Automotive Engine Valve Market Size :

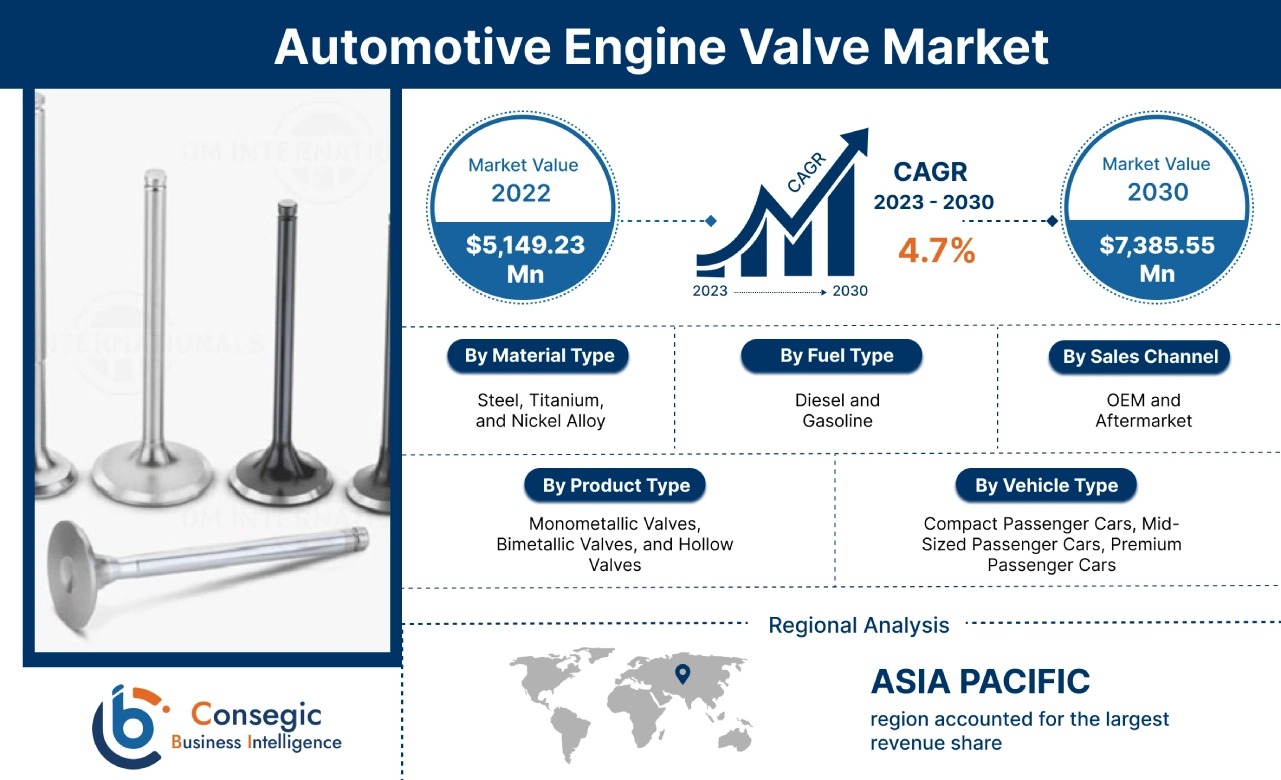

Global Automotive Engine Valve Market size is estimated to reach over USD 7,385.55 Million by 2030 from a value of USD 5,149.23 Million in 2022, growing at a CAGR of 4.7% from 2023 to 2030.

Automotive Engine Valve Market Scope & Overview :

An automotive engine valve is a crucial component in the combustion process of an internal combustion engine. Automotive engine valves are responsible for controlling the flow of air and fuel into the engine's combustion chamber and allowing exhaust gases to exit the system. Moreover, automotive valves are made up of durable materials including steel or alloys, as they are subjected to high temperatures and pressures during engine operation.

