Flexible Graphite Market Size:

The Flexible Graphite Market size is growing with a CAGR of 7.4% during the forecast period (2025-2032), and the market is projected to be valued at USD 1.36 Billion by 2032 from USD 0.78 Billion in 2024. Additionally, the market value for 2025 is attributed to USD 0.83 Billion.

Flexible Graphite Market Scope & Overview:

Flexible graphite is a material that is manufactured from natural flake graphite. It is chemically treated to expand its crystal lattice structure mainly through the intercalation with strong acids. This expanded graphite is then pressed to form a compact structure without the need of additional binders into flexible shapes. This process protects the inherent properties of graphite which results in a material that is highly resistant to extreme temperature, radiation, and chemicals. Its properties such as compressibility, good conformability to irregular surfaces, and superior impermeability to liquids & gases are further contributing to its widespread adoption across several end use industries. These properties make it a suitable material for a wide range of demanding applications.

Flexible Graphite Market Dynamics - (DRO) :

Key Drivers:

Growing Adoption of Electric Vehicles to Drive the Flexible Graphite Market Growth.

Flexible graphite is known because of its unique properties that make them important in various applications within electric vehicles (EVs). Its characteristics, such as exceptional thermal conductivity, lightweight nature, electrical conductivity, chemical resistance, and flexibility, are important for enhancing the performance, longevity, safety of EV components, that mainly includes the battery system and power electronics. The rise in the adoption of electric vehicles is influencing the use of these compounds.

For instance,

- The data by The Oxford Institute for Energy Studies, states that in 2021, 3.5 million electric vehicles were sold in China, out of which 3.3 million were passenger cars. Electric car sales were 16% of total car sales.

Thus, the rise in the adoption of electric vehicles is influencing the flexible graphite market demand.

The Rise in Oil & Gas Production is Accelerating the Flexible Graphite Market Growth.

Flexible graphite is widely being used where extreme temperature, pressure, and corrosive media are present. Its advanced properties make it a good choice for ensuring operational integrity, safety, and efficiency in critical components. The main use of this material in oil and gas production is in gaskets and seals. Equipment such as pipelines, valves, pumps, and other heat exchangers operate under extreme pressure and at high or low temperatures. This influences the use of this compound because of its enhanced and reliable sealing solution. Additionally, the rise in the expansion in the production of oil & gas influences the use of this material.

For instance,

- The data published in EIA, states that S. oil and natural gas production both increased in 2023 compared to 2022. Oil production rose from 12.2 million barrels per day in December 2022 to 13.3 million barrels per day in December 2023.

Thus, the rise in the production of oil and gas is influencing the flexible graphite market expansion.

Key Restraints:

Availability of Substitute Materials to Hinder Flexible Graphite Market Demand.

The availability of substitutes offers convincing advantages in specific use cases, mainly at a lower cost or with different fabrication benefits. One of the primary substitutes is Polytetrafluoroethylene (PTFE) which is commonly known by its brand name Teflon. PTFE is mainly used in sealing and gasketing applications mainly because of its outstanding chemical resistance, low friction, and non-stick properties. Another significant group of substitutes includes various elastomers such as EPDM, Nitrile, and Viton. These materials are mainly used in various sealing applications because of their elasticity, conformability, and cost-effectiveness. Therefore, as per the market analysis, the availability of substitutes contributes to hinderance in market.

Future Opportunities :

Increasing Focus on Green Technologies to Create Flexible Graphite Market Opportunities.

Green technologies refer to those environmental technologies that are utilized for the application of equipment, systems, and products amongst others by minimizing the negative impact on the environment. Flexible graphite plays a crucial and expanding role in the advancement of green technologies due to its unique combination of properties, including excellent thermal and electrical conductivity, chemical inertness, high temperature resistance, and superior sealing capabilities. This leads to a reduction in waste and optimization of resources by providing an energy management system for the industry. In fuel cells, particularly proton exchange membrane (PEM) fuel cells which are vital for clean energy generation in vehicles and stationary power, this material is extensively used for bipolar plates. Its application across the various sectors including power and energy and others is rising and is expected to create lucrative opportunities for the market.

- For instance, according to a study published by Research Gate in 2024, more than 60% of the companies across the globe were utilizing at least one green technology leading to savings of energy by more than 20%.

Thus, due to the aforementioned factors, increasing focus on green technologies to create flexible graphite market opportunities.

Flexible Graphite Market Segmental Analysis :

By Product Type:

Based on Product Type, the market is categorized into sheet, tape, foil, and others.

Trends in the Product Type:

- Increasing emphasis on flexible graphite sheets with metal inserts to enhance mechanical strength, blow-out resistance, and handling is a key trend.

- The inclination of key players towards miniaturizing devices including portable and wearable devices by adopting flexible graphite foil is a positive trend in the market.

