Viscose Staple Fiber Market Size :

Consegic Business Intelligence analyzes that the viscose staple fiber market size is growing with a healthy CAGR of 4.7% during the forecast period (2023-2030), and the market is projected to be valued at USD 18,395.52 Million by 2030 from USD 12,830.00 Million in 2022.

Viscose Staple Fiber Market Scope & Overview:

Viscose staple fiber (VSF) is a biodegradable and natural fiber that has features similar to cotton. The fiber range has superior versatility. As a result, the fiber is an ideal solution for applications such as woven and non-woven fabrics. The fiber has various beneficial performance features such as excellent moisture absorption, superior air permeability, higher dyeability, soft texture, and antistatic. In addition, it is a biomass product. As per the analysis, the waste generated from this fiber can be naturally degraded, thereby ensuring superior environmental benefits. Thus, due to the above-mentioned benefits, fiber is frequently utilized in various end-use industries such as textile, automobile, healthcare, and others.

Viscose Staple Fiber Market Insights :

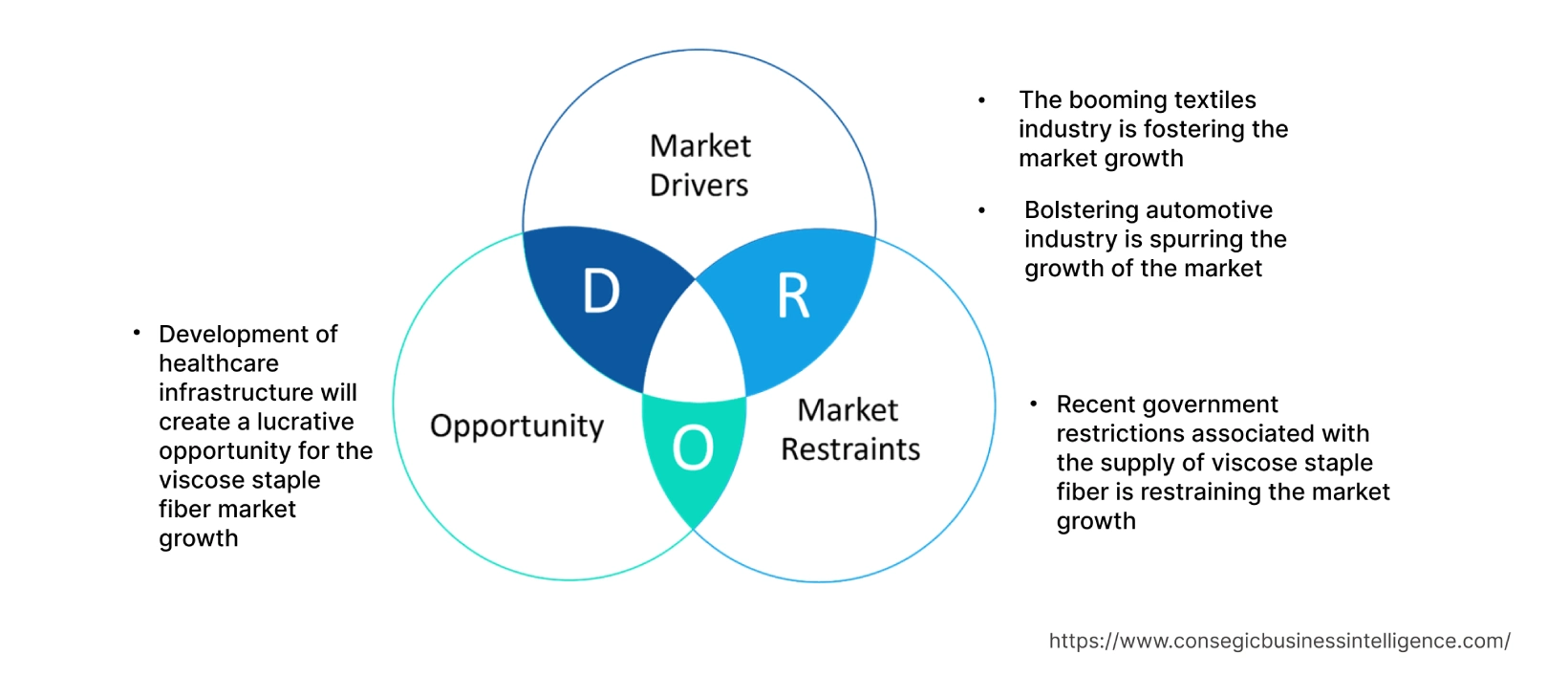

Viscose Staple Fiber Market Dynamics - (DRO) :

