Cellulosic Ethanol Market Size :

Cellulosic Ethanol Market size is estimated to reach over USD 11,184.57 Million by 2032 from a value of USD 3,692.08 Million in 2024 and is projected to grow by USD 4,174.94 Million in 2025, growing at a CAGR of 14.90 % from 2025 to 2032.

Cellulosic Ethanol Market Scope & Overview:

Cellulosic ethanol is a type of biofuel made from non-food plant sources, such as wood, grasses, and agricultural waste. It is produced by breaking down cellulose, a complex carbohydrate found in plant cell walls, into sugars that can be fermented into ethanol. Unlike traditional sources of ethanol such as corn, sorghum, barley, and others, it is manufactured from non-food sources such as energy crops, agriculture residue, wood, non-edible plant parts, and others. The manufacturing process involves breaking down of the plant cellulose into sugar by hydrolysis. These sugars are then fermented into ethanol which is then used to produce energy to power the process.

It is getting popular worldwide owing to its significant advantages over traditional ethanol. Unlike traditional ethanol, it has a lower impact on the food chain as it is manufactured from agricultural waste products or energy crops. It is abundant in nature and satisfies the U.S. Renewable Fuel Standards (RFS) requirements. Its production is contributing to reducing the reliance on fossil fuels and promoting sustainable fuel sources.

Cellulosic Ethanol Market Insights :

Cellulosic Ethanol Market Dynamics - (DRO) :

Key Drivers :

Growing demand for sustainable and renewable energy sources is propelling the market.

Cellulosic ethanol is produced from sugar contained in plant cells in the form of cellulose. It is generally derived from the non-edible part of the plant, whereas first-generation ethanol or regular ethanol is produced from edible plant sources. It is environmentally sustainable as it is made up of agricultural and plant waste and is further used as a biofuel. It has a lower environmental impact compared to other fuel sources and generates lower greenhouse gases in contrast to first-generation ethanol. The increasing awareness about the emission of greenhouse gases due to the use of fossil fuels and the rising focus on reducing the dependency on fossil fuels for transportation, energy, and other applications is driving the need for sustainable and renewable energy sources worldwide. For instance, according to the report by the International Energy Agency in 2021, the global consumption of ethanol in 2020 accounted for 94,188 million liters per year and is expected to reach 111,139 million liters per year in 2026 along with this the global need for biofuel is expected to grow by 41 million liters over 2021-2026. Hence, the analysis of market trends depicts that the increasing need for biofuels and the growth in the consumption of ethanol is boosting the demand for a sustainable and renewable energy source. This prominent factor is boosting the cellulosic ethanol market growth.

Rising government initiatives to promote the use of biofuels are driving the market.

Biofuels are an alternative energy option as they are clean and have low sulfur content thereby having a positive environmental impact. It is a form of biofuel made up of agricultural and plant residues. Various government bodies worldwide are promoting the use of biofuels such as cellulosic ethanol for various applications such as transportation fuel, energy production, and others. For instance, in June 2022, India's Ministry of Petroleum and Natural Gas published its "National Policy on Biofuels" in 2018, and further amended it in June 2022. The policy's objective is to reduce the import of petroleum products by fostering domestic biofuel production. Furthermore, in March 2023, the Energy Independence and Security Act expanded the Renewable Fuel Standard to increase biofuel production to 36 million gallons by 2022. Of the latter goal, 21 million gallons must come from cellulosic biofuel or advanced biofuels derived from feedstocks other than cornstarch. Therefore, the analysis of market trends shows that the rising government initiatives to promote the production and use of biofuel are driving the cellulosic ethanol market growth.

Key Restraints :

The lack of infrastructure to produce cellulosic ethanol is restraining the market.

The production of cellulosic ethanol requires specialized processing facilities that can efficiently break down cellulose into sugars and then ferment those sugars into ethanol. Setting up and maintaining these facilities is capital-intensive and demands advanced technological expertise. The technology required for the breakdown of the plant cellulose into sugars and then into this ethanol is still in the development phase. Due to this, the typical production of this ethanol from the hydrolysis process is expensive. The lack of infrastructure leads to higher production costs making it less competitive as compared to other forms of biofuels. Without proper infrastructure, the production of this ethanol is difficult to scale up and leads to cost parity with its potential substitutes. Furthermore, due to the lack of research and development activities, the conversion rate of raw materials or feedstocks to this ethanol is lower as compared to regular ethanol. Hence, the market analysis shows that the lack of infrastructure along with the production-related difficulties is posing a major bottleneck for cellulosic ethanol market demand worldwide.

