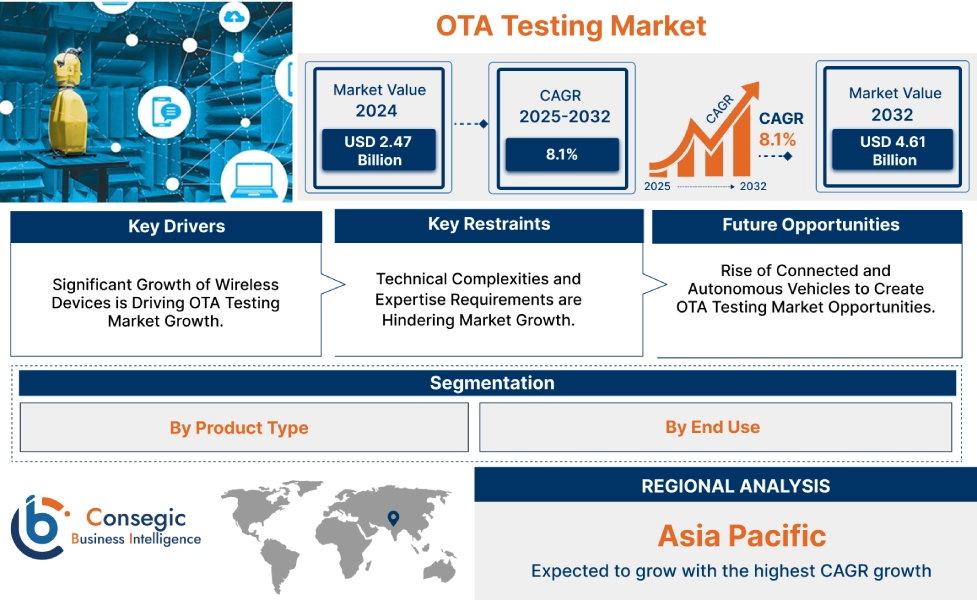

OTA Testing Market Size:

The OTA Testing Market size is growing with a CAGR of 8.1% during the forecast period (2025-2032), and the market is projected to be valued at USD 4.61 Billion by 2032 from USD 2.47 Billion in 2024. Additionally, the market value for 2025 is attributed to USD 2.67 Billion.

OTA Testing Market Scope & Overview:

OTA (Over-the-Air) testing is a process for evaluating the performance of wireless communication devices, assessing how they transmit and receive signals in simulated real-world conditions. As opposed to traditional wired testing, OTA accounts for the crucial impact of the device's integrated antenna, its physical design, and environmental factors on signal quality and overall functionality. This approach is essential for modern wireless products such as smartphones, connected cars, and IoT devices, ensuring they meet performance standards, regulatory compliance, and deliver superior user experience in complex wireless environments.

