Retail Point of Sale Terminal Market Size:

Retail Point of Sale Terminal Market size is estimated to reach over USD 57,750.89 Million by 2031 from a value of USD 37,100.38 Million in 2023 and is projected to grow by USD 38,549.52 Million in 2024, growing at a CAGR of 5.7% from 2024 to 2031.

Retail Point of Sale Terminal Market Scope & Overview:

The Retail Point of Sale system refers to the place where transactions occur in a retail location when a customer purchases products or services. It includes the hardware and software for purchase, inventory, sales, discounts, and promotions. A point of sale is more than a traditional cash transaction between a retail outlet and a customer. The primary benefits of the retail point of sale include inventory management, sales tracking, transaction management, and others. In E-commerce, it is used to process purchases, and transactions and manage inventory by using real-time data analysis and data processing. It can generate insights related to retail outlets and help in increasing operational efficiency.

Retail Point of Sale Terminal Market Insights:

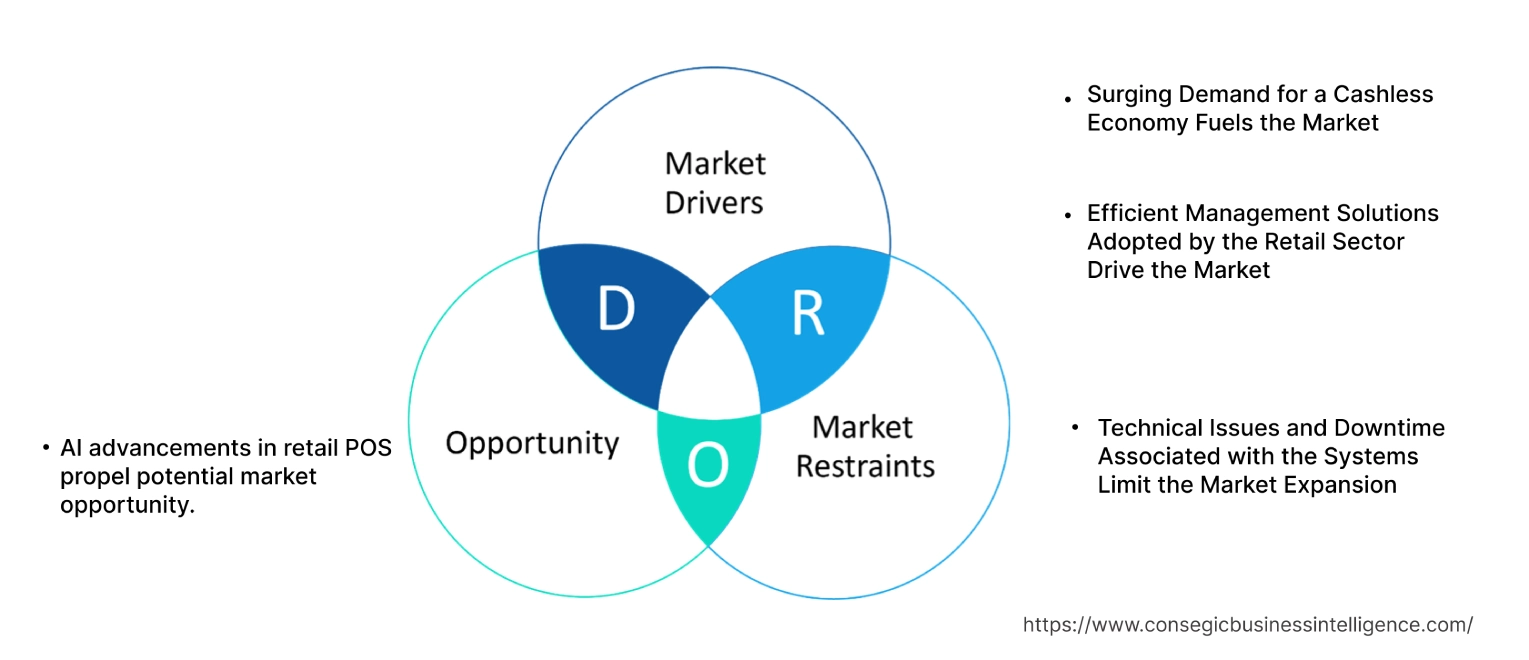

Retail Point of Sale Terminal Market Dynamics - (DRO) :

