Commercial Refrigeration Equipment Market Size:

Commercial Refrigeration Equipment Market size is estimated to reach over USD 60,350.36 Million by 2032 from a value of USD 40,163.76 Million in 2024 and is projected to grow by USD 41,726.13 Million in 2025, growing at a CAGR of 5.7% from 2025 to 2032.

Commercial Refrigeration Equipment Market Scope & Overview:

Commercial refrigeration equipment are used for storing perishable items in cold weather conditions using cold storage equipment. Further, equipment includes reach-in vertical cases and refrigerators, plug-in enclosed vending machines, semi-vertical display cabinets, horizontal cases, deli cases, drop-in coolers, draft beer systems and refrigerators, which are deployed in specialty food stores, supermarkets, convenience stores and grocery stores among others. Moreover, commercial refrigeration equipment consists of various refrigerant technology including hydrofluorocarbons, hydrocarbons, and others.

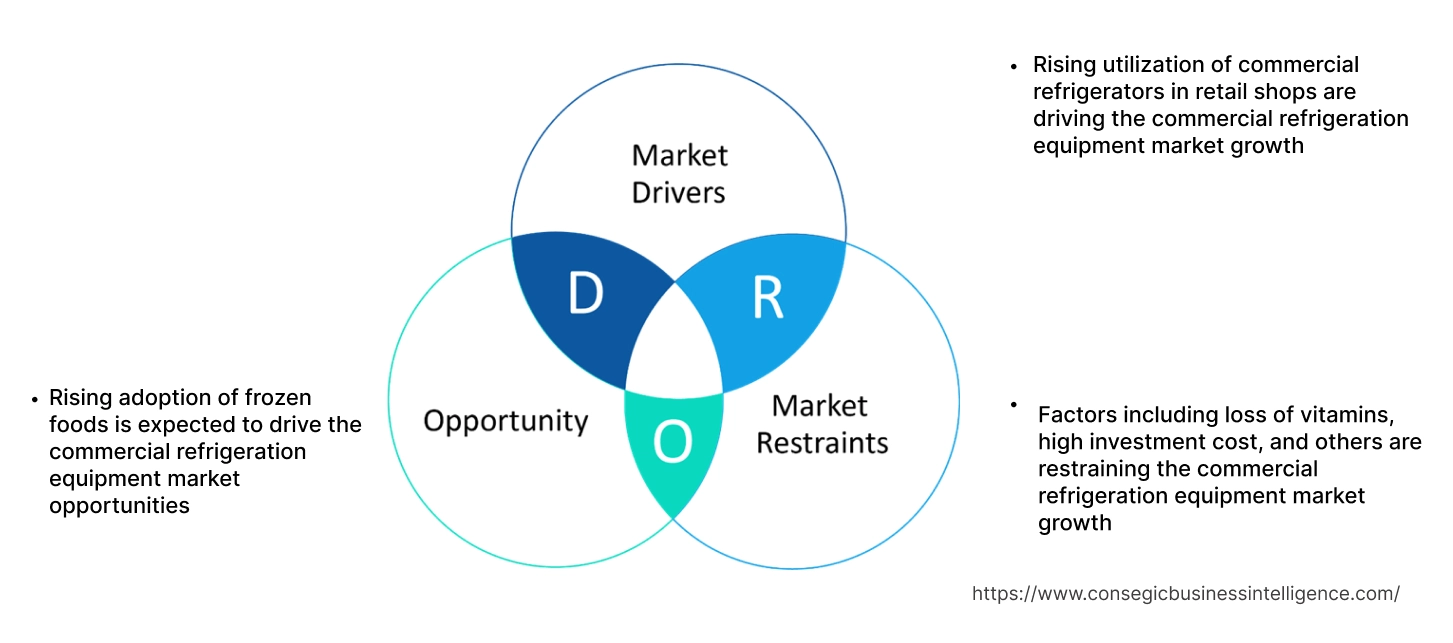

Key Drivers:

Rising utilization of commercial refrigerators in retail shops are driving the commercial refrigeration equipment market growth

In retail shops such as grocery stores, supermarkets, specialty food stores, convenience stores and others, commercial refrigerators are used for storing perishable items. Further, commercial refrigerators offers various benefits in retail outlets such as ensuring food safety, improved energy efficiency, enhanced convenience, increased environmental benefits, and others. Moreover, different type of refrigerators are used in retail shops including undercounter fridges, upright fridges, walk-in fridges, display fridges, undercounter freezers, glass door freezers, and others.

- For instance, in September 2023, Panasonic launched new refrigerator for retail outlets, with improved capacities and upgraded features including bottom-mounted freezer.

