Auto Loans Market Size:

Auto Loans Market size is estimated to reach over USD 540.33 Billion by 2032 from a value of USD 308.07 Billion in 2024 and is projected to grow by USD 325.12 Billion in 2025, growing at a CAGR of 7.9% from 2025 to 2032.

Auto Loans Market Scope & Overview:

Auto Loans refers to loans provided by banks and financial institutions to individuals or businesses looking to buy vehicles by allowing them the option to borrow money. The borrowing of money from the institutions allows the individuals or businesses to buy vehicles that they otherwise cannot afford in cash. Further, automobile loans are offered by financial institutions or banks for various use cases, amounts, interest rates, and flexible repayment options which have resulted in a robust growth in the auto loans market. Moreover, many loan providers provide quick and easy information like EMI calculators allowing the end users to calculate their monthly payments based on the duration, amount, and interest rate.

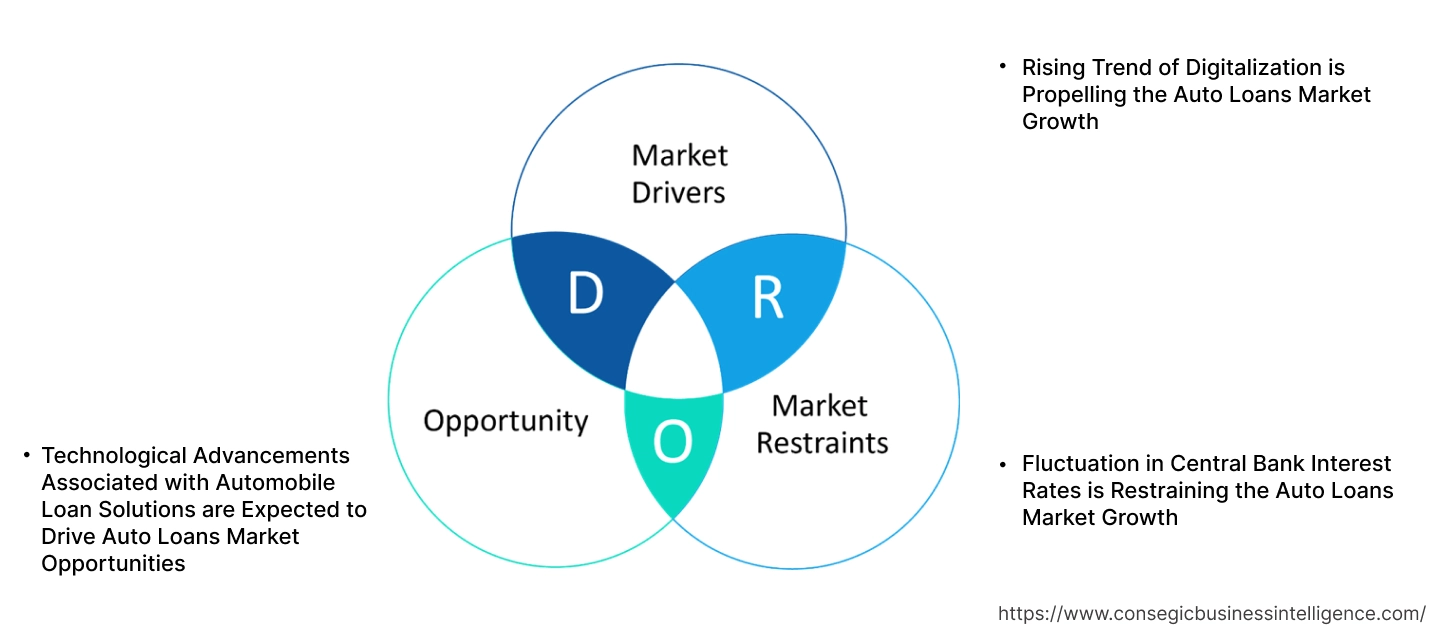

Key Drivers:

Rising Trend of Digitalization is Propelling the Auto Loans Market Growth

Auto loan providers today offer many options for their customers to apply for auto loans online without having to visit a physical bank, saving time of the customers. The process of applying online often takes minutes and can be done from anywhere as long as the end user is connected to the internet. Many companies today are also doing the document verification phase online via software tools making the process easier. The loan amount is also approved and disbursed quickly once verification is done resulting in the rising adoption of automobile loans.

