Silicone Masterbatch Market Size:

Silicone Masterbatch Market size is growing with a CAGR of 7.6% during the forecast period (2025-2032), and the market is projected to be valued at USD 2.62 Billion by 2032 from USD 1.47 Billion in 2024. Additionally, the market value for the 2025 attributes to USD 1.58 Billion.

Silicone Masterbatch Market Scope & Overview:

A silicone masterbatch is a concentrated mixture of silicone polymers in a carrier resin such as polyethylene (PE) and polypropylene (PP) among others. These masterbatches are used as additives during the manufacturing of plastics. This is to improve properties such as surface finish, friction reduction, and release from molds. These mixtures are available in varying silicone content. This includes 30%, 40%, and 50% among others. 30% is used for moderate enhancements, 40% is used for balanced improvements, and 50% is used for maximum performance. This allows manufacturers to precisely control desired properties and optimize costs across industries. These masterbatches find diverse applications across sectors such as electrical & electronics, automotive, consumer goods, construction, and medical.

How is AI Transforming the Silicone Masterbatch Market?

AI transforms the silicone masterbatch market by accelerating material innovation through data-driven R&D, enhancing production efficiency via predictive maintenance and process optimization, and ensuring superior product quality with automated inspection. Also, it enables manufacturers to develop customized formulations, optimize manufacturing processes, predict equipment failures, and perform real-time quality assurance, leading to reduced waste, increased yields, lower costs, and better adaptability to evolving industry demands. Thus, by optimizing processes and improving product quality, AI helps manufacturers lower operational costs and increase competitiveness in the global market.

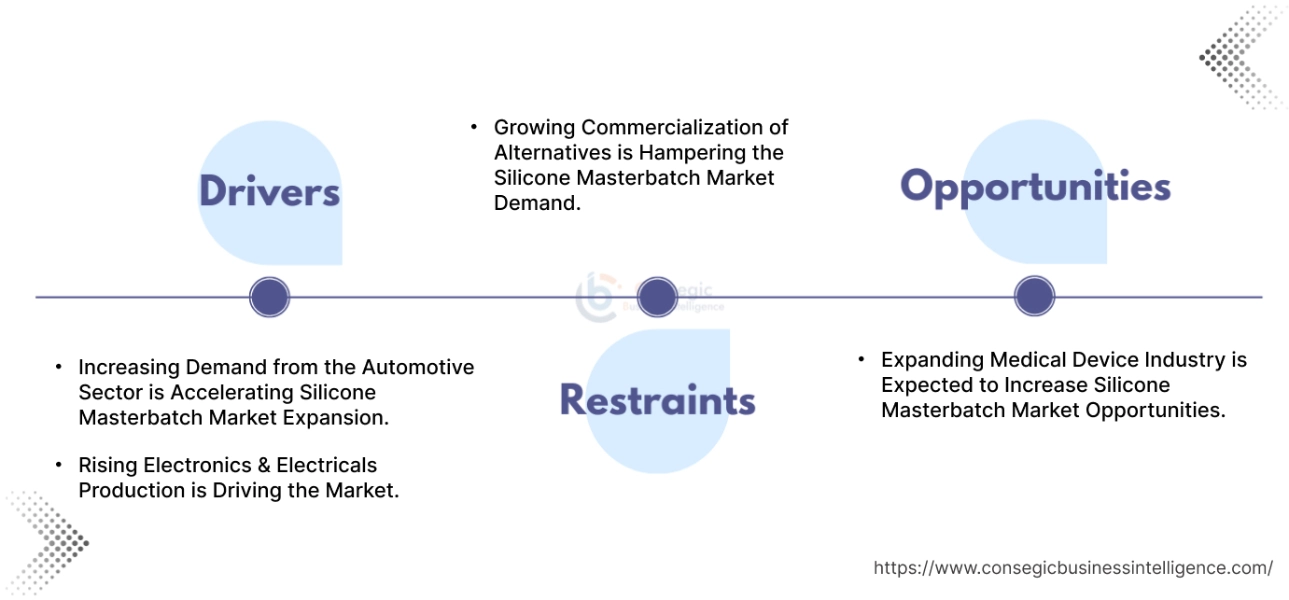

Silicone Masterbatch Market Dynamics - (DRO) :

Key Drivers:

Increasing Demand from the Automotive Sector is Accelerating Silicone Masterbatch Market Expansion.