Automotive Engine Valve Market Insights :

Automotive Engine Valve Market Dynamics - (DRO) :

Key Drivers :

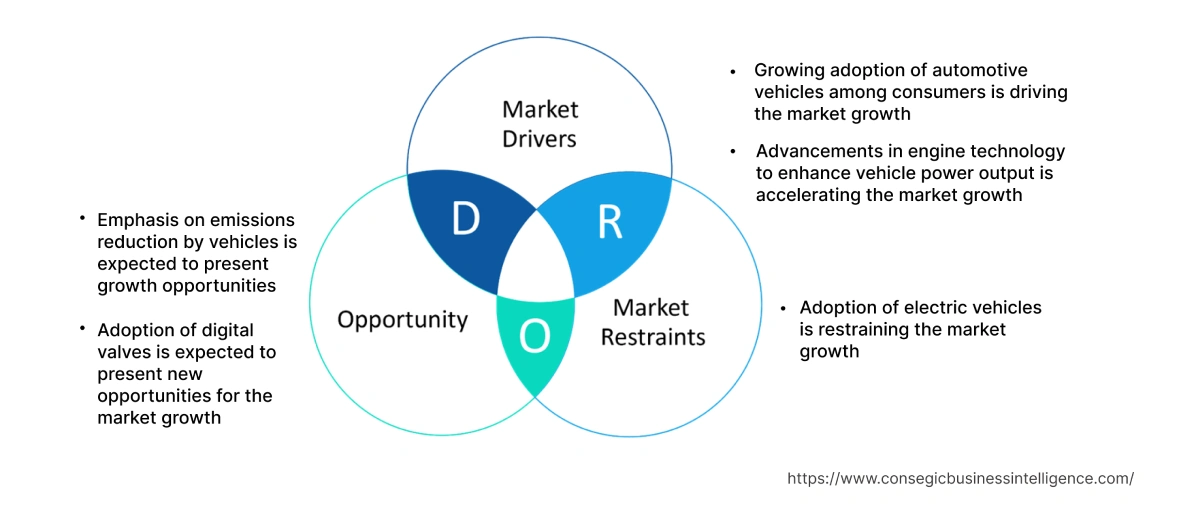

Growing adoption of automotive vehicles among consumers

The growing adoption of vehicles among consumers for commuting and short distance travelling is driving the growth of the market. Analysis of market trends concludes that rising vehicle production and adoption levels directly contribute to the demand for engine valves as they are essential components in every internal combustion engine. Engine valves are compatible for several types of combustion engines including diesel, gasoline, kerosene, natural gas (LNG), or propane (LP). For instance, in March 2021, Eaton introduced sodium-filled hollow-head valves that reduce emissions, improves the fuel economy, and increase performance in gas-powered engines. Moreover, the ability of engine valves to provide strength, durability, and corrosion resistance to the engines is accelerating the automotive engine valve market demand.

Advancements in engine technology to enhance vehicle power output

The technological advancements in engine design and performance drive the demand for advanced engine valves. Engine manufacturers are constantly striving to improve fuel efficiency, reduce emissions, and enhance power output. Analysis of market trends concludes that the development of engines with higher operating temperatures, increased pressure, and Variable Valve Timing (VTT) systems is driving the expansion of the market. For instance, in March 2023, Caterpillar launched 13-liter diesel engine platform called Cat C13D to achieve torque and fuel efficiency, and high power density for optimizing the performance of heavy-duty off-highway applications. Therefore, automotive manufacturers are taking initiatives to reduce the emissions from vehicle engine is thus driving the automotive engine valve market demand.

Key Restraints :

Adoption of electric vehicles

The increasing adoption of electric vehicles among consumers due to fuel-efficiency and low-servicing costs is hindering the growth of automotive engine valve market. Electric vehicles operate on batteries instead of an Internal Combustion Engine (ICE). The vehicle utilizes a large battery pack for efficient functioning of electric motor. Electric vehicles lack liquid fuel components, including a fuel pump, fuel line, or fuel tank as they emit no exhaust gas from the tailpipe. Therefore, the increased dependence of EVs on electricity limits the demand for automotive engines valves, thereby hindering the market expansion.

Future Opportunities :

Emphasis on emissions reduction by vehicles

The environmental regulations and consumer demand for cleaner vehicles continue to drive the need for improved emissions control. Therefore, ICE-based vehicles are still expected to operate on the roads during the forecast period. Developing valves that enable more precise control over air-fuel mixture and exhaust gas recirculation help manufacturers to meet stringent emission standards. Analysis of market trends concludes that the growing emphasis on emissions reduction by vehicles is expected to present growth opportunities for the automotive engine valve market during the forecast period.

