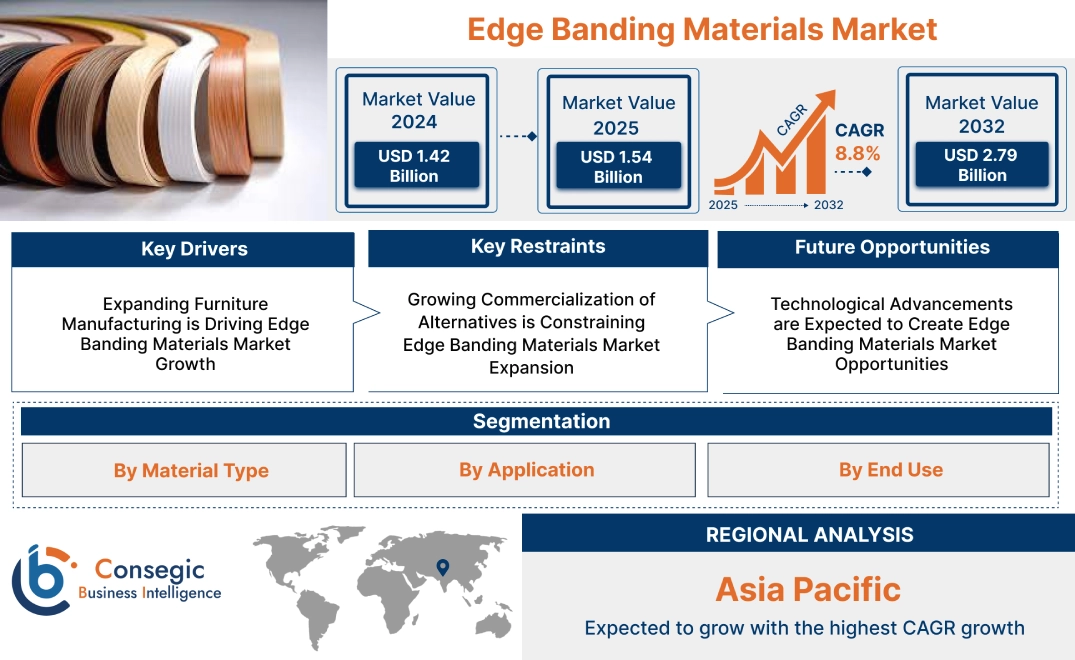

Edge Banding Materials Market Size:

The edge banding materials market size is growing with a CAGR of 8.8% during the forecast period (2025-2032), and the market is projected to be valued at USD 2.79 Billion by 2032 from USD 1.42 Billion in 2024. Additionally, the market value for 2025 is attributed to USD 1.54 Billion.

Edge Banding Materials Market Scope & Overview:

Edge banding refers to the process used to cover and protect the raw edges of plywood, particleboard, and medium-density fiberboard. Materials used in edge banding are of different types such as polyvinyl chloride (PVC), acrylonitrile butadiene styrene (ABS), acrylic, wood, and others. These materials are biodegradable and provide high strength to wooden edges. Edge banding materials are used in various applications such as furniture, countertops, doors and windows, and others. These materials offer several advantages such as moisture resistance, ultraviolet protection, and wear resistance in furniture. Additionally, edge banding materials are used in both residential and commercial sectors where they provide structural integrity and external damage protection to shelves, racks, and windows.