The sheet segment accounted for the largest flexible graphite market share in 2024.

- Flexible graphite sheets are produced by compressing expanded graphite flakes into a continuous, flat material.

- They come in various thicknesses. These sheets are also reinforced with other metals for improved mechanical strength, handling, and blow-out resistance, especially in high-pressure applications.

- Sheets are highly conformable, resistant to extreme temperatures and chemicals.

- In addition, they serve as primary product type used for cutting gaskets for flanges, pipe joints, and other static sealing applications.

- The segment growth is driven to their extensive use of sheets in the largest across various heavy sectors such as oil & gas, petrochemicals, power generation, and automotive.

- Consequently, the sheets segment functions as the principal determinant of dynamics within the broader market.

The foil segment is expected to grow at the fastest CAGR over the forecast period.

- Foil is a thin, continuous form of flexible graphite which is supplied in rolls.

- It is essentially a very thin sheet, maintaining the same core properties of high thermal conductivity, chemical inertness, and flexibility. In addition to this, the foils present excellent capabilities of heat dissipation.

- Foils are extensively used in thermal management applications such as heat spreaders and thermal interface materials in electronic products including smartphones, laptops, LEDs among others.

- In addition to this, the rapidly expanding electronic vehicles market also employs these sheets for thermal management.

- For instance, as per analysis published by IEA, Global electric car production reached 17.3 million units in 2024, a 25% increase from 2023, primarily driven by China's output of 12.4 million electric cars.

- Hence, owing to the above-mentioned analysis, the foil segment is expected to grow at the fastest rate over the future years, supporting the flexible graphite market expansion.

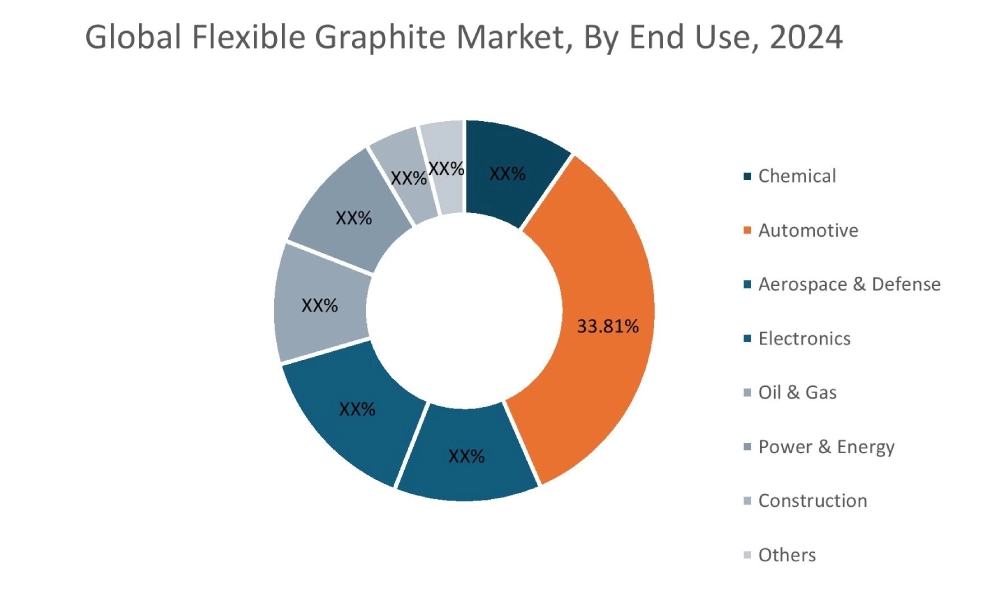

By End Use:

The end use segment is categorized into chemical, automotive, aerospace & defense, electronics, oil & gas, power & energy, construction, and others.

Trends in the End Use:

- The growing integration of flexible graphite in EV battery thermal management systems for improved safety and performance is a trend positively impacting the market.

- Expanding application in electromagnetic interference shielding sensitive components in consumer electronics and telecommunications equipment further supporting the market growth.

The automotive segment accounted for the market share of 33.81% in 2024.

- The automotive segment is a major consumer of flexible graphite sheets for various applications such as gaskets & seals, thermal management, and battery systems among others.

- In internal combustion engine vehicles, it forms critical engine gaskets enduring high temperatures and corrosive fluids.

- It also serves as heat shields and for general fluid sealing. For electric vehicles, flexible graphite is crucial for battery thermal management

- It's also utilized in fuel cell bipolar plates, power electronics thermal management, and contributes to vehicle lightweighting, enhancing overall efficiency.

- For instance, in 2023, Ballard Power Systems announced its plans cut costs and boost production of its next-generation proprietary graphite bipolar plates by implementing disruptive manufacturing technology, a logical step following its development of thin, flexible graphite plates and expanded MEA capacity, aiming for up to 70% cost savings by late 2025.

