Ethylene Oxide Market Scope & Overview:

Ethylene oxide, also referred to as oxirane, is an organic compound with the formula C₂H₄O. It is a colorless and highly flammable gas with a slightly sweet odor in its pure form. It is produced through the direct oxidation process, involving the reaction of ethylene with oxygen in the presence of a silver catalyst. Ethylene is extensively utilized as a starting material for the production of numerous crucial chemicals including ethylene glycol, ethoxylates, ethanolamines, and glycol ethers among others.

As per the market trends analysis, these derivatives find a spectrum of applications such as PET resins, antifreeze, surfactants, and paints which are used in several industries. In addition to this, this compound plays a major role as a sterilant required for the sterilization of medical devices. It effectively eliminates all the microorganisms at low temperatures making it ideal for sterilization of heat-sensitive devices. The significant development of these sectors is promoting the ongoing requirement for this compound.

Ethylene Oxide Market Size:

The Ethylene Oxide Market is projected to be valued at USD 55.23 billion by 2031, growing at a CAGR of 6.4% during the forecast period (2024–2031).

Ethylene Oxide Market Insights:

Ethylene Oxide Market Dynamics - (DRO) :

Key Drivers:

Surging Demand for Medical Devices is Fostering the Market Expansion

Growing demand for medical devices is one of the potential factors significantly contributing to the ethylene oxide market trends. This compound plays a pivotal role in the medical device sector, acting as a major sterilant for a wide range of health appliances. Ethylene oxide gas is majorly used for the process of sterilization of medical devices which eliminates different types of harmful microorganisms including bacteria, spores, fungi, and viruses.

Based on the analysis, this compound possesses several advantages as it is effective and provides decontamination at low temperatures making it suitable for heat-sensitive components. The sterilization of medical devices possesses greater importance in the healthcare and pharmaceutical sectors as it prevents healthcare-associated infections, further ensuring patient safety. Moreover, the escalating growth in the medical device sector is fuelling requirement for the sterilization using this compound.

- According to the data provided by the National Investment Promotion and Facilitation Agency, the market size of the medical devices sector in India accounted for USD 11 billion in 2022 growing steadily at a CAGR of 15% over the last 3 years.

As a result, the surging requirement for medical devices promoting the need for this compound is driving the ethylene oxide market growth.

High Requirement for Polyethylene Terephthalate is Significantly Contributing to the Expansion of the Market

The high requirement for polyethylene terephthalate (PET) is the potential factor fuelling the necessity for this compound. Ethylene oxide is extensively utilized in the manufacturing process of polyethylene terephthalate where it serves as a key precursor in the production of a critical intermediate chemical called ethylene glycol. This compound is polymerized to produce ethylene glycol. As per the analysis, ethylene glycol is a primary raw material used for the production of polyethylene terephthalate. It is synthesized by a reaction between ethylene glycol and terephthalic acid.

Polyethene terephthalate is one of the majorly used plastics globally due to its versatility and beneficial properties, where it finds several applications in packaging, textiles, automotive parts, and medical uses. PET resin is utilized for the manufacturing of a variety of products such as packaging for food and beverages, shampoo and conditioner bottles, medical devices, microwave containers, carpets, automotive parts, electronic components, clothes and housing materials, and other products.

- According to the research article published by the National Institute of Health in June 2022, PET packaging accounted for 44.7% of single-serve beverage packaging in the US in 2021.

Consequently, the expanding requirement for PET is propelling the ethylene oxide market demand worldwide.

Key Restraints :

High Toxicity and the Related Health Concerns are Hampering the Market

Ethylene oxide is a highly versatile chemical with a range of industrial applications, but its toxicity poses risks to human health and the environment. The compound is classified as a Group 1 carcinogen by the International Agency for Research and Cancer (IARC). Prolonged exposure to this compound is associated with the risk of cancer, particularly for workers in industries where it is used, such as sterilization facilities and chemical manufacturing plants.

