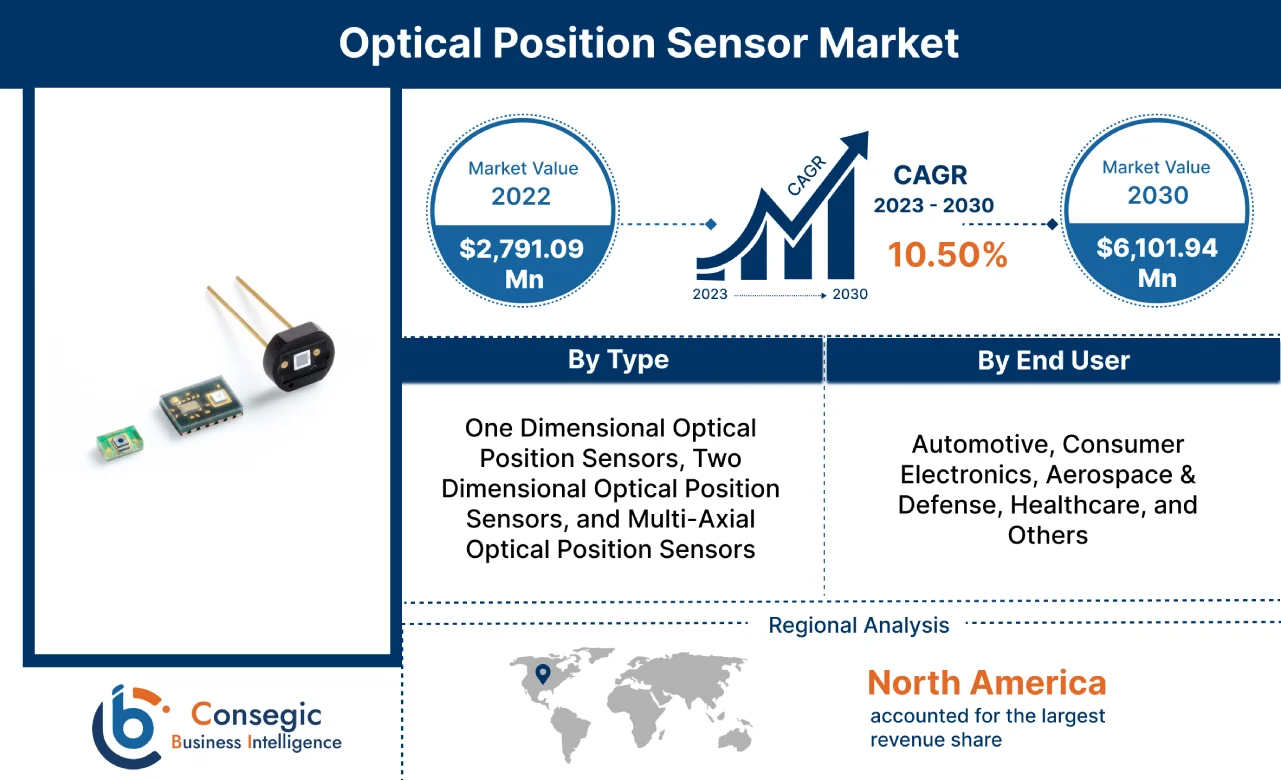

Optical Position Sensor Market size is estimated to reach over USD 6,101.94 Million by 2030 from a value of USD 2,791.09 Million in 2022, growing at a CAGR of 10.50% from 2023 to 2030.

Optical Position Sensor Market Scope & Overview:

Optical position sensors refer to a type of sensor that is capable of detecting the object's movement & converting it into signals that are appropriate for transmission, control, or processing. Optical position sensors utilize changes in the light characteristics such as wavelength, phase, intensity, or polarization to deduce information about the object's position. Moreover, optical position sensors offer a range of benefits including high sensitivity, chemical inertness, lightweight, remote sensing, immunity to electromagnetic interference, wide dynamic range, and reliable operation among others. The aforementioned benefits of optical position sensors are key determinants for increasing its deployment in automotive, consumer electronics, aerospace & defense, healthcare and other industries.