- For instance, HDFC bank offers Express Car Loan that is digital throughout the loan process. The loan amount, once approved, can be disbursed as quickly as 30 minutes making the auto loan process hassle free.

Hence, the growing adoption of internet to deliver auto loans instantly is proliferating the auto loans market size.

Key Restraints:

Fluctuation in Central Bank Interest Rates is Restraining the Auto Loans Market Growth

Central banks around the world increase interest rates to bring inflation under control, making borrowing more expensive. Auto loans are directly affected by the increase in interest rates due to the fact that the rate of auto loans also increases making borrowing more expensive for the end customers. Increasing rates for automobile loans could result in less customers for auto loan providers as the monthly payments and its interest rate incurred by the customers of automobile loans also increases. The continuous hiking of interest rates by central banks can therefore affect the auto loan market and act as a restraint. Additionally, the presence of fraud, specifically synthetic fraud, where individuals use stolen identities to create new identities to defraud financial institutions also poses a threat to the auto loans market.

Future Opportunities :

Technological Advancements Associated with Automobile Loan Solutions are Expected to Drive Auto Loans Market Opportunities

Loan providers are frequently investing in the development of new technologies associated with auto loan risk management and fraud detection to ensure its safe and effective utilization in the automobile loan market. As a result, fraud detection solution providers are launching new solutions integrated with auto loan bank platforms to detect fraud and protect the financial institutions from the loss incurred due to fraud.

- For instance, Informed is a company specializing in fraud detection and customer verification for banks and loan providers. The company offers access to millions of records of applicants and industry insights on dealer fraud making the loan underwriting process easier for banks.

Thus, the rising technological advancements associated with auto loan solutions are projected to drive the auto loans market opportunities during the forecast period.

Auto Loans Market Segmental Analysis :

By Loan Provider:

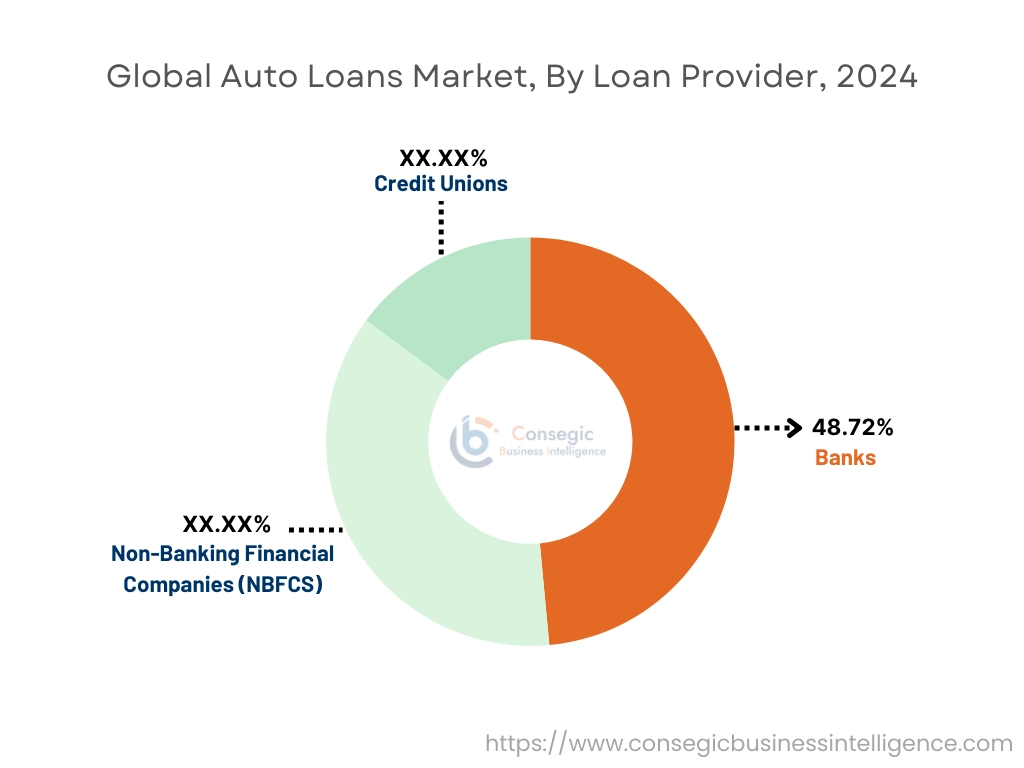

Based on loan provider, the market is segmented into banks, non-banking financial companies (NBFCs), and credit unions.

