Cerebral Thrombectomy Systems Market Introduction :

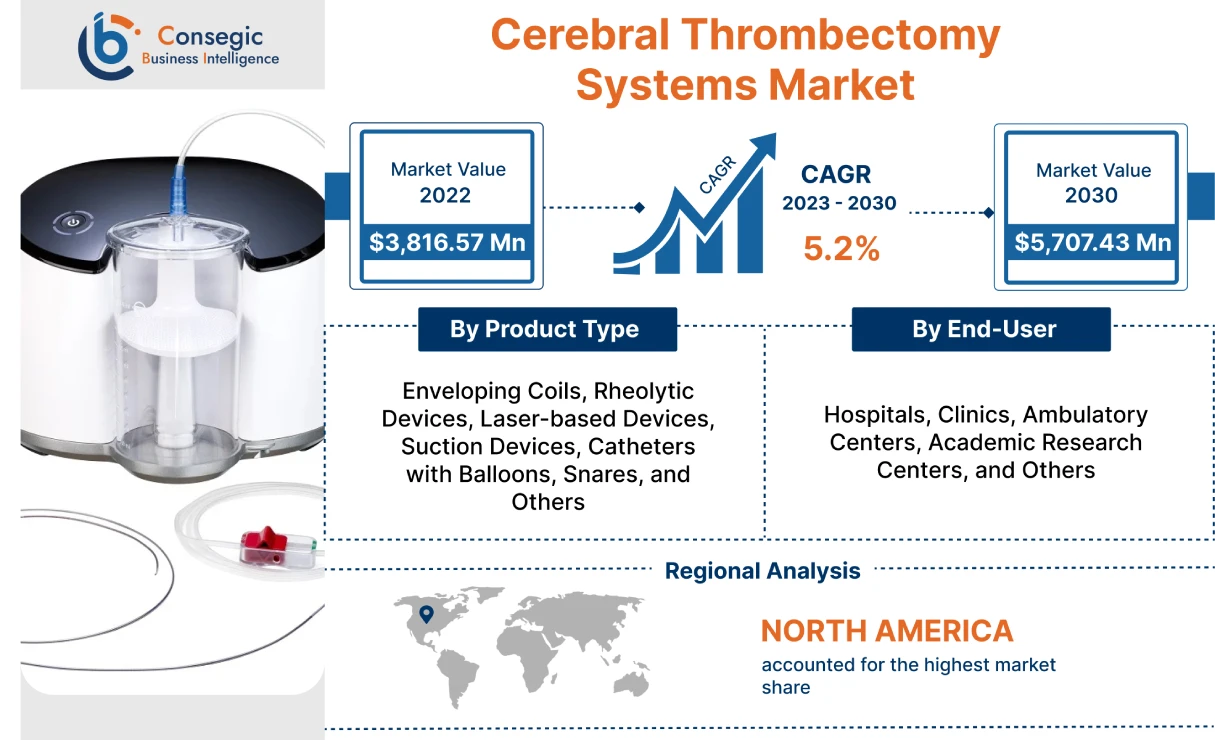

Consegic Business Intelligence analyzes that the Cerebral Thrombectomy Systems market is growing with a healthy CAGR of 5.2% during the forecast period (2023-2030), and the market is projected to be valued at USD 5,707.43 million by 2030 from USD 3,816.57 million in 2022.

Cerebral Thrombectomy Systems Market Definition & Overview:

Cerebral thrombectomy systems is a type of medical device used to remove blood clots from the brain. Such types of devices are used to treat ischemic stroke which is caused by the blockage in the blood vessel in the brain. By mechanically removing the clot from the blood vessel it can help to restore blood flow to the affected area of the brain.

Various types of cerebral thrombectomy systems are commercialized in the market namely, enveloping coils, rheolytic devices, laser-based devices, suction devices, catheters with balloons, and snares, among others. These devices are typically used in combination with other treatments, such as medications and rehabilitation to improve outcomes for patients with ischemic stroke.