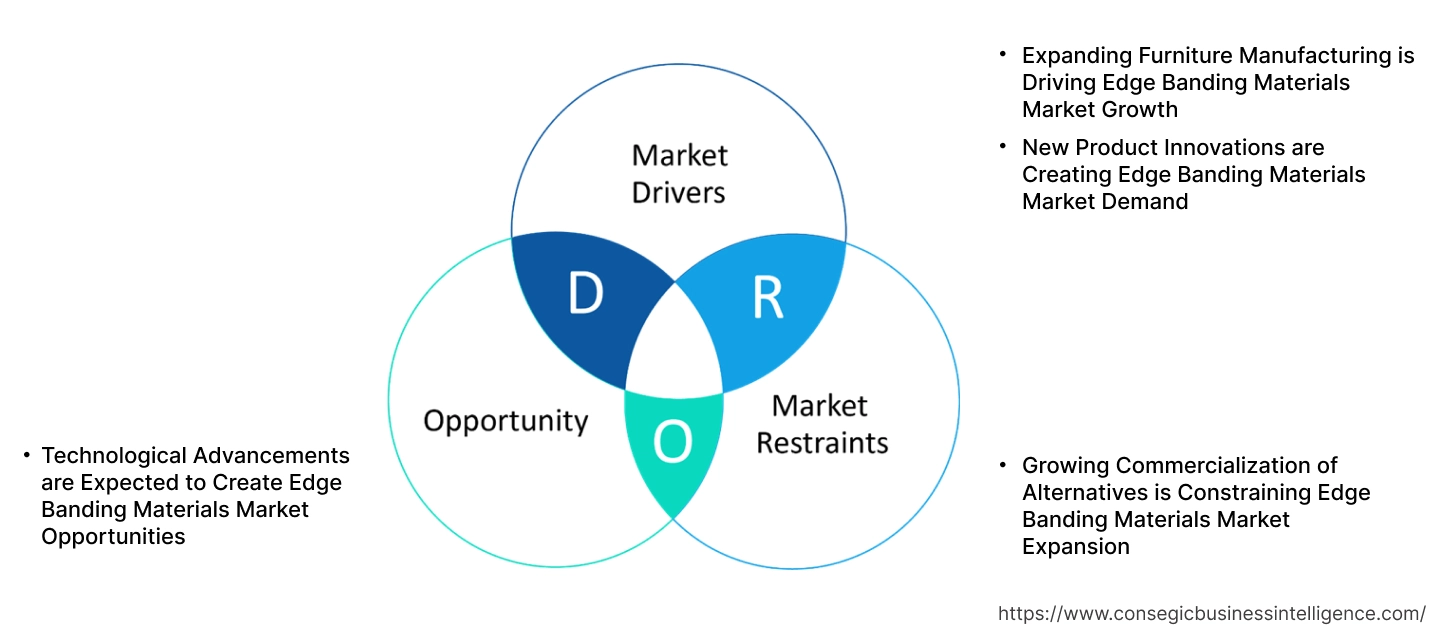

Edge Banding Materials Market Dynamics - (DRO):

Key Drivers:

Expanding Furniture Manufacturing is Driving Edge Banding Materials Market Growth

In furniture manufacturing, edge banding materials are used for dust & dirt prevention as well as for warping or swelling. These materials also enhance structural integrity and stability of furniture. Additionally, companies are investing significantly in furniture manufacturing due to rapid construction activities, urbanization and government support, furthermore, leading to market growth.

- In 2024, Wooden Street invested USD 43 Million in the furniture manufacturing in India. This is facilitating more production of furniture thereby driving the use of edge banding materials for dust and dirt prevention.

Thus, expanding furniture manufacturing is leading to edge banding materials market expansion.

New Product Innovations are Creating Edge Banding Materials Market Demand

Product innovation within the market is creating demand as they cater to evolving consumer needs and preferences. To reduce toxicity, manufacturers are developing edge bands which are made of sustainable material. Also, companies are developing an edge band with enhanced material to offer aesthetic and seamless wooden appearance.

- In 2024, Akij Board launched ProEDGE edge band. This edge is made of polyvinyl chloride material which provides antibacterial and antifungal protection to furniture edges. Also, this edge band is coupled with a built-in adhesive to ensure seamless and refined finishing edges.

Hence, new product innovations are creating edge banding materials market demand.

Key Restraints:

Growing Commercialization of Alternatives is Constraining Edge Banding Materials Market Expansion

The commercialization of alternatives such as solid wood strips, epoxy resin coating amongst others is growing. They provide similar functions to that of edge banding materials. The solid wood strips are widely used in furniture to provide strong and durable edges. Furthermore, epoxy resin coating is used in cabinets, shelves, and closet to improve their moisture and impact resistance. Additionally, other treatments such as painting and molding are cost-effective options for covering edges, especially for painted or finished applications such as tables and racks. Hence, the growing commercialization of alternatives is constraining edge banding materials market growth due to cost effectiveness and superior properties.

Future Opportunities :

Technological Advancements are Expected to Create Edge Banding Materials Market Opportunities

Technological advancements in edge band machines are creating market opportunities. They are enhancing efficiency and precision in the application of edge band materials on furniture edges. In addition to this, technological advancements are ensuring superior consistency, faster production, and reduced labor costs. Moreover, companies are introducing edge band machines with advanced systems.

