HVAC System Market Size:

HVAC System Market size is estimated to reach over USD 386.84 Billion by 2032 from a value of USD 224.45 Billion in 2024 and is projected to grow by USD 235.56 Billion in 2025, growing at a CAGR of 6.4% from 2025 to 2032.

HVAC System Market Scope & Overview:

HVAC (heating, ventilation, and air conditioning) systems are designed to regulate temperature, humidity, and air quality within an enclosed space. It offers a comprehensive solution for maintaining a comfortable and healthy indoor environment, particularly in residential, commercial, and industrial settings. Additionally, HVAC systems provide a wide range of benefits, including improved indoor air quality, enhanced comfort, energy savings, and increased cost efficiency, among others.

How is AI Transforming the HVAC System Market?

The integration of AI is significantly transforming the HVAC system market. AI-powered HVAC equipment can analyze data, predict maintenance needs, optimize energy consumption, and improve indoor air quality. Moreover, AI-powered HVAC systems can learn user preferences and adjust temperature settings accordingly, in turn optimizing energy usage based on occupancy patterns and weather conditions.AI integration can fine-tune HVAC equipment parameters, such as fan speeds and airflow, to ensure optimum performance and energy efficiency. Additionally, AI-powered HVAC solutions are capable of dynamically adjusting to changing conditions, in turn minimizing energy consumption and reducing utility bills. Hence, the aforementioned factors are expected to positively impact the market growth in upcoming years.

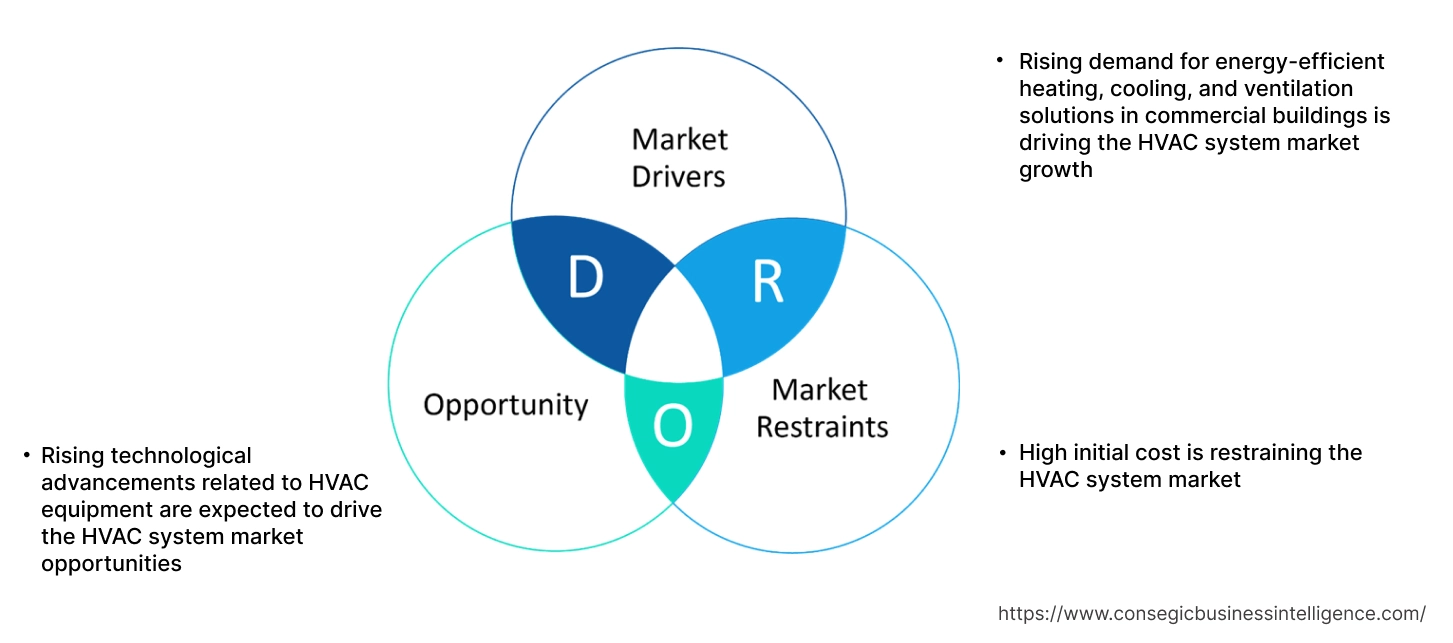

Key Drivers:

