Golf Cart Battery Market Size:

Golf Cart Battery Market size is estimated to reach over USD 273.74 Million by 2032 from a value of USD 184.45 Million in 2024 and is projected to grow by USD 190.49 Million in 2025, growing at a CAGR of 5.1% from 2025 to 2032.

Golf Cart Battery Market Scope & Overview:

Golf cart battery refers to the rechargeable energy storage unit that powers electric golf carts used across golf courses, resorts, airports, and gated communities. These batteries are engineered for deep-cycle performance, enabling consistent energy delivery over extended periods of use.

Common types include lead-acid, AGM (Absorbent Glass Mat), gel, and increasingly lithium-ion variants, each offering distinct advantages in terms of lifespan, charging time, and maintenance requirements. Key features involve high discharge rates, durable casing, vibration resistance, and efficient energy retention.

Golf cart battery solutions support smooth vehicle operation, enhanced range per charge, and reduced operational downtime. Their performance ensures reliable transport across diverse terrains while minimizing environmental impact. The adaptability to fast-charging technologies and integration with smart monitoring systems further boosts their practicality, making them essential components for maintaining fleet efficiency in recreational and commercial electric mobility sectors.

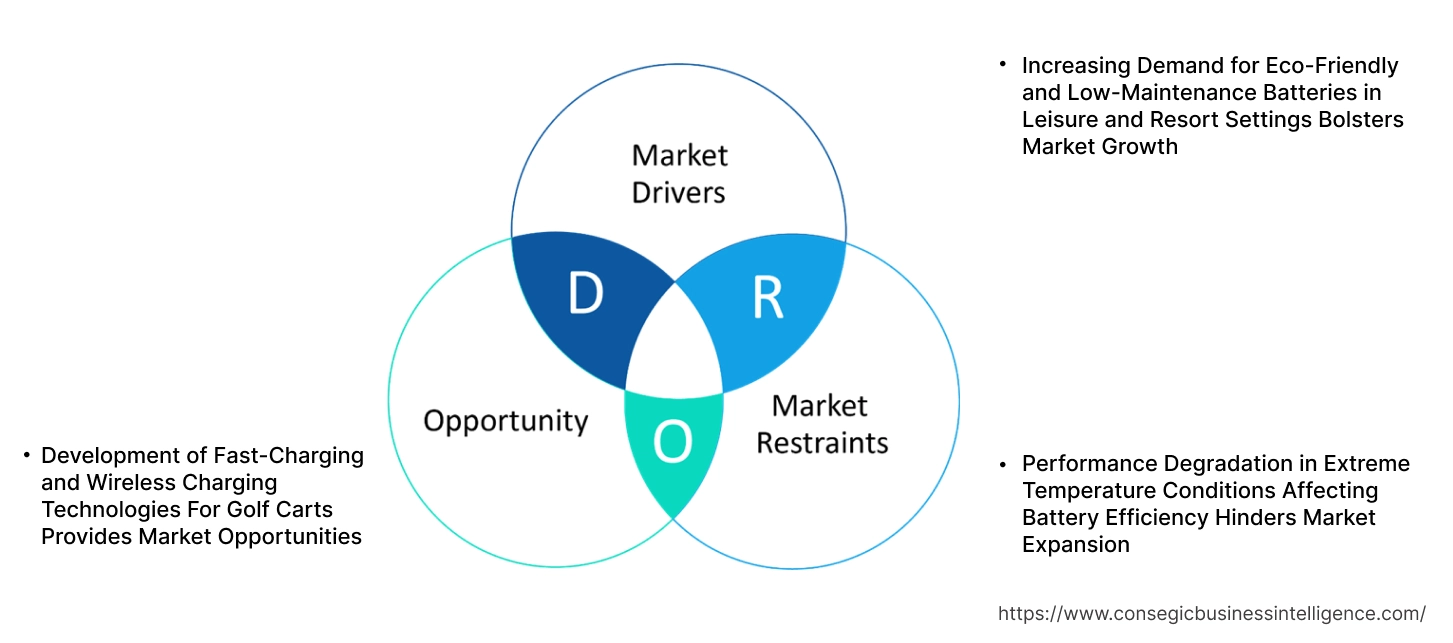

Golf Cart Battery Market Dynamics - (DRO) :

Key Drivers:

Increasing Demand for Eco-Friendly and Low-Maintenance Batteries in Leisure and Resort Settings Bolsters Market Growth

As sustainability becomes a key focus in the leisure and resort industries, the need for eco-friendly solutions is driving the shift towards electric-powered golf carts. These carts are increasingly preferred for their low environmental impact, especially in resorts, gated communities, and recreational facilities where noise reduction and clean energy are highly valued. Lithium-ion batteries, in particular, are gaining popularity due to their longer lifespan, lower maintenance requirements, and reduced weight compared to traditional lead-acid batteries. Their ability to deliver consistent performance and shorter charging times makes them ideal for facilities looking to optimize efficiency and reduce operational costs.

