Video as a Sensor Market Size:

Video as a Sensor Market size is estimated to reach over USD 135.36 Billion by 2032 from a value of USD 69.75 Billion in 2024 and is projected to grow by USD 74.32 Billion in 2025, growing at a CAGR of 7.8% from 2025 to 2032.

Video as a Sensor Market Scope & Overview:

Video as a sensor, also known as VaaS, refers to the concept of capturing and clarifying visual data in real time, which is enhanced by AI (artificial intelligence) in computer vision. Moreover, these smart video systems are integrated with smart technologies that capture, transmit, and process automated responses depending on the application. Additionally, VaaS solutions are primarily used in commercial, residential, government & defense, and industrial sectors, which are further driving the global video as a sensor market.

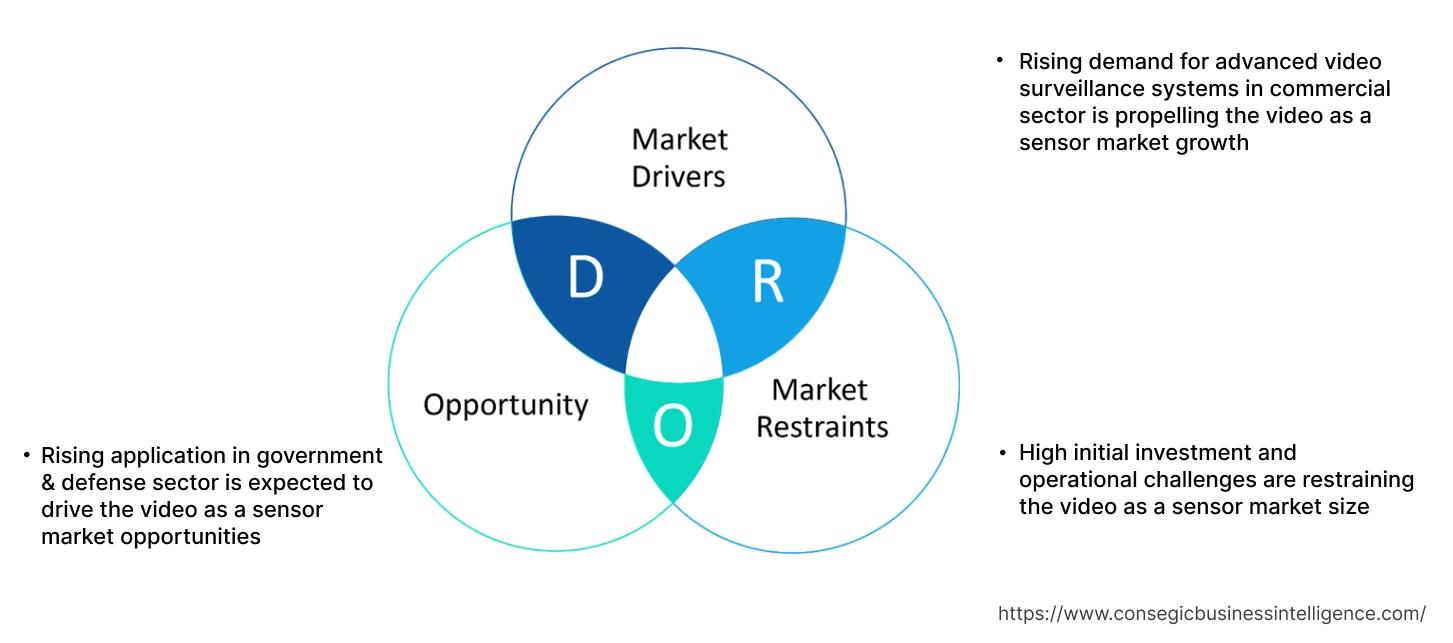

Video as a Sensor Market Dynamics - (DRO) :

Key Drivers:

Rising demand for advanced video surveillance systems in commercial sector is propelling the video as a sensor market growth.

