Banking Encryption Software Market Size:

Banking Encryption Software Market size is growing with a CAGR of 13.50% during the forecast period (2025-2032), and the market is projected to be valued at USD 8.09 Billion by 2032 from USD 2.95 Billion in 2024. Additionally, the market value for 2025 is attributed to USD 3.29 Billion.

Banking Encryption Software Market Scope & Overview:

Banking encryption software is a cybersecurity solution which is developed to protect financial data by converting it into code that is interpreted with the help of a key description. This software is important for protecting a wide range of banking operations that includes online and mobile transactions, internal communication, customer account data, and payment processing systems. This software uses advanced encryption algorithms that protect the data that is stored, moving across networks, and the data which is in use. The encryption software for banking adheres to various stringent regulations which protect the data against cyberattack, data breaches, and unauthorized access of the data.

How is AI Transforming the Banking Encryption Software Market?

The integration of AI is significantly transforming the banking encryption software market. AI integration can help in improving the effectiveness of encryption software by facilitating real-time adjustments to security protocols based on evolving threats. Moreover, AI-powered encryption software can analyze vast datasets, detect patterns, and predict potential vulnerabilities, which further helps in adapting encryption methods dynamically. Therefore, the aforementioned factors are expected to drive the market growth in the upcoming years.

Banking Encryption Software MarketDynamics - (DRO) :

Key Drivers:

Rise in Cyberattacks and Phishing to Drive the Banking Encryption Software Market Growth.

Financial corporations are compelled to invest heavily in advanced encryption solutions mainly for the protection of sensitive data, secure transactions, and maintain regulatory compliance. The rise in threat landscape which includes cyberattacks and phishing activity makes encryption software an important defense solution, influencing in adoption mainly to safeguard financial integrity and the customer’s trust.

For instance,

- The data published in the Cybersecurity Outlook, states that around 72% of organizations reported an increase in cyber risk with ransomware being a top concern. Additionally, there was a rise in phishing and social engineering attacks, with 42% of organizations reporting such incidents.

Thus, the growing concerns and rise in cyberattacks and phishing are driving the banking encryption software market expansion.

Key Restraints :

Regulatory Fragmentation and Evolving Standards to Hinder Banking Encryption Software Market Growth

Banks operate across numerous authorities, each consisting of its own unique data protection, privacy, and encryption regulations. Global banks comply with regulations such as CDGR in Europe, CCPA in California, and various local banking secrecy laws and mandates. Developing and adopting encryption software that satisfies these requirements is mainly complex, resource-intensive, and time consuming. It generally necessitates custom solutions for different regions, extensive legal compliance, and auditing with inflates costs for banks and software providers.

While the requirement for robust encryption in banking is important, the fragmented and dynamic regulatory landscape, along with the growing transformation in cryptographic standards, creates a complex environment that generally hinders the adoption of innovative encryption solutions, thus impacting the overall growth trajectory of the market.

Future Opportunities :

Digital Transformation and Adoption of Quantum Safe Solution to Create Banking Encryption Software Market Opportunities

The rise in the digital transformation in the banking sector and the threats that are posed by quantum computing necessitates the adoption of quantum safe solutions. This dual pressure of digital transformation, and threats of quantum computing influences banks to not-only increase their encryption footprint, by also re-evaluating and upgrading the cryptographic solution they use. This encourages manufacturers in developing solutions to protect against potential threats.

For instance,

- In 2025, Cloudflare announced its expanding end-to-end support for post-quantum cryptography to its Zero Trust Network Access solution. This platform protects against harvest-now decrypt later attacks, deliver quantum safety, and others.

Thus, the digital transformation and adoption of quantum safe solution creates banking encryption software market opportunities

Banking Encryption Software Market Segmental Analysis :

By Component:

Based on Component, the market is categorized into software and services.

Trends in Component:

- The growing need for software with enhanced algorithms such as cryptographic algorithms is driving the banking encryption software market trends.

- The optimal configuration, and maintenance of banking software is influencing the use of various services.

The software segment accounted for the largest Banking Encryption Software market share in 2024.

- The software segment is further classified into encryption tools, and key management systems.

- In the banking encryption, software acts as fundamental engines that enables and set the complete security process.

- This component consists of cryptographic algorithms that secure sensitive financial data alongside the protocols that secure communication and data exchange.

- The software also includes enhanced key management systems which are responsible for storing and distributing cryptographic keys.

- Manufacturers provide various software that secure financial data and provide enhanced data security.

