Smart Oilfield Market Introduction :

Consegic Business Intelligence analyzes that the smart oilfield market size is growing with a CAGR of 5.9% during the forecast period (2023-2030), and the market is projected to be valued at USD 2,632.27 Million by 2030 from USD 1,672.37 Million in 2022.

Smart Oilfield Market Definition & Overview:

Smart oilfield is a term used to describe the use of digital technologies to improve the efficiency and sustainability of oil and gas production. In this, implementation of technologies such as Artificial Intelligence (AI), Internet of Things (IoT), Machine Learning, Deep Learning, and SaaS for the management and optimization of oil and gas production operations at the oilfield. Based on the analysis, implementation of these technology leverages the various digital technologies, data analytics, automation, and real-time monitoring at the oilfield which helps to improve efficiency, safety, and production yield in the oil and gas sector.

Oilfields usually generate a very large amount of data every day. The process of tracking these data is still done by on-field operators, which is a time-consuming process. The data collection and taking insights out of these data are getting important to maintain the production of oil and other hydrocarbons to meet the growing demand across the globe.

Smart Oilfield Market Insights :

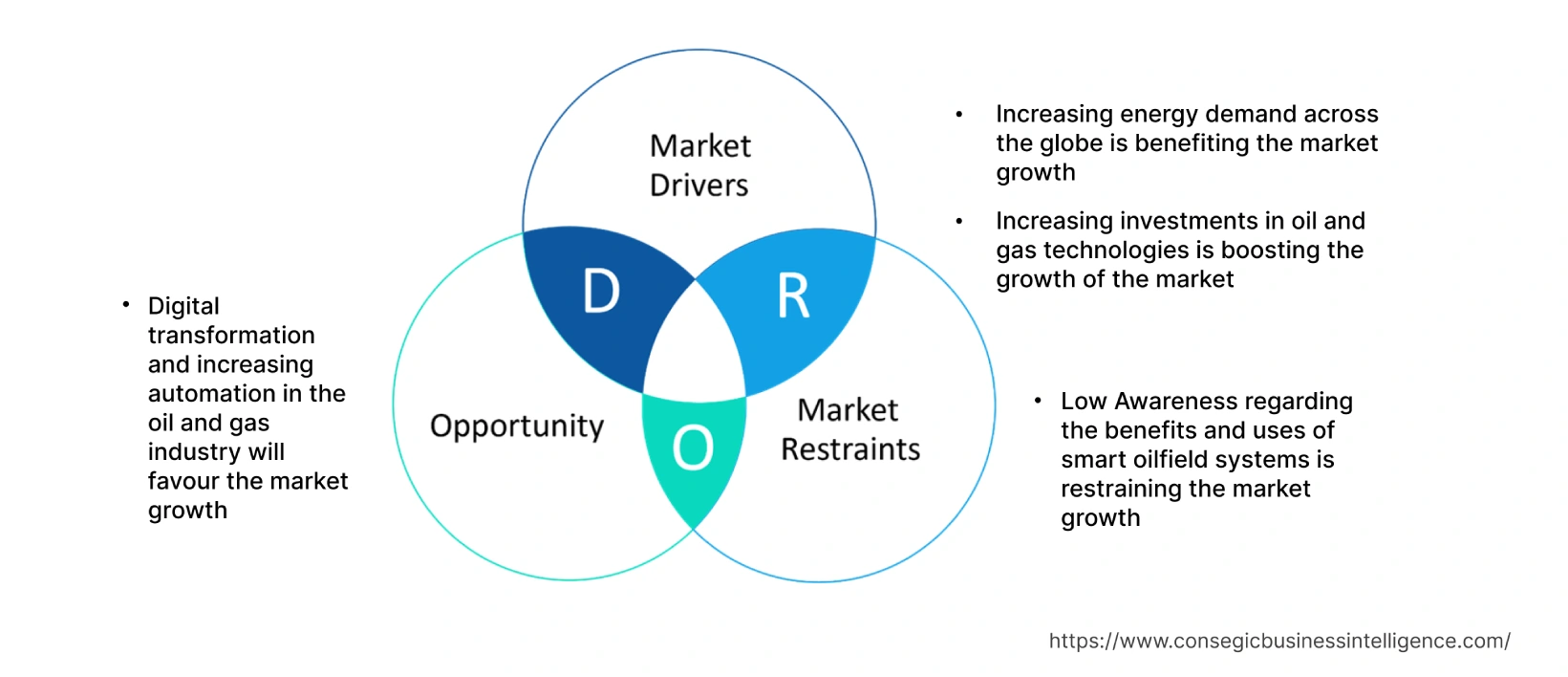

Smart Oilfield Market Dynamics - (DRO) :

Key Drivers :