Cerebral Thrombectomy Systems Market Insights :

Cerebral Thrombectomy Systems Market Dynamics - (DRO) :

Key Drivers :

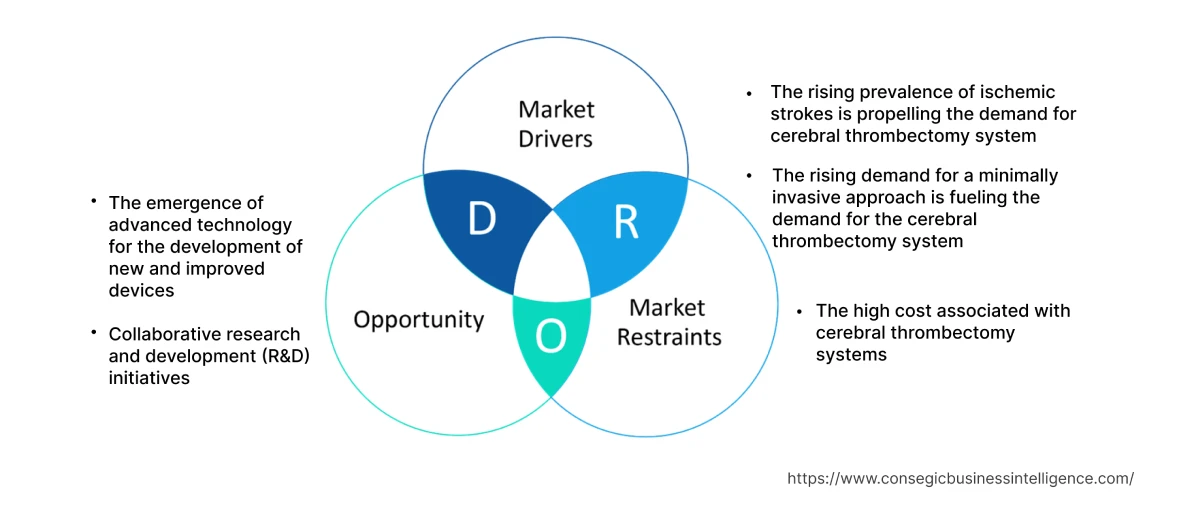

The rising prevalence of ischemic strokes is propelling the demand for cerebral thrombectomy system

The increasing incidence of ischemic strokes or cerebral infarction led by the growing prevalence of obesity and diabetes is boosting the growth of the cerebral thrombectomy systems market. In the case of stroke, cerebral thrombectomy systems such as neurovascular thrombectomy devices are used to remove blood clots in the large blood vessels and re-establish normal blood flow to the brain and prevent stroke.

For instance, according to the Centers for Disease Control and Prevention (CDC), more than 795,000 people in the U.S. have a stroke and around 87% of all strokes are ischemic strokes. Hence, the rising cases of ischemic strokes or cerebral infarction are boosting the growth of the cerebral thrombectomy systems market at the global level.

The rising demand for a minimally invasive approach is fueling the demand for the cerebral thrombectomy system

Cerebral thrombectomy procedures are minimally invasive compared to traditional open surgeries. Such types of approaches offer several benefits, including reduced risks of complications, shorter hospital stays, faster recovery times, and improved patient comfort. Minimally invasive procedures generally lead to faster recovery times for patients. With smaller incisions and reduced trauma to the body, patients experience less pain and discomfort post-procedure. Thus, the shift towards minimally invasive treatments is driving the demand for cerebral thrombectomy systems.

Key Restraints :

The high cost associated with cerebral thrombectomy systems

The cerebral thrombectomy systems ensure effective treatment against chronic diseases, owing to this factor the utilization of the thrombectomy system is increasing in hospitals, clinics, ambulatory centers, and others. However, the deployment of a cerebral thrombectomy device or system adds to the maintenance costs, specialized material requirements such as imaging systems, catheters, guide wires, and staff training. Thus, the high cost associated with the cerebral thrombectomy system is likely to limit its adoption and hamper the growth of the market.

