Portable Monitor Market Size:

Portable Monitor Market size is estimated to reach over USD 1,884.10 Million by 2032 from a value of USD 271.94 Million in 2024 and is projected to grow by USD 341.12 Million in 2025, growing at a CAGR of 23.8% from 2025 to 2032.

Portable Monitor Market Scope & Overview:

Portable monitors (or movable monitors) refer to lightweight, compact display screens that can be easily transported and connected to several devices, including laptops, tablets, smartphones, and gaming consoles, through HDMI, USB, or wireless connections. Additionally, the monitors are available in several display types including LCD, LED, and OLED. These monitors are designed to enhance the user experience by providing additional screens in various settings, ranging from entertainment to professional settings.

How is AI Transforming the Portable Monitor Market?

AI is playing a vital role in shaping the portable monitor market by enhancing functionality, user experience, and adaptability. AI-powered features enable these devices to automatically adjust brightness, contrast, and resolution based on ambient lighting and user activity, ensuring optimal display quality. In professional settings, AI enhances collaboration by supporting intelligent screen sharing, voice recognition, and seamless connectivity with multiple devices. For gaming and entertainment, AI-driven image processing improves refresh rates, reduces lag, and delivers smoother visuals. Additionally, AI helps optimize power consumption, extending battery life for on-the-go use. As demand for flexible and high-performance displays grows, AI integration is driving innovation and accelerating global adoption of portable monitors.

Portable Monitor Market Dynamics - (DRO) :

Key Drivers:

Rising remote/hybrid work culture is driving the portable monitor market growth

The rise of remote/hybrid work culture is significantly driving the demand for portable monitors. These monitors enable users to expand their home-office workspace, making it easier to multi-task, compare different documents, and improve overall productivity. Additionally, the adoption of these monitors for remote work setup offers increased convenience, flexibility, and mobility. As a result, the rising remote/hybrid work culture is driving the adoption of movable monitors.

- For instance, according to the World Economic Forum, European countries, including Germany, Denmark, Netherlands, Spain, Sweden, Portugal, and others, accounted for nearly 50% of the global remote work index in 2023.

Therefore, the rising remote/hybrid work culture is driving the portable monitor market size.

Key Restraints:

Operational limitations and challenges are restraining the portable monitor market

The implementation of portable monitors is often associated with certain operational limitations and challenges, which are among the key factors restraining the market. The primary limitations of these monitors include limited screen size, reduced color accuracy, shorter battery life, and connectivity issues among others.

For instance, movable monitors have relatively smaller screen sizes in comparison to traditional monitors, which may not be ideal for certain tasks, including video editing, graphic design, and others. Additionally, movable monitors are often priced a bit higher as compared to traditional monitors due to the additional features that make them portable. Further, models with built-in batteries often have a shorter battery life. Therefore, the above operational limitations associated with movable monitors are hindering the portable monitor market expansion.

Future Opportunities :

Increasing advancements associated with portable monitors are expected to drive the portable monitor market opportunities

Movable monitor manufacturers are frequently investing in the development of new technologies associated with monitors to ensure their safe and effective utilization in consumer and business applications. As a result, movable monitor manufacturers are launching new products with updated features, which is creating lucrative aspects for market growth.

- For instance, in August 2024, ViewSonic Corporationlaunched its new portable monitors, which offer a broad range of features including touchscreen capabilities, 2K resolution, a color-calibrated panel, along with a model with a built-in battery and wireless casting functionality.

Hence, as per the analysis, the rising advancements related to movable monitors are anticipated to boost the portable monitor market opportunities during the forecast period.

