Petroleum Jelly Market Size :

Consegic Business Intelligence analyzes that the Petroleum Jelly Market size is estimated to reach over USD 765.86 Million by 2032 from a value of USD 523.95 Million in 2024 and is projected to grow by USD 540.08 Million in 2025, growing at a CAGR of 4.90% from 2025 to 2032.

Petroleum Jelly Market Scope & Overview:

It is a clear, colorless, and odorless semi-solid mixture of hydrocarbons that is derived from petroleum. It is also known as petrolatum, white petrolatum, soft paraffin, or multi-hydrocarbon. The jelly has a melting point of 40 to 70 degrees Celsius (105 to 160 degrees Fahrenheit). As per the analysis, it is a mixture of hydrocarbons which include paraffin, naphtha, and asphalt. It is produced by the distillation of waxy petroleum material formed on oil rigs. It is a non-toxic, non-irritating, and non-sensitizing substance and is a common ingredient in skincare products such as baby oil, lip balms, and skin lotions.

The jelly is generally categorized into three grades namely industrial, medical, and cosmetic. It is a versatile and affordable product having a wide range of applications such as soothing protecting, and moisturizing the skin, curing minor injuries, healing chapped lips, and preventing infections. As a result, owing to the above-mentioned factors, the jelly is widely used across cosmetics & personal care, pharmaceutical, food & beverage, rubber & plastic, automotive, and others.

Petroleum Jelly Market Insights :

