Ethernet Switch Market Size :

Ethernet Switch Market size is estimated to reach over USD 25,477.18 Million by 2030 from a value of USD 17,924.68 Million in 2022, growing at a CAGR of 4.7% from 2023 to 2030.

Ethernet Switch Market Scope & Overview:

An Ethernet switch is a networking device that facilitates the interconnection of multiple devices within a local area network (LAN). The switch operates at the data link layer of the Open Systems Interconnection (OSI) model, enabling the efficient transfer of data between connected devices. Additionally, the switch uses the destination MAC address to determine the appropriate port to forward the data, allowing for simultaneous communication between multiple devices connected to different ports. Moreover, the switch enhances network performance and improves data transfer speeds by providing increased bandwidth and reducing collisions.

Ethernet Switch Market Insights :

Key Drivers :

Increasing demand to provide high-speed connectivity to data centers is propelling the market

Data centers are crucial for storing, processing, and managing large volumes of data, and require robust networking infrastructure to ensure efficient data transmission and connectivity. Ethernet switches play a vital role in data center networks by providing high-speed, low-latency, and reliable connections between servers, storage systems, and other network devices. Additionally, the growing data-intensive applications including cloud computing, big data analytics, artificial intelligence, and the Internet of Things (IoT) are leading to a significant increase in data center traffic. The surge in data traffic requires data centers to scale up their networking capabilities to handle the growing needs. They offer scalability, flexibility, and high performance, and thus are increasingly adopted in data centers. For instance, in April 2023, Edgecore Networks Corporation launched DCS520, an ultra-high capacity 400G switch to meet the growing demands of next-generation data centers. Thus, the analysis of market trends shows that the advanced switch is designed to provide flexibility, low-latency, and high-efficiency data processing to cloud operators along with offering 25.6 Tbps switching capacity, hence contributing notably to driving the Ethernet switch market growth.

An increasing number of small-medium enterprises is raising the demand for establishing local area networks (LANs) within SME environments

SMEs require reliable and efficient network infrastructure to support day-to-day operations. Ethernet switches provide a cost-effective solution for establishing local area networks (LANs) within SME environments. The switches enable SMEs to connect computers, servers, printers, and other network devices, allowing for seamless communication, data sharing, and resource utilization. Additionally, SMEs rely heavily on internet connectivity to conduct various operations. They enable the establishment of reliable and high-speed internet connections within the work environment.

Moreover, with the growing reliance on cloud-based applications, online services, and remote working, SMEs require switches to ensure a stable and faster internet connection for the employees. As per the market trends analysis, the growing number of small and medium enterprises is fueling the Ethernet switch market to provide high-speed data connectivity at an affordable price. For instance, in December 2022, according to a report by The House of Commons Library, 99% of businesses in the United Kingdom are small or medium-sized businesses and SMEs accounted for 61% of the United Kingdom's economy. Additionally, the UK has approximately 217,000 small businesses and 36,000 medium-sized enterprises, thus contributing significantly to driving Ethernet switch market growth.

Key Restraints :

High manufacturing and maintenance costs are hindering the market

The cost of production of Ethernet switches is significantly high which compels the users to seek lower-quality switches that are available at cheap prices. The components utilized in switches include Application-Specific Integrated Circuits, Dynamic RAM (DRAM), and Static RAM (SRAM) are expensive to manufacture. In addition, they require regular maintenance and support, including troubleshooting, firmware updates, and potential repairs. The high maintenance costs associated with switches are a deterrent for organizations, restraining the market. Moreover, the cost of replacement and repair of the switch is also high, leading to additional upfront costs, thus negatively impacting the global Ethernet switch market demand.

The short lifecycle of the built-in fans is restraining the market

In an Ethernet switch, one mechanical component that wears out easily and has a short lifecycle is the fan. They contain built-in fans to dissipate heat generated by the switch's components and help to prevent overheating. The fans in them operate continuously to maintain airflow and keep the internal temperature within acceptable limits. Over time, the constant rotation and exposure to dust and debris cause the fan's bearings to wear out resulting in reduced speed and generation of undesirable sound. Consequently, the inefficient functioning of the fan leads to thermal issues, damaging other components of the switch, thus impeding the Ethernet switch market demand.

