Food Service Equipment Market Scope & Overview:

Food service equipment refers to commercial kitchen appliances, tools, and materials used in the serving and cooking of food in large quantities, typically in institutional settings or commercial kitchens. Further, food equipment are designed to facilitate efficient preparation, serving, and storage of food and in a professional food service environment such as full-service restaurants, quick-service restaurants, hotels, resorts, and others. Additionally, food service equipment are used for various applications including cooking & preparation, storage & handling, refrigeration, and other purposes.

Food Service Equipment Market Size:

Food Service Equipment Market size is estimated to reach over USD 60,838.07 Million by 2032 from a value of USD 39,751.59 Million in 2024 and is projected to grow by USD 41,369.12 Million in 2025, growing at a CAGR of 5.9% from 2025 to 2032.

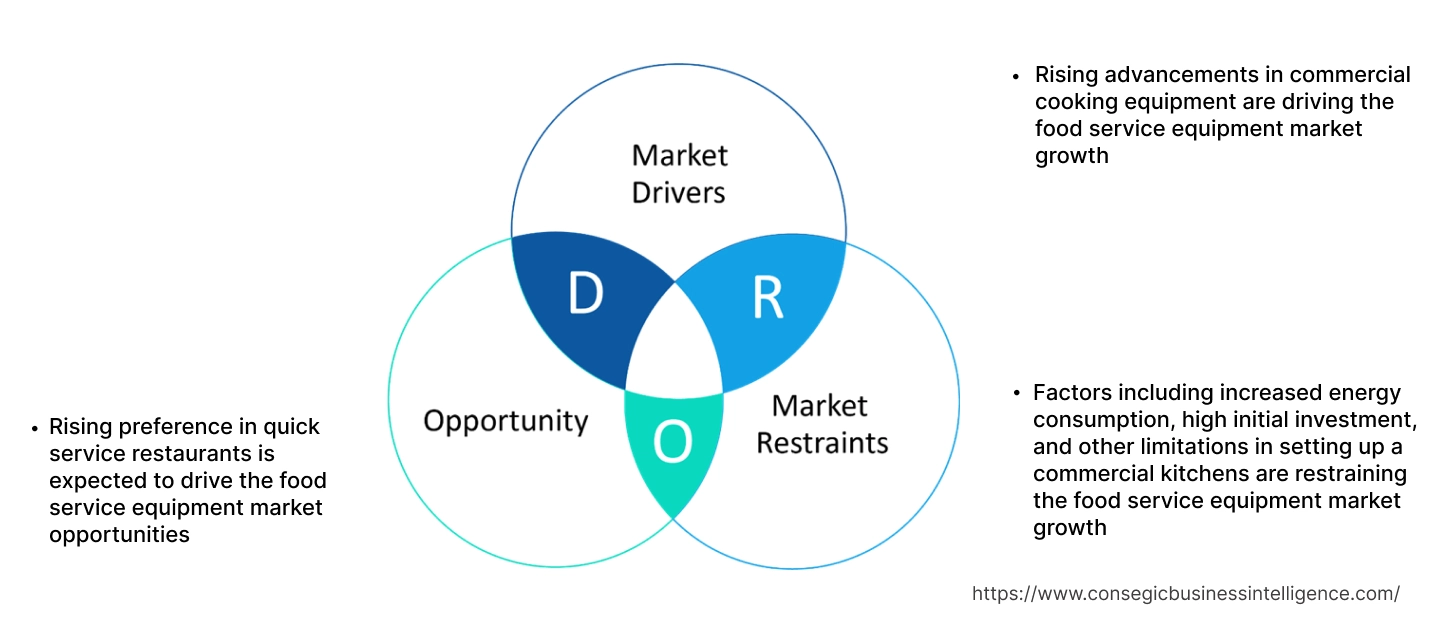

Key Drivers:

Rising advancements in commercial cooking equipment are driving the food service equipment market growth

Increasing advancements in commercial cooking equipment such as smart technologies, energy efficient designs, and multi-functional models, are further driving the market. Moreover, these innovations enhance operational efficiency, reduces energy consumption, and improve food quality and safety standards for commercial restaurants. Additionally, advanced features such as IoT enabled monitoring and automated workflows further reduces manual operation and ensure consistent performance.

