Financial Leasing Market Size :

Financial Leasing Market size is estimated to reach over USD 316.71 Million by 2030 from a value of USD 209.69 Million in 2022, growing at a CAGR of 5.4% from 2023 to 2030.

Financial Leasing Market Scope & Overview:

Financial leasing is defined as a financial arrangement in which a finance company termed as a lessor provides an asset to another party called a lessee for a specific period and the lessee will pay a series of installments to the lessor. The lessor recovers the complete cost or a large part of the asset and also earns interest from the rentals paid by the lessee.

Financial Leasing Market Insights :

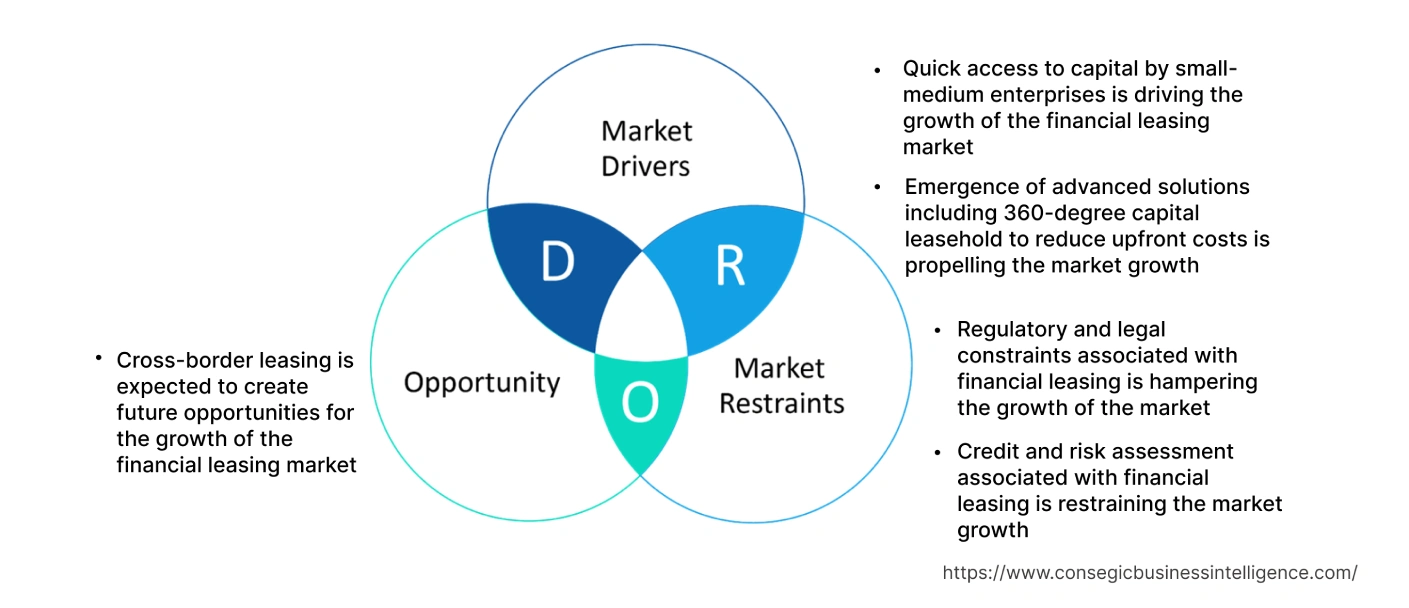

Financial Leasing Market Dynamics - (DRO) :

Key Drivers :

Quick access to capital by small-medium enterprises is driving the financial leasing market

Businesses, particularly small and medium-sized enterprises (SMEs), face capital constraints that prevent SMEs from investing and acquiring assets. Financial leasing provides a viable alternative by allowing businesses to access the necessary equipment, machinery, vehicles, and services without the need for significant capital outlays. Additionally, by providing a means to overcome capital limitations, it enables businesses to expand their operations, enhance productivity, and pursue expansion. For instance, according to the International Finance Corporation, 40% of small-medium enterprises, or 65 million enterprises in developing countries, require approximately USD 5.2 trillion of financial support every year. Hence, the market trends analysis shows that the rising adoption of financial support among SMEs, particularly in developing countries, thus contributes significantly to driving the financial leasing market growth.