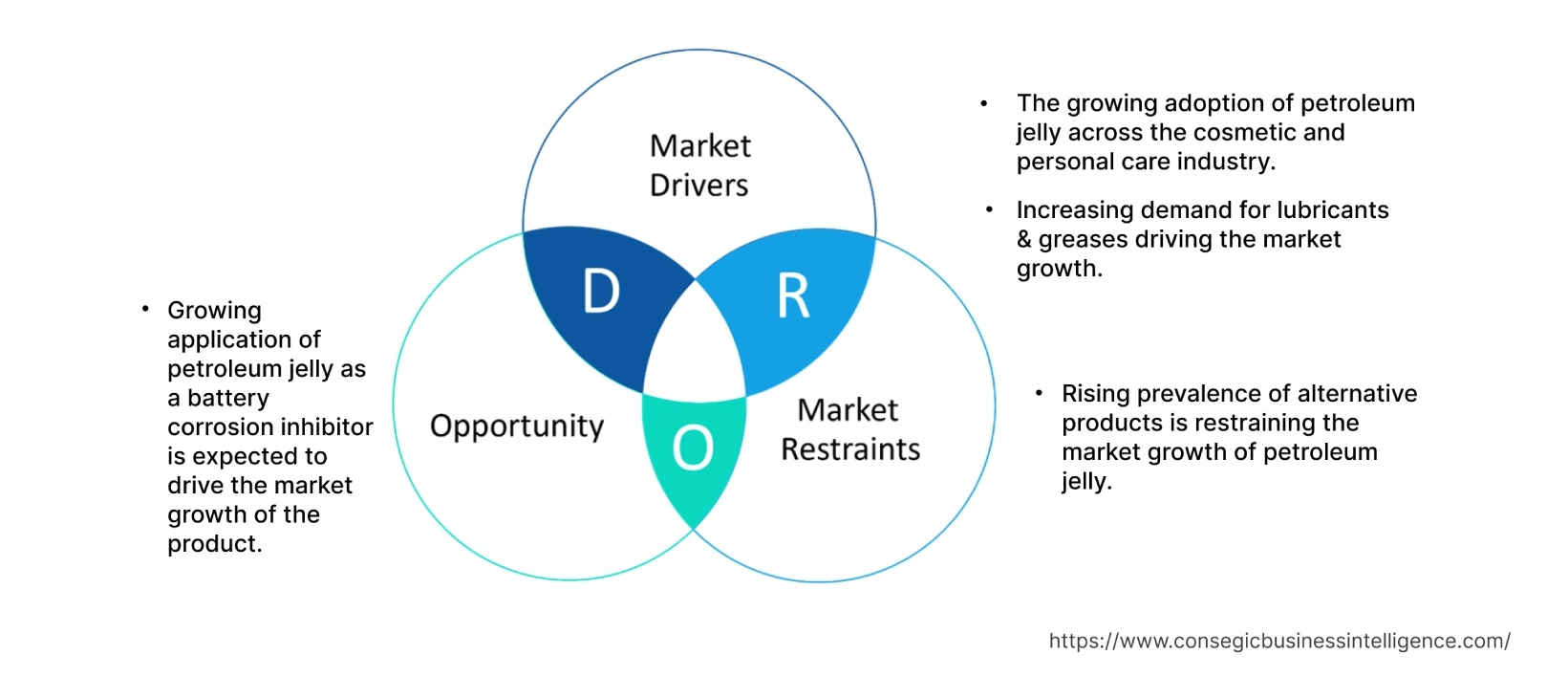

Petroleum Jelly Market Dynamics - (DRO) :

Key Drivers :

The growing adoption of petroleum jelly across the cosmetic and personal care sector Fuels the Market Growth

Petroleum Jelly is used in the cosmetics and personal care sector in the formulation of skincare products, hair conditioners, cleansing products, bath products, shampoos, and other makeup products. Moreover, the jelly slows down the transepidermal water loss from the skin by forming a barrier on the skin's surface. It also enhances the appearance and feel of hair by improving the hair texture that has been damaged physically or by chemical treatment. Based on the analysis, the growing cosmetics & personal care sector across the globe is a major factor driving the demand for this jelly as a cosmetic ingredient.

According to data by Loreal, the global beauty market was estimated to be around USD 270.22 billion in 2022. Moreover, the skincare segment dominated the beauty market with around 41%, whereas the haircare and makeup segments contributed 22% and 16% respectively. Thus, the increasing consumption of cosmetic products worldwide is enhancing the application of this jelly as a cosmetic ingredient, driving the market trends of the product.

Increasing demand for lubricants & greases driving the market expansion

Petroleum Jelly is used as a lubricant in food processing equipment, transmission components, and other industrial production processes. The jelly in the form of Vaseline can be processed as grease with the lubricating properties of oil. As per the analysis, Factors such as water repellent, excellent adhesion, resistance to weather influences, and corrosion prevention contribute to the increasing utilization of this jelly as a lubricant in the food processing sector.

The growing consumption of processed food across the globe owing to the increase in working population and income levels is a major factor driving the food sector. This in turn is further enhancing the utilization of this jelly as a food processing lubricant. For instance, according to the National Investment Promotion & Facilitation Agency, India's food processing sector is expected to reach USD 525 billion by 2025 at a CAGR of 15.2%. Moreover, India's consumer spending is anticipated to reach USD 6 trillion by 2030. Thus, the growing food processing sector is enhancing the application of this jelly as a lubricant across the sector, driving the market trends of the product.

Key Restraints :

The rising prevalence of alternative products is restraining the market expansion

The Jelly is derived as a by-product of petroleum which itself is obtained from crude oil, a non-renewable resource. Global initiatives to reduce the dependence on fossil fuels are a key factor hampering the market trends. The jelly, if not fully refined may contain toxic chemicals such as Polycyclic Aromatic Hydrocarbons (PAHs) which can increase the risk of certain types of cancers and potentially damage reproductive organs.

Moreover, shifting consumer preferences towards safer and natural alternative products for skincare is another major factor restraining the petroleum jelly market trends. Various other natural ingredients are being used in place of this jelly across the cosmetics & personal care sector. Some of them include shea butter, beeswax, olive carrier oil, cocoa butter, coconut carrier oil, and mango butter. For this reason, the rising prevalence of alternative products is restraining the market growth of this jelly.