Future Opportunities :

The emergence of advanced technology for the development of new and improved devices

Advancement in technology provides opportunities to market players the development of new and better-quality devices to improve procedural outcomes, reduce procedure times, and improve patient safety.

For instance, Penumbra, Inc., a global healthcare company, announced the launch of Lightning Flash, the most advanced and powerful mechanical thrombectomy system. Lightning Flash is the novel Lightning Intelligent Aspiration technology with a dual clot detection system. This system is designed to remove large blood clots quickly in the body, including pulmonary emboli (PE) and venous thrombus.

Hence, the development of new techniques and technologies for the development of improved devices is expected to drive the growth of the cerebral thrombectomy systems market.

Collaborative research and development (R&D) initiatives

Collaborative research and development (R&D) initiatives in medical devices such as cerebral thrombectomy systems offer significant opportunities for market players to improve treatment outcomes, and meet the evolving needs of healthcare providers and patients. The collaboration facilitates the development of innovative thrombectomy devices, imaging technologies, navigation systems, and other advancements that improve the effectiveness and safety of the procedure.

For instance, in September 2022, Penumbra and Japanese medical device manufacturer Asahi Intecc announced their collaboration to launch the Indigo Aspiration System in Japan following receipt of regulatory approval. The Indigo Aspiration System enables the restoration of blood flow in venous thrombus and acute limb ischemia cases.

Thus, evolving research and developments are expected to help market players adopt innovative ways of product creation to cater to the growing needs of various end-use industries is expected to drive the market growth of cerebral thrombectomy systems in the forecast years.

Cerebral Thrombectomy Systems Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 5,707.43 Million |

| CAGR (2023-2030) | 5.2% |

| By Product Type | Enveloping Coils, Rheolytic Devices, Laser-based Devices, Suction Devices, Catheters with Balloons, Snares, and Others |

| By End-User | Hospitals, Clinics, Ambulatory Centers, Academic Research Centers, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Penumbra, Inc., Terumo Medical Corporation, Medical Devices Business Services, Inc. (Johnson & Johnson), Stryker, Abbott, Boston Scientific Corporation, Medtronic, Teleflex Incorporated, Cardiovascular Systems, Inc., and Angio Dynamics |

Cerebral Thrombectomy Systems Market Segmental Analysis :

Based on the Product Type :