Rising demand for energy-efficient heating, cooling, and ventilation solutions in commercial buildings is driving the HVAC system market growth

HVAC systems are primarily used in commercial spaces to regulate temperature, humidity, and air quality in large buildings such as offices, retail spaces, educational institutions, hospitals, and others. Moreover, commercial buildings are adopting energy-efficient HVAC systems to reduce operational costs and comply with environmental regulations. Additionally, factors including the rapid pace of urbanization and rising construction activities, particularly in emerging economies, are driving a significant demand for new HVAC systems in commercial spaces.

- For instance, according to Statistics Netherlands, the total number of new constructions of commercial buildings across the Netherlands reached up to 1,042 units in 2022.

Therefore, the rising commercial construction and increasing need for energy-efficient HVAC equipment in commercial buildings are driving the HVAC system market size.

Key Restraints:

High initial cost is restraining the HVAC system market

High initial cost associated with HVAC equipment is among the key factors limiting the market. This includes the cost of HVAC equipment, along with installation costs and potential modifications to existing infrastructure, which may cause financial barriers, particularly for consumers and businesses operating on tighter budgets.

- For instance, HVAC installation costs can typically range from USD 10,000–15,000 for standard-efficiency systems, with premium-efficiency equipment exceeding USD 20,000 for larger homes. Similarly, the cost of air conditioners along with its installation cost, ranges between USD 3,500 - 8,500, while the cost of heat pumps ranges between USD 4,000 - 10,000, and furnaces cost between USD 3,000 - 6,500, with ductwork adding from USD 2,000 - 5,000.

Therefore, high initial costs associated with HVAC equipment are hindering the HVAC system market expansion.

Future Opportunities :

Rising technological advancements related to HVAC equipment are expected to drive the HVAC system market opportunities

HVAC equipment manufacturers are frequently investing in the development of new technologies associated with HVAC systems, such as internet of things (IoT), artificial intelligence (AI), and others, to ensure its safe and effective utilization in residential and commercial applications. As a result, HVAC equipment manufacturers are launching new products with updated features, in turn providing lucrative aspects for market growth. Moreover, the integration of IoT enables real-time monitoring and control of HVAC equipment, thereby optimizing energy consumption based on occupancy, weather conditions, and building needs.

- For instance, in January 2025, Samsung launched its 2025 lineup of BESPOKE AI WindFree model of air conditioners, integrating a premium design with cutting-edge AI technology. These air conditioners are specifically designed for delivering comfort and increased convenience. The air conditioner range utilizes AI-driven innovations for adapting seamlessly to changing climate conditions, in turn ensuring consistent comfort and maximum efficiency.

Hence, as per the analysis, the increasing technological advancements related to HVAC equipment are expected to boost the HVAC system market opportunities during the forecast period.

HVAC System Market Segmental Analysis :

By Product Type:

Based on product type, the market is segmented into heating equipment, cooling equipment, and ventilation equipment.

Trends in the product type:

- Increasing trend towards adoption of cooling equipment in residential and commercial spaces to ensure improved thermal comfort is driving the market.

- Rising progressions associated with heating, cooling, and ventilation systems with advanced features, such as IoT and AI integration, are propelling the segment growth.

Heating equipment segment accounted for a substantial revenue share in the HVAC system market share in 2024.

- Heating equipment segment primarily includes heat pumps, furnaces, boilers, and others. Heating equipment is designed to generate and distribute heat for warming spaces.

- Moreover, heat pumps refer to devices that transfer thermal energy using a refrigeration cycle, moving heat from a colder area to a warmer one, or vice versa.

- Meanwhile, furnaces heat air, which is then circulated through ductwork to heat a building. They typically burn fuel or use electricity to generate heat.

