Expanded Metal Foils Market Size:

The Expanded Metal Foils Market size is growing with a CAGR of 8.5% during the forecast period (2025-2032), and the market is projected to be valued at USD 1.11 Billion by 2032 from USD 0.58 Billion in 2024. Additionally, the market value for 2025 is attributed to USD 0.63 Billion.

Expanded Metal Foils Market Scope & Overview:

Expanded metal foils are materials produced by the simultaneous process of slitting and stretching a single sheet of metal. This results in a distinct monolithic mesh structure without any welds or joints. This process creates a product that is strong in nature yet lightweight along with good electrical and thermal conductivity. With respect to thickness, it ranges from micro-thin to a millimeter, providing flexibility and a high surface area. This makes it a suitable option across a wide range of industries. They are utilized for applications such as lightning strike protection, wind turbine blades, solar panels, flexible printed circuit boards (PCBs), filtration systems, and others.

How is AI Impacting the Expanded Metal Foils Market?

Artificial Intelligence is transforming the expanded metal foils market by improving manufacturing precision, process optimization, and product innovation. In production, AI-powered systems monitor parameters such as tension, thickness, and expansion rate in real time to ensure uniformity and reduce defects. Machine learning models analyze operational data to predict equipment maintenance needs, minimizing downtime and extending machinery lifespan. AI also accelerates the development of customized metal foils with enhanced strength, conductivity, or corrosion resistance for industries like electronics and aerospace. Furthermore, AI-driven demand forecasting helps manufacturers align production with market trends and reduce material waste. Overall, AI is making expanded metal foil manufacturing smarter, more efficient, and better suited to high-performance industrial applications.

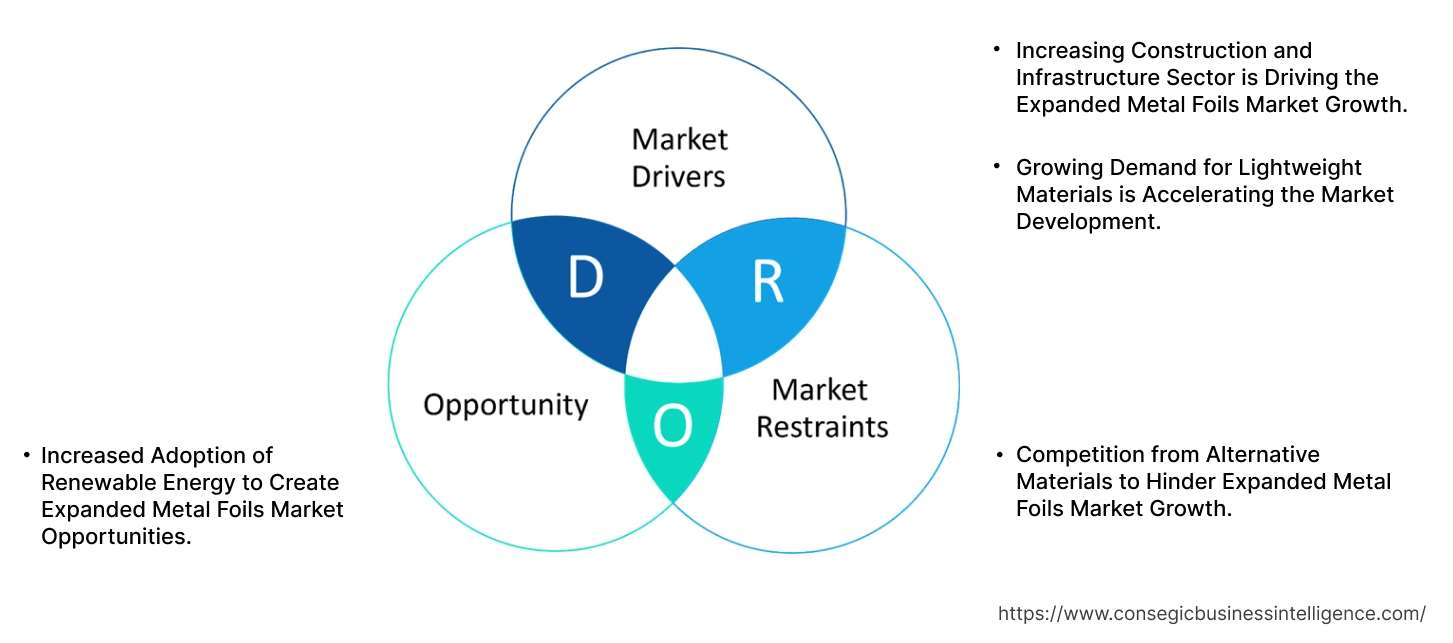

Expanded Metal Foils Market Dynamics - (DRO) :

Key Drivers:

Increasing Construction and Infrastructure Sector is Driving the Expanded Metal Foils Market Growth.