Adoption of digital valves

The adoption of digital valves for real time monitoring of automotive engines is expected to present potential opportunities for the market to grow. The electronic engine valve system offers control over the combustion cycle wherein the flow of fuel through the intake or exhaust valve is controlled, providing power and emissions improvements. Moreover, the system runs under real-time and closed-loop control to monitor the working of the engine. Analysis of market trends concludes that the adoption of digital valves is emerging as one of many automotive engine valve market opportunities that will drive market expansion.

Automotive Engine Valve Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 7,385.55 Million |

| CAGR (2023-2030) | 4.7% |

| By Product Type | Monometallic Valves, Bimetallic Valves, and Hollow Valves |

| By Vehicle Type | Compact Passenger Cars, Mid-Sized Passenger Cars, Premium Passenger Cars |

| By Material Type | Steel, Titanium, and Nickel Alloy |

| By Fuel Type | Diesel and Gasoline |

| By Sales Channel | OEM and Aftermarket |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Continental AG, Cummins, BorgWarner, Denso Corporation, Eaton Corporation PLC, Federal-Mogul Holdings Corp, FTE Automotive GmBH, Hitachi Ltd., Johnson Electric Group, Knorr-Bremse AG, Robert Bosch GmbH, Schaeffler AG |

Automotive Engine Valve Market Segmental Analysis :

By Product Type :

Based on the product type, the market is trifurcated into monometallic valves, bimetallic valves, and hollow valves. In 2022, the monometallic segment accounted for the highest automotive engine valve market share. The widespread adoption of engines in light and heavy-duty vehicles is driving the proliferation of the market. Monometallic valves are made from a single material including steel or a steel alloy. Moreover, monometallic valves offer durability, high-temperature resistance, and excellent sealing properties under normal to high-stress conditions. Additionally, the ability of monometallic valves to provide reliable performance for automotive engines is accelerating the proliferation of the market.

The bimetallic segment is anticipated to register the fastest CAGR growth during the forecast period. The ability of bimetallic valves to provide improved heat dissipation and enhanced performance under high-stress conditions is driving the expansion of the market. Bimetallic valves are made up of two different materials including steel alloys or cobalt-chromium alloys. Therefore, bimetallic valves offer enhanced durability and heat resistance properties to the engines, thereby propelling the proliferation of the market.

By Vehicle Type :

Based on the vehicle type, the market is divided into compact passenger cars, mid-sized passenger cars, premium passenger cars. In 2022, the The mid-sized passenger cars segment accounted for the highest automotive engine valve market share. The increasing demand for a diverse range of valves to provide different power outputs for efficient functioning of mid-sized engines is propelling the proliferation of the market. Manufacturers are constantly producing a wide range of engine valves for both gasoline and diesel engines. Moreover, the production of a wide variety of engine valves including sleeve valve, rotary valve, and reed valve for mid-sized passenger cars to meet the emission standards is accelerating the expansion of the market.

The premium passenger cars segment is expected to emerge as the fastest-growing segment during the forecast period. Premium passenger cars are known for their high performance, advanced technologies, and luxurious features. Thus, premium passenger cars have larger and more powerful engines that require high-performance engine valves for efficient combustion of gases in the engine. Therefore, the incorporation of advanced materials, including high-strength alloys or coatings to ensure durability and optimal engine performance in premium passenger cars is accelerating the automotive engine valve market growth.

