Dredging Equipment Market Size:

Dredging Equipment Market size is estimated to reach over USD 7.96 Billion by 2032 from a value of USD 4.75 Billion in 2024 and is projected to grow by USD 4.98 Billion in 2025, growing at a CAGR of 6.7% from 2025 to 2032.

Dredging Equipment Market Scope & Overview:

Dredging equipment refers to machinery used to remove sediment, debris, or other materials from the bottom of water bodies like rivers, lakes, ports, and canals. These machines are designed to maintain or increase water depth, restore navigable routes, or prepare underwater surfaces for construction and environmental projects.

Different types of dredgers are used based on the type of material and project needs. Common types include cutter suction dredgers, trailing suction hopper dredgers, and bucket dredgers. These systems are made up of parts like suction pipes, cutter heads, pumps, winches, and floating pipelines that work together to remove and move the material. Some equipment is placed on floating platforms, while others are built to work from the shore or in shallow, swampy areas.

Dredging equipment plays a key role in supporting sediment control, shoreline stabilization, and large-scale water infrastructure works. End-users include port authorities, marine contractors, and environmental management agencies needing specialized tools for underwater excavation and maintenance.

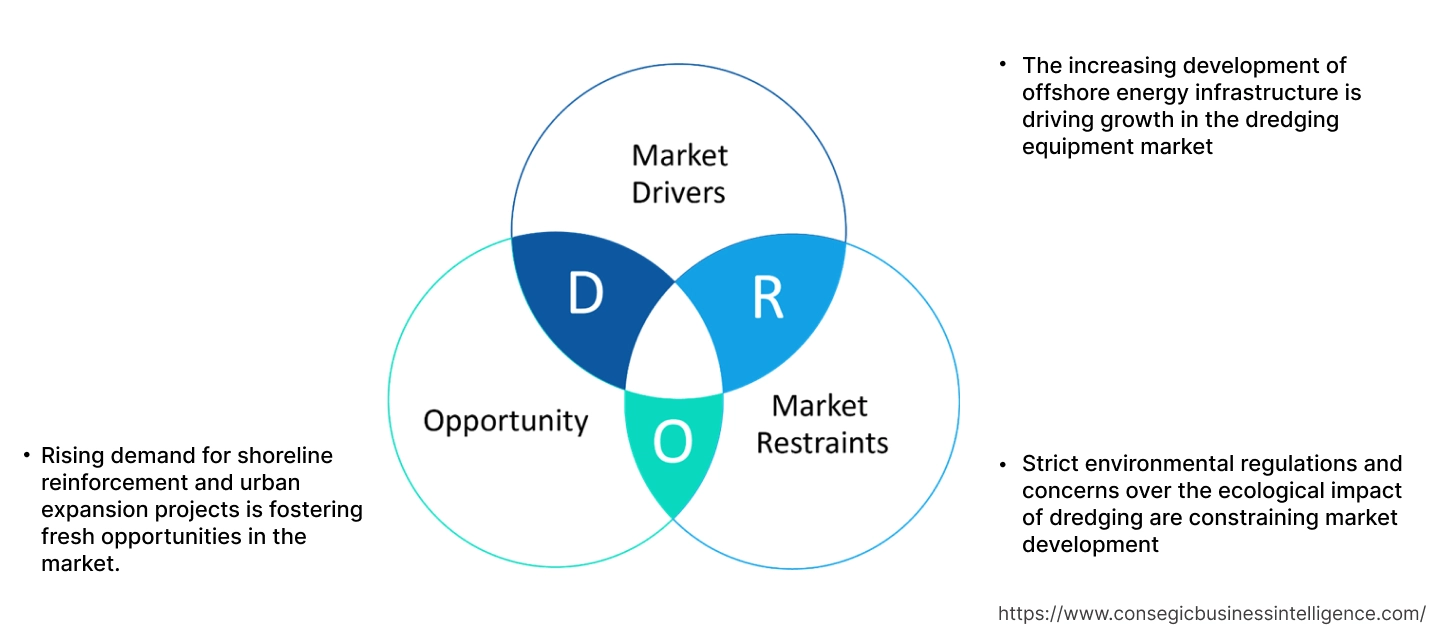

Dredging Equipment Market Dynamics - (DRO) :

Key Drivers:

The increasing development of offshore energy infrastructure is driving growth in the dredging equipment market.