- For instance, in May 2022, Welbilt launched KitchenConnect, a cloud platform with IoT integration with various features such as integration with restaurant equipment.

Thus, the increasing advancements associated with food service equipment for increasing operational efficiency are driving the food service equipment market size.

Key Restraints:

Factors including increased energy consumption, high initial investment, and other limitations in setting up a commercial kitchens are restraining the food service equipment market growth

The primary restricting factors associated with setting up a commercial kitchen includes high initial investment, increased energy consumption, high maintenance costs, limited space, and others. Moreover, commercial kitchens require high initial cost for buying cooking equipment and cooking gadgets installation.

Additionally, food service equipment such as ovens, commercial refrigerators, inductions, and others requires a lot of energy for operation, which increases the operational cost. Further, there is an additional maintenance cost associated with these equipment due to frequent maintenance for keeping the equipment in working condition and ensuring quality of food. Thus, the above factors are constraining the food service equipment market expansion.

Future Opportunities :

Rising preference in quick service restaurants is expected to drive the food service equipment market opportunities

A quick service restaurant refers to restaurant which quickly serves low cost meals to customers through delivery or takeaway services. Further, quick service restaurant is growing due to its simple menus, low price point, faster food delivery, late opening, and others. Moreover, commercial kitchen equipment such as grill, fryers, refrigerators, mixer, convection oven, and others are used by quick service restaurants for cooking, storing, preparing, and serving food.

- For instance, in August 2024, Nyati Plaza announced the launch of McDonalds, a quick service restaurant, in their plaza. This is further driving the adoption of commercial food equipment in QSR.

Thus, as per the food service equipment market analysis, increasing adoption of commercial kitchen equipment by quick service restaurants are further driving food service equipment market opportunities.

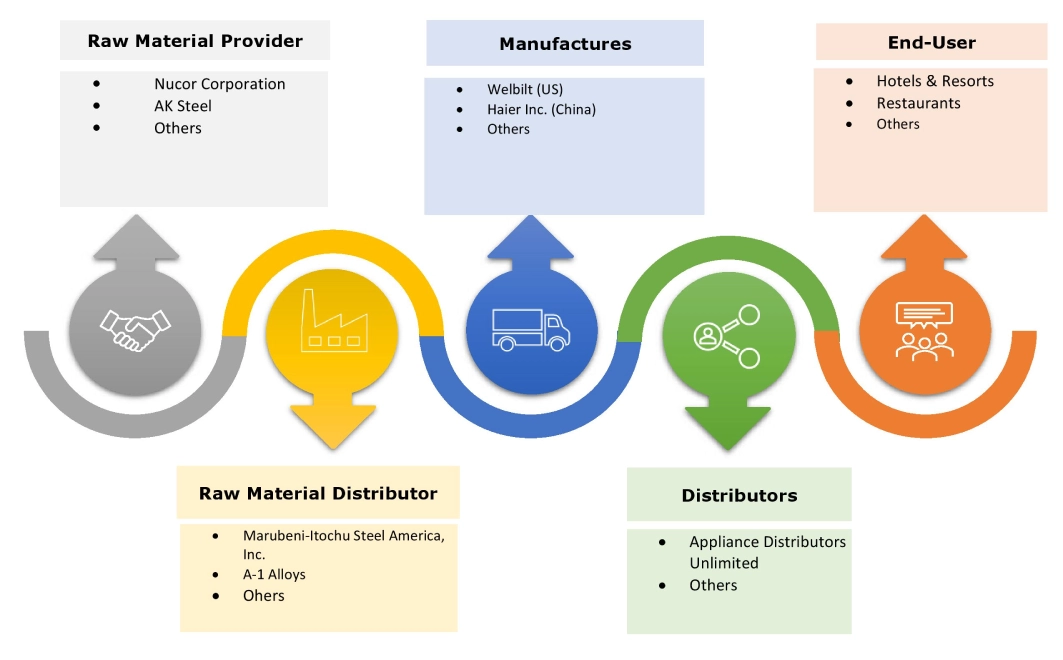

Top Key Players and Market Share Insights:

The food service equipment market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global food service equipment market. Key players in the food service equipment industry include -

- Hoshizaki America, Inc. (US)

- The Vollrath Company, LLC (US)

- ITW Food Equipment Group (US)

- FUJIMAK CORPORATION (Japan)

- Duke Manufacturing (US)

- Smeg Professional (Italy)

- Welbilt (US)

- Haier Inc. (China)

- The Middleby Corporation (US)

- Ali Group S.r.l. (Italy)

Food Service Equipment Market Segmental Analysis :

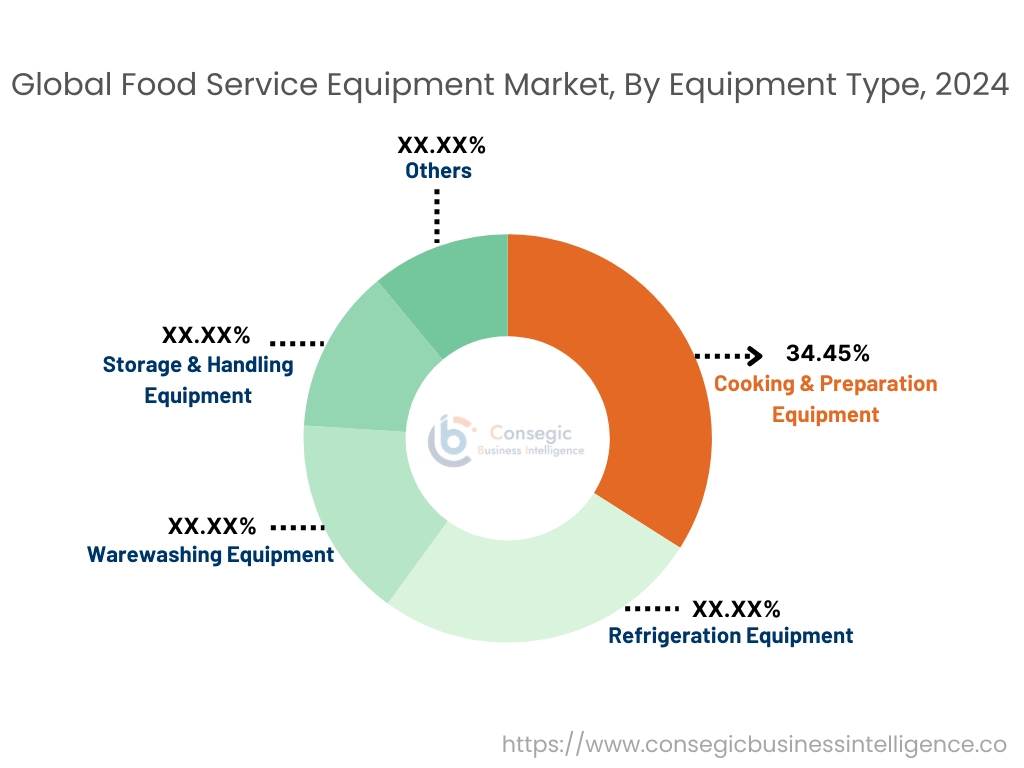

By Equipment Type:

Based on the equipment type, the market is segmented into cooking & preparation equipment, refrigeration equipment, warewashing equipment, storage & handling equipment, and others.

Trends in the Equipment Type:

- There is an increasing trend towards utilization of warewashing equipment in hotels for managing large scale dishwashing operations.

- Increasing utilization of storage & handling equipment in commercial kitchens for storing and controlling materials.

Cooking & preparation equipment accounted for the largest revenue share of 34.45% in the total food service equipment market in 2024

- Cooking & preparation equipment refers to ovens, slicers, mixer, frying pans, mixing bowls, microwave and others for cooking and preparation of food at commercial places.

