Ammonium Nitrate Market Size :

Consegic Business Intelligence analyzes that the ammonium nitrate market size is growing with a CAGR of 5.1% during the forecast period (2024-2031). The market accounted for USD 18,526.67 million in 2023 and is projected to be valued at USD 27,606.20 Million by 2031.

Ammonium Nitrate Market Scope & Overview :

Ammonium nitrate, also known as NH4NO3, is a crystalline powder that varies in color from almost white to brown. This compound is highly reactive and incompatible with several organic and inorganic compounds. It is classified as an oxidizer that accelerates burning when involved in a fire. Although the compound itself does not burn, it can increase the fire hazard and support fire even in the absence of oxygen when in contact with other combustible materials.

The compound exhibits diverse applications across various industries including agriculture and mining. It is a popular high-nitrogen fertilizer in the agricultural sector that promotes plant growth effectively. Additionally, this chemical is a crucial component in the production of explosive mixtures utilized in mining, quarrying, and civil construction. The compound's oxidizing properties make it an indispensable ingredient in various industrial processes and the production of civil explosives. The compound is imperative to handle and with the utmost care due to its potential explosive properties. This is particularly crucial when the compound is heated in a confined space or exposed to certain substances. Therefore, it is essential to observe stringent safety measures when handling the compound to avoid accidents.

How is AI Impacting the Ammonium Nitrate Market?

AI is impacting the ammonium nitrate market primarily through optimizing operations, enhancing safety, and improving market intelligence. AI-powered tools are boosting efficiency in production, supply chain management, and demand forecasting, leading to reduced waste and better responsiveness to market fluctuations. AI-powered systems can monitor production processes in real-time, identify deviations from quality standards, and ensure consistent product quality. Also, AI can optimize logistics and transportation routes, ensuring timely delivery of ammonium nitrate to customers while minimizing costs.

Ammonium Nitrate Market Insights :

