High Performance Polyamides Market Size:

High Performance Polyamides market size is growing with a CAGR of 5.5% during the forecast period (2025-2032), and the market is projected to be valued at USD 4.00 Billion by 2032 from USD 2.62 Billion in 2024. Additionally, the market value for 2025 is attributed to USD 2.75 Billion.

High Performance Polyamides Market Scope & Overview:

High Performance Polyamides (HPPAs) are a distinct class of advanced engineering thermoplastics that significantly enhance properties of a material compared to conventional polyamides. These specialized polymers are developed to provide superior performance characteristics, including exceptional thermal stability, high mechanical strength even at elevated temperatures, excellent chemical resistance, low moisture absorption, and notable dimensional stability. Unlike their standard counterparts, HPPAs are specifically designed to withstand demanding operating environments, ranging from extreme temperatures and aggressive chemicals to high mechanical stresses, making them ideal for critical applications where conventional plastics fall short.

High Performance Polyamides Market Dynamics - (DRO) :

Key Drivers:

The Rise in Adoption of Electric Vehicles to Propel the High-Performance Polyamides Market Expansion.

High Performance Polyamides are important for electric vehicles, mainly for enhancing durability, safety, and efficiency. Polyamides provide superior strength-to-weight ratios, dimensional stability, chemical resistance to coolants & electrolytes, and high dielectric strength, allowing the replacement of heavier metal parts. They are widely utilized in battery module housings, battery structural components, cooling system lines and connectors, power electronics, high-voltage connectors, charging plugs, and even electric motor insulation, contributing significantly to both efficiency and safety of next-generation electric vehicles. The rise in the adoption of electric vehicles is influencing the use of these polyamides for various automotive applications.

For instance,

- According to the data published by the International Energy Agency in 2023, the electric vehicle (EV) is accelerating, with global sales surging to nearly 14 million units in 2023. The electric car sales were 3.5 million higher than in 2023.

Thus, the rise in the adoption of electric vehicles is propelling the high performance polyamides market demand.

Key Restraints:

Stringent Regulations to Hinder High Performance Polyamides Market Expansion.

The global high performance polyamides industry, while continuously innovating to meet evolving requirements for enhanced material properties, faces a significant restraint in the form of stringent regulations. These regulations, mainly driven by growing concerns over environmental impact, human health, and safety, impose considerable hurdles for manufacturers. These regulations require extensive testing, risk assessments, and detailed data submission for new and existing chemical additives that are used in advanced plastics. This leads to significantly increased research and development (R&D) costs and prolonged market approval processes. This slows down the introduction of novel high-performance solutions. As a result, the above-mentioned factors limit the high performance polyamides market demand.

Future Opportunities :

Development of Novel Materials for 3D printing to Create High Performance Polyamides Market Opportunities.

Advancements in 3D printing technologies lead to easy processing of HPPAs like PA11 and PA12 in powder form, allowing the development of complex geometries, lattice structures, and consolidated assemblies. This allows to rapidly prototype and produce end-use parts with superior performance, reduced material waste, shorter lead times, and on-demand customization. Various manufacturers are developing various materials for different industrial applications.

For instance,

- In 2024, HP introduced HP 3D HRPA12S, a new material developed in collaboration with Arkema, which is a significant advancement in industrial 3D printing, specifically leveraging HP's Multi Jet Fusion (MJF) technology.

Thus, as per the market analysis, the development of new materials for a wider range of applications is influencing the high performance polyamides market opportunities.

High Performance Polyamides Market Segmental Analysis :

By Type:

Based on type, the market is categorized into Polyphthalamide (PPA), Polyamide 11 (PA11), Polyamide 12 (PA12), Polyamide 46 (PA46), Polyamide 6T (PA6T), and Others.

Trends in Type:

- The high performance polyamides market trends are influenced by the development of bio-based and sustainable PPA.

- The growing trend for 3D printing solutions is influencing the use of high performance polyamide 12.

The Polyphthalamide (PPA) segment accounted for the largest market share in 2024.

- Polyphthalamide (PPA) is a semi-aromatic polyamide which is as a high-performance engineering thermoplastic that provides significantly enhanced properties compared to conventional polyamides.

- Characterized by its excellent thermal stability, PPA withstands high continuous service temperatures, making it ideal for challenging environments.

- It also exhibits superior mechanical strength, stiffness, and creep resistance, along with exceptional chemical resistance to various automotive fluids, fuels, and industrial solvents.