There is an increase in construction and infrastructure development across the globe. This includes residential and commercial buildings, which are requiring expanded metal foils heavily. These foils offer properties such as lightweight, yet robust structure, and a high strength-to-weight ratio that provide advantages over traditional materials. In the construction sector, they are utilized for decorative panels, ceilings, and sunshades, offering both aesthetic appeal and functional benefits. Moreover, their use in critical structural and protective roles are further contributing to their high requirement.

- For instance, according to Oxford Economics, construction spending across the globe attributed to more than USD 9.5 Trillion in 2022, thus positively impacting expanded metal foils market trends.

Hence, due to the aforementioned factors, increasing construction and infrastructure sector is driving the development of the market.

Growing Demand for Lightweight Materials is Accelerating the Market Development.

The need for lightweight materials in industries such as aerospace, automotive, and defense are requiring materials that significantly reduce weight without compromising strength or performance. Expanded metal foils are a suitable option that aligns with these requirements. They offer an exceptional strength-to-weight ratio, thereby optimizing material usage while maintaining structural integrity. This lightweight characteristic directly translates to improved fuel efficiency and extended range in EVs and others. The growing need for EVs, particularly in China is further contributing to the high requirement of these metal foils.

- For instance, according to IEA, the sales of electric cars in China increased by almost more than 30% from 2023 to 2024 thus positively impacting expanded metal foils market trends.

Thus, owing to the aforementioned factors, the growing need for lightweight materials is accelerating the expanded metal foils market expansion.

Key Restraints :

Competition from Alternative Materials to Hinder Expanded Metal Foils Market Growth.

The market hurdles from alternative materials that offer lower costs, easier processing, and other functionalities that are required for target-specific applications. One of the alternatives is that perforated metal provides diverse hole patterns. They are preferred by manufacturers focusing on specific aesthetics or fine filtration. In addition to this, woven and welded wire meshes provide reinforcement and structural needs. Moreover, solid foils are a suitable option when maximum unperforated strength is required. This competition leads to the limitation of the market. Therefore, the above-mentioned factors are contributing to hindrances in the expanded metal foils market expansion.

Future Opportunities :

Increased Adoption of Renewable Energy to Create Expanded Metal Foils Market Opportunities.

The adoption of renewable energy technologies requires expanded metal foils across various green energy applications. This includes lightning strike protection in wind turbine blades, where their conductive properties deplete electrical charges. In the rapidly growing energy storage sectors, they are utilized as collectors in batteries and gas diffusion layers in fuel cells. This focus on investment in renewable energy infrastructure requires materials such as these metal foils creating potential over the forecast period.

- For instance, according to the IEA, the consumption of renewable energy in the heat, power, and transport sectors is expected to increase by more than 50% by 2030, creating potential for the market.

Thus, due to the aforementioned factors, increased adoption of renewable energy is expected to create expanded metal foils market opportunities.

Expanded Metal Foils Market Segmental Analysis :

By Material Type:

Based on material type, the market is categorized into aluminum foils, copper foils, stainless steel foils, nickel foils, and others.

Trends in Material Type:

- The expanded metal foils made from aluminum are highly preferred by manufacturers due to their inherent lightweight nature, excellent electrical conductivity, and other features.

- Copper-expanded metal foils are experiencing the fastest growth, primarily propelled by the global push for electrification and advanced electronics.

The aluminum foils segment accounted for the largest expanded metal foils market share in 2024.

- The aluminum foils segment holds prominence due to aluminum's combination of properties that align with industrial needs.

- Its lightweight nature allows for application across a wide range of industries such as aerospace for lightning strike protection in composite structures amongst others.

- For instance, according to IATA, the full-year traffic across the globe in 2024 increase by 10.4% in 2024 as compared to 2023, stating the need for new aircraft wherein expanded metal foils are the preferred option.

- Furthermore, aluminum-expanded foils offer electrical conductivity and a robust strength-to-weight ratio. This caters to a wide range of industries apart from aerospace.

- Thus, as per the expanded metal foils market analysis, the aluminum foils segment is dominating the expanded metal foils market demand.

