Interactive Advertising Market Size :

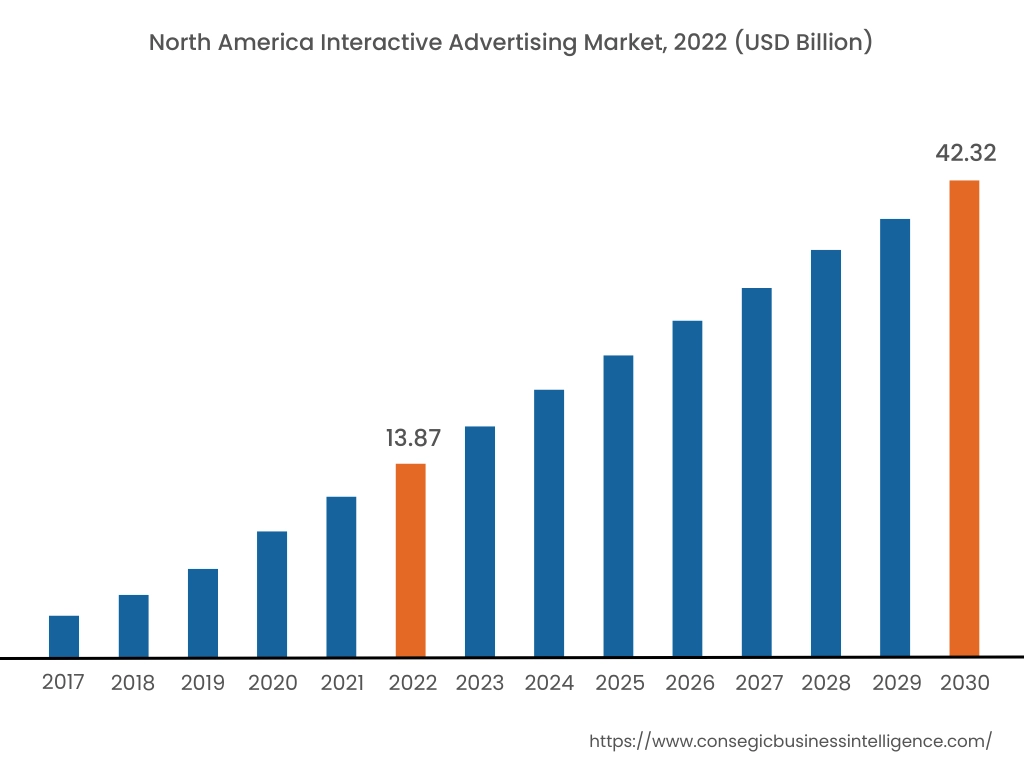

Interactive Advertising Market Size is estimated to reach over USD 122.31 Billion by 2030 from a value of USD 40.31 Billion in 2022, growing at a CAGR of 15.3% from 2023 to 2030.

Interactive Advertising Market Scope & Overview:

Interactive advertising is a type of advertising that utilizes offline or online interactive media for communicating with consumers and for promoting brands, products, services, or announcements. It offers a range of benefits including expanded brand awareness, generation of higher-quality leads, increased brand interaction, improved brand recall, and others. The aforementioned benefits are key determinants for increasing its deployment in media & entertainment, BFSI, retail & consumer goods, automotive, education, and other industries.

How is AI Transforming the Interactive Advertising Market?

AI is increasingly being integrated into the interactive advertising sector, particularly for allowing hyper-personalized content, automating campaign optimization, providing deep customer insights through predictive analytics, and generating dynamic ads in real-time. AI integration can streamline ad creation and targeting, improve user engagement, and optimize ad spend, in turn leading to more relevant experiences for consumers and better ROI (return on investment) for advertisers. Moreover, AI-powered solutions can continuously monitor campaign performance, automatically making real-time adjustments to ad placements, bids, and creative elements to improve results. Consequently, the above factors are projected to boost the market growth in upcoming years.