Thus, the increasing adoption of commercial refrigerators in retail shops is driving the commercial refrigeration equipment market size.

Key Restraints:

Factors including loss of vitamins, high investment cost, and others are restraining the commercial refrigeration equipment market growth

The primary factors restraining the adoption of equipment includes loss of vitamins, texture and taste alteration, and high initial cost of refrigerators. Further, refrigeration process destroys various kinds of vitamins including vitamin B and C. Moreover, there are less antioxidants in frozen foods compared to fresh foods including fruits and vegetables.

Commercial refrigerators cost significantly higher compared to traditional refrigerators which are used in house for refrigeration, due to advanced features and continuous supply of electricity for maintaining optimal temperature, which in turn increases the operational cost. Additionally, the average price of commercial refrigerator often ranges from USD 2,100 to USD 7,000 or more, depending on the type and specification of the refrigerator. Thus the above factors are constraining the commercial refrigeration equipment market expansion.

Future Opportunities :

Rising adoption of frozen foods is expected to drive the commercial refrigeration equipment market opportunities

The growing demand for frozen foods such as exotic fruits, vegetables, and others due to various benefits such as availability, convenience, low cost, and others are providing lucrative aspects for market demand. Further, advanced refrigerant systems are adopted in retail outlets, supermarkets, and food service establishments for increasing shelf life of food. Additionally, frozen foods offer increased shelf life which significantly reduces food waste. Moreover, frozen foods offer reduced cooking procedures such as dicing, chopping, and others.

- For instance, in May 2024, Nestle launched Vital Pursuit, a frozen food product for weight loss medication consumers and users. These products offers high protein, fiber, and essential nutrients.

Thus, as per the commercial refrigeration equipment market analysis, increasing adoption of frozen foods are further driving commercial refrigeration equipment market opportunities.

Commercial Refrigeration Equipment Market Segmental Analysis :

By Refrigerator Type:

Based on the refrigerator type, the market is segmented into display refrigerators, undercounter refrigerators, bar refrigerators, refrigerated prep table, walk-in refrigerators & freezers, and others.

Trends in the Type:

- There is an increasing trend towards utilization of undercounter refrigerators for storing preparation material and premixes.

- Increasing utilization of bar refrigerators in commercial settings for storing snacks and drinks cold in restaurants and bars.

Display refrigerators accounted for the largest revenue in the total commercial refrigeration equipment market in 2024 and it is anticipated to register a significant CAGR growth during the forecast period.

- Display refrigerator, refers to a display fridge which is used in commercial store for showcasing drinks, food products, and perishable items.

- Further, display refrigerators offers various benefits including clear and accurate temperature displays, enhanced security features, superior internal lighting, and more.

- Additionally, display refrigerators are used as a marketing tool for promoting new items through enhanced visibility and ambient lights.

- Moreover, display refrigerators increases aesthetic appeal of products from drinks to dairy items by strategically placing it.

- For instance, Voltas offers display refrigerators in its product offerings. It offers various features including soft aesthetic design, energy efficient compressor, anti-corrosive pre-coated body, and others.

- Thus, the rising utilization of display refrigerators for promoting new items are further driving the commercial refrigeration equipment market trends.