Trends in the loan provider:

- Increasing technological advancements associated with automobile loans such as integration of artificial intelligence (AI), machine learning (ML) and others.

- Rising utilization of big data technologies to calculate and assess credit scores to identify auto loan defaulters.

Banks accounted for the largest revenue share of 48.72% in the year 2024.

- Traditional banks offer many loan products for the automobile industry with competitive interest rates and EMI options.

- Banks help customers avail automobile loans allowing them to buy various vehicles at a custom financing option and special discounts.

- For instance, Bank of America offers a rewards program to its members, which includes interest rate discounts for automobile loans for different tiers of members.

- Additionally, the increase in the speed of processing and approval of documents required to avail automobile loans has resulted in robust increase in the banks segment.

- Thus, according to the auto loans market analysis, the rising adoption of rewards program for members and increase in processing speed in automobile loans provided by banks are driving the automobile loans market trends.

Non-banking financial companies (NBFCs) is anticipated to register the fastest CAGR during the forecast period.

- Non-Banking Financial Institutions (NBFCs) are institutions that provide financing options like automobile loans without being involved in banking services like traditional banks.

- Consumers are turning to NBFCs for lucrative interest rates, payment options, and 100% financing of automobiles which is driving the segment

- For instance, Mahindra Finance offers automobile loans for most major passenger and commercial vehicles at attractive interest rates with up to 100% funding of the car.

- Thus, as per the auto loans market analysis, the increase in NBFC financing has resulted in the rise in auto loans market.

By Loan Duration:

Based on loan duration, the market is segmented into short term and long term.

Trends in the loan duration:

- Rising shift towards use of short term loans due to lower rates and higher disposable incomes, especially in developing countries, allowing for the payment of high EMI.

- Factors including lower EMI and longer ownership of vehicles are driving the long term duration segment.

Long term loans accounted for the largest revenue share in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Long term automobile loans come with higher interest rates, but the EMI is spread throughout at a longer duration resulting in lower monthly payments.

- Consumers with lower disposable income often find the option of lower EMI lucrative even if it comes with higher interest rates due to the rising prices of cars and consumers wanting better and more expensive models of cars.

- For instance, according to a report by KBB, the average car buyer in the US spent close to USD 50000 as of December 2024 for a buying a new car, which was near an all-time high.

- Therefore, the long term auto loan segment has seen rising adoption due to lucrative EMIs during the forecast period.

By Vehicle:

Based on the vehicle, the market is segmented into passenger vehicles and commercial vehicles.

Trends in the vehicles:

- Increasing use of automobile loans in passenger vehicles for financing of SUVs and MUVs has driven the passenger vehicles segment.

- Factors including growing investments in trucks and tractors for transport and agriculture purposes have driven the commercial vehicles segment.

Passenger vehicles accounted for the largest revenue share in the year 2024.

- Passenger vehicles ownership has witnessed robust increase in recent times due to higher disposable incomes.

- Banks, NBFCs, and credit unions are increasingly focusing on passenger vehicles segment by offering different auto loan products to the end consumers, as per the auto loans market trends.

- Moreover, many car manufacturers have developed their own finance division offering various financial products, including automobile loans, to make it easier for the consumers to buy their cars.

- For instance, Toyota Financial Services, a division of Toyota offers many flexible loan options for Toyota and Lexus vehicles tailored to the customer’s requirement, making the purchase of the vehicles convenient.

- Therefore, the increasing use of automobile loans for passenger vehicles as a result of custom loan options is driving the auto loans market size.

Commercial vehicles is anticipated to register the fastest CAGR during the forecast period.

- Commercial vehicles refer to vehicles used for commercial purposes like transportation of goods or people. Trucks, buses, and tractors form the majority of the vehicles in the commercial vehicles segment.