Portable Monitor Market Segmental Analysis :

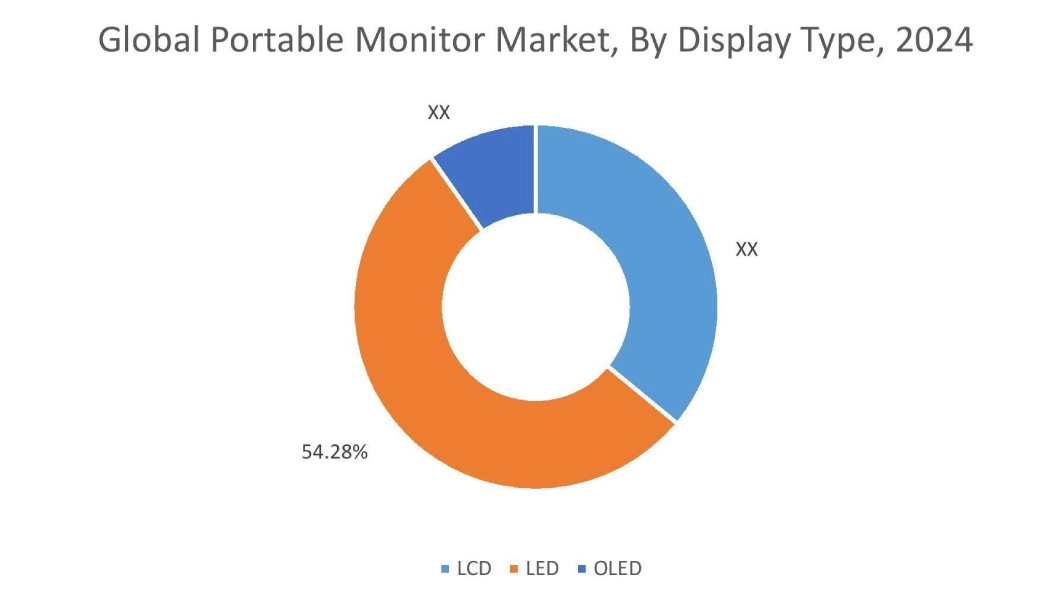

By Display Type:

Based on display type, the market is segmented into LCD, LED, and OLED.

Trends in the display type:

- Significant adoption of LED monitors, due to its lower power consumption, improved brightness, and enhanced energy efficiency, is driving the market.

- Increasing trend towards the adoption of OLED monitors, attributing to its several features such as superior contrast and color accuracy, vibrant colors, faster response time, better viewing angles, and others.

The LED segment accounted for the largest revenue share of 54.28% in the total portable monitor market share in 2024.

- LED display refers to a type of display that utilizes a range of light-emitting diodes (LEDs) as pixels for a video display.

- Moreover, LED display offers several benefits including improved brightness, lower power consumption, enhanced energy efficiency, and others, which are key aspects for increasing its integration into movable monitors.

- For instance, ViewSonic offers VG1655 model of LED-based portable business monitor in its product offerings. The monitor features a compact and lightweight design and includes a 60W USB-C one-cable solution for power charging and multimedia transfer.

- According to the portable monitor market analysis, the above factors are accelerating the portable monitor market growth.

OLED segment is anticipated to register a significant CAGR growth during the forecast period.

- OLED (organic light-emitting diode) display is typically composed of organic compounds that release light when an electric current is applied.

- Moreover, each pixel in an OLED display generates its own light, which enables deeper blacks and vibrant colors.

- Additionally, OLED display offers several benefits including superior contrast and color accuracy, better viewing angles,vibrant colors, faster response time, and others.

- For instance, AsusTek Computer Inc.offers ASUS ZenScreen model of portable OLED monitors. The OLED monitors deliver superior color performance along with minimum blur while dealing with high frame rates.

- According to the market analysis, theincreasing advancements related to portable OLED monitors are expected to drive the portable monitor market size during the forecast period.

By Screen Size:

Based on the screen size, the market is segmented into below 14 inches, 14 – 20 inches, and above 20 inches.

Trends in the screen size:

- Increasing trend in adoption of movable monitorswith 14 – 20 inches screen, due to their compact and lightweight design.

- Rising trend towards the adoption of movable monitors with screen sizes above 20 inches for professional and gaming applications is driving the market.

The 14 – 20 inches segment accounted for the largest revenue in the portable monitor market share in 2024, and it is anticipated to register substantial growth during the forecast period.

