Xanthate Market Size:

Xanthate Market size is growing with a CAGR of 6.2% during the forecast period (2025-2032), and the market is projected to be valued at USD 0.97 Billion by 2032 from USD 0.60 Billion in 2024. Additionally, the market value for the 2025 attributes to USD 0.63 Billion.

Xanthate Market Scope & Overview:

Xanthate is an organosulfur compound, typically a salt or ester of xanthic acid. They appear as yellowish solids with a pungent odor. Their key property lies in their ability to selectively bind to metal ions. This makes them crucial in mineral flotation for separating valuable ores such as copper, gold, and zinc from unwanted materials. The main type of this compound includes sodium ethyl xanthate, potassium Amyl xanthate, and sodium isobutyl xanthate amongst others. Beyond mining, these compounds find end-uses as rubber vulcanization accelerators, agricultural soil fumigants, and intermediates in various chemical synthesis.

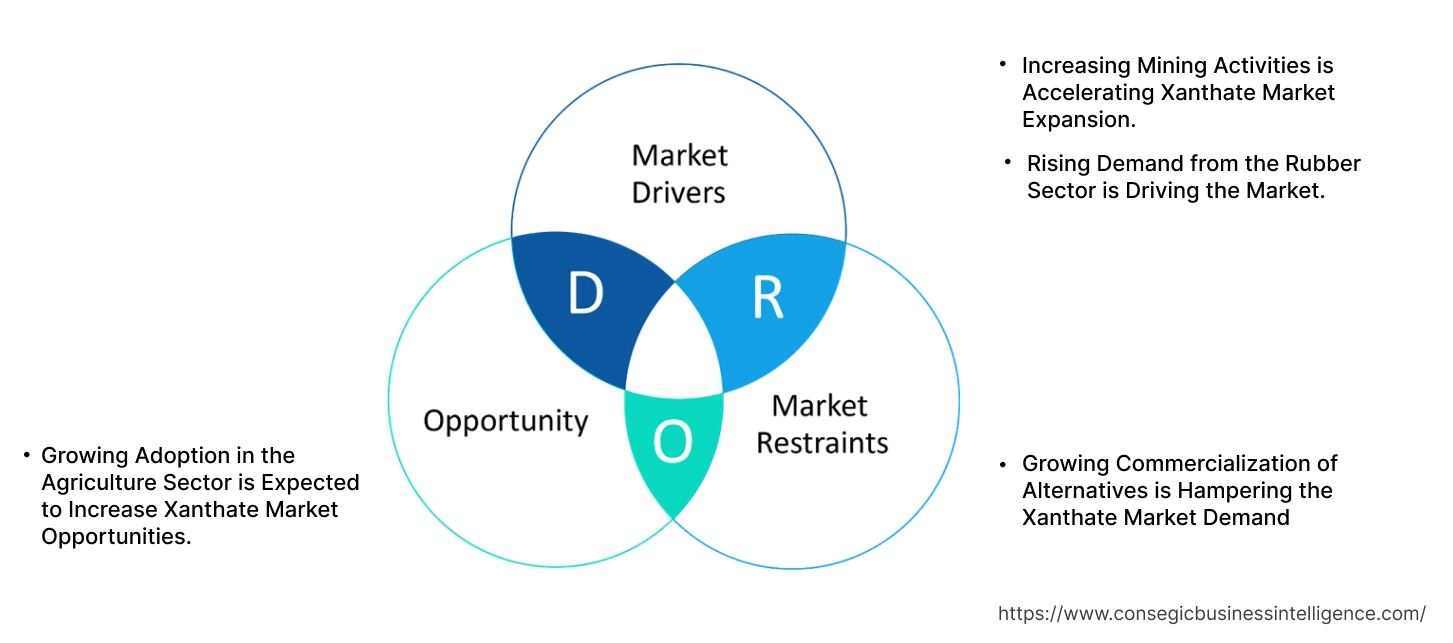

Xanthate Market Dynamics - (DRO) :

Key Drivers:

Increasing Mining Activities is Accelerating Xanthate Market Expansion.

In the mining sector, xanthates are primarily used as collectors in froth flotation to separate valuable metals from ore. They are especially effective for sulfide ores and are commonly used for extracting copper, nickel, silver, and gold. Their efficient separation process significantly enhances the recovery of valuable metals from increasingly complex and low-grade ore bodies. Increased mining activities for energy transition minerals are boosting xanthate demand.

