Lithium Iodide Market Size :

Consegic Business Intelligence analyzes that the lithium iodide market size is growing with a CAGR of 5.5% during the forecast period (2023-2030), and the market is projected to be valued at USD 183.79 Million by 2030 from USD 120.94 million in 2022.

Lithium Iodide Market Scope & Overview:

Lithium iodide is an inorganic compound in comprises lithium and iodine bond with each other to form this compound. The compound easily changes color in the presence of air. This compound is commercialized in two types, lithium iodide anhydrous and lithium iodide trihydrate. As per the analysis, the compound is widely used as an electrolyte additive in Li-S batteries and dye-sensitized solar cells, as it enables long cycle life. Moreover, this compound is also used as a chemical intermediate and catalyst for various chemical reactions such as aldol condensation, cleavage of esters, and organic synthesis of numerous industrial chemicals.

Lithium Iodide Market Insights :

Lithium Iodide Market Dynamics - (DRO) :

Key Drivers :

Increasing demand for lithium iodide for the production of lithium-ion batteries in the automotive sector

The widespread use of lithium iodide as an electrolyte for the production of lithium-ion batteries to offer power solutions in the automotive sector. Such batteries find a wide range of applications in the automotive sector including electric vehicles, owing to the properties such as high energy density, low self-discharge, and minimum maintenance. As per the analysis, the rising automotive sector due to the increasing advancements such as the growing electrification of automobiles and the introduction of low-emission vehicles is surging the requirement for this compound to be used in lithium-ion batteries. For instance, as per the International Energy Agency (IEA), in 2020, global car sales were calculated to be 41 million units. Therefore, the rising requirement for this compound from the automotive sector is fueling the lithium iodide market growth and trend.

The increasing application of lithium-ion batteries in the electronic sector

Lithium iodide is extensively used as an additive to tune the cell chemistry and facilitate charge during the charging process. The widespread application of lithium-ion batteries in the electronic industry such as mobile phones, laptops, digital cameras, and other portable electronic devices is driving the want for this compound. This is due to the advantages offered by these batteries including more power storage, lightweight, and the ability to charge the device easier and faster. The growing inclination of consumers toward smart devices is propelling the expansion of the electronic industry that, in turn, drives the demand for this compound in the production of lithium-ion batteries. Thus, the increasing use of these batteries in the electronic sector is propelling the trend and growth of the market.

Key Restraints :

Stringent government regulations related to the use of lithium iodide are likely to hamper the market

Lithium iodide has a wide scope of applications such as refrigeration processes and artificial pacemakers, among others. However, it is considered a hazardous chemical and prolonged exposure to the compound is likely to cause conditions such as skin irritation, irritation in the respiratory tract, and serious eye irritation. As a result, various regulatory bodies including the Occupational Safety and Health Administration (OSHA) have included this compound in the hazardous substance list. Hence, the stringent government regulations related to the use of this compound is likely to hamper the lithium iodide market growth and trends.

Future Opportunities :

Increasing adoption of renewable energy resources

Lithium iodide is widely used as an electrolyte additive in lithium-ion batteries and dye-sensitive solar cells. The increasing adoption of renewable energy sources such as solar and wind is accelerating the need for efficient energy storage systems including lithium-ion batteries. For instance, according to the paper published by the International Renewable Energy Agency (IRENA) in 2021, 80% of all the new electricity capacity was renewable. Therefore, the increasing adoption of these renewable sources for applications including power generation is anticipated to offer lucrative lithium iodide market opportunities and trends to the key players operating in the lithium iodide market.

Lithium Iodide Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 183.79 Million |

| CAGR (2023-2030) | 5.5% |

| By Form | Powder and Liquid |

| By Type | Lithium Iodide Anhydrous, Lithium Iodide Trihydrate, and Others |

| By Application | Electrolyte, Absorbent, Catalyst, Chemical Intermediate, and Others |

| By End User | Agrochemicals, Automotive, Electronics, Pharmaceutical, Chemical, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Merck KGaA, Albemarle Corporation, American Elements, Leverton Lithium, Samrat Pharmachem, Shanghai Oujin Lithium, Alfa Aesar (a subsidiary of Thermo Fisher Scientific), TCI Chemicals Pvt. Ltd., Toronto Research Chemicals, and Santa Cruz Biotechnology, Inc. |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Lithium Iodide Market Segmental Analysis :

By Form :

The form segment is bifurcated into powder and liquid. In 2022, the liquid segment dominated the lithium iodide market. Liquid-based lithium iodide has wide application scope as an electrolyte and catalyst in various industries such as pharmaceutical, automotive, and electronics among others is proliferating the market. In addition, the integration of the compound in lithium-ion batteries is also driving the market.