- Furthermore, PPA maintains dimensional stability even in the presence of moisture, resisting warping or deformation.

- Manufacturers are introducing novel high performance compounds that are designed for metal replacement applications.

- For instance, in 2021, Solvay introduced Amodel® Supreme PPA, a new line of high-performance polyphthalamide (PPA) compounds designed for challenging e-mobility and metal replacement applications.

- Thus, as per the market analysis, the aforementioned factors are influencing the growth of the segment.

The Polyamide 12 (PA12) segment is expected to grow at the fastest CAGR over the forecast period.

- Polyamide 12 (PA12), also widely known as Nylon 12, is a versatile high-performance thermoplastic polymer which is known for its unique balance of properties, making it a preferred choice in challenging engineering applications.

- Derived primarily from petroleum, PA12 distinguishes itself from other nylons by its notably low water absorption, which ensures exceptional dimensional stability and consistent mechanical properties even in humid or wet environments.

- It provides excellent chemical resistance against a wide range of substances including oils, fuels, hydraulic fluids, and solvents, coupled with high impact strength, toughness, and flexibility, particularly at low temperatures.

- Thus, owing to the aforementioned factors, the PA12 segment is expected to grow at the fastest CAGR in the coming years.

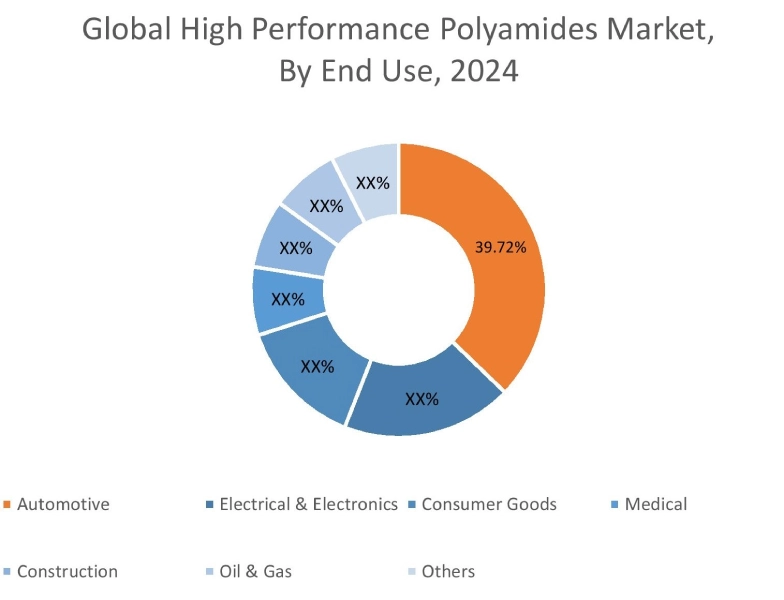

By End Use:

Based on end use, the market is categorized into automotive, electrical & electronics, consumer goods, medical, construction, oil & gas, and others.

Trends in the End Use:

- An increase in trend for lightweight materials for efficient automotives is influencing the use of high-performance compounds.

- A significant trend is the demand for enhanced durability and reliability of electronic devices.

The automotive segment accounted for the largest High Performance Polyamides market share of 39.72% in 2024.

- The automotive sector is using these polyamides mainly to enhance vehicle function, durability, and efficiency.

- The primary reason for this widespread adoption is the critical need for lightweighting to enhance fuel efficiency and reduce emissions.

- The rise in the use of these polyamides in vehicles, including light vehicles, offers enhanced features, thus leading to a rise in production.

- For instance, according to the data provided by TD Economics in April 2024, the U.S. light vehicle market saw a 12.7% increase in sales from 2023.

- Thus, as per the market analysis, the growth in the adoption of automotives is influencing segment share.

The electrical & electronics segment is expected to grow at the fastest CAGR over the forecast period.

- The Electrical and Electronic sector is increasingly demanding materials that withstand challenging operational environments while allowing miniaturization and enhanced performance.

- High Performance Polyamides are uniquely developed to meet these requirements, making them a rapidly growing material choice in this sector.

- Their key properties, such as excellent electrical insulation properties, inherent high thermal stability, and exceptional dimensional stability, are crucial for ensuring the reliability and longevity of electronic components.

- These polyamides are extensively utilized in critical applications like connectors, where they provide robust and reliable electrical pathways; insulators and coil bobbins, preventing short circuits and ensuring efficient current flow; and circuit breaker components among others.