Key Drivers:

Surging Demand for a Cashless Economy Fuels the Market

The cashless system facilitates various options, such as contactless payments, debit/credit cards, and mobile wallets. These instant payments can be checked with the authorization system at POS terminals. Benefits such as loyalty programs can be integrated into systems for specialized discounts and offers, which will help in customer retention and promoting advertisements. Through loyalty programs, data can be collected for sales insights and inventory management. Various analyses can be performed using stored data and using analytical software for solving business queries. Reduced errors in cash handling due to cashless payments result in significant improvement in payment collection and monitoring. POS terminals facilitate cashless transactions by allowing customers to swipe, tap, or insert their cards or use mobile payment apps to complete purchases. These terminals securely process payments and provide instant transaction confirmations.

- For instance, according to the World Payments Report published by Capgemini, global non-cash transaction volumes were set to reach 1.3 trillion in 2023.

Therefore, the growth of cashless transactions in retail purchases is driving the retail point of sale terminal market growth

Efficient Management Solutions Adopted by the Retail Sector Drive the Market

Efficient management solutions include automated inventory tracking for better stock optimization, data-driven business decisions, staff management tools for productivity, and others. Overall customer satisfaction can be improved by reducing time in manual processes in the checkout such as product addition in the cart using barcodes can significantly reduce time and improve customer satisfaction. Operational costs can be reduced by automating daily tasks such as pricing updates of products, and improving management efficiency.

- In May 2023, Zoho Corporation implemented custom-built ERP software for BigBasket, helping the online grocery retailer streamline operations and reduce task completion time by 50%. This custom-built ERP software can significantly improve retail point-of-sale systems by providing real-time inventory tracking and reducing stockouts and overstock situations.

Therefore, the efficient management solutions adopted by the retail sector are driving the retail point of sale terminal market demand.

Key Restraints :

Technical Issues and Downtime Associated with the Systems Limit the Market Expansion

Technical issues refer to downtime and glitches that lead to operational disruption, particularly during peak sales days. Systems that rely on the internet can lead to stressful situations. Many retailer's services are directly controlled by the service provider. Due to this, the risks of performance issues and outages are heightened. Transaction failures lost sales, and damaged customer trust can result from these technical issues, significantly impacting the retailer's revenue. It is necessary to take preventive measures. To prevent such issues, retailers should implement robust infrastructure with backup systems.

- For instance, In July 2024, CrowdStrike, a cyber-security firm, released a software update that led to global technology outages for Microsoft users in retail outlets like Starbucks, which had to revert to cash transactions in some locations.

Thus, the rising technical issues and downtime are hindering retail point of sale terminal market growth.

Future Opportunities :

AI advancements in retail POS propel potential market opportunity.

The AI-powered POS system provides solutions for the fast-growing retail industry, helping businesses stay competitive and adapt to market trends. Rising advancements in AI-powered POS systems offer retail operation solutions that manage inventory, customer data, and market trends while streamlining overall business processes. These systems not only improve operational efficiency but also offer customer insights which can be useful for business.

- In July 2023, Urban Vyapari introduced AI-powered POS software and devices designed to revolutionize the retail sector. This cutting-edge point-of-sale software provides traditional retailers with advanced technological solutions.

Hence, the rising advancement of AI-powered point-of-sale terminals is anticipated to promote retail point of sale terminal market opportunities during the forecast period.

Retail Point of Sale Terminal Market Segmental Analysis :

By Product:

Based on the product the market is segmented into fixed and mobile.

Trends in the Product:

- Fixed retail point-of-sale (POS) systems are evolving rapidly to meet the demands of modern retail environments such as better security and control features.

- The mobile retail point-of-sale market is driven by factors such as the shift from cash to electronic payments and the convenience of mobile card readers.

The fixed retail point of sale accounted for the largest revenue share of the total retail point of sale terminal market share in the year 2023.

