Bisphenol-A Market Size :

Consegic Business Intelligence analyzes that the Bisphenol-A Market size is estimated to reach over USD 32,899.47 Million by 2032 from a value of USD 23,929.95 Million in 2024 and is projected to grow by USD 24,475.11 Million in 2025, growing at a CAGR of 4.10% from 2025 to 2032.

Bisphenol-A Industry Scope & Overview:

Bisphenol-A (BPA) is an industrial chemical with the formula C15H16O2. It is a colorless solid, not flammable with a sweet odor. The compound is widely used in the manufacture of various products such as plastics, paints, adhesives, electronic and electrical parts, construction materials, and others.

Further, this compound is used in the manufacture of polycarbonate and epoxy resins that are used in the production of adhesives, machine parts, and electronic parts. This compound has properties such as high durability, tensile strength, and transparency, among others. Moreover, the utilization of these compounds in the paints and coatings and construction sector is propelling the bisphenol-A market.

Bisphenol-A Market Insights :

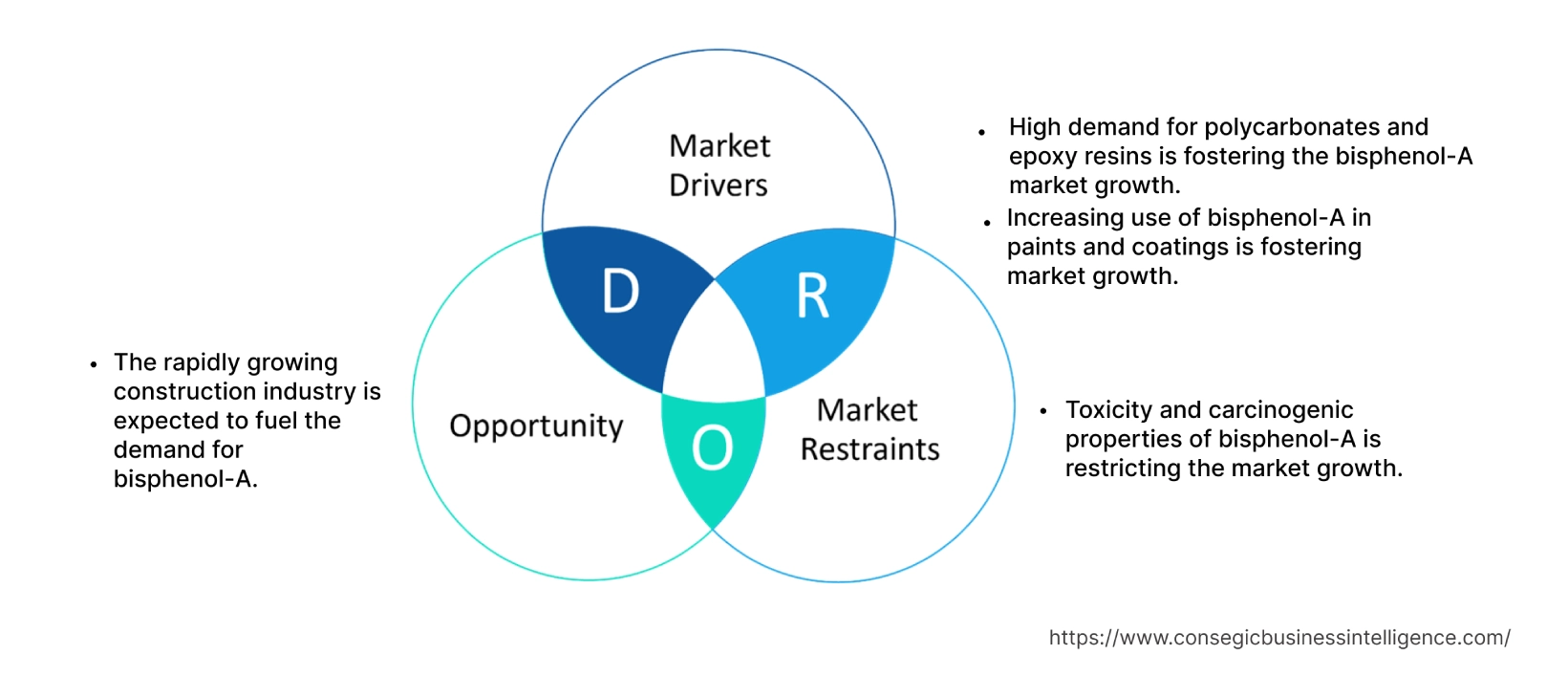

Bisphenol-A Market Dynamics - (DRO):