Optical Position Sensor Market Insights :

Optical Position Sensor Market Dynamics - (DRO) :

Key Drivers :

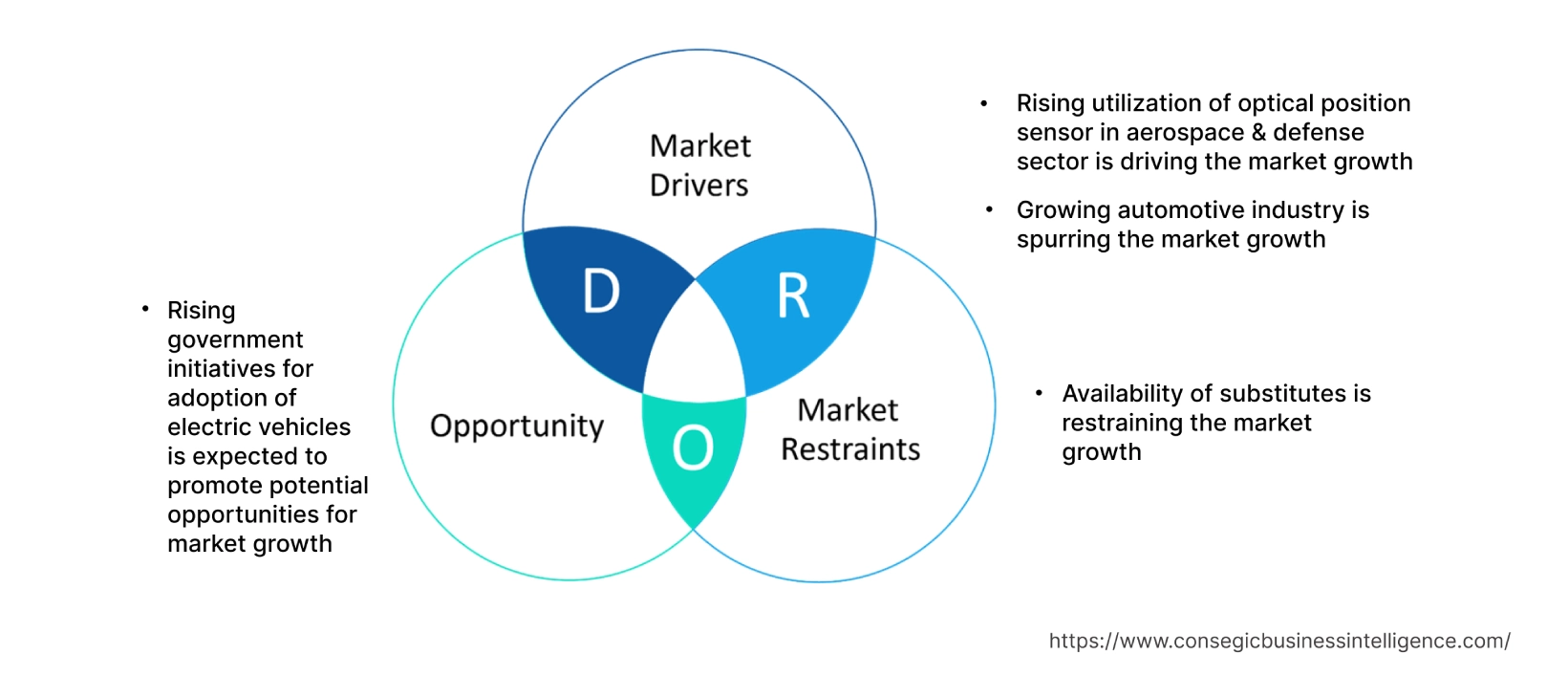

Rising utilization of optical position sensor in aerospace & defense sector is driving the market growth

Optical position sensors are primarily used in the aerospace & defense sector for applications ranging from commercial aircraft to military platforms. Optical position sensors are utilized for measuring the location of aircraft along with sensing the displacement of multiple aircraft components, including the deployment status of thrust reversers. Moreover, the characteristics of optical position sensors including high sensitivity, resistance to shock and vibrations, and others are prime aspects for increasing its utilization in aerospace & defense sector.