- Additionally, boilers heat water, which can be circulated as hot water or steam to provide heat. The heated water or steam is then distributed through pipes and radiators or used in radiant floor systems.

- For instance, in February 2025, Carrier introduced its new AquaSnap 61AQ model of reversible heat pump, specifically for use in commercial applications. The heat pump offers several features, including increased energy efficiency, high temperatures, noise reduction, and enhanced operational performance.

- According to the HVAC system market analysis, the rising advancements associated with heating equipment are driving the market.

The cooling equipment segment is anticipated to register the fastest CAGR during the forecast period.

- The cooling equipment segment includes air conditioners, chillers, coolers, and others.

- Air conditioners are typically used for localized cooling in homes, offices, and smaller spaces.

- Meanwhile, chillers are large-scale systems used for industrial or commercial cooling, often involving a centralized cooling plant.

- Additionally, coolers are generally portable devices that are mainly used for personal or short-term cooling.

- For instance, LG Electronics launched its new ARTCOOL gallery air conditioner featuring a 27-inch LCD screen in 2023. The new model of air conditioner is capable of displaying personalized content along with delivering energy-efficient cooling and heating. The air conditioner is equipped with a dual inverter compressor and 3-way indirect airflow, which helps in providing an enhanced performance with AI Dry while offering a range of user-friendly features.

- Therefore, the increasing innovations related to cooling equipment are anticipated to boost the HVAC system market size during the forecast period.

By Sales Channel:

Based on sales channel, the market is segmented into direct sales and distributor sales.

Trends in the sales channel:

- Factors including the availability of excellent support and warranty, higher product quality, and reliable shipping and return policies are key prospects driving the direct sales channel segment.

- Factors such as higher accessibility to a variety of products, higher flexibility, and expanded reach are key trends driving the distributor sales channel segment.

The direct sales segment accounted for a significant revenue in the overall HVAC system market share in 2024.

- In direct sales channel, HVAC equipment is sold directly to customers through numerous physical outlets, including company outlets, among others.

- Moreover, the direct sales channel also consists of an online mode, wherein the manufacturers sell the HVAC equipment through its own company websites.

- Additionally, purchasing HVAC equipment from direct sales channel offers numerous benefits, including faster response time, higher product quality, higher return on investments, competitive pricing, and others, which are key determinants for increasing the purchase of HVAC equipment from direct sales channel.

- For instance, Samsung and LG Electronics are HVAC equipment manufacturers that offer a broad range of heating, cooling, and ventilation equipment for direct purchase through the company website.

- Therefore, the increasing availability of HVAC equipment in direct sales channels is driving the market.

The distributor sales segment is anticipated to register the fastest CAGR during the forecast period.

- The distributor sales channel involves an indirect distribution of HVAC equipment, wherein the systems are purchased from several regional distributors operating in multiple regions worldwide.

- Moreover, distributor sales channels provide several benefits, including increased market reach, reduced capital expenditure, increased cost efficiency, and others. The above benefits of distributor sales channels are further increasing its utilization for sales of HVAC equipment.

- For instance, Croma, Reliance Digital, Electro Siluz, Sudclimatair S.A., and others are few of the distributors of HVAC equipment.

- Hence, the increasing availability of HVAC equipment in distributor sales channels is anticipated to boost the market during the forecast period.