- Monitors with screen sizes ranging from 14 – 20 inches are compact and lightweight, which makes it easier for users to carry them for performing specific tasks.

- Moreover, monitors with screen sizes ranging from 14 – 20 inches can easily accommodate various working environments and have adequate space to manage multiple applications simultaneously.

- For instance, LG Electronics offers LG gram model of portable monitor featuring a 16-inches screen. The monitor offers several features including auto-rotate, multi-tasking, and anti-glare panel.

- Hence, the rising advancements related to monitors with 14 – 20 inch screens are boosting the portable monitor market trends.

By Sales Channel:

Based on sales channel, the market is segmented into segmented into online and offline.

Trends in the sales channel:

- Factors including the availability of targeted advertising, ease of utilization, competitive pricing, along with reliable shipping and return policies are key prospects driving the online sales channel segment.

- Factors such as higher credibility, strong customer base, and ease of customization as per the target market are major determinants for driving the offline sales channel segment.

Online segment accounted for a significant revenue in the overall monitor market share in 2024.

- Online sales channel deploys a mode of distribution in which the manufacturers sell the products through the company websites or any other third-party e-commercewebsites that are available on the internet.

- Online sales channels offer various benefits including a quicker buying process, easy access to the products, and higher flexibility.

- Moreover, the availability of movable monitors in online sales channels allows quicker comparison of multiple products and prices and reduces overhead as compared to offline sales channels.

- For instance, LG Electronics and Samsung are few of the movable monitor manufacturers that offer a broad range of movable monitors for direct online purchase through the company’s website.

- Therefore, increasing availability of movable monitors in online sales channels is driving the market.

Offline segment is anticipated to register a substantial CAGR growth during the forecast period.

- Offline sales channel involves the distribution of monitors from manufacturers to the end-users directly or indirectly through offline distributors including specialty stores, and others.

- Moreover, offline sales channels play a significant role in enhancing the product supply and fulfilling customer demands in the local markets, which is a prime factor in increasing its utilization for the distribution of monitors.

- For instance, Croma, an Indian retail chain of consumer electronics and goods, offers a wide range of movable monitors for offline purchase through its several retail outlets that are prevalent in multiple cities across India.

- Therefore, the rising availability of movable monitors in offline sales channel is projected to boost the market during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

