Membrane Electrode Assemblies Market Size :

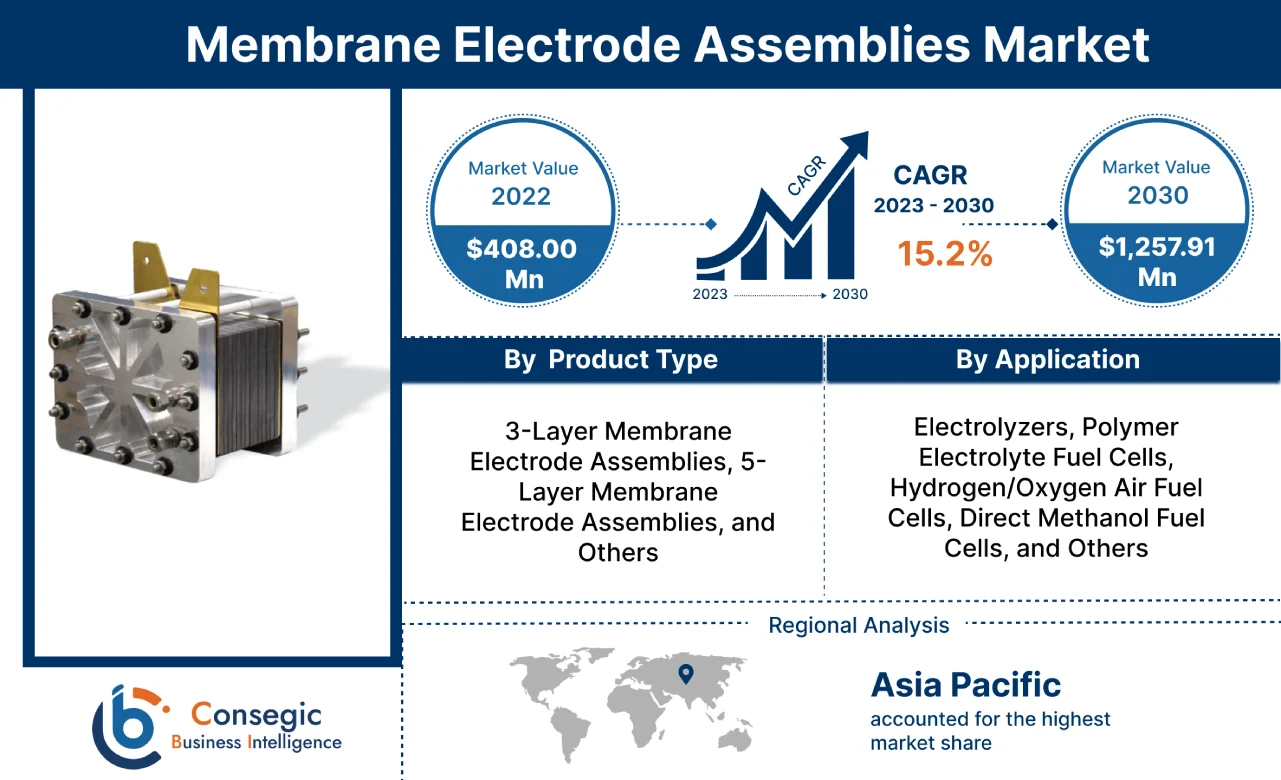

Consegic Business Intelligence analyzes that the membrane electrode assemblies market size is growing with a healthy CAGR of 15.2% during the forecast period (2023-2030), and the market is projected to be valued at USD 1,257.91 Million by 2030 from USD 408.00 Million in 2022.

Membrane Electrode Assemblies Market Scope & Overview:

A membrane electrode assembly (MEA) is a core component of a fuel cell that helps produce the electrochemical reaction needed to separate electrons. It is made up of a proton exchange membrane (PEM), two catalyst layers, and two gas diffusion layers (GDLs). Based on the analysis, the major type include 5-layered, 3-layered, and others. Moreover, they enable sites for chemical reactions occurring in a fuel cell to transform the fuel into usable electrical power. As a result, due to the above benefits, they are frequently utilized in applications such as hydrogen/oxygen air fuel cells, direct methanol fuel cells, electrolyzers, polymer electrolyte fuel cells, and others.