- Hence, owing to the above-mentioned analysis, the electrical and electronics segment is expected to grow at the fastest rate over the future years, creating High Performance Polyamides market trends.

Regional Analysis:

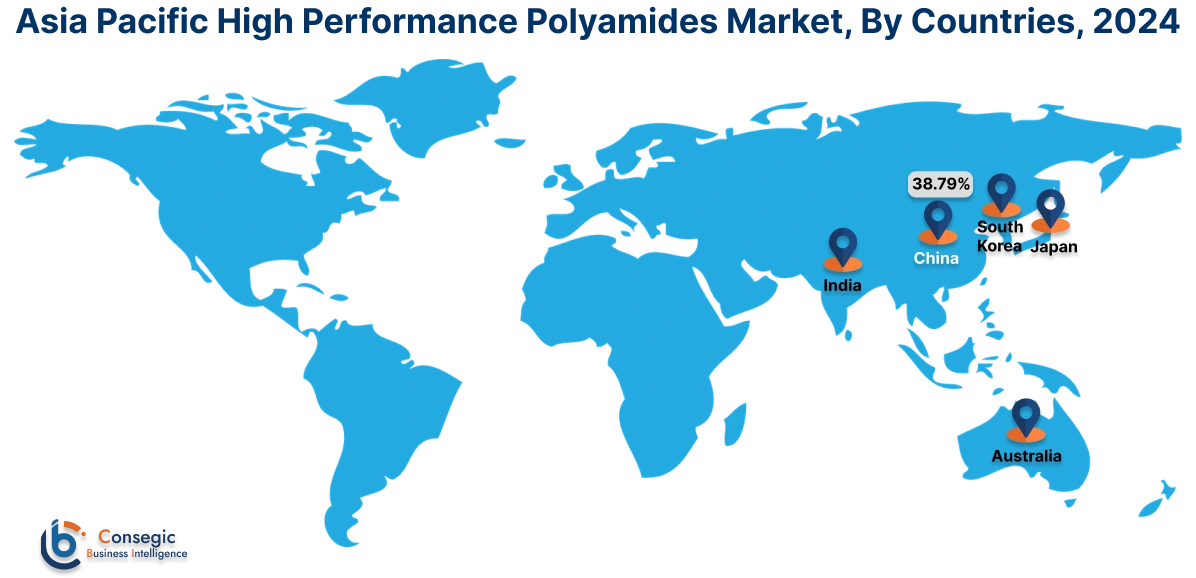

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

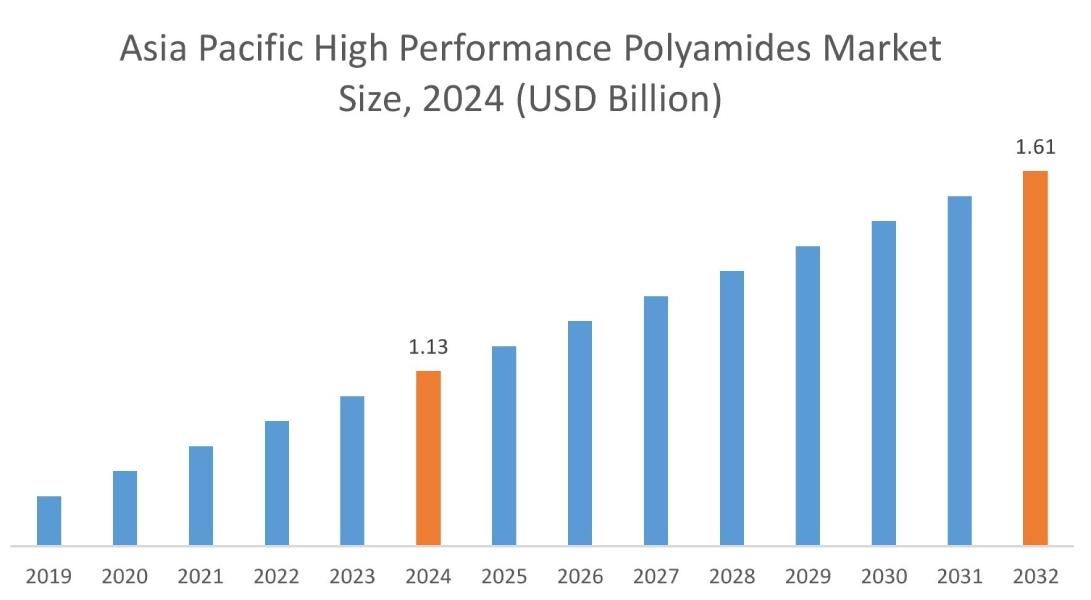

In 2024, Asia Pacific accounted for the highest High Performance Polyamides market share at 43.22% and was valued at USD 1.13 Billion and is expected to reach USD 1.61 Billion in 2032. In Asia Pacific, China accounted for a market share of 38.79% during the base year of 2024. The market in Asia Pacific region is driven by government incentives, growing consumer requirement for sustainable mobility, and robust manufacturing capabilities, particularly in countries like China, Japan, and India. This rapid adoption and widespread production of EVs are creating a significant requirement for High Performance Polyamides, which are important for optimizing EV's functionality, safety, and longevity. The rise in the adoption of electric vehicles such as electric cars is influencing the use of these polyamides.

For instance,

- The data by IEA states that, China's total electric car sales has risen from about 15% in 2020 to nearly 30% in 2024.

Thus, as per the High Performance Polyamides market analysis, these factors create a strong upward trajectory for the Asia Pacific market, positioning it as a key region for players.

In Europe, the industry is experiencing the fastest growth with a CAGR of 7.3% over the forecast period. European industries, especially automotive, aerospace, and medical device manufacturing, are increasingly leveraging HPPAs like PA11, PA12, and PPAs in 3D printing due to their excellent mechanical properties, dimensional stability, and resistance to harsh environments. This allows to produce highly durable and functional prototypes, customized end-use parts, and complex geometries that were previously unachievable with conventional manufacturing or standard 3D printing materials. Thus, as per the high performance polyamides market analysis, the growth of novel material for 3D printing is driving the trends of the market in this region.

The North American region stands as a significant hub for innovation in the high-performance polyamides market, driven by a confluence of factors including stringent regulations, a strong emphasis on sustainability, continuous technological advancements, and requirement from key end-use industries like automotive, construction, and electronics. Manufacturers in North America are increasingly focusing on developing polyamides that not only enhance material properties but also address environmental concerns and contribute to a circular economy. Thus, as per the market analysis, the rise in advancements is propelling the growth of the market in this region.