The copper foils segment is expected to grow at the fastest CAGR over the forecast period.

- The copper foils segment is driven by the inclusion due to their electrification trend. Copper's electrical and thermal conductivity of superior nature makes it an ideal choice for collectors in electric vehicle (EV) batteries and energy storage systems.

- Furthermore, its role in lightning strike protection for wind turbine blades along with the utilization of EMI/RFI shielding in advanced electronics are further contributing to the segment.

- As industries wherein electrification and thermal conductivity are growing, the need for copper-based films is expected to experience high demand as well.

- Thus, based on the expanded metal foils market analysis, the copper foils segment is the fastest growing segment in the market.

By Application:

The Application segment is categorized into lightning strike protection, wind turbine blades, solar panels, flexible printed circuit boards (PCBs), filtration systems, and others.

Trends in the Application

- The utilization of lightning strike protection for aircraft to safely dissipate lightning current across the surface is increasing.

- Expanded metal foils used in flexible PCBs for EMI/RFI shielding in flexible printed circuit boards (PCBs) are gaining traction.

The lightning strike protection segment accounted for the largest market share in 2024 and is expected to grow at the fastest CAGR over the forecast period.

- The lightning strike protection within the aerospace and wind energy sectors is contributing to the growth of the expandable metal foils market.

- This increase in need is due to the increasing adoption of lightweight electrically non-conductive composite materials in aircraft structures and blades of wind turbines.

- As these industries are focusing on fuel efficiency and larger scales, they need solutions to remove the damage that lightning strikes inflict.

- Expanded metal foils, made from aluminum and copper, are used as they are incorporated into composite skins to safely dissipate the high-energy electrical current across the surface.

- Thus, based on the market analysis, as per the aforementioned factors, the lightning strike protection segment is dominating as well as the fastest-growing expanded metal foils market demand.

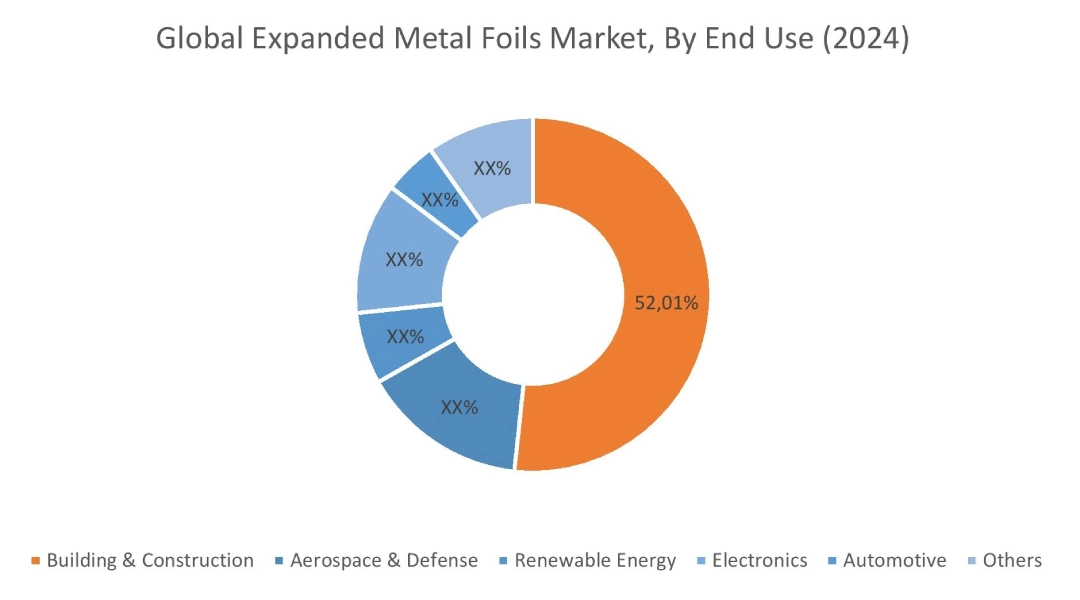

By End Use:

The End Use segment is categorized into building & construction, aerospace & defense, renewable energy, electronics, automotive, and others.

Trends in the End Use:

- The versatility provided by expanded metal foils in building and construction due to their aesthetic offering along with enhanced security are highly preferred.

- Expanded metal foils utilization in wind turbine blades for lightning strike protection is gaining traction.

The building & construction segment accounted for the largest expanded metal foils market share of 52.01% in 2024.

- The dominance of the building and construction segment is due to the properties provided by expanded metal foils. It is suitable for a wide range of applications in modern infrastructure and architectural design.