Increasing energy demand across the globe is benefiting the market

Smart oilfield technologies have the potential to play a significant role in meeting the growing energy requirement sustainably. There is a significant development in the energy requirement across the globe owing to the increasing industrialization in both developed as well as developing economies worldwide. The development in industrialization, population, and industrialization, is driving the requirement for energy across the globe, particularly for oil and gas. The surge in the requirement for energy across the globe is presenting significant strain on the oil and gas sector to meet production targets efficiently, economically, and sustainably. As per the analysis, these technologies provide solutions to address these challenges, making oil and gas production more efficient, safer, and environment friendly by tracking the carbon emission from the processes. For instance, according to the data published by the Our World in Data Organization, the global consumption of natural gas increased from 38,603 TWh in 2020 to 40,671 TWh in 2021. Furthermore, according to the report published by U.S Energy Information Administration in September 2019, global energy consumption will increase by 50% from 2018 to 2050, owing to the increasing requirement from industrial, commercial, residential, and transportation sectors across the globe.

Therefore, the development in energy requirements across the globe will significantly improve the requirement for oil and gas, thus leading to improvements in production efficiency across the oilfield sector. Hence, the increase in energy requirement is boosting the smart oilfield market demand and technological trends to ensure efficient production output of oilfields. This, in turn, is benefiting the market.

Increasing investments in oil and gas technologies are boosting the market

The energy demand is increasing rapidly across the globe, which is influencing the demand for oil and gas for energy production. Various oil and gas producing companies are compelling to explore reserves, optimize production and maximize recovery from existing fields. This high demand for energy across the globe is leading to significant development in the investment in smart oilfield industry and solutions, which offer numerous benefits and advantages in the pursuit of maximizing returns on their investments.

For instance, in November 2019, China announced an investment of USD 75 billion in the Middle East oil and gas projects. These high investments across the oil and gas projects are improving the adoption of new technologies, and thus driving the expansion of the global smart oilfield market trends. Furthermore, in March 2022, China Petroleum and Chemical Corporation, which is also known as Sinopec announced an investment of USD 31.10 billion in 2022 for the upstream production of crude oil across the Inner Mongolia region. Hence, the increasing investment across the oilfield is accelerating the requirement for these technological trends. This, in turn, is driving the market.

Key Restraints :

Low Awareness regarding the benefits and uses of smart oilfield systems is restraining the market

Smart oilfield has emerged as a promising solution for oilfield production optimization, ensuring safety, and real-time data processing technology. However, despite the potential of these technologies, the lower awareness regarding the benefits and uses of these systems is expected to restrain the development of the global smart oilfield market. The oil and gas sector usually requires a high amount of investment in the establishment of an operational plant. Due to this, the sector becomes highly conservative and resistant to the implementation of newer technologies, that require significant changes in the existing workflows. Moreover, the lack of awareness about the potential advantages of these technologies exacerbates the resistance to change and thus it is expected to hinder the smart oilfield market.

Future Opportunities :

Digital transformation and increasing automation in the oil and gas sector will favour the market growth

Smart oilfield is a term used to describe the use of digital technologies. Digital transformation and increasing automation are two key trends that are driving the development of these technologies. Digitalization of the equipment, apparatus, and instruments in the oil and gas industry across the globe is leading to the advancement in the metering, measurement, control, and automation of the various processes in the sector. This increasing automation across the oil and gas sector is based on the Internet of Things (IoT), predictive and self-learning systems which help to improve productivity.

Artificial intelligence helps to reduce the gap of skilled workforce shortages. This adoption of automation and digital technologies in the oil and gas industry provides various benefits such as reduction in cost, provides real-time data, improve efficiency and output, and others. For instance, in June 2022, ABB announced a partnership with Thick Gas, which is a gas distribution company, for the automation of operations across ABB's gas network at several locations. This prominent factor is supplementing the Smart Oilfield market opportunities and trends in the upcoming years.

Smart Oilfield Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 2,632.27 Million |

| CAGR (2023-2030) | 5.9% |

| By Solutions | Hardware, Software and Service, and Data Storage Solutions |

| By Process | Production Optimization, Reservoir Optimization, Drilling Optimization, Safety Optimization and Others (Data Acquisition, etc.) |

| By Application | Onshore and Offshore |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Schlumberger, Halliburton, Weatherford, Siemens, osprey Informatics, Digi International, Baker Hughes, Accenture, Kongsberg Digital, ABB Ltd., and Rockwell Automation |

Smart Oilfield Market Segmental Analysis :

Based on the Solutions :

The solutions segment is categorized into hardware, software and service and data storage solutions. In 2022, the software and service segment accounted for the highest market share and is expected to grow with the fastest CAGR in the smart oilfield market. Oil and gas industries often require software for the development and depletion of mineral deposits. This process requires high levels of safety and costs for the hydrocarbon's recovery. These types of software are used for operations such as production, drilling, and for the simulation of extraction processes. Furthermore, as per the analysis, the adoption of services such as the Internet of Things (IoT), machine learning, artificial intelligence, and big data processing, among others help oil and gas companies to track the real time data of the field to ensure production efficiency, improve performance and ensures safety at the workplace. Thus, due to the above beneficial properties, the adoption of software and services to ensure superior performance benefits is increasing, which, in turn, is benefiting the market growth.