For instance,

- According to a study published by Advances in Engineering Innovation, China's refined copper output reached 10.49 million tons in 2021, a 7.4% year-over-year increase, thus positively impacting xanthate market.

Overall, the increasing mining activities are significantly boosting the xanthate market expansion.

Rising Demand from the Rubber Sector is Driving the Market.

In the rubber sector, xanthate, an organosulfur compound, primarily functions as a vulcanization accelerator, playing a crucial role in the curing process of rubber compounds. They facilitate the cross-linking of polymer chains, a process essential for achieving the desired elasticity, strength, and durability of rubber products. It also improved the mechanical properties of the final rubber goods. Rising automotive and industrial production, coupled with growing global trade, drives a higher need for rubber products, driving the demand for this organosulfur compound.

For instance,

- According to the Malaysian Rubber Council, Malaysia’s rubber product exports saw a significant increase of 17.6% in 2024 compared to 2023, thus influencing the xanthate market trends.

Thus, rising need from rubber sector is accelerating the global xanthate market growth.

Key Restraints:

Growing Commercialization of Alternatives is Hampering the Xanthate Market Demand

The market faces competition from other substitutes available in the market. Xanthate compounds, while effective, face scrutiny due to their toxicity and the hazardous byproduct, carbon disulfide, formed during decomposition. Reagents such as dithiophosphates, thionocarbamates, and hydroxamates are being adopted in mineral flotation due to their lower toxicity and better selectivity for certain ores. These alternatives are particularly favored in regions with stringent environmental regulations. Additionally, bio-based collectors are emerging as viable replacements, driven by the global shift toward sustainable mining practices. These substitutes also provide better thermal stability and are safer to handle and store. Hence, the growing commercialization of substitutes is hampering the xanthate market demand.

Future Opportunities :

Growing Adoption in the Agriculture Sector is Expected to Increase Xanthate Market Opportunities.

Xanthate compounds are used for their properties in pesticides, acting as soil fumigants to control nematodes and fungi in the soil before planting. Moreover, they have potential to be utilized in herbicides and insecticides. Their sulfur-containing structure exhibits toxicity to certain pests and weeds. Pests such as insects, weeds, and diseases are increasingly damaging crops, creating potential for the market.

For instance,

- According to a study published by the National Institute of Food and Agriculture, in 2023, between 20% to 40% of global crop production is lost to pests annually.

Overall, growing adoption in the agriculture sector is expected to increase xanthate market opportunities.

Xanthate Market Segmental Analysis :

By Product Type:

Based on product type, the market is categorized into sodium ethyl xanthate, sodium isobutyl xanthate, sodium isopropyl xanthate, potassium amyl xanthate, potassium ethyl xanthate, and others.

Trends in Product Type:

- Potassium amyl xanthate is gaining traction due to its stronger collecting power, particularly for precious and base metal ores, leading to higher recovery rates in specific mining applications.

- Sodium isobutyl xanthate is witnessing increased need due to its improved selectivity and performance in the flotation of complex sulfide ores, offering better separation efficiency.

The sodium ethyl xanthate segment accounted for the largest market share in 2024.

- Sodium ethyl xanthate exhibits excellent collecting power for a wide range of sulfide minerals, including those of copper, zinc, lead, nickel, silver, and gold.

- Moreover, this compound provides a cost-effective solution for mineral beneficiation without significantly compromising recovery rates.

- Additionally, it has a long history of successful application in the mining industry, with well-established protocols and a deep understanding of its performance characteristics under different conditions. The extraction of metals from sulfide ores is growing, which is having a positive impact on the market trends.

- For instance, according to CEIC Data, Mexico's gold production experienced an increase of 2.6% in 2024 when compared to 2023.

- Overall, as per the market analysis, the increased metal extraction is driving a segment in the xanthate market growth.

The potassium amyl xanthate segment is expected to grow at the fastest CAGR over the forecast period.

- Potassium amyl xanthate is recognized for its stronger collecting power, making it particularly effective in the flotation of certain sulfide minerals, especially when dealing with complex or low-grade ores.

- Moreover, its longer alkyl chain (amyl group) provides enhanced hydrophobicity to the mineral particles, leading to better attachment to air bubbles in the flotation process and thus improved recovery rates.

- Additionally, it is favored in base metal and precious metal mining where a more aggressive collector is required.

- As high-grade, easily accessible ore bodies deplete, the processing of more complex and lower-grade deposits necessitates the use of stronger collectors to achieve economic recovery, driving the segment. Furthermore, rising demand for precious metals supports segment growth.