Key Drivers :

High demand for polycarbonates and epoxy resins is fostering the BPA market

Polycarbonates are a type of plastic that are known for their high strength, durability, and transparency. These plastics are used in a wide variety of products, including automotive parts, appliances, electronics, and medical devices. Further, epoxy resins are a type of polymer that is used in adhesives, coatings, and sealants. The expansion for polycarbonates and epoxy resins is driven by factors such as increasing urbanization, rising disposable incomes, and growing requirement for consumer goods. In addition to this, the increasing requirement for polycarbonates and epoxy resins from various end-user industries, such as automotive, construction, and electronics is another prominent factor accelerating the requirement for bisphenol-A industry.

As per the analysis, in India, the requirement for a wide range of consumer durable goods is growing as a result of the ongoing increase in disposable income and technological innovation. For instance, according to the report published by the India Brand Equity Foundation, the foreign direct investment (FDI) in the Appliances and Consumer Electronics (ACE) industry accounted for USD 481 million in 2022, from USD 198 million in 2021.

Hence, the aforementioned factors are contributing to the growing requirement for polycarbonate and epoxy resins, in tun propelling the bisphenol-A market growth and trends.

Increasing use of bisphenol-A in paints and coatings is fostering market

BPA is a versatile and low-cost chemical, used to improve the performance of paints and coatings in a number of ways, such as increasing their durability, flexibility, and resistance to chemicals and corrosion. It is found in some paints and coatings, but the amount of this compound is used varies depending on the type of paint or coating. Also, based on the analysis, interior paints typically contain more of this compound than exterior paints.

Furthermore, the requirement for high-performance paints and coatings is attributed to the increasing use of paints and coatings in demanding applications such as automotive parts, industrial machinery, and infrastructure. For instance, according to the report published by the American Coatings Association (ACA), the U.S. paint and coatings sector posted a positive trade surplus of USD 1.4 billion in 2021. For this reason, increasing the use of this compound in paints and coatings is fostering trends of the bisphenol-A market.

Key Restraints :

Toxicity and carcinogenic properties of bisphenol-A is restricting the market

Bisphenol-A possesses properties such as durability, molding capacity, and transparency, however, high toxicity to humans and the environment is likely to hamper the product requirement. For instance, according to an article published by the National Library of Medicine, high exposure to this compound increases the risk of developing cardiovascular diseases (CVDs) including atherosclerosis, hypertension, and diabetes.

Stringent government regulations for the use of this compound is another significant factor that is negatively impacting the market trends and growth. For instance, the European Food Safety Authority (EFSA) recommends that pregnant women and infants avoid exposure to this compound as much as possible. As a result, as per the analysis, the above-mentioned factors are likely to limit the bisphenol-A market growth.

Future Opportunities :

The rapidly growing construction sector is expected to fuel the demand for bisphenol-A

BPA is used in a variety of construction materials, including polycarbonate plastics, adhesives, coatings, PVC pipes, among others. As per the analysis, the requirement for this compound in the construction sector is expected to grow in the coming years, driven by factors such as growing requirement for sustainable building materials, and increasing investment in infrastructure projects, among others, and creating lucrative opportunities in the coming years.

Additionally, the growing construction sector across the globe is a major factor in enhancing the application of building materials. For instance, according to the data published by the U.S. Census Bureau, the U.S. Construction Sector was valued at around USD 1.8 trillion in 2022. Moreover, the construction spending in the U.S. in June 2022 was USD 923.72 billion, USD 492.68 billion, and USD 345.91 billion across residential, non-residential, and public sectors respectively. Thus, the growth in construction activities is enhancing the application of building materials, in turn propelling the bisphenol-A market opportunities and trends over the forecast period.