One of the Latin American market trends is the region's focus on infrastructure development. The growing investment in infrastructure contributes significantly to this requirement for polyamides in several applications in residential, commercial, and industrial buildings. Furthermore, the increasing disposable incomes and a growing awareness of fire safety are boosting the need for high performance polyamides in the region. Thus, these aforementioned factors are contributing to the high performance polyamides market growth in this region.

The Middle East and Africa region mainly relies heavily on high-performance materials to ensure the safety, efficacy, and longevity of medical products. High-performance polyamides play a crucial role in enabling these materials, primarily polymers, to meet the stringent requirements of medical applications. HPPAs, such as PA11, PA12, and various Polyphthalamides (PPAs), are highly valued for their exceptional properties, including superior biocompatibility, chemical resistance to sterilization agents, high mechanical strength, dimensional stability at elevated temperatures, and excellent barrier properties. These attributes make them ideal for a range of critical medical components, from high-precision surgical instruments, various types of catheters and drug delivery systems, to durable housings for medical equipment and implantable devices. Thus, the aforementioned factors are influencing the high performance polyamides market growth in this region.

Top Key Players and Market Share Insights:

The Global High Performance Polyamides Market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global High Performance Polyamides market. Key players in the High Performance Polyamides industry include

- Solvay (Belgium)

- RTP Company (U.S.)

- BASF SE (Germany)

- Evonik (Germany)

- Syensqo (Belgium)

- KURARAY (Japan)

- Mitsui Chemicals (Japan)

- EMS-CHEMIE HOLDING AG (Switzerland)

- Arkema (France)

- Lanxess (Germany)

High Performance Polyamides Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 4.00 Billion |

| CAGR (2025-2032) | 5.5% |

| By Type |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the High Performance Polyamides market? +

In 2024, the High Performance Polyamides market is USD 2.62 Billion.

Which is the fastest-growing region in the High Performance Polyamides market? +

Europe is the fastest-growing region in the High Performance Polyamides market.

What specific segmentation details are covered in the High Performance Polyamides market? +

By Type, and End Use segmentation details are covered in the High Performance Polyamides market.

Who are the major players in the High Performance Polyamides market? +

Solvay (Belgium), RTP Company (U.S.), KURARAY (Japan) are some of the major players in the market.