Based on the analysis, short-term exposure to high levels of this compound causes immediate health effects, including respiratory irritation, headaches, dizziness, and nausea. Workers handling this compound are at risk of acute exposure. Furthermore, the use of this compound in sterilization processes, particularly in healthcare facilities, has raised concerns among nearby communities about emissions and potential health effects. This has led to increased scrutiny and stricter emissions controls.

- For instance, according to the Environmental Protection Agency (EPA), prolonged exposure to Ethylene oxide can lead to an increased risk of cancer, particularly leukemia, and lymphoma due to its ability to damage DNA.

Thus, these above-mentioned factors hamper the expansion of the market.

Future Opportunities :

Growing Focus on the Sustainable Sourcing is Expected to Project Market Development in Upcoming Years

There is an increasing need for eco-friendly and sustainable products, including those made with bio-based materials, as consumers become more conscious about the environmental impact of their choices. As per the trends analysis, this compound is widely used in various applications and sustainable sourcing of this compound has become highly necessary. Companies operating in sectors such as textiles, personal care, and packaging are increasingly seeking bio-based alternatives to meet consumer preferences.

Bio-based ethylene oxide is produced from renewable resources such as biomass agricultural waste or sugarcane, making it a more sustainable alternative to conventional ethylene oxide, which relies on fossil feedstocks. This aligns with the growing global emphasis on sustainability and reduced carbon emissions. Additionally, bio-based ethylene oxide production methods often generate fewer toxic byproducts, thereby reducing health and safety risks for workers and nearby communities. Owing to this, several initiatives are being taken to promote biobased products.

- For instance, in April 2023, Clariant IGL Specialty Chemicals Private Limited, an established player, announced the showcasing of a portfolio of renewable-based ethylene oxide derivatives for the first time to ChemExpo India 2023. Its VITA range of 100% bio-based surfactants and ethoxylated derivatives supports carbon footprint reduction in multiple markets. This spectacular launch is expected to lessen the dependence on petrochemicals for the production of this compound and reduce its environmental impact.

Thus, the consistent requirement to come up with innovative solutions is expected to create ethylene oxide market opportunities.

Top Key Players & Market Share Insights:

The Ethylene Oxide market is highly competitive with major players providing products and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global ethylene oxide market. Key players in the ethylene oxide industry include-

- Shell (UK)

- INEOS (UK)

- Balchem Corp (U.S.)

- BASF SE (Germany)

- OUCC (Indiana)

- Dow(U.S.)

- Merck KGaA (Germany)

- LyondellBasell Industries Holdings B.V (US)

- NIPPON SHOKUBAI CO., LTD. (Japan)

- India Glycols Limited (India)

- Clariant IGL( Switzerland)

Ethylene Oxide Market Segmental Analysis :

By Application:

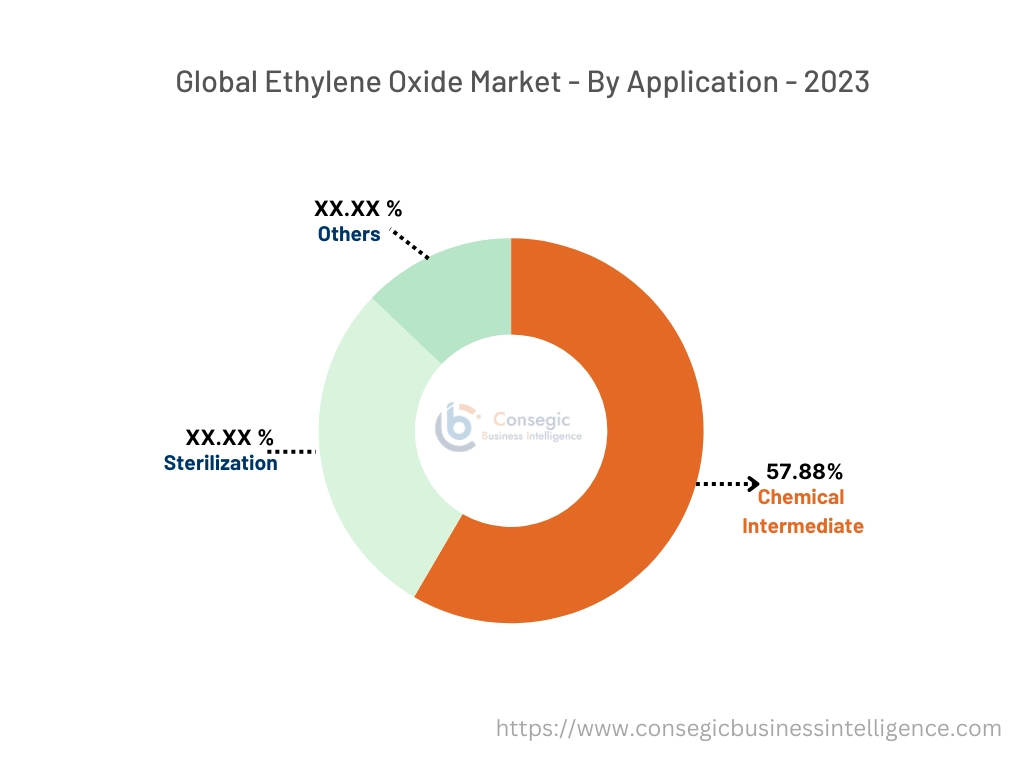

The market is segmented into Chemical Intermediate (Ethylene Glycol, Ethanolamines, Glycol Ethers, Ethoxylates, and Others), Sterilization, and Others.

Trends in the Application:

- The rising requirement for ethylene oxide in various pharmaceutical settings are potential trend for the development of the segment.

- The trend towards personalized medicine and biologics is influencing various innovations in ethylene oxide applications.

The chemical intermediate segment accounted for the largest market share of 57.88% in the ethylene oxide market, in 2023, and it is also expected to grow at the fastest CAGR over the forecast period.

- The chemical intermediate segment is further categorized into ethylene glycol, ethanolamines, glycol ethers, ethoxylates, and others.

- Ethylene oxide plays a pivotal role as a chemical intermediate in the production of several chemical compounds including ethylene glycol, ethanolamines, glycol ethers, and ethoxylates among others.

- Ethylene glycol is a crucial component in the production of PET resins, and antifreeze, as well as in various industrial and consumer products.

- In addition to this, as per the analysis is also utilized in the formation of ethanolamines, which find use in cosmetics, pharmaceuticals, and agriculture.

- Similarly, ethoxylates serve as the major component of surfactants in soaps, detergents, paints, and personal care products.

- Moreover, the escalating expansion of the chemical sector is expected to promote the production of these derivatives in upcoming years.

- According to the data provided by the International Trade Administration in January 2024, the Indian chemicals sector is valued at USD 220 billion and is projected to grow at 9-12 % per annum to reach USD 300 billion by 2026.

- As a result, the rising chemical sector is expected to create enormous ethylene oxide market opportunities in the near future.

By End Users:

Based on the end-use industry segment is categorized into healthcare and pharmaceutical, packaging, chemical, automotive, food and beverage, textile, and others.

Trends in the End Users:

- The expansion of the biopharmaceutical sector, which often requires a sterilization process in healthcare influences the use of ethylene oxide.

In 2023, the packaging segment accounted for the highest market revenue share of the total ethylene oxide market share.

- The packaging sector is recognized as the primary and significant consumer of ethylene oxide and its derivative compounds.

- It plays a critical role in the production of ethylene glycol, which serves as the key precursor material used for the fabrication of polyethylene terephthalate (PET).

- Subsequently, PET is utilized for the production of films and solid-state resins, which are further employed for packaging solutions.

- PET packaging plays a crucial role during the manufacturing of various products such as food containers, beverage bottles, flexible packaging, and blister packs.