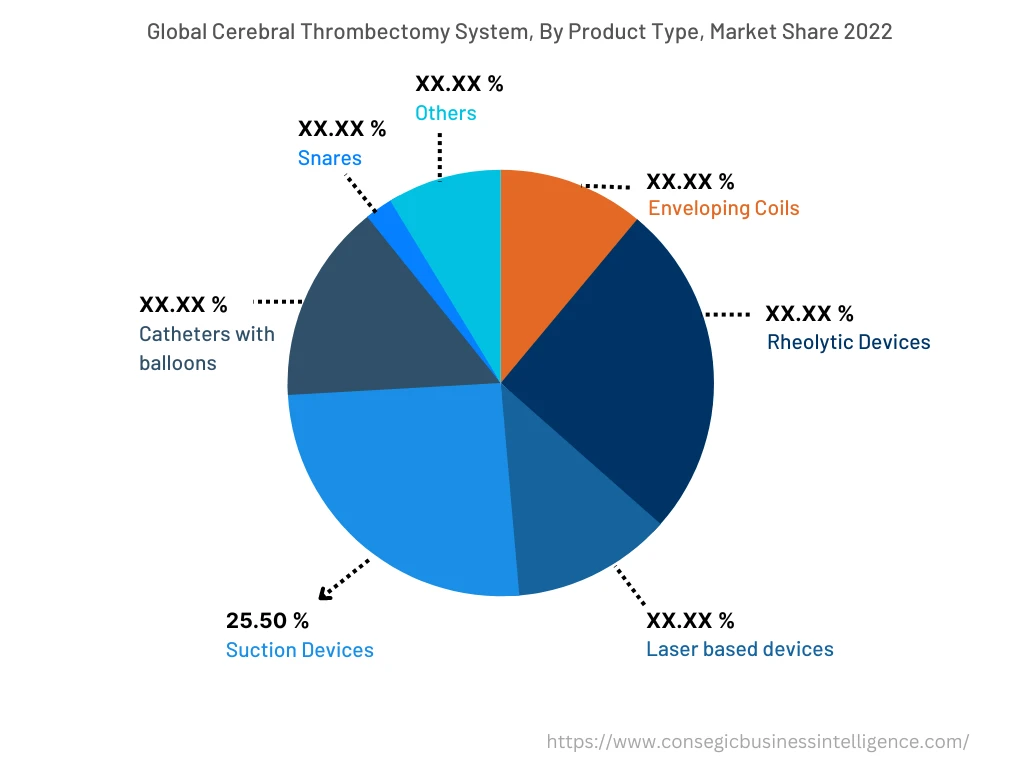

The product type segment is classified into enveloping coils, rheolytic devices, laser-based devices, suction devices, catheters with balloons, snares, and others. In 2022, the suction devices segment accounted for the highest share of 25.50% in the cerebral thrombectomy systems market. Suction devices offer high efficacy in removing blood clots from cerebral blood vessels. Such types of devices directly aspirate and remove the clot by creating negative pressure resulting in restoring blood flow and improving patient outcomes. For instance, BD, a global medical technology company launched the AspirexTM mechanical aspiration thrombectomy system that offers a 3-in-1 mechanism of action designed to aspirate, macerate, and transport clot out of the vessel. It rotates at 40,000 – 60,000 RPMs creating powerful suction at the catheter tip, thereby, aspirating the clot. Hence, the effectiveness of suction devices in achieving successful outcomes is contributing to the growth of the market.

However, the snares segment is expected to grow at the fastest CAGR over the forecast period. Snares are particularly effective for capturing and retrieving large clots or fragments that cannot be easily aspirated or engaged with other devices. Further, the advancements in technology are resulting in the development of smaller and more flexible snares with enhanced visibility under imaging guidance. These technological innovations are anticipated to contribute to the increased adoption and growth of snares in the market.

Based on the End-User :

The end-user segment is classified as hospitals, clinics, ambulatory centers, academic research centers, and others. In 2022, the hospital segment accounted for the highest market share of the cerebral thrombectomy systems market. Hospitals are equipped with specialized stroke care units and neurology departments that provide comprehensive treatment for stroke patients. They have the necessary infrastructure, medical personnel, and resources to handle acute ischemic stroke cases and perform thrombectomy procedures. As a result, hospitals have a higher demand for cerebral thrombectomy systems to ensure timely and effective stroke treatment.

For instance, as per the India Brand Equity Foundation, the hospital sector in India accounts for 80% of the total healthcare market and is expected to reach USD 132 billion by 2023. Hence, the increasing hospital sector is boosting the revenue growth of the cerebral thrombectomy systems market.

However, ambulatory centers are expected to be the fastest-growing segment in the cerebral thrombectomy systems market during the forecast period. Ambulatory centers provide specialized care in a convenient and cost-effective outpatient setting. Further, these centers have the necessary infrastructure and equipment to perform thrombectomy procedures safely and efficiently. As a result, there is an increasing preference for performing cerebral thrombectomy procedures in ambulatory centers which is expected to drive the growth of the market over the forecast period.