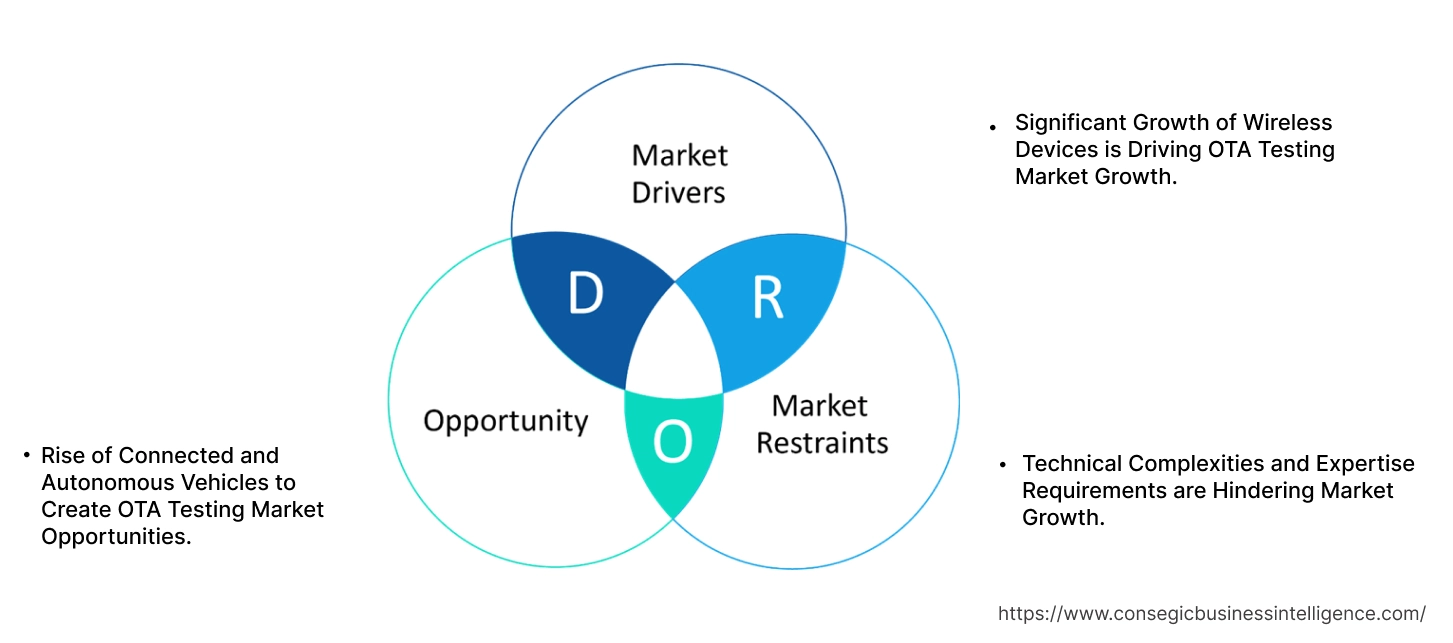

OTA Testing Market Dynamics - (DRO) :

Key Drivers:

Significant Growth of Wireless Devices is Driving OTA Testing Market Growth.

The significant rise in the number and complexity of wireless devices, such as smartphones, IoT devices amongst other acts as a primary factor, driving the market. As more devices integrate multiple wireless technologies, traditional wired testing becomes insufficient. OTA testing, by evaluating real-world performance without physical connections, is important to ensure these devices meet performance standards, achieve regulatory compliance, and provide the seamless, high-quality connectivity expected by the consumers across the globe.

- For instance, according to Exploding Topics, the number of active Internet of Things (IoT) devices has almost doubled from 10 billion in 2019 to an 18.8 billion by 2024.

Hence, due to the aforementioned factors, the growing adoption of wireless devices is driving OTA testing market growth.

Key Restraints:

Technical Complexities and Expertise Requirements are Hindering Market Growth.

Testing advanced technologies such as 5G mmWave, massive MIMO, and integrated antennas requires intricate knowledge of RF engineering, antenna theory, and complex communication protocols. Furthermore, the need for substantial investment in specialized infrastructure such as anechoic chambers and high-end RF equipment, along with the time-consuming nature of these precise measurements are creating a big hurdle for new players to enter. This barrier regarding the complexity and the scarcity of qualified professionals limits broader adoption and drives up costs, restraining the market's full potential. These aforementioned factors are contributing to hindrances in the OTA testing market expansion.

Future Opportunities :

Rise of Connected and Autonomous Vehicles to Create OTA Testing Market Opportunities.

The sector of connected and autonomous vehicles is driven by the need for robust and reliable wireless communication for these advanced systems. As vehicles transition into software-defined platforms relying on continuous OTA updates for safety, features, and security, comprehensive OTA validation becomes vital. Furthermore, the reliance on V2X (Vehicle-to-Everything) communication for autonomous driving and the integration of multiple wireless technologies within an automotive environment, demand specialized OTA testing thereby creating lucrative potential.

- For instance, according to Pinsent Masons, it is estimated that all new cars sold in the UK will be network-connected by 2025.

Thus, as per analysis, the rise of connected and autonomous vehicles is expected to create OTA testing market opportunities.

OTA Testing Market Segmental Analysis :

By Component Type:

Based on Component Type, the market is categorized into solutions and services.

Trends in Component Type:

- The focus of manufacturers is towards investing in in-house OTA testing capabilities or upgrading existing ones to handle the high volume of wireless devices.

The solutions segment accounted for the largest OTA testing market share in 2024.

- The solutions segment, including the hardware and software components such as anechoic chambers, RF test equipment, and specialized automation software utilize OTA testing at a higher magnitude. The growing market for components further supports segment revenue.