Global Bisphenol-A Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 32,899.47 Million |

| CAGR (2025-2032) | 4.1% |

| By Applications | Polycarbonate Resin, Epoxy Resin, Vinyl Ester Resin, Flame Retardants, Unsaturated Polyester Resin, and Others |

| By End-use Industry | Paints and Coatings, Adhesives, Electronics and Electricals, Packaging, Construction, and Others |

| By Distribution Channel | Direct and Indirect |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | BASF SE, LG Chem, NAN YA PLASTICS CORPORATION, Hex ion, Mitsubishi Chemical Corporation, Convector AG, Glen ham Life Sciences. |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Bisphenol-A Market Segmental Analysis :

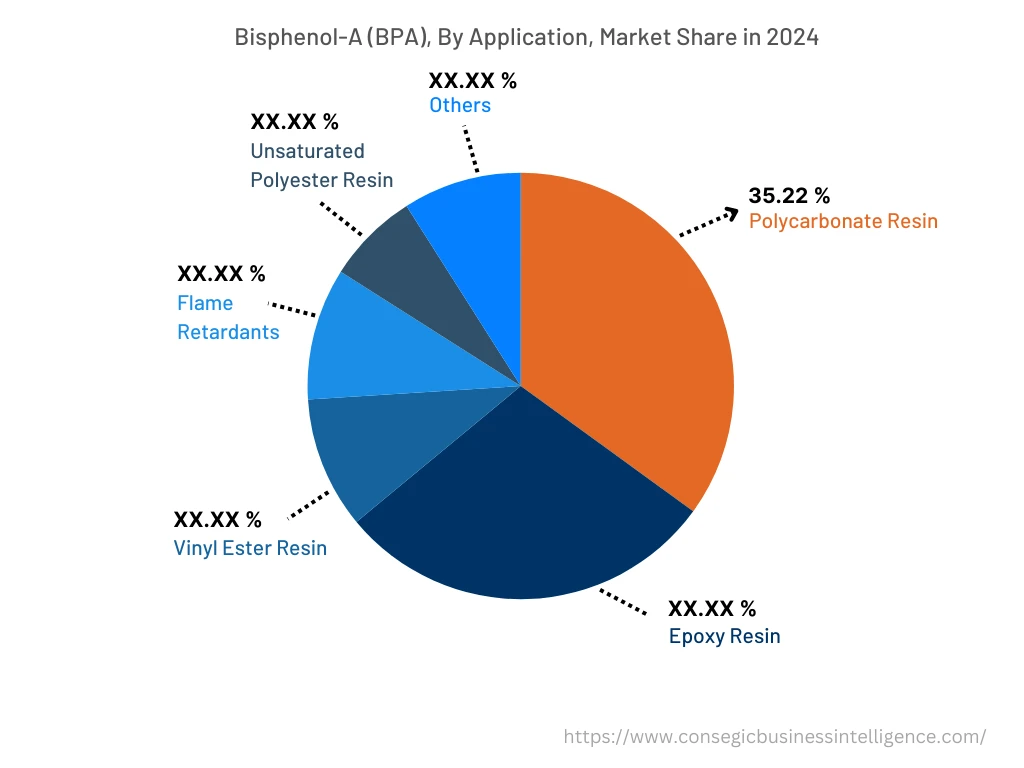

By Application :

The application segment is categorized into polycarbonate resin, epoxy resin, vinyl ester resin, flame retardants, unsaturated polyester resin, and others. In 2024, the polycarbonate resin accounted for the highest Bisphenol-A market share of 35.22% in the market and is also expected to grow at the fastest CAGR over the forecast period. The compound plays a major role in the production of polycarbonate, which is a commonly used plastic used in a multitude of industries. Based on the analysis, these resins play an important role in the formation of strong and durable products for consumer and commercial industries. In addition, polycarbonate resins are also used in the manufacturing of machine parts and electric components. Thus, owing to these benefits, the increasing requirement for this compound for polycarbonate resin applications is anticipated to drive the segment growth and trends during the forecast period.