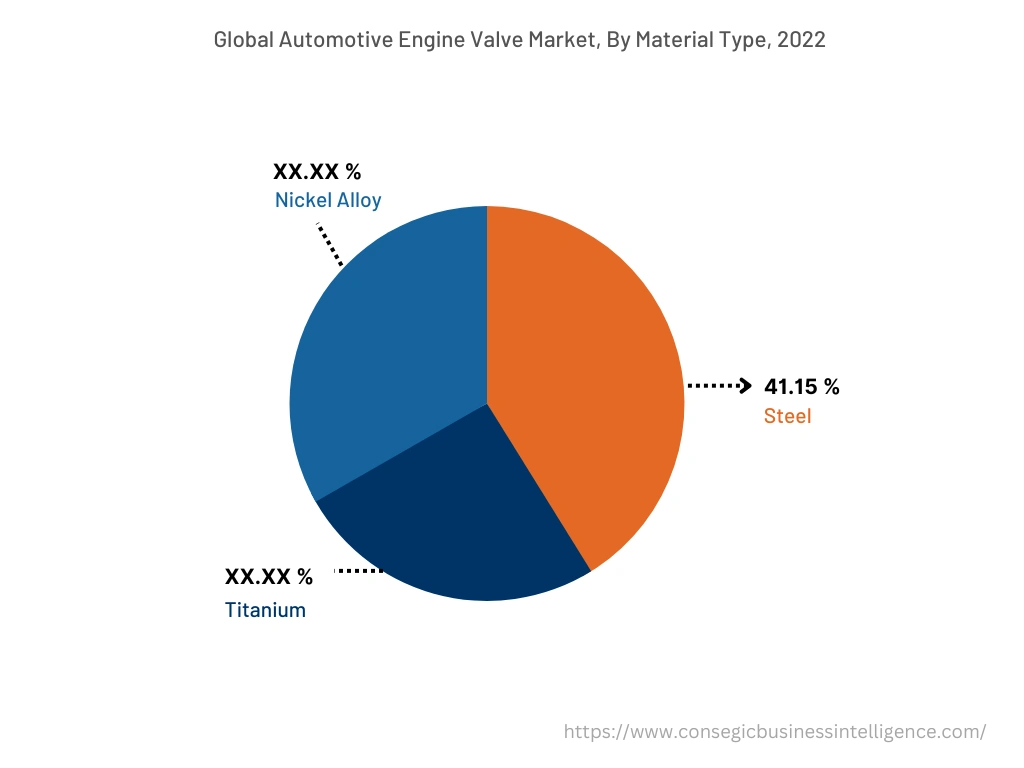

By Material Type :

Based on the material type, the market is trifurcated into steel, titanium, and nickel alloy. The steel segment accounted for the largest revenue share of 41.15% in the year 2022. Automotive engine valves are manufactured from magnetic and non-magnetic steels for application including inlet and exhaust valves in IC engines. The steel valves allow commercial and passenger vehicles to operate under conditions of severe heat and corrosive stress. Moreover, the ability of steel valves to operate under elevated temperatures is accelerating the automotive engine valve market growth.

The nickel alloy segment is projected to emerge as the fastest-growing segment during the forecast period. Nickel alloy is widely used for exhaust valves in high-power diesel engines. The malleability of nickel alloys allows manufacturers to machine or shape valves in different from factors according to the type of engine. Moreover, nickel resists corrosion caused by water and heat exposure, thereby extending the lifespan of the engine. Analysis of automotive engine valve market trends concludes that the application of nickel alloys in manufacturing pistons, valve heads, cylinder liners, and bearing surfaces is accelerating the proliferation of the market.

By Fuel Type :

Based on the fuel type, the market is bifurcated into diesel and gasoline. The gasoline segment accounted for the largest revenue share in the year 2022. Gasoline cars utilizes a spark-ignited ICE engine wherein the fuel is introduced directly into the chamber that further integrates with air present inside the combustion chamber. The air or fuel mixture is ignited by a spark from the spark plug. Analysis of automotive engine valve market trends concludes that the increasing need for high-performance engine valves for efficient transmission of fuels between different chambers is propelling the expansion of the market.

The diesel segment is expected to register the fastest CAGR growth during the forecast period. Diesel cars utilizes a compression-ignited injection system wherein the diesel fuel is introduced into the combustion chamber and ignited by the high temperatures due to the compression of gas by the engine piston. Assessment of market trends indicates that the increasing need to reduce the impact of vehicular carbon emission footprint and improve fuel efficiency is accelerating the expansion of the market.

By Sales Channel :

Based on the sales channel, the market is divided into OEM and aftermarket. The OEM segment accounted for the largest revenue share in the year 2022. OEMs have invested heavily in building brand recognition to establish a loyal customer base. As a result, manufacturers tend to purchase automotive parts including engine valve from a reputed OEM. Assessment of market trends indicates that OEMs offer a wide range of automotive engine valves at affordable price points creating a large consumer base, thus contributing significantly in propelling the market proliferation.