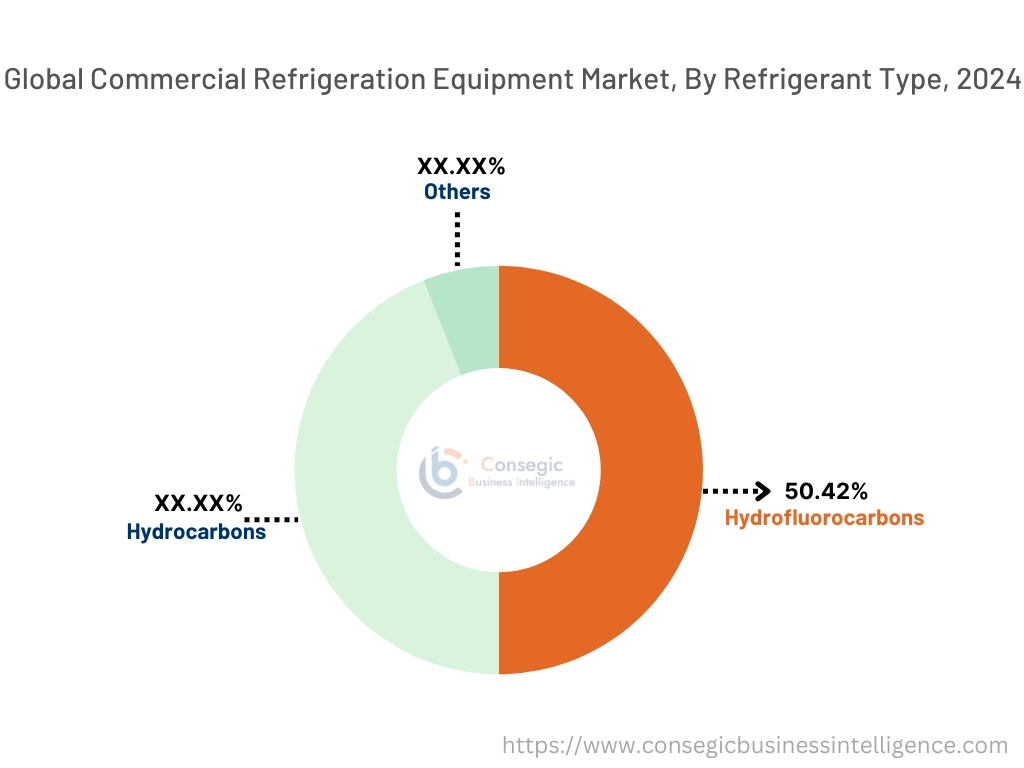

By Refrigerant Type:

Based on the refrigerant type, the market is segmented into hydrofluorocarbons, hydrocarbons, and others.

Trends in the Refrigerant Type:

- Rising utilization of hydrofluorocarbons refrigerant type in in trends for preserving food due to increased energy efficiency.

- Increasing adoption of hydrocarbons in commercial outlets due to its low environmental impact.

Hydrofluorocarbons segment accounted for the largest revenue share of 50.42% in the total commercial refrigeration equipment market share in 2024.

- Hydrofluorocarbons (HFCs) is a type of refrigerant which is comprised of carbon, fluorine, and hydrogen for cooling applications in refrigerators.

- Further, it offers various benefits including safer alternative with less ozone depletion, efficient cooling performance, and more.

- Additionally, it is widely used in supermarket refrigeration for preserving food items, commercial chillers and freezers for storing and processing, and others.

- For instance, Haier offers HFC refrigerant type refrigerator in its product offerings. HFC refrigerant type freezer offers various features including energy-efficiency, dual condenser, and others.

- Thus, as per the analysis, the rising utilization of hydrofluorocarbons in refrigerators, freezers, and others are driving the commercial refrigeration equipment market size.

Hydrocarbons is anticipated to register fastest CAGR growth during the forecast period.

- Hydrocarbon refrigerants is a type of natural hydrocarbon which is more efficient for cooling because of their high latent heat of evaporation.

- Moreover, it offers various benefits including reduced running costs, very low environmental impact, and increased efficiency in refrigeration.

- Additionally, hydrocarbon refrigerant is widely used in various refrigerators including ULT freezers, biomedical freezers, pharmaceutical refrigerators, and others.

- For instance, Aquilo offers hydrocarbon refrigerant type cooled freezers and fridges in its product offerings. It offers various benefits including non-ozone depleting and have a Global Warming Potential (GWP) of under 5.

- Thus, as per the analysis, the rising adoption of hydrocarbon refrigerant type in freezers and refrigerators are driving the commercial refrigeration equipment market trends.

By End User:

Based on the end-user, the market is segmented into restaurants and hotels, retail shops, healthcare, and others.

Trends in the End-User:

- Rising utilization of refrigerator equipment is in trends, in healthcare facilities for storing medicines, vaccines and specimens, at specific temperatures.

- Increasing adoption of centralized systems in supermarkets for distributed refrigeration system.

Retail shops segment accounted for the largest revenue share in the total commercial refrigeration equipment market share in 2024.

- In retail shops such as cake shops, grocery stores, utility shops, confectionery shops, supermarkets, and other, commercial refrigeration equipment are deployed for storing and showcasing perishable products.

- Further, in supermarkets, grocery stores, confectionary shops, it is used for storing and displaying chilled and frozen goods such as vegetables, beverages, and others for commercial sale

- Moreover, retail food refrigeration includes various equipment such as stand-alone equipment which includes freezers, reach-in coolers, and refrigerators, in which all refrigeration components are integrated for operational use.

- Additionally, supermarkets, convenience stores, restaurants, specialty shops, and other locations are often operated through remote condensing units with one condenser located outside of the sales area.

- For instance, in December 2024, T&T Supermarket, an Asian grocery company opened store of 76,000 square feet in Canada. This is further set to increase the adoption of commercial refrigerators in grocery stores.

- Thus, as per the analysis, the rising advancements in retail shops are driving the commercial refrigeration equipment market.