Offshore wind farms require substantial dredging to prepare the seabed for the installation of turbines, underwater cables, and other essential infrastructure. The proliferation of offshore energy projects, particularly offshore wind farms, is significantly driving the demand for dredging machinery. As countries focus more on renewable energy sources, regions such as Europe, Asia-Pacific, and North America are investing heavily in offshore wind energy projects. These large-scale projects require precise and deep seabed excavation to ensure the stability and efficiency of energy production. The push for greener energy solutions has resulted in an increasing need for specialized dredging equipment capable of handling the complex requirements of offshore installations. As offshore renewable energy projects expand, the market for dredgers is growing in tandem, with a significant rise for machinery designed to prepare the seabed for turbine and cable installations. This shift towards renewable energy is propelling market progress.

Key Restraints:

Strict environmental regulations and concerns over the ecological impact of dredging are constraining market development.

Environmental regulations continue to hinder the dredging industry, particularly with regards to the potential negative impacts on waterway habitats and marine ecosystems. Dredging activities, which stir up sediment and disturb aquatic life, must comply with stringent environmental standards. As awareness of the environmental consequences of dredging grows, many projects face delays and increased costs due to the need for environmental clearances and mitigation efforts. For example, in ecologically sensitive areas like marine reserves or near coral reefs, dredging operations may be restricted or require additional protective measures to minimize damage. These regulations, while necessary to preserve marine biodiversity, impose restrictions on the scope and pace of dredging projects. As a result, the growing complexity of environmental compliance creates hurdles for the efficient execution of dredging operations, limiting the market’s overall growth potential.

Future Opportunities :

Rising demand for shoreline reinforcement and urban expansion projects is fostering fresh opportunities in the market.

Urban development in densely populated coastal regions has made land reclamation a practical solution for creating additional space for residential, commercial, and industrial development. Central to this process is dredging, which involves the excavation of seabed or riverbeds to form new land. At the same time, beach nourishment, the process of restoring eroded shorelines with sand has become increasingly important due to rising sea levels and the growing need to protect coastal infrastructure. These activities are particularly prevalent in various regions, where rapid development and land scarcity drive the urgency for such solutions. Dredging equipment is essential for both land reclamation and shoreline restoration, and it is expected to increase significantly as these projects continue to gain momentum.

- For instance, in March 2025, Jan De Nul and DEME JV signed a letter of award with Indian engineering firm ITD Cementation for dredging and reclamation works at Vadhavan Port in Maharashtra, India. The agreement encompasses nearshore reclamation and shore protection over approximately 200 hectares, facilitating the development of breakbulk and liquid cargo handling facilities.

The increasing investment from governments and private developers in climate-resilient and space-creating infrastructure, benefit the dredging equipment market opportunities.

Dredging Equipment Market Segmental Analysis :