Future Opportunities :

Expanding 5G network infrastructure is creating potential opportunities for the Ethernet switch market

5G networks are designed to deliver higher data speeds and lower latency compared to previous generations. The increased performance raises higher demands on the network infrastructure, including Ethernet switches, to handle the higher bandwidth requirements. They play a crucial role in providing the required connectivity and throughput for 5G networks, hence becoming an essential component of the infrastructure. In addition, 5G networks rely on a dense network of amplifiers and base stations to provide widespread coverage and support the massive number of connected devices. Each small cell and base station requires backhaul connections to the core network that are facilitated by switches. The deployment of 5G networks, especially in urban areas is driving the switches to support network densification and ensure reliable and high-speed connectivity. Subsequently, the expanding 5G network infrastructure is creating potential Ethernet switch market opportunities to provide the required connectivity.

Ethernet Switch Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 25,477.18 Million |

| CAGR (2023-2030) | 4.7% |

| By Type | Modular Ethernet Switches and Fixed Configuration Ethernet Switches |

| By Capacity | 100 Megabyte, 1 Gigabyte, 10 Gigabyte, 40 Gigabyte, and 100 Gigabyte |

| By End-User | Consumer Electronics, Healthcare, IT & Telecom, Transportation, Automotive, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Advantech Co., Ltd., NXP Semiconductors N.V., Alcatel-Lucent, Allied Telesis, Brocade Communications Systems, Inc., Cisco Systems Inc., Dell Technologies, D-Link Corporation, Eaton Corporation, Hewlett-Pack Corporation, Honeywell International, Huawei Technologies, Siemens SE |

Ethernet Switch Market Segmental Analysis :

By Type :

The type segment is bifurcated into modular and fixed-configuration. The fixed configuration accounted for the largest market share in 2022 of the global Ethernet switch market share and is also projected to witness the fastest CAGR during the forecast period. Fixed configuration E comprises unmanaged switches, smart switches, managed L2 switches, managed L3 switches, divided switches, and modular switches. Unmanaged switch holds the largest market share as the switches are incredibly easy to use and require no configuration and management. Additionally, unmanaged switches are plug-and-play devices, allowing users to simply connect the devices and immediately start using the network. Moreover, they are more cost-effective in comparison to other fixed-configuration switches, further driving the market. Further, the switches can withstand harsh environmental conditions and are manufactured using corrosion-resistant material, thus contributing considerably to boosting the Ethernet switch market trends. For instance, in April 2022, Versitron Inc. launched unmanaged industrial switches with 100/1G SFP slots and 10/100/1000 RJ45 ports. The switches are designed for basic plug-and-play installations and are corrosion-resistant to withstand harsh environmental conditions.

By Capacity :

The capacity segment is categorized into 100 megabytes, 1 gigabyte, 10 gigabytes, 40 gigabytes, and 100 gigabytes. 1-gigabyte switches accounted for the largest market share in 2022 of the overall Ethernet switch market share, as the switches offer a good balance between speed, cost, and compatibility with existing infrastructure. In addition, many devices, namely computers, servers, and network equipment, are equipped with 1 Gigabit Ethernet port, further driving the dominance of the 1 Gbps segment. Moreover, they are extensively adopted in various network environments, including homes, offices, schools, and small to medium-sized businesses. Furthermore, the 1 Gigabit Ethernet connection provides ample bandwidth to handle network activities, including internet browsing, file sharing, video streaming, and VoIP services. Consequently, the segment trends analysis shows that the aforementioned factors including sufficient bandwidth, cost-effectiveness, and compatibility with existing infrastructure are contributing significantly to bolstering the growth of the 1 gigabyte segment.

100 gigabytes are anticipated to witness the fastest CAGR during the forecast period. This is credited to the increasing adoption of 100 Gbps in industrial and commercial applications namely cloud services, edge computing, and big data. In addition, data centers serve as the backbone of modern digital infrastructure, requiring high-speed and scalable networking solutions. They offer the necessary throughput to connect servers, storage systems, and other networking equipment within the data center, enabling efficient data transfer and supporting the growing needs of data-intensive applications. For instance, in January 2021, Infinite Electronics International, Inc. brand L-com launched WM8-4G-4GP+ and DT10-2G-8GP+, two industrial 100/1000 gigabyte switches with eight ports and ten ports respectively. Thus, the analysis of segment trends analysis shows that advanced switches are introduced to fulfill various commercial and industrial applications by providing required servers and storage systems, hence contributing notably to spurring the Ethernet switch market trends.