- For instance, according to IT Brief Asia, the anechoic chamber market grew at a CAGR of more than 15% from 2023 to 2024.

- Additionally, as wireless technologies grow in complexity and the need for in-house testing capabilities by major manufacturers continues to increase, the value of these advanced solutions becomes high.

- Thus, as per the market analysis, the solutions segment dominates the OTA testing market expansion.

The services segment is expected to grow at the fastest CAGR over the forecast period.

- The services segment is primarily driven by the escalating technical complexities of testing advanced wireless technologies, like 5G mmWave, and the persistent shortage of in-house expertise.

- This is further driven by the capital expenditure required for OTA testing solutions, leading to many companies looking to outsource. By utilizing specialized third-party providers, businesses focus on core competencies, thereby achieving a faster time-to-market.

- Thus, based on OTA testing market analysis, the services segment is expected to grow at the fastest CAGR over the forecast period.

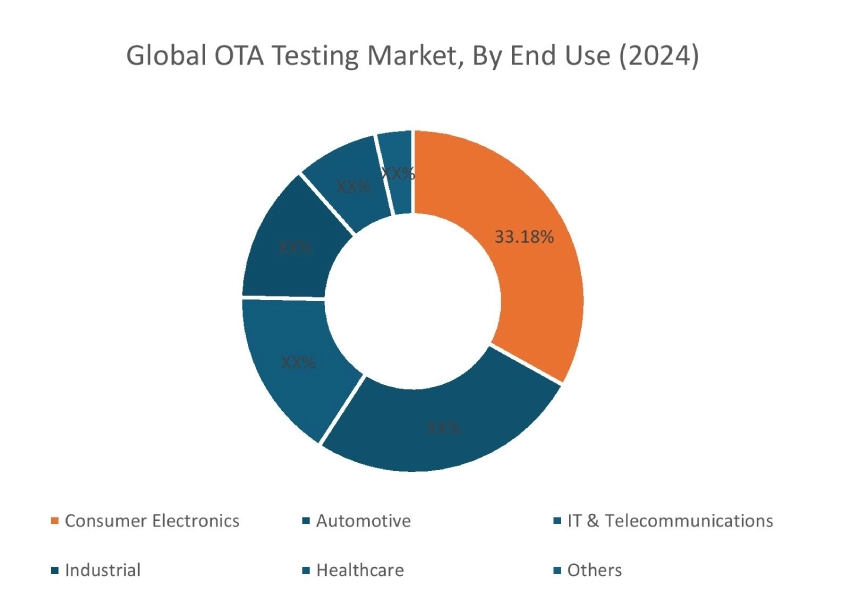

By End Use:

Based on End Use, the market is categorized into consumer electronics, automotive, IT & telecommunications, industrial, healthcare, and others.

Trends in the End Use

- The trend of integration of 5G capabilities and advanced Bluetooth standards into consumer electronic devices require OTA testing across diverse networks is rising.

- The focus of IT & telecommunications towards ensuring seamless interoperability between different network components, leading to an OTA testing for new and upgraded equipment is growing trend.

The consumer electronics segment accounted for the largest OTA testing market share of 33.18% in 2024.

- Consumer electronics holds dominance due to the strong volume of wireless consumer devices produced on a yearly basis.

- For instance, according to India Business Trade, Indian consumer electronics market experienced a growth rate of more than 6% in terms of volume in the first half of FY 2023.

- In addition to this, the rapid innovation cycles and the integration of multiple complex wireless technologies are further contributing to the segment’s revenue.

- As users demand flawless connectivity from their ever-miniaturizing gadgets, OTA testing becomes vital aspect for optimizing performance, ensuring regulatory compliance, and meeting high consumer expectations.

- Thus, based on market analysis, the consumer electronics segment dominated the market share.

The automotive segment is expected to grow at the fastest CAGR over the forecast period.

- The automotive segment is driven by the growing shift towards Software-Defined Vehicles (SDVs), where a car's functionality is governed by intricate software. This requires continuous OTA software for performance enhancements and security patches.

- Furthermore, the high adoption of connected cars and the advancements in autonomous driving systems depend on robust, low-latency Vehicle-to-Everything (V2X) communication.

