Connected Car Market Size:

Global Connected Car Market size is estimated to reach over USD 278.83 Billion by 2032 from a value of USD 91.84 Billion in 2024 and is projected to grow by USD 103.60 Billion in 2025, growing at a CAGR of 13.2% from 2025 to 2032.

Connected Car Market Scope & Overview:

Connected cars, also known as connected vehicles, refer to vehicles which are integrated with advanced technology that enables it to communicate with other vehicles, internet, and external devices. Connected cars are transforming the driving experience and providing a range of benefits for passengers, drivers, and automobile manufacturers. Moreover, connected cars offer a broad range of benefits such as improved convenience, elevated entertainment, optimized performance, and others.

How is AI Transforming the Connected Car Market?

The integration of AI is considerably transforming the connected car market, particularly for facilitating improved safety, personalized user experiences, predictive maintenance, and improved operational efficiency, among others. AI is capable of converting large amounts of data generated by connected vehicles into actionable insights that improve everything, ranging from autonomous driving capabilities to in-cabin comfort and remote diagnostics. In addition, AI also plays an important role in facilitating autonomous driving capabilities, assisting vehicles in perceiving their environment, predicting behavior of other road users, along with making decisions for navigating safely. Hence, the above factors are expected to positively impact the market growth in the upcoming years.

Connected Car Market Dynamics - (DRO) :

Key Drivers:

Rising integration of driver assistance systems in modern cars is propelling the connected car market growth

Advanced driver-assistance systems are primarily integrated in modern cars for assisting drivers with safe operation of a vehicle. Advanced driver-assistance system utilizes automated technology involving sensors and cameras for detecting nearby obstacles or driver errors, and responding accordingly to avoid an accident, which facilitates connected vehicle operations. Moreover, the integration of advanced driver assistance systems in modern connected cars facilitate several vehicle functionalities such as adaptive cruise control, intelligent park assistance, rollover stability control, lane departure warning, blind spot detection, and automatic emergency braking among others. Additionally, governments worldwide are introducing favorable initiatives and regulations for installation of ADAS in modern vehicles, which is further driving the market.

- For instance, in April 2022, Honda Cars India Limited launched its new hybrid electric vehicle, Honda City eHEV. The Honda City eHEV is also integrated with ADAS technology to provide an enhanced driving experience. The ADAS system enables several features such as adaptive cruise control, lane keep assist, road departure warning, auto high beam control, and collision mitigation braking system.

Therefore, as per the analysis, the rising integration of driver assistance system in modern cars is proliferating the connected car market size.

Key Restraints :

High initial investment associated with connected cars is restraining the connected car market expansion

High initial investment associated with the integration of connected vehicle technologies and system is among the primary factors restraining the market. The upfront costs associated with developed connected vehicles including costs of hardware components, software, and others along with integrating them into vehicles can be significantly high, which may cause financial barriers, particularly for smaller businesses or businesses operating on tighter budgets.

Additionally, connected vehicle technologies and systems often require the attention of specialized technicians for repair in an event of technical issue, which could lead to increased costs and vehicle downtime. Hence, high initial investments associated with the deployment of connected vehicle technologies are restraining the market.

Future Opportunities :

Increasing advancements associated with autonomous vehicles are expected to drive the connected car market opportunities

Autonomous vehicles are gaining significant popularity since recent years, attributing to its ability to facilitate safer commuting, enhance driving experience, and improve traffic flow among others. Moreover, connected vehicle technology plays a critical role modern autonomous vehicles in assisting safe operation of the vehicle. The integration of connected vehicle technology with autonomous vehicles offers improved safety and optimized driving experience. As a result, the increasing advancements associated with autonomous vehicles are providing lucrative aspects for market development.

- For instance, in July 2023, Volkswagen Group commenced its first autonomous vehicle test program in Austin, United States. The program includes the rollout of a batch of 10 all-electric Buzz vehicles integrated with an autonomous driving technology platform. Volkswagen Group also intends in increasing its test fleet in Austin and expanding its testing operations to four more cities in the U.S. Additionally, the company plans to launch its autonomous driving vehicles in Austin by 2026.