Video surveillance systems utilize video cameras as sensors to monitor and record activity, which enhances security and provides valuable data for various applications. Video surveillance plays a crucial role in the commercial sector, including retail, banking, healthcare, and others, for real-time monitoring and surveillance applications. Moreover, the utilization of video surveillance systems in the retail sector enables retailers to optimize store layouts and product placements by tracking customers’ journeys, evaluating routes, and detecting walking patterns. Similarly, video surveillance systems help retailers in monitoring product stock levels in real-time, restocking products based on demand while preventing out-of-stock situations, and maximizing sales. Additionally, video surveillance plays a significant role in improving the overall security of retail stores by leveraging intelligent video surveillance monitoring and reducing the risk of theft and losses.

Further, video surveillance system is often utilized in banking firms for monitoring all their branches and ATM locations remotely around the clock. Video surveillance systems help banking firms increase safety and situational awareness by leveraging their existing surveillance networks to monitor and respond to events, as well as search and filter videos for accelerating post-event investigations.

- For instance, in September 2023, Ralph Lauren Corporation launched its first retail store in Canada, as a part of the company’s expansion strategy. The store is located in Yorkdale Shopping Centre in Toronto and adds to the brand’s existing outlet presence in the country. The corporation has 12 Ralph Lauren outlet stores in Canada along with wholesale presence at retailers including Harry Rosen, Hudson’s Bay, and others.

Hence, the growing need for advanced video surveillance systems in the commercial sector, including retail, banking, healthcare, and others is propelling the video as a sensor market expansion.

Key Restraints:

High initial investment and operational challenges are restraining the video as a sensor market size

The implementation of video surveillance systems utilizing video cameras as sensors is often associated with certain operational limitations and challenges, which are among the key factors restraining the market. For instance, VaaS solutions are often associated with high initial investment and implementation costs. The system also requires additional ongoing costs related to maintaining and upgrading the system hardware and software, as well as training employees for its effective utilization.

Moreover, VaaS solutions integrating video cameras as sensors can be quite complex and challenging to implement, particularly for small businesses with limited IT and financial resources, as the software usually requires a certain degree of customization and integration with existing systems, which can be costly and time-consuming. Additionally, data privacy concern is a significant limitation in VaaS solutions, specifically when dealing with personally identifiable data or sensitive information. Therefore, the aforementioned factors are hindering the market growth.

Future Opportunities :

Rising application in government & defense sector is expected to drive the video as a sensor market opportunities.

Video surveillance systems utilizing cameras as a sensor have been transforming the manner in which government and defense agencies monitor public spaces, respond to critical situations and emergencies, and secure infrastructure. The integration of VaaS solutions enables government agencies to obtain valuable information from the surveillance footage, undertake data-driven decisions, and drive impactful results. Moreover, the utilization of VaaS solutions enables government and defense personnel to commence proactive threat detection and swift response to critical situations and emergencies. Further, the adoption of VaaS solutions in the government and defense sector provides several benefits, including improved public safety, efficient resource management, preventive action against possible incidents, and facilitation of extensive perimeter surveillance among others.

- For instance, according to the European Defense Agency, the general budget for the European Defence Agency was valued at USD 54,095.5 million in 2024, witnessing an increase of 11.1% in comparison to USD 48,704.4 million in 2023.

Hence, the rising investments in the government & defense sector are projected to increase the adoption of VaaS solutions, in turn driving the video as a sensor market opportunities during the forecast period.

Video as a Sensor Market Segmental Analysis :

By Camera Type:

Based on camera type, the market is segmented into IP, thermal, machine vision, and hyperspectral.

Trends in the camera type:

- There is a rising trend towards the adoption of thermal camera type due to increasing security concerns, which is further driving the market.

- Increasing adoption of hyperspectral camera, due to increasing advancements in artificial intelligence and machine learning is driving the video as a sensor market growth.