The emergence of advanced solutions including 360-degree capital leasehold to reduce upfront costs is propelling the market

The widespread adoption of the internet and digital platforms has revolutionized the industry. Online platforms offer convenience for lessors and lessees to connect and transact, facilitating efficient and streamlined lease processes. In addition, digital platforms including 360-degree capital leaseholds provide a convenient and transparent way for businesses to search for leasing options, compare rates, submit applications, and manage lease agreements. Moreover, they also offer greater tax benefits as payments are 100% tax-deductible, further driving the market. For instance, in May 2021, Skootr introduced a 360-degree leasing solution model Skootr FinSave for large and medium-sized enterprises. The solution integrates additional tax benefits, effective stock management, fleet operations, warranty, and equipment compliance solutions to reduce the upfront costs, hence contributing remarkably to accelerating the financial leasing market growth.

Key Restraints :

Regulatory and legal constraints associated are hampering the market

Accounting standards including the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP) are among the regulatory bodies regulating standards for financial leasing. Any changes in the standards create a significant impact on the balance sheet and financial ratios of both lessors and lessees. In addition, changes in accounting standards necessitate businesses to reevaluate lease agreements to focus on the net gain or loss. For instance, in January 2019, the IFRS Foundation changed the accounting for lessees by eliminating the lessee's classification of leases as either operating leases or finance leases to improve the economic status of the market. Thus, the market trends analysis shows that the aforementioned factors drive the financial leasing market demand.

Credit and risk assessment associated is restraining the market

Credit and risk assessment challenges make lessors more cautious about extending lease financing to businesses. Lessors need to evaluate the creditworthiness and financial stability of lessees to assess the risk of defaults or late payments. Limited access to accurate financial information, particularly for small businesses, makes the risk assessment process more challenging, resulting in higher interest rates by the lessor to mitigate the perceived risks. Additionally, credit and risk assessment create limited financing prospects for lessees with poor credit histories or high-risk profiles. Lessors are reluctant to provide leasing options to businesses with a higher probability of financial instability, thus impeding the financial leasing market trends.

Future Opportunities :

Cross-border leasing is expected to create future opportunities for the market

Cross-border leasing enables businesses to expand their operations into new markets and countries and financial leasing provides a flexible and cost-effective solution to acquire assets without committing to long-term ownership. It creates new prospects for lessors, to cater to the equipment needs of multinational corporations and businesses. Additionally, it allows businesses to mitigate foreign exchange risks associated with asset acquisition. Businesses avoid the challenges of currency fluctuations and exchange rate risks by leasing assets in local currencies. Lessors offer lease contracts denominated in the local currency of the lessee, providing stability and predictability in lease payments. The risk mitigation aspect makes it an attractive option for businesses expanding into foreign markets and is expected to create potential financial leasing market opportunities.

Financial Leasing Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 316.71 Million |

| CAGR (2023-2030) | 5.4% |

| By Type | Banks and Non-Banks |

| By Product | Domestic Business and International Business |

| By Application | Transportation, Medical Devices, Energy & Environment, Construction Equipment, Industrial Machinery, IT & Telecom, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Bank of America Corporation, BNP Paribas Leasing Solutions, Commerce Bancshares, Inc., Crest Capital, Fifth Third Bank, HSBC Group, M&I Equipment Finance, North Star Leasing, SMBC Group, Texas Capital Bancshares, Inc., Wells Fargo Bank N.A., XCMG America Financial LLC |

Financial Leasing Market Segmental Analysis :

By Type :

The type segment is bifurcated into banks and non-banks. Banks accounted for the largest market revenue in 2022 in the total financial leasing market share, as banks have well-established infrastructure and networks to offer a wide range of financial products and services, including financial leasing. In addition, they have existing relationships with customers, access to capital markets, and the necessary expertise in risk management that gives banks a competitive advantage in providing leasing services. Furthermore, they are entering into partnerships with leasing firms to enhance the customer base among small and medium enterprises, thus contributing significantly to driving the market. For instance, in November 2021, Zhujiang Financial Leasing Company and Asian Development Bank signed a contract for USD 40 million to enhance the company's leasing portfolio by offering funds to small and medium organizations in the People's Republic of China. Thus, the analysis of segment trends shows that the aforementioned reasons drive the segmental growth.

