Industrial Alcohol Market Size:

Industrial Alcohol Market size is estimated to reach over USD 287.89 Billion by 2031 from a value of USD 140.85 Billion in 2023 and is projected to grow by USD 151.51 Billion in 2024, growing at a CAGR of 9.3% from 2024 to 2031.

Industrial Alcohol Market Scope & Overview:

Industrial alcohol is a chemical compound majorly composed of ethanol, along with methanol and isopropanol. It is mostly produced by the fermentation of organic materials such as sugar cane, corn, etc. They are meant to be used topically, unlike the alcoholic beverages. They can function as a solvent, disinfectant, biofuel component, preservative, textiles, inks, and an intermediary product during the manufacturing process of chemicals. Some of the other industries where this compound can be utilized are the automotive, food & beverages, and manufacturing industries. The primary end-use users include the pharmaceutical, energy, and chemical industries.

How is AI Transforming the Industrial Alcohol Market?

The use of AI is emerging in industrial alcohol market, specifically for optimizing production, enhancing supply chains, and improving operational efficiency. AI-powered systems can monitor real-time data from manufacturing plants, identify inefficiencies, and suggest adjustments to improve yield and reduce waste.

Moreover, AI systems can monitor critical parameters throughout the alcohol production process, in turn identifying deviations earlier during the production process and ensuring consistent product quality. In addition, AI-powered automation streamlines both batch and continuous production systems, which further increases throughput and reduces labor costs. Consequently, the above factors are expected to positively impact the market growth in upcoming years.

Industrial Alcohol Market Insights:

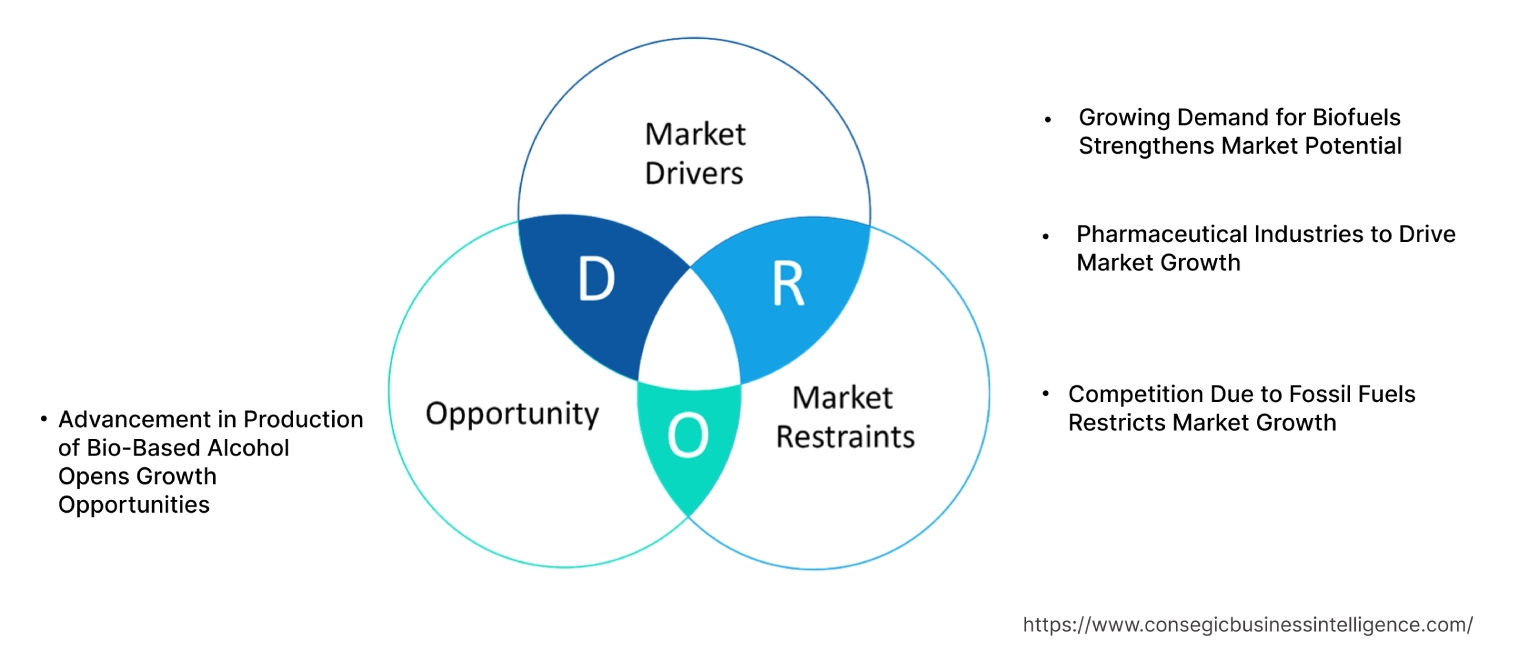

Industrial Alcohol Market Dynamics - (DRO) :