Factors including growing commercial flight activities, rising aircraft production, and increasing investments in air defense systems are fostering the growth of the aerospace & defense sector.

For instance, Boeing, a U.S.-based airline company, delivered 99 commercial jets in the fourth quarter of 2021, witnessing a significant increase of 68% as compared to 59 deliveries in the fourth quarter of 2020.

Additionally, Boeing delivered 340 commercial aircraft in 2021, depicting a significant growth of over 100% as compared to 157 aircraft deliverables in 2020. Thus, the growth of aerospace & defense sector is increasing the adoption of optical position sensors for measuring the aircraft location along with sensing the displacement of multiple aircraft components, in turn driving the growth of the market.

Growing automotive industry is spurring the market growth

Optical position sensor is used in the automotive industry for applications including LiDAR and ADAS (advanced driver-assistance systems) applications among others. Optical position sensors are primarily used in applications involving steering wheel for measurement of the angle. Moreover, optical position sensors are used in automobiles to help keep the vehicle in a certain location or trajectory by ensuring that the vehicle stays within its lane, or within a selected area. Additionally, optical position sensors are also used for keeping track of automobiles in close proximity to prevent collisions.

Factors including the increasing production of automobiles, advancements in autonomous driving systems, and growing need for enhanced automobile sensor solutions and safety are driving the growth of the automotive industry.

According to the OICA (International Organization of Motor Vehicle Manufacturers), the overall automotive production across the world reached 85.01 million in 2022, witnessing a growth of approximately 6% in comparison to 80.14 million in 2021.

Furthermore, according to the European Automobile Manufacturers Association, the production of passenger cars in the Europe Union reached up to 10.9 million in 2022, witnessing an incline of 8.3% in comparison to 2021. Hence, the growing automotive industry is increasing the adoption of optical position sensor for utilization in aforementioned applications, in turn proliferating the market growth.

Key Restraints :

Availability of substitutes is restraining the market growth

Optical position sensors have various substitutes such as magnetic position sensors, ultrasonic position sensors, and others. Comparatively, the substitutes have similar performance, properties, and applications, with respect to optical position sensors, which is a key factor restricting the market growth.

For instance, magnetic position sensor act as an ideal alternative to optical position sensors for application in automotive, electronics, aerospace & defense, and other related industries. Moreover, magnetic position sensor is a suitable alternative to optical position sensors in cases where dust, dirt, humidity, and other contaminants impairing the performance of optical sensors are an application concern.

Additionally, magnetic position sensors offer a range of benefits as compared to optical position sensors including reliable detection through various materials, large sensing ranges, longer operating periods, and others. Therefore, the availability of multiple substitutes for optical position sensors is limiting the growth of the market.

Future Opportunities :

Rising government initiatives for adoption of electric vehicles is expected to promote potential opportunities for market growth

The rising government initiatives for manufacturing and adoption of electric vehicles (EVs) are expected to present potential opportunities for the growth of the optical position sensor market. Optical position sensors are often used in electric vehicles for applications involving steering wheel for measurement of the angle along with automotive LIDAR and ADAS applications among others.

Factors including the advent of electro-mobility, availability of a wide range of models, accessibility of tax rebates and subsidies, and eco-friendliness are driving the adoption of electric vehicles. For instance, tax benefits and purchase incentives for electric vehicles are available in 21 countries listed in the European Union including Austria, Belgium, Netherlands, Poland, Spain, Ireland, and other countries as of 2022.

Furthermore, governments worldwide are framing policies and initiative for reducing pollution and increasing the deployment of electric vehicles, which is anticipated to stimulate the adoption of EVs.