Membrane Electrode Assemblies Market Insights :

Membrane Electrode Assemblies Market Dynamics - (DRO) :

Key Drivers :

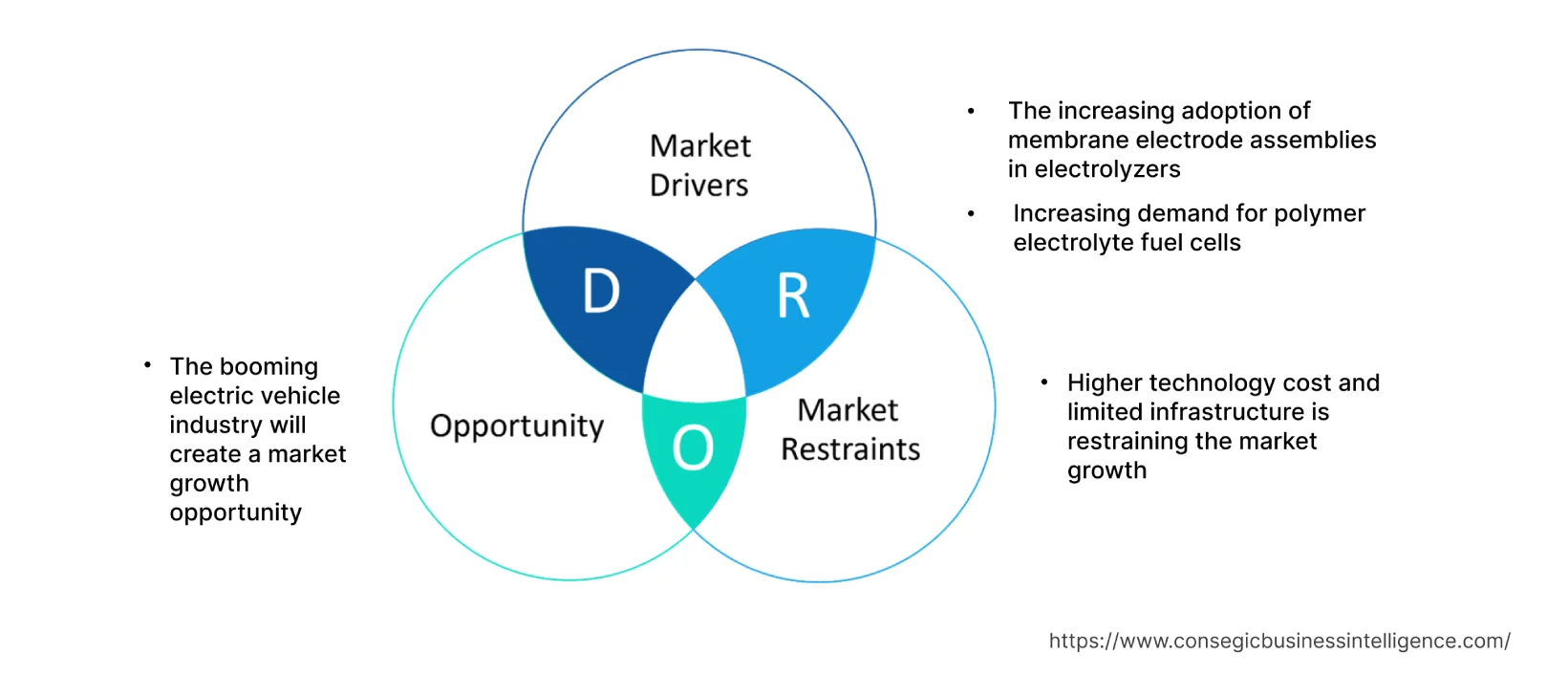

The increasing adoption of membrane electrode assemblies in electrolyzers

The membrane electrode assemblies are deployed in electrolyzers' electricity to convert water into hydrogen and oxygen, which in turn elevated product gas purity. Based on the analysis, the international players in the electrolyzers industry are developing new manufacturing facilities in key countries. For instance, in August 2021, Ohmium, a US-based hydrogen manufacturer opened a green hydrogen electrolyzergiga facility in India. The new renewable energy start-up is set to locate in Bangalore, India since these materials are considered the latest ultimate equipment for generating green hydrogen to break water into hydrogen in a clean way. Thus, the rising adoption of these materials in electrolyzers ensures the seamless process of converting electricity into hydrogen. This, in turn, is driving the market growth and trends.