- Overall, considering the aforementioned analysis, the share of the automotive segment is the largest in the flexible graphite market demand.

The electronics segment is expected to grow at the fastest CAGR over the forecast period.

- Flexible graphite is crucial in electronics due to its superior thermal & electrical conductivity, chemical stability, and lightweight nature.

- It excels in thermal management, functioning as heat spreaders, TIMs, and insulation for devices from smartphones to EV power electronics, ensuring optimal performance.

- Additionally, its conductivity and shareability make it suitable for EMI shielding in various electronics.

- In semiconductor manufacturing, high-purity graphite foils are used for insulation, heating, and as flexible layers.

- The effective need for efficient thermal management is growing driven by continuous miniaturization of devices and the increasing power density in consumer electronics, data centers, and 5G infrastructure.

- Considering the aforementioned factors, the segment is expected to continue its upward trajectory.

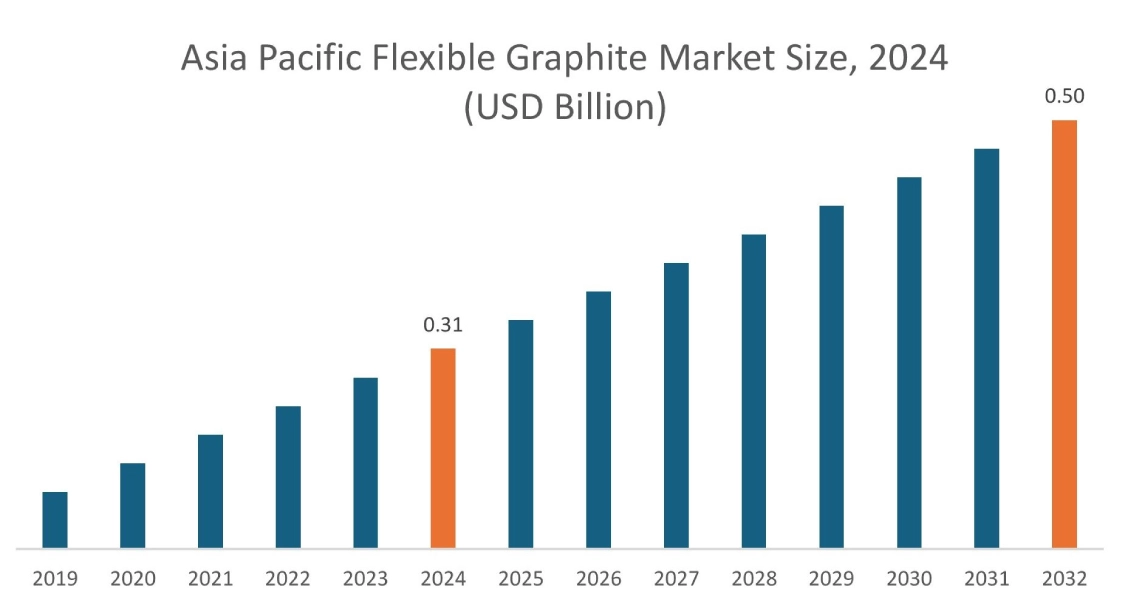

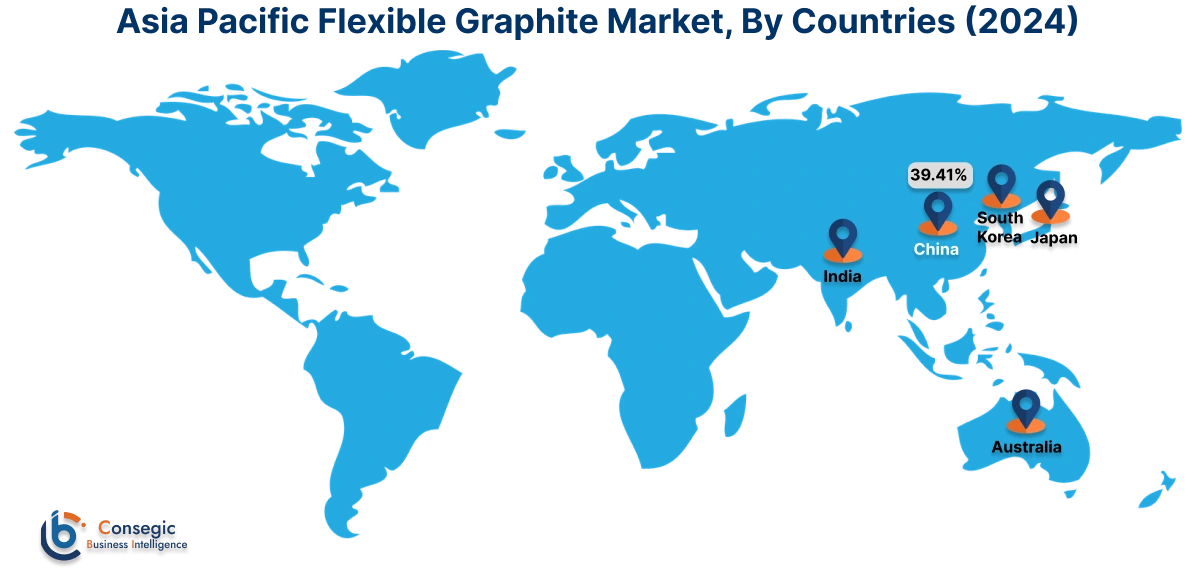

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, Asia Pacific accounted for the highest market share at 40.41% and was valued at USD 0.31 Billion and is expected to reach USD 0.50 Billion in 2032. In the Asia Pacific, China accounted for the Flexible Graphite market share of 39.41% during the base year of 2024. The Asia Pacific market is dominating due to the automotive sector being the key user of this material. This dominance is attributed to the large manufacturing, with countries such as China, Japan, and South Korea playing key roles. In addition to this, the concentration of electronics manufacturing creates a high demand for this material, which serves as a crucial component in numerous electronic devices. Additionally, the region is rapidly expanding its electronics infrastructure. This requires a large volume of flexible graphite products.

- For instance, as per data published by IBEF, India’s electronic manufacturing sector experienced significant growth, reaching USD 67.3 billion in 2020-21.

Thus, due to the above-mentioned factors, Asia Pacific showcases a key regional contribution in the overall flexible graphite market analysis.

In Europe, the flexible graphite industry is experiencing the fastest growth with a CAGR of 9.8% over the forecast period, as the region primarily presents a strong focus on sustainability and energy efficiency. Stringent EU regulations regarding emissions control and energy consumption drive the adoption of this graphite into applications that improve energy efficiency and reduce environmental impact. The growing electric vehicle market and the emphasis on lightweighting in the automotive sector also contribute to the adoption of this material. These are the major factors contributing to the market growth in this region.