- For instance, AxCrypt AB provides AxCrypt which is a software that mainly protects sensitive financial data and files using the AES-256 algorithm. It mainly encrypts and protects customer information, financial data, and other things.

- Thus, as per the market analysis, the rise in the use of software for protecting data is influencing the development of the segment.

The services segment is expected to grow at the fastest CAGR over the forecast period.

- The service segment is further classified into consulting, integration & deployment, and support & maintenance.

- These services consist of consultation and advisory, where experts help banks to evaluate their specific encryption needs, regulatory compliance requirements and existing IT infrastructure to design a tailored encryption strategy.

- Post-deployment, ongoing maintenance and support services are important in covering software updates, and patch management.

- Thus, as per the banking encryption software market analysis, these services collectively guarantee that the encryption software is optimally configured, maintained, and continuously aligned with changing threat landscapes.

By Deployment Mode :

The Deployment Mode segment is categorized into on-premise, cloud-based, and hybrid.

Trends in the Deployment Mode:

- There is sole control over the security, hardware, and software is driving the on-premise deployment method.

- The rise in digitalization and adoption of enhanced encryption capabilities through the internet is propelling the adoption of cloud-based methods.

The on-premise segment accounted for the largest market share in 2024.

- On-premise deployment for banking encryption software is the installation and working of the encryption solution directly in the bank's own physical data centers and IT infrastructure.

- In this model, the bank has full control over the hardware, software, and data, with its internal IT teams responsible for deployment, maintenance, updates, and security management.

- This approach is preferred by financial institutions mainly because of their stringent regulatory compliance requirements, enhanced security concerns, and the requirement for absolute control over important customer and financial data.

- Thus, based on the market analysis, as per the aforementioned factors, the on-premise segment is influencing the Banking Encryption Software market trends.

The cloud-based segment is expected to grow at the fastest CAGR over the forecast period.

- Cloud-based deployment for banking encryption software is the practice where the encryption solutions, that include the software, cryptographic keys, and the management tools, are presented and managed by a third-party service provider in a cloud environment, rather than on the bank's own on-premise servers.

- This model allows banks to access robust encryption capabilities through the internet.

- The benefits mainly consist of improved scalability, allowing banks to quickly adjust encryption capacity according to the evolving data volumes and transactional needs without significant expenditure.

- As a result, owing to the aforementioned factors, the cloud-based segment is expected to be lucrative over the forecast period.

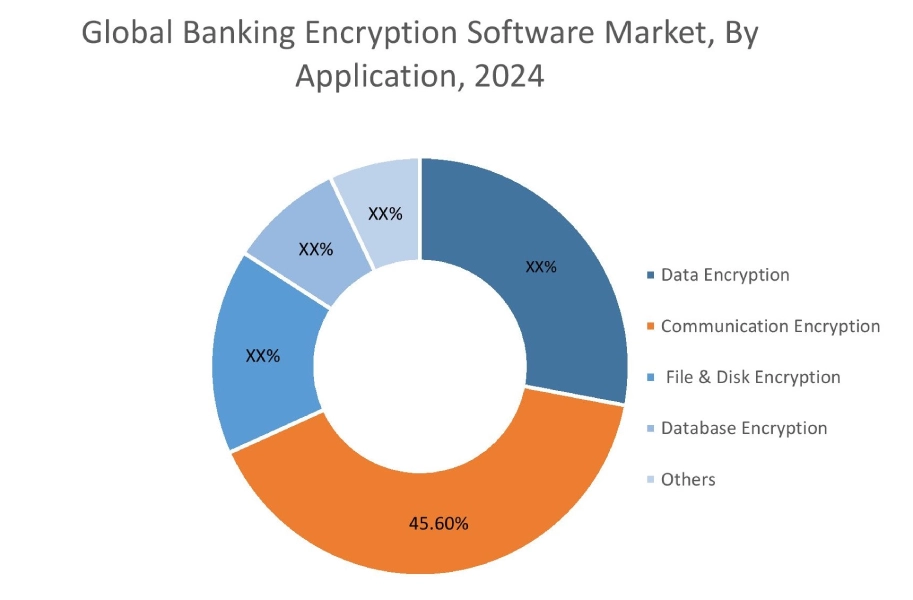

By Application:

The Application segment is categorized into data encryption, communication encryption, file & disk encryption, and database encryption.

Trends in the Application:

- There is a growing demand for securing sensitive data which is influencing the need for data encryption.

- The rising need for enhancing the bank security standards is propelling communication encryption.