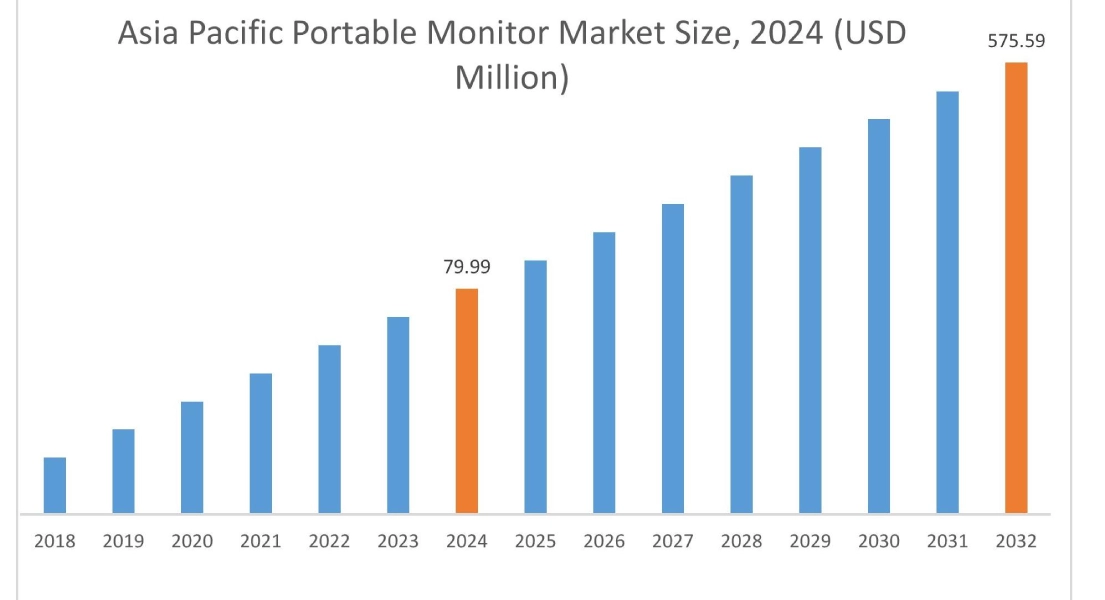

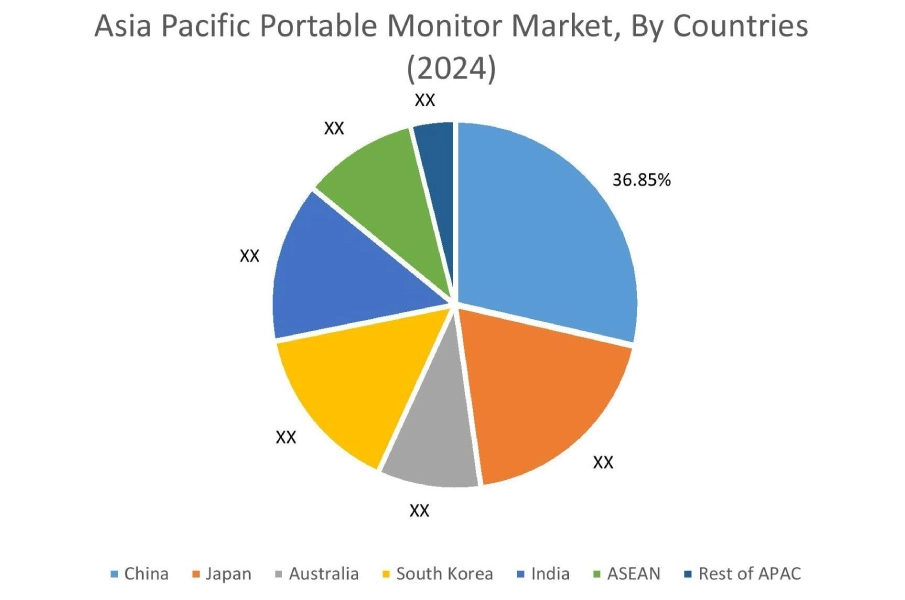

Asia Pacific region was valued at USD 79.99 Million in 2024. Moreover, it is projected to grow by USD 100.67 Million in 2025 and reach over USD 575.59 Million by 2032. Out of this, China accounted for the maximum revenue share of 36.85%. As per the portable monitor market analysis, the adoption of movable monitors in the Asia-Pacific region is primarily driven by the rising remote work & hybrid work arrangement, growing gaming sector, and increasing multi-device usage among others. Additionally, the rising adoption of movable monitors for gaming applications is further accelerating the portable monitor market expansion.

- For instance, according to the China Audio-Video and Digital Publishing Association, the overall sales revenue of the gaming sector in China reached USD 41.68 billion in 2023, representing an increase of 13.95% as compared to 2022. The growing gaming sector is driving the adoption of portable gaming monitors to facilitate a more immersive gaming experience, thereby driving industry growth in the Asia-Pacific region.