- Their utilization includes unique aesthetic elements, ceilings, and interior design to offer functional purposes such as controlled ventilation, and enhanced security amongst others.

- Furthermore, their lightweight nature makes them a suitable choice for reinforcement in concrete, and walkways amongst others, further contributing to the segment.

- For instance, according to the Associated General Contractors of America, more than 900k establishments of construction were built in the U.S. in 2023 the first Quarter.

- Thus, based on the market analysis, as per the aforementioned factors, the building & construction segments are dominating the market.

The renewable energy segment is expected to grow at the fastest CAGR over the forecast period.

- The renewable energy segment is driven by the rising commitment to sustainable energy sources across the globe. Expanded metal foils are utilized as key components in renewable technologies.

- They are utilized for lightning strike protection in wind turbine blades, a major segment in renewable energy requiring a high need for these metal foils.

- Their conductive properties help in dissipating the electrical charges safely. Furthermore, their superior electrical conductivity makes them an ideal option for current collectors in the electric vehicle (EV) battery and energy storage systems markets.

- Thus, based on market analysis and aforementioned factors, the renewable energy segment is the fastest-growing segment in the industry.

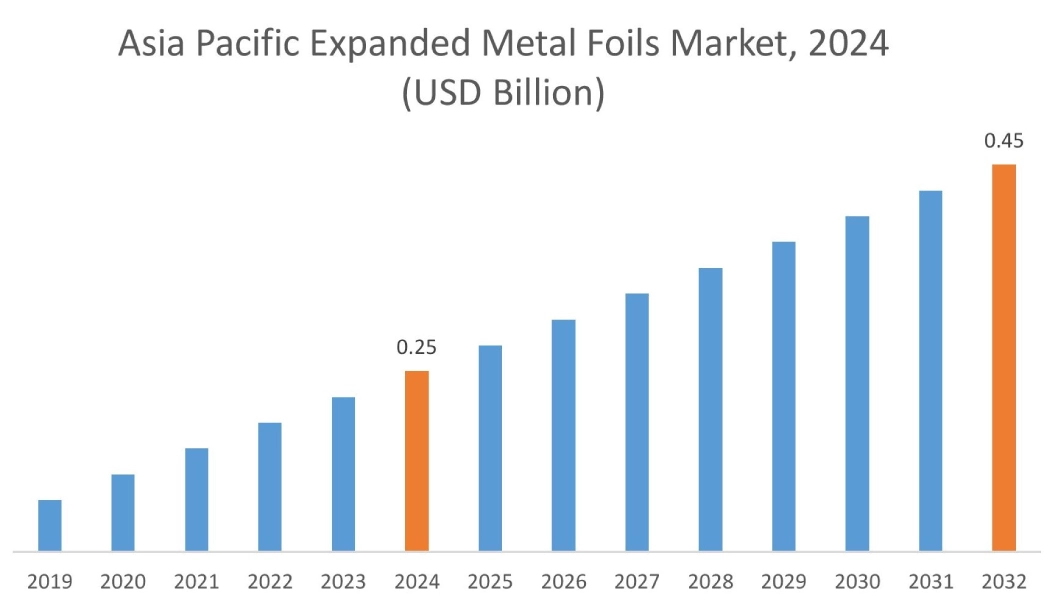

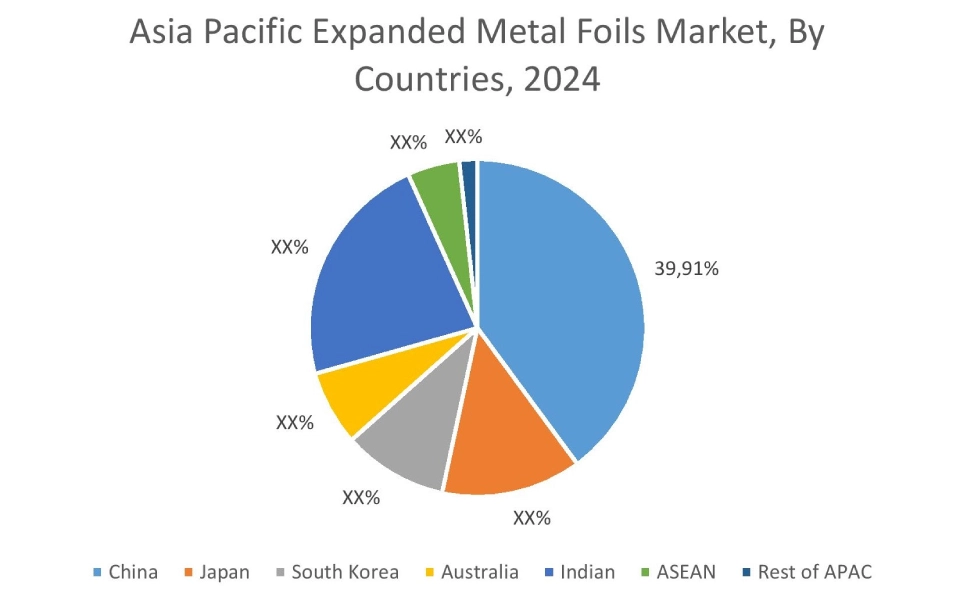

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, Asia Pacific accounted for the highest market share at 43.12% and was valued at USD 0.25 Billion and is expected to reach USD 0.45 Billion in 2032. In Asia Pacific, China accounted for a market share of 39.91% during the base year of 2024. The Asia Pacific region's construction and infrastructure sector is driven by government investments. The requirements for lightweight, durable, and aesthetically versatile materials in countries such as China, Japan, and India is surging. Expanded metal foils are used for building facades, cladding, and others that align with the region's strong emphasis on green building practices and technological advancements. These trends are contributing to market revenue in the region.

- For instance, according to Japan Build, the construction market in Japan is expected to increase by 3.3% from 2024 to 2029, with a focus on reconstruction efforts amongst others.

Based on the market analysis, these factors create a strong upward trajectory for the market in Asia Pacific, positioning it as a key region for players.

In Europe, the expanded metal foils industry is experiencing the fastest growth with a CAGR of 8.5% over the forecast period. The European expanded metal foils market is driven by electric vehicles (EV) production, primarily in countries such as Germany, France, and the UK market. Additionally, the growing focus of the EU government with a focus on stringent EU emission targets, and an expanding range of EV models are contributing to the region’s growth. This surge in EV manufacturing is contributing to the demand for essential battery components. Thus, the aforementioned factors are driving the market in the region.