- The fixed retail point of sale is the on-premise POS System whose system and server are locally installed. It is used to process transactions, collect data, and manage inventory. It consists of a monitor, terminal, barcode scanner, cash drawer, and receipt printer. Benefits include customer management, employee management, inventory management, and others.

- Fixed retail point of sale is widely used in retail stores such as grocery stores, electronics stores, and various other stores for streamlining the process.

- In April 2024, Shopify launched the POS terminal Countertop Kit for mid-market retailers, featuring reliable Wi-Fi and ethernet, a customer-facing display, support for various payment methods via Shopify Payments, customizable branding, and seamless integration with IOS and Android tablets.

- Thus, enhanced security, better hardware integration, and reduced dependence on internet connectivity are driving the retail point of sale terminal market demand.

The mobile retail point of sale is anticipated to register the fastest CAGR during the forecast period.

- A mobile retail point of sale is a mobile device installed with software that allows a retail store to take payments without going to the counter. Benefits include lightness, flexibility, and mobility at the point of sale.

- Mobile retail point of sale can be used in a restaurant while paying the bill, rather than customers going to the bill counter.

- In October 2022, Unzer launched POS Go, which combines card reader, printer, POS system, and scanner and accepts all common payment methods. It offers digital receipt storage, digital accounting, and real-time sales analysis.

- Thus, there is a rise in adoption of mobile retail point of sale in small and medium-sized businesses which is anticipated to boost the retail point of sale terminal market trends during the forecast period.

By Component:

Based on the components, the market is segmented into software and hardware.

Trends in the Component:

- The hardware component is driven by factors such as security, data collection, operational accuracy, and overall improvement in customer efficiency.

- Benefits such as real-time data analysis, inventory management, and sales processing are driving the retail point-of-sale market growth.

The hardware component accounted for the largest revenue share of the overall retail point of sale terminal market share in the year 2023.

- The hardware segment refers to the physical components in the retail POS. It includes a cash drawer, receipt printer, terminal, monitor, and barcode scanner. Benefits include efficiency, accuracy, security, and data collection.

- In a hospital cafeteria, a retail point of sale can be implemented by installing a terminal, printer, cash drawer, and receipt printer.

- In April 2024, PAX Global Technology Limited revealed the M8, the Android PayTablet integrated with the SmartPOS payment processing engine. This device is designed for retail businesses, offering features such as portability, display, and support for Android apps.

- Thus, as per the analysis, the smooth integration of point of sale improves the overall operation of a retail business, in turn driving the retail point of sale terminal market expansion.

The software component is anticipated to register the fastest CAGR during the forecast period.

- The software segment at the retail point of sale refers to the digital programs and applications that control the functionality of the hardware component. It includes POS software, sales processing, reporting and analytics, sales processing, and others. The benefits of POS software include real-time analysis, improved data processing, and others.

- Software can help in inventory management and customer interactions to get customer insights.

- In May 2022, SumUp, the London-based software point of sale company, raised USD 625 million in a funding round, valuing the company at USD 8.5 billion as it aimed to expand its services for small and medium-sized businesses.

- Thus, the growing advancements in POS software are anticipated to project significant growth in the market during the forecast period.