Interactive Advertising Market Insights :

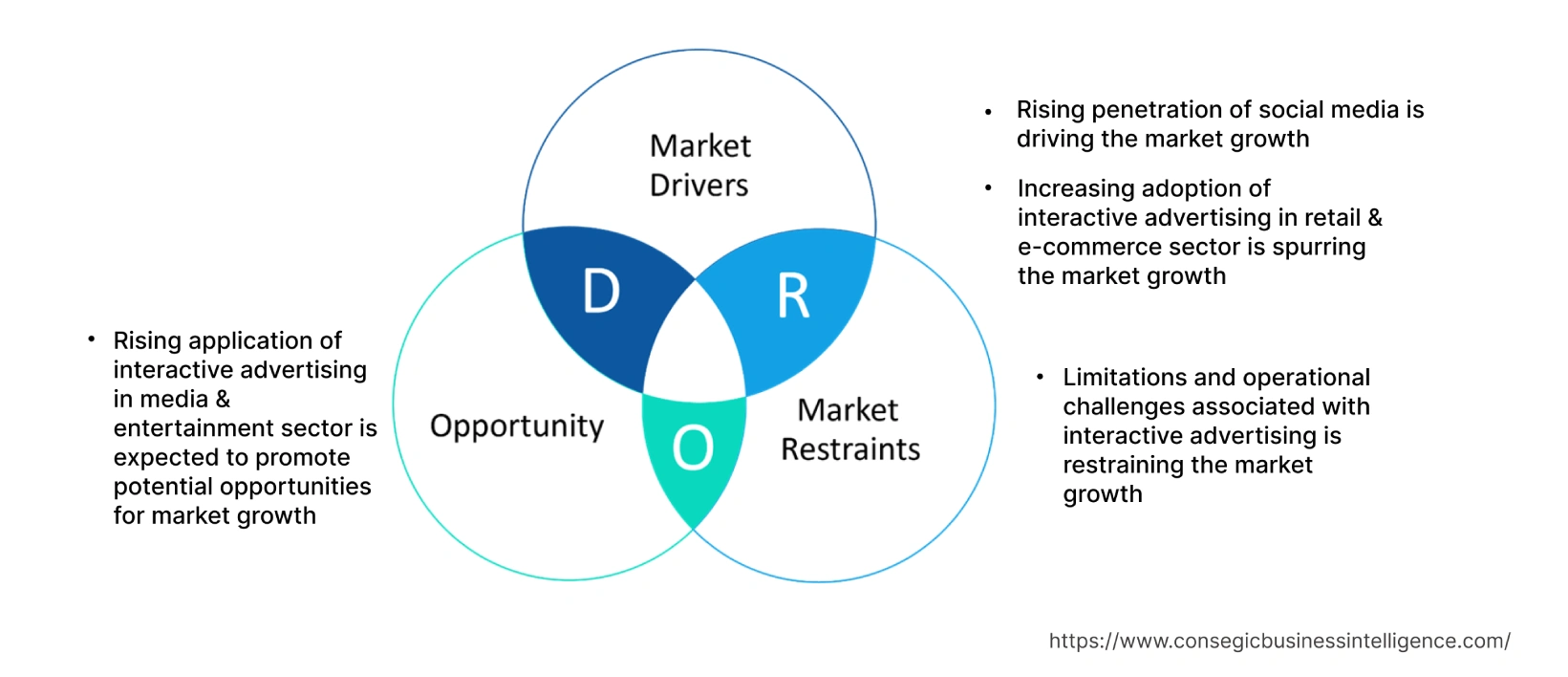

Interactive Advertising Market Dynamics - (DRO) :

Key Drivers :

Rising penetration of social media is driving the market

Interactive advertising is a form of media-based marketing technique that encourages consumer participation and utilizes interactive online media such as social media among others. It utilizes social media networks including Facebook, Instagram, and Twitter for the delivery of paid ads to the target audience, which is a quicker and more effective method for connecting with consumers and boosting marketing campaigns.

Factors including the growing consumer shift towards digital content for learning and entertainment activities and increasing penetration of social media users for content consumption are among the key prospects driving the market.

