Real-Time Payments Market Size:

Real-Time Payments Market size is estimated to reach over USD 179.83 Billion by 2032 from a value of USD 23.47 Billion in 2024 and is projected to grow by USD 29.86 Billion in 2025, growing at a CAGR of 34.1% from 2025 to 2032.

Real-Time Payments Market Scope & Overview:

Real-Time Payments (RTP) refer to digital payment systems that enable the instantaneous transfer of funds between accounts, within seconds, 24 hours a day, 7 days a week. This allows for real-time confirmation of payment and immediate availability of funds for the recipient, contrasting with traditional payment methods that take hours or even days to process. These systems are designed to be permanent once authorized, offering certainty to both payers and payees. Examples of real-time payment systems include UPI in India, Pix in Brazil, and the RTP Network and FedNow in the United States.

Key Drivers:

Increasing demand for convenience is driving the real-time payments market growth

Consumers demand instant access to information, entertainment, and services, leading to increased financial transactions due to the ability to send and receive money instantly for various purposes, such as peer-to-peer transfers (splitting bills, gifting), online purchases, and bill payments. These payments directly address this need by offering instantaneous transaction processing and immediate availability of funds. Additionally, RTP simplifies the payment process by enabling quick and easy transfers through various channels like mobile apps, online banking, and QR codes, consequently driving the real-time payments market size.

- For instance, in Jan 2024, Mastercard and The Clearing House (TCH) extended their partnership to boost the adoption of real-time payments (RTP) on the RTP network. Mastercard will remain the exclusive software provider for TCH's instant payments, allowing both companies to develop new and innovative ways for individuals, businesses, and governments to utilize RTP across various payment scenarios as the digital economy evolves.

Consequently, increasing demand for convenience is driving the real-time payments market growth.

Key Restraints:

Limited transaction amounts is restraining the global real-time payments market

B2B payments for invoices and supply chains, along with significant consumer purchases like down payments, exceed the restrictive transaction limits of current RTP systems. This compels businesses and individuals to continue using traditional methods like wire transfers or ACH for these larger amounts. Furthermore, companies handling payroll and bulk payouts find that per-transaction limits necessitate managing numerous smaller payments, increasing operational complexity and leading to higher fees compared to single, larger transfers. These limitations hinder the broader adoption of RTP for a significant segment of the transaction landscape.

Therefore, as per the analysis, these combined factors are significantly hindering real-time payments market share.

Future Opportunities :

Increasing adoption of real-time payments in the realm of Business-to-Business (B2B) transactions is projected to create market opportunity

Traditional B2B payment methods like checks, wire transfers, and ACH are slow, costly, and lack transparency. RTP offers an alternative by providing near-instantaneous settlement, reduced transaction fees, and real-time visibility into payment status. Additionally, B2B transactions involve complex supply chains and diverse operational expenses. RTP is expected to streamline these payments by enabling just-in-time payments, instant settlement of invoices, and faster disbursement of funds, hence boosting real-time payments market demand.

Hence, based on the analysis, increasing adoption of real-time payments in the realm of Business-to-Business (B2B) transactions is expected to create real-time payments market opportunities.

Real-Time Payments Market Segmental Analysis :

By Payment Type:

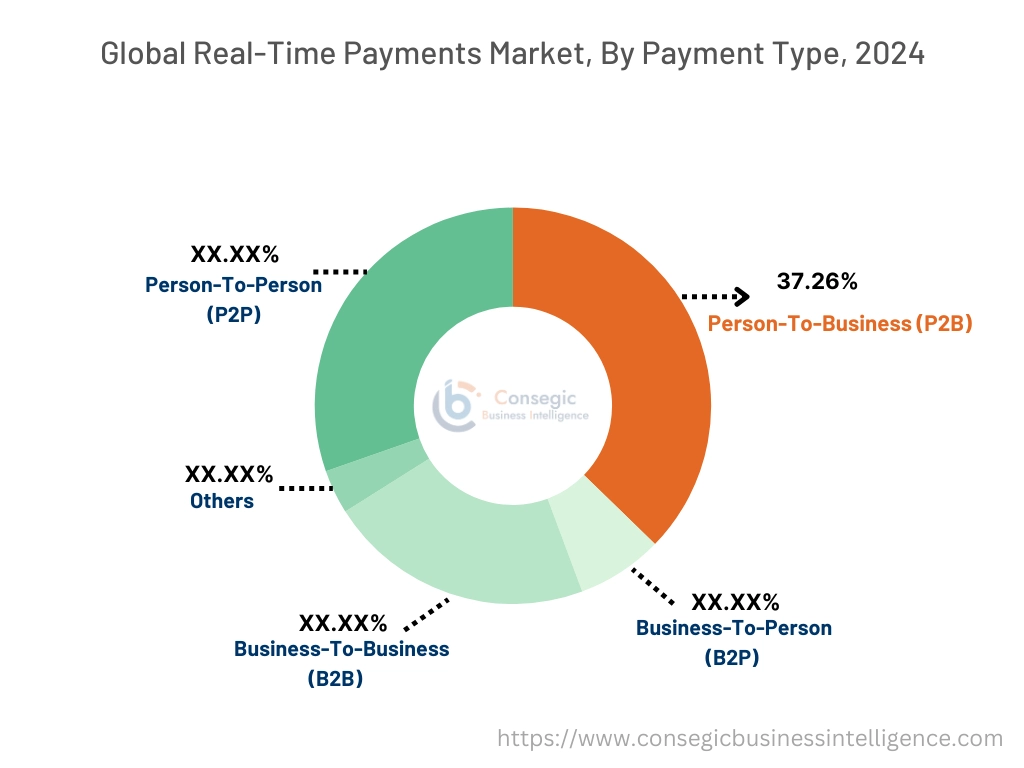

Based on the Payment Type, the market is categorized into Person-to-Person (P2P), Person-to-Business (P2B), Business-to-Person (B2P), Business-to-Business (B2B), and Others.

The payment type allows for immediate transfer of funds between different or similar banks. The key payment type in the real-time payment include person-to-person (P2P), person-to-business (P2B), business-to-person (B2P), business-to-business (B2B), and others. Moreover, the rise of digital payments methods is driving the person-to-person (P2P) segment. The ongoing digitalization in businesses is diving the adoption of person-to-business (P2B). Additionally, the rise in real-time transaction processing with the help of mobile payment app is propelling the progress of business-to-business (B2B).

Trends in the Payment Type:

- Businesses are leveraging RTP for instant payroll disbursements, quicker insurance claim payouts, vendor payments, and payments, offering enhanced efficiency and speed.

- Adoption of initiatives promoting digital payments and modernizing payment infrastructure are contributing to the adoption of real-time payments across P2P, P2B, B2P, and B2B transactions.

Person-to-Business (P2B) accounted for the largest revenue share of 37.26% in 2024.

The increasing need from consumers for fast payments for online purchases, bill payments, and service payments in the booming e-commerce and mobile commerce sectors is fueling this trend. Real-time payments offer merchants faster receipt of funds and reduced interchange fees compared to traditional card payments, thereby boosting the real-time payments market size.