- Moreover, the trend of integration of cutting-edge wireless technologies into these complex vehicular ecosystems requires specialized and rigorous OTA testing for seamless data exchange and reliable operation in dynamic, real-world conditions.

- Thus, based on market analysis, the automotive segment is expected to grow at the fastest CAGR over the forecast period.

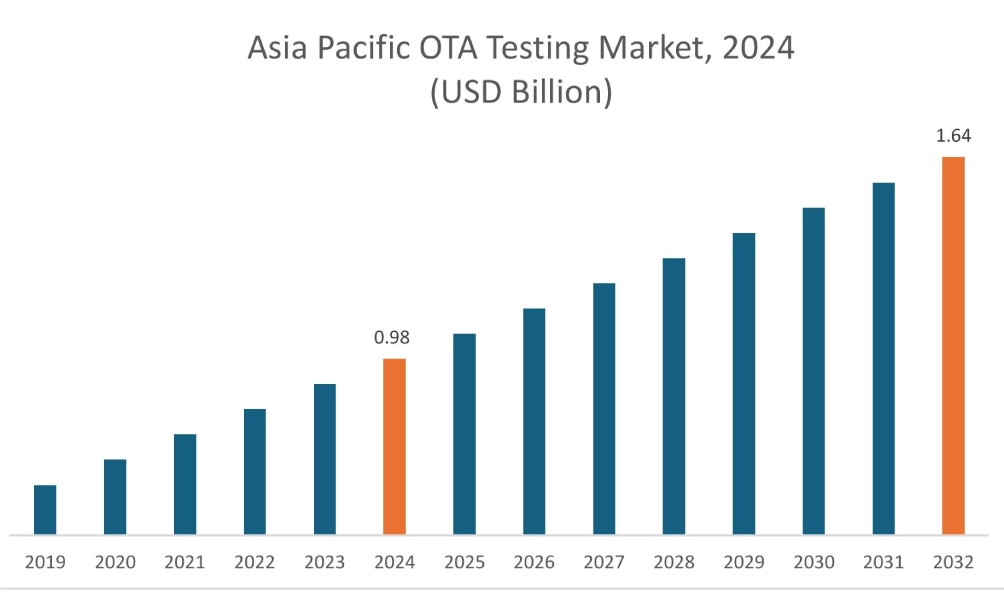

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

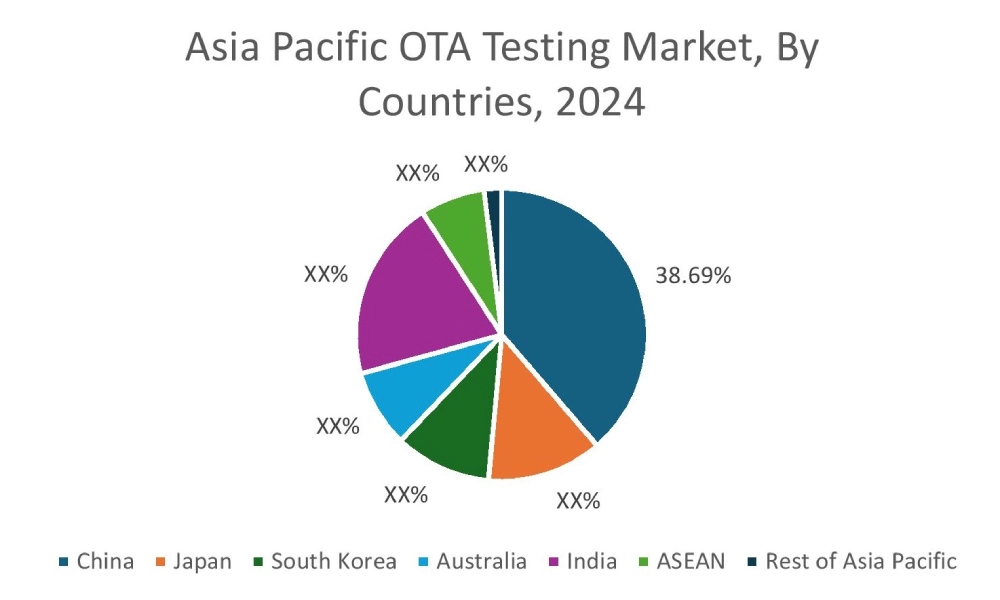

In 2024, Asia Pacific accounted for the highest market share at 39.78% and was valued at USD 0.98 Billion and is expected to reach USD 1.64 Billion in 2032. In Asia Pacific, China accounted for a market share of 38.69% during the base year of 2024. The region's significant share in wireless devices is one of the major factors contributing to the OTA testing market demand. Additionally, the expanding consumer base, particularly in nations such as China and India, leading to a widespread adoption of smartphones, wearables, and smart home devices is supporting the regional revenue. As a global manufacturing hub, APAC's concentration of leading OEMs and its deployment of 5G, further requires extensive OTA validation.