Moreover, the powder segment is anticipated to witness the fastest CAGR over the forecast period. Based on the analysis, the rising application of this compound in the pharmaceutical sector in the production of various other pharmaceutical drugs is expected to fuel the market. Moreover, the increasing demand for powdered form of this compound from the agrochemical sector is also propelling market trends and opportunities.

By Type :

The type segment is divided into lithium iodide anhydrous, lithium iodide trihydrate, and others. The lithium iodide anhydrous segment held the highest market share in 2022. Lithium iodide anhydrous is widely used in the development of solid-state batteries. In addition, as per the analysis, the compound also finds a wide range of applications in the production of other industrial chemicals including N-alkyl 2-pyridone. For instance, Merck KGaA, headquartered in Germany, offers Lithium iodide anhydrous in a solid form used in the synthesis of chemicals such as β-mannosides and β-rhamnoside. Hence, the wide adoption of lithium iodide anhydrous as a catalyst in the chemical sector is propelling market trend.

However, the lithium iodide trihydrate segment is anticipated to register the fastest CAGR over the forecast period. The rising adoption of lithium salts for the treatment of bipolar disorders in the pharmaceutical sector is anticipated to fuel market. The growing awareness regarding psychological illness among the population is expected to contribute to lithium iodide market trend.

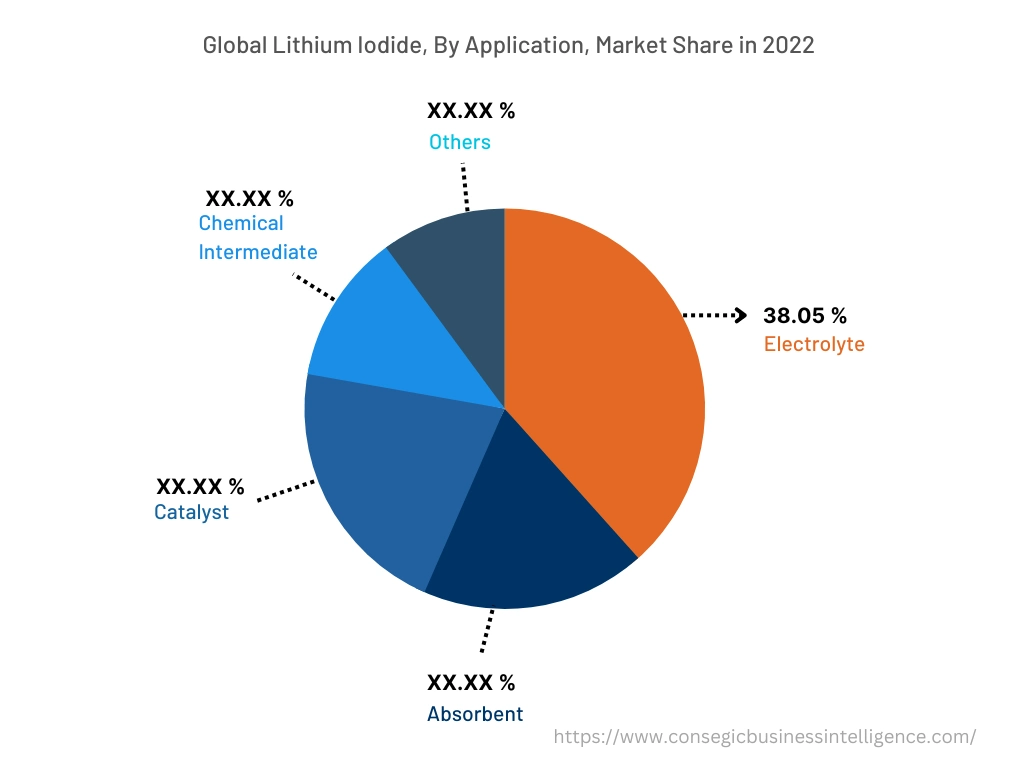

By Application :

Based on application, the market is divided into electrolyte, absorbent, catalyst, chemical intermediate, and others. The electrolyte segment accounted for the highest lithium iodide market share of 38.05% in the overall market. The compound is extensively used as an electrolyte in the production of artificial pacemakers, lithium-ion batteries, and mineral water. For instance, Albemarle Corporation, headquartered in the U.S. specializes in manufacturing this compound that is deployed in lithium-ion batteries and artificial pacemakers. Therefore, the wide scope of applications in various end use industries including automotive, electronics, and pharmaceutical is accelerating the lithium iodide market demand.