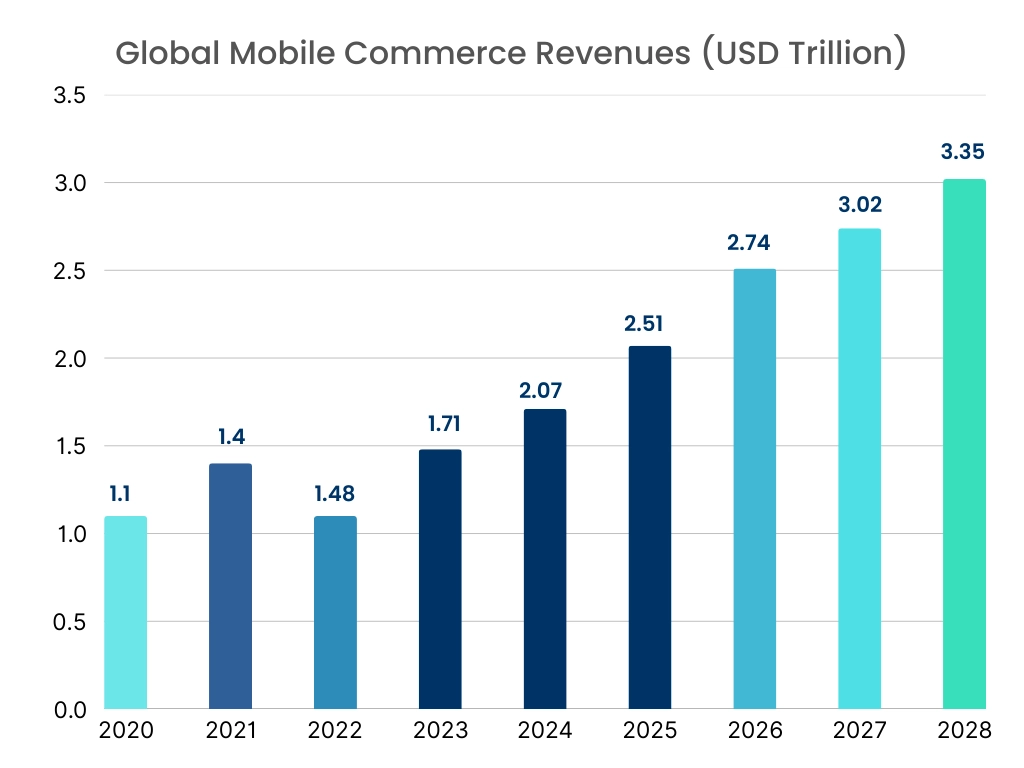

- For instance, according to the statistics provided by Oberlo, global mobile commerce sales are forecast to hit USD 2.07 trillion in 2024, showing a 21.1% increase from the USD 1.71 trillion recorded in 2023. This year is also projected to be the first time mobile sales exceed USD 2 trillion, making up 57% of all e-commerce sales.

Thus, as per the real-time payments market analysis, the aforementioned factors are driving Person-to-Business (P2B) segment.

Person-to-Person (P2P) is predicted to register the fastest CAGR during the forecast period.

Rising popularity of mobile payment apps and digital wallets for instant money transfers between individuals for various use cases like splitting bills, gifting, and loan repayments is driving real-time payments market trend. Additionally, companies specializing in international payments are actively working to create instant Person-to-Person (P2P) payment options. They are forming key partnerships with established banks and other financial service organizations. Subsequently, the above-mentioned factors are contributing notably in spurring market.

By Component:

Based on the component, the market is classified into Solutions and Services.

The component helps in initiating transaction, handling processing and settlement of digital transactions. The components involved in the process includes solutions and services. The solutions component offers flexibility and efficiency in managing finances of individual or business. Also, the services segment provide instant fund transfer facility through mobile apps or online banking which is available 24/7 is driving the adoption of services component of the market.

Trends in the Component:

- Solutions are incorporating advanced fraud detection and prevention mechanisms for real-time monitoring and risk assessment.

- Growing demand for consulting services to help financial institutions and businesses understand the benefits, navigate implementation challenges, and develop effective strategies.

Solutions accounted for the largest revenue share in 2024 and are also predicted to witness fastest CAGR during the forecast period.

Shift towards cloud-based deployment of RTP solutions is driving the real-time payments market demand to offer scalability and cost-effectiveness for financial institutions and payment service providers. Additionally, businesses are collaborating with payment gateway companies to reach customers in new markets. The high volume of transactions these merchants handle is driving them to integrate gateway systems directly into their sales platforms.

- For instance, in Sep 2024, Easebuzz partnered with NPCI Bharat BillPay Ltd. (NBBL) to introduce a platform for managing and paying B2B invoices. This platform enhances interoperability within the ecosystem, making business payments simpler by successfully processing invoice payments across different platforms using Easebuzz's system and payment gateway.

Thus, as per the real-time payments market analysis, the aforementioned factors are driving solutions segment growth.

By Deployment Mode:

Based on the Deployment Mode, the market is divided into On-Premises and Cloud.

The deployment mode consist of on-premise and cloud deployment mode. Also, the ability to perform real-time transactions without dependence on a third-party provider is driving the adoption of on-premises deployment mode for the market. Coud-based infrastructure reduces costs of infrastructure compared to traditional on-premises infrastructure which in turn drives scalability and reliability of cloud based deployment in the market.

