Cold Planers Market Size:

Cold Planers Market size is estimated to reach over USD 4.00 Billion by 2032 from a value of USD 2.65 Billion in 2024 and is projected to grow by USD 2.74 Billion in 2025, growing at a CAGR of 5.3% from 2025 to 2032.

Cold Planers Market Scope & Overview:

Cold planers are heavy-duty machines designed to remove asphalt or concrete surfaces efficiently by grinding and milling pavement layers to precise depths. Commonly used in road construction, rehabilitation, and maintenance, these machines enable accurate surface preparation before resurfacing or repaving.

Equipped with rotating drums fitted with cutting teeth, they offer features such as depth control systems, conveyor discharge mechanisms, and high-capacity engines. Advanced models integrate automated leveling, dust suppression systems, and telematics for real-time performance monitoring.

The primary benefits include enhanced milling precision, efficient material removal, and minimal disruption to the surrounding pavement. Cold planers improve productivity in large-scale roadway projects while reducing waste and facilitating material recycling. Their versatility in handling different surface conditions makes them a key asset for contractors and municipal agencies aiming to maintain road quality and extend pavement lifespan across a variety of project scopes and environments.

Key Drivers:

Increasing Demand for Road Resurfacing and Maintenance Activities Drives Market Growth

With aging infrastructure and increasing traffic loads, the need for road resurfacing and maintenance is steadily rising. Cold planers, also known as milling machines, are essential for efficiently removing the top layers of pavement, preparing the road surface for new layers of asphalt or concrete. These machines are crucial for urban road repairs, highway resurfacing, and rural road upgrades. As governments and private sectors worldwide invest heavily in maintaining and upgrading road infrastructure, the need for advanced equipment that ensures quick, high-quality work is growing. Their use is integral to road restoration and resurfacing projects, reducing downtime and enhancing worksite efficiency. Additionally, the shift toward sustainable road repair methods, like asphalt recycling, is driving further adoption.

- For instance, in February 2025, Blue Diamond Attachments unveiled a new line of self-leveling cold planers. The product line containing 8 models is designed for road surface milling, concrete scarification, and asphalt removal applications. Ranging from 14 to 48 inches in milling width, it is compatible with skid steer and compact track loaders. In addition, milling depths from 4.3 inches to 6.7 inches and working speeds of up to 16.4 feet per minute are enabled.

This growing emphasis on road maintenance and improvements is driving the cold planers market expansion, as contractors seek reliable, high-performance machinery for resurfacing projects.

Key Restraints:

Environmental Concerns Related to Noise, Vibration and Emissions During Operation Hamper Market Expansion

Cold planers, while effective for road resurfacing, are often associated with high levels of noise, vibration, and emissions during operation, which creates challenges in urban and residential areas. As these machines work at high power and speed, the noise and vibration they generate can disturb nearby residents and affect surrounding environments, especially in noise-sensitive areas. Additionally, their diesel engines contribute to emissions, raising environmental concerns, particularly in regions with strict emission regulations. This has led to increased scrutiny and regulatory hurdles that hinder the growth of the market. Although the demand for road maintenance equipment continues to rise, the environmental impact of these machines poses a significant challenge, restricting the cold planers market growth, particularly in eco-conscious markets and urban zones with noise and emission control standards.

Future Opportunities :

Integration of Telematics and Automation to Improve Productivity Presents New Market Opportunities

Telematics systems enable real-time data monitoring of equipment performance, fuel consumption, and maintenance schedules, allowing fleet managers to optimize operations and reduce downtime. Automation features, such as GPS-guided milling and automated depth control, enhance the precision of milling work, reducing material wastage and improving overall quality. As demand for smarter, more efficient construction machinery increases, these technological advancements are driving the development of next-generation cold planers with enhanced capabilities. The ability to streamline operations, reduce manual intervention, and increase machine uptime presents significant cold planers market opportunities, as construction firms and municipalities continue to invest in technologies that improve productivity and reduce operational costs.

