Onshore Drilling Fluid Market Introduction :

Consegic Business Intelligence analyzes that the onshore drilling fluid market is growing with a CAGR of 5.1% during the forecast period (2023-2031), and the market is projected to be valued at USD 6,660.67 Million by 2031 and USD 4,457.40 Million in 2023 from USD 4,269.19 Million in 2022.

Onshore Drilling Fluid Market Definition & Overview:

Onshore drilling fluids are specialized fluids that are used during the drilling and exploration of oil and gas wells on land. These fluids are designed to perform several important functions, including lubrication, cooling, and stabilization of the drilling equipment, and removal of cuttings from the wellbore. Onshore drilling fluids are essential for drilling operations as they help to maintain the stability and integrity of the wellbore, prevent damage to the equipment, and ensure efficient drilling progress.

Onshore Drilling Fluid Market Insights :

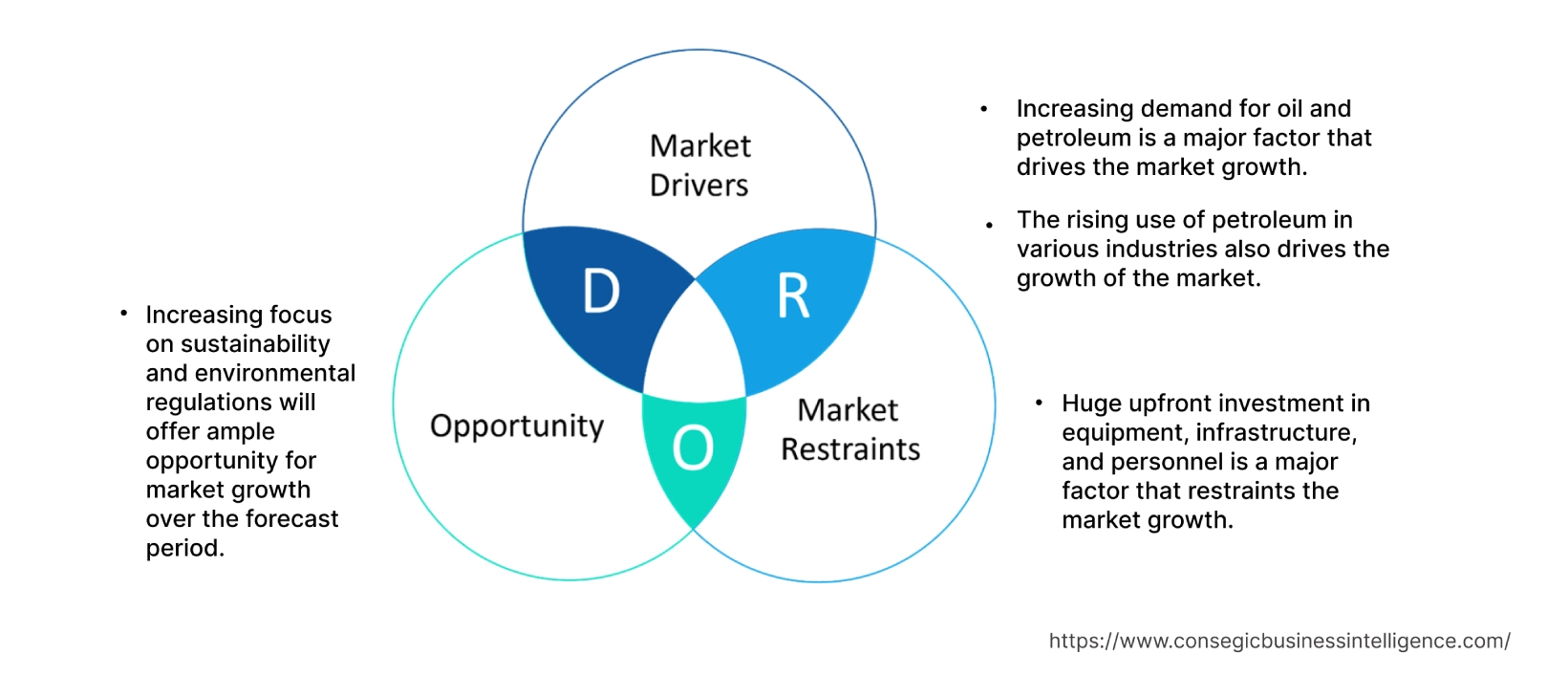

Onshore Drilling Fluid Market Dynamics - (DRO) :