By End-Use Industry :

The end-use industry segment is categorized into paints and coatings, adhesives, electronic and electrical, packaging, construction, and others. In 2024, the packaging segment accounted for the highest market share and the fastest CAGR over the forecast period in the overall bisphenol-A market. The compound is used to produce polycarbonate plastic and epoxy resins, which are both used in a variety of food and beverage packaging materials. Polycarbonate plastic is used to make clear, durable food and beverage containers, such as water bottles, food storage containers, and baby bottles. Epoxy resins are used to coat the inside of metal food and beverage cans to protect them from corrosion and prevent the metal from leaching into the food or beverage. Hence, as per the analysis, the high use of these materials for packaging applications in the food and beverage sector is accelerating market growth. For instance, according to the data published by the Flexible Packaging Association, the food packaging in food packaging accounts for 52% of the total shipments in the U.S. Thus, the aforementioned factors are propelling the bisphenol-A market trends of the segment

By Distribution Channel :

The distribution channel segment is categorized into direct and indirect. In 2024, the indirect segment accounted for the highest market share and is also projected to grow at the fastest CAGR over the forecast period. Based on the bisphenol-A market analysis, the segment growth is driven by the increasing bisphenol-A market demand from various end-user industries, such as construction, automotive, and electronics. The market is highly fragmented, with a large number of small and medium-sized enterprises (SMEs) operating in the market. These SMEs often rely on distributors to reach their target markets. As a result, the aforementioned factors are contributing to the segment opportunities and trends in the upcoming years.