- For instance, in March 2024, Caterpillar announced VisionLink® Productivity for Cat® PM600 and PM800 Series Cold Planers. The cloud-based platform gathers and summarizes machine telematics and jobsite data to improve the contractor’s productivity. The system allows the incorporation of fleets with mixed OEM equipment brands.

Thus, the integration of smart features is opening up new growth avenues for the market.

Cold Planers Market Segmental Analysis :

By Planer Type:

Based on planer type, the market is divided into wheeled and tracked cold planers.

The tracked segment accounted for the largest cold planers market share in 2024.

- Tracked machines are preferred for heavy-duty applications, offering greater stability and traction on uneven surfaces.

- These machines are widely used in road maintenance and construction projects that require high maneuverability and durability over rough terrain.

- Tracked planers are ideal for large-scale milling projects, such as resurfacing highways and city streets, due to their increased lifting capacity and stability under high loads.

- As per the cold planers market analysis, tracked models dominate due to their superior performance in challenging work environments and extensive use in large infrastructure projects.

The wheeled segment is expected to grow at the fastest CAGR during the forecast period.

- Wheeled models offer greater mobility, making them ideal for smaller or medium-scale road maintenance projects where flexibility is required.

- These machines are generally lighter and more cost-effective, making them popular in urban environments for quick, surface-level milling jobs.

- Wheeled planers are easier to transport, offering operational efficiency when working on smaller roads or in tight spaces.

- According to cold planers market trends, the increasing requirement for versatile, mobile equipment in urban construction projects is driving the growth of the wheeled cold planer segment.

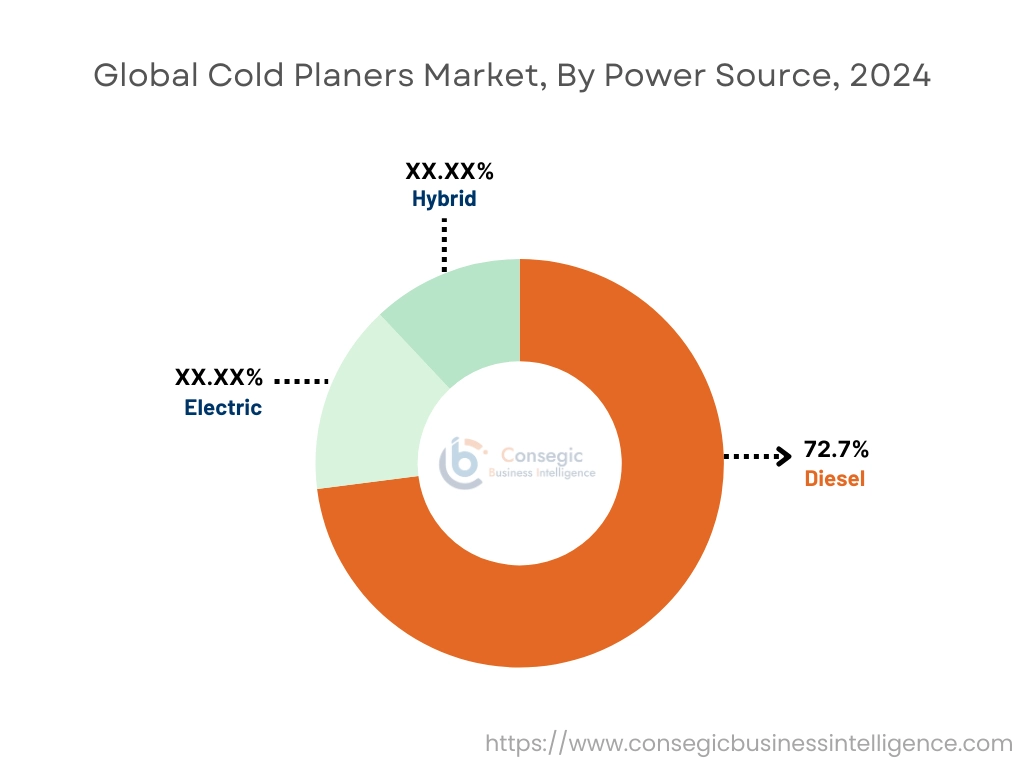

By Power Source:

Based on power source, the market is segmented into diesel, electric, and hybrid.