In the automotive industry in North America, fuel efficiency standards and the rise in EV production are driving the need for lighter components, wherein expanded aluminum and copper foils are utilized. Similarly, the aerospace and defense industries rely on these foils for EMI/RFI shielding and lightning strike protection in composite aircraft and defense systems. In building and construction, the trend towards lighter components is increasing requirements. The above aforementioned factors are driving the market in the region.

In Latin America, expanded metal foils are preferred for utilization in renewable energy. The rise in investments in wind and solar power in countries such as Brazil, and Chile amongst others is requiring the need for crucial components such as these metal foils. These foils are crucial for lightning strike protection in wind turbine blades as well as collectors in the EV battery manufacturing sector. Government policies supporting energy security are further contributing to regional growth. These factors collectively contribute to the Latin American expanded metal foils market demand.

The market in Middle East and Africa region is driven by the requirement for EMI/RFI shielding. In addition to this, the expedited deployment of 5G networks and adoption of Internet of Things (IoT) devices are making expanded metal foils important for reliable performance in smart applications. Moreover, the rising consumption of consumer electronics requires robust internal shielding for miniaturized designs further contributing to the growth in this region. These factors collectively contribute to the Latin American expanded metal foils market demand.

Top Key Players & Market Share Insights:

The Global Expanded Metal Foils Market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Expanded Metal Foils market. Key players in the Expanded Metal Foils industry include

- Niles International (U.S.)

- New Metals, Inc. (U.S.)

- Yilida Metal Wire Mesh Co., Ltd. (Canada)

- CThru Metals (U.S.)

- Wallner Expac (U.S.)

- Alabama Metal Industries Corporation (AMICO) (U.S.)

Expanded Metal Foils Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 1.11 Billion |

| CAGR (2025-2032) | 8.5% |

| By Material Type |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Expanded Metal Foils market? +

In 2024, the Expanded Metal Foils market is USD 0.58 Billion.

Which is the fastest-growing region in the Expanded Metal Foils market? +

Europe is the fastest-growing region in the Expanded Metal Foils market.

What specific segmentation details are covered in the Expanded Metal Foils market? +

By Material Type, Application and End Use segmentation details are covered in the Expanded Metal Foils market.

Who are the major players in the Expanded Metal Foils market? +

Niles International (U.S.), CThru Metals (U.S.), and Wallner Expac (U.S.) are some of the major players in the market.