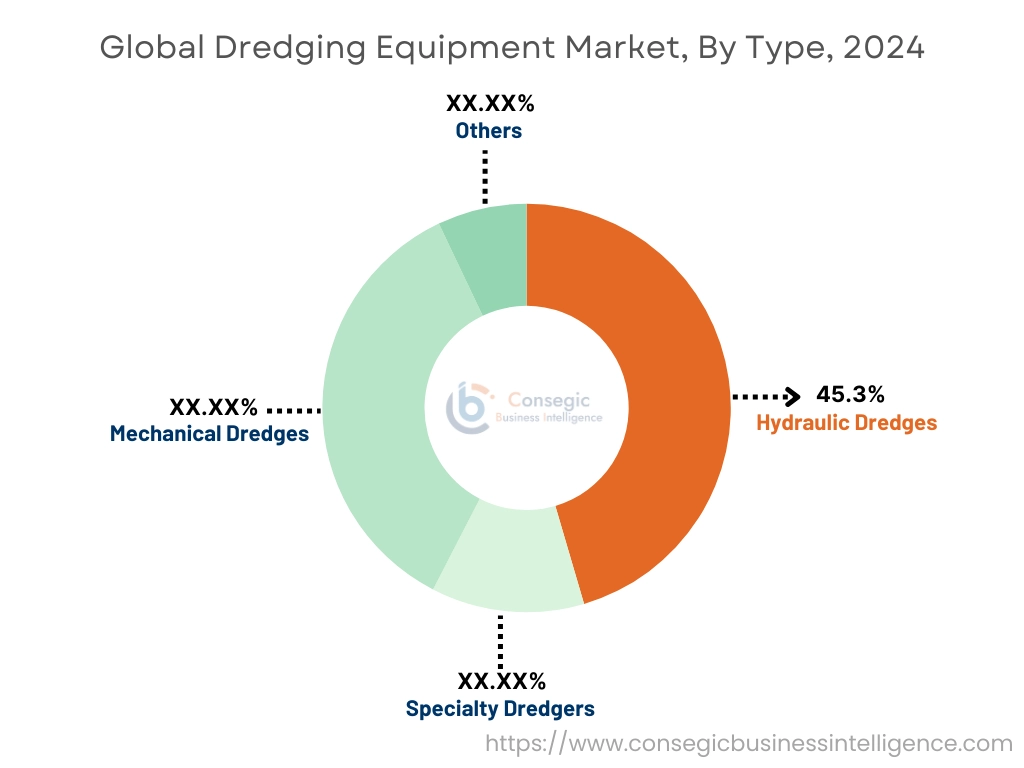

By Type:

Based on Type, the market is categorized into Mechanical Dredges, Hydraulic Dredges, Specialty Dredgers, and Others.

The Hydraulic Dredges segment holds the largest revenue of the overall Dredging Equipment Market share of 45.3% in the year 2024.

- Hydraulic dredges, including cutter suction dredgers and trailing suction hopper dredgers are the most widely used equipment for capital and maintenance dredging due to their continuous and high-volume material handling capacity.

- These dredges operate by suctioning sediment via pumps and transporting it hydraulically through pipelines, making them suitable for port development, land reclamation, and channel deepening.

- The ability to dredge in bulk with high efficiency reduces project timelines and makes hydraulic systems the preferred choice for large-scale infrastructure projects.

- According to the dredging equipment market analysis, their high utilization in both government and private marine works, hydraulic dredges hold the largest revenue share, fueling the global dredging equipment market expansion.

The Specialty Dredgers segment is expected to grow at the fastest CAGR during the forecast period.

- Specialty dredgers are purpose-built for highly specific operations such as environmental dredging, confined space projects, or sediment removal in contaminated or delicate ecosystems.

- These systems often include amphibious dredgers, auger dredgers, and low-turbidity units equipped with real-time monitoring and precision tools.

- The growing need for ecosystem restoration, sediment remediation, and dredging in hard-to-reach or regulated zones is driving adoption of specialized dredging systems.

- As per the market analysis, the rising stringency of environmental compliance and increasing non-standard project requirements fuel the market growth.

By Application:

Based on Application, the market is categorized into Capital Dredging, Maintenance Dredging, Aggregate Dredging, and Environmental Dredging.

The Capital Dredging segment holds the largest revenue of the overall Dredging Equipment Market share in the year 2024.

- Capital dredging involves the creation of new ports, canals, or navigation channels by deepening seabeds and inland waterways.

- This type of dredging is critical for facilitating the operation of large cargo ships and accommodating growing trade volumes.

- Most port authorities and marine construction companies rely on CSDs and TSHDs for capital projects that require large-volume material excavation.

- For instance, in May 2023, Union Dredgers & Marine Contracting (UDMC) expanded its operational capabilities by adding a new Cutter Suction Dredger (CSD) to its fleet. The newly acquired dredger is designed for high-performance dredging tasks, capable of handling demanding projects in land reclamation, port development, and coastal protection. This addition reinforces UDMC’s commitment to delivering efficient and timely dredging solutions across the UAE and surrounding regions.

- According to the dredging equipment market analysis, its growing scale, high investment, and foundational importance to coastal infrastructure significantly fuels the market growth.

The Environmental Dredging segment is expected to grow at the fastest CAGR during the forecast period.

- Environmental dredging focuses on removing contaminated sediments and restoring ecological balance in rivers, lakes, and industrial water bodies.

- Need is increasing in response to environmental regulation, sediment remediation mandates, and wetland restoration initiatives.

- Specialized dredgers equipped with low-turbidity tools and real-time monitoring are deployed to minimize ecological disruption.

- As sustainability and environmental recovery take priority globally, environmental dredging is expected to grow substantially driving the global dredging equipment market demand.

By End User:

Based on End-User, the market is segmented into Government & Public Authorities, Oil & Gas Companies, Mining Companies, and Others.

The Government & Public Authorities segment holds the largest revenue share of the overall Dredging Equipment Market in the year 2024.

- Governments are the primary end-users of dredging equipment through port development boards, public works departments, and inland waterway authorities.

- Public authorities fund large-scale maintenance and capital dredging projects to support shipping, flood management, and inland navigation.

- Procurement is typically project-based, with long-term contracts for fleet renewal or national dredging programs.