- Additionally, the escalating requirement for packaging materials is influencing the ethylene oxide market trends.

- For instance, according to the data provided by the India Brand Equity Foundation in October 2022, the export of packaging materials from India grew at a CAGR of 9.9% to USD 1,119 million in 2021-22 from USD 844 million in 2018-19.

- Thus, the wide applications of the compound in the packaging sector are contributing to the ethylene oxide market demand.

The pharmaceutical and healthcare segment is anticipated to register the fastest CAGR during the forecast period.

- Ethylene oxide is widely used for the sterilization of medical devices, such as surgical instruments, implants, and single-use medical products.

- The requirement for sterile medical equipment continues to grow with the increasing need for surgeries, diagnostics, and healthcare services.

- Furthermore, substantial progress in the medical device sector is expected to forge segment growth in the future years.

- According to the data published by the India Brand Equity Foundation in December 2023, the size of the Indian medical devices market is estimated at USD 11 billion in 2022 and is expected to grow at a CAGR of 16.4 %. To USD 50 billion by 2030.

- Overall, the necessity of the compound for the sterilization of health appliances along with the growing medical device sector is expected to boost the ethylene oxide market expansion.

Ethylene Oxide Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 55.23 Billion |

| CAGR (2024-2031) | 6.4% |

| By Application |

|

| By End Use Industry |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

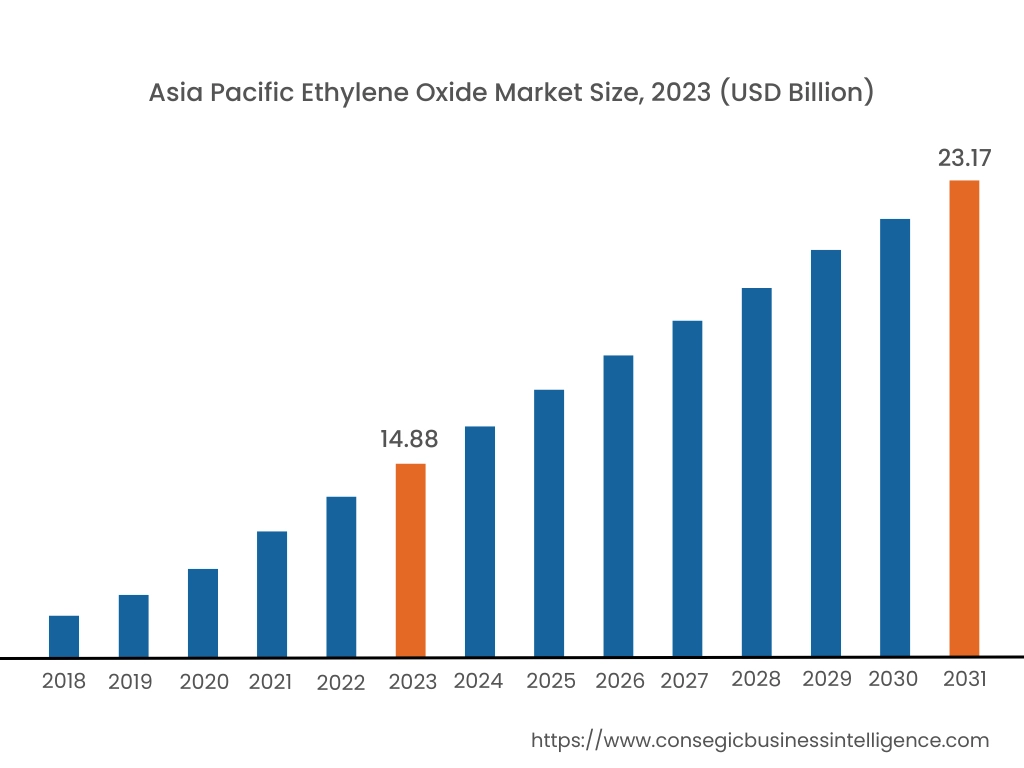

In 2023, Asia-Pacific accounted for the highest market share at 41.56% and was valued at USD 14.88 Billion, and is expected to reach USD 23.17 Billion in 2031. In Asia-Pacific, China accounted for the highest market share of 23.11% during the base year of 2023. The remarkable dominance of the ethylene oxide market across the Asia Pacific region is attributed to factors such as significant growth in the packaging, automotive, food and beverages, pharmaceutical healthcare, textile, and chemical industries. The growth of these industries is leading to a higher requirement for the compound as it is employed for the majority of end-user products and processes used by them. Furthermore, the investment by the governments of countries in this region for industrial development is fueling the consumption of the compound.

- According to the data provided by the India Brand Equity Foundation in August 2023, in Budget 2023-24, capital investment outlay for infrastructure is being increased by 33% to USD 122 billion, which would be 3.3 percent of GDP. Additionally, India plans to spend USD 1.4 trillion on infrastructure through the ‘National Infrastructure Pipeline' in the next five years.

North America is expected to witness the fastest CAGR over the forecast period of 7.3% during 2024-2031. Based on the ethylene oxide market analysis, the growing use of this compound in the pharmaceutical and healthcare sector for the sterilization of medical devices and equipment along with the growing demand for the compound. The natural gas purification application of the oil and gas sector impacts this sector.