Key Drivers :

Increasing demand for oil and petroleum is a major factor that drives the market growth

Onshore drilling fluids are heavy viscous liquids that are used in carrying out oil and gas extraction operations on land. They are also known as oil-based muds (OBMs). OBMs are made up of a base oil, such as diesel or kerosene, and various additives, such as dispersants, rheology modifiers, and fluid loss control agents. The global demand for oil and gas continues to rise, particularly in emerging economies. The Oil 2023 medium-term market report forecasts that based on current government policies and market trends, global oil demand will rise by 6% between 2022 and 2028 to reach 105.7 million barrels per day (mb/d) supported by robust demand from the petrochemical and aviation sectors. This led to increased exploration and production activities, which drives the demand for drilling fluids. For instance, for the exploration and production of oil and gas wells, drilling fluids play a critical role. They are used to lubricate and cool the drilling equipment, stabilize the wellbore, and remove cuttings from the well. Thus, the growing demand for oil and petroleum drives the market growth.

The rising use of petroleum in various industries also drives the growth of the market

Onshore drilling fluids are essential for the use of petroleum. They are used to drill wells and to produce oil and gas. Robust economic development, growing industrialization, urbanization, and infrastructure growth, along with increasing vehicle sales, contributed to the overall higher demand for transportation, energy, and fuel, thus driving up the consumption of petroleum products. According to the U.S. Energy Information Administration, In 2022, U.S. total petroleum consumption averaged about 20.28 million barrels per day (b/d). U.S. total petroleum consumption was about 2% higher in 2022 than in 2021 and about 12% higher than in 2020. For this reason, the rising use of petroleum in various industries drives the growth of the market.

Key Restraints :

Huge upfront investment in equipment, infrastructure, and personnel is a major factor that restraints the market growth

The onshore drilling industry requires significant upfront investment in equipment, infrastructure, and personnel because drilling for oil and gas is a complex and technically challenging process that involves several stages. The upfront investment includes the cost of drilling rigs and equipment pipelines, storage tanks, and transportation systems which hinders the growth of the market.

Future Opportunities :

Increasing focus on sustainability and environmental regulations will offer ample opportunity for market growth over the forecast period

One major opportunity for the onshore drilling fluids market is the increasing focus on sustainability and environmental regulations. As the world shifts towards cleaner energy sources and more sustainable practices, there is a growing demand for eco-friendly drilling fluids that have a minimal environmental impact. This presents an opportunity for companies to develop and market new types of drilling fluids that are biodegradable, non-toxic, and more environmentally friendly. For instance, the development of eco-friendly drilling fluid by using biodegradable polymers as its base. These fluids have a lower environmental impact than traditional oil-based drilling fluids, which can contaminate soil and water in the event of a spill. For this reason, increasing focus on sustainability and environmental regulations will offer ample opportunity for market growth over the forecast period.

Onshore Drilling Fluid Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 6,660.67 Million |

| CAGR (2023-2031) | 5.1% |

| By Product Type | Oil-based Drilling Fluid, Synthetic-based Drilling Fluid, Water-based Drilling Fluid, and Others |

| By Well Type | HPHT and Conventional |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Schlumberger Limited, Halliburton Energy Services, Inc., Newpark Resources Inc., Petrochem Performance Chemical LLC, McAda Drilling Fluids, AES Drilling Fluids LLC, Weatherford International Plc, Baker Hughes Company, Tetra Technologies Inc., and Canadian Energy Services L.P. |

Onshore Drilling Fluid Market Segmental Analysis :