The diesel segment held the largest revenue share of 72.7% in 2024.

- Diesel-powered models are widely used in the market due to their ability to provide high torque and continuous operation for heavy-duty applications.

- These planers are commonly used in large-scale projects such as highways, bridges, and airports, where high power output and long working hours are essential.

- The availability of diesel fuel and its long operational life contribute to the dominance of this segment in traditional cold planer applications.

- As per cold planers market demand, diesel-powered machines remain the top choice for industrial applications due to their reliability, affordability, and fuel efficiency.

The electric segment is projected to experience the fastest CAGR during the forecast period.

- Electric machines are gaining popularity due to their environmental benefits, reduced emissions, and quieter operation, which makes them suitable for urban areas and construction projects with noise restrictions.

- These machines are increasingly used in small-scale projects and residential areas where noise pollution and emissions are a concern.

- With growing sustainability trends and stricter environmental regulations, the need for electric models is expected to surge.

- According to cold planers market trends, electric-powered machines are anticipated to witness significant expansion due to the increasing shift toward eco-friendly construction practices.

By End Use:

Based on end-use, the market is segmented into construction, road maintenance, mining, paving, and others.

The construction segment held the largest revenue share in 2024.

- Cold planers are integral in construction projects for surface preparation, road resurfacing, and milling tasks, especially in urban areas with high traffic.

- These machines are used to remove asphalt, concrete, and other materials to create a smooth surface for new layers of pavement.

- The increasing demand for infrastructure development, urbanization, and road expansion in developing countries is driving their need in construction.

- As per segmental trends, the construction sector remains the dominant end-user due to the rising need for efficient and reliable milling machines in large-scale projects, driving the cold planers market expansion.

The road maintenance segment is projected to grow at the fastest CAGR during the forecast period.

- Road maintenance requires frequent resurfacing, milling, and repairs, which they are ideally suited for.

- The aging road infrastructure in developed economies, along with the rapid urbanization in emerging markets, is driving its adoption for road maintenance applications.

- They help improve road conditions by efficiently removing deteriorating surfaces and making way for resurfacing or patchwork, improving the longevity of roads.

- According to cold planers market analysis, the road maintenance sector is expected to expand rapidly as governments invest more in infrastructure renewal and maintenance.

By Sales Channel:

Based on sales channel, the market is divided into OEMs and the aftermarket.

The OEM segment accounted for the largest cold planers market share in 2024.

- Original Equipment Manufacturers (OEMs) supply them directly to large construction companies, infrastructure developers, and mining operations, ensuring high-quality machinery and long-term performance.

- OEMs offer a variety of models, including customized solutions to meet specific application requirements.

- The demand for OEM machines is supported by the increasing investments in large-scale construction, mining, and infrastructure projects worldwide.

- As per cold planers market growth forecast, the OEM segment remains dominant due to the ongoing need for high-quality, durable machines in commercial applications.

The aftermarket segment is expected to witness strong CAGR during the forecast period.

- The aftermarket segment is critical in providing replacement parts, maintenance services, and accessory sales for existing models.

- With their increasing operational life and the growing fleet of machines in the field, aftermarket services and parts are becoming essential.

- This segment benefits from its widespread adoption across industries, as equipment owners seek cost-effective solutions for maintenance and repairs.