- According to the data published in the Impacts of the Oil and Natural Gas Sector on the US economy, in April 2023, states that the oil and natural gas sector's total impact on the US GDP accounted for USD 1.8 trillion, which is approximately 7.6% of the national total in 2021.

Europe plays a significant role in the global ethylene oxide market due to its robust chemical and industrial sectors. The region is a key producer and consumer of the compound, which is primarily used in the production of ethylene glycol, a vital component in antifreeze, polyester, and PET plastics. Growth in industries such as automotive, textiles, and packaging drives the demand for ethylene oxide derivatives in Europe. The European Union's push for sustainability and safer chemical alternatives could influence future demand, potentially slowing ethylene oxide market growth in the region.

The Middle East and Africa (MEA) region are emerging players in the market, primarily driven by increasing industrialization and infrastructural development. The Middle East, with its abundance of petrochemical resources, is a key producer, leveraging cost-effective raw materials like ethylene from natural gas, whereas, in Africa, the market is smaller but steadily growing, supported by the expanding manufacturing and automotive industries. Latin America's ethylene oxide market is growing steadily, driven by industrialization and the expansion of sectors like automotive, textiles, and healthcare.

Recent Industry Developments :

Acquisitions & Mergers:

- In December 2023, INEOS, a global petrochemicals manufacturer, announced the acquisition of the LyondellBasell Ethylene Oxide and Derivatives business and production facility at Bayport Texas for USD 700 Million.

- In October 2023, BASF, the global chemical company, announced the expansion of ethylene oxide and ethylene oxide derivatives at its Verbund site in Antwerp, Belgium. This aligns with its customer-focused corporate strategy. The investment accounted for USD 540.84 million and added about 400,000 metric tons per year to BASF's production capacity for the corresponding products.

New launches:

- In July 2022, INEOS introduced its new Bio-Attributed Ethylene Oxide, which as a whole, substitutes fossil feedstocks with renewable biomass.

Key Questions Answered in the Report

How big is the ethylene oxide market? +

In 2023, the ethylene oxide was USD 35.80 Billion.

Which is the fastest-growing region in the ethylene oxide market? +

North America is the fastest-growing region in the ethylene oxide market.

What specific segmentation details are covered in the ethylene oxide market? +

Application and End-Use Industry are the segments that have been covered in the ethylene oxide market.

Who are the major players in the ethylene oxide market? +

Shell, INEOS, Balchem Corp, BASF SE, Merck KGaA, LyondellBasell Industries Holdings B.V, Reliance Industries Limited., NIPPON SHOKUBAI CO., LTD., India Glycols Limited., OUCC, Dow, and Clariant IGL.