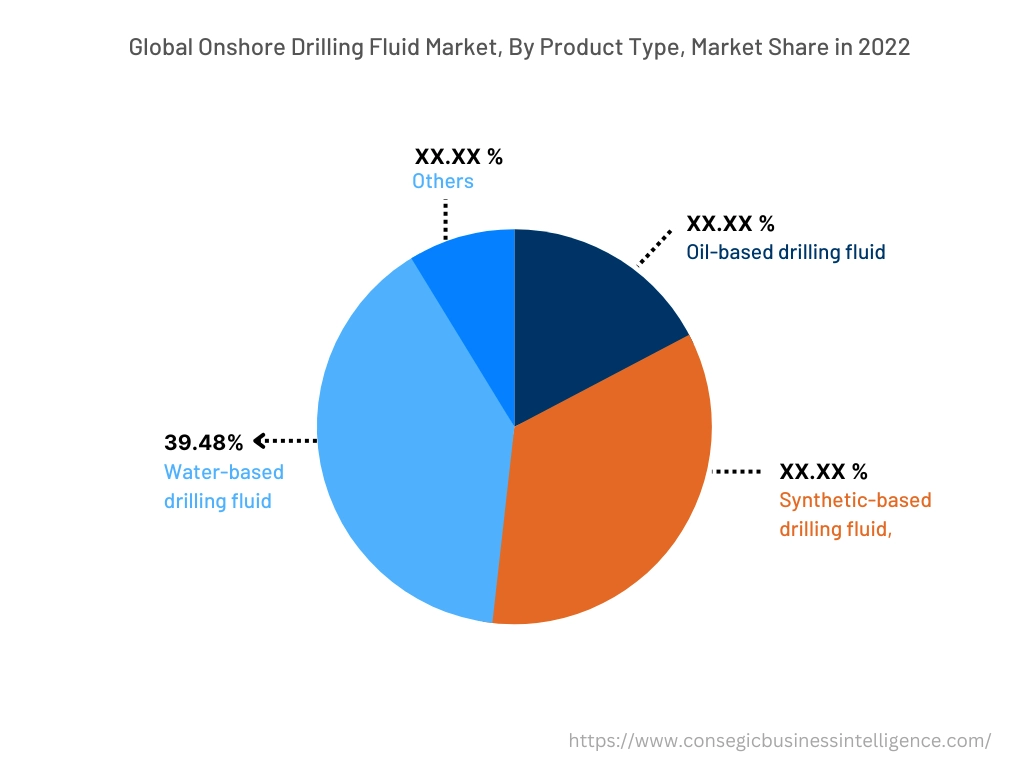

Based on the Product Type :

The type segment is categorized into oil-based drilling fluid, synthetic-based drilling fluid, water-based drilling fluid, and others. In 2022, the water-based drilling fluid segment accounted for the highest market share of 39.48% in the onshore drilling fluids market. This is because, water-based drilling fluids offer a good balance of performance, environmental considerations, and cost-effectiveness, making them a popular choice for many drilling operations. Further, water-based drilling fluids are generally considered to be safer to handle and use than other types of drilling fluids, as they are less toxic and pose fewer health risks to workers. Hence, contributing to the growth of the segment.

However, synthetic-based drilling fluid is expected to be the fastest-growing segment in the market over the forecast period as this offers superior performance in certain drilling conditions, such as high-temperature and high-pressure environments. They also offer better lubricity, thermal stability, and shale inhibition compared to water-based drilling fluids. Thus, these above-mentioned properties are expected to increase the growth of the segment.

Based on the Well Type :

The well-type segment is categorized into HPHT and conventional. In 2022, the conventional segment accounted for the highest market share. The conventional based well type typically involves shallower drilling depths and lower well temperatures and pressures compared to HPHT wells. In addition, conventional wells have been the primary source of oil and gas production for decades, and many oil and gas companies have established expertise in drilling and operating conventional wells. As a result, these companies have established infrastructure, personnel, and operational procedures that are optimized for conventional drilling, further contributing to the dominance of this well-type segment.