Increasing demand for polymer electrolyte fuel cells

Membrane electrode assemblies are employed in polymer electrolyte fuel cells to produce the electrochemical reaction for separating electrons. Based on the analysis, the development of new renewable energy projects at the global level is fostering the demand for polymer electrolyte fuel cells to efficiently convert the chemical energy of a fuel directly into electrical energy. For instance, in 2022, the USD 800 million Abukuma Wind Farm, a 150 MW wind energy project began in Fukushima, Japan. The construction work of Abukuma Wind Farm is anticipated to be completed by 2027. The prime focus of this project is to ensure an increase in electricity connectivity in Fukushima, Japan. Henceforth, the construction of new wind energy projects in Japan is boosting the demand for polymer electrolyte fuel cells, which are utilized in wind turbines, fuel cell hybrid systems, and others. This prominent factor is boosting the demand for these materials, thereby favoring membrane electrode assemblies market growth.

Key Restraints :

Higher technology cost and limited infrastructure is restraining the market growth

The limited infrastructure development and expensive technology adoption are the key variables restraining the growth of the membrane electrode assemblies industry. For instance, the higher cost of production and other related technology that is critical is leading to expensive technology. In addition, as per the analysis, highly qualified professionals are required to deal with the scalable implementation of these membranes. Furthermore, the higher electricity cost, transportation cost, and others are impacting the technology price. Therefore, the above-mentioned factors impact technology and limited infrastructure. This, in turn, is posing a major bottleneck for the growth of the membrane electrode assemblies market.

Future Opportunities :

The booming electric vehicle industry will create a market growth opportunity

The rise in the electric vehicles sector is creating lucrative membrane electrode assemblies market opportunities and trends in the coming years. Electric vehicles utilize products such as hydrogen/oxygen air fuel cells, electrolyzers, and others. These products deploy these materials to ensure superior physical, chemical, and mechanical characteristics. As per the analysis, factors including the availability of a wide range of models, eco-friendliness, along with the accessibility of subsidies and tax rebates are driving the adoption of electric vehicles at the global level. For instance, according to the European Environment Agency, the total electric car registrations in Europe reached approximately 1.73 million units in 2021, witnessing a significant increase of around 63% in comparison to 1.06 million units in 2020. As a result, the booming electric vehicle industry at the global level is boosting the requirement for hydrogen/oxygen air fuel cells, electrolyzers, and others. This, in turn, is creating lucrative opportunities and trends in the coming years.

Membrane Electrode Assemblies Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 1,257.91 Million |

| CAGR (2023-2030) | 15.2% |

| By Product Type | 3-Layer Membrane Electrode Assemblies, 5-Layer Membrane Electrode Assemblies, and Others |

| By Application | Electrolyzers, Polymer Electrolyte Fuel Cells, Hydrogen/Oxygen Air Fuel Cells, Direct Methanol Fuel Cells, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Ballard Power Systems Inc., Giner Inc., Greenerity GmbH, HyPlat (Pty) Ltd., IRD Fuel Cell Technology A/S, Johnson Matthey Plc, 3M, L. Gore & Associates, Inc., Wuhan WUT New Energy Co., Ltd., and FuelCellsEtc |

Membrane Electrode Assemblies Market Segmental Analysis :

By Product Type :