The aftermarket segment is expected to witness the fastest CAGR during the forecast period. Aftermarket electric vacuum pump products cater to various needs of the consumers including customization, upgradation, and replacement of existing engine valves. Additionally, the aftermarket segment caters to the need for affordable and reliable vehicle parts after the expiration of the warranty period by the OEMs. Consequently, aftermarket products offer multiple products according to the requirements of the vehicle resulting in market expansion.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

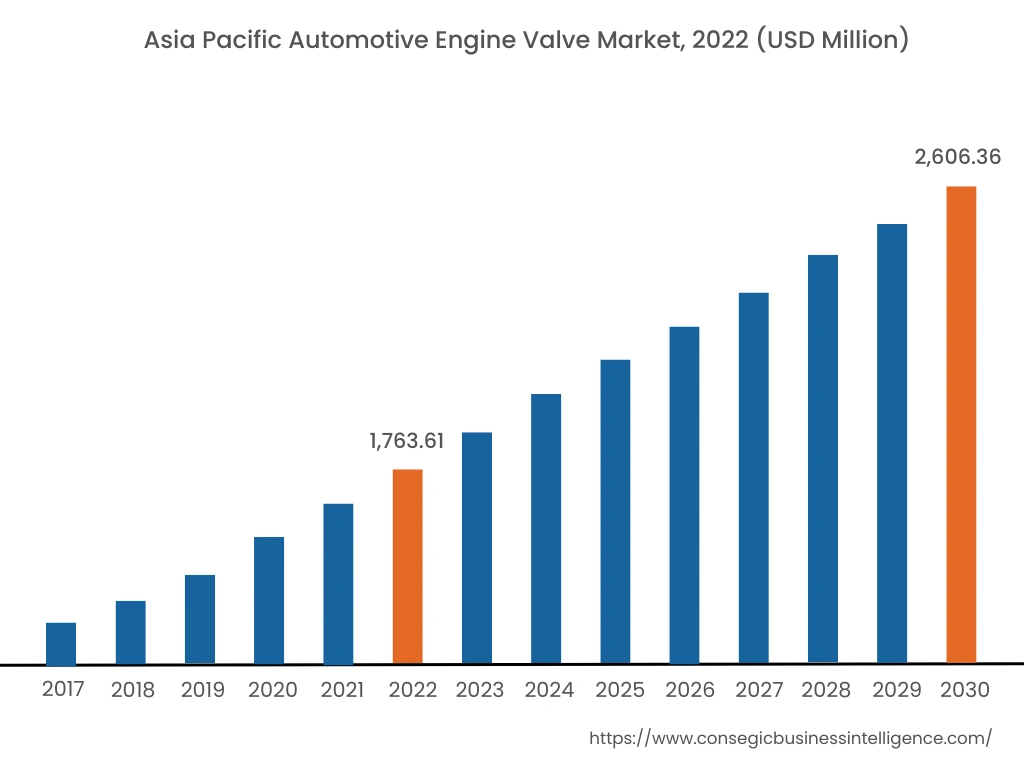

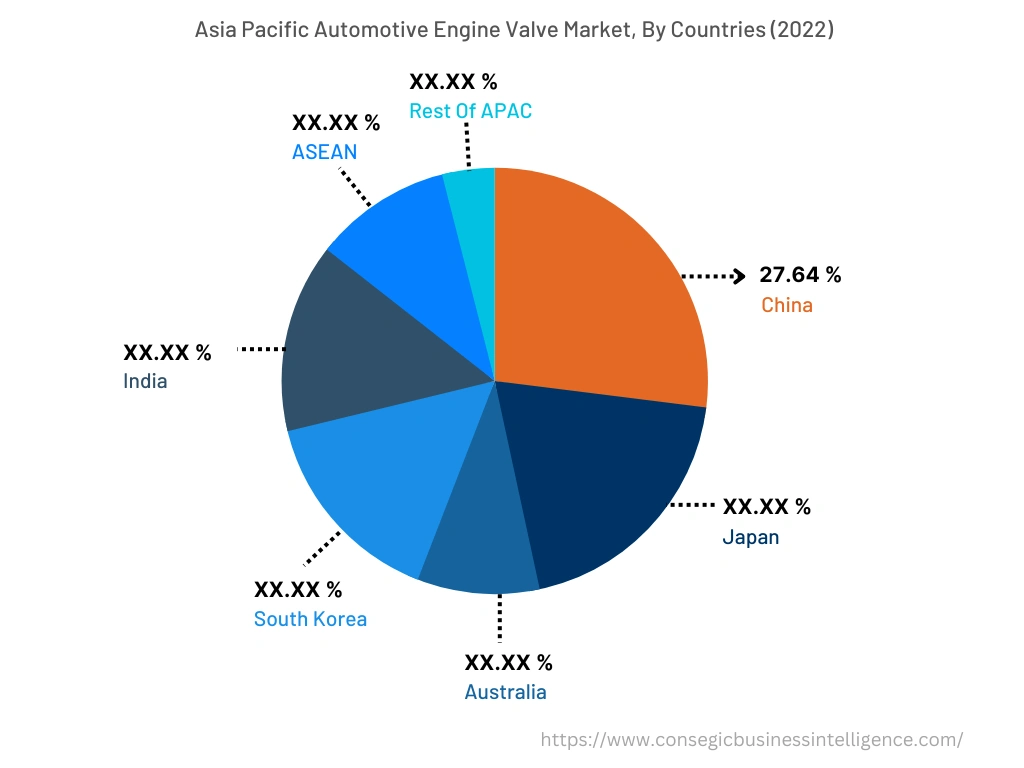

The Asia-Pacific region accounted for the largest revenue share of USD 1,763.61 million in 2022 and is expected to reach USD 2,606.36 million in 2030, registering a CAGR of 5.2% during the forecast period. Additionally, in the region, China accounted for the revenue share of 27.64% in the year 2022. The growing sales for automobiles in countries including India, China, and Japan for commuting and day-to-day travelling is driving the need for automotive engine valve market. Moreover, the region is also expected to register the fastest CAGR during the forecast period, 2023-30. Furthermore, governments in countries including China and India have implemented stringent emission standards and fuel efficiency targets. As a result, manufacturers are adopting advanced engine technologies that require high-performance engine valves to comply with the environmental regulations. According to International Energy Agency (IEA), Transportation industry relies heavily on fossil fuels and account for 37% of the total CO2 emissions in 2021. The development of efficient ICE engine valves allows for efficient transportation of fuels in the engine, thereby reducing the problems of congestion and air pollution. The automotive engine valve market analysis concluded that the expansion of manufacturing facilities and investments in the automotive industry contribute to the proliferation of the engine valve market in the region.

Top Key Players & Market Share Insights :

The automotive engine valve market is characterized by the presence of major players providing high-performance automotive engine valves for internal combustion of gases. The major companies operating in the automotive engine valve industry operating in the market are adopting several business strategies including research and development (R&D), product innovation, and application launches that accelerate the proliferation of automotive engine valve market. Key players in the market include-