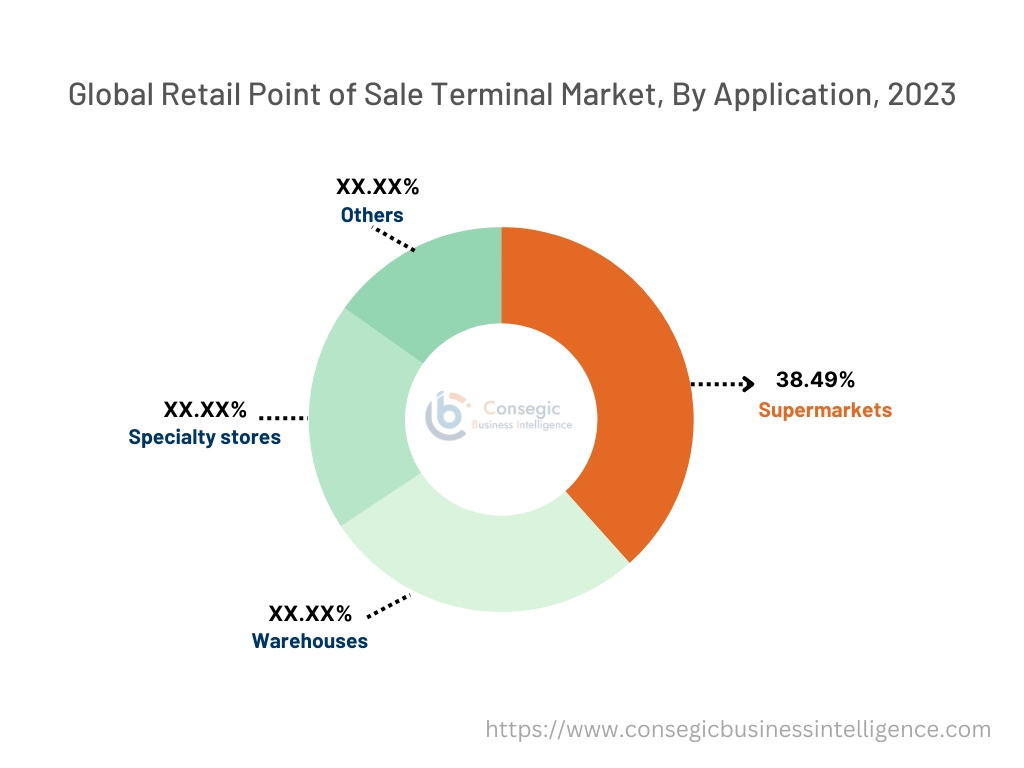

By Application:

Based on the application, the market is segmented into supermarkets, warehouses, specialty stores, and others.

Trends in the Application:

- Supermarkets continue to grow by offering a diverse range of products and enhancing convenience through both in-store and e-commerce.

- Retail warehouses are experiencing growth due to increased demand for bulk sales and competitive pricing.

The supermarkets accounted for the largest revenue share of 38.49% during the year 2023.

- A supermarket is a shop that is operated on a self-basis and it sells drinks, groceries, fresh produce, baked products, meat, dairy products, and goods used at home.

- The benefits of shopping at a retail supermarket include fixed prices, freedom of selection, quality assurance, a wide variety of products, convenience, special offers, and loyalty programs.

- For instance, according to the Walmart INC. annual report 2023, Walmart world's prominent retailer generated a total revenue of USD 164.0 billion from stores and e-commerce.

- Thus, supermarkets are a key part of the retail point of sale market, driving growth through in-store and online sales.

The warehouses are anticipated to register the fastest CAGR during the forecast period.

- Retail warehouses are large stores designed for bulk sales, often selling items including furniture, appliances, electronics, and home improvement goods.

- Retail warehouses offer several benefits, including competitive pricing, bulk purchase discounts, wider product availability, spacious layouts for easy shopping, and cost savings on larger purchases. These advantages make retail warehouses an attractive option for consumers looking to maximize value and convenience.

- In July 2023, Prozo launched three new warehouses located on Ferozpur Road in Ludhiana, as well as in Makali and Bidadai in Bengaluru. Their goal is to streamline supply chain operations for the retail industry.

- Thus, the retail warehouse segment is anticipated to experience the fastest growth in the market, offering bulk products and cost-efficiency to customers, boosting the retail point of sale terminal market trends.