Future Opportunities :

Growing trends and initiatives for the development of production plants are likely to accelerate market opportunities.

The key players dealing in cellulosic ethanol and government bodies across the globe are substantially investing in the production expansion and development of new production facilities. For instance, in August 2022, the Prime Minister of India inaugurated the country's first 2G cellulosic ethanol biorefinery, the Indian Oil project at Panipat, Haryana. This 100 KLPD 2G Ethanol Bio-Refinery spans 35 acres processing 200,000 tons of rice straw and producing 30 million liters of ethanol annually. Furthermore, the government of India is also providing several initiatives for the development of second-generation biofuel plants across the country. The government of India launched the "Pradhan Mantri JI-VAN Yojana" scheme for providing financial support to integrated bio-ethanol projects, using lignocellulosic biomass and other renewable feedstock. In this scheme, financial support to twelve Integrated Bio ethanol Projects using lignocellulosic biomass & and other renewable feedstock with a total financial outlay of USD 238.5 million for the period 2018-19 to 2023-24 will be provided along with support to ten demo projects for 2G biofuel technologies across the country. Henceforth, the analysis of market trends shows that the launch of such government initiatives will create potential cellulosic ethanol market opportunities in the upcoming years.

Cellulosic Ethanol Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 11,184.57 Million |

| CAGR (2025-2032) | 14.9% |

| By Feedstock | Energy Crops, Agricultural Residues, Organic Municipal Solid Waste, Forest Residue, and Others |

| By Process | Dry Grind, Wet Mills, and Others |

| By Application | Industrial Solvents, Fuel & Fuel Additives, Beverages, Chemical Additives, and Others |

| By End-user Industry | Transportation, Energy, Chemicals, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Raizen SA, Logen Corporation, GranBio, POET-DSM Advanced Biofuels, Iogen Corporation, Praj Industries, Cargill, Inc., Ginkgo Bioworks, Bioamber Inc, Genomatica Inc., and Clariant AG |

Cellulosic Ethanol Market Segmental Analysis :

By Feedstock :

The feedstock segment is categorized into energy crops, agricultural residues, organic municipal solid waste, forest residue, and others. In 2024, the agriculture residue segment accounted for the highest market share in the global cellulosic ethanol market. Agricultural residues include rice straw, wheat straw, rice husk, and corn stover, which are mostly left on the fields after harvests and used for fodder and landfill material or burnt in many places. Forestry residues consist of branches, leaves, bark, and other portions of wood. Agriculture residue has low manufacturing costs, and it is readily available across the globe. Furthermore, the processing of agriculture residue leads to relatively lower greenhouse gas emissions due to which it is getting popular as a most effective and highly available feedstock segment growth across the globe. Thus, the analysis of segment trends shows that the high availability and lower cost of conversion of agriculture residue is fostering the revenue of the cellulosic ethanol industry during the forecast period.

However, the energy crops segment is expected to be the fastest-growing segment during the forecast period. The use of energy crops for energy production can be beneficial because of their carbon neutrality. It represents a cheaper alternative to fossil fuels while being extremely diverse in the species of plants that can be used for ethanol production.

By Process :

The process segment is categorized into dry grind, wet mills, and others. In 2024, the dry grind segment accounted for the highest revenue in the overall cellulosic ethanol market share and is expected to grow at a high CAGR over the forecast period. The dry grind process has the potential to overcome some of the challenges faced by traditional production methods such as cost efficiency, higher ethanol yield, resource optimization, and lower impact on the environment. The integration of dry grind technology for the manufacturing of production increases production efficiency and potentially reduces overall manufacturing costs. The growth of the dry grind process is gaining popularity owing to the increasing research and development activities for the optimization of technologies. Hence, the high affordability and acceptance of the dry grind process are fostering cellulosic ethanol market demand.