Future Opportunities :

Growing application of petroleum jelly as a battery corrosion inhibitor is expected to drive the market expansion

Petroleum Jelly is a useful chemical for preventing corrosion on battery terminals, and create lucrative opportunities in the coming years. It lubricates the battery terminals, strengthens the connection, and prevents further corrosion. The growing automotive sector across the globe is a major factor expected to propel the use of batteries across the sector which in turn is expected to drive the application of this jelly as a corrosion inhibitor. According to data by the European Automobile Manufacturers' Association (ACEA), global vehicle production in 2021 was 79,081 thousand units in comparison to 78,084 thousand units in 2020, witnessing an increase of 1.3%. The increasing production of automotives is aggravating the usage of batteries which is expected to enhance the application of petroleum as a corrosion inhibitor.

Moreover, the rising demand for electric vehicles is further expected to enhance the utilization of batteries across the automotive sector. Global initiatives to cut down carbon emissions and achieve the net-zero emissions target by 2050 are a major factor driving the adoption of electric vehicles globally. Thus, the increasing adoption of electric vehicles is anticipated to propel the application of batteries which are creating lucrative petroleum jelly market opportunities and trends in the coming years.

Petroleum Jelly Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 765.86 Million |

| CAGR (2025-2032) | 4.9% |

| By Grade | Industrial, Medical, and Cosmetic |

| By Type | White Petroleum Jelly, Yellow Petroleum Jelly, and Others |

| By Application | Cosmetic Ingredient, Creams & Ointments, Anti-rusting Agent, Plasticizer, Food Processing, and Others |

| By End-use Industry | Cosmetics & Personal Care, Pharmaceutical, Food & Beverage, Rubber & Plastic, Automotive, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Sasol, Eastern Petroleum, LODHA Petro, APAR Industries, Sun Chem Private Limited, Adinath Chemicals, Unisynth Group, Unilever, Gandhar Oil Refinery (India) Limited, Repsol, Lubricon, Sonneborn LLC (part of HollyFrontier) |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Petroleum Jelly Market Segmental Analysis :

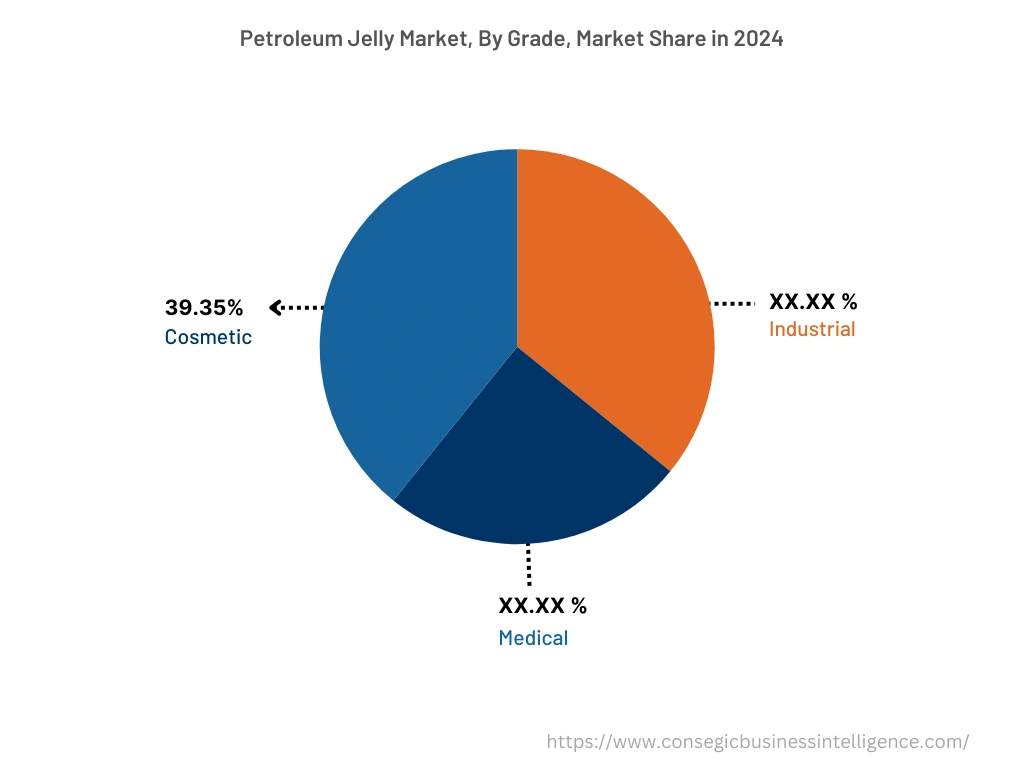

By Grade :