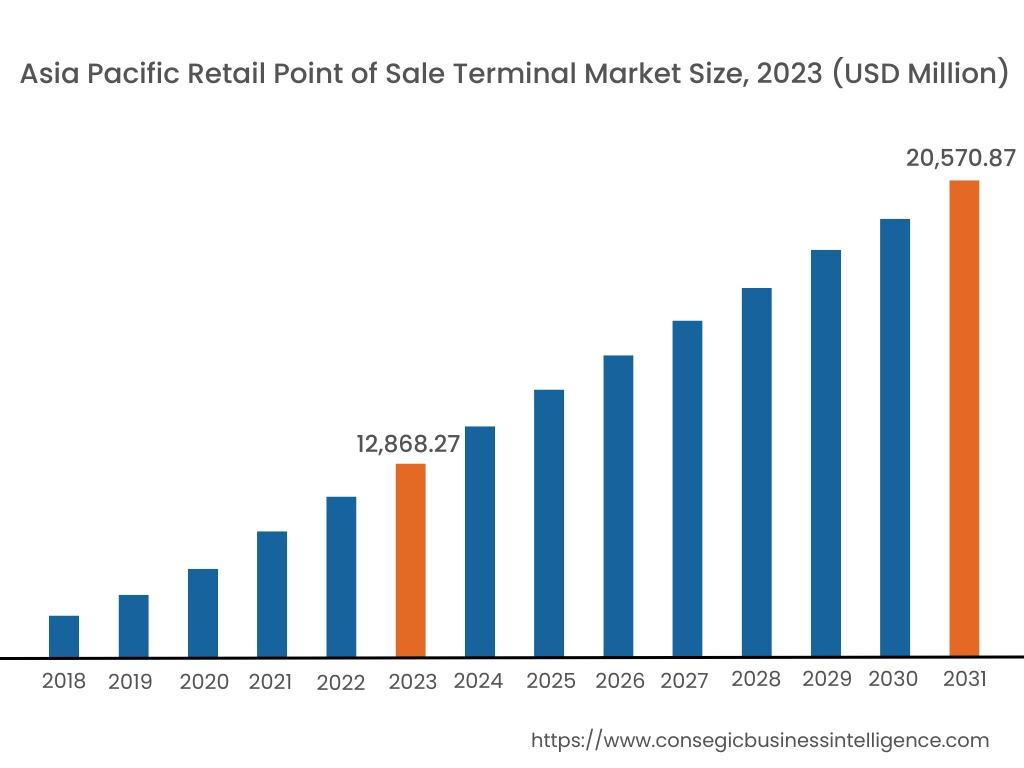

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 12,868.27 Million in 2023. Out of this, China accounted for the maximum revenue share of 32.7%. Moreover, it is projected to grow by USD 13,400.94 Million in 2024 and reach over USD 20,570.87 Million by 2031. The Asia Pacific region's growing pace of urbanization and development offers lucrative growth prospects for the retail point of sale market. Additionally, the factors such as increasing investment in the retail sector, and growth in retail shopping are contributing to the market growth for the Asia-Pacific region.

- For instance, according to the India Brand Equity Foundation, Amazon is increasing its investment in the retail sector or outlets in India by USD 15 billion from 2024 to 2030 bringing its total investment to USD 26 billion. Thus, the above factor is projected to boost the retail point of sale market growth in the Asia-Pacific region during the forecast period.

North America is estimated to reach over USD 18,087.58 Million by 2031 from a value of USD 11,589.23 Million in 2023 and is projected to grow by USD 12,044.56 Million in 2024. As per the retail point of sale terminal market analysis, the growth in North America is mainly driven by their increasing deployment in supermarkets, warehouses, specialty stores, and others.

- In April 2022, Square unveiled Square Stand, an iPad-based point-of-sale product for small and medium-sized business users. It is a combination of hardware and software into a complete solution.

Furthermore, factors including an increase in retail shopping in the region are projected to drive the retail point of sale market expansion in North America during the forecast period.

As per the retail point of sale market analysis, Europe is anticipated to witness substantial growth that is backed by the increasing adoption of fixed and mobile retail point of sale in supermarkets, warehouses, and specialty stores. Companies invest in innovative technologies to cater to the surging demand for advanced retail points of sale across the region.

The Middle East, Africa, and Latin America are expected to grow at a considerable rate due to increasing investments in the development of urbanization and industrialization in countries such as Brazil, UAE, and others.