By Application :

The application segment is categorized into industrial solvents, fuel & fuel additives, beverages, chemical additives, and others. In 2024, the fuel & fuel additives segment accounted for the highest market share in the overall cellulosic ethanol market, and it is expected to grow at the fastest CAGR over the forecast period. It is used as fuel & and fuel additives due to its higher octane number and premium blending properties in gasoline. Furthermore, blending ethanol in fuel leads to lower emissions and acts as a fuel stabilizer. Owing to these beneficial properties of ethanol as a fuel additive, government bodies across the globe are promoting ethanol blending in the fuel to lower the overall gasoline prices and increase sustainability in fuels. For instance, in March 2022, the Government of the U.S. announced its plan to increase the addition of ethanol into gasoline to lower the prices. Therefore, such rising initiatives are fostering the demand for fuel & and fuel additives applications and thereby driving cellulosic ethanol market trends.

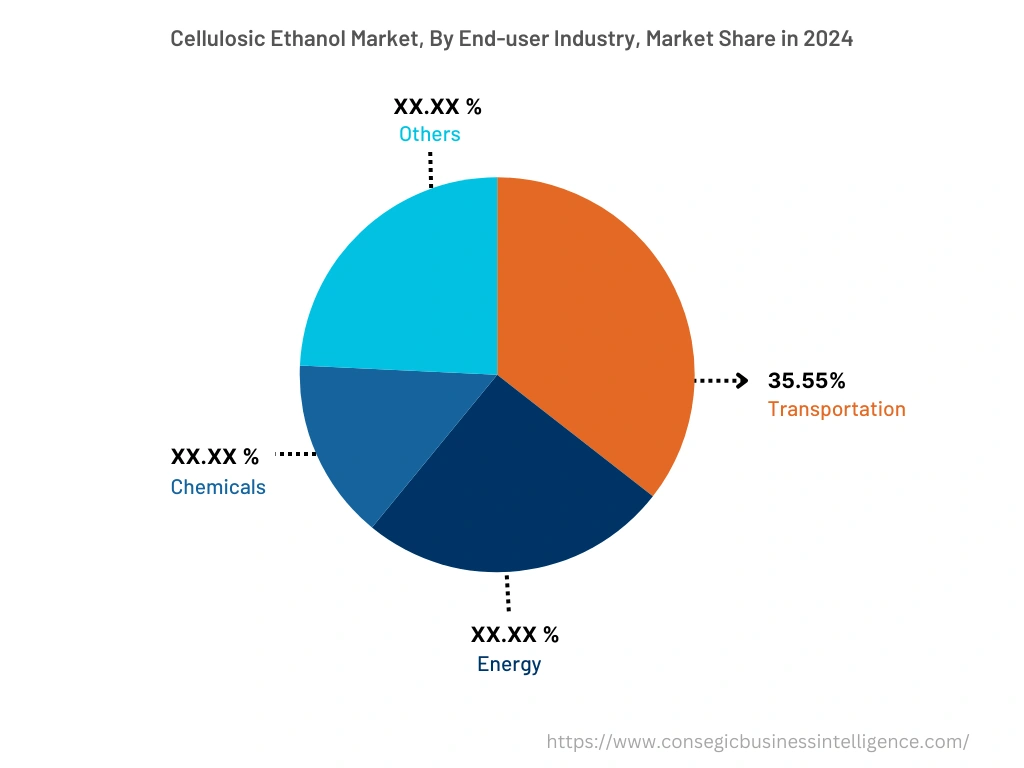

By End-Use-Industry :

The end-user industry segment is categorized into transportation, energy, chemicals, and others. In 2024, the transportation segment accounted for the highest market share of 35.55% in the overall cellulosic ethanol market share and is expected to hold the highest CAGR over the forecast period. It is a renewable fuel made from various plant materials collectively known as "biomass." Ethanol is used as a fuel and fuel additive in the transportation sector. Gasoline contains 10% ethanol and 90% gasoline. Such a high content of ethanol in gasoline helps to reduce the air pollution caused by vehicle emissions. The increasing government initiatives to increase the blending of ethanol and gasoline to promote sustainability in fuel and reduce the dependency on fossil fuels are driving the segment growth. For instance, according to the report by The Association of French Alcohol Producers, in June 2022, the surge in oil prices accelerated consumption of E85 super ethanol reaching a 53% increase in consumption from May 2021 to April 2022. Furthermore, the number of stations selling E85 has also greatly increased in the country in recent years, rising from 1,015 in 2018 to 2,856 in 2022. Hence, the segmental trends analysis, the increasing adoption of ethanol blended fuel across the globe is fostering cellulosic ethanol market trends.