- Continental Automotive Technologies GmbH

- BorgWarner

- Knorr-Bremse AG

- Robert Bosch GmbH

- Schaeffler AG

- Cummins Inc.

- Denso Corporation

- Eaton Corporation PLC

- Federal-Mogul Holdings Corp

- FTE Automotive GmBH

- Hitachi Ltd

- Johnson Electric Group

Recent Industry Developments :

- In December 2022, BorgWarner launched 142 parts and additional 21 parts including fuel pump hanger, fuel pump strainer sets, module assemblies, and fuel pump check valves for automobiles.

- In February 2023, Eaton launched valve actuation technologies including Vehicle Group Cylinder Deactivation (CDA) and Late Intake Valve Closing (LIVC) to reduce nitrogen oxides (NO2) and carbon dioxide (CO2) emissions from the vehicle.

Key Questions Answered in the Report

What is automotive engine valve? +

Automotive engine valves are the mechanical components utilized in internal combustion engines to restrict or allow the flow of air or gas into the combustion chambers during engine operation.

What specific segmentation details are covered in the automotive engine valve report, and how is the dominating segment impacting the market growth? +

The automotive engine valve report comprises of segments including product type, vehicle type, material type, fuel type and sales channel. Each segment has key dominating sub-segment being driven by the industry trends and market dynamics. For instance, by product type has witnessed monometallic valves as the dominating segment in the year 2022, due to its durability, high-temperature resistance, and excellent sealing properties under normal to high-stress conditions.

What specific segmentation details are covered in the automotive engine valve market report, and how is the fastest segment anticipated to impact the market growth? +

Each segment in the automotive engine valve market is projected to have the fastest-growing sub-segment being fuelled by industry trends and drivers. For instance, by material type segment has witnessed nickel alloy as the fastest-growing segment during the forecast period due to the highly malleable and corrosion-resistant properties of nickel valves.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

North America is expected to register fastest CAGR growth during the forecast period due to technological advancements in automotive engines including direct injection and Variable Valve Timing (VTT).