- According to market analysis, complex ores, and precious metal requirements will drive the segmental share for the upcoming years.

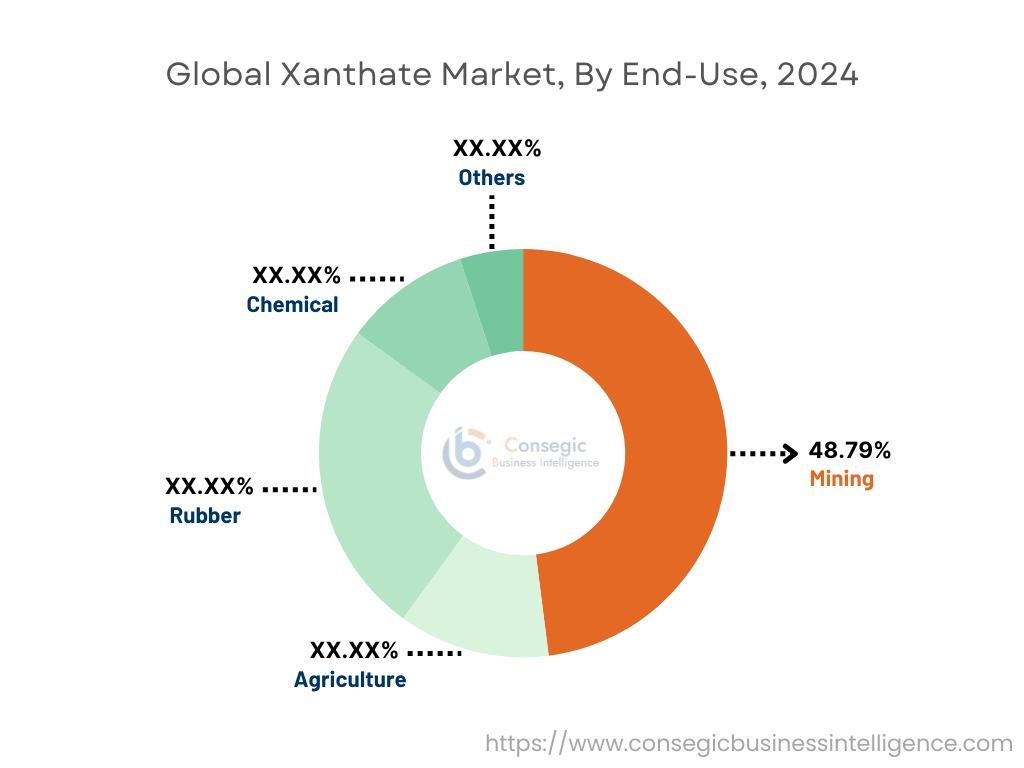

By End-Use:

Based on end-use, the market is categorized into mining, agriculture, rubber, chemical, and others.

Trends in the End-Use

- Xanthate is gaining importance as an important intermediary in the synthesis of various organic compounds in the chemical sector.

- The requirements for xanthate as a vulcanization accelerator in the rubber industry are influenced by trends in automotive and industrial rubber product manufacturing.

The mining segment accounted for the largest market share of 48.79% in 2024.

- Xanthate compounds are added to ore slurries in flotation tanks. They selectively bind to sulfide minerals, making them hydrophobic, meaning they repel water and cling to bubbles.

- The hydrophobic sulfide minerals then float to the surface and are skimmed off, separating them from other minerals in the ore.

- They are used in the extraction of various metals and minerals, including copper, nickel, silver, gold, and sulfide minerals.

- It is given to make their bones strong. It also enhances the overall health of animals.

- Ongoing innovations in flotation cell design, automation, and process control optimize the effectiveness and consumption of these compounds, thus driving the segment.

- Overall, as per the xanthate market analysis, technological advancements are driving the segment in the xanthate industry.

The agriculture segment is expected to grow at the fastest CAGR over the forecast period.

- Xanthate compounds have found applications in agriculture such as pesticides, and antifungal agents, and for their potential in controlling weeds.

- Specifically, they act as agrochemicals (fungicides), inhibiting mycelial growth, and as larvicides.

- Moreover, they are used in the development of controlled-release pesticide formulations, such as starch xanthate-EPTC products.

- Climate change is altering weather patterns and temperatures, creating more favorable conditions for pests to thrive and spread on plants, creating potential for the market.