Silicone masterbatch is used in automotive interior parts such as dashboards, door panels, and trims. This is to prevent damage from everyday use. Moreover, it also improves impact resistance in bumpers, body panels, and other exterior components. This also provides flexibility, heat resistance, and chemical resistance. Increasing demand for both commercial and passenger vehicles has led to sector growth, thus requiring these masterbatches in the production process.

For instance,

- According to the Autovista Group, in 2022, German passenger car production saw an increase of nearly 11% compared to the previous year, thus positively impacting silicone masterbatch market trends.

Overall, increasing demand from the automotive sector is significantly boosting the silicone masterbatch market expansion.

Rising Electronics & Electricals Production is Driving the Market.

In the electrical & electronics sector, silicone masterbatch is widely used in applications such as wire, cable, connectors, electronic housing, and PC/ABS parts for consumer electronics (TV frames, laptop enclosures, and others). These masterbatches enhance the flexibility of materials. This makes it easier to handle and install. Moreover, they enhance their durability and resistance to wear and tears. The growing need for smart devices and IoT technology has led to a sector increase, thus requiring these masterbatches.

For instance,

- In 2024, Havells India started commercial cable production at its new facility in Karnataka, India, thus positively impacting the silicone masterbatch market trends.

Overall, electronics & electrical production is accelerating the global silicone masterbatch market growth.

Key Restraints:

Growing Commercialization of Alternatives is Hampering the Silicone Masterbatch Market Demand.

The market faces competition from other substitutes available in the market. For instance, amide waxes are common alternatives. They are used for improving slip and anti-blocking properties in plastic, which is later then used in multiple industries. Similarly, fluoropolymer-based processing aids (PPAs) are used to reduce die drool and improve melt flow. Additionally, lubricants, especially organic in nature are employed to enhance polymer processability. While silicone-based masterbatches offer unique property enhancements, these other substitutes provide similar benefits at a lower cost and with different processing characteristics. Hence, the growing commercialization of substitutes is hampering the silicone masterbatch market demand.

Future Opportunities :

Expanding Medical Device Industry is Expected to Increase Silicone Masterbatch Market Opportunities.

In medical devices, a masterbatch made of silicone is vital for components that require high-performance standards. This includes catheters, implants, tubing, seals, gaskets, respiratory bellows, and even parts of surgical instruments. They offer advantages such as biocompatibility, durability, and resistance to sterilization. This makes them ideal for long-term use in the body. Raising chronic disease prevalence and increasing healthcare spending has led to industry growth.

For instance,

- According to Masson International, the medical device market of Europe is expected to grow at a CAGR of 4.09% from 2022 to 2027. This creates the potential for the market.

Overall, expanding the medical device industry is expected to increase the silicone masterbatch market opportunities.

Silicone Masterbatch Market Segmental Analysis :

By Silicone Content:

Based on silicone content, the market is categorized into upto 40% and above 40%.

Trends in Silicone Content:

- The above 40% type is most used due to its superior performance such as enhanced scratch resistance and reduced friction.

- Industries are increasingly opting for above 40% silicone content in the masterbatches as they allow for lower dosage rates in the final product.

The above 40% segment accounted for the largest market share in 2024 and is expected to grow at the fastest CAGR over the forecast period.

- Above 40% of the type includes masterbatches which have more than 40% of active polymer content.

- Higher silicone content ensures more pronounced improvements in scratch resistance.

- It also provides excellent slip properties, wear resistance, and processing aids. This is the same level of properties even at low addition rates in the final polymer.

- This efficiency and the ability to solve complex manufacturing challenges make them highly attractive for multiple applications.

- It is used in multiple industries such as automotive and construction among others. Growth in these industries is driving the segment share.

- For instance, according to Construct Connect, Canada’s residential construction grew by 19.7% in the year 2021, when compared to the previous year. This has required these masterbatches in building materials to improve their weather resistance and durability.

- Overall, as per the market analysis, the need for superior performance and complex manufacturing solutions is driving the segment in the silicone masterbatch market growth.