- In 2025, Samach launched edge band machine with PLC-controlled system. The system ensures the precise application of glue, providing a flawless bond between the edge material and the base material, while minimizing waste. The machine is also able to apply edge banding materials to both straight and curved work pieces with equal efficiency.

Hence, technological advancements are expected to create edge banding materials market opportunities.

Edge Banding Materials Market Segmental Analysis:

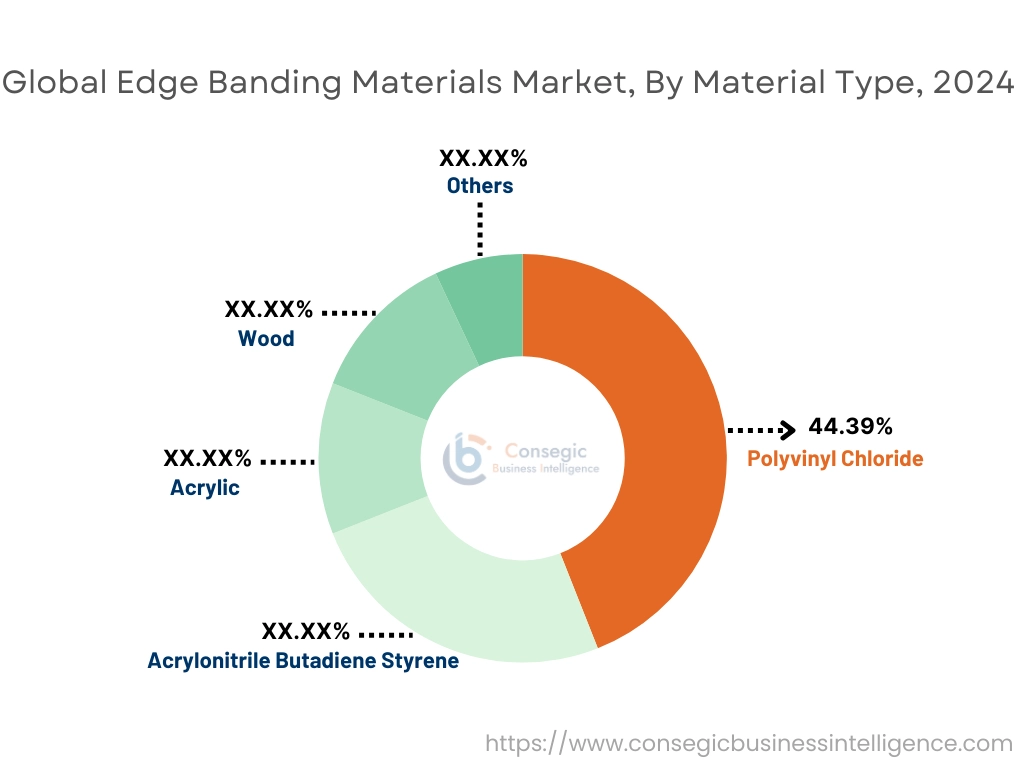

By Material Type:

Based on Material Type, the market is categorized into polyvinyl chloride, acrylonitrile butadiene styrene, acrylic, wood, and others.

Trends in Material Type:

- The polyvinyl chloride is extensively utilized in edge banding for wooden finishes to enhance their durability.

- The adoption of acrylonitrile butadiene styrene is growing in edge banding due to its sustainability as per market trends.

The polyvinyl chloride segment accounted for the largest market share of 44.39% in the year 2024.

- Polyvinyl chloride is a synthetic thermoplastic polymer which is widely used as edge banding material.

- The edge banding made of polyvinyl chloride material offers durability, flexibility, and easy maintenance for premium furniture.

- This material protects the raw edges of furniture from moisture and external damage.

- Furthermore, the adoption of PVC edge bands are growing due to increased construction activities, the rising demand for ready-made furniture, and the need for durable & aesthetic wooden finishes. To cater this, companies are investing in PVC edge bands.

- For instance, in 2024, Gdecor launched new range of PVC edge band. This edge band is used to protect the raw edges of furniture from moisture.