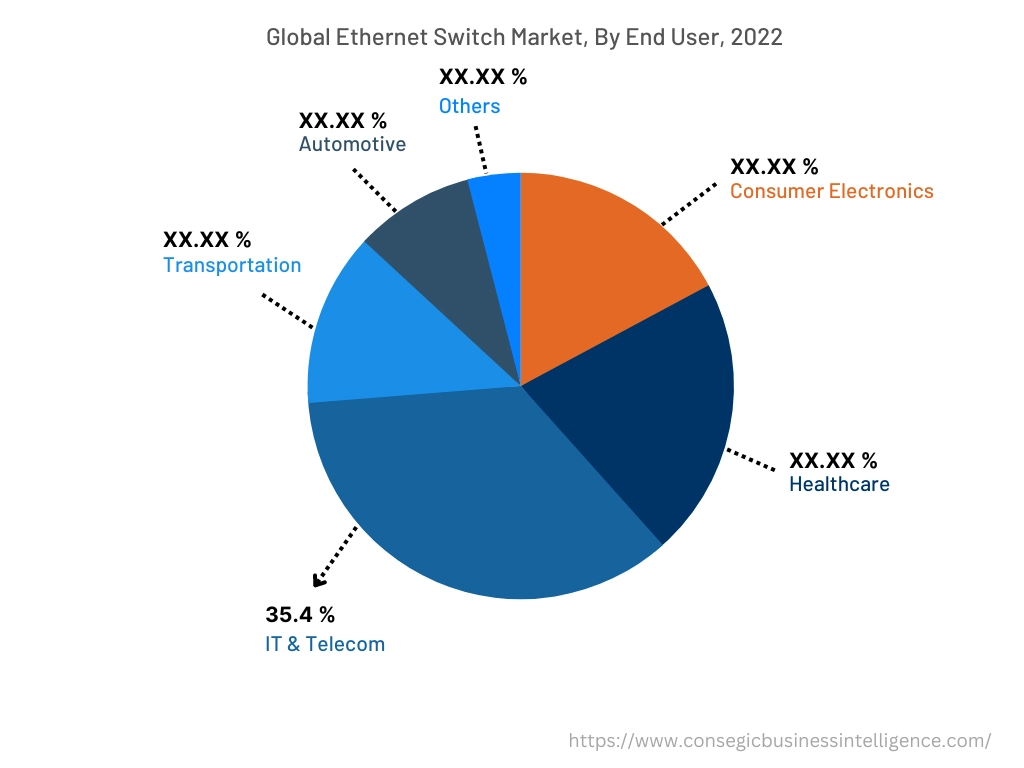

By End-User :

The end-user segment is classified into consumer electronics, healthcare, IT & telecom, transportation, automotive, and others. IT & telecom accounted for the largest market share of 35.4% in 2022 as switches are the primary components to build passive optical LANs in IT and telecom environments. The switches provide connectivity and facilitate data transmission among computers, servers, printers, and other network devices within a local area network. Additionally, they also allow efficient and reliable communication within the LAN, enabling users to share resources and access network services. Consequently, the market trends analysis shows that the expanding IT industry is raising the demand for switches for the development of LANs to provide seamless data transmission. For instance, in February 2023, according to the India Brand Equity Foundation (IBEF), the IT industry accounted for 7.4% of India's GDP in FY22 and is expected to reach 10% by 2025. The expansion in the IT industry thus contributes remarkably to driving the Ethernet switch market.

The consumer electronics segment is predicted to register the fastest CAGR in the Ethernet switch market during the forecast period. They play a vital role in creating home networks, enabling multiple devices to connect to the internet and communicate with each other. In addition, the segment trends analysis shows that the switches facilitate wired connections between devices including computers, gaming consoles, smart TVs, streaming devices, and network-attached storage (NAS) devices. These switches provide the necessary ports to connect devices and establish a reliable and high-speed wired network within the home, thus contributing significantly to driving the Ethernet switch market opportunities.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