Based on the Process :

The process segment is categorized into production optimization, reservoir optimization, drilling optimization, safety optimization, and others. In 2022, the production optimization segment accounted for the highest market share of 35.50% in the overall smart oilfield market. Production optimization technologies provide advanced reservoir management capabilities, which allow operators to optimize production across the reservoir of the oil and gas sector. As a result, improving the overall production capabilities of the oilfield products. Furthermore, as per the analysis, production optimization also improves operational efficiency. The overall running cost of the oil and gas industry is high. The increasing innovations in production optimization technologies are expected to drive segment growth across the globe over the forecast period. For instance, in February 2023, Baker Hughes, an oilfield service providing company announced the launch of AI software that allows oilfield operators to track real-time production data. Hence, the ongoing innovations in production optimization will increase the smart oilfield market demand and growth to ensure protection from chemicals. This, in turn, will boost the segment growth and trends in the market.

However, the reservoir optimization segment is expected to grow with the fastest CAGR during the forecast period owing to the requirement for water management across the oilfield, increasing government regulation, and others. Thus, the aforementioned factors are propelling the opportunities and trends of the market.

Based on the Application :

The application segment is categorized into onshore and offshore. In 2022, the onshore segment accounted for the highest market revenue in the smart oilfield market. Smart oilfield technologies enable onshore operators to optimize production processes. Various processes such as real-time data monitoring and analytics help to identify production insufficiencies, allowing operators to make data-driven decisions to enhance the overall oilfield output.

As per the analysis, the increasing onshore oilfield discoveries are the major factors driving the segment growth. For instance, in May 2022, ADNOC (Abu Dhabi National Oil Company) announced the discovery of three new onshore oil reserves that will add 650 million barrels of oil to the UAE's hydrocarbon reserves.

However, the offshore segment is expected to be the fastest-growing segment during the forecast period owing to the increasing offshore oilfield investments, offshore oilfield discoveries, and others. Thus, the aforementioned factors are propelling the market trend.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2022, North America accounted for the highest smart oilfield market share at 38.50% and was valued at USD 643.86 million and is expected to reach USD 1,018.69 million in 2030. In North America, the U.S. accounted for the highest market share of 65.05% during the base year of 2022. This is due to the expansion of the oilfield projects across the country. For instance, in February 2022, BP Plc. announced the expansion of its Herschel Project in the Gulf of Mexico. The expansion of this project comprises the development of a new subsea oil and gas production system with an annual production capacity of 10,600 barrels of oil per day. Henceforth, the increase in the oilfield expansion strategies across the North America region is proliferating the smart oilfield market growth.

Furthermore, Asia Pacific is expected to witness significant growth over the forecast period, growing at a CAGR of 6.4% during 2023-20230. Based on the smart oilfield market analysis, this is due to the increasing energy consumption, the launch of new offshore and onshore oilfield projects, and government initiatives for the development of the oil and gas sector across the region.

Top Key Players & Market Share Insights:

The smart oilfield market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Schlumberger

- Halliburton

- Kongsberg Digital

- ABB Ltd.

- Rockwell Automation

- Weatherford

- Siemens

- Osprey Informatics

- Digi International

- Baker Hughes

- Accenture

Recent Industry Developments :

- In January 2023, Bakery Hughes, a global oilfield company announced the launch of a new digital solution Leucipa, which is an automated field production solution that helps to enable oil and gas production management across the oilfield.

- In April 2021, Lavoro Technologies, which is an Internet of Things (IoT) automation service provider for various industries announced a partnership with Agora IoT. The partnership helped Lavoro to expand its customer base for oil and gas companies.

- In July 2020, OSIsoft, a real-time data management software manufacturing company announced a partnership with Tendeka for the optimization, monitoring, and analysis of oil and gas reservoir data.

Key Questions Answered in the Report

What was the market size of the smart oilfield industry in 2022? +

In 2022, the market size of smart oilfield was USD 1,672.37 million

What will be the potential market valuation for the smart oilfield industry by 2030? +

In 2030, the market size of smart oilfield will be expected to reach USD 2,632.27 million.

What are the key factors driving the growth of the smart oilfield market? +

Increasing energy demand across the globe is benefiting market growth.

What is the dominating segment in the smart oilfield market by process? +

In 2022, the production optimization segment accounted for the highest market share of 38.05% in the overall Smart Oilfield market.

Based on current market trends and future predictions, which geographical region is the dominating region in the smart oilfield market? +

North America accounted for the highest market share in the overall smart oilfield market.