Fleet Insurance Market Size:

Fleet Insurance Market size is estimated to reach over USD 147.89 Billion by 2032 from a value of USD 86.88 Billion in 2024 and is projected to grow by USD 91.34 Billion in 2025, growing at a CAGR of 7.5% from 2025 to 2032.

Fleet Insurance Market Scope & Overview:

Fleet vehicles refer to a group of vehicles that are owned, rented, or leased by a business. Businesses use a vehicle fleet for many reasons, like transportation of goods, packages, and passengers. Fleet vehicle insurance refers to the insurance of the group of vehicles owned or leased by the business to protect from unexpected financial loss that comes from accidents, theft, fire, and natural disasters. Since businesses that own a fleet of vehicles are usually involved in the business of transporting goods or people over longer distances, they are exposed to risks that may affect the bottom line and operating expenses, making insurance for fleets a necessity.

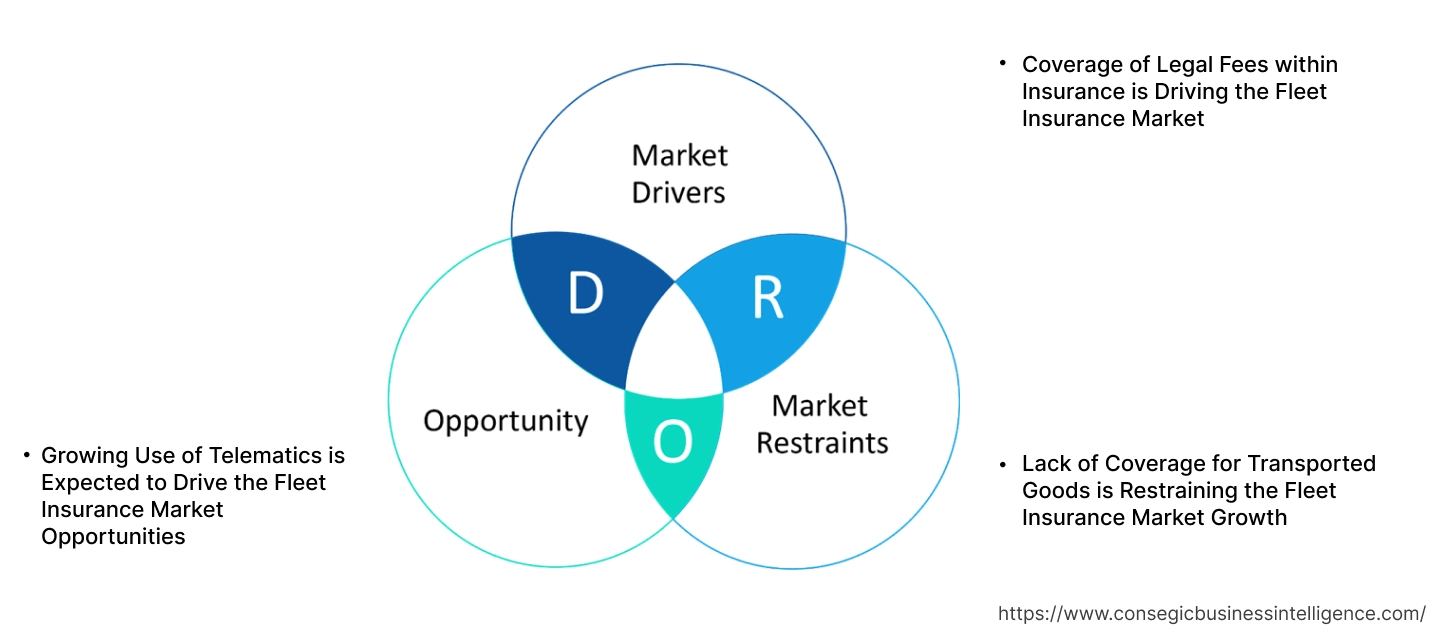

Fleet Insurance Market Dynamics - (DRO) :

Key Drivers:

Coverage of Legal Fees within Insurance is Driving the Fleet Insurance Market

Many insurance providers today offer legal fees coverage within their insurance policies to protect the owner from the high cost of legal fees that may arise due to accidents or collisions. If a large goods vehicle like a truck is involved in an accident with a passenger car, the case can get serious as more damage will be caused to the car. The inclusion of legal fees within insurance policies has resulted in the popularity of fleet vehicle insurance, driving the market.