Hence, as per the analysis, the increasing advancements associated with autonomous vehicles are projected to increase the integration of connected vehicle technologies in autonomous vehicles, in turn driving the connected car market opportunities during the forecast period.

Connected Car Market Segmental Analysis :

By Technology:

Based on technology, the market is segmented into embedded, tethered, and integrated system.

Trends in the technology:

- Rising integration of embedded system for improved vehicle connectivity and performance.

- There is a rising trend towards adoption of integrated system in connected vehicle, attributing to its enhanced functionalities and improved communication.

The integrated system segment accounted for a significant revenue in the overall market in 2024, and it is anticipated to register a substantial CAGR during the forecast period.

- Integrated systems includes a combination of embedded and tethered systems, wherein various subsystems and technologies within the vehicle work together seamlessly.

- Integrated system combine various systems, which in turn provides more inclusive features, including predictive maintenance or improved route planning through real-time data from multiple sources.

- Moreover, integrated systems enable seamless data exchange among different vehicle systems and external networks, which further enhances situational awareness and overall safety.

- According to the connected car market analysis, the aforementioned benefits of integrated system is increasing its adoption in connected vehicle, in turn proliferating the connected car market trends.

By Vehicle Type:

Based on the vehicle type, the market is segmented into ICE cars, electric cars, and hybrid cars.

Trends in the vehicle type:

- Increasing adoption of ICE cars, due to its several benefits including increased availability of refueling stations, quicker acceleration, higher power output, and others.

- There is a rising trend towards adoption of electric cars, attributing to its lower emissions and eco-friendliness.

ICE cars segment accounted for the largest revenue share in the total connected car market share in 2024.

- ICE (internal combustion engine) cars include petrol/diesel-powered cars, which are the most prevalent in the automotive sector.

- Moreover, petrol/diesel is readily available at fueling stations, making it convenient for consumers to refuel their vehicles.

- Additionally, ICE cars offer a range of benefits including quicker acceleration, higher power output, smooth operation, and lower costs, which are primary determinants for increasing its adoption among users.

- For instance, according to the Press Information Bureau (PIB), the total registration of ICE vehicles in India including petrol vehicles and diesel vehicles reached up to 1,80,56,749 units and 24,02,341 units respectively in 2023.

- According to the analysis, the rising adoption of ICE cars is propelling the connected car market trends.

Electric cars segment is anticipated to register fastest CAGR growth during the forecast period.

- Electric cars use electric motors powered by batteries instead of internal combustion engines.

- Moreover, electric cars provide numerous benefits including lower emissions, eco-friendliness, immediate torque delivery, cost-efficiency, and availability of wide range of models among others. The above benefits of electric cars are driving the growth of the segment.

- For instance, according to the International Energy Agency, the total sales of battery electric vehicles (BEVs) in Europe reached 2.2 million units in 2023, demonstrating a substantial increase of 37.5% in comparison to 1.6 million units in 2022.

- Therefore, the increasing adoption of electric vehicles is anticipated to propel the market during the forecast period.

By Connectivity Type:

Based on connectivity type, the market is segmented into DSRC and cellular.

Trends in the connectivity type:

- Significant integration of DSRC technology due to its ability to provide high-speed communication and operate in extreme weather conditions.

- There is a rising trend towards utilization of cellular connected vehicle, attributing to its several benefits including direct communication over longer distance, improved non-line-of-sight performance, enhanced reliability of security messaging and features, and others.

The DSRC segment accounted for a significant revenue in the overall market in 2024.

- Dedicated short-range communication (DSRC) refers to a technology used for facilitating direct wireless exchange of connected vehicle and other intelligent transportation system data among vehicles, other road users, as well as roadside infrastructure.

- DSRC primarily operates in the 5.9 GHz band, and offers low latency, direct information exchange among vehicles and the infrastructure.

- Moreover, DSRC can provide high-speed communication even in the presence of obstructions. DSRC is also capable of handling fast-changing environment at high speeds and operating in extreme weather conditions.