- For instance, in March 2025, Yamaha Motor announced the plan to launch the new five-seater electric golf carts, G30Es and G31EPs, in Japan in June 2025 for enhanced rider comfort. It features a lithium-ion battery and high-performance AC motor for a quiet, smooth and stable ride. The combined regenerative braking system and AC motor reduces power consumption by nearly 30% compared to earlier models.

As more golf courses and resorts prioritize green initiatives, the necessity for high-performance, low-maintenance golf cart batteries continues to rise, contributing significantly to the golf cart battery market expansion.

Key Restraints:

Performance Degradation in Extreme Temperature Conditions Affecting Battery Efficiency Hinders Market Expansion

Extreme temperatures, both hot and cold, can significantly affect the performance of golf cart batteries, particularly in regions with harsh seasonal variations. In hot climates, high temperatures lead to increased evaporation of electrolytes in traditional lead-acid batteries, causing them to lose efficiency over time. Similarly, cold temperatures cause the internal resistance of lithium-ion batteries to increase, reducing their capacity and overall runtime. These performance issues impact both user experience and operational efficiency, as golf carts may need more frequent charging or reduced functionality in extreme weather. Additionally, some battery types are not optimized for frequent temperature fluctuations, creating reliability concerns. As demand for reliable and consistent performance grows, these temperature-related challenges continue to hinder the golf cart battery market growth, particularly in regions with highly variable weather conditions.

Future Opportunities :

Development of Fast-Charging and Wireless Charging Technologies For Golf Carts Provides Market Opportunities

As the demand for convenience and efficiency increases, the development of fast-charging and wireless charging solutions presents significant opportunities for the golf cart battery market. Faster charging times allow for minimal downtime between uses, making golf carts more practical for busy commercial environments like golf courses, resorts, and public parks. Additionally, wireless charging technology eliminates the need for physical connections, providing a more user-friendly experience and reducing maintenance needs. These innovations align with the growing need for more efficient, eco-friendly, and convenient electric transportation solutions. As both residential and commercial users prioritize operational efficiency, the advancement of these technologies is poised to enhance the value proposition of electric golf carts.

- For instance, in December 2024, Vatrer Power launched an innovative smart golf cart battery, equipped with an advanced Battery Management System (BMS) that continuously monitors and regulates performance. The battery metrics are accessible to users through a Bluetooth-connected app for real-time tracking. The 105Ah capacity allows vehicles to cover up to 50 miles on a single charge. Furthermore, it features fast charging capability, which enables recharging from 0% to 100% in just 5 hours, reducing downtime.

The rise of these next-generation charging solutions presents substantial golf cart battery market opportunities, fostering long-term growth in the sector.

Golf Cart Battery Market Segmental Analysis :

By Battery Type:

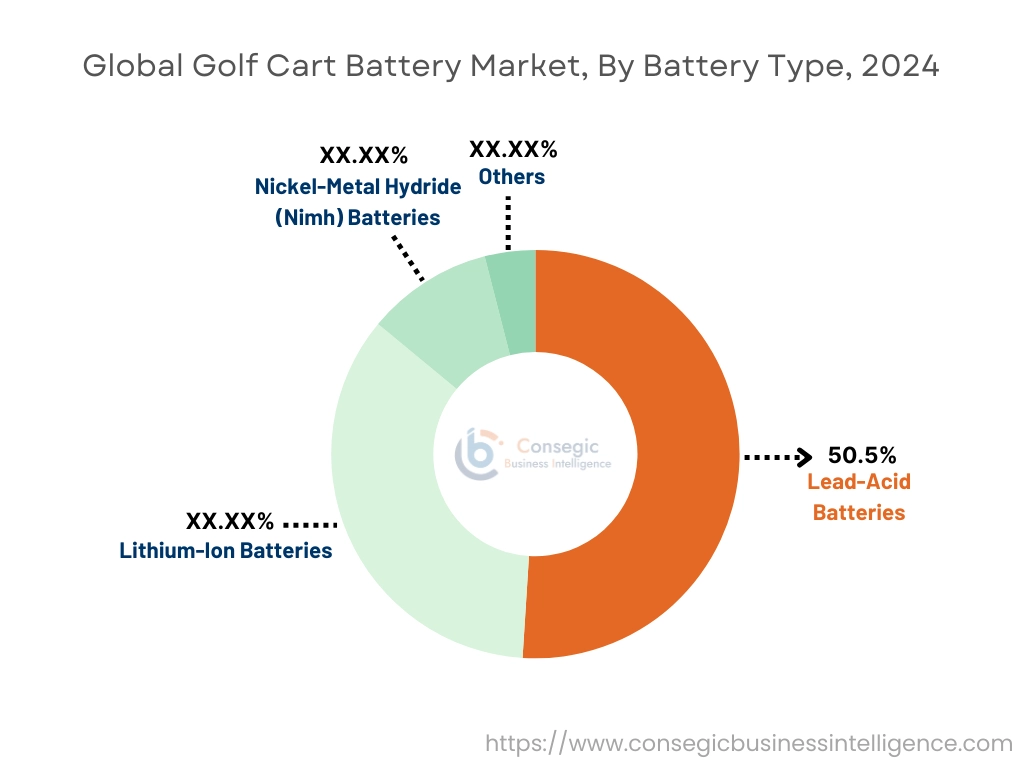

Based on battery type, the market is segmented into lead-acid batteries, lithium-ion batteries, nickel-metal hydride (NiMH) batteries, and others.

The lead-acid batteries segment accounted for the largest golf cart battery market share of 50.5% in 2024.

- Lead-acid batteries are widely used in golf carts due to their cost-effectiveness and proven performance over decades.

- They are durable, offer reliable power for short durations, and are easy to replace, making them ideal for entry-level golf carts and budget-conscious buyers.

- Their availability and lower upfront cost contribute significantly to their dominant share in the market.

- As per golf cart battery market analysis, lead-acid batteries continue to dominate due to their affordability and the widespread adoption in both residential and commercial applications.

The lithium-ion batteries segment is expected to grow at the fastest CAGR during the forecast period.

- Lithium-ion batteries are gaining popularity in the golf cart battery market due to their lightweight nature, longer lifespan, and higher energy density compared to lead-acid batteries.

- These batteries provide faster charging times, greater reliability, and a longer range, which makes them ideal for high-end and commercial golf carts.

- The growing preference for eco-friendly, sustainable solutions in the leisure and transportation sectors is driving the need for lithium-ion batteries.

- For instance, in March 2025, Trojan Battery Company launched the new Trojan Lithium OnePack™ Extended Range 48V lithium-ion battery pack, which travels up to 75 miles on a single charge. The product delivers multiple layers of safety, greater capacity and the best in-class warranty. Furthermore, real-time monitoring of battery status is available through the Trojan SmartBattery App.

- According to market trends, the demand for lithium-ion batteries is rising as the industry shifts towards cleaner, more efficient alternatives, driving the golf cart battery market growth.

By Voltage:

Based on voltage, the golf cart battery market is segmented into below 10V, 10- 50V, and above 50V.

The 10- 50V segment held the largest revenue share in 2024.

- Golf carts typically operate in this voltage range, providing sufficient power for daily use in golf courses, resorts, and other leisure environments.

- Batteries within this range offer a good balance between performance, cost, and energy capacity, making them ideal for the majority of users in the golf cart market.

- This voltage range is widely adopted in both lead-acid and lithium-ion batteries.

- For instance, Litharv offers 48V 150Ah Lithium Golf Cart Batteries with an integrated Battery Management System (BMS) to protect against overcharge, over-discharge, and other potential issues. It features fast charging, reaching full power in just 3-5 hours.

- As per golf cart battery market analysis, the 10- 50V segment continues to dominate, supported by its compatibility with the majority of golf cart models.

The above 50V segment is expected to witness the fastest CAGR during the forecast period.

- Batteries with voltages above 50V are used in higher-performance golf carts, including those designed for heavy-duty commercial use or long-distance travel.

- These batteries support more powerful motors, providing faster speeds and longer ranges, which makes them essential for use in large-scale facilities, resorts, or public transportation systems.

- The shift toward electric vehicles in various transportation sectors is expected to increase requirement for high-voltage batteries.