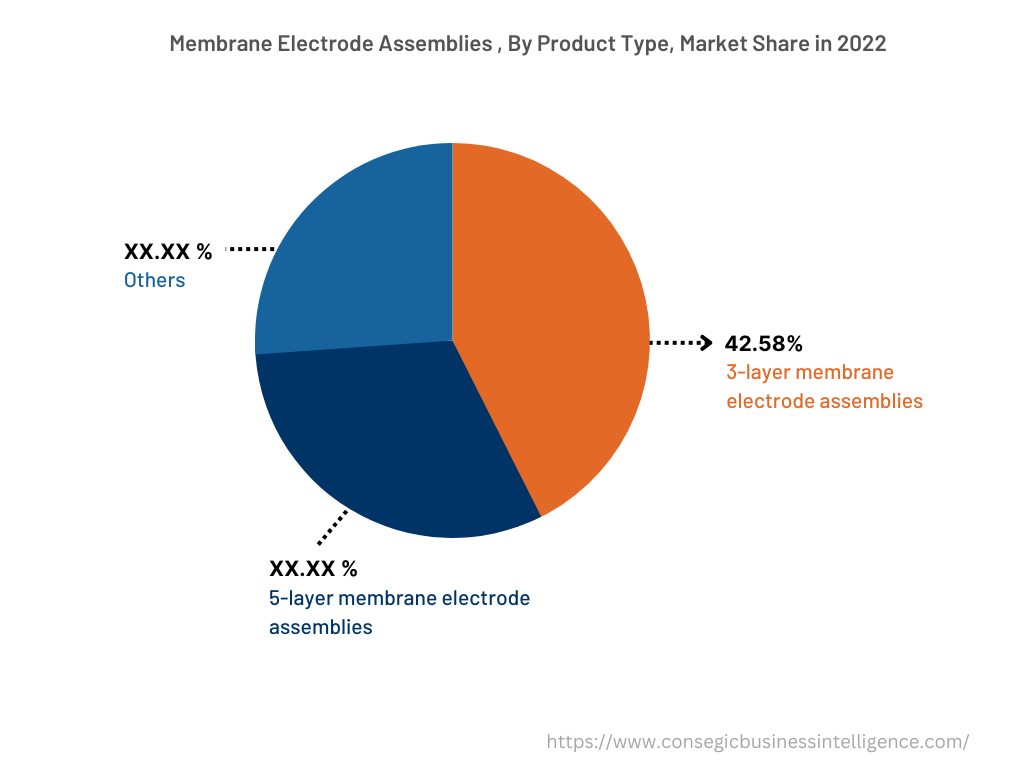

The product type segment is categorized into 3-layer, 5-layer, and others. In 2022, the 3-layer segment accounted for the highest market share of 42.58% in the overall market. 3-layered are composed of polymer electrolyte membrane combined with catalyst layers applied to the anode and cathode. The 3-layered ensure superior performance and durability. These benefits make 3-layer an ideal solution for applications such as polymer electrolyte fuel cells, electrolyzers, and others. The leading manufacturers of these materials are expanding their manufacturing facilities to ensure the rising requirement for fuel cells. For instance, Ballard Power Systems, a leading manufacturer of these membranes based in Canada expanded the MEA production capacity by 6 times to meet projected expansion in fuel cell electric vehicle demand. Thus, the production activities related to 3-layered to ensure enhanced cell performance is fueling the membrane electrode assemblies market.

However, the 5-layer segment is projected to be the fastest-growing segment during the forecast period. This is due to the increasing new developments associated with 5-layer at the global level, which is spurring segmental expansion.

By Application :

The application segment is categorized into electrolyzers, polymer electrolyte fuel cells, hydrogen/oxygen air fuel cells, direct methanol fuel cells, and others. In 2022, the electrolyzers segment accounted for the highest market share in the membrane electrode assemblies market. The key technical features associated with membrane electrode assemblies include performance at 0.8 V in 300 mA cm−2, platinum group metal (PGM) total loading (both electrodes) at 0.125 mg PGM cm−2 electrode area, durability with cycling at 5000 hours, performance-rated power (150 kPaabs) at 1000 mW cm−2, and others. Based on the analysis, these properties make membrane electrode assemblies an ideal solution for electrolyzers. For instance, in December 2022, Linde Engineering, headquartered in India announced the development of a 24 MW PEM Electrolyzer Plant. The new electrolyzer will produce hydrogen to produce 20,500 tonnes of ammonia per year which can be transformed into the range of 60,000 and 80,000 tonnes of green fertilizer. Thus, the development of new electrolyzer manufacturing plants will foster the membrane electrode assemblies market demand to ensure superior performance properties. This, in turn, is driving the market trends.