- Hence, as adoption of PVC edge band is growing, the need for polyvinyl chloride material has also increased, in turn driving the segment.

The acrylonitrile butadiene styrene segment is expected to grow at the fastest CAGR over the forecast period.

- The acrylonitrile butadiene styrene is a thermoplastic polymer which is made by combining acrylonitrile, butadiene, and styrene monomers.

- It is used as edge banding material to cover and protect the exposed edges of particleboard to create a finished and durable edge.

- The ABS material provides high abrasion resistance and impact resistance to shelves and doors edges.

- This material is also environmentally friendly which is more recyclable and less harmful in terms of toxic emissions during production and disposal.

- Furthermore, the demand for environmentally friendly edge bands is growing due to environmental concerns and sustainability regulations. To cater this, manufacturers are incorporating acrylonitrile butadiene styrene material in the production of their edge band.

- Hence, as the adoption of environmentally friendly edge band is growing, the need for ABS material will also increase. This will drive the segment for the forecasted years.

By Application:

Based on Application, the market is categorized into furniture, countertops, doors and windows, and others.

Trends in Application:

- According to edge banding materials market trends, these materials are extensively used to protect vulnerable edges of furniture.

- Adoption of edge banding materials is growing in doors and windows to provide heat resistance to wooden edges as per market trends.

The furniture segment accounted for the largest market share in the year 2024.

- The edge banding materials are used in furniture to protect vulnerable edges while maintaining their aesthetics.

- These materials act as a protective barrier, safeguarding the edges of furniture from breakage and damage caused by daily wear and tears.

- They also provide an added layer of impact resistance to furniture edges and preserve the structural integrity of the premium furniture.

- Furthermore, adoption of premium furniture is growing due to rising disposable incomes, urbanization and proliferation of digital media. To cater for this, manufacturers are incorporating edge banding materials in premium furniture for impact resistance.

- Thus, as the adoption of premium furniture is growing, the need for these materials has also increased, in turn driving the segment.

The door and windows segment are expected to grow at the fastest CAGR over the forecast period.

- In doors and windows, edge banding materials are used to protect the edges from damage and improves their appearance.

- These materials also enhance the durability of doors and windows by providing heat resistance to their edges.

- Furthermore, the need for doors and windows is growing due to population growth, growing construction, and technological advancements. To deal with this, companies are investing in the manufacturing of doors and windows.

- For instance, in 2024, Golden Windows Ltd. invested USD 30 Million in the manufacturing of doors and windows. This is leading to more production of doors and windows thereby driving use of edge banding materials for damage protection.

- Hence, as manufacturing of doors and windows is growing, the need for these materials will also increase. This will drive the segment for the forecasted years.

By End-Use:

Based on End-Use, the market is categorized into residential and commercial.

Trends in End-Use:

- As per edge banding materials market trends, these materials are widely used in residential sectors to give polished look to tables, shelves, and closets.

- Use of edge banding materials is increasing in the commercial sector to prevent fading and discoloration of office cabinets as per market trends.

The residential segment accounted for the largest market share in the year 2024.

- In residential, edge banding materials are used to give a finished and polished appearance to the exposed edges of tables, workstations, shelves, and closets.

- They are also used to protect the edges of kitchen and bathroom cabinets from moisture, increase durability, and provide a coherent look.

- Furthermore, the growing adoption of residential furniture is driven by increasing housing development and changing consumer preferences. To deal with this, companies are investing in manufacturing of residential furniture.

- For instance, in 2024, The Belfield Group invested USD 8.1 Million in the production of residential furniture. This is facilitating residential furniture production thereby driving the use of edge banding materials to give a finished and polished appearance to the exposed edges.

- Hence, as production of residential furniture is growing, the need for these materials has also increased, in turn driving the segment.

The commercial segment is expected to grow at the fastest CAGR over the forecast period.

- In commercial, edge banding materials are used to enhance the durability of office cabinets, sofa, conference table, and others.

- These materials are also used to prevent fading, discoloration, and ultraviolet damage in the office furniture.

- In addition to this, these materials help to prevent the edge bands from deteriorating or peeling away over time, even in high-humidity conditions.

- Furthermore, the adoption of office furniture is fueled by corporate expansion, employment rates, and increasing emphasis on workplace comfort. To cater this, manufacturers are increasing manufacturing of office furniture, leading to more use of edge banding materials for ultraviolet damage protection.