- According to golf cart battery market trends, the market for higher-voltage systems is growing rapidly as more customers seek longer operational times and increased power.

By Distribution Channel:

Based on the distribution channel, the market is segmented into OEMs and the aftermarket.

The OEM segment accounted for the largest golf cart battery market share in 2024.

- OEMs supply golf cart manufacturers with batteries for new units, which makes this the dominant segment in terms of volume.

- Golf cart manufacturers rely heavily on established partnerships with battery producers to provide reliable and high-performance batteries for their new products.

- OEMs typically offer batteries with warranties and optimized designs, which adds to their attractiveness for new buyers.

- Thus, the OEM segment remains the largest supplier to the golf cart battery market demand due to the consistent production of new golf carts in residential, commercial, and leisure sectors.

The aftermarket segment is expected to register a strong CAGR during the forecast period.

- Aftermarket sales include replacement and upgrade batteries for existing golf carts, driven by the need to replace worn-out or outdated batteries.

- As golf carts age, the need for aftermarket batteries increases, especially in markets with older fleets of carts.

- Aftermarket suppliers also cater to customers who wish to upgrade their batteries to more efficient, longer-lasting options, such as lithium-ion.

- According to golf cart battery market trends, the aftermarket segment is experiencing growth as more users invest in high-performance replacements or upgrades.

By End-Use:

Based on end-use, the market is segmented into golf courses, hospitality, educational institutes, healthcare, airports, and others.

The golf course segment held the largest revenue share in 2024.

- Golf courses are the largest consumers of golf carts, which are used extensively for transporting players and staff across large estates.

- The requirement for high-performance, reliable batteries is driven by the need for carts that can operate for long hours throughout the day without frequent recharging.

- Golf courses increasingly adopt electric carts due to their eco-friendly nature and operational cost savings.

- As per golf cart battery market demand, the golf course sector remains the dominant end-use industry for batteries due to the sheer volume of carts in operation.

The hospitality segment is expected to witness the fastest CAGR during the forecast period.

- Hotels, resorts, and theme parks are increasingly adopting electric golf carts for guest transport, which is fueling the need for batteries in the hospitality industry.

- These applications require high efficiency, long-range, and easy-to-maintain batteries to provide uninterrupted services to guests.

- As the hospitality industry continues to embrace eco-friendly solutions, the need for battery-operated transport, including golf carts, is expected to rise.

- According to the golf cart battery market expansion, the hospitality sector is projected to experience a rapid increase in golf cart adoption due to rising investments in sustainable and guest-friendly services.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