The data encryption segment accounted for the largest market share of 45.60% in 2024.

- Data encryption is a primary application that provides an enhanced layer of security for sensitive financial information.

- In banking encryption software, data encryption involves changing the readable data into an unreadable, scrambled format by utilizing complex algorithms.

- These algorithms are only cracked when a correct cryptographic key is inserted.

- Banks utilize this application mainly to protect large quantities of confidential data, that include the personal details of the customer, account numbers, transaction histories, and payment credentials.

- Thus, based on the market analysis, the data encryption segment is influencing the Banking Encryption Software market demand.

The communication encryption segment is expected to grow at the fastest CAGR over the forecast period.

- Communication encryption is the process of protecting the confidential exchange of information.

- It involves converting the sensitive data in transit, like during online banking sessions, and interbank transfers into an unreadable, encoded format known as ciphertext.

- Banks generally rely on secure messaging platforms and end-to-end encryption protocols to protect internal and external communications.

- The segment’s growth is fueled by the preference of neobanking and digital collaboration, which require robust encryption technologies to maintain security and confidentiality.

- Various companies are collaborating to enhance the banking security standards.

- For instance, in 2024, Liveplex partnered with a group of large global commercial and investment banks to alter the digital banking experience. Liveplex used Eclypses’ patented encryption on Amazon Web Services (AWS) to ensure enhanced data security for its affiliated banks at scale.

- As a result, the communication encryption segment is expected to be lucrative over the forecast period.

By Enterprise Size :

The Enterprise size segment is categorized into small & medium enterprises (SMEs) and large enterprises.

Trends in Enterprise Size:

- The large enterprises are moving towards comprehensive, multi-layered, and intelligent encryption strategies

- The growing preference for cost-effective, user-friendly, and cloud-based encryption solution in small and medium-sized enterprises.

The large enterprise segment accounted for the largest Banking Encryption Software market share in 2024.

- Large enterprises in the banking sector are characterized by their wide global operations, huge customer bases, and complex digital ecosystems.

- They rely heavily on banking encryption software as a primary layer of their cybersecurity strategy.

- For this enterprise, encryption is a critical component for protecting high volume of highly sensitive data.

- This software is placed comprehensively through various banking channels and systems, encompassing everything from online banking portals and mobile applications to internal databases, interbank communication networks, and cloud infrastructure.

- Thus, based on the market analysis, the large enterprise segment is influencing the Banking Encryption Software market expansion.

The small & medium enterprises (SMEs) segment is expected to grow at the fastest CAGR over the forecast period.

- Small and medium-sized enterprises (SMEs) in the banking sector, such as regional banks, credit unions, or specialized financial service providers, face unique challenges in cybersecurity.

- Banking encryption software is a major requirement for securing their operations and maintaining client trust.

- Unlike large financial institutions with vast IT budgets, SMEs mainly operate with more constrained resources, require cost-effective, scalable, and user-friendly encryption solutions.

- As a result, owing to the aforementioned factors, the small & medium enterprises segment is expected to be lucrative over the forecast period.

By End-Use:

The End Use segment is categorized into retail banking, investment banking, commercial banking, and others.

Trends in the End Use:

- The shift towards real-time data analytics, algorithmic trading, and cloud-based financial infrastructure necessitates robust encryption.

- The need to maintain customer trust and prevent reputational damage from security incidents are critical trends propelling the demand for encryption.

The retail banking segment accounted for the largest market share in 2024.

- Retail banking directly serves individual consumers and small businesses with services such as checking and savings accounts, loans, credit cards, mortgages, and online banking.

- The core of retail banking consists of handling vast quantities of highly sensitive personal and financial data, which includes account numbers, passwords, and others.

- The use of encryption software ensures confidentiality, data integrity, and authentication, thereby building and maintaining customer trust, protecting against fraud, and allowing retail banks to meet stringent regulatory compliance mandates

- Thus, as per the aforementioned factors, the retail banking segment is influencing the development of the segment.

The investment banking is expected to grow at the fastest CAGR over the forecast period.

- Investment banking is a prime end-user of banking encryption software due to the highly sensitive nature of its operations.

- These firms deal with a wide volume of confidential financial data, including client portfolios, merger and acquisition (M&A) deal terms, proprietary trading algorithms, intellectual property related to financial models, and personally identifiable information.

- Banking encryption software provides an essential layer of security, thereby protecting against advanced cyber threats, insider breaches, and unauthorized access.

- As a result, owing to the aforementioned factors, the investment banking segment is expected to be lucrative over the forecast period.