Therefore, rising government initiatives for adoption of electric vehicles are projected to increase the integration of optical position sensors in EVs, in turn fostering opportunities for market growth during the forecast period.

Optical Position Sensor Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 6,101.94 Million |

| CAGR (2023-2030) | 10.50% |

| By Type | One Dimensional Optical Position Sensors, Two Dimensional Optical Position Sensors, and Multi-Axial Optical Position Sensors |

| By End-User | Automotive, Consumer Electronics, Aerospace & Defense, Healthcare, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Hamamatsu Photonics K.K., Micro-Epsilon, Sensata Technologies Inc., Sharp Corporation, TE Connectivity, Panasonic Corporation, Opto Diode Corporation, Siemens, Melexis, Optoi Srl |

Optical Position Sensor Market Segmental Analysis :

By Type :

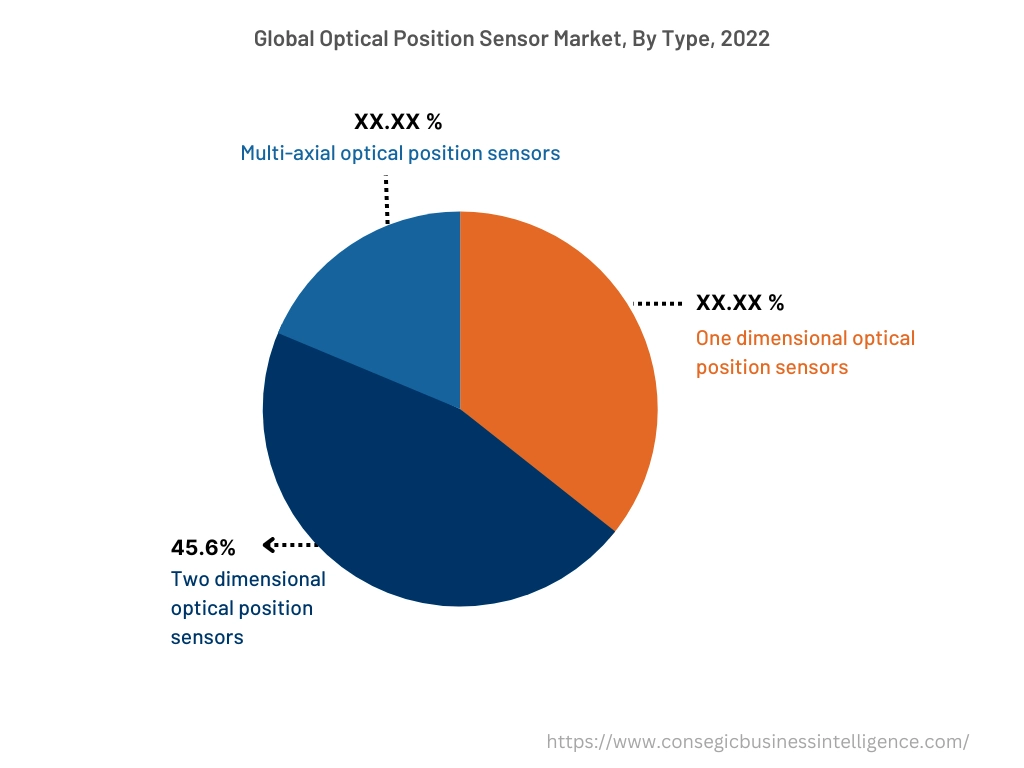

Based on the type, the market is bifurcated into one dimensional optical position sensors, two dimensional optical position sensors, and multi-axial optical position sensors. The two dimensional optical position sensors segment accounted for the largest revenue share of 45.6% in the year 2022. Two dimensional optical position sensors utilize photodiode surface resistance for measuring the two-dimensional position of an object. The working principle of two dimensional optical position sensors is established on the phototransistor effect and sensing changes in reflected light intensity when an object moves between two settings.