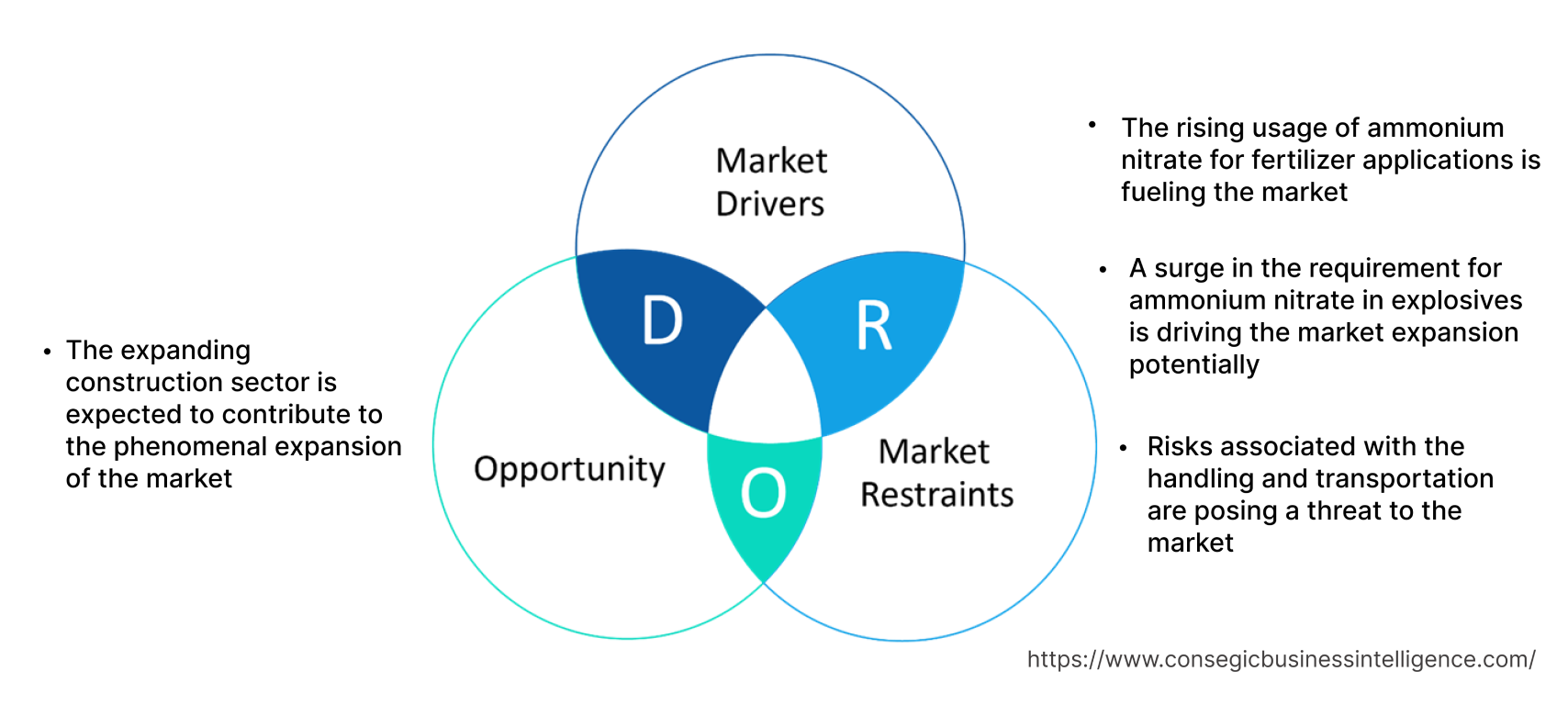

Ammonium Nitrate Market Dynamics - (DRO) :

Key Drivers :

The rising usage of ammonium nitrate for fertilizer applications is fueling the market

Escalating the requirement for this compound by the fertilizer sector assists as a driving factor for ammonium nitrate market trend across the globe. The compound plays a pivotal role in modern agriculture providing essential nitrogen-based fertilizer for crop growth. Nitrogen is a critical element for the formation of proteins, enzymes, chlorophyll, and other essential components vital for plant growth. As a soluble fertilizer, it easily dissolves in water, allowing plants quick access to the nitrogen they require for their development. As per the analysis, the compound delivers this nitrogen in a form that plants readily absorb, aiding in their overall health and productivity. Hence, farmers use this compound to replenish nitrogen levels in the soil, especially in crops with high nitrogen requirements like legumes, corn, wheat, and vegetables. Additionally, an efficient nitrogen release over time helps sustain plant growth throughout the growing season.

For instance, According to the data published by the U.S. Department of Agriculture on March 10, 2023, The USDA has announced USD 29 million in grants to increase American-made fertilizer production, spur competition, provide more choices for farmers, and reduce dependence on foreign sources. This creates a higher demand for AMN in fertilizer applications.

Overall, the use of this compound in fertilizers serves as a valuable tool for farmers, contributing significantly to increased crop yields and ensuring food security which is potentially boosting the ammonium nitrate market.

A surge in the requirement for ammonium nitrate in explosives is driving the market expansion potentially

Primarily, this compound is used in the production of explosives such as ANFO (ammonium nitrate/fuel oil). ANFO is a widely employed industrial explosive mixture comprising this compound and a hydrocarbon fuel, typically fuel oil. This combination forms a highly effective and stable explosive in mining, quarrying, and construction industries for tasks like blasting rock formations and earthmoving. Hence, this explosive is extensively utilized in the mining, and construction sectors. The rising usage of ammonium nitrate by the mining and construction sector is one of the prominent factors fuelling its requirement globally.

For instance, In October 2023, The U.S. Army stated that it has awarded USD 1.5 billion in contracts to nine companies in the U.S., Canada, India and Poland to boost global production of 155mm artillery rounds. The contract also includes procuring 14.2 million pounds of bulk energetics, consisting of several explosives.

As a result, the significant investment military sector is boosting ammonium nitrate market demand and trends in explosives further drive the market expansion.

Key Restraints :

Risks associated with the handling and transportation are posing a threat to the market

Disadvantages associated with the ammonium nitrate are significantly hampering the market expansion. It is a highly reactive chemical that is highly explosive under certain conditions, especially when exposed to heat and shock. As the compound is combustible, it intensifies fires, accelerating combustion, and leading to more significant damage. This limits its transportation with other chemicals or combustibles and requires good handling practices to prevent accidents. Additionally, as per the analysis, when heated or involved in a fire, it releases toxic gases including nitrogen oxide, which is harmful to human health if inhaled.

For instance, the burning rate of technical-grade of this compound falls within the Class 2 oxidizer criteria, and it has the potential for unstable reactive hazard properties, uncontrolled decomposition, and/or detonation under certain circumstances possessing the potential for injuries, fires, and property damage. As a result, restraint associated with this compound is posing a potential challenge to market expansion.

