High Purity Sulfuric Acid Market Size:

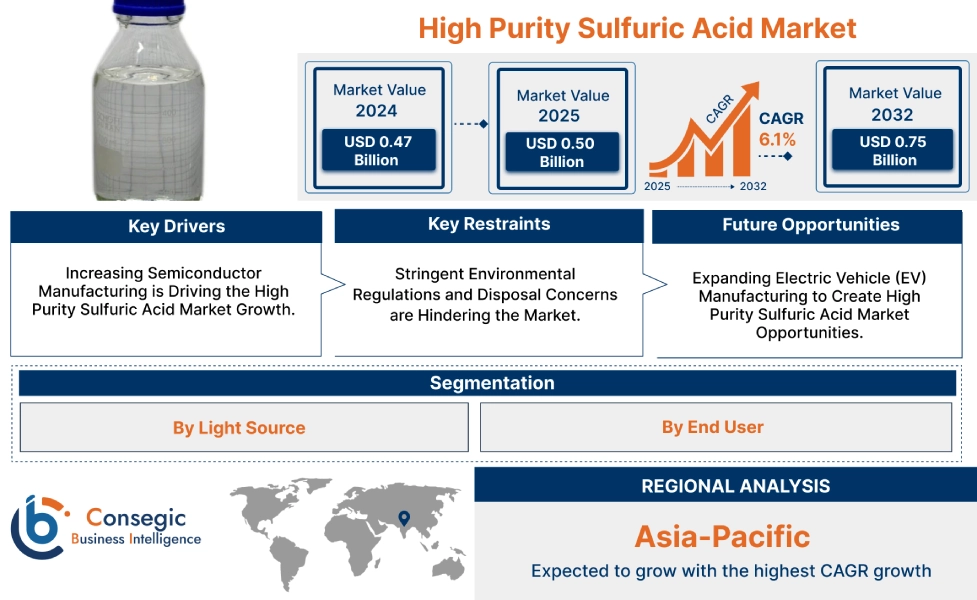

The High Purity Sulfuric Acid Market size is growing with a CAGR of 6.1% during the forecast period (2025-2032), and the market is projected to be valued at USD 0.75 Billion by 2032 from USD 0.47 Billion in 2024. Additionally, the market value for 2025 is attributed to USD 0.50 Billion.

High Purity Sulfuric Acid Market Scope & Overview:

High purity sulfuric acid (HPSA) is a specialized chemical defined by its purification property to achieve impurity levels that are crucial for preventing contamination in sensitive applications. This superior purity is vital for the electronics and semiconductor industries, where this chemical plays a fundamental role in cleaning and etching processes. These are important for fabricating advanced integrated circuits and other microelectronic components. It is characterized by its purity-driven segmentation, and significant geographic concentration in key electronics manufacturing hubs, contributing to its high requirements across several industries.

High Purity Sulfuric Acid Market Dynamics - (DRO) :

Key Drivers:

Increasing Semiconductor Manufacturing is Driving the High Purity Sulfuric Acid Market Growth.

High-purity sulfuric acid is important for wafer fabrication processes such as cleaning and etching amongst others. Tiny impurities have the ability to significantly reduce chip yield, thereby driving the need for this high-grade acid in the semiconductor market. This is driven by the increasing complexity of semiconductors, alongside their widespread adoption of emerging technologies such as AI, 5G, and IoT, amongst others.

- For instance, according to Deloitte, the semiconductor industry experienced a growth rate of more than 15% in 2024 from its previous year, thus positively influencing high purity sulfuric acid market trends.

Hence, due to the aforementioned factors, increasing semiconductor manufacturing is driving the high purity sulfuric acid market growth.

Key Restraints:

Stringent Environmental Regulations and Disposal Concerns are Hindering the Market.

Stringent environmental regulations and the inherent concerns regarding the disposing of high purity sulfuric acid are significant hurdles to the market. The corrosive and hazardous nature of chemicals requires substantial investments in specialized infrastructure for manufacturing, storage, and transportation, leading to increased operational costs. Furthermore, companies are experiencing an increase in expenses due to strict limits on emissions and wastewater discharge, alongside the complex and costly processes required for recycling high purity sulfuric acid to prevent environmental contamination. Therefore, the above-mentioned factors are contributing to hindrance in the high purity sulfuric acid market expansion.