Moreover, two dimensional optical position sensors offer several benefits including high position resolution, lower dark current, high-speed response, easy bias application, improved position detection, lower fabrication cost, and others. The above benefits of two dimensional optical position sensors are increasing its application in automotive, aerospace & defense, and healthcare sectors among others.

According to the European Medical Technology Industry, the medical device sector in the U.S. and Europe accounted for 43.5% and 27.3% of the total share of the global medical device sector in 2021. It further states that the medical device sector in Germany accounted for 25.8% of the total share of the European medical device industry in 2021, followed by France with 14.3%, UK with 10.4%, Italy with 9.0%, and Netherlands with 6.4% among others. Thus, the rising production of medical devices is among the key factors driving the adoption of two dimensional optical position sensors for sensing the angular position and capturing the velocity and acceleration during medical imaging applications, in turn contributing to the growth of the market.

The one dimensional optical position sensors segment is anticipated to register fastest CAGR growth during the forecast period. One-dimensional optical position sensors include a long, narrow photosensitive area and are capable of detecting positions in a longitudinal direction. Moreover, one-dimensional optical position sensors offer various benefits including high reliability, excellent position detection resolution, high inter-electrode resistance, and others. The above benefits of one-dimensional optical position sensors make it ideal for utilization in electronics, automotive, and other industries.

For instance, according to the Brazilian Electrical and Electronics Industry Association (ABINEE), the electrical and electronics industry in Brazil was valued at USD 42.2 billion in 2022, witnessing a growth of nearly 8% in comparison to USD 39.2 billion in 2021. One-dimensional optical position sensors are often employed in electronics industry for applications including optical proximity switches, auto-focus camera systems, distance measurement, and other related applications. Therefore, rising production from electronics sector is anticipated to drive the market growth during the forecast period.

By End-User :

Based on the end-user, the market is segregated into automotive, consumer electronics, aerospace & defense, healthcare, and others. The aerospace & defense segment accounted for the largest revenue share in the year 2022. Factors including the growing commercial flight activities, rising aircraft production, and increasing investments in air defense systems are driving the growth of the aerospace & defense sector.

For instance, in December 2022, Dassault Aviation, a French manufacturer of business jets and military aircraft, launched a Rafale fighter aircraft for its application in the French military procurement agency called the Directorate General of Armaments. Therefore, the growth of aerospace & defense sector is driving the adoption of optical position sensors for measuring the aircraft location along with sensing the displacement of multiple aircraft components, in turn proliferating the growth of the market.

Automotive segment is expected to witness fastest CAGR growth during the forecast period. The growth of automotive segment is attributed to several factors including rising investments in expansion of automotive manufacturing facilities, increasing automobile production of automobiles, and advancements in autonomous driving systems.

For instance, according to the China Association of Automobile Manufacturers, the total production of passenger cars in China reached up to 14.8 million units in January-August 2022, depicting a YoY growth of 14.7%. Optical position sensor is primarily used in the automotive industry for applications including LIDAR and ADAS applications among others. Thus, the rising automotive production is projected to drive the adoption of optical position sensors, in turn driving the growth of the market during the forecast period.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