- For instance, in October 2023, National Marine Dredging Company (NMDC) and Abu Dhabi Ports have signed a strategic agreement to collaborate on dredging and marine construction projects within the UAE and globally. The partnership aims to enhance port infrastructure, boost economic competitiveness, and support Abu Dhabi’s long-term maritime and logistics vision. Under the agreement, NMDC will provide specialized dredging and marine expertise, while Abu Dhabi Ports will leverage its network and operational capabilities to deliver large-scale infrastructure solutions.

- Thus, the scale, recurring demand, and regulatory priority, government authorities represent the largest end-user segment, significantly driving the global dredging equipment market trends.

The Oil & Gas Companies segment is expected to grow at the fastest CAGR during the forecast period.

- Dredging is critical for offshore oil platform access, pipeline trenching, and deep water infrastructure maintenance.

- Energy companies lease or subcontract dredging operations for laying undersea pipelines, cable protection, and port deepening for LNG terminals.

- Project timelines in the energy sector align well with high-capacity, fast-operating dredgers, especially TSHDs and cutter dredgers.

- With the expanding offshore exploration, the oil and gas end-user segment is projected to grow, significantly fueling the global dredging equipment market expansion.

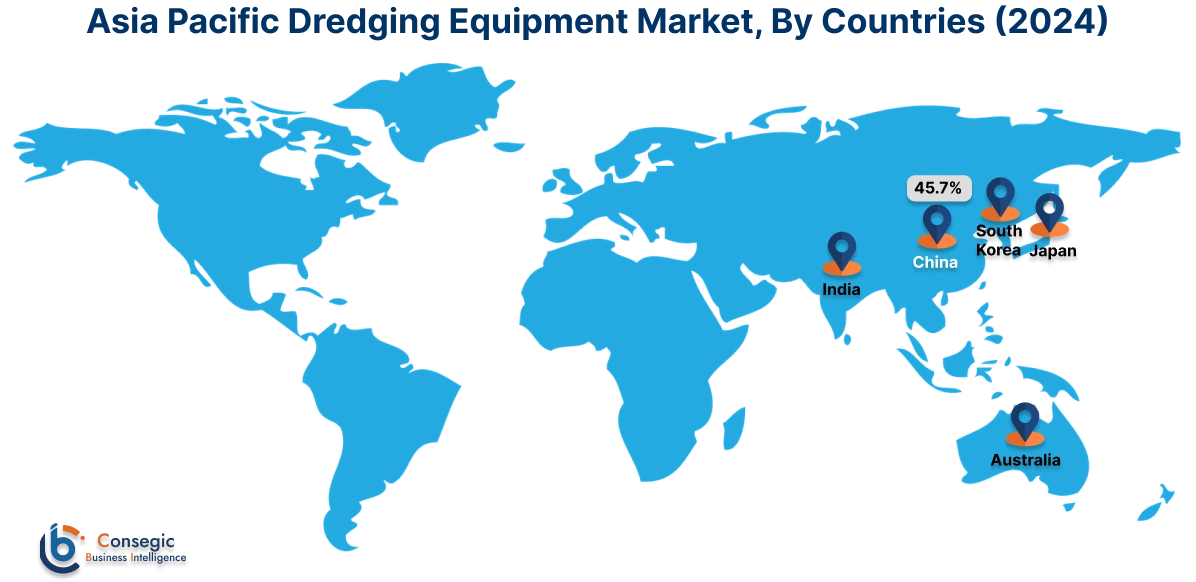

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 1.29 Billion in 2024. Moreover, it is projected to grow by USD 1.35 Billion in 2025 and reach over USD 2.18 Billion by 2032. Out of this, China accounted for the maximum revenue share of 45.7%.

Major port extensions and coastal reclamation projects are spurring demand for advanced dredging solutions in the Asia-Pacific region. In countries like Singapore and Australia emphasis on environmentally sensitive maintenance dredging to preserve channel depths and marine habitats drives market development. A notable trend centers on dual-fuel propulsion systems to meet urban air-quality targets, while another trend highlights AI-driven planning platforms that forecast ecological impacts.

- For instance, in January 2023, HID Shipyard introduced a multifunctional amphibious dredger designed to operate efficiently across diverse terrains, including dry land, shallow waters, and marshy environments. This self-propelled vessel integrates multiple functionalities such as suction dredging, excavation, raking, and pile-driving, into a single platform, enhancing versatility and reducing the need for multiple machines.