- Further, in commercial outlets, cooking & preparation equipment are utilized in full service restaurants, quick service restaurants, hotels & resorts, and others.

- Additionally, cooking & preparation equipment increases efficiency by hassle free cooking, offers consistency of quality in food preparation, and helps in maintaining large scale operations among others.

- For instance, in August 2021, Lincoln launched Lincoln 2424 Aperion Impinger Conveyor Oven, a conveyor oven that offers improved efficiency and quality.

- Thus, the rising utilization of cooking & preparation equipment in commercial kitchens are further driving the food service equipment market trends.

Refrigeration equipment segment is anticipated to register a significant CAGR growth during the forecast period.

- Commercial refrigeration equipment are used for storing perishable items in cold weather conditions using cold storage equipment.

- Further, refrigeration equipment includes reach-in vertical cases and refrigerators, semi-vertical display cabinets, horizontal cases, deli cases, drop-in coolers, and others.

- Additionally, refrigerators such as display refrigerators are used as a marketing tool for promoting new items through enhanced visibility and ambient lights.

- For instance, In January 2023, GE Appliances launched commercial-style refrigerator in single and French doors, with improved aesthetics for perishable items such as cold drinks, meat, and others.

- Thus, the rising utilization of refrigeration equipment in food service sector for storing perishable foods are further driving the food service equipment market trends.

By Distribution Channel:

Based on the distribution channel, the market is segmented into offline and online

Trends in the Distribution Channel:

- Rising utilization of offline stores for buying commercial kitchen equipment due to increased convenience and improved customer support.

- Increasing adoption of online e-commerce platform for buying specific kitchen equipment such as freezers and refrigerators for commercial kitchens.

Offline segment accounted for the largest revenue in the total food service equipment market share in 2024.

- Offline distribution channel refers to traditional physical outlets such as retail stores, wholesale outlets, and others for buying food equipment.

- Further, offline channel offers in-person shopping, which helps in finding the best equipment with the understanding of power, electrical/voltage requirements, power source options, configurations available, and other related features.

- For instance, Dmart offers commercial food equipment in its product offerings. It offers various equipment including gas griddle plate half, burner, induction and others.

- Thus, as per the analysis, the rising preference of buying kitchen equipment in offline stores are driving the market.

Online segment is anticipated to register a substantial CAGR growth during the forecast period.

- Online channel refers to online stores such e-commerce stores for selling commercial kitchen equipment by delivering the product.

- Further, online store offers detailed description of products in terms of dimension, material, and wide varieties of kitchen equipment.

- For instance, The Commercial Kitchen Store offers commercial kitchen equipment for sale through its online platform. It offers various products including deep fryers, display cabinets, bar blenders, coffee machines and others.

- Thus, as per the analysis, the rising adoption of online platform for buying commercial kitchen equipment are driving the food service equipment market size.

By End-User:

Based on the end-user, the market is segmented into quick service restaurants (QSR), full service restaurants (HSR), hotels & resorts, and others

Trends in the End-User:

- Rising utilization of food equipment is trending in full service restaurants for improving food services and facilitating faster food preperation.

- Increasing adoption of food equipment due to various benefits including improved speed of service and low price.

Full service restaurants (HSR) segment accounted for the largest revenue share in the total food service equipment market share in 2024.

- Full service restaurants refers to a type of restaurant where table service is provided to guests from receiving the order to serving the order.

- Further, full service restaurants incorporate equipment such as slicers, stoves, ranges, hoods, mixers, ovens, dishwashing machines, and others in their cooking and serving process.

- Additionally, full service restaurants requires large cool storage for storing adequate amount of food items and cooking utensils for large scale cooking.

- For instance, in November 2024, Eater launched new restaurants in Los Angeles, North America. This is further set to increase the adoption of food service equipment in restaurants.

- Thus, as per the analysis, the rising adoption of commercial kitchen appliances and gadgets in full service restaurants are driving the food service equipment market.

Quick service restaurants (QSR) is anticipated to register a substantial CAGR growth during the forecast period.

- A quick service restaurant quickly serves low cost meals to customers through delivery or takeaway services.