Trends in the Deployment Mode:

- Increasing trend towards the modernization of on-premises deployments to gain benefits of cloud while maintaining control over sensitive data.

- The primary driver for the growth of cloud infrastructure is the inherent scalability and flexibility. It allows financial institutions and payment service providers to easily adjust resources based on transaction volumes.

Cloud accounted for the largest revenue in 2024 and is also projected to register the fastest CAGR.

Cloud solutions reduce capital expenditure on hardware and infrastructure maintenance, leading to cost-effective deployments, hence driving the market trend. Additionally, the rising popularity of mobile payment options worldwide is also a key factor fueling cloud-based deployments in the market. Moreover, many fintech firms are improving their international payment services by integrating with cloud platforms, aiming to provide smoother and more efficient experience for their users. In conclusion, the above-mentioned reasons are contributing notably in spurring the market.

By Enterprise Size:

Based on the Enterprise Size, the market is categorized into Small and Medium-Sized Enterprises (SMEs) and Large Enterprises.

Real-time payments are impacting enterprises of all sizes, but the specific benefits and adoption rates differ between Small and Medium-Sized Enterprises (SMEs) and Large Enterprises. Real-time payments provide SMEs with faster access to funds, improving their working capital management and reducing reliance on credit. Additionally, automating payments and reconciliation processes through real-time systems significantly reduce manual work, errors, and operational costs in large enterprises.

Trends in the Enterprise Size:

- SMEs are shifting from traditional paper-based invoicing and payment methods towards digital solutions like real-time payments to enhance efficiency and reduce costs.

- Large organizations are investing in real-time payments technologies to streamline their large volumes of transactions and improve payment processing efficiency.

Large Enterprises accounted for the largest revenue share in 2024.

Large enterprises are leveraging real-time payments for high-value B2B payments and supply chain financing is further enabling this trend. Additionally, with larger transaction values and greater regulatory scrutiny, large enterprises place a strong emphasis on the payment security features and compliance capabilities.

- For instance, in Oct 2024, Broadridge Financial Solutions, Inc. has introduced a robust and adaptable managed service designed for instant payments. This service handles connectivity, message processing, and workflow management, enabling real-time money transfers around the clock, with transactions completing in under 10 seconds from the sender to the receiver.

Thus, as per the real-time payments market analysis, the aforementioned factors are driving large enterprises segment expansion.

Small and Medium-Sized Enterprises (SMEs) is predicted to register the fastest CAGR during the forecast period.

The immediate settlement offered by real-time payments is beneficial for SMEs, improving their cash management and providing quicker access to working capital. Additionally, automating payment processes through real-time payments significantly reduces the administrative burden associated with payment tracking. Moreover, the 24/7 availability of real-time payments enables SMEs to explore new business models and offer services that require immediate payment or payouts. Subsequently, the above-mentioned factors are contributing notably in spurring real-time payments market expansion.

By End-Use Industry:

Based on the End-Use Industry, the market is categorized into BFSI, Retail and E-commerce, IT and Telecommunications, Government, Energy and Utilities, And Others.

The real-time payments market is experiencing rapid growth across various end-use industries including BFSI, Retail and E-commerce, IT and Telecommunications, Government, and Energy and Utilities. Banks are implementing these solutions to provide customers with instant transaction capabilities. Additionally, mobile wallets and QR code-based payments are also gaining popularity in this sector. Moreover, the proliferation of smartphones and mobile internet is driving the adoption of mobile-based solutions in IT and telecommunications. Further, governments are promoting real-time payments as part of their digital transformation initiatives to create cashless economies and improve transparency. In addition, real-time payment systems facilitate instant top-ups for prepaid electricity, gas, and water services.

Trends in the End-Use Industry:

- IT and telecommunications industry is using real-time payments for instant bill payments, subscription fee collections, and payouts.

- Real-time Payments facilitate real-time top-ups for prepaid energy and utility services.

BFSI accounted for the largest revenue share in the market in 2024.

The growth is driven by the need to enhance customer experience through instant fund transfers, faster loan and insurance claim processing. Additionally, financial institutions are also using real-time payments to improve operational efficiency in interbank transactions and internal processes. Furthermore, the real-time payments infrastructure is enabling the development of innovative financial products and services. Thus, as per the real-time payments market analysis, the aforementioned factors are driving BFSI segment.