Future Opportunities :

The expanding construction sector is expected to contribute to the phenomenal expansion of the market

In construction industries, the compound is primarily utilized as an explosive material for blasting operations. The high nitrogen content of this compound makes it suitable for creating explosives when combined with other substances, typically fuel oil, to form an ammonium nitrate fuel oil mixture. This mixture is stable and cost-effective, making it widely utilized for blasting in mining, quarrying, and construction activities to break rocks for various purposes.

For instance, According to the data published by the International Trade Administration in July 2023, overall investment in new infrastructure during the 14th Five-Year Plan period (2021-2025) in China may reach roughly USD 4.2 trillion.

As a result, owing to the rising construction sector ammonium nitrate market is expected to witness significant expansion and trends shortly.

Ammonium Nitrate Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 27,606.20 Million |

| CAGR (2024-2031) | 5.1% |

| By Grade | Technical Grade, Agricultural Grade, and Medical Grade |

| By Form | Solid (Powder and Prill), and Liquid |

| By Application | Fertilizers, Explosives, Anesthetic Gases, and Others |

| By End-use Industry | Agriculture, Construction, Mining, Pharmaceuticals, and Others |

| By Region | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Players | San Corporation, Dyno Nobel, Yara, Acron, EuroChem Group, TradeMark Nitrogen, Junsei Chemical Co., Ltd., CF Industries Holdings, Inc., Merck KGaA, TKG HUCHEMS, Uralchem, LAT Nitrogen, and Orica Limited. |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Ammonium Nitrate Market Segmental Analysis :

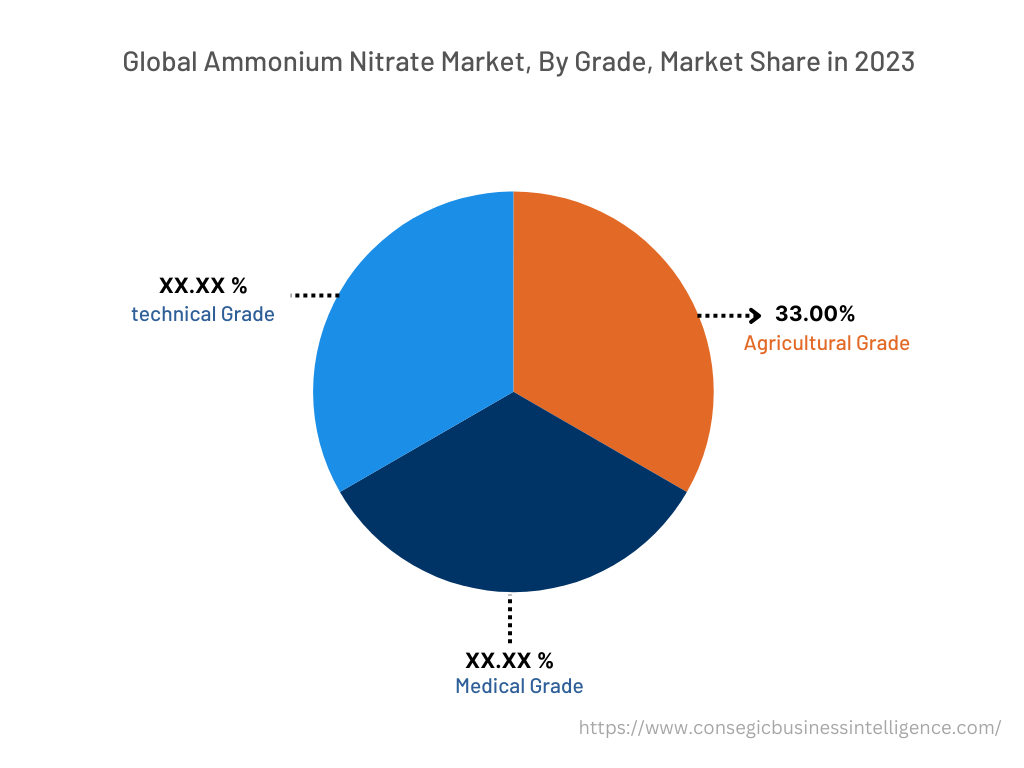

By Grade :

The grade is categorized into technical grade, agricultural grade, and medical grade. In 2023, the agricultural grade segment accounted for the highest ammonium nitrate market share of 33.02% in the ammonium nitrate market. Agricultural-grade compound is widely utilized in agriculture due to its high nitrogen content and ability to provide nitrogen in both nitrate and ammonium forms, which are readily available for plant uptake. It is widely used as a fertilizer component for various crops, including vegetables, crops, and fruits. Additionally, based on the analysis, the growing agriculture and farming sector is increasing the trend for fertilizers thereby fueling the requirement for the ammonium nitrate market.