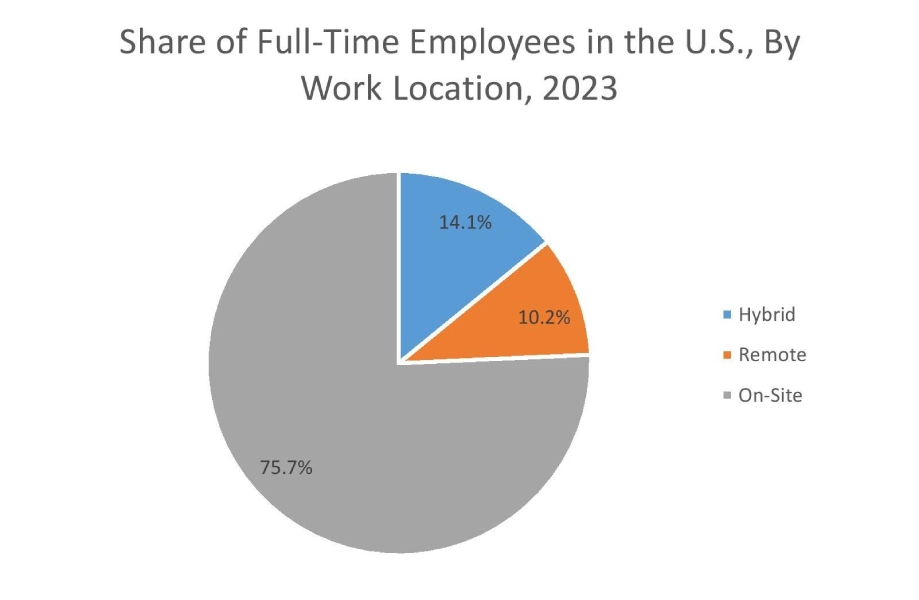

North America is estimated to reach over USD 656.61 Million by 2032 from a value of USD 95.14 Million in 2024 and is projected to grow by USD 119.30 Million in 2025. In North America, the growth of portable monitor industry is driven by the rising enterprise shift towards remote and hybrid work model along with increasing demand for multi-device solutions in home-office setups among others. Similarly, the prevalence of significant number of gamers and rising adoption of portable gaming monitors are contributing to the portable monitor market demand in the region.

- For instance, approximately 22.8% of U.S. employees worked remotely (completely and partially remote) as of March 2025, accounting for 36.07 million individuals. The above factors are expected to propel the portable monitor market trends in North America during the forecast period.

Additionally, the regional analysis depicts that the significant proliferation of remote work culture and rising adoption of movable monitors for personal and professional applications, including remote work setups are driving the portable monitor market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as the rising pace of urbanization, rising enterprise shift towards remote/hybrid work, and presence of substantial number of gamers among others.

Top Key Players and Market Share Insights:

The global portable monitor market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the portable monitor market. Key players in the portable monitor industry include-

- Lenovo(China)

- Dell Inc.(USA)

- GeChic Corporation (Taiwan)

- AOC Systems Inc. (USA)

- BenQ (Taiwan)

- Micro-Star Int'l Co. Ltd. (Taiwan)

- LG Electronics(South Korea)

- Samsung (South Korea)

- AsusTek Computer Inc. (Taiwan)

- Acer Inc. (Taiwan)

- HP Inc. (USA)

- ViewSonic Corporation (USA)

Recent Industry Developments :

Product Launch:

- In May 2025, Acer Inc. introduced its new range of portable and dual-screen foldable monitors. The Acer PD243Y E and Acer PD163QT models of movable monitors offer wide viewing angles and dual-screen features, which are ideal for multi-tasking.

Portable Monitor Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 1,884.10 Million |

| CAGR (2025-2032) | 23.8% |

| By Display Type |

|

| By Screen Size |

|

| By Sales Channel |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the portable monitor market? +

The portable monitor market was valued at USD 271.94 Million in 2024 and is projected to grow to USD 1,884.10 Million by 2032.

Which is the fastest-growing region in the portable monitor market? +

Asia-Pacific is the region experiencing the most rapid growth in the portable monitor market.

What specific segmentation details are covered in the portable monitor report? +

The portable monitor report includes specific segmentation details for display type, screen size, sales channel, and region.

Who are the major players in the portable monitor market? +

The key participants in the portable monitor market are Lenovo (China), Dell Inc. (USA), LG Electronics (South Korea), Samsung (South Korea), AsusTek Computer Inc. (Taiwan), Acer Inc. (Taiwan), HP Inc. (USA), ViewSonic Corporation (USA), GeChic Corporation (Taiwan), AOC Systems Inc. (USA), BenQ (Taiwan), Micro-Star Int'l Co. Ltd. (Taiwan), and others.