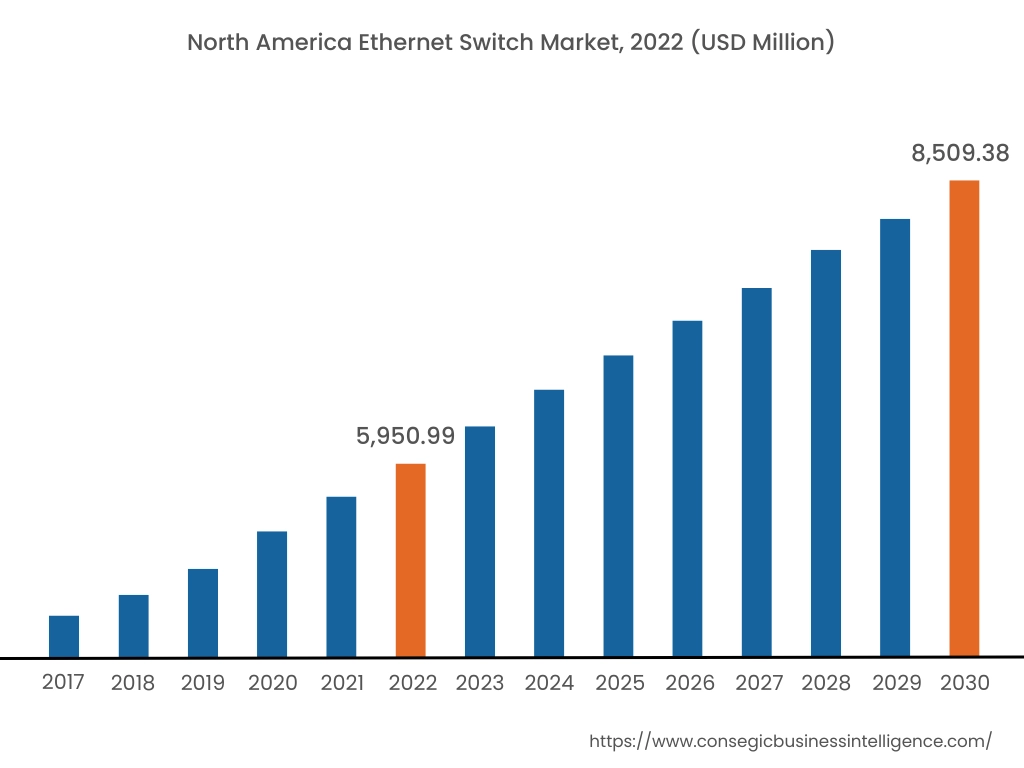

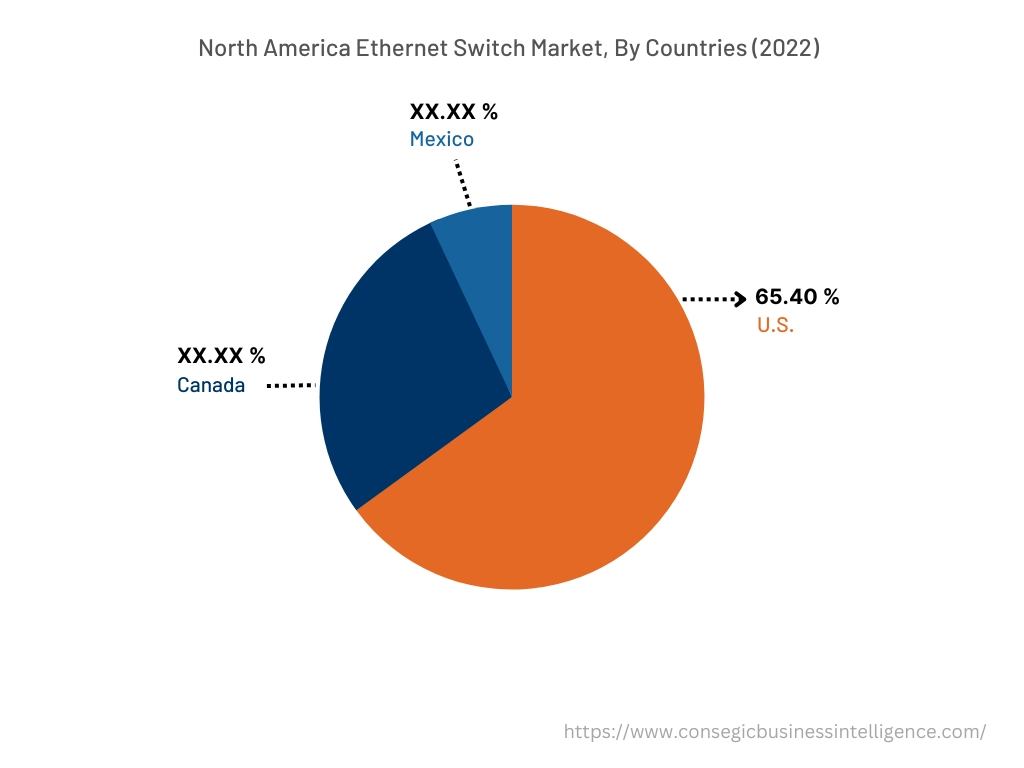

North America accounted for the largest revenue of USD 5.950.99 million in 2022 and is predicted to reach USD 8,509.38 million in 2030 in the Ethernet switch market. In addition, in the region, the U.S. accounted for the maximum revenue of 65.40% in the year 2022. As per the Ethernet switch market analysis, this is attributed to a large number of data centers and cloud service providers. Additionally, the presence of numerous large enterprises and multinational corporations with extensive networking needs requires high-performance and scalable networking solutions, including Ethernet switches, to support the operations. Consequently, the large number of data centers and the presence of key players are the major factors responsible for driving the growth of the Ethernet switch market in the region. For instance, in July 2020, Marvell Technology, Inc. launched a switch to enable efficient and secure data connectivity throughout enterprise networks. Thus the analysis shows that this switch provides higher bandwidth and zero downtime for video and content sharing hence, contributing remarkably to propelling the market growth in the region.

Asia Pacific accounted is expected to register the fastest CAGR of 4.9% in the Ethernet switch market. The growth is credited to the rapid industrialization and infrastructure development in many Asia Pacific countries including India, China, and Japan. The infrastructure development includes smart city initiatives, transportation systems, manufacturing facilities, and energy networks. They play a vital role in providing connectivity and networking capabilities in these infrastructure projects, supporting efficient communication and data exchange. In addition, governments in the Asia Pacific are actively promoting digital transformation initiatives and investing in infrastructure development to foster technological innovation. They are essential for building the necessary networking infrastructure to support government initiatives, hence contributing to market growth.

Top Key Players & Market Share Insights :

The landscape of the Ethernet switch market is highly competitive and has been examined in the report, along with complete profiles of the key players operating in the industry. In addition, the surge in innovations, acquisitions, mergers, and partnerships has further accelerated the Ethernet switch market. Major players in the Ethernet switch industry include-