For instance, According to the report published by the Department for Environment, Food, and Rural Affairs, in 2023, the UK total income from farming (TIFF) accounted for USD 8.63 billion in 2023, an increase of USD 1.2 billion (17%) from 2021.

Thus, the growth in farming income is significantly propelling the segment's development.

Moreover, the technical grade segment is expected to hold the highest CAGR over the forecast period. Technical grade ammonium nitrate (TGAN) is a chemical compound used in both construction and mining sector. It is employed for various industrial purposes such as the manufacture of civil explosives and the mining sector. Furthermore, TGAN is also employed for chemical purposes and is a high-quality chemical widely used in several industries which is expected to create opportunities for the segment expansion in the future.

By Form :

The form segment is categorized into solid and liquid. In 2023, the solid segment accounted for the highest market share in the overall ammonium nitrate market, and it is also expected to hold the fastest CAGR over the forecast period. The solid segment is further bifurcated into powder and prill. The powdered compound is a white crystalline powder that is highly soluble in water and is commonly utilized as a fertilizer in agriculture due to its high nitrogen content. Additionally, it is also utilized in the production of cold packs, reactive/binary targets for shooting practice, and in pyrotechnics, herbicides, and insecticides. On the other hand, prill is produced by solidifying molten droplets that are sprayed into the air. The resulting small, porous pellets are typically used as a solid oxidizer ingredient for explosive compositions in the mining and blasting sector. Notable examples of these compositions include ANFO, WR ANFO, and Heavy ANFO emulsion. These compositions are extensively employed in mining and construction works.

Moreover, the rise in the mining sector is escalating the requirement for ammonium nitrate explosives.

For instance, According to the data published by the India Brand Equity Foundation, in August 2023, India's mining GDP increased from USD 8.98 billion in the fourth quarter of 2020 to USD 11.09 billion in the first quarter of 2021.

As a result, the booming mining industry is contributing to the increased requirement for explosives which is expected to propel the segment expansion.

By Application :

The application segment is categorized into fertilizers, explosives, anesthetic gases, and others. In 2023, the fertilizers segment accounted for the highest market share in the overall ammonium nitrate market and is expected to hold the fastest CAGR over the forecast period. The compound is a versatile chemical utilized for the production of nitrogen-source fertilizers. It boasts approximately 34% nitrogen content making it a potent source of crucial plant nutrients as nitrogen promotes the vigorous development of the plant. In addition to this, fertilizer produced from this compound delivers nitrogen in two forms including nitrate and ammonium. Nitrate is readily available for plants to absorb, providing an immediate boost, whereas ammonium is gradually converted to nitrate by soil microbes, ensuring sustained nitrogen supply throughout the growing season. Moreover, the new nitrogen-based product launches are boosting the requirement for this compound in fertilizers.

For instance, In February 2023, Corteva Agriscience announced the launch of a new above-ground nitrogen stabilizer, PinnitMax TG nitrogen stabilizer, which protects urea-ammonium nitrate applications from volatilization for up to 14 days.

Furthermore, these fertilizers are suitable for various crops including vegetables, fruits, grains, and forages which are applied during pre-planting, topdressing or as a fertigation solution. Thus, the ascending use of nitrogen sources in fertilizers is boosting the demand for this compound which is expected to create new opportunities propelling the segment expansion.

By End-Use Industry :

The end-use industries segment is categorized into agriculture, construction, mining, pharmaceuticals, and others. In 2023, the agriculture segment accounted for the highest market share in the overall ammonium nitrate market, and it is also expected to hold the fastest CAGR over the forecast period. In the agriculture industry, the compound plays a crucial role as a source of nitrogen, a vital nutrient for plant growth. This compound is primarily employed in the production of fertilizers. The compound provides plants with easily absorbable nitrate ions, boosting their growth and yield. Additionally, compared to other alternatives it offers high nutrient content at a relatively lower price which is suitable for various crops adapting to different soil conditions. Hence, the compound is a readily available, cost-effective and versatile source of nitrogen in the agriculture sector.

Moreover, the growing government support is thriving the agriculture industry which is positively impacting the demand for this compound.