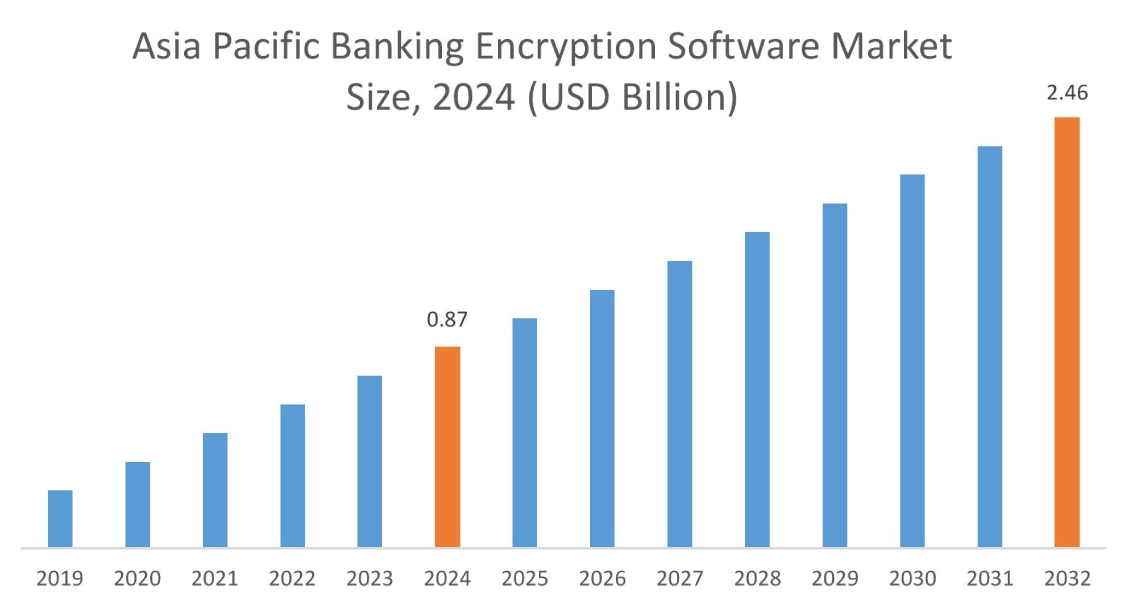

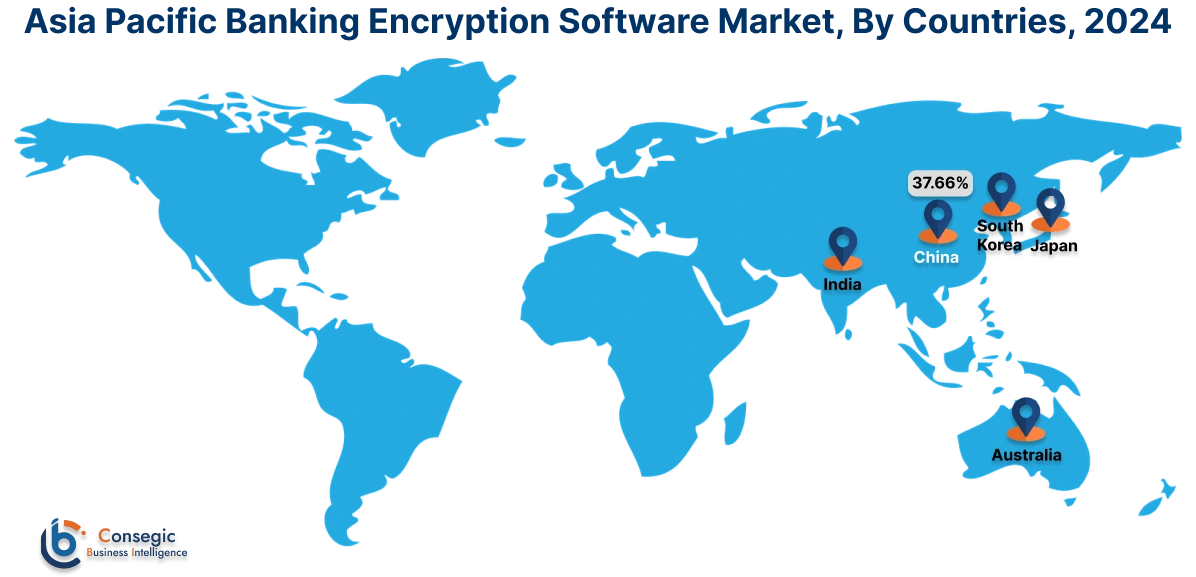

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, Asia Pacific accounted for the highest market share of 30.17% at and was valued at USD 0.87 Billion and is expected to reach USD 2.46 Billion in 2032. In Asia Pacific, China accounted for the market share of 37.66% during the base year of 2024. Asia-Pacific is experiencing rapid growth in the banking encryption software industry, driven by increasing digitalization in countries such China, India, and Japan. The growing adoption of online banking platforms and mobile banking services has increased the focus on encryption technologies to prevent cyber-attacks. Encryption software protects online banking transactions from data breaches and fraud. Online banking is gaining popularity because of various security features and mobile banking apps. Various banks are introducing novel solutions to tackle fraud.

For instance,

- Reserve Bank of India, introduced bank.in domain to tackle financial frauds, enhances digital security measures. This initiative will ensure customers can distinguish legitimate banking websites from fraudulent ones.

Thus, as per the market analysis, the rise in online banking and banking initiative is driving the growth of the segment.

In North America, the Banking Encryption Software industry is experiencing the fastest growth with a CAGR of 15.3% over the forecast period. North America leads the banking encryption software market because of its stringent cybersecurity regulations, including CCPA in the U.S. and data protection laws in Canada. The region’s advanced digital banking ecosystem and development of quantum safe solutions are driving the use of encryption software to secure transactions. Major financial institutions, in collaboration with technology providers, are investing heavily in solutions to combat the rising incidences of data breaches. Thus, the aforementioned factors are driving the demand for encryption software in this region.

Europe is a prominent market for banking encryption software, primarily influenced by stringent regulations such as GDPR which mandates robust data protection measures. Countries such as Germany, the UK, and France are focusing on the adoption of encryption tools to protect sensitive financial data. Additionally, the growing shift towards cashless transactions and contactless payments across the region are further strengthening the demand for encryption software. These factors thereby directly have a positive impact on the Banking Encryption Software market demand.

The Middle East & Africa (MEA) region is completely expanding its use of encryption software. The rise in the banking services and the region’s push for financial sector transformation has driven the adoption of secure data management. Additionally, the rise in cyber threats targeting banking systems has speed up investments in encryption technologies. Thus, as per the market analysis, the rise in requirement for modern financial setup is contributing to the market development in the region.