- According to the market analysis, the aforementioned benefits of DSRC technology is increasing its adoption in connected vehicles, in turn driving the connected car market size.

The cellular segment is anticipated to register a substantial CAGR growth during the forecast period.

- Cellular communication technology enables network and direct connection among cars and other vehicles, infrastructure, electronics, and gadgets.

- Cellular communication technology is capable of transmitting data on multiple variables such as vehicle position, direction, and speed, along with conditions on the road, between cars and other devices through LTE and 5G.

- For instance, Qualcomm offers cellular vehicle-to-everything (C-V2X) technology in its solution offerings. Qualcomm’s C-V2X technology can help in improving vehicle connectivity in connected vehicles, enhancing autonomous driving, and supporting smart transportation.

- Thus, increasing advancements associated with cellular communication technology for integration in connected vehicles are anticipated to propel the market during the forecast period.

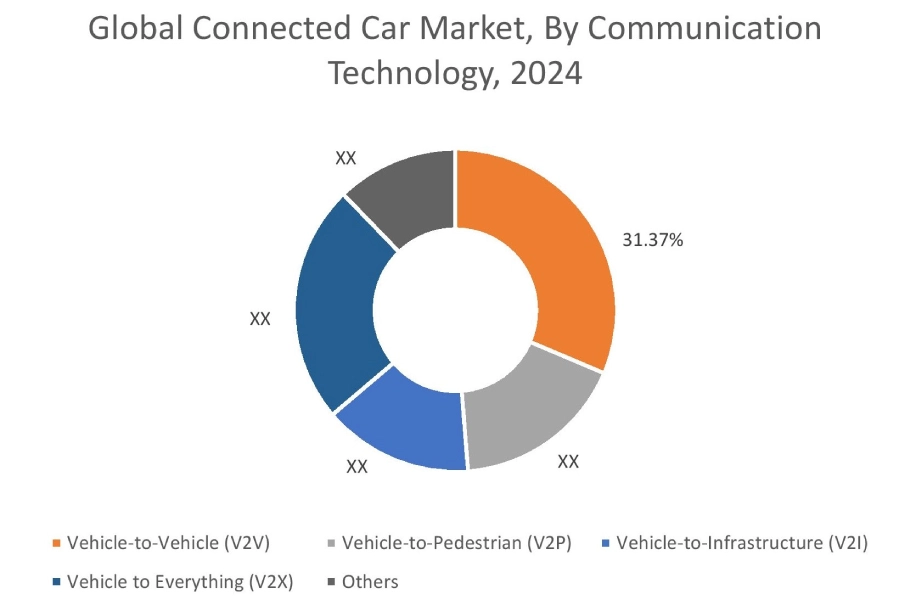

By Communication Technology:

Based on communication technology, the market is segmented into vehicle-to-vehicle (V2V), vehicle-to-pedestrian (V2P), vehicle-to-infrastructure (V2I), vehicle to everything (V2X), and others.

Trends in the communication technology:

- Rising trend towards integration of vehicle-to-vehicle (V2V) technology to enable vehicles to connect to one another and share information related to speed, braking, geolocation, stability, and travel direction among others.

- Increasing adoption of vehicle-to-pedestrian (V2P) technology to provide warnings to the pedestrian of an approaching vehicle or warnings to the vehicle regarding vulnerable road users.

The vehicle-to-vehicle (V2V) segment accounted for the largest revenue share of 31.37% in the total connected car market share in 2024, and it is anticipated to register a substantial CAGR growth during the forecast period.

- Vehicle-to-vehicle (V2V) refers to a communication technique in which vehicles connect with one another by using dedicated short-range communications (DSRC) or 5G connectivity, which further helps in crash avoidance.

- Moreover, V2V communication enables cars to communicate directly with each other, for sharing information related to location, speed, and potential road hazards.

- For instance, Qualcomm’s cellular-vehicle-to-everything technology enables vehicles to directly communicate with other vehicles (V2V), with low-latency messages for driving applications for providing an immediate safety benefit.