Thermal segment accounted for the largest revenue share in the overall video as a sensor market share in 2024.

- Thermal cameras, also known as infrared cameras, are devices that capture and display images based on infrared radiation emitted by objects.

- Moreover, thermal cameras can operate in complete darkness, making them useful for identifying objects or people in various environments.

- For instance, Fluke Corporation offers a wide range of thermal cameras, including handles, articulated, and mountain options, which provide high-resolution thermal images with features such as focus options, temperature measurement accuracy, and others.

- Therefore, the rising advancements related to thermal cameras are driving the market growth.

Hyperspectral segment is anticipated to register a substantial CAGR growth during the forecast period.

- Hyperspectral cameras are devices that capture a series of images, creating a 4D data cube for detailed material identification.

- Moreover, these cameras have a wide range of applications, including remote sensing, medical imaging, industrial inspection, and others.

- For instance, in January 2025, Pixel launched a hyperspectral satellite constellation, which is integrated with an advanced hyperspectral camera, enabling it to capture detailed spectral information.

- Hence, the above factors are projected to drive the video as a sensor market size during the forecast period.

By Sensor Type:

Based on sensor type, the market is segmented into charged coupled device (CCD) and complementary metal oxide semiconductor (CMOS).

Trends in the sensor type:

- Increasing adoption of CMOS sensors due to its high resolution, high sensitivity, enhanced dynamic range, and improved frame rates is driving the market.

- Factors including high-resolution colour imaging, integrated AI-powered video analytics, and others are further driving the segment development.

Complementary metal oxide semiconductor (CMOS) segment accounted for the largest revenue share in the overall market in 2024, and it is anticipated to register a substantial CAGR growth during the forecast period.

- A complementary metal oxide semiconductor is an electronic chip that converts photons to electrons, which are widely used in various types of integrated systems.

- Moreover, CMOS sensors offer a wide range of benefits including high resolution, high sensitivity, enhanced dynamic range, and improved frame rates among others.

- For instance, in April 2025, OMNIVISION announced the launch of its latest OV50X model of CMOS sensors, which offers a high dynamic range for video capturing and premium image quality in a compact form.

- Thus, the rising advancements associated with CMOS sensors are projected to drive the video as a sensor market trends during the forecast period.

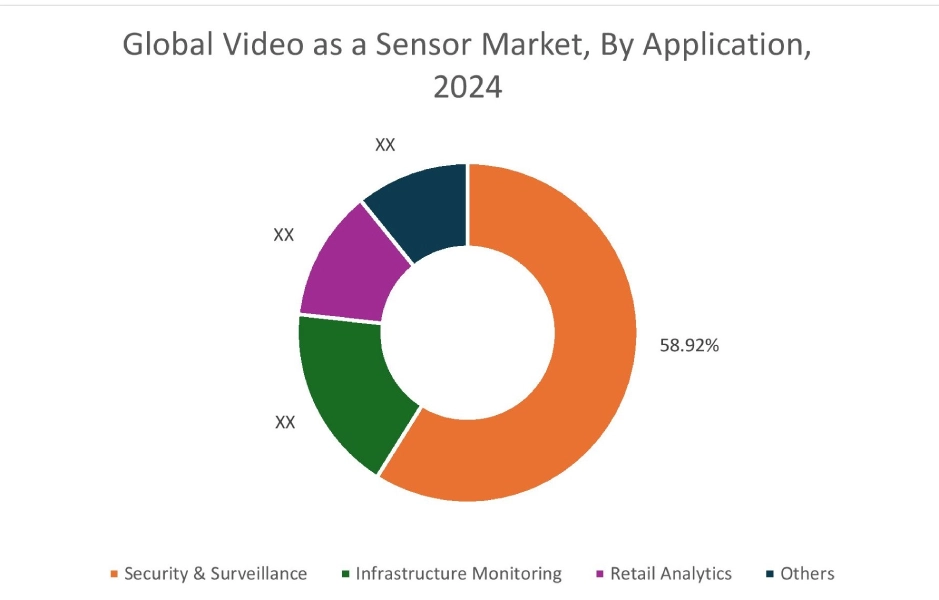

By Application:

Based on application, the market is segmented into security & surveillance, infrastructure monitoring, retail analytics, and others.