- For instance, according to the IBEF, the Indian agrochemicals sector is expected to grow at a CAGR of 9% between fiscal years 2025 and 2028.

- Thus, according to market analysis, the growing agrochemical requirements will drive segmental growth for the forecasted years.

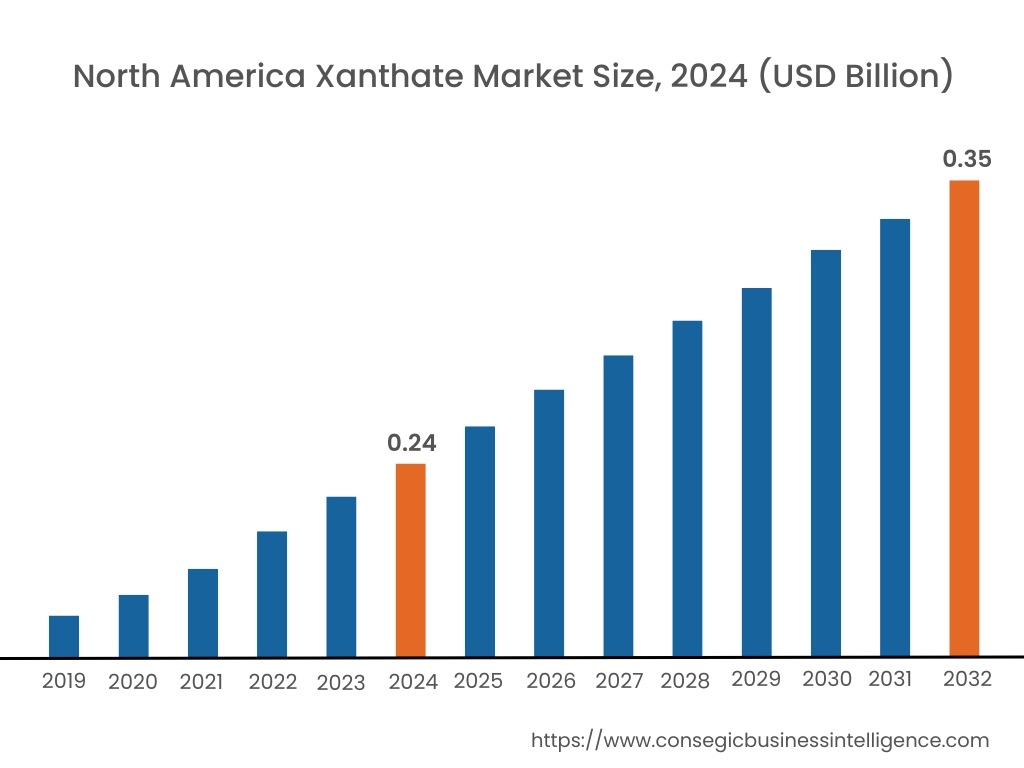

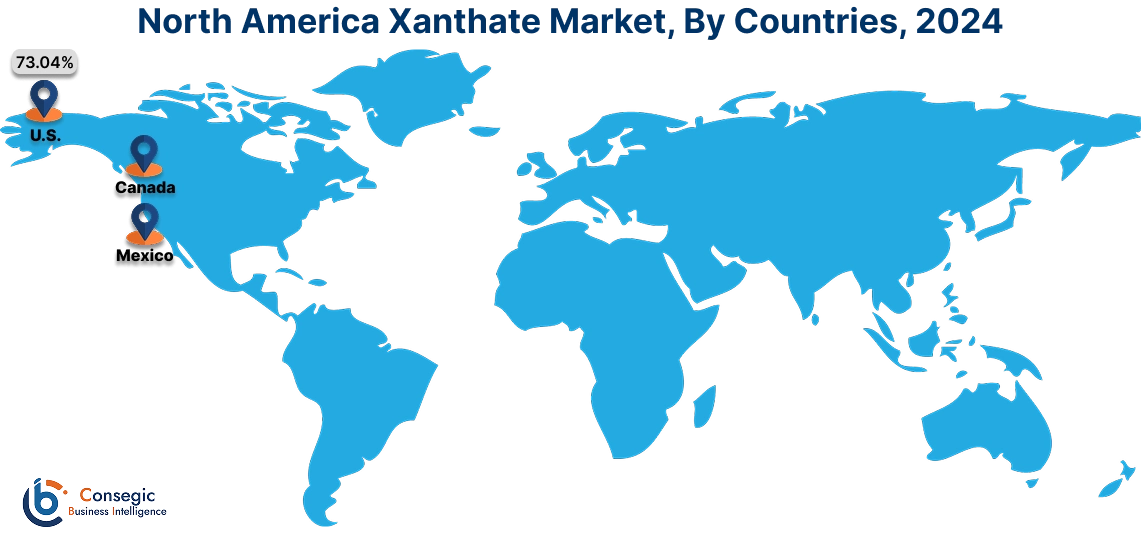

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, North America accounted for the highest xanthate market share at 39.98% and was valued at USD 0.24 Billion and is expected to reach USD 0.35 Billion in 2032. In North America, the U.S. accounted for the xanthate market share of 73.04% during the base year of 2024. There is an increasing manufacturing of rubber products in the region, particularly tires for the growing automotive sector (including electric vehicles) and industrial rubber goods for the expanding construction and manufacturing industries.

For instance,

- According to ISED Canada, rubber product manufacturing increased by 12.2% in 2021 compared to 2020.

Xanthate compounds are crucial as vulcanization accelerators in rubber processing, enhancing the final product's durability and performance. Thus, expanding rubber products manufacturing is driving the market in the region.

In Asia Pacific, the xanthate market is experiencing the fastest growth with a CAGR of 8.2% over the forecast period. The growing adoption of xanthate in agriculture, particularly as soil fumigants and potentially as intermediates in the synthesis of certain pesticides, is contributing to market growth. The increasing awareness of soil health and the need for effective pest management in this agriculturally significant region are driving the market. This trend is supported by the large agricultural base in countries such as India and China, where efforts to enhance crop yields and protect harvests are leading to greater utilization of these chemicals in specific applications.

Europe's xanthate market analysis indicates that several key trends are contributing to its growth in the region. The region’s mining sector serves as a significant driver for the market. A rise in the extraction of base metals such as copper, zinc, and lead, alongside precious metals, directly boosts the demand for xanthate compounds, which are essential as flotation reagents in ore processing. Furthermore, another trend is ongoing investment in mining technologies and expansions of existing mining operations across Europe, contributing to greater consumption of these compounds for efficient mineral beneficiation and enhanced metal recovery rates, positively impacting the market.