- Therefore, increasing advancements associated with V2V communication technology are driving the connected car market growth.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

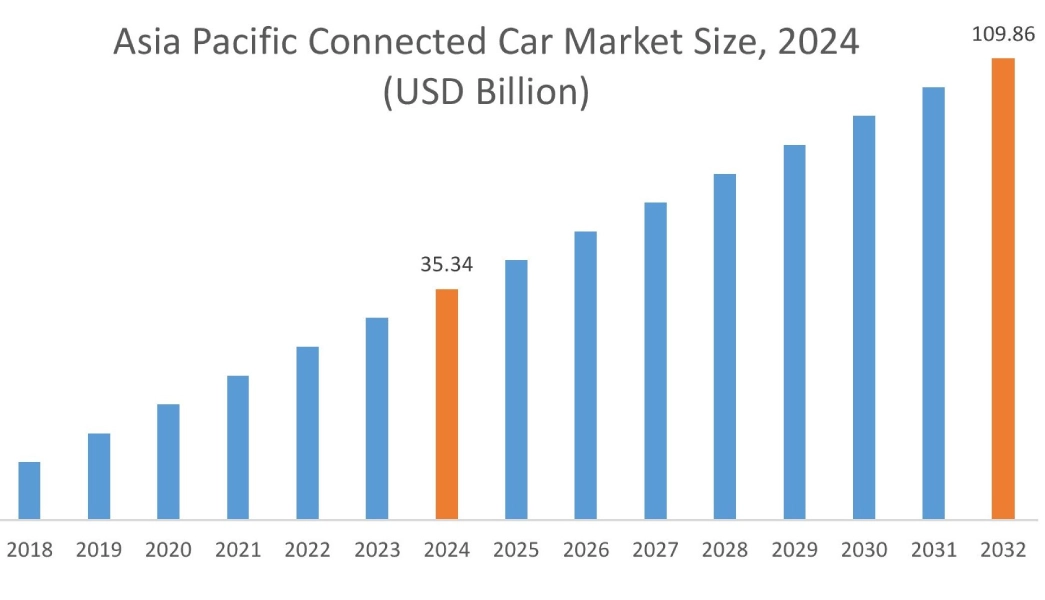

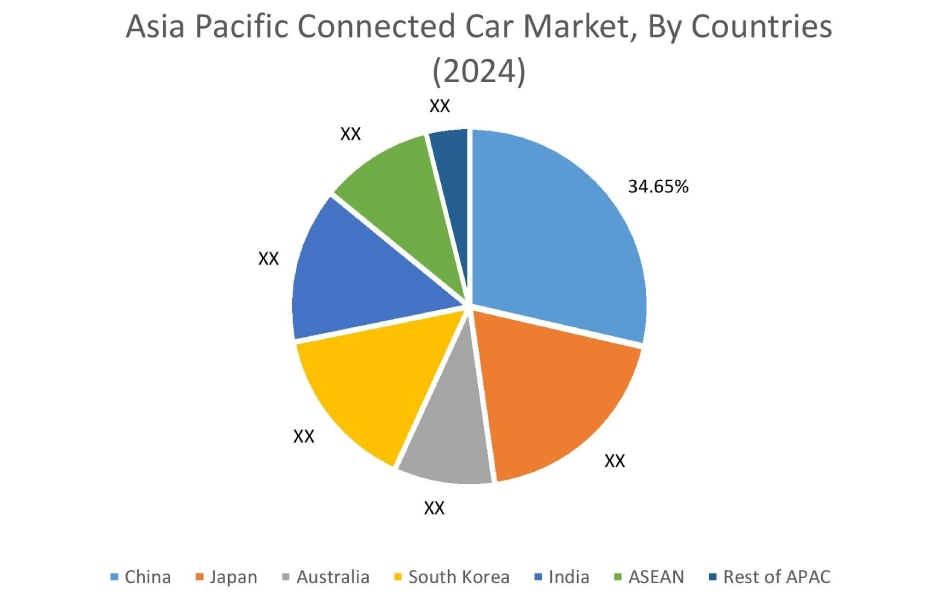

Asia Pacific region was valued at USD 35.34 Billion in 2024. Moreover, it is projected to grow by USD 39.94 Billion in 2025 and reach over USD 109.86 Billion by 2032. Out of this, China accounted for the maximum revenue share of 34.65%. As per the connected car market analysis, the adoption of connected vehicles in the Asia-Pacific region is primarily driven by increasing government investments in automotive industry, rising automobile production, and increasing adoption of electric vehicles. Additionally, the rising advancements associated with passenger cars and increasing integration of advanced driver assistance system (ADAS) in modern vehicles are further accelerating the connected car market expansion.

- For instance, according to the Society of Indian Automobile Manufacturers (SIAM), the total production of passenger cars in India reached 49,01,844 units during FY 2023-24, representing an incline of 7% in comparison to 45,87,116 units during FY 2022-23. The above factors are further propelling the market demand in the Asia-Pacific region.

North America is estimated to reach over USD 72.44 Billion by 2032 from a value of USD 24.11 Billion in 2024 and is projected to grow by USD 27.17 Billion in 2025. In North America, the growth of connected car industry is driven by rising production of automobiles and increasing adoption of electric vehicles (EVs) in the region. Similarly, rising advancements associated with autonomous vehicles are further contributing to the connected car market demand.

- For instance, in October 2024, Tesla introduced the Cybercab, the company’s robotaxi, and also announced plans to commence autonomous driving of its Model 3 and Model Y cars in Texas and California states in the U.S in 2025. The above factors are projected to boost the market demand in North America during the forecast period.

Additionally, the regional analysis depicts that the increasing vehicle production, advent of electro mobility, and advancements in autonomous vehicles are propelling the connected car market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as growing automotive sector and increasing investments in electric vehicles among others.

Top Key Players & Market Share Insights:

The global connected car market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the connected car market. Key players in the connected car industry include-

- Harman International (United States)

- AT&T (United States)

- General Motors (United States)

- Ford Motor Company (United States)

- Hyundai Motor Group (South Korea)

- Volvo (Sweden)

- Robert Bosch GmbH (Germany)

- Daimler AG (Germany)

- Continental AG (Germany)

- Audi (Germany)

- TomTom Inc. (Netherlands)

Recent Industry Developments :

Product Launch:

- In February 2024, Harman launched its new HARMAN Ready Connect 5G Telematics Control Unit (TCU), which leverages Qualcomm Snapdragon digital chassis connected car technologies. The connected vehicle solution represents a substantial progression in automobile connectivity while providing enhanced in-cabin experiences for consumers.

Partnerships and Collaborations:

- In January 2025, JLR and Tata Communications announced a partnership for JLR’s connected vehicle ecosystem, with the aim of transforming the driving experience through the Tata Communications MOVE platform. Additionally, the partnership will support next-generation vehicles from JLR with constant connectivity and access to intelligent services in several locations across 120 countries.

Connected Car Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 278.83 Billion |

| CAGR (2024-2031) | 13.2% |

| By Technology |

|

| By Connectivity Type |

|

| By Communication Technology |

|

| By Vehicle Type |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the connected car market? +

The connected car market was valued at USD 91.84 Billion in 2024 and is projected to grow to USD 278.83 Billion by 2032.

Which is the fastest-growing region in the connected car market? +

Asia-Pacific is the region experiencing the most rapid growth in the connected car market.

What specific segmentation details are covered in the connected car report? +

The connected car report includes specific segmentation details for technology, connectivity type, communication technology, vehicle type, and region.

Who are the major players in the connected car market? +

The key participants in the connected car market are Harman International (United States), AT&T (United States), Robert Bosch GmbH (Germany), Daimler AG (Germany), Continental AG (Germany), Audi (Germany), TomTom Inc. (Netherlands), General Motors (United States), Ford Motor Company (United States), Hyundai Motor Group (South Korea), Volvo (Sweden), and others.