For instance, According to the data published by the Organisation for Economic Co-operation and Development in 2023, total government support to the agricultural sector reached USD 817 billion per year in 2019-21 for the 54 countries which is a 13% increase over the USD 720 billion reported for 2018-20.

Thus, the significant trends in agriculture investment is propelling the demand for this further boosting the market growth across the globe.

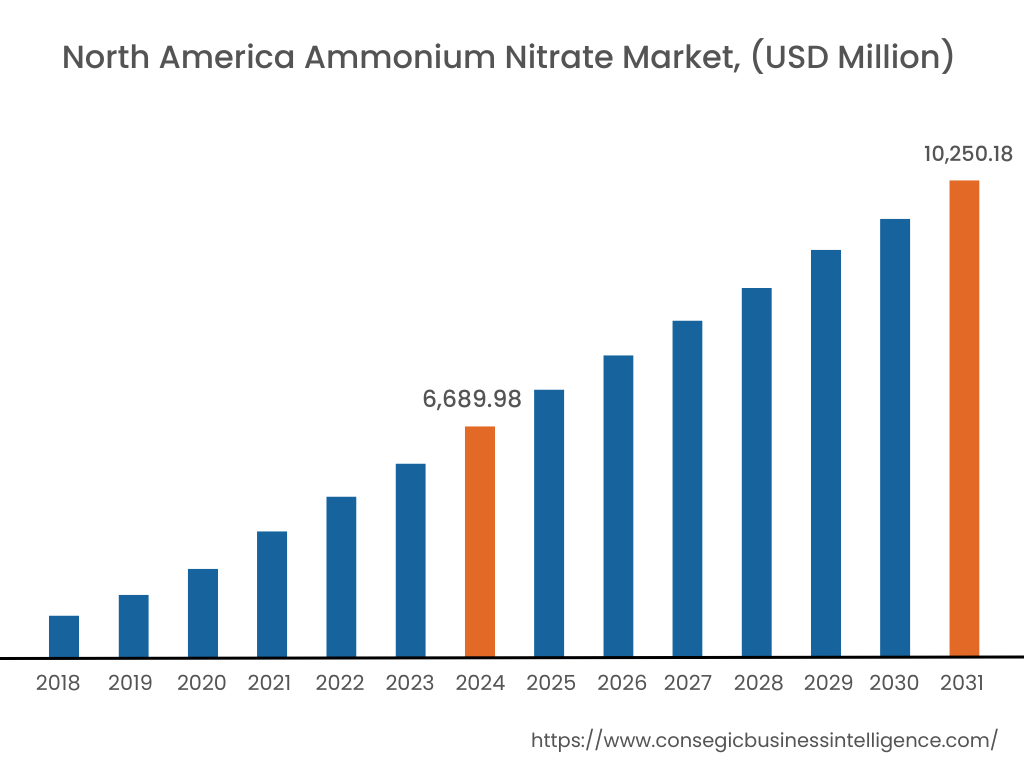

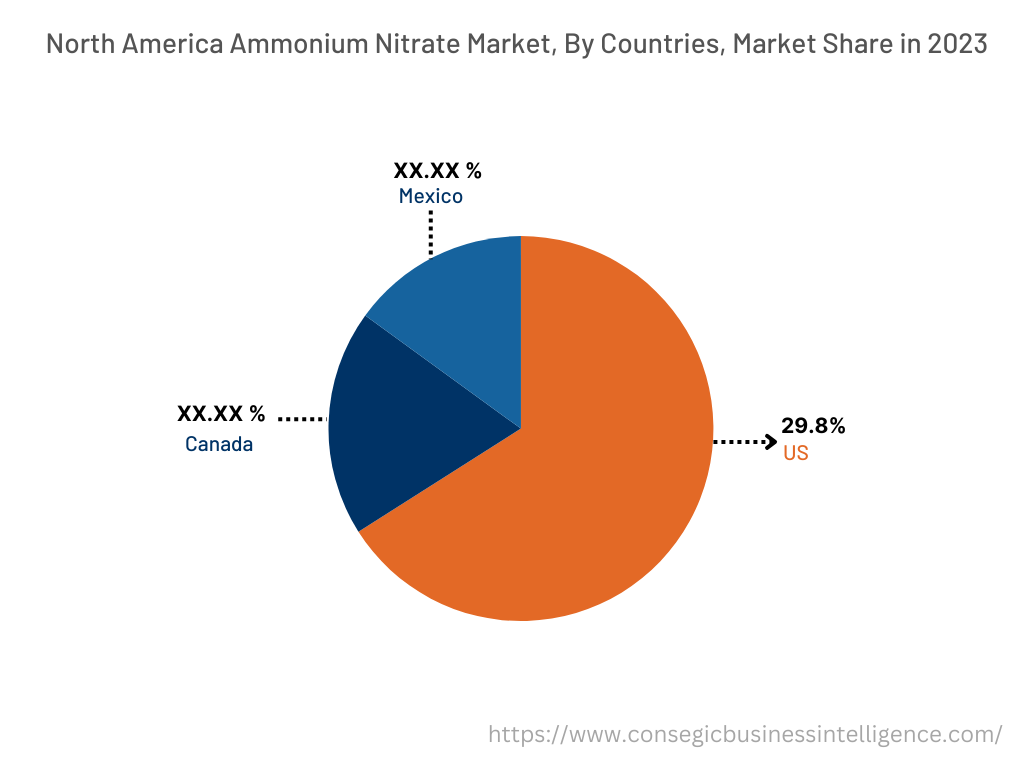

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2023, North America accounted for the highest market share at 36.11% valued at USD 6,689.98 Million in 2023 and it is expected to reach USD 10,250.18 Million in 2031. In North America, the U.S. accounted for a major market share of 63.77% in the year 2023. As per the ammonium nitrate market analysis, across the North America region growing owing to its significant use in the agriculture, mining, and construction sectors. The ascending demand for food and crop yields is fueling the agriculture sector which is increasing the demand for this compound for fertilizer production. Additionally, North America boasts a larger share of land available for agriculture practices which is potentially boosting the consumption of ammonium nitrate in the region. Moreover, the potential expansion in the agriculture, construction, and mining sectors is also driving market expansion.

For instance, According to the data published by the U.S. Department of Agriculture U.S., in May 2023, agricultural exports were valued at USD 177 billion in 2021, an 18 % increase relative to 2020.

Furthermore, the Asia Pacific region is expected to witness significant expansion over the forecast period, growing at a CAGR of 5.9% during 2024-2031. The high population in the Asia Pacific region is expected to increase the demand for food. Additionally, the escalating agricultural production in the region is expected to propel the market growth. Similarly, the increasing urbanization in the region is expected to propel the demand for infrastructure development further promoting the use of ammonium nitrate in the construction sector. All these above-mentioned factors are creating lucrative ammonium nitrate market opportunities and trends in the Asia Pacific region.