- Thus, the aftermarket segment is expanding to meet the growing number of cold planers market demand machines in use and the need for regular maintenance to ensure optimal performance.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

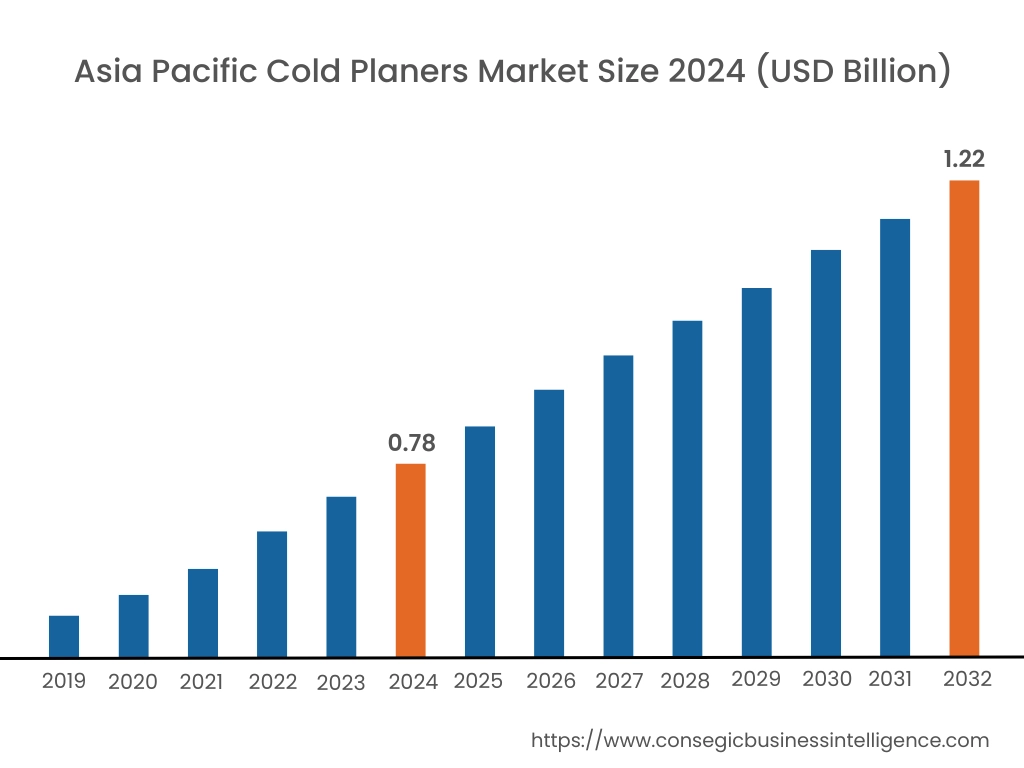

Asia Pacific region was valued at USD 0.78 Billion in 2024. Moreover, it is projected to grow by USD 0.81 Billion in 2025 and reach over USD 1.22 Billion by 2032. Out of this, China accounted for the maximum revenue share of 28.8%. Asia-Pacific is experiencing rapid growth in the cold planers industry, propelled by urbanization, highway expansion, and increasing rehabilitation of aging roadways. In countries like China, India, Japan, and Australia, cold milling machines are extensively used in major expressway projects and metro rail corridors. Market analysis shows a strong necessity for both half-lane and full-lane machines with advanced rotor drive systems and efficient conveyor configurations. Growth is also supported by rising adoption in airport runway resurfacing and industrial zone development. With infrastructure budgets increasing across emerging markets, the region continues to offer significant opportunities for manufacturers and rental service providers.

North America is estimated to reach over USD 1.30 Billion by 2032 from a value of USD 0.88 Billion in 2024 and is projected to grow by USD 0.91 Billion in 2025. In North America, cold planers are a critical part of road resurfacing and municipal maintenance programs. The United States and Canada maintain extensive highway networks that require periodic upgrades and rehabilitation, making cold milling machines essential for removing worn-out surfaces with precision. Market analysis reveals increasing demand for high-performance models with automated grade control systems and dust suppression features. Growth in this region is driven by infrastructure spending initiatives and a strong emphasis on reducing lifecycle costs through machine efficiency and improved pavement quality. Contractors also benefit from access to advanced operator training and rental fleet availability, supporting wider adoption across varying project sizes.