HPHT well allows for the extraction of oil and gas reserves that were previously inaccessible due to extreme temperatures and pressures. They offer benefits such as higher productivity, longer well life, and increased reserves recovery. Additionally, these wells may help to offset declining production from conventional wells and provide access to new sources of energy. Hence, the HPHT well type is expected to be the fastest-growing segment during the forecast period.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

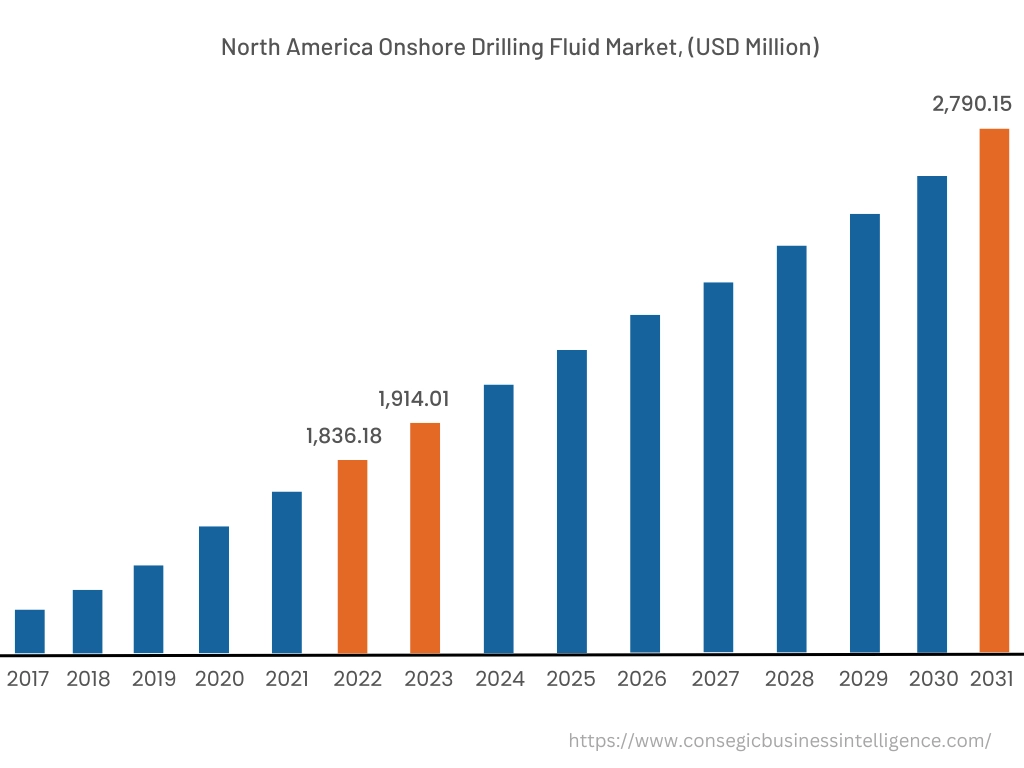

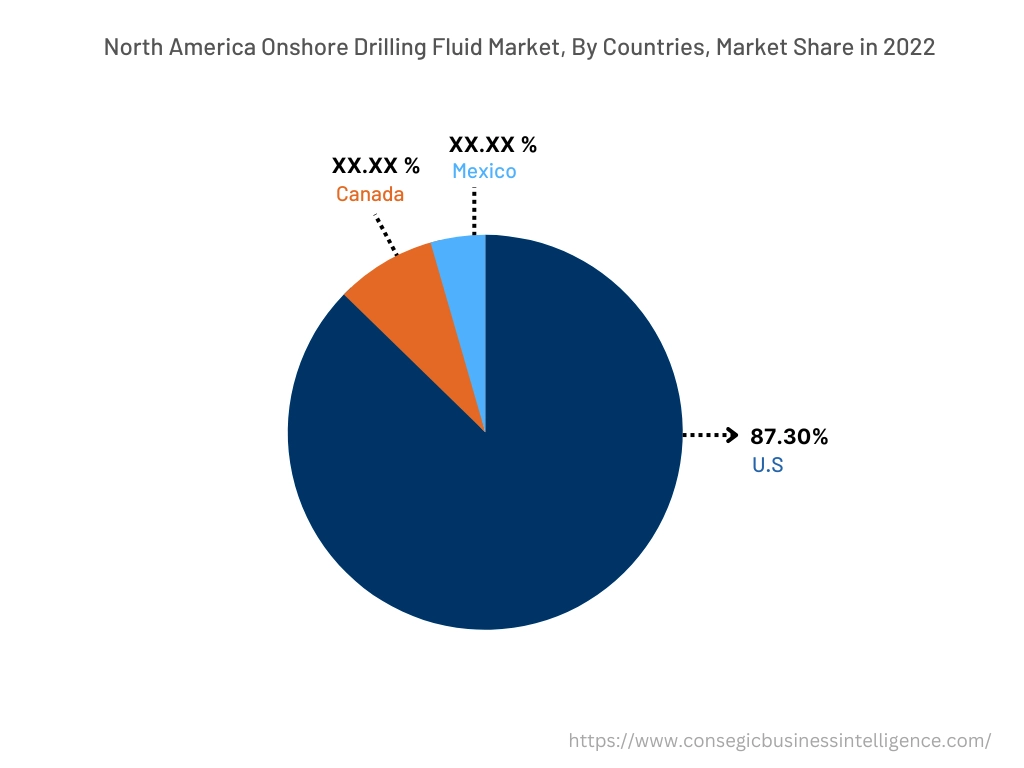

In 2022, North America accounted for the highest market share at 43.01% valued at USD 1,836.18 million in 2022 and USD 1,914.01 million in 2023, it is expected to reach USD 2,790.15 million in 2031. In North America, the U.S. accounted for the highest market share of 87.30% during the base year of 2022. In 2022, North America accounted for the highest market share in the onshore drilling fluids market. This is because North America is the base of some of the world's largest oil and gas producers and has a well-established drilling industry. The U.S., in particular, is a major market for onshore drilling fluid products, driven by shale gas and tight oil production.

However, Asia Pacific is expected to be the fastest-growing region in the market during the forecast period driven by increasing demand for energy from emerging economies such as China and India. These countries have significant potential for onshore oil and gas production, and they are investing heavily in exploration and production activities. In addition, increasing environmental concerns and regulations in the region drive the demand for environmentally friendly drilling fluids and additives.

Top Key Players & Market Share Insights:

The onshore drilling fluid market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong product capabilities and a strong presence in the market through their extensive product portfolios. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Schlumberger Limited