Trends in the application:

- There is a rising trend towards the adoption of advanced imaging systems, which is further driving the market.

- Increasing trend in adoption of edge computing and AI-powered video analytics is driving the market.

Security & surveillance segment accounted for the largest revenue share of 58.92% in the overall market in 2024, and it is anticipated to register a significant CAGR growth during the forecast period.

- Video surveillance systems use cameras as sensors to capture visual data to detect events, track individuals, and provide evidence for investigations.

- Moreover, smart security surveillance cameras are integrated with high-resolution cameras, artificial intelligence, and internet of things (IoT) to provide real-time data management.

- For instance, Senstar offers video as a sensor solution for security surveillance, which provides video management systems including intelligent video analytics and integration with other security sensors like perimeter intrusion detection systems.

- Hence, according to the market analysis, the rising adoption of VaaS solutions in security & surveillance applications is driving the video as a sensor market trends.

By End User:

Based on end user, the market is segmented into commercial, residential, government & defense, and industrial.

Trends in the end user:

- Increasing adoption of VaaS solutions in commercial sector, including retail, banking, healthcare, hospitality, and others, for facilitating real-time video monitoring and surveillance applications.

- There is a rising trend towards the utilization of VaaS solutions in the government & defense industry to support constant monitoring of public spaces, respond to critical situations and emergencies, as well as secure infrastructure.

Commercial segment accounted for the largest revenue in the overall video as a sensor market share in 2024.

- Video as a sensor solution plays a vital role in the commercial sector, including retail, banking, healthcare, hospitality, and others, for real-time monitoring and surveillance applications.

- The use of VaaS solutions in the retail sector enables retailers to optimize store layouts and product placements by tracking customer’s journeys, evaluating routes, and detecting walking patterns.

- Moreover, VaaS solutions help retailers in monitoring product stock levels in real-time, restocking products based on demand while preventing out-of-stock situations, and maximizing sales.

- Additionally, VaaS solutions are often utilized in banking firms for monitoring all their branches and ATM locations remotely around the clock.

- VaaS solutions also help banking firms increase safety and situational awareness by leveraging their existing surveillance networks to monitor and respond to events, along with assisting in searching and filtering videos for accelerating post-event investigations.

- Further, factors including rising investments in commercial sector, increasing development of retail, banking, healthcare, and other commercial facilities, along with growing demand for advanced video surveillance solutions for constant monitoring and improved operational efficiency and security, are among the key prospects driving the segment.

- Therefore, according to the market analysis, the above factors are driving the video as a sensor market.

The government & defense segment is anticipated to register the fastest CAGR growth during the forecast period.

- VaaS solutions have been transforming the manner in which government and defense agencies monitor public spaces, respond to critical situations and emergencies, and secure infrastructure.

- The integration of VaaS solutions enables government & defense agencies to obtain valuable information from the surveillance footage, undertake data-driven decisions, and drive impactful results.

- Moreover, the integration of VaaS solutions in the government and defense sector provides numerous benefits, including improved public safety, preventive action against possible incidents, efficient resource management, facilitation of extensive perimeter surveillance, and others.

- Hence, according to the video as a sensor market analysis, the growing government & defense sector is projected to boost the video as a sensor market during the forecast period.