Key Drivers:

Growing Demand for Biofuels Strengthens Market Potential

Biofuels are a greener alternative to environmentally hazardous fossil fuels, as they are mostly composed of organic materials such as plants and animals. With the growing implementation of government policies and regulations, emphasizing the reduction of greenhouse gases, there is a major shift towards the usage of biofuels.

Moreover, ethanol, as a major component in biofuel production, also serves as an important feedstock for renewable energy resources.

- In October 2022, Honeywell launched its new ethanol-to-jet fuel (ETJ) processing technology that produces sustainable aviation fuel (SAF) from corn-based, cellulosic, or sugar-based ethanol.

Hence, the shift towards greener alternatives is driving the industrial alcohol market growth.

Pharmaceutical Industries to Drive Market Growth

In the pharmaceutical sector, alcohol is widely used as an important solvent, excipient, and also for the synthesis of API's. With increasing needs in the medical sector along with the invention of new drugs, the requirement for various industrial alcohols is skyrocketing. The increasing focus on personalized medicine and innovative drug delivery systems is pushing the need for specific types of alcohol. Biologics and complex pharmaceutical development require high-quality alcohol, vital for efficacy and safety.

Thus, the advancements in the pharmaceutical industries drive the industrial alcohol market growth.

Key Restraints :

Competition Due to Fossil Fuels Restricts Market Growth

Fossil fuels are the driving factor when it comes to energy markets because the infrastructure is relatively cheap and has low operating costs. There's always a price difference between industrial alcohols and fossil fuels.

Moreover, these fuels are readily available, making them more accessible and an inexpensive and easier choice. The production and processing cost of fossil fuels such as petroleum, natural gas, and coal, is also much lower which accelerates their usage.

- In July 2022, the U.S. Energy Information Administration said these three sources of energy—petroleum, natural gas, and coal—accounted for 79% of the 97 quadrillion British thermal units of primary energy consumed in the U.S. This was to illustrate that fossil fuels are still the major dominant sources of energy and are outplaying industrial alcohol and other alternative sources.

Therefore, the low operational cost of fossil fuels restrains the industrial alcohol market demand.

Future Opportunities :

Advancement in Production of Bio-Based Alcohol Opens Growth Opportunities

New developments that are leading to the production of bio-based alcohols help the future of the existing alcohol market. As time goes on, new technologies come in that further help tune down development processes, which in turn helps companies make industrial alcohol for a competitive price and also from renewable sources. A few examples of recent developments are advanced fermentation technology, enhanced catalytic processes, and the use of engineered microorganisms for better production efficiency and cost.

- FOr example, in May 2023, ArcelorMittal and LanzaTech announced the first production of ethanol from their €200 million Steelanol CCU facility at ArcelorMittal Ghent, Belgium. This plant converts carbon-rich waste gases from steelmaking into high-grade ethanol by using biobased processes developed by LanzaTech. This helps the company cut down on their greenhouse gas emissions.

Hence, the growth in the industrial alcohol market opportunities appears very promising due to the advancements in the production of biobased alcohol.

