Digital Power Utility Market Size:

Digital Power Utility Market size is estimated to reach over USD 537.3 Billion by 2032 from a value of USD 99.54 Billion in 2024 and is projected to grow by USD 121.12 Billion in 2025, growing at a CAGR of 23.50% from 2025 to 2032.

Digital Power Utility Market Scope & Overview:

Digital power utility refers to the digitization of power distribution systems using new and advanced technologies such as the Internet of Things (IoT). They provide real-time solutions for improved asset management options, which are data-driven. The key advantages include significant improvement in productivity, reliability, safety, customer experience, compliance, and revenue management. The applications range from optimized plant maintenance, spare parts management, and fuel management to improved decision-making, improved overall energy balance, and optimized operations and management. The primary end users that use digital power utility services are utility and grid operators, renewable energy producers, regulatory bodies, and technology providers.

Digital Power Utility Market Insights:

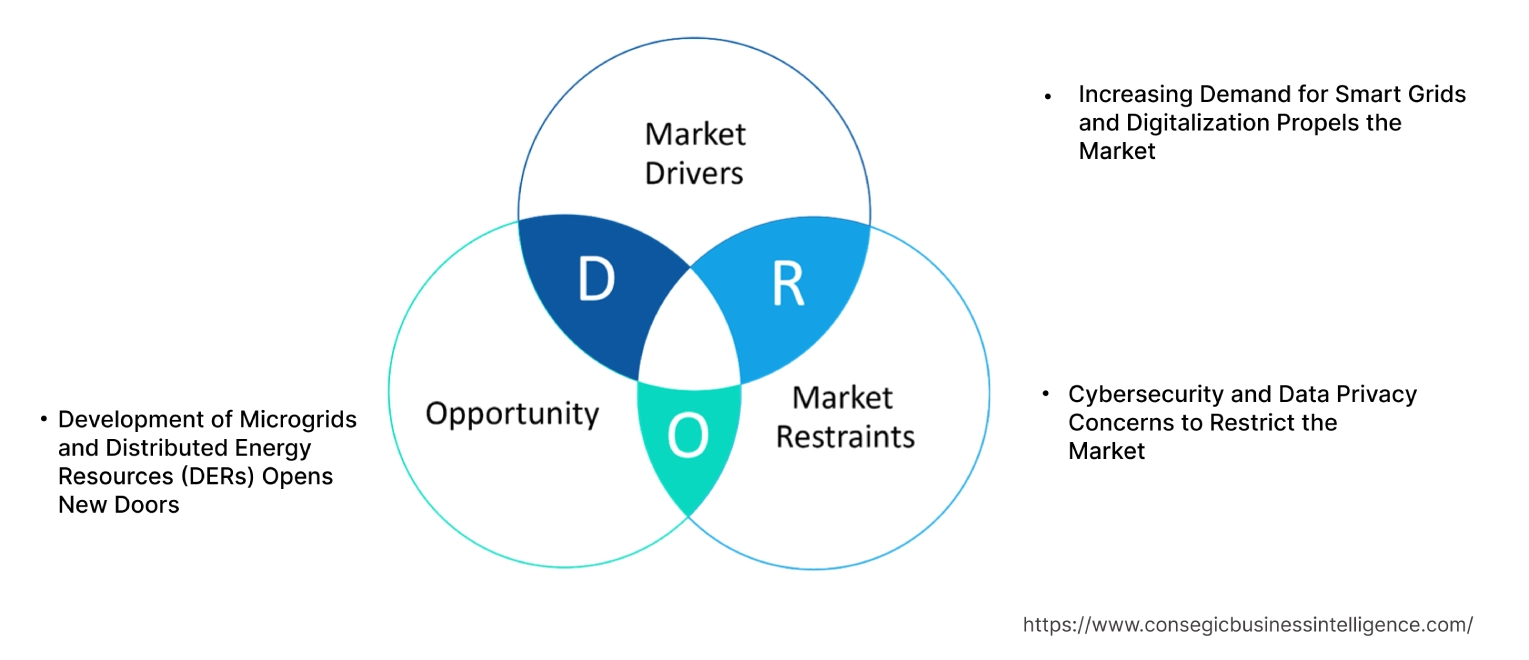

Digital Power Utility Market Dynamics - (DRO) :

Key Drivers:

Increasing Demand for Smart Grids and Digitalization Propels the Market

Smart grids address the increasing demand for efficient energy management and the modernization of electricity grids. By integrating advanced IoT technologies, smart grids enable data-driven analyses, planning, and diagnostics. Furthermore, they empower utilities to make informed decisions based on data collected from households, including information about electrical equipment in need of repair and electricity usage. This ensures smoother operations overall, further alluring the electricity providers.