Latin America is a growing market for banking encryption software, due to growing internet banking activities and government initiatives that are promoting digital security. Financial institutions in these countries are focusing on improving encryption capabilities to adhere with evolving data protection laws and prevent rising cyber frauds. In addition to this, based on the Banking Encryption Software market analysis the rise in development of novel solutions further contributing to the market expansion in this region.

Top Key Players & Market Share Insights:

The Global Banking Encryption Software Market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Banking Encryption Software market. Key players in the Banking Encryption Software industry include

- IBM Corporation (USA)

- AxCrypt AB (Canada)

- Trend Micro Incorporated (Japan)

- TaskUs (USA)

- ESET (Slovakia)

- Evervault Inc. (Ireland)

- Thales Group (France)

- McAfee, LLC (USA)

- Intel Corporation (USA)

- Sophos Ltd. (UK)

Recent Industry Developments :

- In July 2024, AxCrypt, a leading file encryption software company, emphasizes the importance of data security in the finance and banking sectors. With increasing cyber threats, encryption ensures compliance with regulations like GDPR and PCI-DSS, while protecting sensitive data during storage and transmission.

- In September 2024, HDFC Bank emphasizes the critical role of encryption in online banking to safeguard sensitive customer data. It helps protect personal and financial details during online transactions, ensuring confidentiality and preventing unauthorized access.

Banking Encryption Software Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 8.09 Billion |

| CAGR (2025-2032) | 13.50% |

| By Component |

|

| By Deployment Mode |

|

| By Application |

|

| By Enterprise Size |

|

| By End-Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Banking Encryption Software market? +

In 2024, the Banking Encryption Software market is USD 2.95 Billion.

Which is the fastest-growing region in the Banking Encryption Software market? +

North America is the fastest-growing region in the Banking Encryption Software market.

What specific segmentation details are covered in the Banking Encryption Software market? +

By Component, Deployment Mode, Application, Enterprise Size and End Use segmentation details are covered in the Banking Encryption Software market.

Who are the major players in the Banking Encryption Software market? +

IBM Corporation (USA), AxCrypt AB (Canada), Evervault Inc. (Ireland) are some of the major players in the market.