Industrial Alcohol Market Segmental Analysis :

By Type:

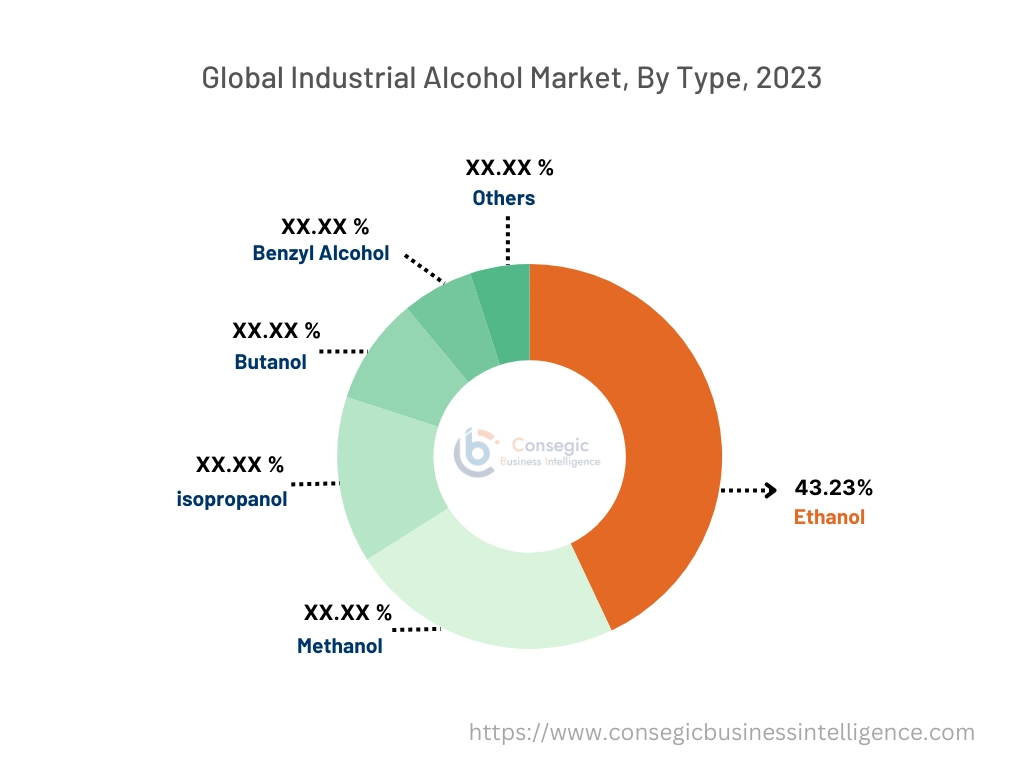

Based on type, the industrial alcohol market is segmented into ethanol, methanol, isopropanol, butanol, benzyl alcohol, and others.

Trends in the Type:

- Methanol is majorly used as a primary feedstock in the production of olefins and plastics.

- Butanol is increasingly used in the production of biofuels due to its superior blending characteristics.

- Benzyl alcohol is used as a preservative mostly for injectables in the pharmaceutical sector.

The ethanol segment accounted for the largest revenue of 43.23% of the industrial alcohol market share in 2023.

- Ethanol is a flammable, odorless, and colorless liquid, which is volatile. Its chemical formula is C₂H₅OH and can be used in solvents, disinfectants, and fuels. It is also used in the pharmaceutical and cosmetics sectors.

- It is majorly used in developed countries due to their strict environmental rules and regulations, as they reduce carbon emissions to a significant extent.

- The U.S. Energy Information Administration in 2022, reported that ethanol accounted for 10.34% of America's gasoline in 2021.

- Therefore, the rising shift towards eco-friendly solutions in developed nations is driving the industrial alcohol market demand.

The isopropanol sector is expected to make a mark on the fastest CAGR during the forecast period.

- Isopropanol is a chemical substance with a pungent odor, which is colorless and flammable. It plays an important role in various industries, due to its usage as a solvent and disinfectant.

- It is used in sanitizers in the personal hygiene sector and as solvents in the personal care and pharmaceutical industries.

- The electronics sector also uses it to clean electronic components, due to its efficiency as a solvent.

- In September 2022, the FDA approved the OMLONTI® (Omidenepag Isopropyl Ophthalmic Solution) 0.002%

- Hence, the requirement for isopropanol in multiple industries drives the market.

By Source:

The segments within the industrial alcohol market include corn, grains, sugar & molasses, fossil fuels, and others.

Trends in the Source:

- Bioethanol is increasingly produced using grains like barley and wheat, especially in countries that are rich in grain resources.

- Fossil fuel-based alcohols are converted into greener solutions using CCU technologies.

The corn sector accounted for the largest revenue of the overall industrial alcohol market share in 2023.

- Corn is used as a primary feedstock for the production of ethanol, due to its high yield, especially in the United States.