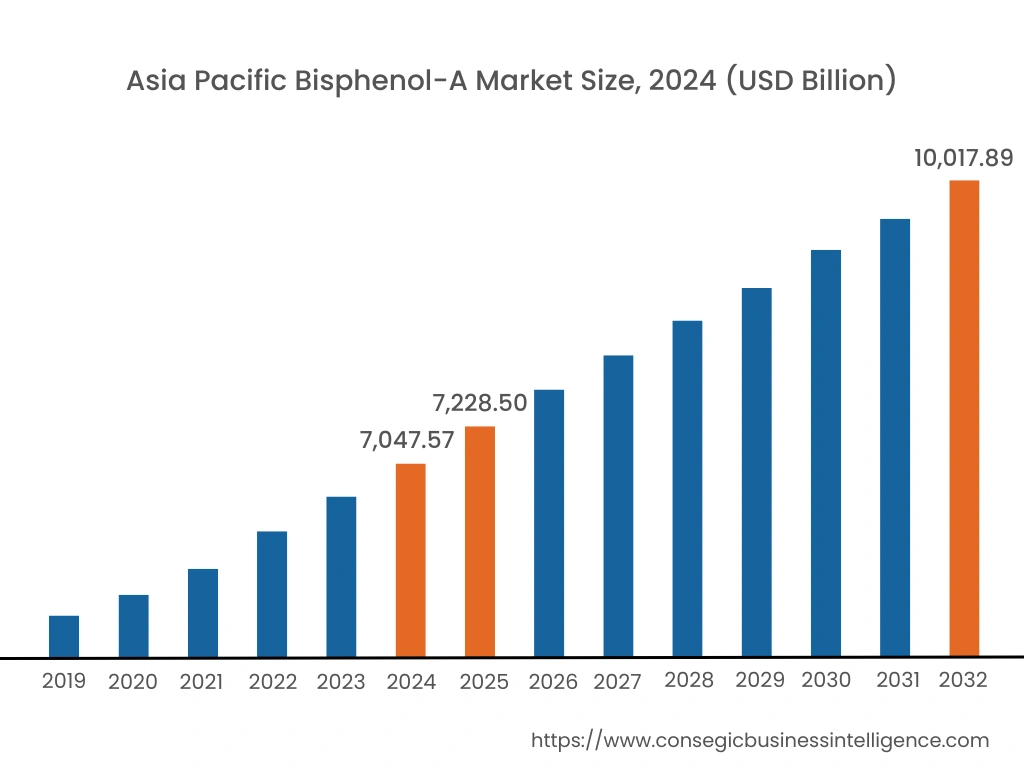

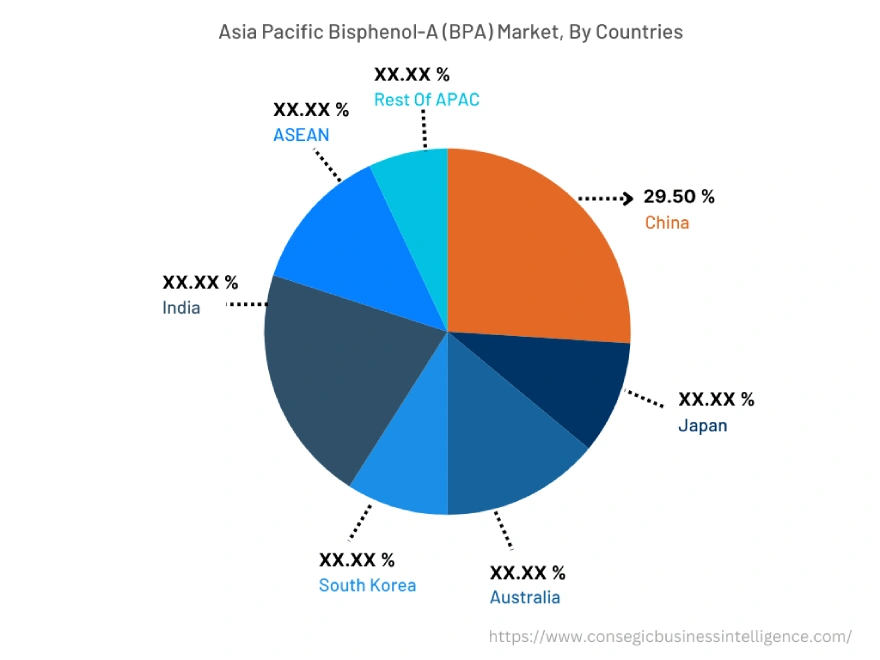

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 7,047.57 Million in 2024. Moreover, it is projected to grow by USD 7,228.50 Million in 2025 and reach over USD 10,017.89 Million by 2032. In Asia Pacific, China accounted for the highest market share of 29.50% during the base year of 2024. The growing demand for electric vehicles in the region is driving the demand for BPA-based plastics, that are used in the production of electric vehicle batteries. In addition to this, the rapidly growing paint and coatings sector is one of the major factors proliferating the demand for the compound in the region. For instance, according to the report published by the American Coatings Association, China accounted for approximately 28% of the global paints and coatings sector. However, Europe is anticipated to grow at the fastest CAGR over the forecast period.

Top Key Players & Market Share Insights:

The bisphenol-A market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The bisphenol-A market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market revenue through mergers, acquisitions, and partnerships. The key players in the bisphenol-A market include -

- BASF SE

- KUMHO P&B CHEMICALS., INC

- Convector AG

- Glen ham Life Sciences

- LG Chem

- NAN YA PLASTICS CORPORATION

- Hex ion

- Mitsubishi Chemical Corporation

Key Questions Answered in the Report

What was the market size of the bisphenol-A market in 2024? +

In 2024, the market size of bisphenol-A was USD 23,929.95 Million.

What will be the potential market valuation for the bisphenol-A industry by 2032? +

In 2032, the market size of bisphenol-A will be expected to reach USD 32,899.47 Million.

What are the key factors driving the growth of the bisphenol-A market? +

Growing demand for polycarbonate resins and epoxy resins across the globe is fueling market growth at the global level.

What is the dominating segment in the bisphenol-A market for the application? +

In 2024, the polycarbonate resin segment accounted for the highest market share in the overall bisphenol-A market.

Based on current market trends and future predictions, which geographical region is the dominating region in the bisphenol-A market? +

Asia Pacific accounted for the highest market share in the overall market.