Based on the Region :

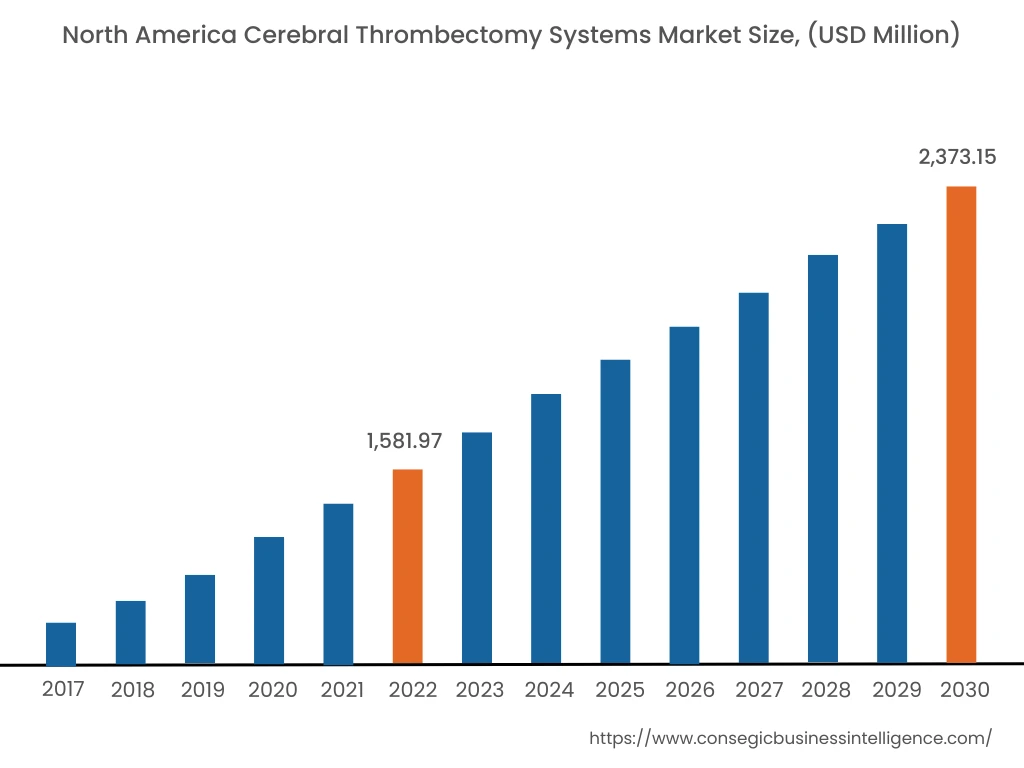

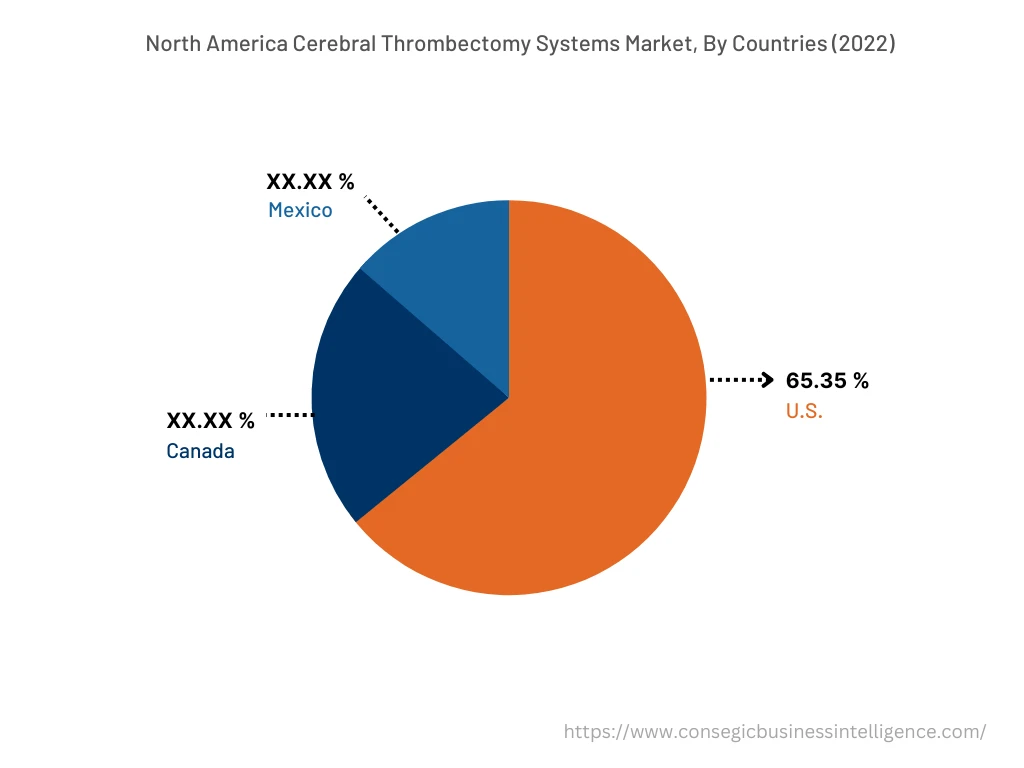

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

In 2022, North America accounted for the highest market share at 41.45% and was valued at USD 1,581.97 million, and is expected to reach USD 2,373.15 million in 2030. In North America, the U.S. accounted for the highest market share of 65.35% during the base year of 2022. The growth is attributed to the increasing investment in healthcare infrastructure and growing advanced medical device companies in the U.S.

However, Asia Pacific is expected to grow at the fastest CAGR of 5.5% over the forecast period in the market owing to the increasing prevalence of obesity and diabetes particularly in the China and India leading to ischemic stroke.

For instance, according to the World Health Organization, in India, there are estimated 77 million people above the age of 18 years suffering from diabetes (type 2) and nearly 25 million are prediabetics.

Hence, the rising cases of diabetes is anticipated to contribute to the growth of cerebral thrombectomy system over the forecast period.

Top Key Players & Market Share Insights:

The cerebral thrombectomy systems market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Penumbra, Inc.

- Terumo Medical Corporation

- Teleflex Incorporated

- Cardiovascular Systems, Inc.

- Angio Dynamics

- Medical Devices Business Services, (Johnson & Johnson)

- Stryker

- Abbott

- Boston Scientific Corporation

- Medtronic

Recent Industry Developments :

- In February 2022, Cardiovascular Systems announced its partnership with Innova Vascular to commercialize the new thrombectomy devices from Innova Vascular.