- Its utilization as feedstock is continuously increasing due to the expansion of crop production and the increase in the production of ethanol. This in turn increases its profitability and sustainability.

- According to the U.S. Department of Agriculture's National Agricultural Statistics Service (NASS) there has been a surge in the yield of corn and soybeans released in the 2021 Crop Production Annual Summary.

- Therefore, the usage of corn as a source in the production of alcohol is driving the industrial alcohol market trends.

The segment of sugar & molasses is expected to show the fastest CAGR during the forecast period.

- In terms of ethanol production, sugar and molasses are the primary feedstocks, especially in tropical countries due to the availability of raw material in excess.

- Due to the cost efficiency and energy efficiency in terms of production, they are among the feasible renewable energy sources.

- Additionally, the increasing focus on sustainable agriculture is encouraging the production of bioethanol from sugar and molasses around the world.

- In May 2021, Kilombero announced a significant increase in cane supply, which in turn surged the sugar manufacturing expansion.

- Hence, the growing focus on sustainable agriculture and the availability of raw materials drives the segment towards faster industrial alcohol market opportunities.

By Application:

Based on application, the market segmentation includes fuel, chemical intermediates, pharmaceuticals, personal care products, food & beverage, and others.

Trends in the Application:

- Alcohols including ethanol and isopropanol are utilized as preservatives and astringents in the personal care sector highlighting the need for safer and cleaner solutions among consumers.

- Ethanol can also be used in preservatives and solvents in the food & beverage sector.

The fuel sector dominated the market share with the highest revenue in 2023.

- Alcohols, majorly ethanol are used in fuel blending processes to a certain extent as regulated by government policies.

- Ethanol is increasingly used as additives in fuels, allowing the shift towards biofuels, and providing a sustainable alternative source of energy.

- In countries where fossil fuels are expensive, ethanol can be used as a lower-priced and less polluting option in such scenarios.

- According to a 2022 report by the U.S. Department of Energy biofuels are sustainable and have lower negative impacts compared to fossil fuels. They are nontoxic substances and in case they are spilled they decompose into harmless substances as they are biodegradable. They also have no harmful effects on burning as they produce fewer emissions.

- As per the analysis, the dependence of the fuel sector on these alcohols makes it the largest sector in the application segment.

The pharmaceutical segment is expected to show the fastest CAGR during the forecast period.

- In the pharmaceutical sector, ethanol and isopropanol are mostly used in the preparation of solvents, preservatives, and antiseptics. They are among the few primary ingredients required for the manufacturing of drugs.

- These alcohols are used in various pharmaceutical processes, globally, in the expanding contract manufacturing sector.

- For instance, SASMA's Pharma Grade Alcohol is manufactured according to the Good Manufacturing Practice (GMP) guidelines. These high-quality alcohols are used for the production of medicinal drugs, homeopathic products, disinfectants, and extracts.

- Thereby, as per the segmental trends analysis, the pharmaceutical sector accounts for the fastest-growing industrial alcohol market trends owing to the rising pharmaceutical sector.

By End-Use Industry:

Based on the end-use industry, the global industrial alcohol market is segmented into transportation, pharmaceuticals, personal care & cosmetics, food & beverage, chemical manufacturing, and others.

Trends in the End-Use Industry:

- Renewable alcohols are used in the packaging sector for various purposes including eco-friendly packaging and synthesis of biodegradable plastics and coatings.

- Within the construction sector, they are also used in the production of sustainable building materials, especially with the surging rise for green construction.

The transportation sector accounted for the largest revenue share in 2023.

- In the transportation sector, it is majorly used as an additive to fuels to achieve the regulatory requirements laid out by the government, to lower greenhouse gas emissions.

- The stringent emission policies and advancements in biofuel production have further accelerated the need for these alcohols as a feedstock within the transportation sector.

- A report by the U.S. Department of Energy highlights that ethanol can be used as a renewable, domestically produced transportation fuel, reducing emissions significantly. Corn-based ethanol reduces emissions by 40% and cellulosic ethanol reduces by 108%.

- In conclusion, the requirement of these alcohols in the transportation sector and the governmental norms mandating their usage, place them as the largest in the market.

The pharmaceuticals segment is expected to record the highest CAGR during the forecast period.

- In the pharmaceutical segment industrial alcohols are used in preservatives, sanitizers, and in the formulation of drugs.