Key Drivers :

The booming textiles sector is fostering the market expansion

Viscose staple fiber is ideal for the textile sector to provide comfort and breathability. The fiber is deployed in textile products such as apparel, home textiles, and others. Based on the analysis, the factors such as trends in the research & development associated with the development of new eco-friendly textile products, increasing investments in textile zones, and others are some of the crucial factors accelerating the trends of the textile sector at the global level. For instance, according to the recent statistics published by the Italian Federation of Textiles, Fashion, and Accessories, in 2021, the Italian textiles sector showcased a positive trend over 2020. Furthermore, the Italian textiles market was valued at more than Euro 5.8 billion (USD 6.9 billion) in 2021, registering a year-on-year growth rate of 9.6% as compared with 2020. Hence, the booming textile sector is fostering the demand for this fiber to ensure excellent fiber performance. This, in turn, is spurring the viscose staple fiber market trends.

Bolstering the automotive sector is spurring the expansion of the market

The key properties associated with this fiber include wear resistance, light resistance, and low volatile organic compounds (VOCs). Hence, this fiber is utilized in automotive interiors such as passenger cars, light commercial vehicles, and heavy commercial vehicles. As per the analysis, the increasing purchasing power of people, the rising adoption of electric vehicles, and others are some of the prominent factors accelerating the expansion of the automotive sector. For illustration, according to the Organisation Internationale des Constructeurs d'Automobiles (OICA), in 2021, the production of automotive vehicles at the global level was 80,205,102 units, and in 2022, it was 85,016,728 units, an increase of 6%. Therefore, the rapidly growing automotive sector is a prime factor boosting the viscose staple fiber market demand at the global level to increase the strength of car upholstery. This factor is driving the viscose staple fiber market trends at the global level.

Key Restraints :

Recent government restrictions associated with the supply of VSF are restraining the market expansion

The various government restrictions associated with the global viscose staple fiber industry such as stringent quality control, anti-dumping duties, import restrictions, and others are posing a bottleneck for the market trends. For instance, in January 2023, the government of India extended the Quality Control Orders (QCOs) measures on viscose staple fiber by 60 days. Based on the analysis, the primary aim of Quality Control Orders (QCOs) is to control the import of sub-quality raw materials and to ensure that customers get superior-quality products. As a result, the imposition of stringent regulations is impacting the supply of viscose staple fiber. This is creating a roadblock for the expansion of the market during the projected forecast period.

Future Opportunities :

Development of healthcare infrastructure will create a lucrative opportunity for the VSF market expansion

Viscose staple fiber ensures vital properties for healthcare products to ensure superior softness, safe nature, and others. As a result, the fiber is utilized in healthcare products such as pads, bed sheets, and others. As per the analysis, the increasing investment in the healthcare infrastructure, increasing government initiatives, and others are favoring the development of new healthcare facilities. For instance, in 2022, various hospital construction projects commenced at the global level, including USD 800 million Techo Santepheap Phnom Penh Covid-19 Treatment Center project in Cambodia (project completion year 2030), USD 538 million Gainesville Hospital Expansion project in the United States (project completion year 2030), USD 1,760 million Lok Ma Chau Emergency Hospital Development in China (project completion year Q4 2023), among others. Thus, the development of new healthcare facilities will accelerate the demand for pads, bed sheets, and others. This, in turn, will boost the demand for this fibre to ensure high absorbency, thereby creating a potential viscose staple fiber market opportunities and trends in the coming years.