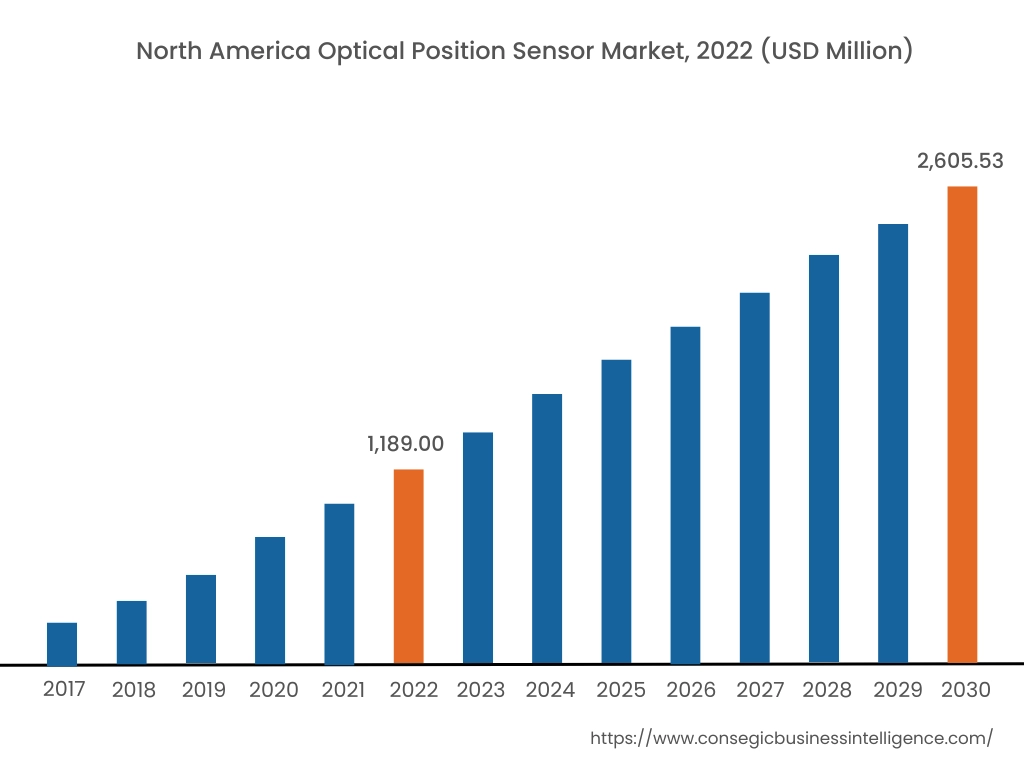

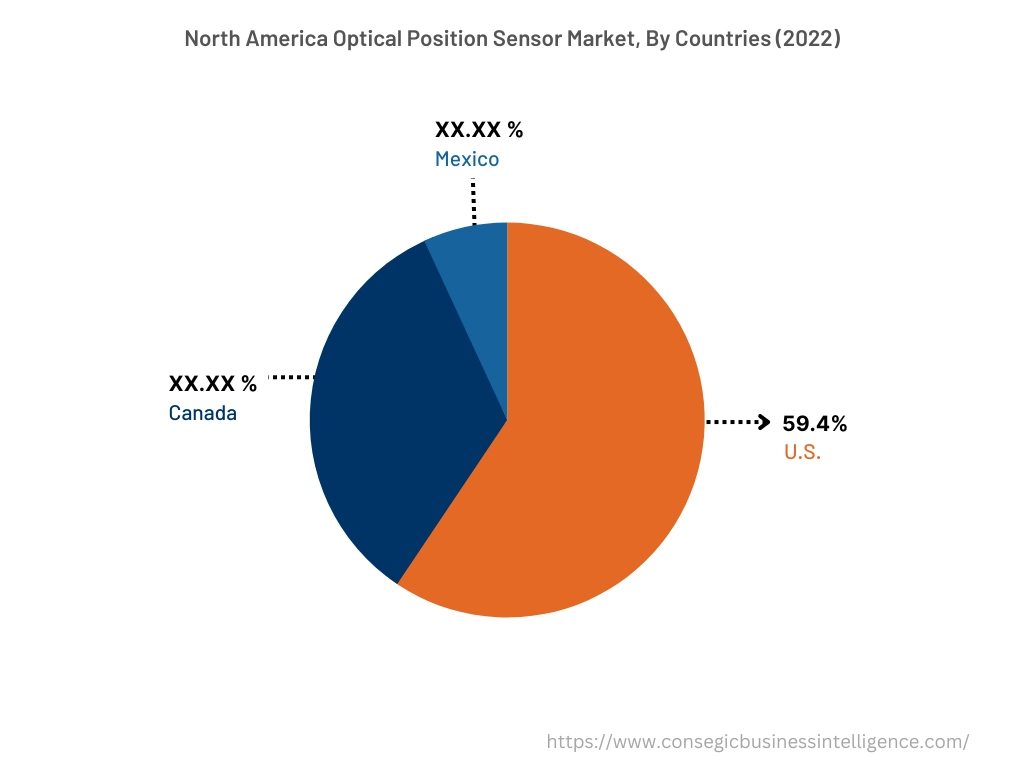

North America accounted for the largest revenue share of USD 1,189.00 Million in 2022 and is expected to reach USD 2,605.53 Million by 2030, registering a CAGR of 10.5% during the forecast period. In addition, in the region, the U.S. accounted for the maximum revenue share of 59.4% in the same year. The adoption of optical position sensors in the North American region is primarily driven by its usage in automotive, aerospace & defense, healthcare, and other sectors. Additionally, North America has been a prime hub for companies related to autonomous vehicle manufacturing. The increasing application of optical position sensors in automobile LIDAR and advanced driver assistance system is among the significant factors driving the market growth in the region. For instance, according to the OICA (International Organization of Motor Vehicle Manufacturers), the automobile production in North America reached 14,798,146 units in 2022, witnessing a growth of around 10% from 13,467,065 units in 2021. The above factors are fostering the growth of the optical position sensor market in the North American region. Additionally, rising investments in medical imaging and electric vehicles are anticipated to provide lucrative growth aspects for the market in North America during the forecast period.

Asia-Pacific is expected to register fastest CAGR growth of 10.7% during the forecast period. The growing pace of industrialization and development is creating lucrative growth aspects for the market in the region. Moreover, factors including the growth of multiple industries such as consumer electronics, automotive, and others are fostering the market growth for optical position sensors in the Asia-Pacific region.

For instance, according to the India Brand Equity Foundation, the consumer electronics sector in India was valued at USD 9.84 billion in 2021, and it is projected to grow at a considerable rate to reach USD 21.18 billion by 2025. Hence, the growing consumer electronics sector is anticipated to drive the utilization of optical position sensors for applications including optical proximity switches, auto-focus camera systems, and others, thereby, proliferating the market growth in the Asia-Pacific region during the forecast period.