However, the hydrogen/oxygen air fuel cells segment is expected to be the fastest-growing segment during the forecast period. This requirement is attributed to factors such as increasing investment in new hydrogen/oxygen air fuel cell plants, increasing government initiatives, and others. Thus, the aforementioned factors is propelling the market trends.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

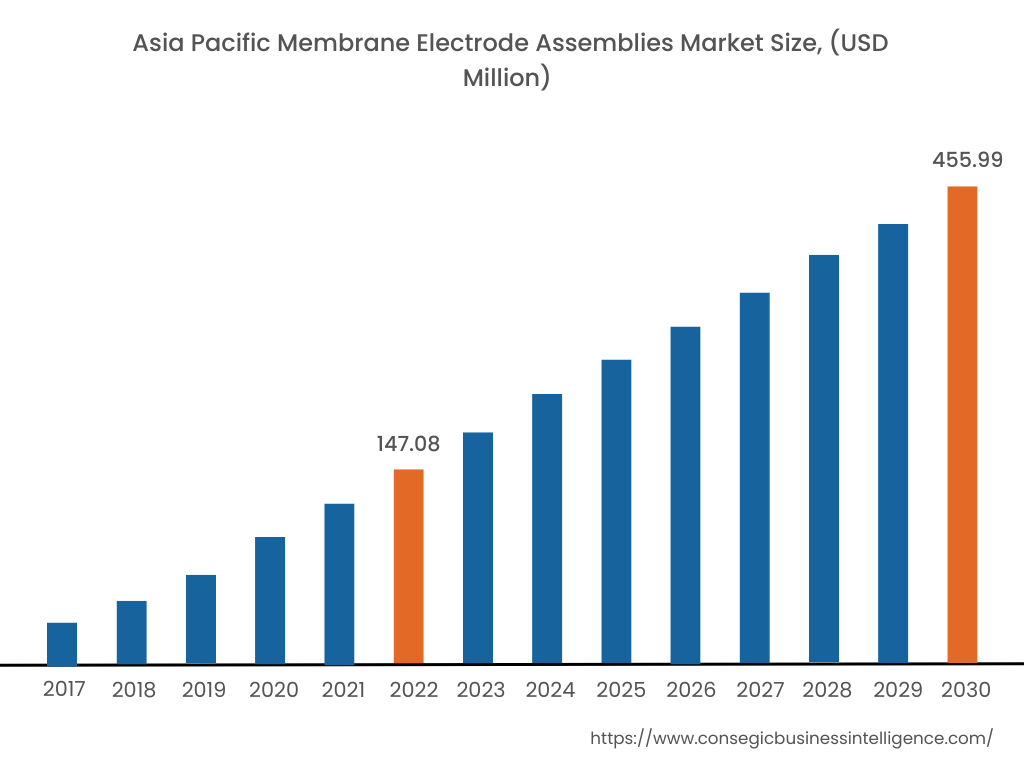

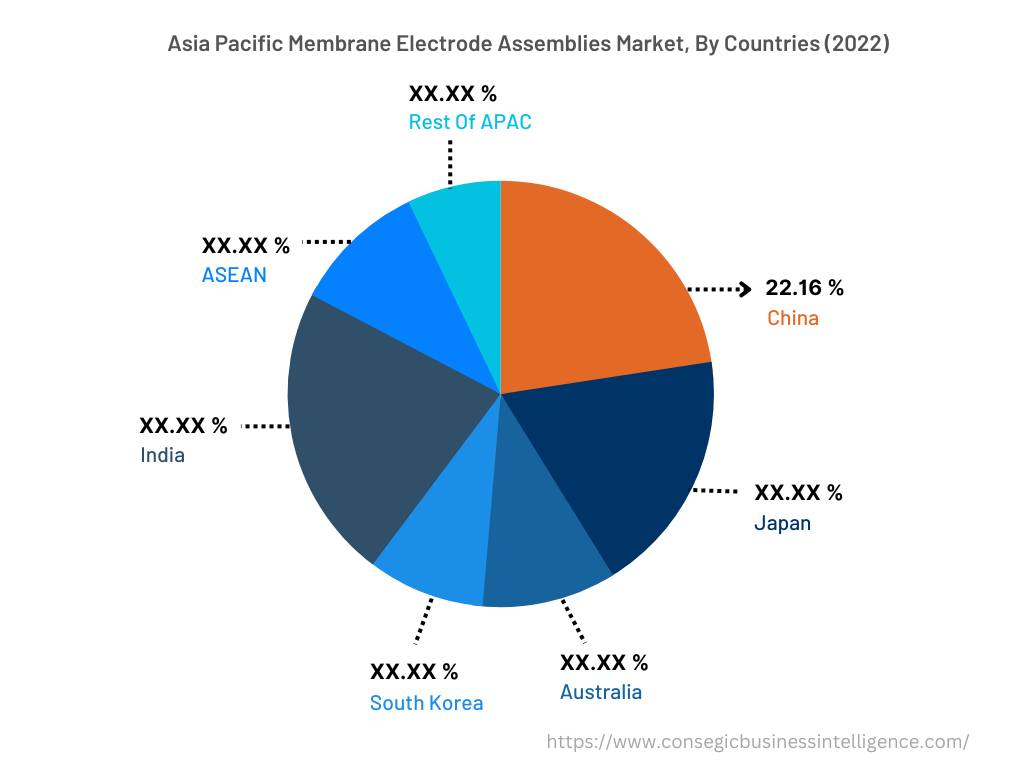

In 2022, Asia Pacific accounted for the highest market membrane electrode assemblies market share at 36.05% and was valued at USD 147.08 million, and is expected to reach USD 455.99 million in 2030. In Asia Pacific, China accounted for the highest market share of 22.16% during the base year of 2022. Based on the membrane electrode assemblies market analysis, this is due to the development of new electronic manufacturing facilities, renewable energy plants, and others, which are fostering the membrane electrode assemblies market growth in the Asia Pacific region. For instance, in October 2021, Foxconn, a leading Taiwanese multinational electronics contract manufacturer, announced its plans for the development of electric vehicles plant in India by the end of 2024. Hence, the development of new electric vehicle facilities in the region is driving the demand for fuel cells, electrolyzers, and others. This, in turn, is supplementing the market.

Furthermore, North America is expected to witness significant development over the forecast period, growing at a CAGR of 15.8% during 2023-20230. Key trends such as the presence of key players in the North American region, the development of new hospitals, and others are boosting membrane electrode assemblies market trends in the North American region.

Top Key Players & Market Share Insights:

The global membrane electrode assemblies market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Ballard Power Systems Inc.

- Giner Inc.

- L. Gore & Associates, Inc.

- Wuhan WUT New Energy Co., Ltd.

- FuelCellsEtc

- Greenerity GmbH

- HyPlat (Pty) Ltd.

- IRD Fuel Cell Technology A/S

- Johnson Matthey Plc

- 3M

Recent Industry Developments :

- In May 2023, Advent Technologies, a fuel cell manufacturer in Greece opened a manufacturing facility in Massachusetts, the United Kingdom. The new manufacturing facility will scaled-up roll to roll production for Ion-Pair membrane electrode assemblies. Hence, the development of new manufacturing facilities for membrane electrode assemblies will boost market growth in the forecast years.

Key Questions Answered in the Report

What was the market size of the membrane electrode assemblies industry in 2022? +

In 2022, the market size of membrane electrode assemblies was USD 408.00 million.

What will be the potential market valuation for the membrane electrode assemblies industry by 2030? +

In 2030, the market size of membrane electrode assemblies will be expected to reach USD 1,257.91 million.

What are the key factors driving the growth of the membrane electrode assemblies market? +

The increasing adoption of membrane electrode assemblies in electrolyzers is bolstering market growth.

What is the dominating segment in the membrane electrode assemblies market by product type? +

In 2022, the 3-layer membrane electrode assemblies segment accounted for the highest market share of 42.58% in the overall membrane electrode assemblies market.

Based on current market trends and future predictions, which geographical region is the dominating region in the membrane electrode assemblies market? +

Asia Pacific accounted for the highest market share in the overall membrane electrode assemblies market.