- Further, quick service restaurants utilize food equipment to enhance efficiency by reducing time for food preparation and ensuring consistent taste & quality of food.

- Additionally, food equipment can be used for various applications including food preparation, refrigeration, point of services, and others.

- For instance, Duck Donuts expanded by opening 10 franchise agreements in Australia in 2023. This is further expected to increase the adoption of commercial kitchen appliances in QSR.

- Thus, as per the analysis, the rising utilization of food service equipment in quick service restaurants are driving the food service equipment market trend.

Food Service Equipment Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 60,838.07 Million |

| CAGR (2025-2032) | 5.9% |

| By Equipment Type |

|

| By Distribution channel |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

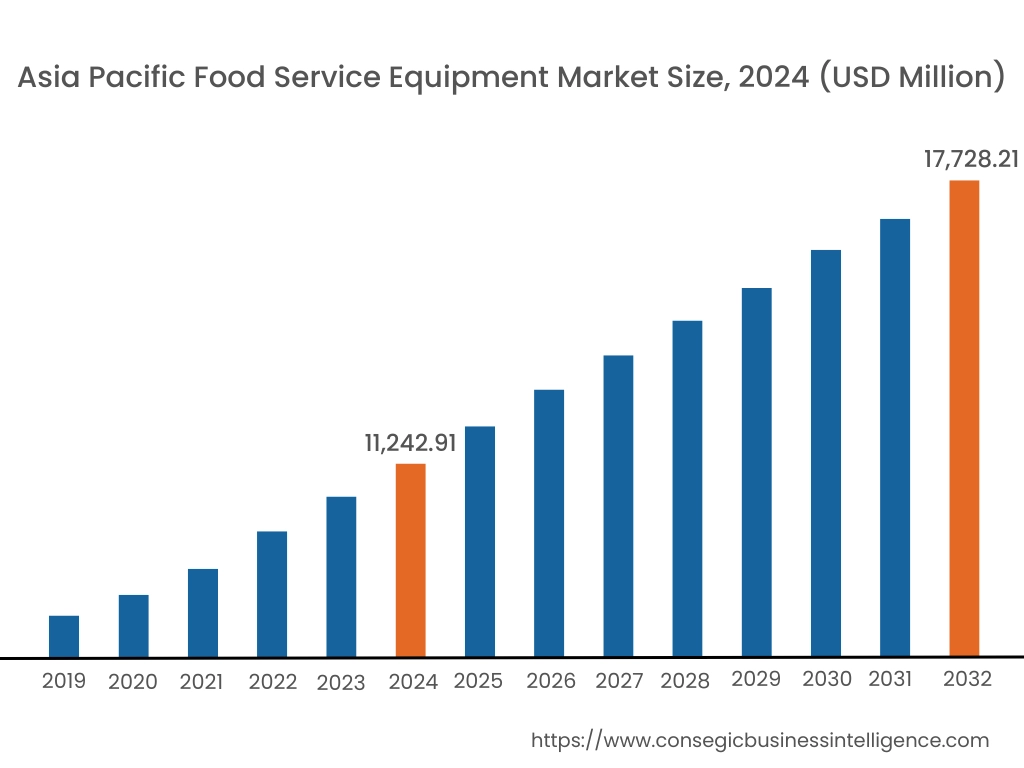

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

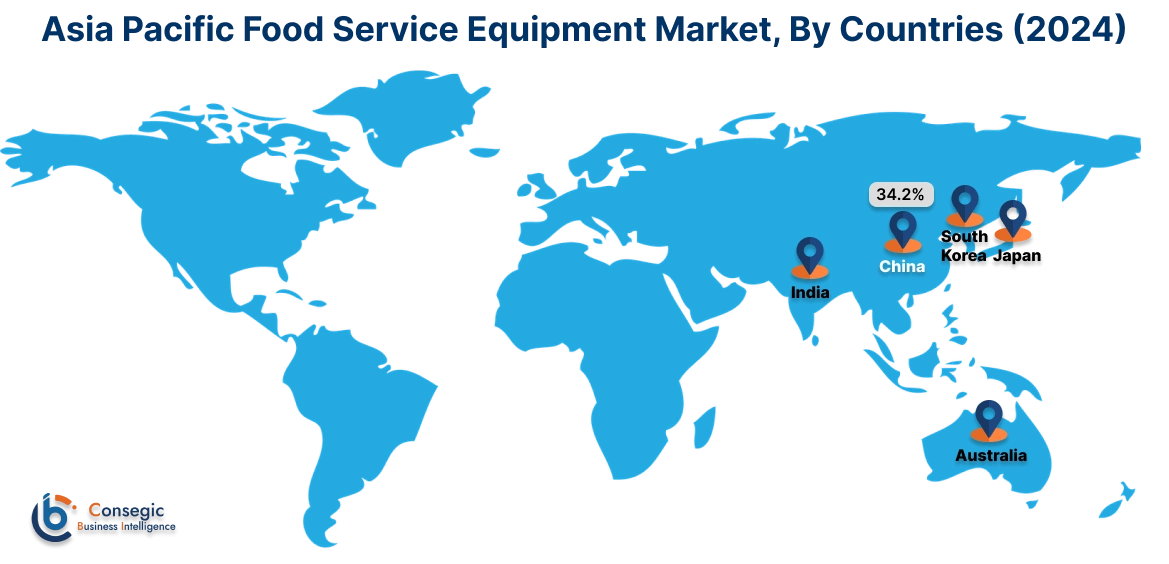

Asia Pacific region was valued at USD 11,242.91 Million in 2024. Moreover, it is projected to grow by USD 11,729.94 Million in 2025 and reach over USD 17,728.21 Million by 2032. Out of this, China accounted for the maximum revenue share of 34.2%.

As per the food service equipment market analysis, there is an rising preference of quick service restaurants, particularly in countries such as China, India, and Japan, due to rising number of fast food chains, cafes, and others. The rapid development and growing investments in food and beverage industry and hospitality sector are accelerating the food service equipment market expansion.

- For instance, in November 2024, Accor launched 27 hotels across the globe including Asia. This is further driving the adoption of commercial kitchen appliances in hotels, which is projected to drive the market in the Asia-Pacific region.

North America is estimated to reach over USD 19,583.77 Million by 2032 from a value of USD 12,799.38 Million in 2024 and is projected to grow by USD 13,319.91 Million in 2025.