Moreover, the catalyst segment is expected to witness the fastest CAGR over the forecast period. Based on the analysis, the rising application of this compound as a catalyst in the refrigeration process is anticipated to surge the market. In addition, the growing requirement for the compound in the pharmaceutical sector as the primary source of iodine in the production of other drugs is also proliferating the market.

By End-User :

The end-user segment is categorized into agrochemicals, automotive, electronics, pharmaceuticals, chemicals, and others. The electronics sector held the highest market revenue in the overall lithium iodide market. The compound has a wide adoption has wide adoption in the production of lithium-ion batteries that are used in various consumer electronics proliferating the lithium-ion market. As per the analysis, this is due to the advantages offered by these batteries including longevity, versatility, and performance.

Moreover, the automotive segment is expected to witness the fastest CAGR over the forecast period. The growth is attributed to the rising demand for automobiles that require lithium-ion batteries owing to the increasing technological advancements including autonomous driving, diverse mobility connectivity, and electrification. For instance, as per the European Automobile Manufacturers Association, the market for passenger cars in Europe grew by 11.3% in 2023. Hence, the rising application of this material in the production of lithium-ion batteries is propelling the lithium iodide market growth.

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

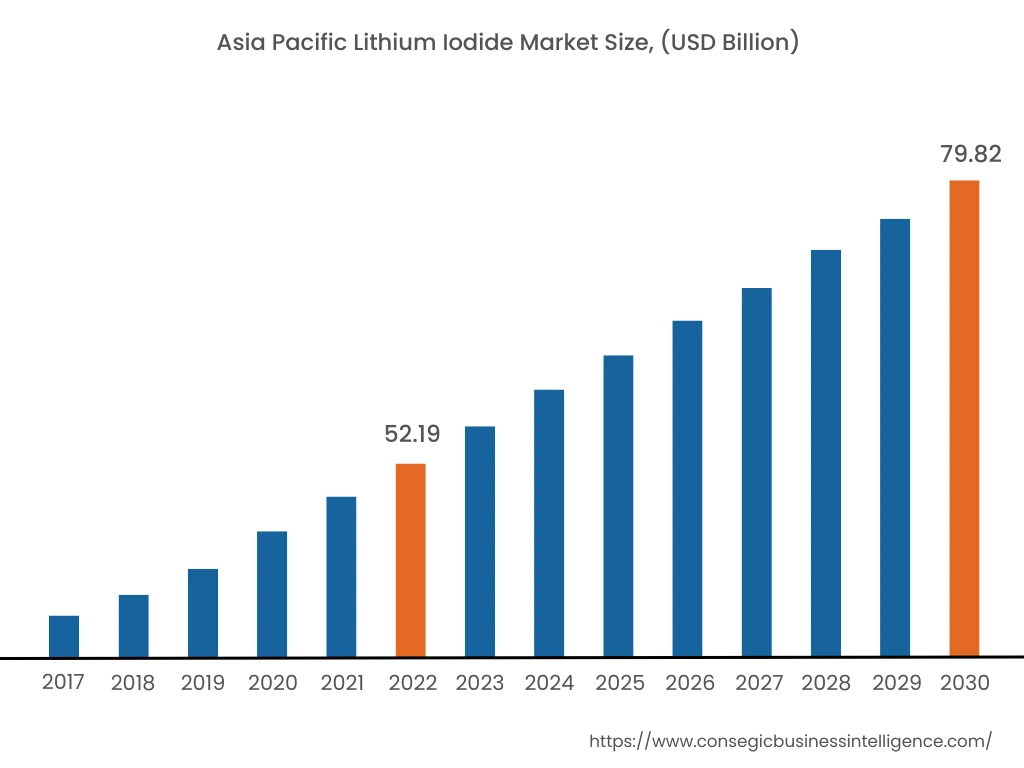

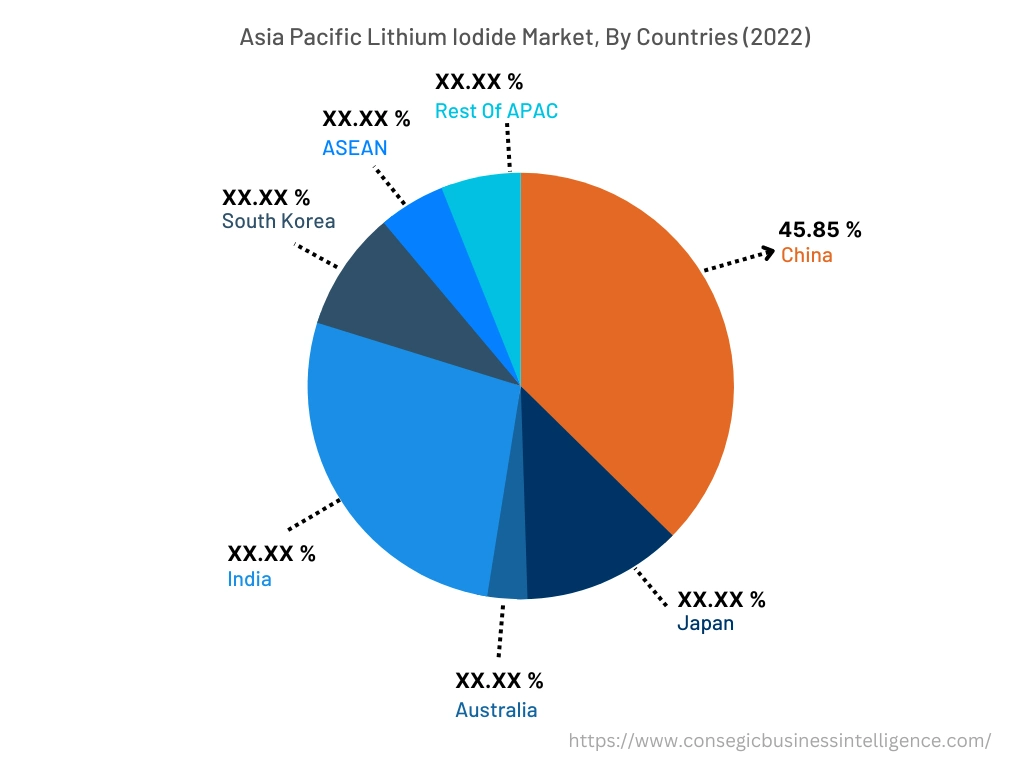

In 2022, Asia Pacific accounted for the highest market share at 43.15% and was valued at USD 52.19 million, and is expected to reach USD 79.82 million in 2030. In Asia Pacific, China accounted for the highest market share of 45.85% during the base year of 2022. Based on the lithium iodide market analysis, the increasing digitalization and inclination of the population towards smart gadgets is surging the demand for electronics. For instance, according to the Indian Ministry of Electronics & IT, the electronics manufacturing sector is projected to account for USD 300 billion by 2025-2026. In addition, the rising pharmaceutical sector in the region is also driving market growth as this material is used as the iodine source in the production of various drugs. Thus the aforementioned factors are creating lucrative lithium iodide market trends in this region.