Future Opportunities :

Expanding Electric Vehicle (EV) Manufacturing to Create High Purity Sulfuric Acid Market Opportunities.

The rise in the automotive industry's shifts towards electrification has led to an increased demand for advanced electronic components, including power semiconductor, control units, and other critical microelectronic parts. All these parts and components rely on high purity sulfuric acid for their fabrication processes. Furthermore, while not directly used in the battery cells themselves, it is also incorporated in the manufacturing of certain high-purity materials as well as in the cleaning of components within EV battery systems. This expansion in the EV landscape is expected to positively influence high purity sulfuric acid market trends.

- For instance, according to IEA, in 2023, more than 10 million electric vehicles were registered across the globe.

Thus, as per analysis, expanding electric vehicle manufacturing is creating high purity sulfuric acid market opportunities.

High Purity Sulfuric Acid Market Segmental Analysis :

By Application:

Based on Application, the market is categorized into cleaning, etching, and others.

Trends in Application:

- There is a growing trend in wafer cleaning due to the rising complexity of integrated circuits (ICs) requiring more stringent contamination control.

- The evolution of advanced etching techniques for intricate circuit patterns is also a rising trend.

The cleaning segment accounted for the largest high purity sulfuric acid market share in 2024 and is expected to grow at the fastest CAGR over the forecast period.

- The rise in the need for semiconductor manufacturing is the primary factor driving segmental share in the market. The consistent focus on the development of smaller process nodes in chip fabrication necessitates increasingly stringent purity levels for HPSA.

- Additionally, the growing complexity of Integrated Circuits (ICs) states that cleaning steps are becoming more frequent, driving segments.

- Beyond traditional semiconductors, the increase of related electronics industries, including LCD panel manufacturing, PCB fabrication, and the growing production of advanced LED are further contributing to the cleaning segment.

- For Instance, according to the Press Information Bureau, the production of electronics experienced significant growth with the production value increasing by 1.5 times from 2017 to 2023 in India, and is expected to maintain a lucrative CAGR over the forecast period.

- Thus, as per the high purity sulfuric acid market analysis, the cleaning segment is dominating the high purity sulfuric acid market demand.

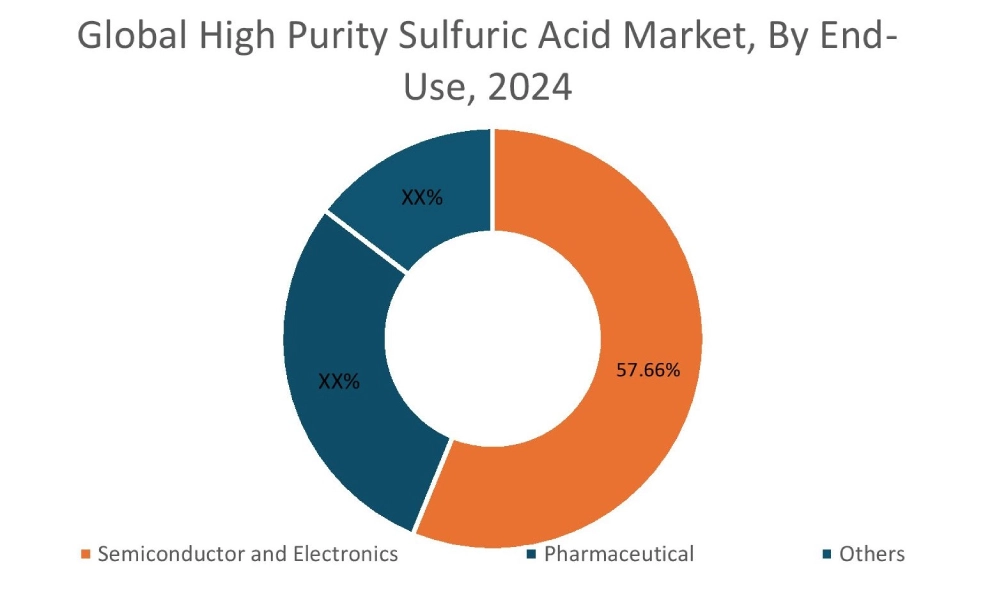

By End-Use:

Based on the end use, the market is categorized into semiconductor and electronics, pharmaceutical, and others.