- For instance, Tata AIG in its Third Party Liability policy covers legal expenses in the event of a legal case against the owner of the vehicle.

Hence, the inclusion of legal fees within the policies is proliferating the fleet insurance market size.

Key Restraints:

Lack of Coverage for Transported Goods is Restraining the Fleet Insurance Market Growth

Many companies provide only coverage of third party liability risk, car repair costs, theft, and fire accidents cost. The goods transported in fleet vehicles are not included in vehicle insurance policies for fleets. For fleet vehicle owners who want to insure the goods being transported in their vehicles, a different insurance product called transit insurance is required which involves different payments. The cost incurred by businesses due to the two premiums can affect small to medium businesses and act as a restraint on the fleet insurance market size. Thus, the lack of coverage for goods in the transport vehicles acts as a restraint on the fleet insurance market growth.

Future Opportunities :

Growing Use of Telematics is Expected to Drive the Fleet Insurance Market Opportunities

Insurance providers, in order to track the safety of the vehicle being insured or the safety of the driver driving the vehicle, have started using telematics to collect driving data. The data is collected through telematics devices installed on the vehicle and is transferred to software. Insurers review the data and price the policies based on the data to charge higher premiums for drivers with risky driving behavior, which is driving the fleet insurance market share.

- For instance, The Hartford offers a fleet management program called Fleet Ahead that integrates telematics to help businesses increase safety by generating analytics to track driver performance.

Thus, the rising use of telematics is projected to drive the fleet insurance market opportunities during the forecast period.

Fleet Insurance Market Segmental Analysis :

By Insurance Type:

Based on insurance type, the market is segmented into third party liability, collision/own damage cover, comprehensive coverage, and others.

Trends in the insurance type:

- Third party liability insurance is mandated by many governments around the world, which in turn drives the market.

- Attractive premium rates of third party liability insurance are driving the overall market.

Third party liability accounted for the largest revenue share in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Third party liability insurance can protect businesses from damages caused to a third party, like property damage or injury to a person.

- Many small businesses are often at risk of paying hefty financial compensation in the event their uninsured vehicle causes damage to a third party.

- Small businesses like food truck owners and shop owners who use pickup vans for transportation have experienced a growing need for third party liability insurance.

- For instance, Farmers Insurance offers insurance to protect businesses, especially small businesses, from third party risks like property damage caused by the insured vehicle.

- Thus, the growing demand for third party liability insurance due to protection from hefty financial compensation has resulted in the adoption of fleet vehicle insurance.