- The usage of these alcohols is growing rapidly due to a surge in pharmaceutical products, especially in Asian countries.

- They are continuously used in API and excipients and the formulation of new drugs.

- Moreover, they are being used in the alcohol-based drug delivery systems further accelerating the need for them in the pharmaceutical sector.

- As per the analysis, the surge in the advancement in the pharmaceutical sector is driving the growth of the market in this sector.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

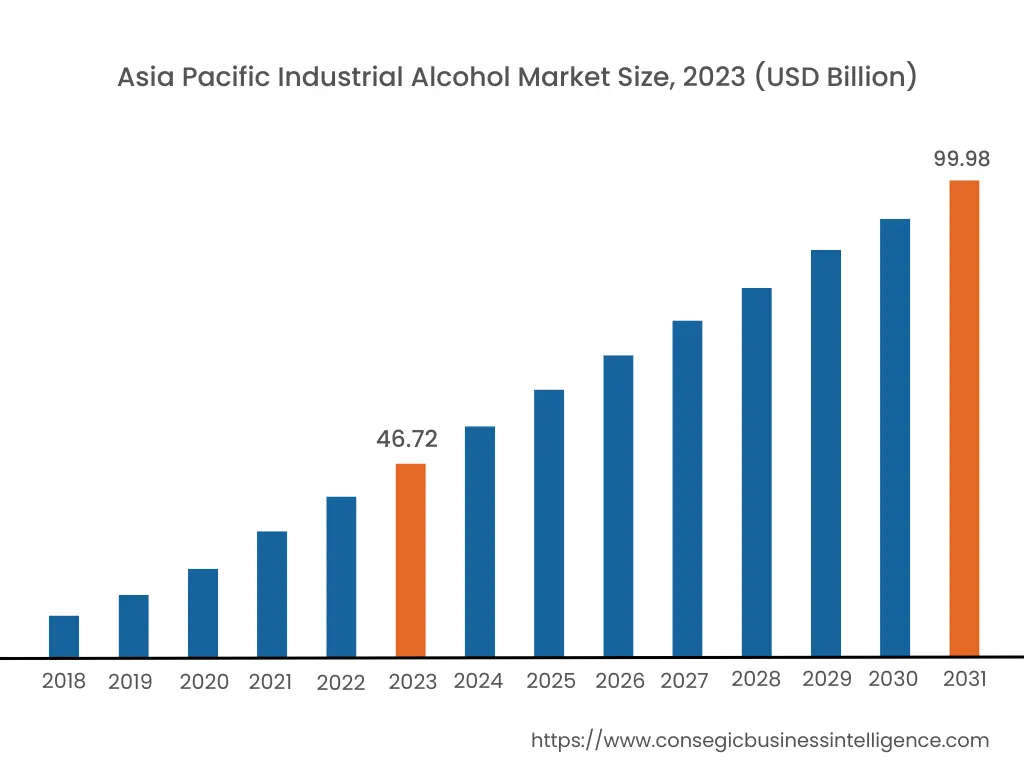

Asia Pacific region was valued at USD 46.72 Billion in 2023. Moreover, it is projected to grow by USD 50.45 Billion in 2024 and reach over USD 99.98 Billion by 2031. Out of this, China accounted for the maximum revenue share of 35.4%.

As per the industrial alcohol market analysis, this is due to the increasing usage of these alcohols in sectors such as pharmaceutical and personal care. They are majorly used in the production of sanitizers, disinfectants, and solvents in this region. Due to the advancements in the manufacturing sector and healthcare, countries such as India and China remain at the forefront of this industrial development.

- In December 2022, Clariant announced the expansion of its Care Chemicals facility in Daya Bay, Huizhou, China, boosting the overall production capacity, accounting for its CHF 80 investment.

North America is estimated to reach over USD 108.79 Billion by 2031 from a value of USD 52.27 Billion in 2023 and is projected to grow by USD 56.31Billion in 2024. This growth is due to the surge in the demand for biofuels, which lowers carbon emissions, eventually reducing the dependence on fossil fuels. The usage of ethanol as biofuel is mandated by government policies, especially the RFS mandate. The consumption of these alcohols is also growing in the transportation sector of this region.

- In May 2023, LANXESS will expand the production capacity at the Kalama site, USA for benzyl alcohol. This supports the growing demand for benzyl alcohol in the pharmaceutical, consumer care, and food sectors in North America.