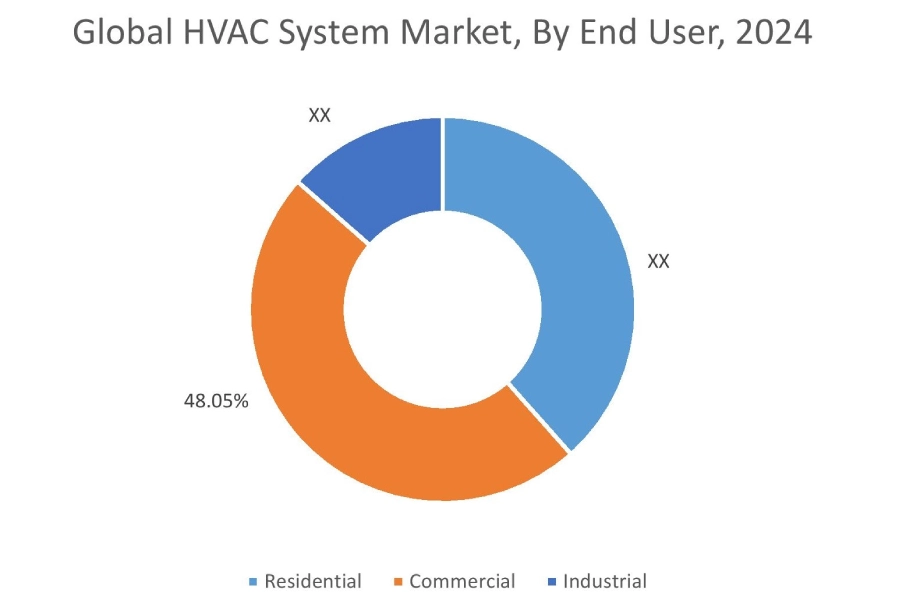

By End User:

Based on the end user, the market is segmented into residential, commercial, and industrial.

Trends in the end user:

- Factors including rising pace of urbanization, increasing commercial construction involving offices, hospitals, educational institutions, and others, along with growing demand for efficient thermal solutions in commercial buildings are primary aspects driving the commercial segment.

- Factors including the increasing disposable income, rising investments in residential development, and government policies including tax incentives, subsidies, and rebates are key trends driving the residential segment growth.

The commercial segment accounted for the largest revenue share of 48.05% in the market in 2024.

- HVAC equipment is primarily used in the commercial sector for maintaining comfortable and healthy environments in large buildings by regulating temperature, humidity, and air quality.

- They are essential for ensuring improved air quality and thermal comfort of various commercial spaces, including offices, shopping malls, educational institutes, and other spaces.

- Moreover, commercial HVAC equipment is designed to handle larger spaces, varying occupancy levels, and complex zoning requirements.

- For instance, according to Statistics Canada, the total commercial construction permits in Canada was valued at USD 1,682,511 in January 2024, representing a substantial increase of 29.5% in comparison to USD 1,299,688 in December 2023.

- According to the analysis, the growing development of commercial spaces is increasing the adoption of HVAC equipment, thereby driving the HVAC system market trends.

The residential segment is anticipated to register a significant CAGR during the forecast period.

- HVAC equipment plays a vital role in maintaining a comfortable and healthy living environment in residential buildings.

- It provides temperature control, air quality management, and humidity regulation for residential spaces.

- Moreover, the integration of HVAC equipment in residential spaces provides a comfortable indoor environment regardless of external weather conditions.

- Additionally, modern HVAC equipment is often designed to be energy-efficient, which potentially reduces energy consumption and utility bills.

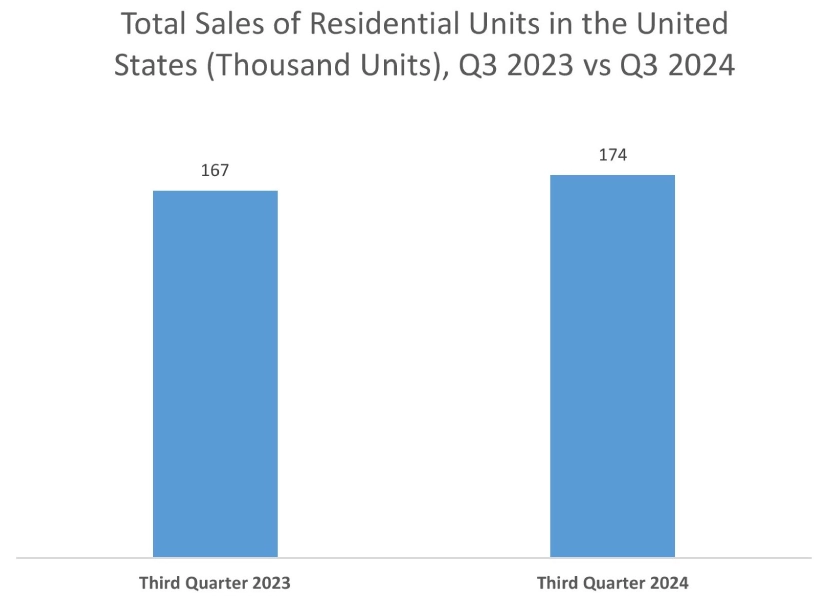

- For instance, according to the United States Census Bureau, the total number of new residential units sold in the United States reached up to 174 thousand units during the third quarter of 2024, witnessing an increase of 4.2% in comparison to 167 thousand units in the third quarter of 2023.