Top Key Players & Market Share Insights :

The Ammonium Nitrate market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The ammonium nitrate industry is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market through mergers, acquisitions, and partnerships. The key players in the market include-

- San Corporation

- Dyno Nobel

- EuroChem Group

- TradeMark Nitrogen

- Junsei Chemical Co., Ltd.

- Uralchem

- LAT Nitrogen

- Yara

- Acron

- CF Industries Holdings, Inc.

- Merck KGaA

- TKG HUCHEMS

- Orica Limited

Recent Industry Developments :

- In July 2023, Borealis AG, a subsidiary of LAT Nitrogen announced the merger with AGROFERT, a Czech-based conglomerate with operations across multiple industries, including chemicals, agriculture, and food production for the nitrogen business of Borealis. The merger was announced for a transaction valued at USD 884.39 million.

- In March 2023, EuroChem Group, a leading global fertilizer producer, announced that a Group subsidiary has completed the purchase of a controlling 51.48% share in Brazilian distributor Fertilizantes Heringer S.A., further strengthening the Group's production and distribution capabilities in Brazil, one of the most important crop nutrient markets in the world.

Key Questions Answered in the Report

What was the market size of the ammonium nitrate market in 2023? +

In 2023, the market size of ammonium nitrate was USD 18,526.67 million.

What will be the potential market valuation for the ammonium nitrate industry by 2031? +

In 2031, the market size of ammonium nitrate will be expected to reach USD 27,606.20 million.

What are the key factors driving the growth of the ammonium nitrate market? +

The rising usage of ammonium nitrate by fertilizer industries is fuelling the market growth. A surge in the demand for ammonium nitrate in explosives is driving the market growth potentially.

What is the dominant segment in the ammonium nitrate market for the grade? +

In 2023, the agriculture grade segment accounted for the highest market share of 33.02% in the overall ammonium nitrate market.

Based on current market trends and future predictions, which geographical region is the dominating region in the ammonium nitrate market? +

North America accounted for the highest market share in the overall market.