By Region :

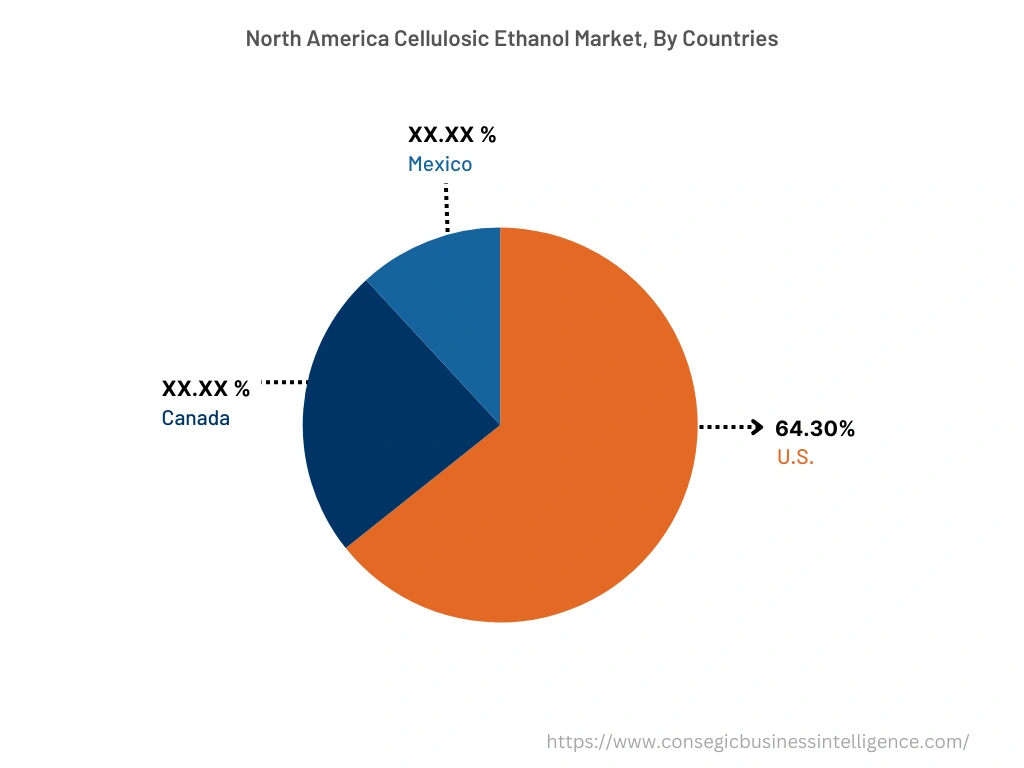

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

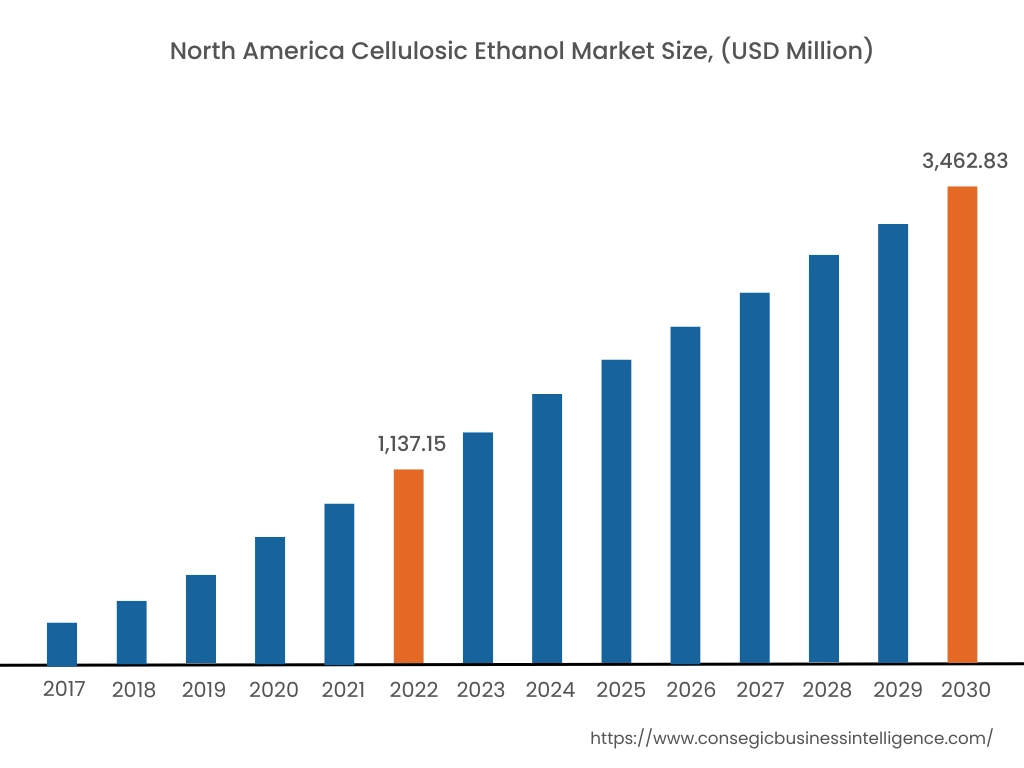

North America is estimated to reach over USD 3,624.92 Million by 2032 from a value of USD 1,224.70 Million in 2024 and is projected to grow by USD 1,382.22 Million in 2025, owing to the increasing biofuel production across the region. The cellulosic ethanol market analysis shows that the increasing investments in the production of sustainable biofuels across the region are accelerating the cellulosic ethanol market in the North American region. For instance, in January 2023, The U.S. Department of Energy (DOE) today announced USD 118 million in funding for 17 projects to accelerate the production of sustainable biofuels for America's transportation and manufacturing needs. Furthermore, in August 2021, Deputy Under Secretary for Rural Development Justin Maxson today announced that the U.S. Department of Agriculture (USDA) is investing USD 26 million to build infrastructure to expand the availability of higher-blend renewable biofuels by 822 million gallons annually in 23 states in the U.S. Henceforth, the rising initiatives and funding to produce biofuel in the North America region is fostering cellulosic ethanol market expansion.

Furthermore, Asia Pacific is expected to witness significant growth over the forecast period, growing at a CAGR of 15.3% during 2025-2032. This is due to the increasing demand for sustainable and renewable energy sources to reduce the dependency on fossil fuels for various applications. Furthermore, in January 2020, Clariant Anhui Guozhen, and Chemtex announced a partnership for the development of a full-scale ethanol production plant in China, with an annual production capacity of 50,000 tons. Such initiatives are expected to drive the cellulosic ethanol market opportunities across the Asia Pacific region over the forecast period.