- Hence, as the adoption of office furniture is growing, the need for these materials will also increase. This will drive the segment for the forecasted years.

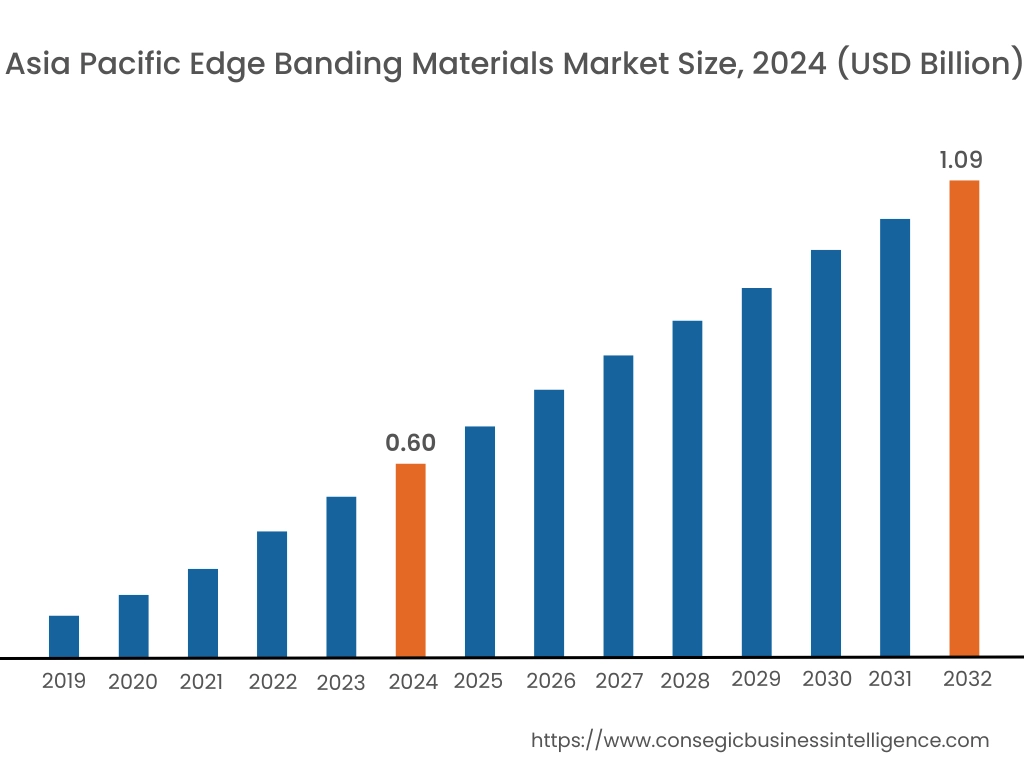

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

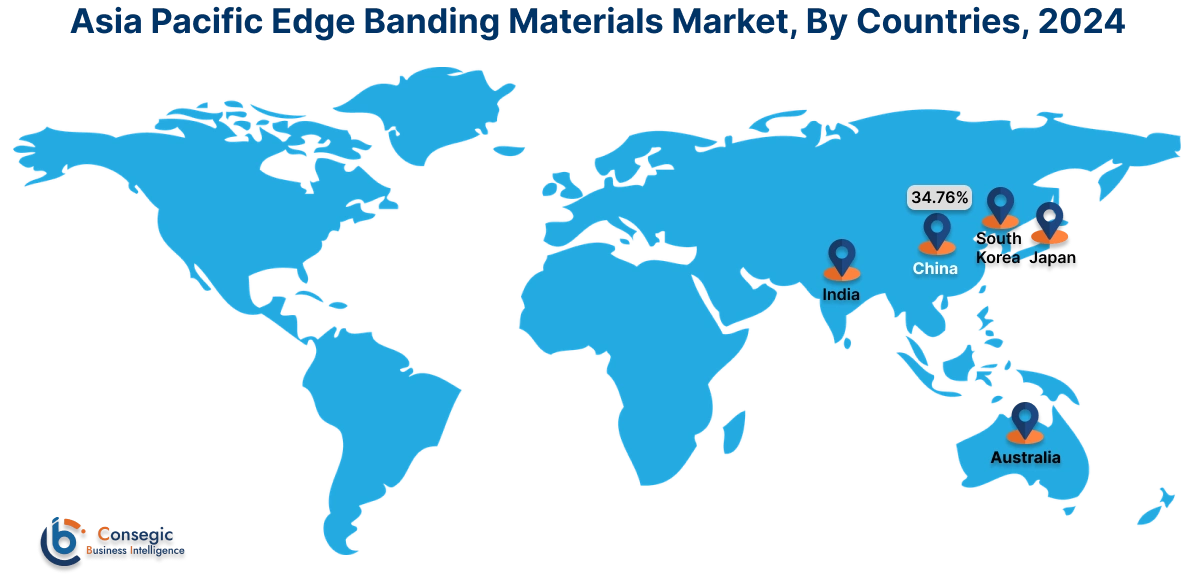

In 2024, Asia Pacific accounted for the highest market share at 42.26% and was valued at USD 0.60 Billion and is expected to reach USD 1.09 Billion in 2032. In Asia-Pacific, the China accounted for the highest edge banding materials market share of 34.76% during the base year of 2024. As per analysis, Asia Pacific region holds a dominant position in the market due to expanding furniture industry. In this industry, edge banding materials are used for absorption of sound vibration in wooden finishes. These materials also protect furniture edges from scratching and enhance its longevity. Moreover, in countries such as China, India, Japan, and South Korea adoption of furniture is growing, furthermore driving the market adoption.

- According to National Bureau of Statistics of China, the retail sales of furniture is increased by 8.8% in China in 2024 as compared to the year 2023. This growing adoption of furniture is driving the use of edge banding materials for the absorption of sound vibration and scratch protection.

Therefore, due to the above-mentioned factors, the Asia Pacific region is dominating in the market as per analysis.

Europe is expected to witness the fastest CAGR of 10.6% over the forecast period of 2025-2032. According to edge banding materials market analysis, Europe region is growing considerably in the market driven by stringent environmental regulations. These regulations are driving the use of edge banding materials which are less toxic and recyclable. These materials are cost-effective and also minimize waste in furniture manufacturing. Additionally, countries such as Germany, France, and United Kingdom are increasing sustainable manufacturing of furniture, furthermore, driving the market across the region. Hence, edge banding materials market share of Europe is expected to emerge rapidly through stringent environmental regulations as per analysis.