- For instance, in 2021 Hitachi ABB launched a smart digital substation for power grids . The advantages include unique predictive, prescriptive, and prognostic capabilities.

Thus, the increasing shift towards digitization of electric grids drives the digital power utility market growth.

Key Restraints :

Cybersecurity and Data Privacy Concerns to Restrict the Market

With the move towards digitalization of the power industry, data collection and exchange are becoming highly prevalent. Even though, the data used gives informed decisions based on the analytics performed it also leads to digital threats. Moreover, the interconnectivity of the electricity grids and power operations, makes the data transmitted vulnerable to cyber breaches and cyberattacks. This could eventually disrupt the power operations and compromise sensitive data.

- For instance, a 2022 report from the World Economic Forum emphasizes the need for cybersecurity measures across power grid operations and the energy industry . In nearly 66% of cyberattack cases within the interconnected world of energy supply, attackers specifically targeted companies' customers by compromising sensitive data.

Therefore, the market trends analysis portrays that the cybersecurity and data privacy concerns restrain the digital power utility market demand.

Future Opportunities :

Development of Microgrids and Distributed Energy Resources (DERs) Opens New Doors

A microgrid is separated from the main grid in order the lower the reliance on the main grid, detecting power outages with the integration of DERs, such as rooftop solar panels and battery storage. They revolutionize energy distribution systems by providing a decentralized way of managing and generating power. This enables microgrids to surpass primary grid outages by powering the loads using DERs.

- In May 2023, EcoStruxure Microgrid Flex, an all-in-one microgrid solution was launched by Schneider Electric. The data from the microgrid can be plugged into the AI-enabled AutoGrid VPP for further analysis and optimization.

As per the analysis, the decentralization enabled by distributed energy resources and microgrids is driving digital power utility market opportunities.

Digital Power Utility Market Segmental Analysis :

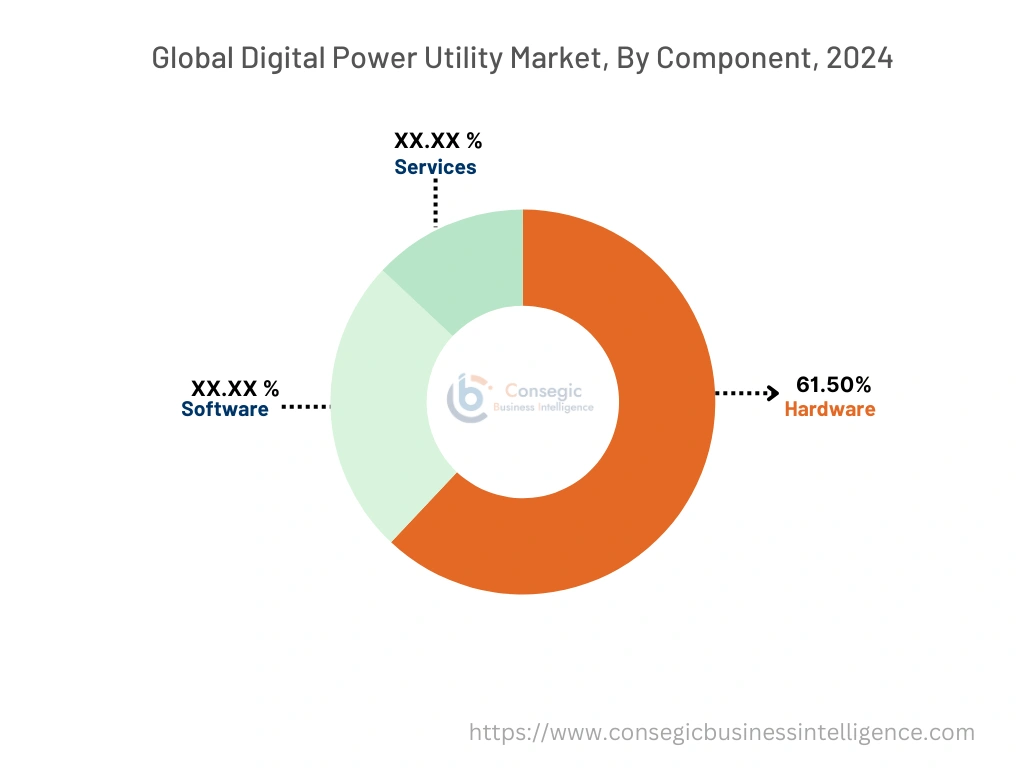

By Component:

Based on components, the market is trifurcated into hardware, software, and services.