- Consequently, the increasing residential construction and rising integration of HVAC equipment in residential spaces are expected to drive the market growth during the forecast period.

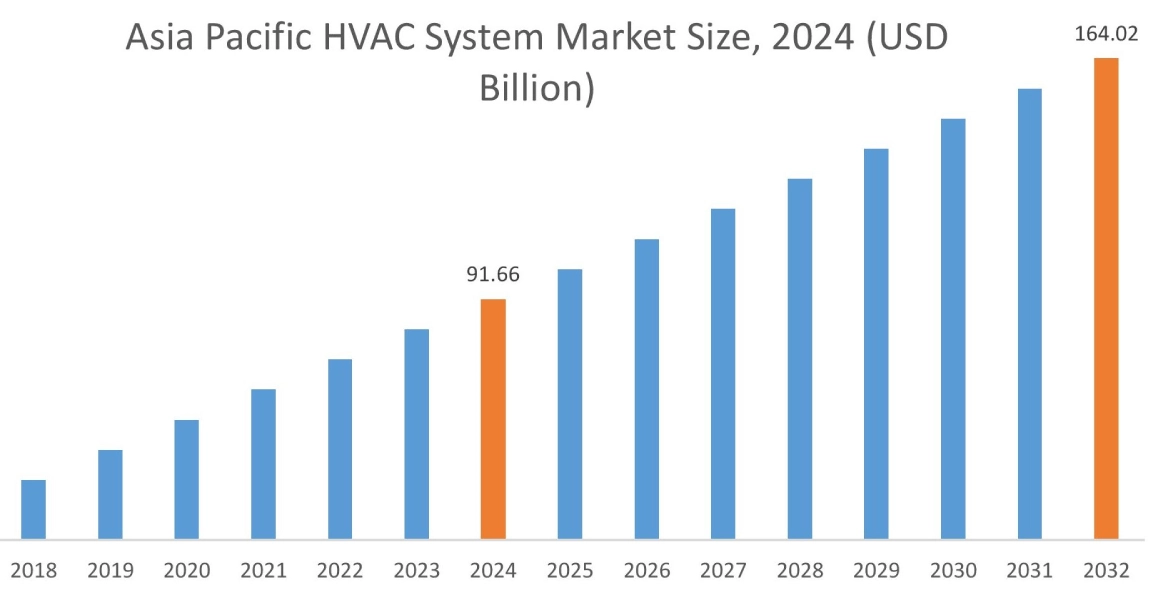

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

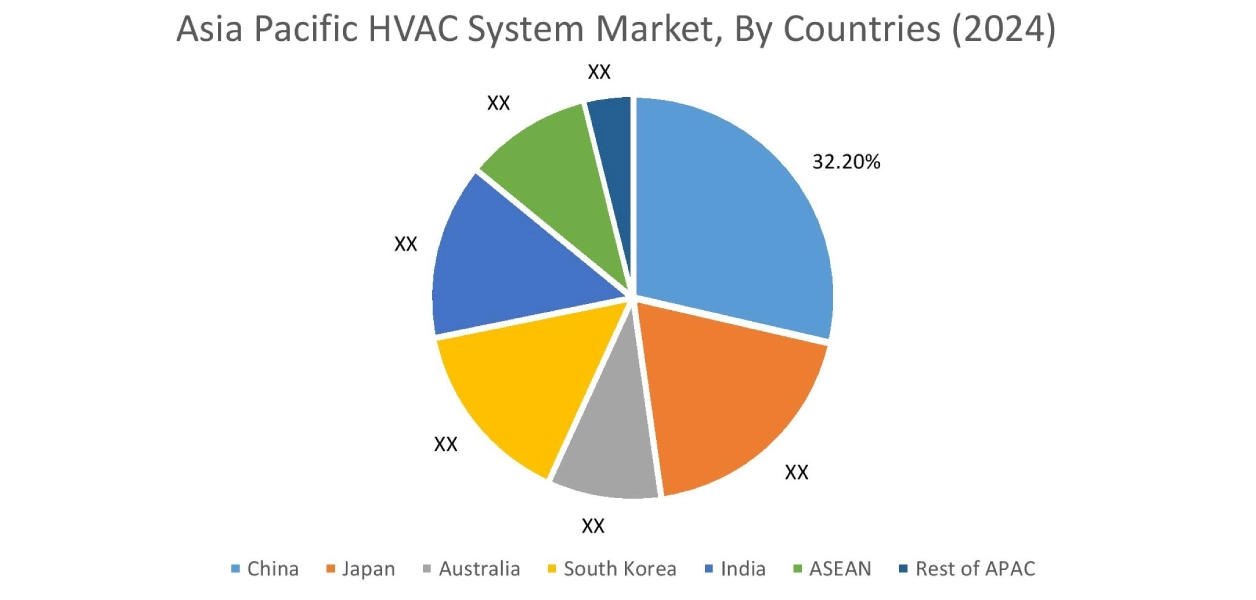

Asia Pacific region was valued at USD 91.66 Billion in 2024. Moreover, it is projected to grow by USD 96.50 Billion in 2025 and reach over USD 164.02 Billion by 2032. Out of this, China accounted for the maximum revenue share of 32.20%. As per the HVAC system market analysis, the adoption of HVAC equipment in the Asia-Pacific region is primarily driven by increasing pace of urbanization along with rising development of commercial and residential spaces among others. Additionally, the rising adoption of HVAC solutions in residential and commercial spaces to ensure optimal thermal comfort and improved air quality is further accelerating the HVAC system market expansion.

- For instance, according to the Building and Construction Authority of Singapore, the total construction demand, including residential and commercial construction, in Singapore reached between USD 24 billion to USD 29 billion by the end of 2024. Consequently, the above factors are driving the industry in the Asia-Pacific region.

North America is estimated to reach over USD 106.19 Billion by 2032 from a value of USD 62.74 Billion in 2024 and is projected to grow by USD 65.75 Billion in 2025. In North America, the growth of the HVAC system industry is driven by the rising investments in residential, commercial, and industrial construction projects along with increasing integration of HVAC equipment within buildings among others. Similarly, the rising penetration of smart and connected devices in residential spaces is increasing the adoption of smart HVAC equipment, further contributing to the HVAC system market demand.

- For instance, according to the United States Census Bureau, the total number of new residential units sold in the United States reached up to 666 thousand units in 2023, witnessing an increase of nearly 4% in comparison to 641 thousand units in 2022. The above factors are expected to drive the HVAC system market trends in North America during the forecast period.

Meanwhile, the regional analysis depicts that rising construction activities, favorable government measures for development of smart homes, along with the prevalence of various air quality standards are driving the HVAC system market demand in Europe. In addition, according to the market analysis, the market in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as rising pace of urbanization and increasing investments in residential and commercial construction among others.