- Halliburton Energy Services, Inc.

- Baker Hughes Company

- Tetra Technologies Inc.

- Canadian Energy Services L.P.

- Newpark Resources Inc.

- Petrochem Performance Chemical LLC

- McAda Drilling Fluids

- AES Drilling Fluids LLC

- Weatherford International Plc

Recent Industry Developments :

- In March 2022, Schlumberger secured a contract from TotalEnergies for the provision of drilling, completions, and production services for the Tilenga onshore oil development project in Uganda. The contract is expected to involve a comprehensive range of services, highlighting Schlumberger's capability in delivering end-to-end solutions for oil and gas projects.

- In September 2021, Chevron U.S.A. Inc. and Bunge North America, Inc. signed a memorandum of understanding (MOU) to establish a proposed 50-50 joint venture aimed at meeting the growing demand for renewable fuels and developing lower carbon-intensity feedstocks.

Key Questions Answered in the Report

What was the market size of the onshore drilling fluid industry in 2022? +

In 2022, the market size of onshore drilling fluid was USD 4,269.19 million.

What will be the potential market valuation for the onshore drilling fluid industry by 2031? +

In 2031, the market size of onshore drilling fluid will be expected to reach USD 6,660.67 million.

What are the key factors driving the growth of the onshore drilling fluid market? +

Increasing demand for oil and petroleum is a major factor that drives the market growth.

What is the dominating segment in the onshore drilling fluid market by the product Type? +

In 2022, water-based drilling fluid accounted for the highest market share of 39.48% in the overall onshore drilling fluid market.

Based on current market trends and future predictions, which geographical region is the dominating region in the onshore drilling fluid market? +

North America accounted for the highest market share in the overall onshore drilling fluid market.