Trends in the Component:

- The digital utilities, which include maintenance of software, system upgrades, and data security are handled using managed services.

- In order to enhance efficiency and reduce operational risks, virtual twins of the assets are created for predictive maintenance and real-time simulation.

The hardware sector accounted for the largest revenue of 61.50% of the total digital power utility market share in 2024.

- The hardware components in the digital power utility infrastructure include smart meters, sensors, transformers, etc., to ensure seamless collection of consumer data.

- The data collected is then used by utilities and city planners, to perform smart sensing and data analytics for further environmental planning and integrated municipal operations.

- For instance, in February 2023, Hitachi launched its next-generation "TXpert hub". They store and analyze the data gathered from the transformer's digital sensors.

- Therefore, the need for efficient analyses of consumer data drives the hardware sector in the digital power utility market growth.

The software sector is anticipated to register the fastest CAGR during the forecast period.

- The software components are integrated into the hardware component to monitor and optimize power operations.

- The AI-enabled software components significantly improve the efficiency and effectiveness of handling power outages and demand.

- They also make the decision-making processes related to grid operations much easier and well-informed.

- For instance, Schneider Electric's "EcoStruxure™ Grid Engineering Advisor" consists of visual packages, as well as the visual representation of the devices associated with the network. This allows users to make informed and intuitive decisions effectively.

- In conclusion, the increasing focus on energy optimization and data analytics drives the software sector in the digital power utility market trends.

By Application:

Based on application the market is segmented into generation, transmission, distribution, and retail.

Trends in the Application:

- With the increasing focus on energy efficiency and customer-centric approaches, innovations such as microgrids and peer-to-peer energy trading are gaining traction.

- Advancements in customer engagement platforms are leading to the adoption of technologies such as AI-enabled applications, ensuring energy efficiency and systems to monitor the user's energy consumption.

The distribution sector accounted for the largest revenue share of the overall digital power utility market share in 2024.

- The distribution of energy involves the utilization of technologies such as real-time data analytics, automatic switches, etc for seamless delivery to the end-users.

- Moreover, software components such as the advanced distribution management system (ADMS) automate the outage restoration process and grid optimization.

- For instance, Siemens Spectrum Power™ ADMS, integrates renewable sources to create a sustainable energy system, utilizing smart power distribution management.

- Therefore, the surge in the demand for automated distribution systems drives the digital power utility market demand.

The transmission sector is anticipated to register the fastest CAGR during the forecast period.

- In digital utilities, transmission involves the transportation of electricity from the primary plants to the distribution network.

- The high voltage direct current minimizes the overall loss that occurs during the transportation process, especially over long distances.

- For instance, the 525 kV HVDC cable technology was launched by Prysmian Group aiming to achieve an efficient and reliable power transmission process.

- In conclusion, the transmission sector with minimal loss during transportation drives digital power utility market trends.

By End-User:

Based on End-User, the market is segmented into residential, commercial & industrial, utilities, and government.

Trends in the End-User:

- AI-based home energy management systems are increasingly being adopted to reduce electricity usage and hence, the reduction in electricity bills.

- Advanced technologies such as digitalized energy management systems, with the integration of AI-driven forecasting tools are utilized to build smart cities.

The utility sector accounted for the largest revenue share in 2024.

- Due to the several benefits provided by the digitalization of power operations such as reduced operations cost, enhanced grid optimization, etc., utility companies are slowly inclining towards it.

- Real-time monitoring, data gathering, and analyses allow the companies to save on manual labor and utilize these features to enhance operations.

- Moreover, AI-powered forecasting tools let companies take relevant actions towards cost-cutting or increase process efficiency.

- Therefore, the recent innovations involving the digitalization of power utilities drive the sector towards rapid development.

The commercial & industrial sector is anticipated to register the fastest CAGR during the forecast period.

- The commercial & industrial sector is moving towards the optimization of energy consumption and adoption of smart energy solutions.

- The IOT and cloud technologies allow industries to access real-time solutions, reduce waste of energy, and lower operational costs.

- These innovative technologies and devices allow commercial buildings to store energy efficiently and access it when required.

- For instance, the energy storage systems by AceOn Group allow consumers to optimize energy objectives, involving both on and off-grids. It can be used in situations or places where energy availability is scarce.

- In conclusion, the analysis of segmental trends depicts that the requirement for energy efficiency and minimizing cost drives the commercial & industrial sectors in the digital power utility market opportunities.