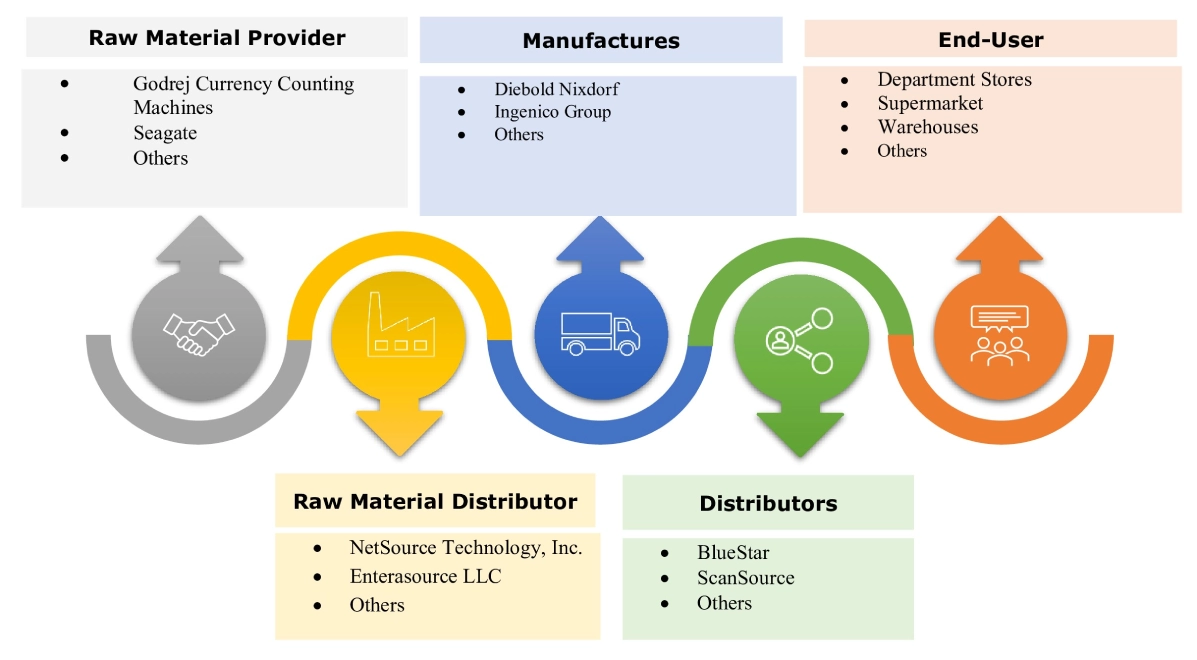

Top Key Players & Market Share Insights:

The retail point of sale terminal market is highly competitive with major players providing POS to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global retail point of sale terminal market. Key players in the retail point of sale terminal industry include-

- Diebold Nixdorf (US)

- Epicor Software Corporation (US)

- NCR Corporation (US)

- NEC Corporation (Japan)

- Panasonic Corporation (Japan)

- Ingenico Group (France)

- PAX Technology (China)

- Samsung Electronics Co. Ltd (South Korea)

- Square, Inc. (US)

- VeriFone Systems, Inc. (US)

Retail Point of Sale Terminal Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 57,750.89 Million |

| CAGR (2024-2031) | 4.4% |

| By Product |

|

| By Component |

|

| By Power Source |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the retail point of sale terminal market? +

Retail Point of Sale Terminal Market size is estimated to reach over USD 57,750.89 Million by 2031 from a value of USD 37,100.38 Million in 2023 and is projected to grow by USD 38,549.52 Million in 2024, growing at a CAGR of 5.7% from 2024 to 2031.

Which is the fastest-growing region in the retail point of sale terminal market? +

Asia-Pacific is the region experiencing the most rapid growth in the retail point of sale terminal market.

What specific segmentation details are covered in the retail point of sale terminal market report? +

The retail point of sale terminal market report includes specific segmentation details for the system by product, component, application, and region.

Who are the major players in the retail point of sale terminal market? +

The key participants in the retail point of sale terminal market are Diebold Nixdorf (US), Epicor Software Corporation (US), Ingenico Group (France), NCR Corporation (US), NEC Corporation (Japan), Panasonic Corporation (Japan), PAX Technology (China), Samsung Electronics Co. Ltd (South Korea), Square, Inc. (US). VeriFone Systems, Inc. (US).