In North America’s Flexible Graphite market analysis, strict environmental and safety regulations, particularly in sectors such as oil & gas, chemicals, and automotive serve as prominent factor. The region's focus is on the high-performance sealing solutions to minimize emissions and ensure operational safety. This region's commitment to reducing emissions and enhancing operational efficiency across industries compels the adoption of advanced materials for critical sealing and thermal management applications. Moreover, North America's strong aerospace and defense sectors are major consumers of high-performance materials, in turn supporting the flexible graphite market trend.

In the Middle East and African (MEA) market analysis, graphite of flexible nature is experiencing significant demand from the oil and gas sector. This region's substantial investments in oil and gas exploration, production, refining, and midstream infrastructure create a significant demand for high-performance sealing solutions. Ongoing projects to expand and modernize energy infrastructure, coupled with stringent safety and environmental regulations in the sector, further support the adoption of flexible graphite products. The specific needs of its dominant energy sector ensure consistent adoption.

The Latin America market is driven by its expanding industrial base and increasing technology adoption. The region is now witnessing a notable uptick in the electronics sector. This is supported by rising needs for consumer electronics, coupled with growing investments in local manufacturing and assembly plants. As device miniaturization and the need for efficient thermal management intensify, the material’s properties are becoming increasingly crucial in Latin America's evolving electronics landscape. Collectively, the flexible graphite market trend is expected to be lucrative over the forecast period in the region.

Top Key Players and Market Share Insights:

The Global Flexible Graphite Market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Flexible Graphite market. Key players in the Flexible Graphite industry include

- SGL Carbon (Germany)

- DURLON (Canada)

- Curtiss-Wright Corporation (U.S.)

- GARLOCK (U.S.)

- Xuran New Materials Limited (China)

- NeoGraf (U.S.)

- Klinger AG Egliswil (Switzerland)

- Mersen (France)

- KYBON CARBON Technologies (U.S.)

- WEITEN GROUP (China)

Flexible Graphite Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 1.36 Billion |

| CAGR (2025-2032) | 7.4% |

| By Product Type |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Flexible Graphite market? +

In 2024, the Flexible Graphite market is USD 0.78 Billion.

Which is the fastest-growing region in the Flexible Graphite market? +

Europe is the fastest-growing region in the Flexible Graphite market.

What specific segmentation details are covered in the Flexible Graphite market? +

By Product Type and End Use segmentation details are covered in the Flexible Graphite market.

Who are the major players in the Flexible Graphite market? +

SGL Carbon (Germany), DURLON (Canada), NeoGraf (U.S.), Klinger AG Egliswil (Switzerland) are some of the major players in the market.