The non-banks are anticipated to witness the fastest CAGR in the financial leasing market during the forecast period. Non-bank financial institutions, including fintech companies and specialized leasing firms, bring innovation and disruption to the financial services sector. The companies leverage technology and digital platforms to offer alternative and streamlined leasing solutions. In addition, non-bank financial institutions specialize in specific sectors and possess expertise in specific domains, to offer tailored leasing solutions that meet the unique requirements of businesses. Niche expertise enables non-bank institutions to differentiate themselves from traditional banks and attract customers looking for specialized leasing options. Consequently, analysis of segment trends shows that the ability of non-bank organizations to cater to specific industry needs contributes significantly to propelling the financial leasing market opportunities.

By Product Type :

The product segment is bifurcated into domestic business and international business. Domestic businesses accounted for the largest market share in 2022 in the total financial leasing market share, as domestic businesses have a deep understanding of the local market conditions, including industry dynamics, customer preferences, and regulatory frameworks. In addition, domestic organizations have established relationships with local suppliers, manufacturers, and customers that provide a competitive advantage in identifying and fulfilling leasing chances. Familiarity with the local market allows domestic businesses to better assess risks, structure lease agreements, and provide tailored solutions to meet the specific needs of local customers. Moreover, the domestic market players constantly apply innovative strategies to expand their portfolios in the regional market, thus contributing considerably to bolstering the market. For instance, in March 2022, Quiklyz, a subscription platform and vehicle leasing of Mahindra & Mahindra Financial Services announced the expansion of the leasing services in 5 additional cities in India, accounting for a total of 13 cities across India.

International business is predicted to register the fastest CAGR in the financial leasing market during the forecast period. This is endorsed by the ability of international businesses that have sufficient resources and capabilities to expand their operations beyond domestic borders. Furthermore, international businesses seek leasing options to acquire assets and equipment in new emerging markets that contribute remarkably to spurring the market. Additionally, international businesses have cross-border operations to access assets in different countries and it offers flexibility and convenience in acquiring the assets eliminating the need for capital-intensive purchases. International businesses effectively manage asset requirements across multiple locations by utilizing cross-border leasing, leading to increased demand for services. In conclusion, the analysis of segment trends shows that the aforementioned factors are collectively responsible for boosting the international business segment during the forecast period, thus in turn driving the financial leasing market demand.

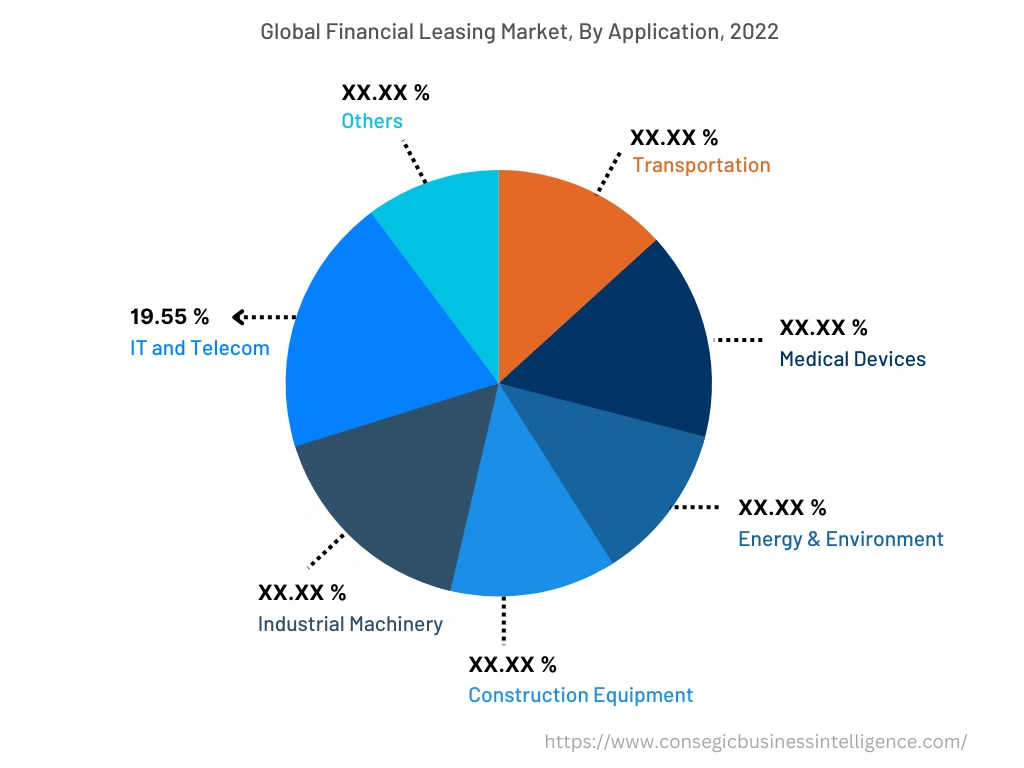

By Application :