In North America, the growth of food service equipment industry is driven by the rising adoption of frozen foods such as pizza, burger and instant foods. Rising adoption of cold storage containers for storing and preserving of food items in food service sector is also driving the market demand. Further, increasing investment in developing advanced equipment for food service sector with improved power efficiency and reduced carbon emissions are driving the growth of food service equipment market demand.

- For instance, Marriott expanded its hotels in the United States and Canada in 2023. This is further expected to drive the adoption of commercial kitchen appliances in hotels and restaurants, which in turn is anticipated to boost the market in the North America during the forecast period.

The regional analysis depicts that the rising adoption of commercial cooking equipment such as refrigerators, ovens, and others is driving the food service equipment market demand in Europe. Further, as per the market analysis, the primary factors driving the market growth in the Middle East and African region includes increasing demand of commercial cooking equipment in hotels and resorts. The rising utilization of commercial cooking equipment such as refrigerators, ovens, grills, and others in food service outlets are further driving the market demand in the Latin America region.

Recent Industry Developments :

Product Launches:

- In 2024, Blue Star launched new range of freezers ranging from 60 to 600 liters for restaurants, convenience stores, hospitality, supermarkets, and others

Key Questions Answered in the Report

How big is the food service equipment market? +

The food service equipment market was valued at USD 39,751.59 Million in 2024 and is projected to grow to USD 60,838.07 Million by 2032.

Which is the fastest-growing region in the food service equipment market? +

Asia-Pacific is the region experiencing the most rapid growth in the food service equipment market.

What specific segmentation details are covered in the food service equipment report? +

The food service equipment report includes specific segmentation details for equipment type, distribution channel, end-user, and region.