Regional Analysis:

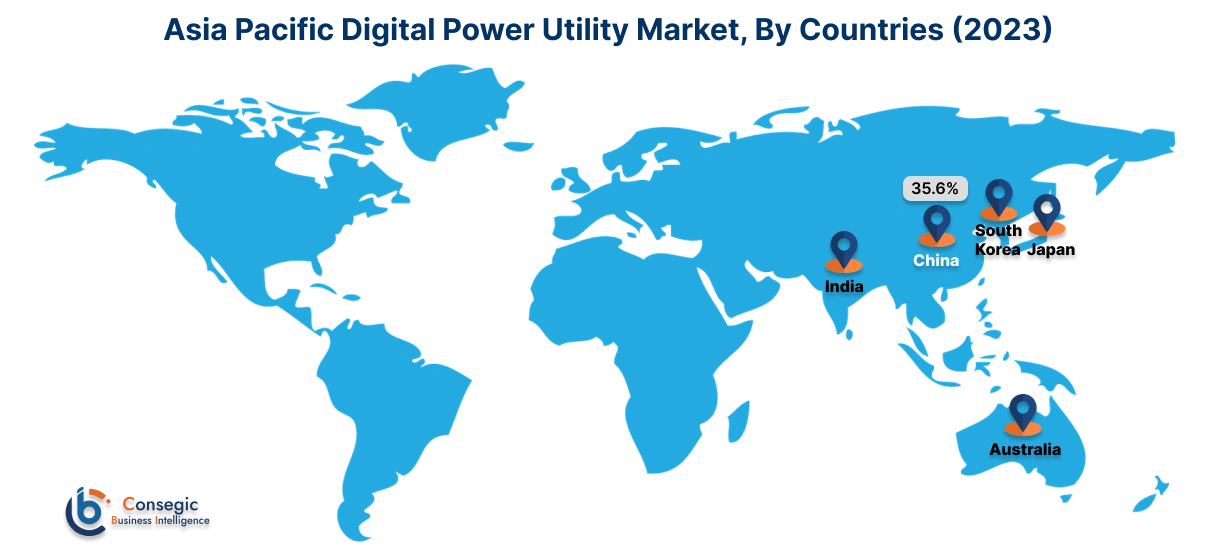

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

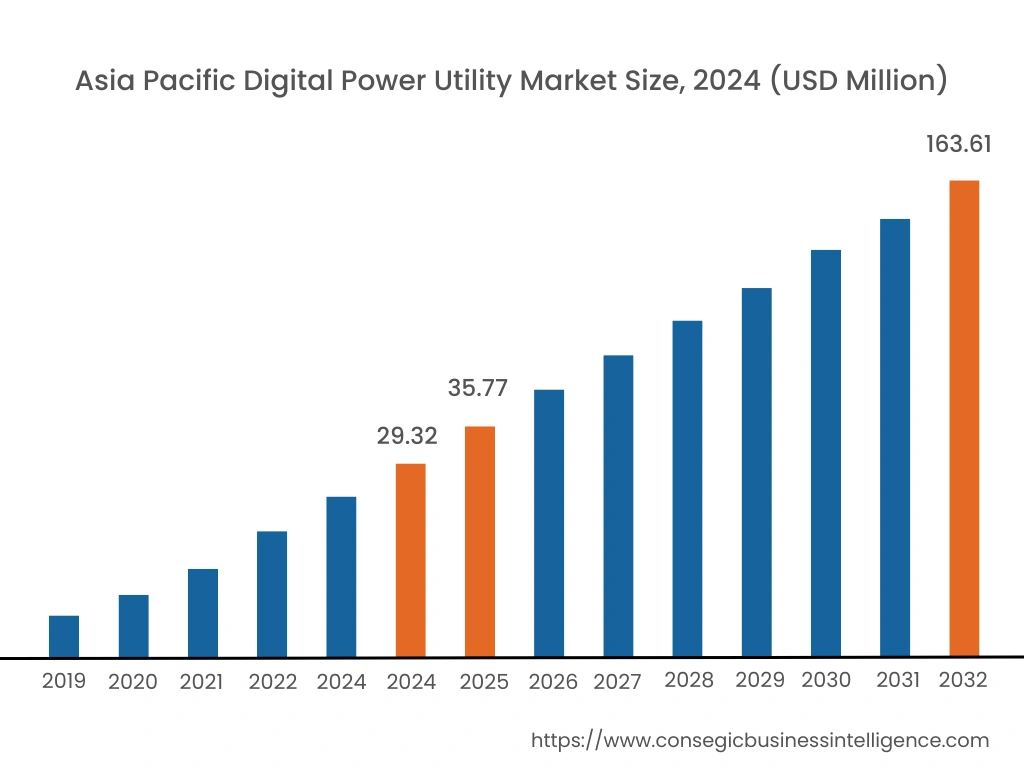

Asia Pacific region was valued at USD 29.32 Billion in 2024. Moreover, it is projected to grow by USD 35.77 Billion in 2025 and reach over USD 163.61 Billion by 2032. Out of this, China accounted for the maximum revenue share of 35.6%./p>