- In September 2021, Abbott announced the acquisition of Walk Vascular, LLC, a medical device company to incorporate Walk Vascular's peripheral thrombectomy systems into Abbott's existing endovascular product portfolio.

- In June 2021, Cardiovascular Systems, Inc. announced the U.S. commercial launch of jade over-the-wire non-compliant peripheral balloon catheters for people suffering from peripheral and coronary artery disease.

Key Questions Answered in the Report

What was the market size of the cerebral thrombectomy systems industry in 2022? +

In 2022, the market size of cerebral thrombectomy systems was USD 3,816.57 million.

What will be the potential market valuation for the cerebral thrombectomy systems industry by 2030? +

In 2030, the market size of cerebral thrombectomy systems will be expected to reach USD 5,707.43 million.

What are the key factors driving the growth of the cerebral thrombectomy systems market? +

The rising prevalence of ischemic strokes and demand for a minimally invasive approach minimally invasive approaches are the key factors driving the growth of the cerebral thrombectomy systems market.

What is the dominating segment in the cerebral thrombectomy systems market by end-user type? +

In 2022, the hospital segment accounted for the highest market share in the overall cerebral thrombectomy systems market.

Based on current market trends and future predictions, which geographical region will have the fastest impact on the cerebral thrombectomy systems market's growth in the coming years? +

Asia Pacific is expected to be the fastest-growing region in the market during the forecast period.