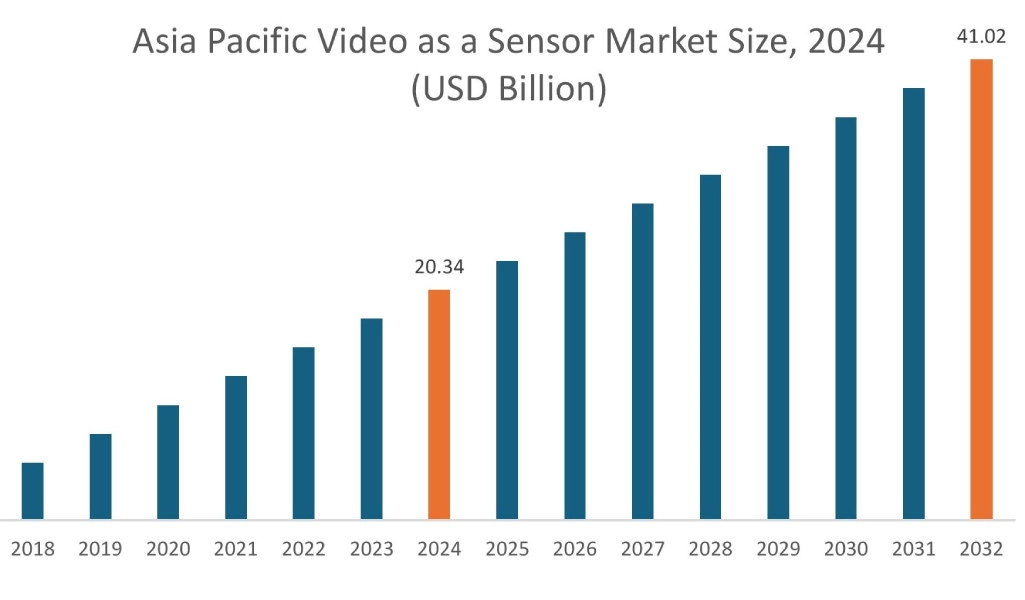

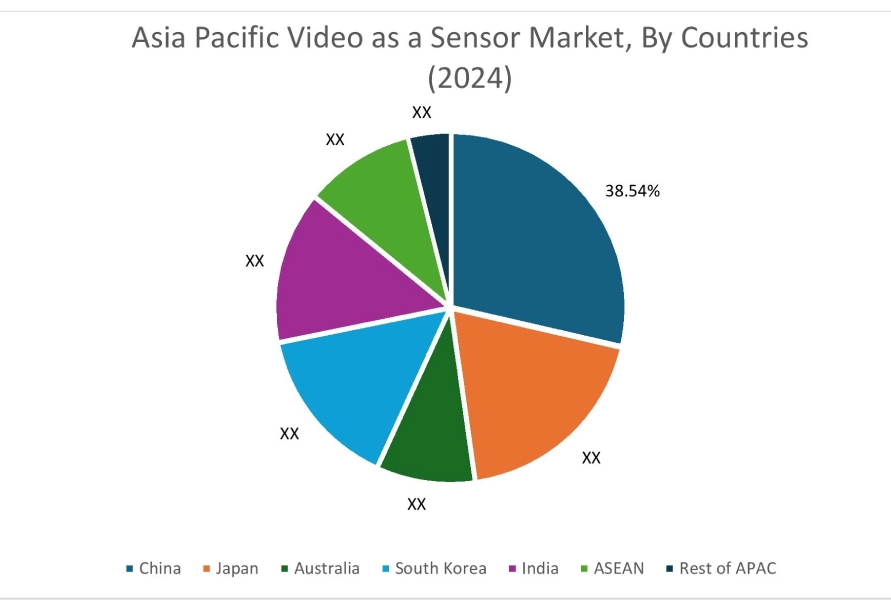

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 20.34 Billion in 2024. Moreover, it is projected to grow by USD 21.75 Billion in 2025 and reach over USD 41.02 Billion by 2032. Out of this, China accounted for the maximum revenue share of 38.54%. As per the video as a sensor market analysis, the adoption of VaaS solutions in the Asia-Pacific region is primarily driven by the rising government initiatives for smart cities and growing retail, transportation, healthcare, and BFSI sectors, among others. Additionally, the growing retail sector and increasing adoption of VaaS solutions among retail enterprises for facilitating real-time monitoring and surveillance along with streamlining retail operations are further accelerating the video as a sensor market expansion.