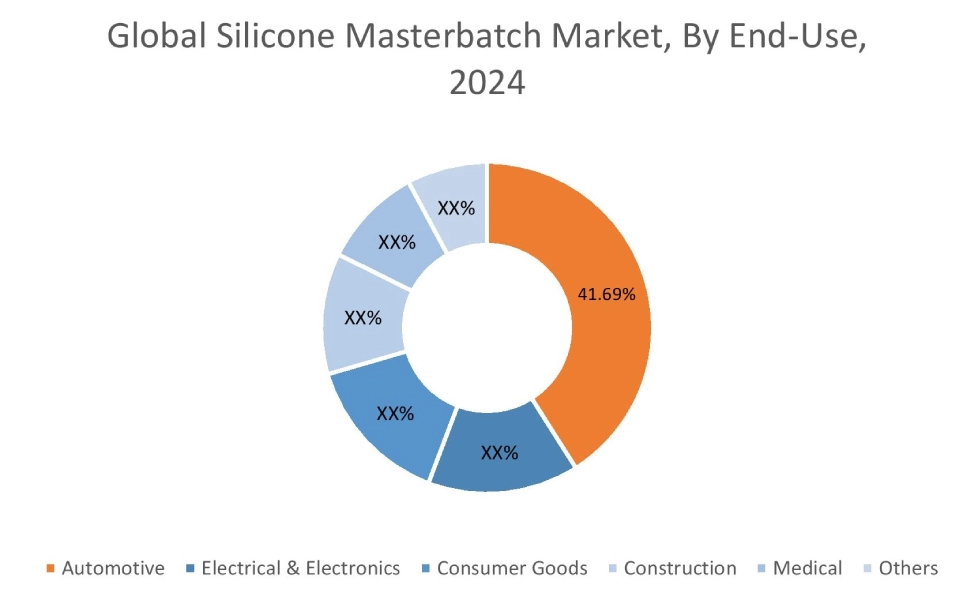

By End Use:

Based on end-use, the market is categorized into automotive, electrical & electronics, consumer goods, construction, medical, and others.

Trends in the End-Use

- Rising usage of silicone masterbatch to reduce vehicle weight for fuel efficiency. It also enhances interior aesthetics with improved scratch resistance.

- There is also a growing trend of using these masterbatches in compact electronic devices for improved insulation and flame retardancy.

The automotive segment accounted for the largest market share of 41.69% in 2024.

- In the automotive sector, it is extensively used in diverse components such as interior trim and engine parts.

- This integration enhances their thermal stability, lubrication, and weather resistance.

- Moreover, it also prolongs their lifespan and boosts overall performance. Also, they are added to improve scratch resistance and increase surface quality.

- The growing middle class and demand for personal & commercial transportation are leading to increased production, thus driving the use of these masterbatches.

- For instance, the International Trade Administration, Canada's automotive sector experienced significant growth, with a 23% increase in 2021 followed by approximately 15% in 2022.

- Overall, as per the market analysis, the growing automotive sector is driving the segment in the silicone masterbatch industry.

The medical segment is expected to grow at the fastest CAGR over the forecast period.

- Silicon masterbatch allows for easy and precise pigmentation of silicone elastomers. This enhances the aesthetics of medical devices.

- It also aids in identifying range-specific devices. Moreover, they improve biocompatibility and chemical resistance in medical devices.

- They are particularly beneficial for devices requiring contact with the human body, such as implants, drug delivery systems, and respiratory devices.

- Moreover, some of these masterbatch are supported by comprehensive master files (MAF) submitted to the FDA. This ensures compliance with regulatory requirements.

- Additionally, these masterbatches are a more efficient and cost-effective alternative to liquid silicone rubber (LSR) for certain medical applications, thus driving its usage.

- Thus, according to the silicone masterbatch market analysis, the aforementioned factors will drive the segment for the forecasted years.