Top Key Players & Market Share Insights:

The optical position sensor market is highly competitive with major players providing optical position sensor to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and application launches to hold a strong position in optical position sensor market. Key players in the optical position sensor market include-

- Hamamatsu Photonics K.K.

- Micro-Epsilon

- Siemens

- Melexis

- Optoi Srl

- Sensata Technologies Inc.

- Sharp Corporation

- TE Connectivity

- Panasonic Corporation

- Opto Diode Corporation

Recent Industry Developments :

- In May 2022, Micro-Epsilon launched its new optoelectronic CLS1000 optical sensor series. The optical sensors are designed for reliable position control along with position and presence detection.

Key Questions Answered in the Report

What is optical position sensor? +

Optical position sensors refer to a type of sensor that is capable of detecting the object’s movement & converting it into signals that are appropriate for transmission, control, or processing.

What specific segmentation details are covered in the optical position sensor report, and how is the dominating segment impacting the market growth? +

For instance, by type segment has witnessed two dimensional optical position sensors as the dominating segment in the year 2022, owing to its increasing utilization in automotive, aerospace & defence, and healthcare sectors among others.

What specific segmentation details are covered in the optical position sensor market report, and how is the fastest segment anticipated to impact the market growth? +

For instance, by end-user segment has witnessed automotive as the fastest-growing segment during the forecast period due to the rising adoption of optical position sensors in automotive LIDAR and ADAS applications.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Asia-Pacific is anticipated to register fastest CAGR growth of 10.7% during the forecast period due to rapid pace of industrialization and growth of multiple industries such as consumer electronics, automotive, aerospace & defence, and others.