Healthcare is anticipated to register a substantial CAGR growth during the forecast period.

- In healthcare, commercial refrigeration equipment are used in hospitals, medical laboratories, care homes, and others for preserving vaccines, patient samples, medicines, and other pharmaceutical or biological products.

- Further, commercial freezers and fridges are used for accurate temperature monitoring of injectable, patient samples, and medicines.

- For instance, in January 2025, Esco lifesciences Group, launched Esco Laboratory Refrigerator in its product offerings. It offers various benefits including energy efficiency, unmatched performance, and user-friendly operation.

- Thus, as per the analysis, the rising utilization of refrigeration equipment in healthcare facilities are driving the commercial refrigeration equipment market.

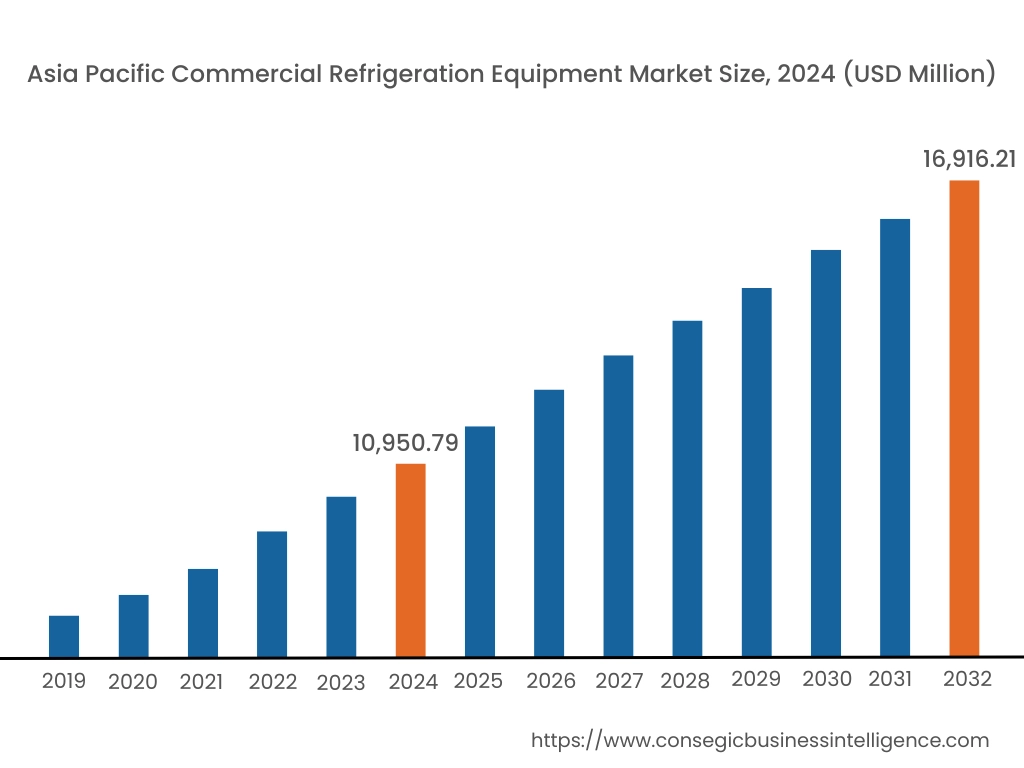

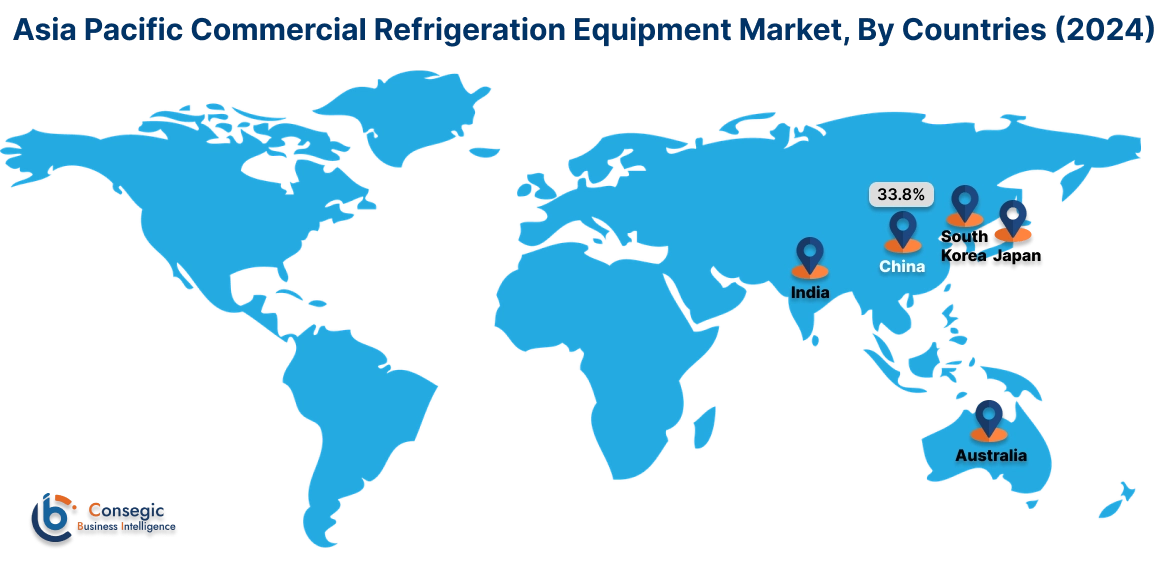

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 10,950.79 Million in 2024. Moreover, it is projected to grow by USD 11,403.36 Million in 2025 and reach over USD 16,916.21 Million by 2032. Out of this, China accounted for the maximum revenue share of 33.8%. As per the commercial refrigeration equipment market analysis, there is an increasing adoption of refrigerators in food and beverage sectors, particularly in countries such as China, India, and Japan, due to rising number of retail shops including hotels, restaurants, cafes, or other perishable food items. The rapid development and growing investments in refrigeration technology for food industry are accelerating the commercial refrigeration equipment market expansion.

- For instance, in November 2024, Accor launched development of 27 hotels across globe including Asia. This is further driving the adoption of commercial refrigerators in hotels, which is projected to drive the market in the Asia-Pacific region during the forecast period.

North America is estimated to reach over USD 19,499.20 Million by 2032 from a value of USD 12,980.29 Million in 2024 and is projected to grow by USD 13,484.93 Million in 2025. In North America, the growth of commercial refrigeration equipment industry is driven by the rising utilization of cooling equipment in import and export sector. Rising adoption of cold storage containers for sharing consumer goods, machinery, and raw materials, are also driving the market. Further, the increasing investment in developing advanced refrigerator equipment with improved power efficiency and reduced carbon emissions are driving the adoption of commercial refrigerators, which is contributing to the growth of commercial refrigeration equipment market demand.