The grade segment is categorized into industrial, medical, and cosmetic grades. In 2024, the cosmetic grade segment accounted for the highest petroleum jelly market share of 39.35% in the overall petroleum jelly market. As per the analysis, the cosmetic grade jelly is a semi-solid mixture of hydrocarbons comprising around 20 carbon atoms in the chemical structure. The cosmetic grade exhibits dry skin curing properties and is thus used in numerous applications such as skin & hair care, hair grooming, moisture loss, skin lubrication, and others. Owing to the above-mentioned factors, cosmetic-grade jelly is dominating the overall petroleum jelly market demand.

However, the industrial grade segment is anticipated to be the fastest growing segment during the forecast period owing to the increasing utilization of this jelly as a lubricant and grease across various industries such as food processing. Thus, these factors create lucrative trends in the coming years.

By Type :

The type segment is classified into white, yellow, and others. In 2024, the yellow segment dominated the overall petroleum jelly market. Yellow is a semi-solid mixture of hydrocarbons consisting of selected waxes, forming ointment like gels, which are nearly odorless and possess excellent hydrating characteristics. Based on the analysis, the resultant gels comprise good emollient properties and consistency for formulation with other active ingredients. Owing to the mentioned factors, yellow petroleum jellies are widely used in the formulation of various cosmetic products such as hair conditioners, lip balms, hand cleaners, moisturizing lotions, and others. This is a major factor enhancing the application of yellow jelly across the cosmetics sector, driving the market growth and trends of the product.

However, the white segment is expected to be the fastest growing segment during the forecast period owing to the increasing utilization of the product in the food processing industry. The jelly is also found in cosmetic and skin care products as a moisturizing agent to keep the skin hydrated. Additionally, on wound application, this jelly prevents the wounds from drying and forming scab, that takes longer to heal. Thus, these factors are creating demand for the development of the market in the coming years.

By Application :

The applications segment is divided into cosmetic ingredients, creams & ointments, plasticizers, anti-rusting agents, food processing, and others. In 2024, the cosmetic ingredient segment accounted for the highest market share in the overall petroleum jelly market. The jelly is used as a cosmetic ingredient mainly for skin and hair care applications. In skincare, the jelly finds applications as a lubricant and coating agent for dry and chapped lips. Moreover, it is also used as an ingredient in various types of skin lotions and creams. In haircare, this jelly is used in the treatment of dry scalp & dandruff and as a hair pomade for grooming.

According to a report by Loreal, the global skincare product market was valued at around USD 111.41 billion in 2022. Moreover, the global haircare product market was valued at around USD 55 billion in 2022. Thus, as per the analysis, the growing demand for skincare and haircare products is a major factor enhancing the application of this jelly as a cosmetic ingredient, driving the market growth of the product.

However, the anti-rusting agent segment is anticipated to be the fastest growing segment over the forecast period. The jelly is used as an anti-rusting agent in iron goods such as blades and wire surgical instruments.

By End-Use-Industry :

The end-use industry segment is categorized into cosmetics & personal care, pharmaceutical, food & beverage, rubber & plastic, automotive, and others. In 2024, the cosmetics & personal care segment held the highest market share of the overall petroleum jelly market. The jelly is used in cosmetic and personal care applications in the formulation of suntan products, shampoos, hair conditioners, bath products, cleansing products, and others. The growing cosmetics & personal care sector is a major factor enhancing the application of petroleum jelly across the sector, driving the market growth of the product. According to data by Cosmetics Europe, the European cosmetics & personal care sector was valued at around USD 95.65 billion in 2022 at retail sales price. The major cosmetic & personal care markets across Europe included Germany, France, Italy, UK, Spain, and Poland.