The strict environmental laws, focused on reducing carbon emissions are one of the driving factors leading to the industrial alcohol market expansion in Europe. They are used in industries such as biofuels, pharmaceuticals, and personal care products, mostly due to the growing demand for bio-based chemicals.

The industrial alcohol market analysis shows that in the Middle East and Africa region, there is a growing demand for these alcohols in the food and beverages sector. The requirement for alcohol-based preservatives and flavoring agents is also increasing due to population increase and rapid urbanization in this region.

The regional trends analysis depicts that in Latin America, ethanol is majorly produced in the agricultural sector, especially in countries like Brazil. The ethanol produced from sugarcane is utilized as a biofuel and other industrial applications in this region.

Top Key Players & Market Share Insights:

The industrial alcohol market is highly competitive with major players providing industrial alcohol to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the industrial alcohol market. Key players in the industrial alcohol industry include -

- Mitsubishi Chemical Group Corporation (Japan)

- DuPont (U.S)

- Westlake Vinnolit GmbH & Co. KG (Germany)

- ADM (U.S)

- Sasol Limited (Africa)

- Yara (Norway)

- LyondellBasell Industries Holdings B.V. (UK)

- TAIYO HOLDINGS CO., LTD. (Japan)

- BASF (Germany)

- INEOS (UK)

- Dow (U.S)

- Cargill, Incorporated (U.S)

- Unilever (Netherland)

- China Petroleum & Chemical Corporation (China)

- TotalEnergies (France)

Recent Industry Developments :

Product Launches:

- In March 2024, a new automotive fuel Ethanol 100 was launched at the IndianOil Retail Outlet by the Union Minister for Petroleum & Natural Gas Shri Hardeep Singh Puri. It reduces carbon emissions significantly and offers a greener, high-octane gasoline alternative.

- In March 2024, Blue Biofuels using its Cellulose-to-Sugar (CTS) technology launched its initial batch of cellulosic ethanol.

Business Expansions & Announcements:

- In 2024, the Freedom Pines Fuels facility in Soperton, Georgia was inaugurated by LanzaJet, and partially developed by the U.S. Department of Energy. It is the first ethanol-based alcohol-to-jet SAF production plantglobally.

- In December 2023, the world's largest coal-based ethanol production plant began its test operation in the Huaibei, Anhui province, producing almost 600,000 tonnes a year, using coal as a feedstock.

- In November 2023, the Low Emission Methanol Shipping Company (LEMSCO) was launched by ProMarine. The methanol produced will be used by the vessels built by CSSC Offshore and Marine Engineering.

Partnerships & Collaborations:

- In July 2024, CF Industries and POET entered into a strategic partnership to reduce the carbon intensity of ethanol. POET's corn production process will be supported by the low-carbon ammonia fertilizer by CF industries.

Industrial Alcohol Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 287.89 Billion |

| CAGR (2024-2031) | 9.3% |

| By Application |

|

| By Source |

|

| By Application |

|

| By End Use Industry |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Industrial Alcohol Market? +

Industrial Alcohol Market size is estimated to reach over USD 287.89 Billion by 2031 from a value of USD 140.85 Billion in 2023 and is projected to grow by USD 151.51 Billion in 2024, growing at a CAGR of 9.3% from 2024 to 2031.

What specific segmentation details are covered in the industrial alcohol market report? +

The industrial alcohol report includes specific segmentation details for type, application, source, end-use industry, and region.

Which is the fastest segment anticipated to impact the market growth? +

In the type segment, Isopropanol is the fastest-growing segment during the forecast period due to its application in products related to hygiene and the manufacturing of electronics.

Who are the major players in the Industrial Alcohol market? +

The key participants in the Industrial Alcohol market are Mitsubishi Chemical Group Corporation (Japan), DuPont (U.S), Westlake Vinnolit GmbH & Co. KG (Germany), ADM (U.S), Sasol Limited (Africa), INEOS (UK), Dow (U.S), Cargill, Incorporated (U.S), Yara (Norway), Unilever (Netherland), China Petroleum & Chemical Corporation (China), BASF (Germany), LyondellBasell Industries Holdings B.V. (UK), TAIYO HOLDINGS CO., LTD. (Japan), TotalEnergies (France).