Top Key Players & Market Share Insights:

The cellulosic ethanol market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market stake through mergers, acquisitions, and partnerships. The key players in the cellulosic ethanol industry include-

- Logen Corporation

- Iogen Corporation

- Bioamber Inc

- Genomatica Inc.

- Clariant AG

- GranBio

- POET-DSM Advanced Biofuels

- Raizen SA

- Praj Industries

- Cargill, Inc.

- Ginkgo Bioworks

Recent Industry Developments :

- In February 2021, Clariant AG, announced a partnership with Harbin Hulan Sino-Dan Jianye Bioenergy, a Chinese green energy company for its sunliquid ethanol technology.

- In March 2022, Raizen SA announced an investment of USD 395 million for the development of 2 new ethanol manufacturing plants in São Paulo, Brazil.

Key Questions Answered in the Report

What was the market size of the cellulosic ethanol industry in 2024? +

In 2024, the market size of cellulosic ethanol was USD 3,692.08 million.

What will be the potential market valuation for the cellulosic ethanol industry by 2032? +

In 2032, the market size of cellulosic ethanol will be expected to reach USD 11,184.57 million.

What are the key factors driving the growth of the cellulosic ethanol market? +

Growing demand for sustainable and renewable energy sources is propelling market growth.

What is the dominating segment in the cellulosic ethanol market by end-user industry? +

In 2024, the transportation segment accounted for the highest market share of 35.55% in the overall cellulosic ethanol market.

Based on current market trends and future predictions, which geographical region is the dominating region in the cellulosic ethanol market? +

North America accounted for the highest market share in the overall cellulosic ethanol market.