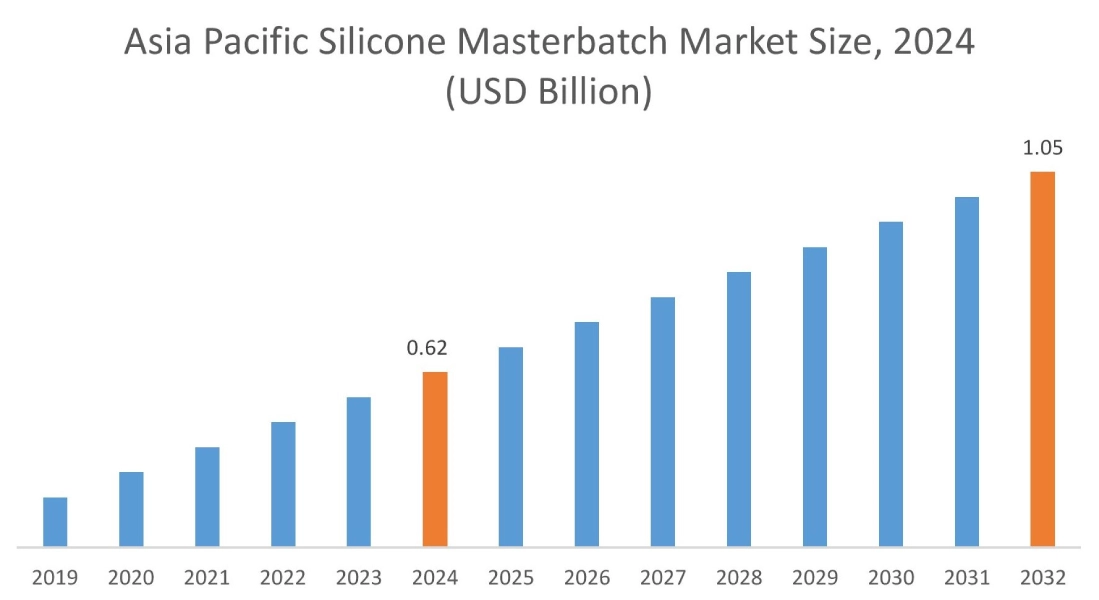

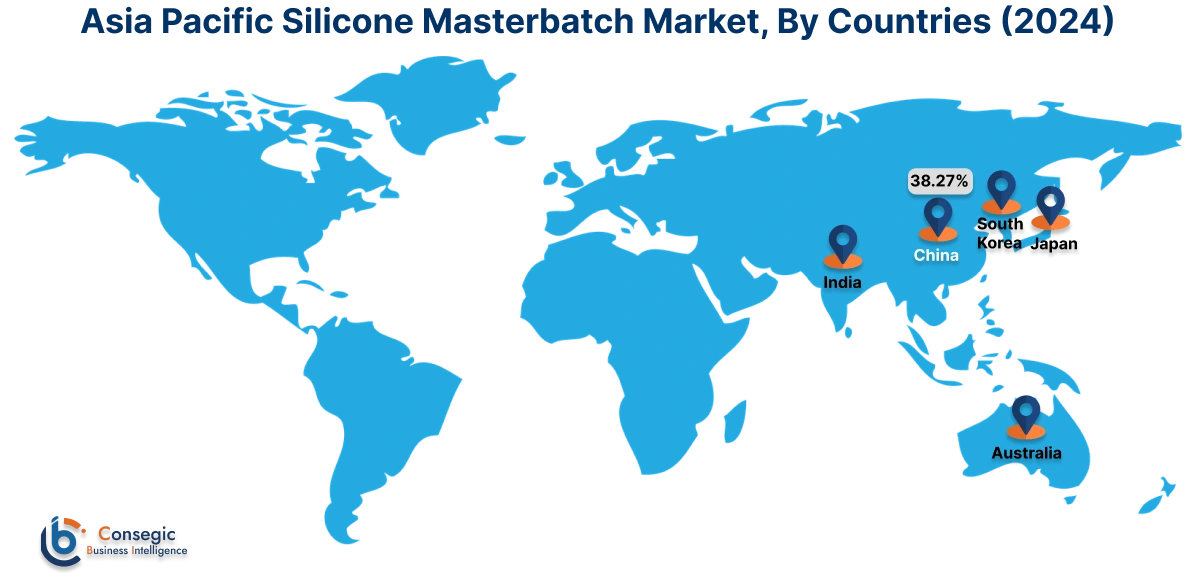

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Download Sample

In 2024, Asia Pacific accounted for the highest silicone masterbatch market share at 42.18% and was valued at USD 0.62 Billion and is expected to reach USD 1.05 Billion in 2032. In Asia Pacific, the China accounted for the silicone masterbatch market share of 38.27% during the base year of 2024. There is rapidly expanding electronics production in the region. Countries such as China, South Korea, Japan, and India are manufacturing hubs for a vast array of electronic devices. This includes everything from smartphones and laptops to advanced automotive electronics and IoT devices.

For instance,

- According to IBEF, India's domestic electronics production grew at a CAGR of 13.20% from 2017 to 2023.

Silicone masterbatch is crucial for enhancing properties such as electrical insulation in wires and cables. It improves flame retardancy for safety in components. This facilitates smoother processing for intricate electronic parts. The trend towards miniaturization in electronics further fuels this demand for specialized silicone additives. Overall, growing electronics production is driving the market in the region.

Download Sample

In Europe, the silicone masterbatch market is experiencing the fastest growth with a CAGR of 9.2% over the forecast period. The driver for the market in the region is overall car production. The growing trend of using electric vehicles (EVs) and the increasing requirement for premium interiors are key factors. Masterbatches made from silicone are used for enhancing scratch resistance in interior components such as dashboards and door panels. This improves tactile feel and reduces squeaking noises. They also provide crucial thermal stability and electrical insulation in EV battery systems. This contributes to safer, more efficient, and durable vehicles across the continent.