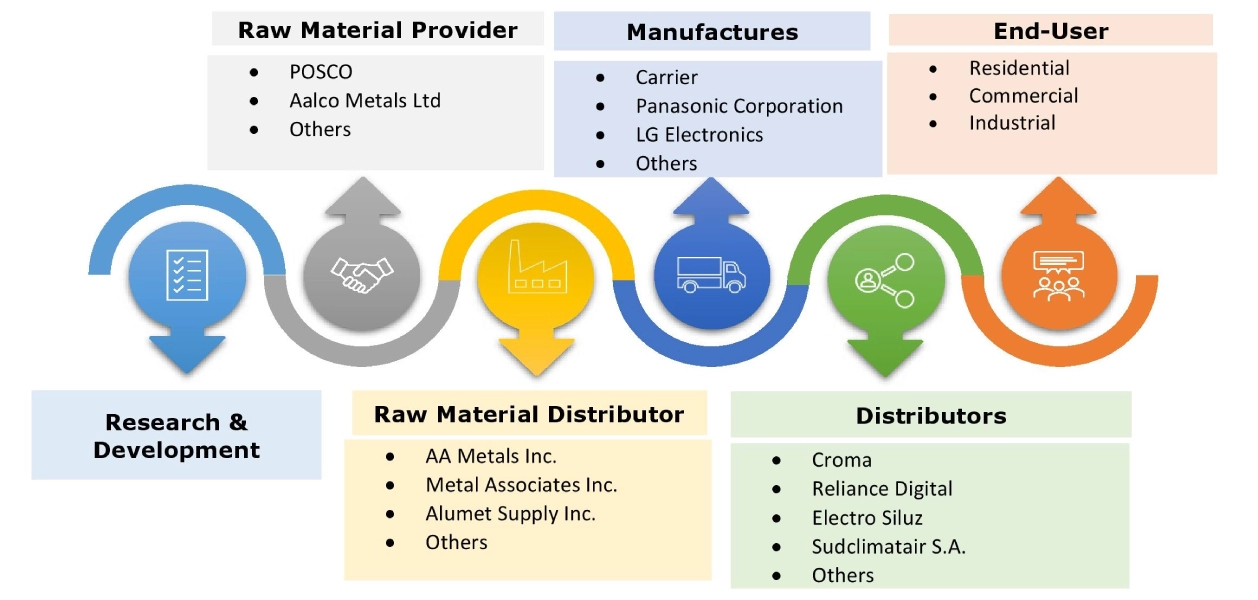

Top Key Players and Market Share Insights:

The global HVAC system market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the HVAC system market. Key players in the HVAC system industry include-

- Carrier (U.S.)

- Panasonic Corporation (Japan)

- Samsung (South Korea)

- Johnson Controls International Plc (Ireland)

- Nortek Global HVAC LLC (U.S.)

- Emerson Electric Co. (U.S.)

- Trane Technologies (Ireland)

- LG Electronics (South Korea)

- Haier Group (China)

- Lennox International Inc. (U.S.)

- Daikin Industries Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

Recent Industry Developments :

Product launches

- In March 2025, Daikin unveiled its new EWYK-QZ model of air-to-water heat pump, which features a R-290 (propane) refrigerant. The heat pump is designed to fulfil a broad range of comfort cooling, heating, and domestic hot water needs. The official launch is set for the end of 2025.

- In January 2025, LG Electronics launched its new DUALCOOL AI model of residential air conditioner. The new air conditioner offers exceptional comfort, improved energy efficiency, and an optimized air conditioning environment that can be customized to each user’s preferences.

- In February 2024, Panasonic Life Solutions India launched its 2024 line-up of air conditioners (Acs). Panasonic introduced 60 new models across its entire range of ACs, due to the rising demand for cooling appliances. The new models of ACs are available across all leading outlets, including the Panasonic Brand Store and e-commerce platforms.

HVAC System Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 386.84 Billion |

| CAGR (2025-2032) | 6.4% |

| By Product Type |

|

| By Sales Channel |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the HVAC system market? +

The HVAC system market was valued at USD 224.45 Billion in 2024 and is projected to grow to USD 386.84 Billion by 2032.

Which is the fastest-growing region in the HVAC system market? +

Asia-Pacific is the region experiencing the most rapid growth in the HVAC system market.

What specific segmentation details are covered in the HVAC system report? +

The HVAC system report includes specific segmentation details for product type, sales channel, end user, and region.

Who are the major players in the HVAC system market? +

The key participants in the HVAC system market are Carrier (U.S.), Panasonic Corporation (Japan), LG Electronics (South Korea), Haier Group (China), Lennox International Inc. (U.S.), Daikin Industries Ltd. (Japan), Mitsubishi Electric Corporation (Japan), Samsung (South Korea), Johnson Controls International Plc (Ireland), Nortek Global HVAC LLC (U.S.), Emerson Electric Co. (U.S.), Trane Technologies (Ireland), and others.