Trends in the End Use

- There is a growing trend of using high purity sulfuric acid in smaller electronic devices due to their superior cleaning properties.

- The usage of high purity sulfuric acid in the pharmaceutical industry due to strict regulations for active pharmaceutical ingredients is also a rising trend.

The semiconductor and electronics segment accounted for the largest market share of 57.66% in 2024 and is expected to grow at the fastest CAGR over the forecast period.

- The increasing focus on miniaturization and advanced process nodes, in integrated circuit (IC) manufacturing, is contributing to the segment.

- For instance, according to WSTS, the sale of integrated circuits across the globe experienced a growth rate of more than 20% in 2024 from 2023.

- Additionally, the need is further driven by the rise in global investments in expanding semiconductor fabrication plant (fab) capacities across Asia Pacific, North America, and Europe

- Furthermore, the utilization of semiconductor applications in high-growth areas such as Artificial Intelligence (AI), the Internet of Things (IoT), and advanced automotive electronics, including Electric Vehicles, is creating an increase in segment in the market.

- Thus, based on the high purity sulfuric acid market analysis, the semiconductor and electronics segment dominate high purity sulfuric acid market demand.

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

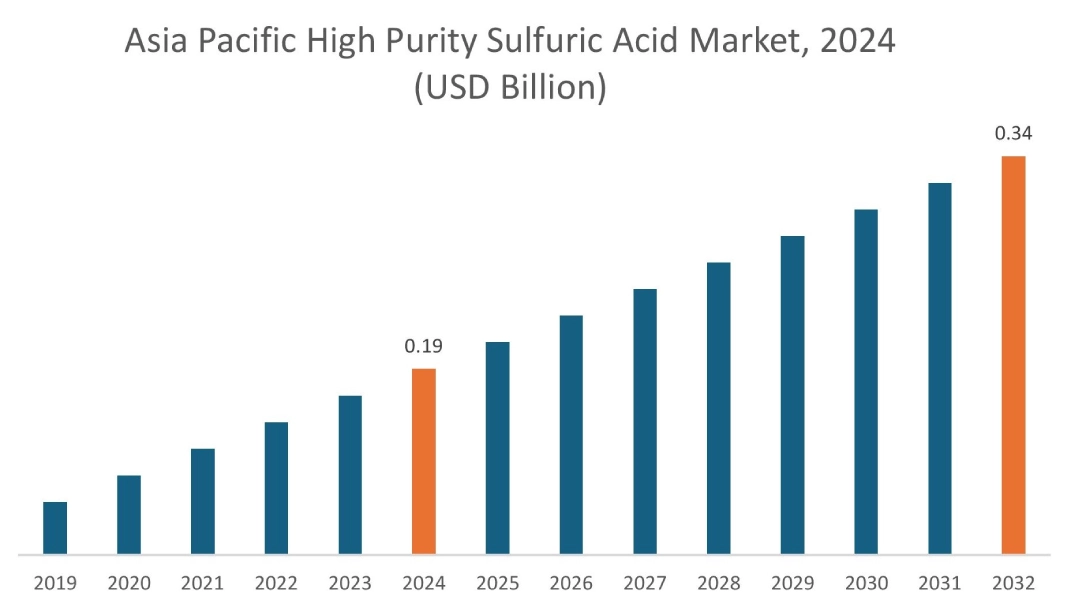

In 2024, Asia Pacific accounted for the highest market high purity sulfuric acid market share at 40.12% and was valued at USD 0.19 Billion and is expected to reach USD 0.34 Billion in 2032. In Asia Pacific, China accounted for a market share of 39.22% during the base year of 2024. The region's dominance is driven by the concentration of memory chip manufacturers in countries such as Taiwan, South Korea, China, and Japan, all investing heavily in expanding and upgrading their fabrication lines. These fabrication lines require a massive and consistent supply of HPSA for critical wafer processing steps. Furthermore, government initiatives across APAC to boost domestic chip production, along with the increasing global demand for semiconductors across diverse applications are contributing to the demand for HPSA. Overall, as per analysis, the aforementioned factors are driving the market in the Asia Pacific.