According to edge banding materials market analysis, the North America region is growing considerably in the market driven by technological advancements. Advancement in laser edge binding machines have enhanced the efficiency, sustainability, and cost-effectiveness in the application of edge banding materials. Innovations in automation and 3D printing driven process control are optimizing production and ensuring high-performance materials for furniture and doors & windows. This is furthermore fueling the market growth across the region.

The Middle East & Africa region is experiencing moderate growth in the market, driven by the expanding commercial sector. In this sector, particularly in hotel and commercial spaces, edge banding materials are used to cover and protect the edges of wooden furniture. These materials also enhanced both durability and aesthetics of cabinetry. In countries such as Dubai, Saudi Arabia, and South Africa, commercial sector is expanding thereby driving the market growth across the region.

As per analysis, the market in Latin America is driven by the residential sector. In this sector, edge banding materials are used in home furnishing to enhance impact resistance. It is also used in wooden sofas, door panels, and dining tables to enhance water and chemical resistance. Additionally, in countries such as Brazil, Argentina, and Columbia, residential construction projects are expanding. This is leading to the market demand across the region.

Top Key Players and Market Share Insights:

The edge banding materials industry is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and material innovation to hold a strong position in the global edge banding materials market. Key players in the edge banding materials industry include-

Edge Banding Materials Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 2.79 Billion |

| CAGR (2025-2032) | 8.8% |

| By Material Type |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the edge banding materials market? +

In 2024, the edge banding materials market is USD 1.42 Billion.

Which is the fastest-growing region in the edge banding materials market? +

Europe is the fastest-growing region in the edge banding materials market.

What specific segmentation details are covered in the edge banding materials market? +

Material Type, Application, and End-Use are covered in the edge banding materials market.

Who are the major players in the edge banding materials market? +

EGGER (Austria), REHAU (Switzerland), and MKT GmBH (Germany) are some of the major players in the market.