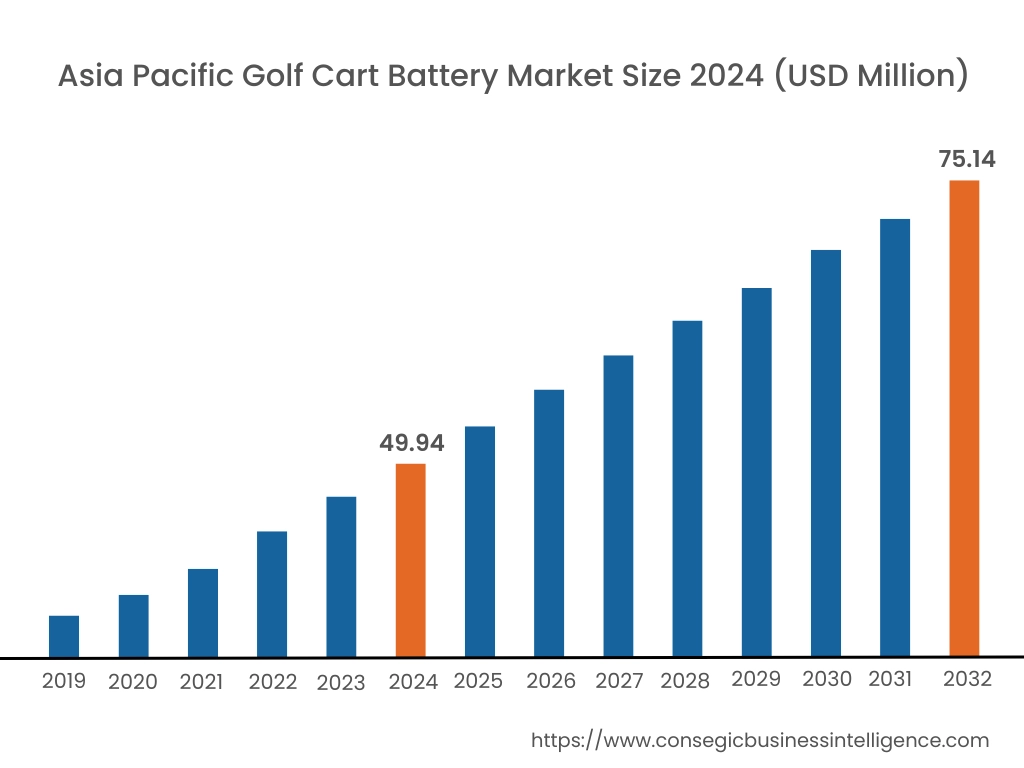

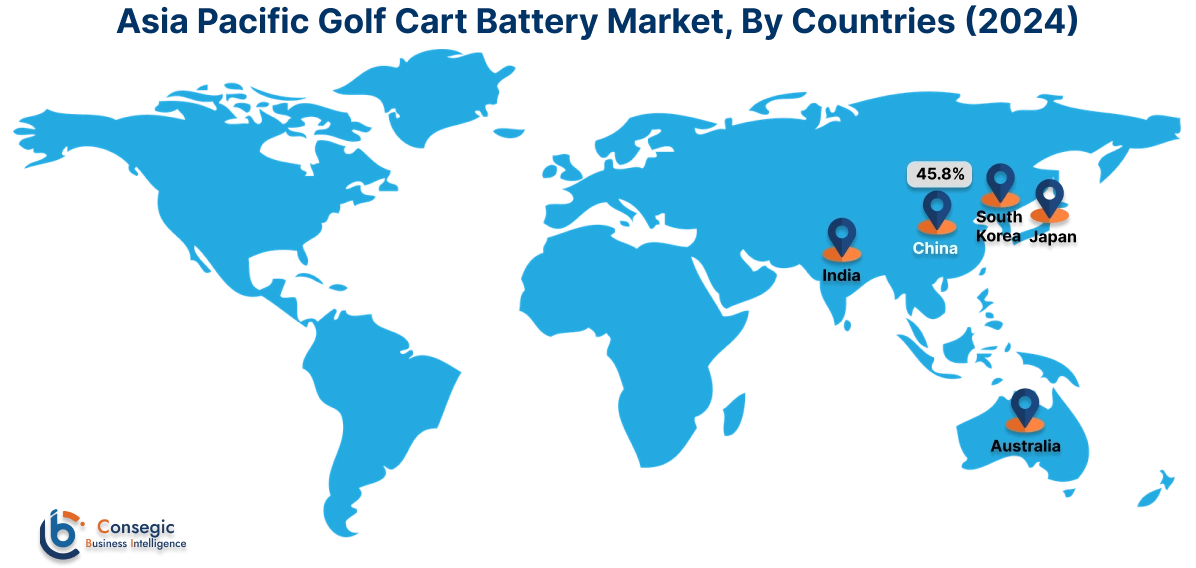

Asia Pacific region was valued at USD 49.94 Million in 2024. Moreover, it is projected to grow by USD 51.63 Million in 2025 and reach over USD 75.14 Million by 2032. Out of this, China accounted for the maximum revenue share of 45.8%. Asia-Pacific is witnessing rapid growth in the golf cart battery industry, particularly in China, Japan, India, and Southeast Asia. Market analysis shows increasing adoption of electric carts not only in golf resorts but also in airports, industrial zones, and academic campuses. The region is transitioning from traditional lead-acid batteries to lithium iron phosphate variants due to longer service life, compact size, and thermal stability. Growth is further fueled by urban development projects and government-backed clean mobility programs. Domestic battery manufacturing capabilities and regional pricing competitiveness enhance accessibility for both standard and high-performance battery types.

North America is estimated to reach over USD 91.18 Million by 2032 from a value of USD 61.32 Million in 2024 and is projected to grow by USD 63.34 Million in 2025. North America remains a dominant region, driven by widespread use of golf carts in leisure facilities, gated communities, and commercial campuses. The United States and Canada have seen consistent replacement cycles for lead-acid batteries and rising adoption of lithium-ion variants. Market analysis highlights a growing preference for maintenance-free, fast-charging, and longer-cycle-life batteries. Growth in this region is supported by the expansion of golf courses, increasing electrification in hospitality and real estate projects, and sustainability goals that encourage lightweight battery solutions. Seasonal usage patterns and extreme temperature variations also shape product design and replacement preferences.