In Europe, the high purity sulfuric acid industry is experiencing the fastest growth with a CAGR of 5.5% over the forecast period. The increasing production of electric vehicle manufacturing is a significant driver for the high purity sulfuric acid market expansion in the region. This is driven by the need for advanced automotive electronics, such as power semiconductors and microcontrollers, which are crucial to EVs and rely heavily on high purity sulfuric acid for their fabrication. Furthermore, it acts as a suitable vital reagent in the research and development of next-generation battery technologies and other advanced materials for EVs. Overall, the aforementioned factors are driving the market in the region.

In North America, as per the market analysis, factors such as the increase in research and development in advanced materials science are contributing to the high purity market growth. North America's academic institutions, government labs, and private companies consistently require high purity sulfuric acid for the synthesis and purification of new materials such as next-generation semiconductors and nanomaterials, where its ultra-purity prevents contamination. Furthermore, it is important for highly controlled wet etching and cleaning steps in fabricating new devices and for the accurate laboratory analysis and quality control of these advanced materials. These factors collectively are contributing to the region’s demand.

The high purity sulfuric acid market in Latin America is increasingly influenced by the stringent purity requirements within its expanding pharmaceutical and fine chemical industries. As countries like Brazil, Argentina, and Colombia are increasing their domestic drug manufacturing, they are compelled to adhere to GMP and pharmacopeial standards, requiring high purity sulfuric acid for the synthesis of active pharmaceutical ingredients, ensuring drug safety and efficacy. Similarly, the region's fine chemical sector, producing specialized chemicals requires high purity sulfuric acid to prevent contamination and uphold product quality.

Innovation in high purity sulfuric acid for packaging and delivery systems creates potential within the Middle East and Africa market that are driven by the region's growing industrial diversification. Due to the region’s harsh climate and complex logistics, advanced packaging materials and designs are crucial for maintaining HPSA's ultra-high purity during extended transit. Furthermore, innovations are enhancing safety during the handling and transportation of this corrosive chemical through specialized bulk containers and smart monitoring. As MEA countries increasingly invest in high-tech industries such as electronics assembly and specialized manufacturing, the demand for high purity sulfuric acid is rising in the region.

Top Key Players and Market Share Insights:

The Global High Purity Sulfuric Acid Market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global High Purity Sulfuric Acid market. Key players in the High Purity Sulfuric Acid industry include

- Sumitomo Chemical (Japan)

- TIB Chemicals (U.S.)

- Kanto Chemical (Japan)

- Asia Union Electronic Chemicals (Taiwan)

- Suzhou Crystal Clear Chemical (China)

- Nouryon (Netherlands)

- Mitsubishi Chemical (Japan)

- BASF (Germany)

- Avantor (U.S.)

High Purity Sulfuric Acid Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 0.75 Billion |

| CAGR (2025-2032) | 6.1% |

| By Application |

|

| By End-Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the High Purity Sulfuric Acid market? +

In 2024, the High Purity Sulfuric Acid market is USD 0.47 Billion.

Which is the fastest-growing region in the High Purity Sulfuric Acid market? +

Europe is the fastest-growing region in the High Purity Sulfuric Acid market.

What specific segmentation details are covered in the High Purity Sulfuric Acid market? +

By Application and End Use segmentation details are covered in the High Purity Sulfuric Acid market.

Who are the major players in the High Purity Sulfuric Acid market? +

Sumitomo Chemical (Japan), TIB Chemicals (U.S.), Nouryon (Netherlands), Mitsubishi Chemical (Japan), BASF (Germany), Avantor (U.S.), Kanto Chemical (Japan) are some of the major players in the market.