Viscose Staple Fiber Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 18,395.52 Million |

| CAGR (2023-2030) | 4.7% |

| By Application | Woven and Non-Woven |

| By End-use Industry | Textile, Automotive, Healthcare, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | LENZING AG, Sateri, Birla Cellulose, Kelheim Fibres GmbH, Asia Pacific Rayon Limited, Glanzstoff, SNIACE Group, Clossus Tex, China Hi-Tech Group Corporation (CHTC), and Tangshan Sanyou Group Xingda Chemical Fibre Co. Ltd |

Viscose Staple Fiber Market Segmental Analysis :

By Application :

The application segment is categorized into woven and non-woven. In 2022, the woven segment accounted for the highest viscose staple fiber market share. The prominent features of this fiber include superior gloss, higher heat, excellent chromatography, and others. As a result of the above-mentioned properties, the corrosion of this fiber is significant as compared with synthetic fiber. Thus, the fiber is frequently utilized in woven fabric to ensure superior esthetics and hanging dynamics. The woven fabric is employed in the textile sector. For instance, according to recent data published by the International Trade Administration (ITA), in 2020, the Peru textile and apparel market was valued at USD 907.7 million compared to USD 677.5 million in 2019, representing a year-on-year growth rate of 33.9%. Hence, the advancement in the textile sector is favoring the demand for woven fabric to ensure efficient dyeability. This, in turn, is driving the segment trends.

However, the non-woven segment is projected to be the fastest-growing segment during the forecast period. This is due to the increasing new developments associated with non-woven fabrics at the global level, which is spurring segmental trends.

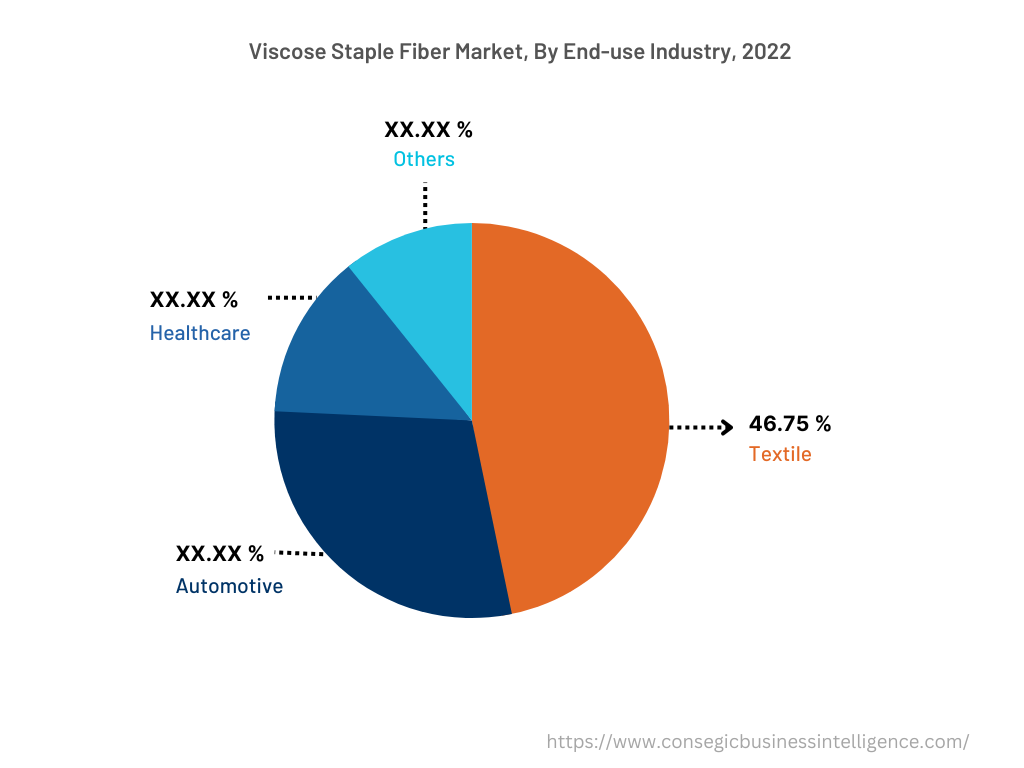

By End-Use-Industry :

The end-use industry segment is categorized into textile, automotive, healthcare, and others. In 2022, the textile segment accounted for the highest market share of 46.75% in the overall Viscose staple fiber market. The fiber is versatile and easily blendable fiber. It is utilized in its original form or can be blended with natural & synthetic fibers to ensure enhanced comfort, feel, and luster. The fiber is deployed in textile products such as dress materials, knitted wear, apparel, home textiles, and others. The federal governments at the global level are adopting various measures to promote modernization, sustainable expansion, increased exports, value addition, and general development of the textile sector, which is resulting in the expansion of the textile sector. For instance, according to the European Union 2030 Vision for Textiles Strategy, favorable measures will be taken in the European Union region to promote the textile sector as greener, highly competitive, and more resilient to global shocks. Therefore, the increasing developments in the textile sector are fueling the demand for this fiber to ensure the soft texture of fabrics. This, in turn, is amplifying the market trends.