Retail and E-commerce is predicted to register the fastest CAGR during the forecast period.

Retail banking is rapidly embracing real-time payments due to increasing consumer demand for instant transactions. These payments offer faster and convenient checkout experience, leading to lower transaction costs for merchants compared to traditional card payments. Furthermore, the payment enables instant refunds and the implementation of real-time loyalty programs, enhancing customer satisfaction. Subsequently, the above-mentioned factors are contributing notably in spurring real-time payments market expansion.

Regional Analysis:

The global real-time payments market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

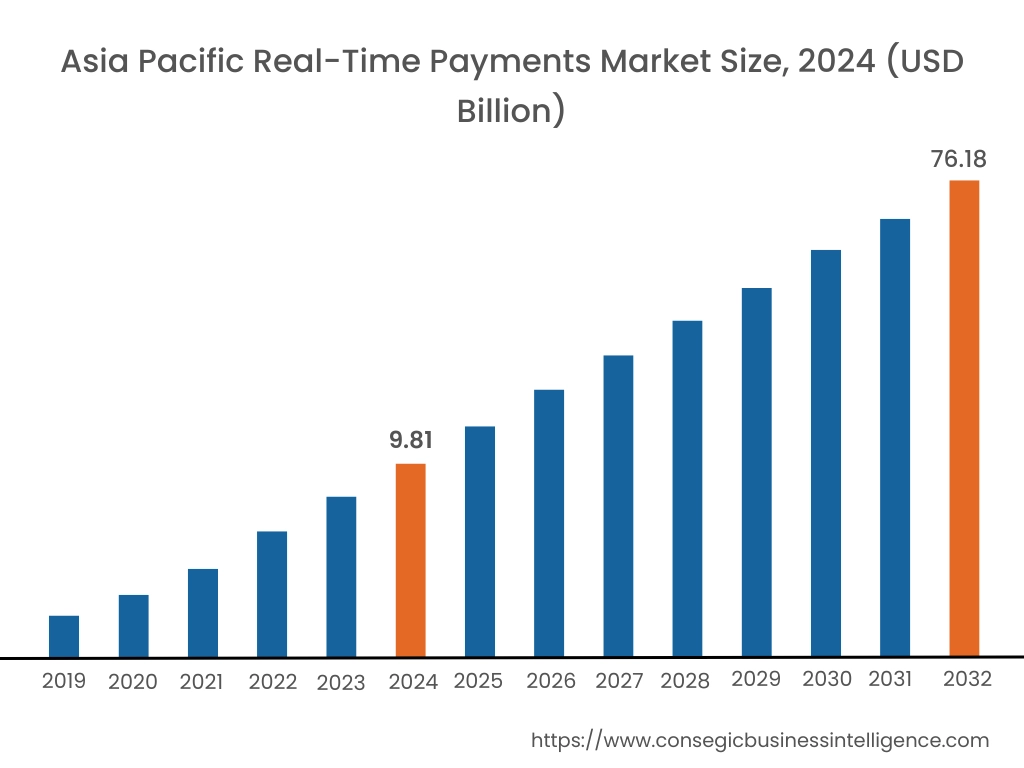

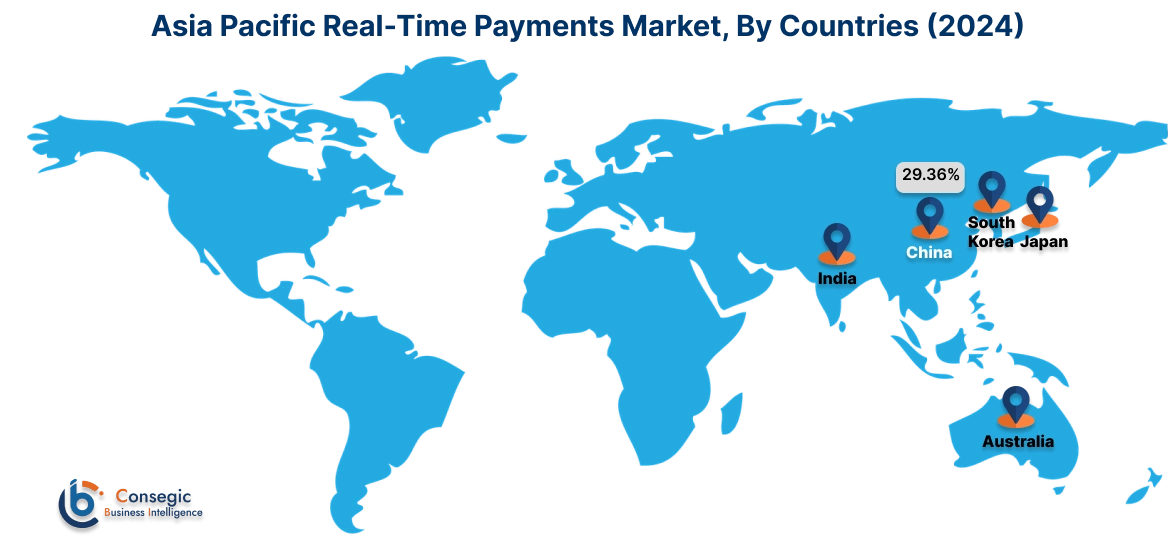

In 2024, Asia Pacific was valued at USD 9.81 Billion and is expected to reach USD 76.18 Billion in 2032. In Asia Pacific, China accounted for the highest share of 29.36% during the base year of 2024. The region encompasses world's largest markets, including India, China, and Thailand, with India leading globally in transaction volume. Additionally, governments and regulatory bodies across Asia Pacific are actively promoting the adoption of real-time payments to modernize their financial infrastructure and enhance financial inclusion. Initiatives like India's UPI and Singapore's PayNow serve as prime examples of successful government-backed systems.

North America region was valued at USD 5.60 Billion in 2024. Moreover, it is projected to grow by USD 7.12 Billion in 2025 and reach over USD 42.75 Billion by 2032. The increasing use of mobile wallets and the growth of e-commerce are also fueling the need for instant payment solutions. Additionally, the presence of key players in the region is also contributing notably in driving the market.

- For instance, HighRadius introduced a new B2B payments platform designed to streamline payment processes across more than 100 methods worldwide. This integrated platform includes a Payment Gateway, Surcharge Management, and an Interchange Fee Optimizer to enhance financial efficiency for businesses.