In Europe, golf cart battery adoption is shaped by energy efficiency regulations, compact recreational environments, and institutional use across resorts and public parks. Market analysis reveals a growing trend toward lithium-based batteries due to EU restrictions on hazardous materials and increasing consumer demand for eco-friendly solutions. Countries such as the UK, France, and Spain are modernizing golf course infrastructure and embracing electric vehicle transitions, including utility and shuttle carts powered by advanced battery systems. The golf cart battery market opportunity in Europe is further driven by integrated energy management practices and facility operators aiming to reduce long-term operating costs.

Latin America presents emerging demand for golf cart batteries, particularly in Brazil, Mexico, and Chile. Market analysis suggests growing utilization of electric carts in tourism resorts, gated residential developments, and healthcare institutions. Although traditional batteries still dominate, there is a gradual shift toward advanced chemistries to support longer runtime and less frequent maintenance. Growth in this region is supported by rising investments in recreational infrastructure and expansion of luxury hospitality services. The market opportunity lies in offering durable and affordable solutions tailored to diverse terrain and climate conditions, as well as increasing awareness of lifecycle cost advantages.

In the Middle East and Africa, the market is growing steadily, with adoption driven by golf tourism, smart city developments, and the use of electric carts in airports and event venues. Countries like the UAE, Saudi Arabia, and South Africa are integrating electric mobility into high-end residential and commercial zones. Market analysis indicates a growing need for high-temperature-resistant batteries and sealed, low-maintenance options. As infrastructure expands in desert climates and off-grid resorts, battery performance reliability and durability become top priorities. Growth is expected to continue as regional operators modernize their fleets and explore solar-compatible charging ecosystems.

Top Key Players and Market Share Insights:

The golf cart battery market is highly competitive with major players providing products and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global golf cart battery market. Key players in the golf cart battery industry include -

- Microtex Energy Private Limited (India)

- Exide Industries Ltd. (India)

- Sebang Global Battery Co., Ltd. (South Korea)

- C&D Technologies (subsidiary of KPS Capital Partners) (Canada)

- GS Yuasa Corporation (Japan)

- Enersys Australia Pty Ltd (Australia)

- Leoch International Technology Limited (China)

- BAE Batterien GmbH (Germany)

- East Penn Manufacturing Company (Deka Batteries) (USA)

- Crown Battery Manufacturing Company (USA)

Recent Industry Developments :

Acquisitions:

- In January 2025, the leading provider of advanced power and energy solutions, Motive Energy acquired Deep Cycle Battery San Diego, a trusted supplier of automotive, marine, RV, golf cart, and commercial batteries, to expand its presence and service capabilities in Southern California.

Partnerships:

- In April 2025, the leading lithium-ion battery manufacturer and electric energy solution provider in China, CBAK Energy Technology Inc., partnered with Kandi Technologies Group, Inc., an international leader in new energy innovation, to establish two lithium battery production facilities in the United States.

Golf Cart Battery Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 273.74 Million |

| CAGR (2025-2032) | 5.1% |

| By Battery Type |

|

| By Voltage |

|

| By Distribution Channel |

|

| By End-Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Golf Cart Battery Market? +

Golf Cart Battery Market size is estimated to reach over USD 273.74 Million by 2032 from a value of USD 184.45 Million in 2024 and is projected to grow by USD 190.49 Million in 2025, growing at a CAGR of 5.1% from 2025 to 2032.

What specific segmentation details are covered in the Golf Cart Battery Market report? +

The Golf Cart Battery market report includes specific segmentation details for battery type, voltage, distribution channel and end-use.

What are the end-use of the Golf Cart Battery Market? +

The end-use of the Golf Cart Battery Market are golf courses, hospitality, educational institutes, healthcare, airports, and others.

Who are the major players in the Golf Cart Battery Market? +

The key participants in the Golf Cart Battery market are Microtex Energy Private Limited (India), Exide Industries Ltd. (India), Sebang Global Battery Co., Ltd. (South Korea), C&D Technologies (subsidiary of KPS Capital Partners) (Canada), Enersys Australia Pty Ltd (Australia), Leoch International Technology Limited (China), BAE Batterien GmbH (Germany), East Penn Manufacturing Company (Deka Batteries) (USA), Crown Battery Manufacturing Company (USA) and GS Yuasa Corporation (Japan).