- For instance, according to the S. Department of Agriculture, the United States exported USD 3,717 Million worth fresh fruits and Vegetables in 2021 which is a significant rise of 7 percent compared to 2020. This is further expected to drive the adoption of commercial refrigeration technology for exporting fresh vegetables and fruits, which in turn is projected to boost the market in the North America during the forecast period.

The regional analysis depicts that the rising adoption of commercial refrigerators in healthcare facilities for storing samples, vaccines, and others at ideal temperature are among the primary factors driving the commercial refrigeration equipment market demand in Europe. Further, as per the market analysis, the primary factors driving the market in the Middle East and African region includes rising development of retail outlets and increasing adoption of cooling technology for refrigeration. The rising utilization of commercial refrigerators in retail shops and hospitality sector are further driving the market demand in the Latin America region.

Top Key Players and Market Share Insights:

The commercial refrigeration equipment market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global commercial refrigeration equipment market. Key players in the commercial refrigeration equipment industry include -

Recent Industry Developments :

Product Launch:

- In January 2023, GE Appliances launched commercial-style refrigerator in single and French doors, with improved aesthetics for perishable items such as cold drinks, meat, and others.

Commercial Refrigeration Equipment Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 60,350.36 Million |

| CAGR (2025-2032) | 5.7% |

| By Refrigerator Type |

|

| By Refrigerant Type |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the commercial refrigeration equipment market? +

The commercial refrigeration equipment market was valued at USD 40,163.76 Million in 2024 and is projected to grow to USD 60,350.36 Million by 2032.

Which is the fastest-growing region in the commercial refrigeration equipment market? +

Asia-Pacific is the region experiencing the most rapid growth in the commercial refrigeration equipment market.

What specific segmentation details are covered in the air traffic control equipment report? +

The commercial refrigeration equipment report includes specific segmentation details for refrigerator type, refrigerant type, end-user, and region.

Who are the major players in the commercial refrigeration equipment market? +

The key participants in the commercial refrigeration equipment market are Carrier (US), Emerson Electric Company (US), Daikin (Japan), Danfoss (Denmark), GEA Group (Germany), Johnson Controls (Ireland), Lennox International Inc. (U.S.), Minus Forty Technologies Corp. (Canada), Panasonic Corporation (Japan), and Voltas Commercial Refrigeration Equipment (India).