However, the healthcare segment is expected to be the fastest-growing segment during the forecast period. This expansion is attributed to factors such as increasing investment in new healthcare facilities, increasing government initiatives, and others.

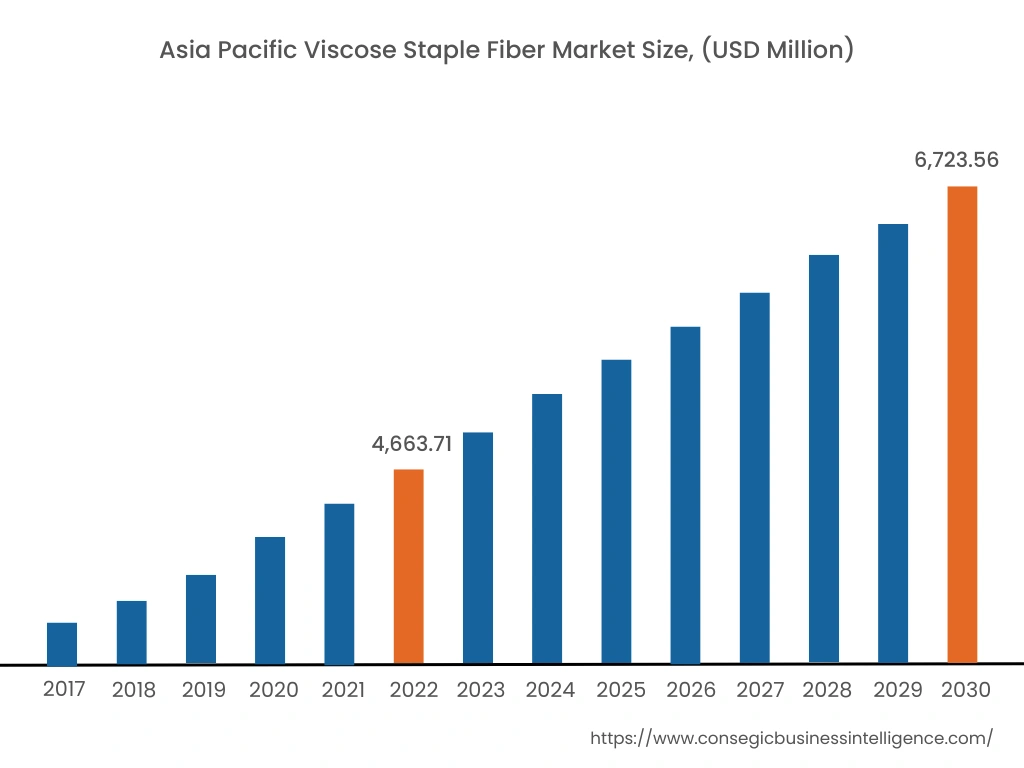

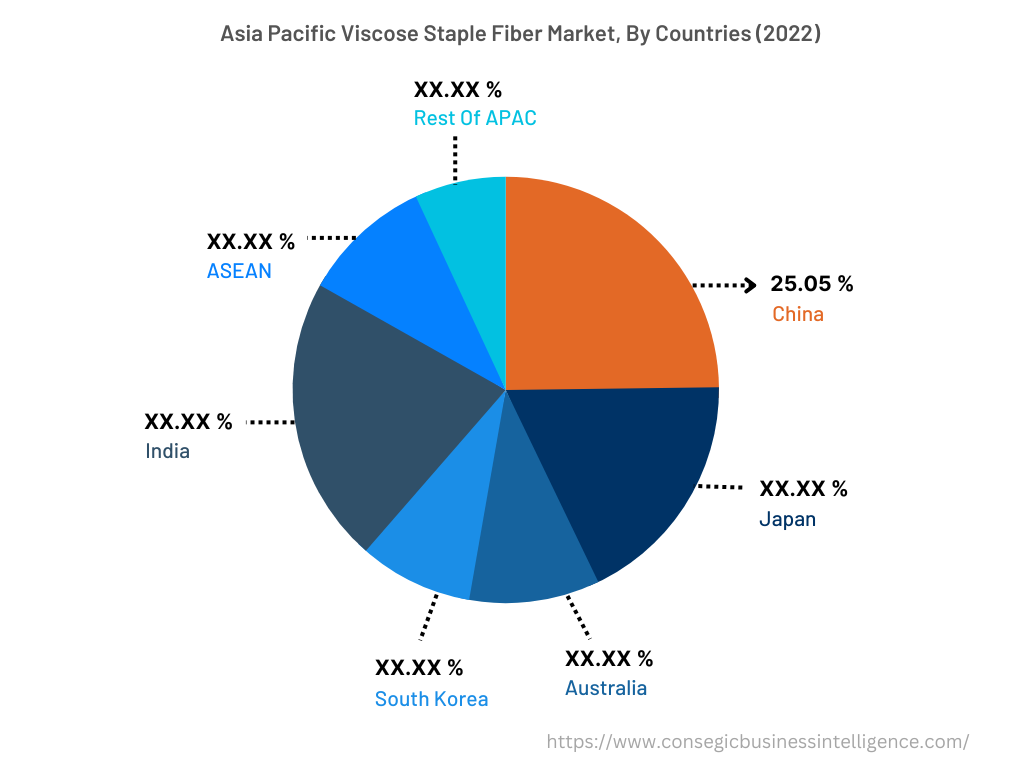

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2022, Asia Pacific accounted for the highest market share at 36.35% and was valued at USD 4,663.71 million, and is expected to reach USD 6,723.56 million in 2030. In Asia Pacific, China accounted for the highest market share of 25.05% during the base year of 2022. As per the viscose staple fiber market analysis, advancements in sectors such as textile, healthcare, and others are accelerating the growth of the viscose staple fiber market in the Asia Pacific region. For instance, according to recent statistics published by Invest India, the Indian textile sector has witnessed a CAGR growth of 28% during the forecast period of 2019 to 2021. Additionally, in April 2022, Xihe Textile Technology Bangladesh Limited invested USD 12.89 million for the development of a new textile manufacturing facility at Mongla Export Processing Zone (EPZ) in Bangladesh. The development of the project will be completed by the end of 2023. As a result, the revenue expansion of the above end-use industries is boosting the viscose staple fiber market growth.

Furthermore, North America is expected to witness significant growth over the forecast period, growing at a CAGR of 5.3% during 2023-20230. Key trends such as the presence of key players in the North American region, the development of new automotive plants, and others are boosting the market growth in the North American region.