As per the digital power utility market analysis, the regional growth is driven by the rising focus on renewable energy and the implementation of government policies. Moreover, the adoption of green energy initiatives mostly in countries like India and China, further accelerates the digital power utility market expansion.

- For instance, the adoption of "new-type energy storage systems" (NTESS) is increasingly being emphasized by the Chinese government This includes multiple methods revolving around energy storage, including electrochemical systems, compressed air energy storage, flywheel systems, and supercapacitors.

North America is estimated to reach over USD 174.14 Billion by 2032 from a value of USD 33.02 Billion in 2024 and is projected to grow by USD 40.1 Billion in 2025. The increasing adoption of smart meters, sensors, and grids, surges the digital power utility market expansion in this region. Moreover, the growing investments in energy efficiency and power generation further accelerate the growth.

- According to a report by the U.S. Energy Information Administration (EIA), 119 million advanced (smart) metering infrastructure (AMI) were installed in the utilities.

As per the digital power utility market analysis, the growth in the industrial sector and increasing investments in power operations accelerate the market growth in Europe, creating more opportunities. Moreover, the installation of power grids further contributes to the growth.

The regional trends in the Middle East & Africa and Latin America, expect potential growth in the market, due to the advancements in distributed energy sources integrated with data analytics and artificial intelligence.

Top Key Players & Market Share Insights:

The digital power utility market is highly competitive with major players providing digital power utility services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global digital power utility market. Key players in the digital power utility industry include -

- Cisco Systems, Inc. (US)

- General Electric Company (US)

- Siemens (Germany)

- Capgemini Ltd (France)

- IBM Corporation (U.S)

- ABB (Switzerland)

- Schneider Electric (France)

- SAP SE (Germany)

- Microsoft Corporation (U.S)

- Oracle Corporation (U.S)

- Eaton (U.S)

Recent Industry Developments :

Product Launches:

- In May 2024, a new smart energy meter, called "Oakmeter" was launched by Oakter, integrating technologies such as advanced metering infrastructure, real-time data analytics, and the Internet of Things (IoT).

- In February 2024, an autonomous grid management system "Gridscale X™" was launched by Siemens to enhance DER visibility and improve the planning, operations, and maintenance phase for grid operators.

Mergers & Acquisitions:

- In July 2024, Energy Computers Systems was acquired by QEI Automation, aiming to include Advance Distribution Management Systems (ADMS) Software to expand its portfolio.

- In April 2023, Jiangsu Ryan Electrical Co. Ltd. was acquired by Eaton, aiming to provide better solutions to transition towards the renewable energy sector.

Partnerships & Collaborations:

- In July 2024, Vodafone and Suez entered into a partnership aiming to provide a cost-effective, vendor-agnostic, Advanced Metering Infrastructure (AMI). This partnership involves the SUEZ innovating AMIs with Wize technology and NB-IoT and Vodafone collecting real-time data and demand management.

- In April 2023, Airtel entered into a partnership with Secure Meters, deploying 1.3 million NB-IoT-powered smart meters.

Digital Power Utility Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 537.3 Billion |

| CAGR (2025-2032) | 23.5% |

| By Component |

|

| By Application |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the digital power utility market? +

Digital Power Utility Market size is estimated to reach over USD 537.3 Billion by 2032 from a value of USD 99.54 Billion in 2024 and is projected to grow by USD 121.12 Billion in 2025, growing at a CAGR of 23.50% from 2025 to 2032.

What specific segmentation details are covered in the digital power utility market report? +

The digital power utility market report includes specific segmentation details for components, applications, end-users, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the treatment component, the software sector is the fastest-growing segment during the forecast period due to the growing demand for grid optimization and data analytics in power operations.

Who are the major players in the digital power utility market? +

The key participants in the digital power utility market are Siemens (Germany), Capgemini Ltd (France), IBM Corporation (U.S), Cisco Systems, Inc. (U.S), General Electric Company (U.S), SAP SE (Germany), Schneider Electric (France), Microsoft Corporation (U.S), Oracle Corporation (U.S), Eaton (U.S), ABB (Switzerland)