Europe presents a technology-driven and regulation-conscious market, especially in countries like Germany, France, and Italy, where maintenance of existing transportation infrastructure is a strategic priority. Market analysis highlights a growing preference for compact and fuel-efficient models capable of operating on narrow city roads while meeting stringent noise and emission norms. They are increasingly integrated with intelligent systems for precise depth control, contributing to reduced material waste and minimal disruption to urban mobility. The potential for market development in Europe is supported by regional commitments to road modernization, green construction practices, and long-term pavement performance.

Latin America is gradually adopting them, with Brazil, Mexico, and Chile being notable contributors due to their expanding road maintenance programs. Market analysis indicates growing usage in resurfacing and municipal roadway repair, especially in areas with fluctuating climate conditions that accelerate pavement wear. Contractors seek machines that offer reliable milling performance, quick transportability, and reduced fuel consumption. Although cost sensitivity can limit initial procurement, public-private partnerships and infrastructure revitalization projects are improving access. The cold planers market opportunity here lies in strengthening local distribution channels and offering application training for efficient and safe operation.

The Middle East and Africa have an emerging cold planers market, driven by heavy infrastructure investments in road construction, industrial hubs, and urban expansion. Countries like the UAE, Saudi Arabia, and South Africa are deploying them in large-scale highway rehabilitation, often under extreme climate conditions. Market analysis highlights a preference for robust, high-output machines with minimal maintenance requirements. In parts of Africa, donor-supported infrastructure programs are encouraging its adoption for rural road development and urban resurfacing. Regional growth is expected as machine accessibility improves, and governments prioritize asset preservation through proactive pavement management.

Top Key Players and Market Share Insights:

The cold planers market is highly competitive with major players providing products and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global cold planers market. Key players in the cold planers industry include -

- Wirtgen GmbH (Part of John Deere) (Germany)

- Caterpillar Inc. (USA)

- Zoomlion Heavy Industry Science & Technology Co., Ltd. (China)

- CMI Roadbuilding Ltd. (Canada)

- Liugong Machinery Co., Ltd. (China)

- Dynapac (Fayat Group) (Sweden)

- Bomag GmbH (Germany)

- Roadtec Inc. (Astec Industries) (USA)

- SANY Group (China)

- XCMG Group (China)

Recent Industry Developments :

Product Launches:

- In March 2025, Caterpillar updated their cold planer models, PM620, PM622, PM820, PM822 and PM825, to ensure operator comfort, higher efficiency and better equipment management. This involved the addition of telescoping center console displays, anti-fatigue floor mats, cushioned arm and hip rests, extra operator console adjustments and multiple seat options as well as remote diagnostics and software update capabilities.

Cold Planers Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 4.00 Billion |

| CAGR (2025-2032) | 5.3% |

| By Planer Type |

|

| By Power Source |

|

| By End Use |

|

| By Sales Channel |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Cold Planers Market? +

Cold Planers Market size is estimated to reach over USD 4.00 Billion by 2032 from a value of USD 2.65 Billion in 2024 and is projected to grow by USD 2.74 Billion in 2025, growing at a CAGR of 5.3% from 2025 to 2032.

What specific segmentation details are covered in the Cold Planers Market report? +

The Cold Planers market report includes specific segmentation details for planer type, power source, end-use and sales channel.

What are the end-use of the Cold Planers Market? +

The end-use of the Cold Planers Market are construction, road maintenance, mining, paving, and others.

Who are the major players in the Cold Planers Market? +

The key participants in the Cold Planers market are Wirtgen GmbH (Part of John Deere) (Germany), Caterpillar Inc. (USA), Dynapac (Fayat Group) (Sweden), Bomag GmbH (Germany), Roadtec Inc. (Astec Industries) (USA), SANY Group (China), XCMG Group (China), Zoomlion Heavy Industry Science & Technology Co., Ltd. (China), CMI Roadbuilding Ltd. (Canada) and Liugong Machinery Co., Ltd. (China).