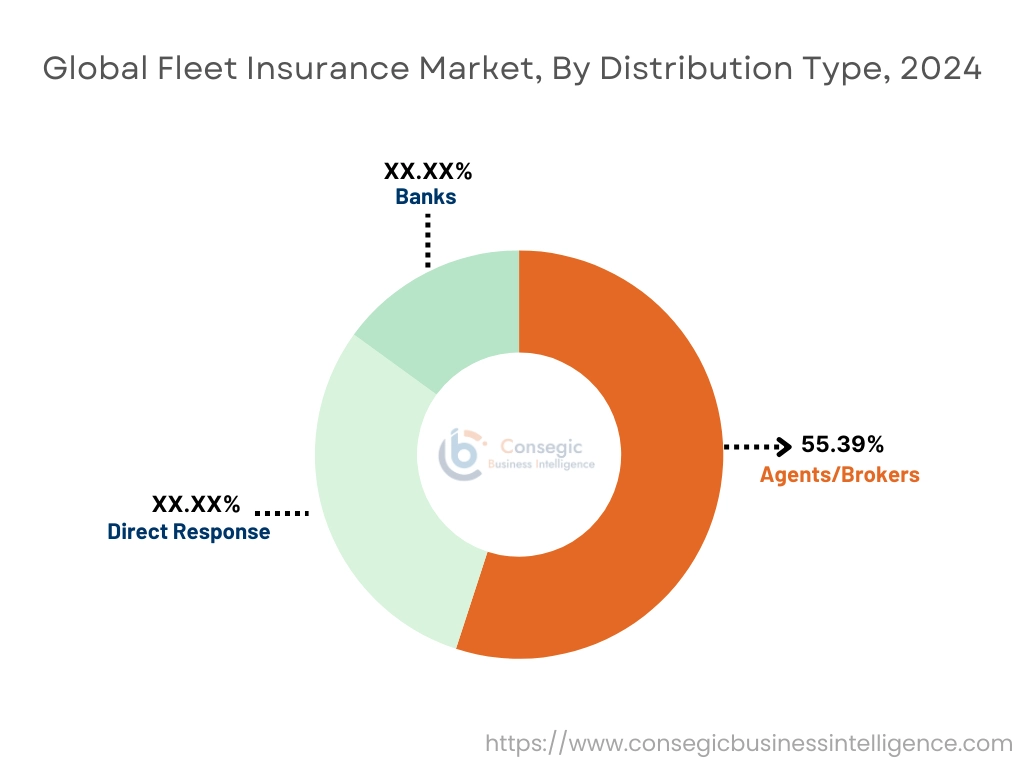

By Distribution Type:

Based on the distribution type, the market is segmented into agents/brokers, direct response, and banks.

Trends in the distribution type:

- Growing requirement of agents/brokers due to better and appropriate policy selection is driving the segment.

- Rising trend in the adoption of direct response due to increased cost savings is driving the market.

Agents/Brokers accounted for the largest revenue share of 55.39% in the year 2024.

- Agents/Brokers of fleet vehicle insurance offer deep expertise, guidance, and business-specific advice to fleet owners, making them popular to shop for insurance.

- Many insurance brokers offer a wide variety of fleet vehicle insurance products from different financial institutions, making it easier for owners to compare policies.

- Additionally, many online services today offer the quotations of fleet vehicle insurance, making the purchase convenient for businesses, as per the fleet insurance market analysis.

- For instance, GIBL broking offers fleet vehicle insurance quotes and the ability to compare, buy, and renew vehicle insurance through its website.

- Thus, growth in fleet vehicle insurance buying through agents/brokers has driven the market.

Direct response is anticipated to register fastest CAGR growth during the forecast period.

- Direct response channel is when the insurance provider sells insurance directly to the consumer without any intermediary.

- Direct response insurance channels have been on the rise due to the ease of buying and managing fleet insurance through websites or mail order, helping businesses save money on intermediary fees.

- For instance, Berkshire Hathaway offers the management of insurance policies through its website, making it convenient for users as it is open 24/7.

- Moreover, many insurance providers also offer the option to renew and pay for insurance through online payment methods, which is driving the market.

- According to the fleet insurance market analysis, the increasing advancements related to the ease of buying from direct response channels are anticipated to boost the fleet insurance market trends during the forecast period.

By End User:

Based on the end user, the market is segmented into transportation and logistics, construction, retail and wholesale distribution, public sector, and others.

Trends in the end user:

- Increasing adoption of insurance for fleets in the construction industry, due to the growing need to protect vehicles used in the construction industry, is driving the fleet insurance market trends.

- Growing trend of reliance on road freight is driving the transportation and logistics segment.

Transportation and logistics accounted for the largest revenue share in the year 2024.

- Transportation and logistics have seen an upward trend in the fleet vehicle insurance market due to the growing reliance on road freight.

- Road freight offers several advantages, like cost efficiency and flexibility to the drivers, making it popular. The growth in road freight has driven the fleet insurance market in the transportation and logistics segment due to the need to secure the business vehicles from unexpected damage when moving from one component of the supply chain to the other.

- The vast network of roads offers many advantages for easy transportation of goods, resulting in growth in the transportation and logistics segment, which in turn drives the fleet insurance market.

- For instance, in the U.S., road freight experienced a growth of 6.6% in 2023 due to the vast network of roads connecting to each other in the country. The increasing dependence on road freight is expected to boost the fleet vehicle insurance market as truck fleet owners adopt insurance to protect from third party risks.

- Therefore, the cost efficiency and vast network of roads are driving the trends in the transportation and logistics segment, in turn, proliferating the fleet insurance market demand.

Construction is anticipated to register fastest CAGR growth during the forecast period.

- Construction businesses frequently use vehicles to move sand, cement, and other materials during construction projects.

- Various types of vehicles like concrete mixer trucks and dump trucks are used in construction projects. Construction business owners are increasingly using fleet vehicle insurance to protect from hefty costs when the equipment gets damaged.

- Many companies have started offering fleet vehicle insurance products specifically for use cases in the construction segment to protect vehicles from construction and road accidents.

- For instance, The Hartford offers insurance for dump truck fleets under its commercial auto insurance policy.

- Thus, the rising adoption of fleet insurance due to the coverage of vehicles in construction is propelling the fleet insurance market demand during the forecast period.