- For instance, according to Canalys, Mainland China's smartphone market shipped more than 250 million units in 2024 showcasing a moderate growth rate of 4% from past two years.

Thus, as per the OTA testing market analysis, these factors create a strong upward trajectory for the Asia Pacific market, positioning it as a key region for players.

In Europe, the OTA testing industry is experiencing the fastest growth with a CAGR of 10.7% over the forecast period. The rise of connected and autonomous vehicles is driving the OTA testing market demand in Europe, due to the region’s robust automotive industry, stringent regulatory environment, and strategic digital initiatives. Europe's leading OEMs are investing in connected and autonomous technologies, directly contributing to the need for advanced OTA testing. This demand is further intensified by the UNECE regulations, such as R156 for Software Update Management Systems and R155 for Cybersecurity Management Systems, which effectively mandate secure OTA update capabilities and robust cybersecurity throughout a vehicle's lifecycle, requiring rigorous testing for compliance.

The North American OTA testing market trend is experiencing rise, due to the focus on investments regarding 5G and the trend into 6G technologies. As North America leads global 5G adoption, with 289 million connections and 77% population coverage in 2024, the widespread deployment of complex mmWave frequencies and massive MIMO systems necessitates OTA testing to validate beamforming capabilities and ensure robust performance. Furthermore, North American academic institutions and industry leaders are heavily investing in 6G R&D, pushing wireless communication into higher sub-terahertz and terahertz frequency ranges. This will demand new OTA testing methodologies and equipment to validate integrated functionalities.

The expansion of smart city initiatives throughout the Middle East and Africa represents an opportunity for the market, due to the increasing government initiatives and rapid urbanization. Mega-projects, such as Saudi Arabia's NEOM and Dubai's Smart City initiatives, involve the extensive deployment of wirelessly connected devices for smart utilities, transportation, public safety, and more, all requiring OTA testing to ensure reliable connectivity and optimal performance in challenging urban environments driving the need for comprehensive OTA testing in the region.

The Latin American OTA testing market trend is towards the increasing adoption of cloud-based testing platforms, a preference due to the region's unique economic landscape. These platforms offer crucial cost efficiency, allowing businesses to overcome the upfront capital expenditure associated with traditional OTA lab setups. Offering on-demand scalability and remote accessibility, cloud solutions enable flexible resource management and foster enhanced collaboration among geographically dispersed teams. Overall, cloud-based platforms contribute to the region’s growth over the forecast period.

Top Key Players and Market Share Insights:

The global OTA testing market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global OTA testing market. Key players in the OTA testing industry include

- Anritsu (Japan)

- Rohde & Schwarz (Germany)

- UL LLC (U.S.)

- Intertek Group plc (UK)

- Keysight Technologies (U.S.)

- ETS-Lindgren (U.S.)

- Bluetest AB (Sweden)

- TÜV Rheinland (Germany)

- SGS Société Générale de Surveillance SA. (Switzerland)

OTA Testing Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 4.61 Billion |

| CAGR (2025-2032) | 8.1% |

| By Component Type |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the OTA Testing Market? +

In 2024, the OTA Testing Market is USD 2.47 Billion.

Which is the fastest-growing region in the OTA Testing Market? +

Europe is the fastest-growing region in the OTA Testing Market.

What specific segmentation details are covered in the OTA Testing Market? +

By Component Type and End Use segmentation details are covered in the OTA Testing Market.

Who are the major players in the OTA Testing Market? +

Anritsu (Japan), Rohde & Schwarz (Germany), Keysight Technologies (U.S.), ETS-Lindgren (U.S.), Bluetest AB (Sweden) are some of the major players in the market.