- Carritech Limited

- Extreme Networks, Inc.

- Qualcomm TechCompany, Inc.

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

- Ribbon Communications Operating Company, Inc.

- FiberHome Technologies

- Fujitsu Limited

- Huawei Technologies Co. Ltd

- Juniper Networks, Inc.

- Rakuten Mobile, Inc.

- NEC Corporation

- Nokia Corporation

Recent Industry Developments :

- In February 2020, Advantech Co., Ltd. launched 10G industrial Ethernet switches with non-blocking mass data aggregation to deliver the high bandwidth needed to support machine vision and video surveillance applications.

- In January 2020, NXP Semiconductors N.V. introduced NXP SJA1110, a multi-gigabit Ethernet switch to enable automakers to provide the high-speed networks required for evolving connected vehicles.

Key Questions Answered in the Report

What is an Ethernet switch? +

An Ethernet switch is a networking device that facilitates the interconnection of multiple devices within a local area network (LAN). The switch operates at the data link layer of the OSI model, enabling the efficient transfer of data between connected devices.

What specific segmentation details are covered in the Ethernet switch market report, and how is the dominating segment impacting the market growth? +

1 gigabyte Ethernet switches dominates the market as the switches offer a good balance between speed, cost, and compatibility with existing infrastructure. In addition, many devices namely computers, servers, and network equipment, are equipped with 1 Gigabit Ethernet port, further driving the dominance of the 1 gbps segment.

What specific segmentation details are covered in the Ethernet switch market report, and how is the fastest segment anticipated to impact the market growth? +

Consumer electronics will register the fastest CAGR as Ethernet switches play a vital role in creating home networks, enabling multiple devices to connect to the internet and communicate with each other.

Which region is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Asia Pacific is anticipated to witness the fastest CAGR during the forecast period due to the rapid industrialization, infrastructure development and increasing investment by the government.