The application segment is categorized into transportation, medical devices, energy & environment, construction equipment, industrial machinery, IT & telecom, and others. IT & telecom accounted for the largest market share of 19.55% in 2022 as the companies require a range of hardware and equipment including servers, networking devices, telecommunications equipment, data centers, and communication towers. It allows businesses to acquire assets without a large upfront capital investment.

Moreover, leasing agreements are structured to cover the cost of the equipment, installation, maintenance, and upgrades, providing flexibility and ensuring that businesses have access to the latest technology. In addition, several leasing companies are entering into partnerships with IT & telecom enterprises to expand their customer base, hence contributing significantly to fueling the market. For instance, in May 2022, SatLease Capital announced the enhancement of the existing partnership with Blue C Mobile. The goal of the partnership is to improve the operational efficiency of all of Blue C Mobile's hardware solutions using lower throughput communications technologies including Inmarsat Fleet Broadband or Iridium. Thus, the analysis of segment trends indicates that the previously mentioned reasons are the driving force behind the segmental expansion.

Medical devices are predicted to register the fastest CAGR in the global financial leasing market during the forecast period. Medical imaging devices including MRI machines, CT scanners, ultrasound machines, and X-ray systems are essential for diagnosing and monitoring various medical conditions. The devices are expensive to purchase outright, thus leasing enables healthcare providers to acquire the latest imaging equipment without a huge upfront investment. Additionally, this leasing is also employed for acquiring laboratory equipment, including analyzers, spectrophotometers, and DNA sequencers. The devices play a crucial role in diagnostic testing, research, and drug development. It allows healthcare facilities, research institutions, and pharmaceutical companies to access the latest laboratory technology while managing costs, thus contributing remarkably to driving the medical devices segment.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America accounted for the largest revenue share in the year 2022 owing to the well-developed and established financial services sector. North America encompasses some of the largest banks, financial institutions, and leasing companies globally. In addition, the institutions have extensive experience, expertise, and infrastructure in providing leasing services. Furthermore, the market trends analysis shows that the long-standing presence and market dominance contribute remarkably to North America's leadership in the financial leasing market. Moreover, the presence of key players in the region, including Wells Fargo Leasing, XCMG America Financial LLC, and M&I Equipment Finance constantly apply strategic decisions through mergers and collaboration to strengthen the market position. For instance, in June 2022, QuickFi partnered with XCMG America Financial LLC to offer to fund Xuzhou Construction Machinery Group Co., Ltd. equipment. The partnership aims to offer financial funding for the development of XCMG equipment including MEWP, excavators, wheel loaders, graders, and compactors across the U.S.