- Many financial institutions today offer commercial vehicle loans to cater to the growing demand for trucks and buses. The loan products offered are tailored to the requirement of the end customer, vehicle type, and purpose.

- For instance, Chartway Credit Union, offers loan options to commercial vehicle buyers, often businesses, with various options and coverage like loans on vehicles that weigh up to 26000 lbs GVWR (Gross Vehicle Weight Rating).

- Thus, the rising number of commercial vehicles is driving the adoption of automobile loans, in turn, propelling the market during the forecast period.

By Ownership:

Based on the ownership, the market is segmented into new vehicles and used vehicles.

Trends in the ownership:

- Increasing adoption of automobile loans for used vehicles due to growing vehicle prices, better vehicles quality, and growth in online marketplaces.

- There is a rising utilization of financing cars new cars using automobile loans due to quick disbursement, resulting in auto loans market demand.

New vehicles accounted for the largest revenue share in the year 2024.

- This dominance is attributed to the rising number of auto loan options offered by banks and NBFCs to better address the needs of customers.

- Ownership of a new vehicle is often associated with high initial costs, making many consumers turn to automobile loans due to affordability.

- Moreover, options like 100% financing, life insurance coverage, and longer tenure loans have made automobile loans popular for new cars, as per the auto loans market trends.

- For instance, SBI offers 100% financing option for new cars, MUVs, SUVs based on the ‘On road price’ along with life insurance coverage and tenure of repayment of up to 7 years.

- Therefore, the increasing development of auto loan products for new vehicles has resulted in the auto loans market expansion.

Used vehicles is anticipated to register the fastest CAGR during the forecast period.

- Used cars have seen robust rise due to the emergence of online marketplaces connecting sellers with buyers.

- The increase in automobile loans for used vehicles can also be attributed to the fact that a new car’s value depreciates quickly, usually faster than a used car, right from the first year of purchase.

- For instance, according to Money Helper, depending on the car’s model, its value can depreciate from 15% to 35% within the first year and up to 50% in the next three years.

- Hence, the growing used cars segment is projected to increase the utilization of automobile loans during the forecast period.

By End User:

Based on the end user, the market is segmented into individuals and enterprises.

Trends in the end user:

- Increasing utilization of automobile loans by enterprises to manage finances and avail insurance to protect from business related risks and get automobile loans for different business requirements, is driving the auto loans market share.

- Enterprises in the transport and fleet management business have seen robust growth in the usage of automobile loans for purchase of new vehicles.

Individuals accounted for the largest revenue share in the year 2024.

- The rise in individual automobile loans can be attributed to better awareness of credit options to buy vehicles due to the internet.

- The use of internet-based tools and articles available on online marketplaces, banks, and NBFCs websites has made it easier for individuals to compare auto loan interest rates and down payment options of different loans by financial institutions and make an informed decision.

- For instance, My Auto Loan is an online platform that offers users the option to select the vehicle they want to buy, duration of the loan, and other basic information. The best loan offer is then presented to the user along with the lender’s information, allowing the user to compare different lender offerings.

- Thus, the rise in individual auto loan market has driven the overall auto loan market during the forecast period.

Enterprises accounted for the fastest growing revenue in the overall market in 2024.

- Enterprises are increasingly using automobile loans to finance their business needs in sectors like transportation.

- Many auto loan providers have started offering automobile loans for vehicles like tractors to agricultural businesses.

- Moreover, many construction or fleet businesses also avail automobile loans for construction vehicles and fleet vehicles, which is increasing the auto loans market share.

- For instance, Tata Motors Finance offers automobile loans for large, medium and small-sized fleet businesses that operate passenger and commercial vehicles like buses and trucks.

- Hence, as per the analysis, the growing demand for automobile loans by enterprises for fleets has resulted in the auto loans market expansion.