However, North America is expected to register the fastest CAGR of 6.3% during the forecast period. The demand for consumer electronics in the region is increasing exponentially. Hence, the wide adoption of lithium-ion batteries across various consumer electronic goods including smartphones, and tablets is contributing to the growth of the market.

Top Key Players & Market Share Insights:

The global lithium iodide market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The lithium iodide industry is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Merck KGaA

- Albemarle Corporation

- TCI Chemicals Pvt. Ltd.

- Toronto Research Chemicals

- Santa Cruz Biotechnology, Inc

- American Elements

- Leverton Lithium

- Samrat Pharmachem

- Shanghai Oujin Lithium

- Alfa Aesar (a subsidiary of Thermo Fisher Scientific)

Recent Industry Developments :

- In February 2023, Albemarle Corporation merged with Mineral Resources Limited which is a mining service company, to reorganize the parties' MARBL lithium joint venture located in Australia.

- In October 2022, Albemarle Lithium UK Limited, a subsidiary of the Albemarle Corporation acquired Guangxi Tianyuan New Energy Materials Co., Ltd for about USD 200 million.

Key Questions Answered in the Report

What was the market size of the lithium iodide industry in 2022? +

In 2022, the market size of lithium iodide was USD 120.94 million

What will be the potential market valuation for the lithium iodide market industry by 2030? +

In 2030, the market size of lithium iodide will be expected to reach USD 183.79 million.

What are the key factor driving the growth of the lithium iodide market? +

Increasing demand for lithium-ion batteries from the automotive and electronic industry is serving as the major driving factor in the lithium iodide market.

What is the dominating segment in the lithium iodide market by application? +

In 2022, the electrolyte segment accounted for the highest market share of 38.05% in the overall lithium iodide market.

Based on current market trends and future predictions, which geographical region will have the fastest impact on the Lithium Iodide market's growth in the coming years? +

North America is expected to be the fastest-growing region in the market during the forecast period.