For instance, according to GS Statcounter, the total global consumption of social media content in 2022 was attributed to platforms such as Facebook, Instagram, Twitter, Pinterest, and YouTube, which accounts for 63.93%, 13.91%, 12.18%, 4.74%, and 3.98% of the total share respectively. Thus, the analysis of market trends shows that the rising penetration of social media is driving the adoption of this advertising in social media platforms for the generation of higher-quality leads and expanded brand awareness, in turn driving the interactive advertising market growth.

Increasing adoption in the retail & e-commerce sector is spurring the market

Interactive advertising is primarily employed by brands operating in the retail & e-commerce sector to bridge the gap between in-store and online shopping by offering consumers interactive ads that are more entertaining and engaging. Interactive ads also enable consumers to build trust in the brand while boosting conversions and sales, gaining access to customer insights for refining brand approaches, increasing customer loyalty, and gaining new customers among others. The above benefits are increasing its adoption in the retail & e-commerce sector.

Factors including the rise in digitalization, increasing consumer preference for online shopping, and the growing deployment of interactive marketing strategy by retail enterprises are driving the retail & e-commerce sector.

In April 2022, the government of India announced its plan to launch an online retail network across 100 Indian cities to provide consumers with an alternative to multinational platforms including Amazon and Flipkart. Moreover, according to the U.S. Census Bureau of the Department of Commerce, the e-commerce sector in the United States grew significantly by 10.8% during the third quarter of 2022 as compared to the third quarter of 2021. Hence, the market trends analysis shows that the growing retail & e-commerce sector is increasing the adoption of this advertising to expand brand awareness and boost conversion and sales, in turn proliferating the interactive advertising market growth.

Key Restraints :

Limitations and operational challenges associated are restraining the market

The implementation of interactive advertising is often associated with certain limitations and operational challenges, which is a key factor constraining market demand.

For instance, this advertising requires a longer time for preparation. Success requires extensive analysis of a brand's competitors, gathering data for building potential clients' profiles and ensuring that the ads target the right audience, which is a time-consuming process. Additionally, it is relatively more expensive than traditional forms of advertising. It is associated with the high costs required for gathering consumer data and creating ads. Further, creating interactive ads independently is quite challenging and requires the hiring of an ad setup specialist, which in turn generates additional expenditures. Hence, the analysis of market trends shows that the aforementioned limitations and operational challenges associated with interactive advertising are restraining the interactive advertising market trends.

Future Opportunities :

The rising application in the media & entertainment sector is expected to promote potential opportunities for the market

Media & entertainment companies utilize interactive advertising to reach a larger range of target audiences with their marketing content. Moreover, the availability of multiple social media platforms including YouTube, Instagram, Facebook, and others enables entertainment companies to target specific segments of their market. Likewise, advertising enables entertainment companies to put movie and TV series trailers as advertisements on other videos to attract their target audience.

Factors including the increasing investments in the media & entertainment sector, the rising popularity of OTT platforms, along the growing demand for VOD (video-on-demand) content are among the major determinants fostering the media & entertainment sector. For instance, according to the Motion Picture Association, the global entertainment sector was valued at USD 99.7 billion in 2021, witnessing a growth of 20% in comparison to 2020. Therefore, the growing entertainment sector is anticipated to increase the application, in turn promoting interactive advertising market opportunities during the forecast period.

Interactive Advertising Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 122.31 Billion |

| CAGR (2023-2030) | 15.3% |

| By Type | Social Media Ads, Playable In-App Ads, Display Ads, Interactive Video Ads, and Others |

| By End-User | Media & Entertainment, BFSI, Retail & E-Commerce, Automotive, Education, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Grey Advertising, Butler Branding, Crispin Porter Bogusky, Ogilvy, BBDO, Droga5, Wieden Kennedy, The Martin Agency, Shine Interactive, DEUTSCH, MullenLowe Global |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Interactive Advertising Market Segmental Analysis :