Regional Analysis:

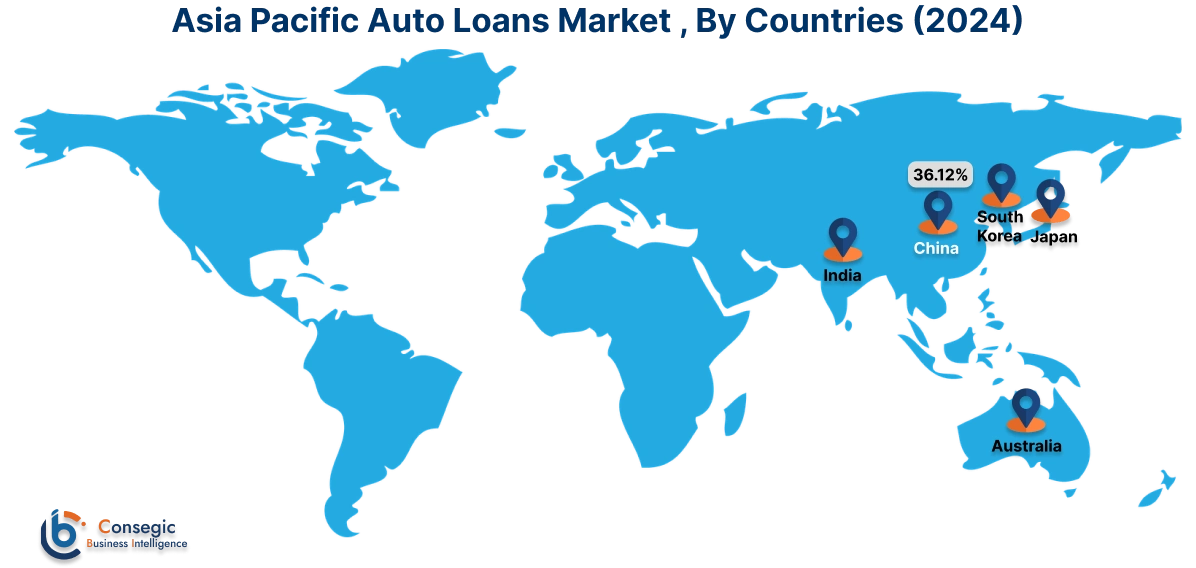

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

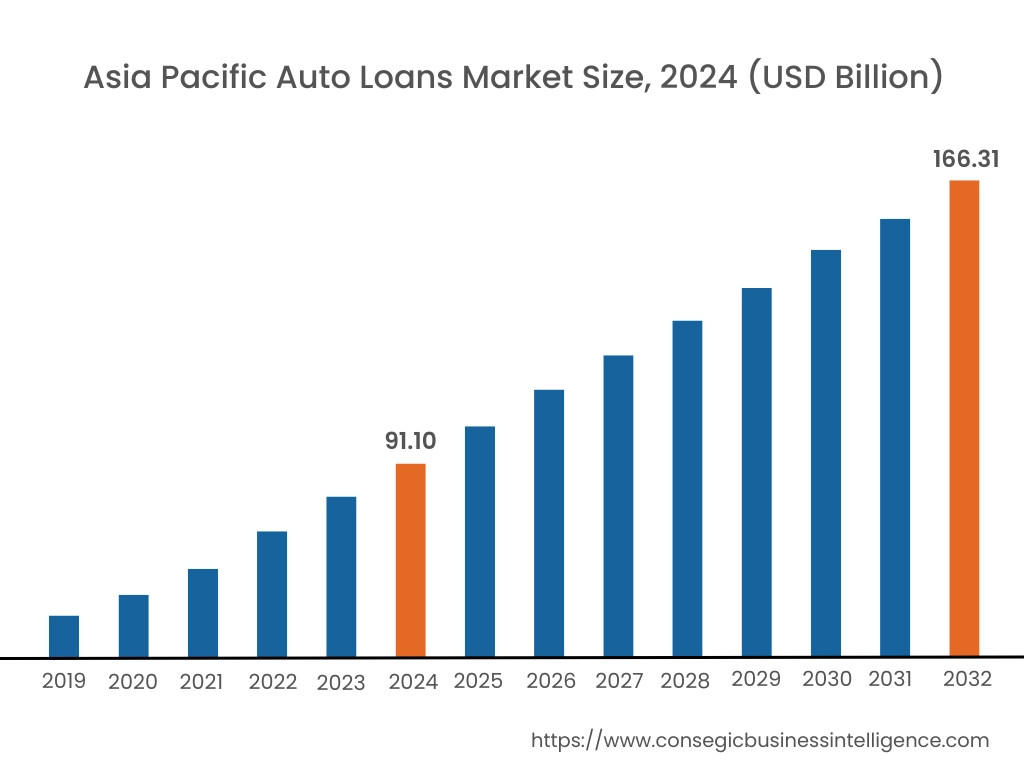

Asia Pacific region was valued at USD 91.10 Billion in 2024. Moreover, it is projected to grow by USD 96.47 Billion in 2025 and reach over USD 166.31 Billion by 2032. Out of this, China accounted for the maximum revenue share of 36.12%. As per the auto loan market analysis, the adoption of automobile loans in the Asia-Pacific region is primarily driven by the growing income levels of individuals, rising trade, and increasing need for automobile loans for commercial vehicles for transportation of goods.

- For instance, according to the Eicher financial report, its commercial vehicles segment in India saw a Year-to-Data (YTD) increase of 5.2% in the year 2024-25 from 2023-24. Thus, the growing sales of commercial vehicles in India will drive the market for automobile loans.

North America is estimated to reach over USD 167.55 Billion by 2032 from a value of USD 95.89 Billion in 2024 and is projected to grow by USD 101.17 Billion in 2025. In North America, the growth of auto loans market is driven by the growing investments in hybrid and electric vehicles. Moreover, the increasing adoption of automobile loans for luxury vehicles is contributing to the auto loans market demand.

- For instance, Mercedes USA offers various loan financing options for new and most pre-owned cars for models up to 5 years old, making the loan of car easier for the end customer as the financing can be done by Mercedes itself. Therefore, the in-house financing of cars done by Mercedes and other market players is expected to drive the overall automobile loans market.

Additionally, the regional analysis depicts that the growing emphasis on reducing carbon emissions with the use of electric and hybrid vehicles are driving the auto loans industry demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America is expected to grow at a considerable rate due to increase in the growth of credit unions offering affordable interest rates. Middle East, and African regions are expected to grow at a considerable rate due to factors like growing vehicle ownership in the agriculture sector and growing use of automobile loans by fleet operators, among others.

Top Key Players and Market Share Insights:

The global auto loans market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the auto loans market. Key players in the auto loans industry include-

- Wells Fargo (U.S.)

- Bank of America Corporation (U.S.)

- Santander Bank (Spain)

- Ally Financial Inc. (U.S)

- KBC Group (Belgium)

- BNP Paribas (France)

- JP Morgan Chase and Co. (U.S.)

- HDFC Bank Ltd. (India)

- Revfin (India)

- ICICI Bank Ltd. (India)

Recent Industry Developments :

Partnerships and Collaborations:

- In August 2024, Toyota Kirloskar Motor announced their partnership with Union Bank of India with the aim of offering better vehicle financing solutions for customers wanting to buy Toyota vehicles via Union Bank of India. The partnership aims to offer various financing options with Union Bank of India’s digitized loan process.

Product Launch:

- In February 2025, Cars24 announced the launch of Loans24 to provide auto and non-auto loans to consumers. Loans24 provides 100% financing options with up to 200% top ups and loan repayment options of up to six years, making the process of buying automobile loans convenient and instant for consumers.

Auto Loans Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 540.33 Billion |

| CAGR (2025-2032) | 7.9% |

| By Loan Provider |

|

| By Loan Duration |

|

| By Vehicle |

|

| By Ownership |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the auto loans market? +

The auto loans market is estimated to reach over USD 540.33 Billion by 2032 from a value of 308.07 Billion in 2024 and is projected to grow by USD 325.12 Billion in 2025, growing at a CAGR of 7.9% from 2025 to 2032.

Which is the fastest-growing region in the auto loans market? +

Asia-Pacific region is experiencing the most rapid growth in the auto loans market.

What specific segmentation details are covered in the auto loans market report? +

The auto loans market report includes specific segmentation details for loan provider, loan duration, vehicle, ownership, end user, and region.

Who are the major players in the auto loans market? +

The key participants in the auto loans market are Wells Fargo (U.S.), Bank of America Corporation (U.S), BNP Paribas (France), JP Morgan Chase and Co. (U.S), HDFC Bank Ltd. (India), Revfin (India), ICICI Bank Ltd. (U.S), Santander (Spain), Ally Financial Inc. (U.S.), KBC Group (Belgium), and others.