Middle East and Africa (MEA) market analysis indicates the region is increasing the adoption of xanthate compounds within the chemical sector. They serve as crucial intermediates in the production of various organic compounds and specialty chemicals, including certain polymers and pharmaceutical intermediates. The growing industrialization and diversification of the chemical manufacturing base in the MEA, coupled with investments in developing local production capabilities for specialty chemicals, are leading to a greater requirement for these compounds as essential building blocks in these processes.

Latin America's region creates potential for the market. The escalating requirements for critical minerals vital for renewable energy and electronics are a significant driver for the market in the region. This rising need for fuels increased mining activities across the region, directly boosting the consumption of xanthate as an essential flotation reagent for extracting valuable resources such as lithium, cobalt, and rare earth elements found in sulfide ores. Moreover, the presence of an established supply chain and existing technical expertise in production and application ensures consistent availability and supports efficient utilization.

Top Key Players and Market Share Insights:

The Xanthate market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Xanthate market. Key players in The Xanthate industry include-

- Tokyo Chemical Co., Ltd. (Japan)

- Hefei TNJ Chemical Co., Ltd. (China)

- CDH Fine Chemical (India)

- Sinoran Mining & Metallurgy (China)

- Vizag Chemicals (India)

- Jam Group Co (Iran)

- Amruta Industries (India)

- Jinchangsheng Chemical Technology Co., Ltd. (China)

- Manas Petro Chem (India)

- Charles Tennant & Company (Canada)

Xanthate Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 0.97 Billion |

| CAGR (2025-2032) | 6.2% |

| By Product Type |

|

| By End-Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Xanthate market? +

In 2024, the Xanthate market is USD 0.60 Billion.

Which is the fastest-growing region in the Xanthate market? +

Asia Pacific is the fastest-growing region in the Xanthate market.

What specific segmentation details are covered in the Xanthate market? +

Product Type and End-Use segmentation details are covered in the Xanthate market

Who are the major players in the Xanthate market? +

Tokyo Chemical Co., Ltd. (Japan), Hefei TNJ Chemical Co., Ltd. (China), Jam Group Co (Iran), Amruta Industries (India), and Jinchangsheng Chemical Technology Co., Ltd. (China) are some major players in the market.