Top Key Players & Market Share Insights:

The viscose staple fiber market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- LENZING AG

- Sateri

- Clossus Tex

- China Hi-Tech Group Corporation (CHTC)

- Tangshan Sanyou Group Xingda Chemical Fibre Co. Ltd

- Birla Cellulose

- Kelheim Fibres GmbH

- Asia Pacific Rayon Limited

- Glanzstoff

- SNIACE Group

Recent Industry Developments :

- In July 2020, Renewcell, a textile company based in Sweden formed a collaboration with Levi on the Wellthread line. The line of jeans contains 40% circulose viscose staple fiber and is combined with 60% virgin organic cotton. Thus, the increasing partnership for the supply of viscose staple fiber is driving the market growth.

Key Questions Answered in the Report

What was the market size of the viscose staple fiber industry in 2022? +

In 2022, the market size of viscose staple fiber was USD 12,830.00 million.

What will be the potential market valuation for the viscose staple fiber industry by 2030? +

In 2030, the market size of viscose staple fiber will be expected to reach USD 18,395.52 million.

What are the key factors driving the growth of the viscose staple fiber market? +

The booming textiles industry is fostering the viscose staple fiber market growth at the global level.

What is the dominating segment in the viscose staple fiber market by end-use industry? +

In 2022, the textile segment accounted for the highest market share of 46.75% in the overall viscose staple fiber market.

Based on current market trends and future predictions, which geographical region is the dominating region in the viscose staple fiber market? +

Asia Pacific accounted for the highest market share in the overall viscose staple fiber market.