Thus, as per the Video as a Sensor Market analysis, these factors create a strong upward trajectory for the Asia Pacific market, positioning it as a key region for players.

North America is estimated to reach over USD 45.67 Billion by 2032 from a value of USD 23.59 Billion in 2024 and is projected to grow by USD 25.13 Billion in 2025. In North America, the market is driven by growing investments in banking, retail, government & defense, intelligent transportation, and industrial sectors. Moreover, the increasing adoption of VaaS solutions in the banking sector for monitoring employee interactions, checking workflow efficiency, and maintaining improved security and operational efficiency is further contributing to the video as a sensor market demand in the North American region.

Additionally, the regional analysis depicts that the growing healthcare, banking, defense, and other sectors and increasing adoption of CCTV cameras for surveillance purposes are driving the video as a sensor market demand in Europe. Further, as per the market analysis, the market in Latin America, Middle East, and African regions is expected to grow at a substantial rate due to several factors such as the increasing pace of urbanization, significant investments in government & defense sector, and growing need for advanced surveillance systems for improved public safety & security among others.

For instance, according to the India Brand Equity Foundation, the retail sector in India was valued at USD 1,200 billion in 2023, and it is projected to grow up to USD 2,500 billion by 2035. The above factors are anticipated to drive the market in the Asia-Pacific region during the forecast period.

For instance, according to Canalys, Mainland China's smartphone market shipped more than 250 million units in 2024 showcasing a moderate growth rate of 4% from past two years.

Top Key Players and Market Share Insights:

The global video as a sensor market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the video as a sensor industry. Key players in the video as a sensor industry include-

- Hangzhou Hikvision Digital Technology Co., Ltd. (China)

- Dahua Technology Co., Ltd (China)

- Sharp Corporation (Japan)

- NXP Semiconductors (Netherlands)

- L3Harris Technologies Inc. (U.S.)

- Avigilon (Motorola Solutions Inc.) (Canada)

- Honeywell International Inc. (U.S.)

- Axis Communications AB (Sweden)

- Sony Corporation (Japan)

- Teledyne Technologies Incorporated (U.S.)

Recent Industry Developments :

- In February 2025, Hikvision launched its new Pro series network cameras integrated with ColorVu 3.0 technology. The new cameras are designed to improve video security to exceptional levels while offering enhanced image quality, improved audio capabilities, more intelligent functions, and enhanced product design and materials.

Video as a Sensor Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 135.36 Billion |

| CAGR (2025-2032) | 7.8% |

| By Camera Type |

|

| By Sensor Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the video as a sensor market? +

The video as a sensor market was valued at USD 69.75 Billion in 2024 and is projected to grow to USD 135.36 Billion by 2032.

Which is the fastest-growing region in the video as a sensor market? +

Asia-Pacific is the region experiencing the most rapid growth in the video as a sensor market.

What specific segmentation details are covered in the video as a sensor report? +

The video as a sensor report includes specific segmentation details for camera type, sensor type, application, end user, and region.

Who are the major players in the video as a sensor market? +

The key participants in the video as a sensor market are Hangzhou Hikvision Digital Technology Co., Ltd. (China), Dahua Technology Co., Ltd (China), Avigilon (Motorola Solutions Inc.) (Canada), Honeywell International Inc. (U.S.), Axis Communications AB (Sweden), Sony Corporation (Japan), Teledyne Technologies Incorporated (U.S.), Sharp Corporation (Japan), NXP Semiconductors (Netherlands), L3Harris Technologies Inc. (U.S.) and others.