Analysis of the market showed that national port modernization programs and public-private partnerships underpin fleet upgrades, significantly driving the dredging equipment market demand.

North America is estimated to reach over USD 2.65 Billion by 2032 from a value of USD 1.58 Billion in 2024 and is projected to grow by USD 1.66 Billion in 2025.

In North America, reliable navigation and coastal infrastructure maintenance are driving continuous dredging fleet upgrades across the region. In the United States, deployment of trailing-suction hopper and cutter-suction dredgers have gained traction, while in Canada collaborations with private firms on modular hopper dredging drives market progress. Trends governing the region include remote-monitored cutter-suction dredgers that optimize fuel consumption and beneficial reuse of dredged sediments for shoreline restoration. Analysis of the market showed that stable maintenance funding and public–private partnerships are significantly driving the Dredging Equipment industry growth in this region.

Europe exhibits a strong presence in the market due to the stringent environmental standards and high cargo throughput requirements. Notable trends in the Netherlands show increased employment of integrated tools for dredging and in Germany, the use of hydraulic dredgers under rigorous sediment management protocols are gaining traction. Analysis of the market showed that EU environmental mandates and cross-border infrastructure grants fuel technology upgrades, significantly boosting the dredging equipment market growth in this region.

Across the Middle East and Africa, rapid waterfront developments and strategic canal extensions are influencing dredging equipment needs. In the United Arab Emirates, mega-project waterfronts rely on corrosion-resistant cutterheads for extended dredging operations. One trend involves solar-assisted auxiliary power to reduce bunker consumption, while another trend focuses on water-lubricated bearings for extended cutterhead life in saline conditions. Analysis of the market showed that sovereign infrastructure funds and strategic partnerships drive procurement of specialized dredgers, fueling the dredging equipment market in this region.

In Latin America, the shifting trend for global shipping-lane competitiveness and coastal port modernization are driving dredging equipment adoption. In Brazil, the hopper-dredge campaigns to support cargo terminals amid evolving trade patterns propel market proliferation. One significant trend highlights multi-role dredgers with quick-change cutter and hopper modules. Analysis of the market showed that trade-corridor investments and private-sector concessions are driving equipment renewal, substantially propelling dredging equipment market growth in this region.

Top Key Players and Market Share Insights:

The Dredging Equipment Market is highly competitive with major players providing products and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global Dredging Equipment Market. Key players in the Dredging Equipment industry include -

- Great Lakes Dredge & Dock Corporation (USA)

- Van Oord (Netherlands)

- SRS Crisafulli, Inc. (USA)

- Dragflow S.r.l. (Italy)

- Western Dredge & Supply Co. (USA)

- National Marine Dredging Company (NMDC) (UAE)

- Ellicott Dredges (USA)

- DSC Dredge, LLC (USA)

- Damen Shipyards Group (Netherlands)

- IMS Dredges (USA)

Recent Industry Developments :

Partnerships and Collaborations:

- In January 2025, Damen Shipyards Group signed a contract with Port Otago and Napier Port in New Zealand for the delivery of a Trailing Suction Hopper Dredger (TSHD) 1000. The vessel, jointly owned by both ports, is designed to support harbor maintenance and dredging operations critical for ensuring navigational depth and port efficiency. The TSHD 1000 will be equipped with advanced technology for optimal performance and environmental compliance.

Dredging Equipment Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 7.96 Billion |

| CAGR (2025-2032) | 6.7% |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Dredging Equipment Market? +

Dredging Equipment Market size is estimated to reach over USD 7.96 Billion by 2032 from a value of USD 4.75 Billion in 2024 and is projected to grow by USD 4.98 Billion in 2025, growing at a CAGR of 6.7% from 2025 to 2032.

What specific segments are covered in the Dredging Equipment Market? +

The Dredging Equipment Market specific segments for Type, Application, End-Users and Region.

Which is the fastest-growing region in the Dredging Equipment Market? +

Asia pacific is the fastest growing region in the Dredging Equipment Market.

What are the major players in the Dredging Equipment Market? +

The key players in the Dredging Equipment Market are Great Lakes Dredge & Dock Corporation (USA), Van Oord (Netherlands), National Marine Dredging Company (NMDC) (UAE), Ellicott Dredges (USA), DSC Dredge, LLC (USA), Damen Shipyards Group (Netherlands), IMS Dredges (USA), SRS Crisafulli, Inc. (USA), Dragflow S.r.l. (Italy), Western Dredge & Supply Co. (USA), and others.