North America’s silicone masterbatch market analysis indicates that several key trends are contributing to its growth in the region. There is a rapidly expanding construction sector. This expansion is fueled by the increasing need for both residential and non-residential projects. It also includes infrastructure development, creating a robust need for advanced building materials. Silicon masterbatch improves weather resistance and durability in pipes, window profiles, and roofing membranes. They also serve as processing aids for easier manufacturing of various plastic-based building elements. It contributes to thermal insulation and fire safety in specific applications. This ensures longer lasting and more efficient structures.

The Middle East and Africa (MEA) market analysis indicates that the medical sector is growing in the region. This is fueled by increasing healthcare investments, rising infrastructure, growing chronic disease prevalence, and a push for advanced medical technologies. Masterbatch made from silicone are used in medical devices such as catheters, tubing, seals, and surgical instrument components. Their use ensures vital properties such as biocompatibility for patient safety and low friction for smooth device operation. Also, they have the ability to withstand various sterilization methods. This provides excellent flexibility and durability.

Latin America's region creates potential for the market. The analysis states that the market is increasingly driven by two factors. First, there are significant technological advancements, and second, rising government investment, particularly in infrastructure. Countries such as Brazil and Argentina lead the market. They are embracing modern manufacturing techniques and adopting higher-performance materials to enhance various industries. Simultaneously, governments are committing substantial capital to infrastructure projects. It includes roads, public transport, and utilities. This focuses on modernization and development fuels the need for silicone masterbatch to improve durability, weather resistance, and processing efficiency.

Top Key Players and Market Share Insights:

The Silicone Masterbatch market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Silicone Masterbatch market. Key players in The Silicone Masterbatch industry include-

- ACSIC (United States)

- Chengdu Silike Technology Co., Ltd (China)

- Bajaj Plast Pvt. Ltd. (India)

- Hangzhou Peijin Chemical Co., Ltd. (China)

- Silibase Silicone (China)

- CHT Group (Germany)

- Xiamen Xiangxi New Material Co., Ltd. (China)

- DuPont (United States)

- Shenzhen Tosichen Technology Co., Ltd. (China)

- TECH-LINK (United States)

Silicone Masterbatch Market Report Insights :

| Report Attributes |

Report Details |

| Study Timeline |

2019-2032 |

| Market Size in 2032 |

USD 2.62 Billion |

| CAGR (2025-2032) |

7.6% |

| By Silicone Content |

|

| By End Use |

- Automotive

- Electrical & Electronics

- Consumer Goods

- Construction

- Medical

- Others

|

| By Region |

- Asia-Pacific

- Europe

- North America

- Latin America

- Middle East & Africa

|

| Key Players |

- ACSIC (United States)

- CHT Group (Germany)

- Xiamen Xiangxi New Material Co., Ltd. (China)

- DuPont (United States)

- Shenzhen Tosichen Technology Co., Ltd. (China)

- TECH-LINK (United States)

- Chengdu Silike Technology Co., Ltd (China)

- Bajaj Plast Pvt. Ltd. (India)

- Hangzhou Peijin Chemical Co., Ltd. (China)

- Silibase Silicone (China)

|

| North America |

U.S. Canada Mexico |

| Europe |

U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC |

China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa |

GCC Turkey South Africa Rest of MEA |

| LATAM |

Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

- Revenue Forecast

- Competitive Landscape

- Growth Factors

- Restraint or Challenges

- Opportunities

- Environment

- Regulatory Landscape

- PESTLE Analysis

- PORTER Analysis

- Key Technology Landscape

- Value Chain Analysis

- Cost Analysis

- Regional Trends

- Forecast

|

Key Questions Answered in the Report

How big is the Silicone Masterbatch market? +

In 2024, the Silicone Masterbatch market is USD 1.47 Billion.

Which is the fastest-growing region in the Silicone Masterbatch market? +

Europe is the fastest-growing region in the Silicone Masterbatch market.

What specific segmentation details are covered in the Silicone Masterbatch market? +

Silicone Content and End-Use segmentation details are covered in the Silicone Masterbatch market.

Who are the major players in the Silicone Masterbatch market? +

ACSIC (United States), CHT Group (Germany), Xiamen Xiangxi New Material Co., Ltd. (China), DuPont (United States), and Shenzhen Tosichen Technology Co., Ltd. (China) are some major players in the market.