As per the real-time payments market analysis, Europe is experiencing substantial growth in real-time payments, driven by regulatory support like PSD2 and the increasing adoption of digital wallets and contactless payments. Additionally, Latin America's digital payment market is expanding, propelled by rising smartphone penetration and innovative fintech solutions. ME&A region is experiencing the fastest growth in real-time payments globally, driven by increasing mobile adoption and government investments in digital transformation.

Top Key Players and Market Share Insights:

The market is highly competitive with major players providing real-time payments to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the real-time payments industry include-

- Visa Inc. (United States)

- Mastercard Incorporated (United States)

- Wirecard AG (Germany)

- Ripple Labs Inc. (United States)

- Ant Group (Alipay) (China)

- PayPal Holdings, Inc. (United States)

- Fiserv, Inc. (United States)

- FIS (United States)

- ACI Worldwide, Inc. (United States)

- Temenos AG (Switzerland)

Real-Time Payments Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 179.83 Billion |

| CAGR (2025-2032) | 34.1% |

| By Payment Type |

|

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By End-Use Industry |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Real-Time Payments Market? +

In 2024, the market was USD 23.47 Billion.

What will be the potential market valuation for the Real-Time Payments Market by 2032? +

In 2032, the market size of market is expected to reach USD 179.83 Billion.

What are the segments covered in the market report? +

The payment type, component, deployment type, enterprise size, and end-user industry are the segments covered in this report.

Who are the major players in the Real-Time Payments Market? +

Visa Inc. (United States), Mastercard Incorporated (United States), PayPal Holdings, Inc. (United States), Fiserv, Inc. (United States), FIS (Fidelity National Information Services, Inc.) (United States), ACI Worldwide, Inc. (United States), Temenos AG (Switzerland), Wirecard AG (Germany), Ripple Labs Inc. (United States), Ant Group (Alipay) (China) are the major players in the market.