However, the automotive sector segment is expected to be the fastest-growing segment over the forecast period owing to the increasing utilization of this jelly as a corrosion inhibitor in car batteries.

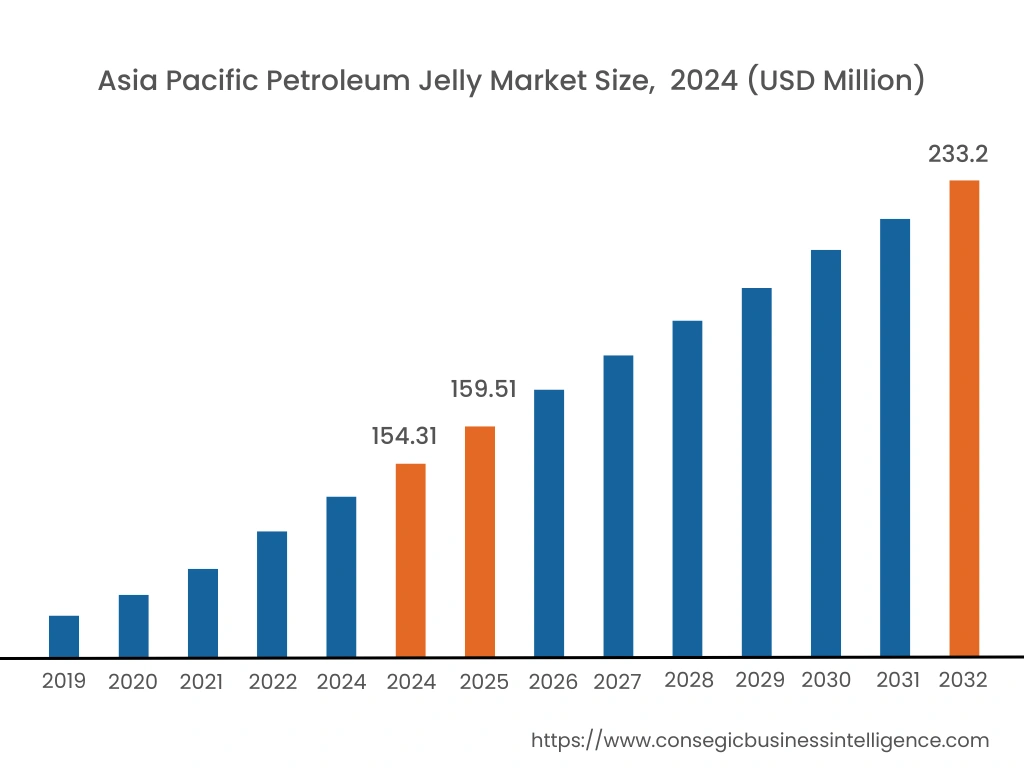

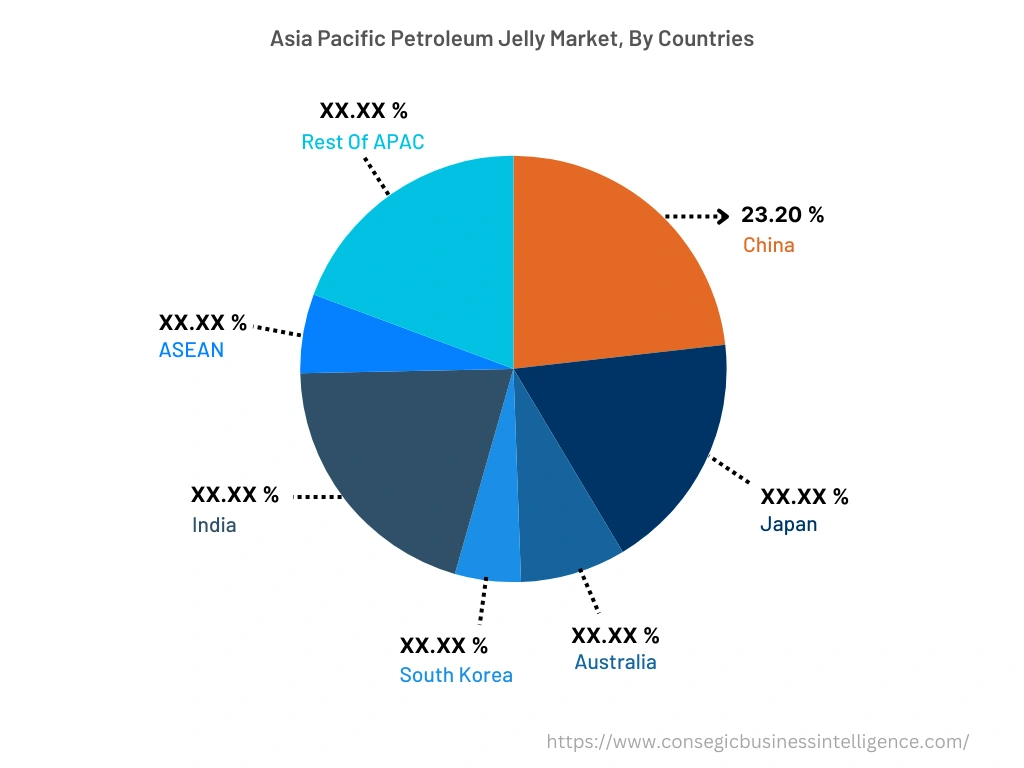

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, the Asia Pacific region accounted for the highest share of 35.70% of the overall petroleum jelly market. The market was valued at USD 154.31 Million in 2024. Moreover, it is projected to grow by USD 159.51 Million in 2025 and reach over USD 233.2 Million by 2032. In 2024, China accounted for the highest market share of 23.20% in the Asia Pacific region. Based on the petroleum jelly market analysis, the growing cosmetics and manufacturing sector across the region is a major factor enhancing the application of this jelly as an ingredient and lubricant respectively which is driving the market growth of the product. For instance, according to a report by Loreal, the North Asia region held the highest share of 32% of the overall global beauty & cosmetic market in 2022 comprising skincare, haircare, makeup, fragrances, and hygiene products. Moreover, the presence of a significant number of key players across the region is another important factor propelling the petroleum jelly market growth in Asia Pacific.

Furthermore, the North America region is expected to witness significant growth over the forecast period. This is due to the increasing adoption of this jelly as a plasticizer in the rubber and plastic sector across the region.

Top Key Players & Market Share Insights:

The global petroleum jelly market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The petroleum jelly industry is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Sasol

- Eastern Petroleum

- Gandhar Oil Refinery (India) Limited.

- Repsol

- Lubricon

- Sonneborn LLC (part of HollyFrontier)

- LODHA Petro

- APAR Industries

- Sun Chem Private Limited

- Adinath Chemicals

- Unisynth Group

- Unilever

Recent Industry Developments :

- In February 2019, HollyFrontier Corporation completed the acquisition of Sonneborn, a U.S. based manufacturer of refined hydrocarbons, including white oils, petrolatum, and microcrystalline waxes. The acquisition was valued at USD 655 million and facilitated HollyFrontier's downward integration strategy into specialty products.

Key Questions Answered in the Report

What was the market size of the petroleum jelly industry in 2024? +

In 2024, the market size of petroleum jelly was USD 523.95 million.

What will be the potential market valuation for the petroleum jelly industry by 2032? +

In 2032, the market size of petroleum jelly will be expected to reach USD 765.86 million.

What are the key factors driving the growth of the petroleum jelly market? +

The growing adoption of petroleum jelly across the cosmetic & personal care industry is fueling the market growth at the global level.

What is the dominating segment in the petroleum jelly market by grade? +

In 2024, the cosmetic grade segment accounted for the highest market share of 39.35% in the overall petroleum jelly market.

Based on current market trends and future predictions, which geographical region is the dominating region in the petroleum jelly market? +

Asia Pacific accounted for the highest market share in the overall petroleum jelly market.