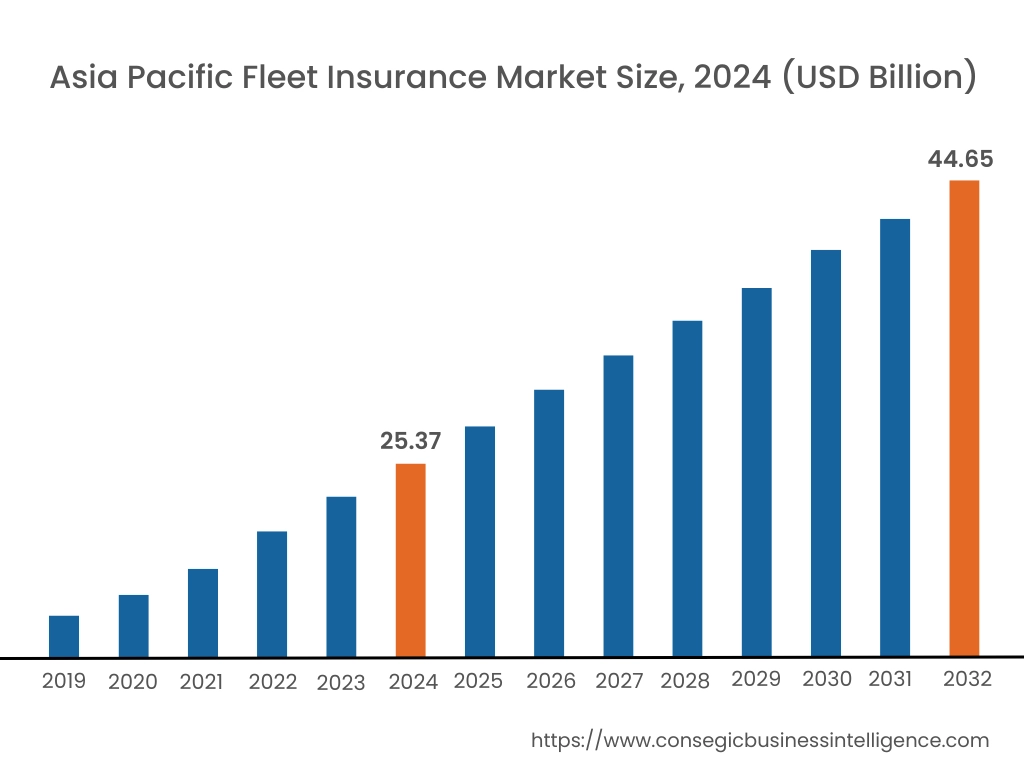

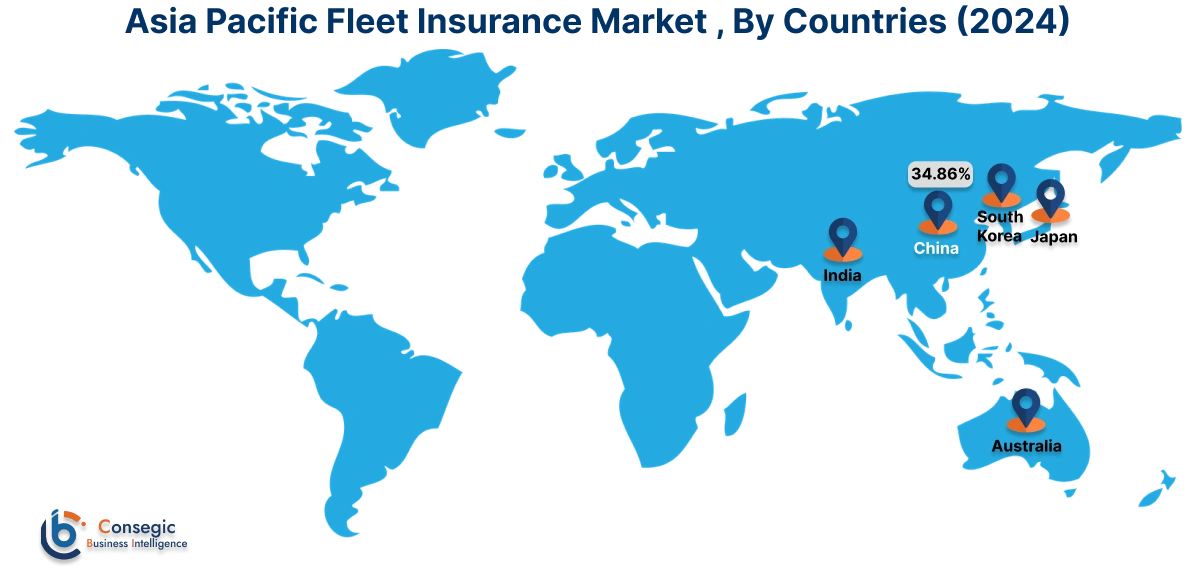

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 25.37 Billion in 2024. Moreover, it is projected to grow by USD 26.75 Billion in 2025 and reach over USD 44.65 Billion by 2032. Out of this, China accounted for the maximum revenue share of 34.86%. As per the fleet insurance analysis, the adoption of fleet insurance in the Asia-Pacific region is primarily driven by the increase in direct response insurance companies and the rising number of small to medium enterprises looking to protect their fleets from unexpected risks or damages.

- For instance, according to the IBEF, the MSME sector in India contributes approximately 6 percent to the manufacturing GDP and 24% to the service sector GDP. The growing MSME sector, especially in ride-hailing, will drive the fleet insurance market expansion.

North America is estimated to reach over USD 45.92 Billion by 2032 from a value of USD 26.87 Billion in 2024 and is projected to grow by USD 28.26 Billion in 2025. In North America, the growth of the fleet insurance industry is driven by the growing use of construction vehicles in the construction industry, the increase in transport vehicles, and the increasing use of technology in insurance risk models.

- For instance, Nirvana Insurance offers features like telematics and AI to fleet owners to monitor and assess driving safety. The company uses telematics to personalize insurance premium rates based on the driving history and offers personalized recommendations based on the data.

Additionally, the regional analysis depicts that the growing need for electric buses used for public transportation is driving the fleet insurance market expansion in Europe. Furthermore, as per the market analysis, the market in Latin America is expected to grow at a considerable rate due to the increasing need for corporate fleet vehicle owners to protect themselves from third party risks. Middle East and African regions are expected to grow at a considerable rate due to factors such as the increase in ride sharing and online taxi services, growing awareness among business owners about fleet insurance, and others.

Top Key Players and Market Share Insights:

The global fleet insurance market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the fleet insurance market. Key players in the fleet insurance industry include-

- The Hartford (U.S.)

- Assicurazioni Generali S.p.A. (Italy)

- Acko Technology & Services Pvt. Ltd. (India)

- Allianz (Germany)

- Bajaj Allianz (India)

- Arthur J. Gallagher & Co. (U.K.)

- Tata AIG General Insurance Company Limited (India)

- Farmers Insurance (U.S.)

- Aviva (U.K.)

- Geico (U.S.)

Recent Industry Developments :

- In June 2024, Flock and Admiral Group announced their partnership to transform fleet insurance in the UK by incorporating advanced technology and real-time risk management. The partnership aims to target courier fleets, business fleets, and service vehicles.

- In March 2025, Nirvana Insurance secured USD 80 million in a Series C funding round led by General Catalyst. Nirvana Insurance is an insurtech company that offers insurance for commercial trucking fleets using AI and telematics to calculate risk models and premiums.

Fleet Insurance Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 147.89 Billion |

| CAGR (2025-2032) | 7.5% |

| By Insurance Type |

|

| By Distribution Type |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the fleet insurance market? +

The fleet insurance market is estimated to reach over USD 147.89 Billion by 2032 from a value of USD 86.88 Billion in 2024 and is projected to grow by USD 91.34 Billion in 2025, growing at a CAGR of 7.5% from 2025 to 2032.

Which is the fastest-growing region in the fleet insurance market? +

Asia-Pacific region is experiencing the most rapid growth in the fleet insurance market.

What specific segmentation details are covered in the fleet insurance market report? +

The fleet insurance market report includes specific segmentation details for insurance type, distribution type, end user, and region.

Who are the major players in the fleet insurance market? +

The key participants in the fleet insurance market are The Hartford (U.S.), Arthur J. Gallagher & Co. (U.K.), Tata AIG General Insurance Company Limited (India), Farmers Insurance (U.S.), Aviva (U.K.), Geico (U.S.), Allianz (Germany), Assicurazioni Generali S.p.A. (Italy), Acko Technology & Services Pvt. Ltd. (India), Bajaj Allianz (India), and Others.