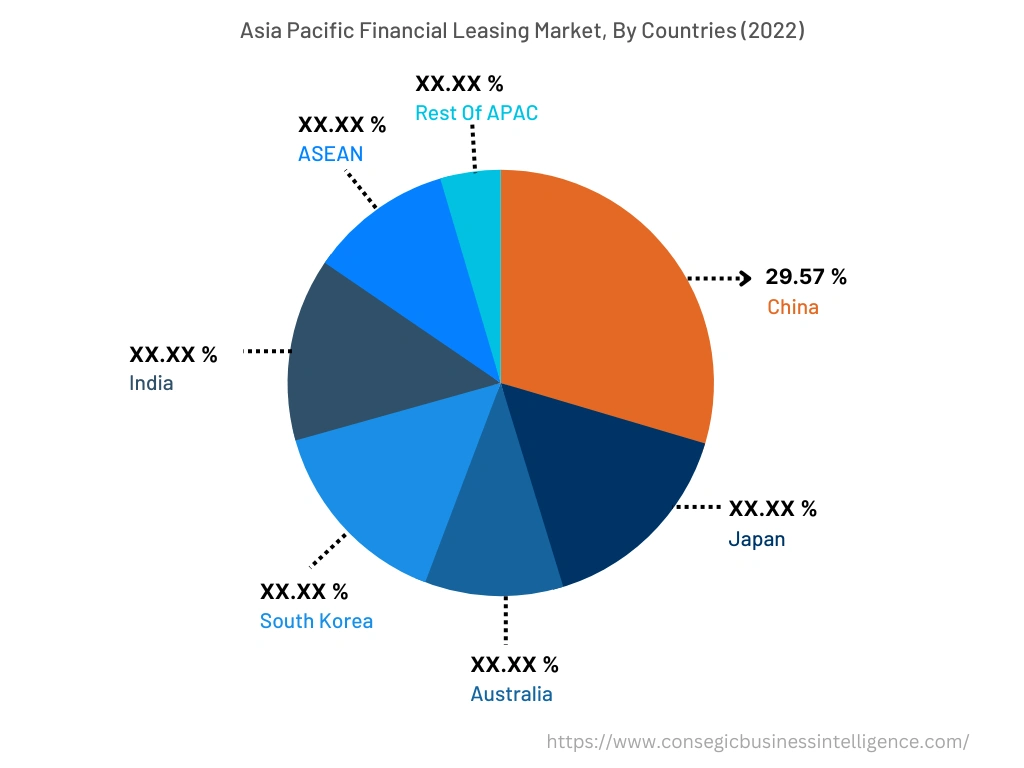

Asia Pacific accounted for USD 61.75 Million in 2022 and is expected to register the fastest CAGR of 5.5% accounting for USD 93.91 Million in 2030 in the financial leasing market. In addition, in the region, China accounted for the maximum revenue share of 29.57% in the year 2022. According to the financial leasing market analysis shows that the growing market in the region is attributed to the technological advancements and digital transformation in China, India, and Southeast Asian countries. The region is witnessing significant growth in the IT, telecommunications, e-commerce, and fintech sectors that require access to cutting-edge technology and equipment that is efficiently obtained through it.

Moreover, the increasing demand for digital devices, data centers, and software assets is also contributing to the rapid growth of leasing in the region. Furthermore, the region is also experiencing rapid economic growth and development that require significant capital investment in infrastructure development. It provides an attractive option for businesses to acquire assets and equipment without large upfront costs, driving the demand for leasing services and contributing to the region's fast CAGR.

Top Key Players & Market Share Insights:

The landscape of the financial leasing market is highly competitive and has been examined in the report, along with complete profiles of the key players operating in the l. In addition, the surge in innovations, acquisitions, mergers, and partnerships has further accelerated the growth of the transit card market. Major players in the financial leasing industry include

- Bank of America Corporation

- BNP Paribas Leasing Solutions

- SMBC Group

- Texas Capital Bancshares, Inc.

- Wells Fargo Bank N.A.

- XCMG America Financial LLC

- Crest Capital

- Commerce Bancshares, Inc.

- Fifth Third Bank

- HSBC Group

- M&I Equipment Finance

- North Star Leasing

Recent Industry Developments :

- In June 2022, Sumitomo Mitsui Banking Corporation entered into a strategic alliance with Marathon Capital LLC to accelerate the company's growth and expansion. The alliance aims to focus on the origination and implementation of advanced ESG-related advisory services to clients for the energy transition.

- In March 2020, BNP Paribas Leasing Solutions launched commercial operations in Denmark and Sweden. The launch of the commercial operation is considered a part of the company's ongoing strategic expansion in the Nordic region.

Key Questions Answered in the Report

What is financial leasing? +

Financial leasing is a financial arrangement in which one party, the lessor, purchases and owns an asset and then leases the assets to another party, the lessee, for a specific period.

What specific segmentation details are covered in the financial leasing market report, and how is the dominating segment impacting the market growth? +

The IT & telecom segment dominated the market by application in 2022 as financial leasing allows businesses to acquire a range of hardware and equipment without a large upfront capital investment.

What specific segmentation details are covered in the financial leasing market report, and how is the fastest segment anticipated to impact the market growth? +

International businesses are projected to witness the fastest CAGR by product type in the financial leasing market. The growth is endorsed by the ability of international businesses that have sufficient resources and capabilities to expand their operations beyond the domestic borders. Furthermore, international businesses seek financial leasing options to acquire assets and equipment in new emerging markets that contribute remarkably to spurring market growth.

Which region is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Asia Pacific is anticipated to witness the fastest CAGR during the forecast period due to the technological advancements and digital transformation in China, India, and Southeast Asian countries.