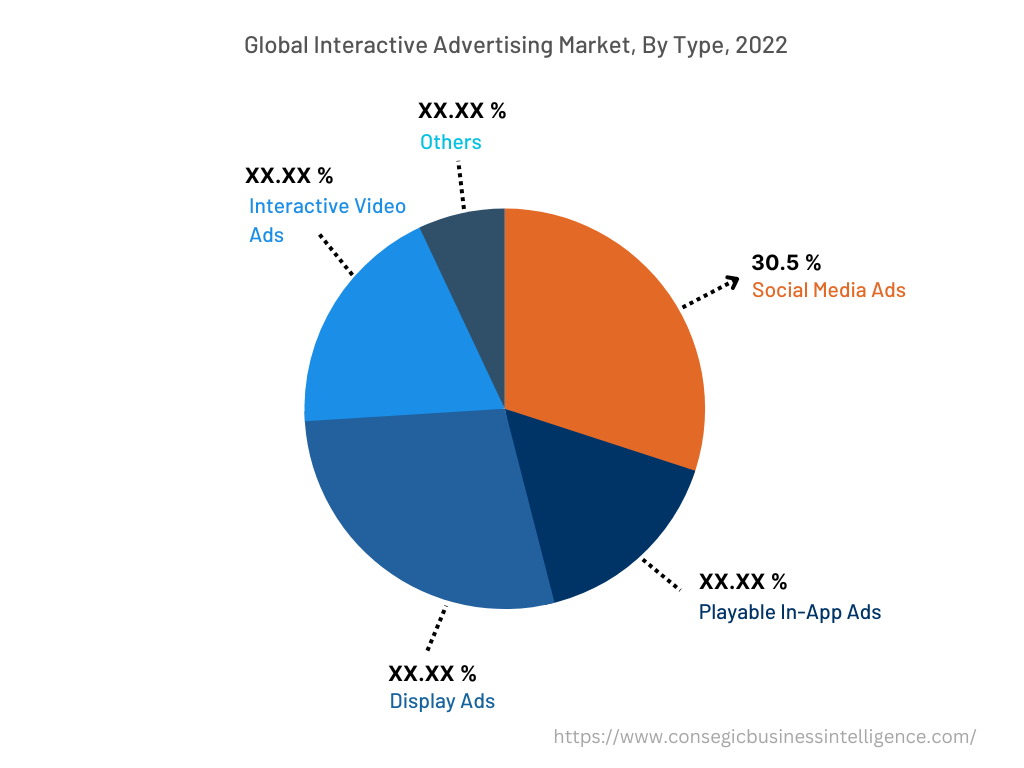

By Type :

Based on the type, the interactive advertising market is bifurcated into social media ads, playable in-app ads, display ads, interactive video ads, and others. The social media ads segment accounted for the largest revenue share of 30.5% in the year 2022 of the global interactive advertising market share. Social media ads utilize social networks including Instagram, Facebook, and Twitter for the delivery of paid ads to the target audience. Moreover, social media ads offer several benefits including increased brand awareness, improved brand loyalty, higher conversion rates, in-depth analytics, and increased lead generation among others. The above benefits of social media ads are increasing their application in media & entertainment, BFSI, retail & e-commerce sectors among others.

According to Meta, Facebook's monthly active users reached 2.96 billion as of December 2022, witnessing a growth of 2% year-over-year. Hence, the analysis of segmental trends shows that the rising penetration of social media is among the key factors driving the adoption of interactive advertising in social media platforms, in turn, contributing to the interactive advertising market demand.

The display ads segment is anticipated to register the fastest CAGR during the forecast period. Display ads include a wide range of visual applications that are utilized by brands or businesses to attract audiences to websites, social media pages, or other digital channels while encouraging audiences to take specific actions. Display ads primarily consist of a combination of graphics, text, and video or image components to appeal to audiences encourage them to click through several digital platforms, and perform particular actions that lead to an outcome. Interactive display ads are an ideal approach to obtain greater engagement and increase ROI (Return on Investment). Display ads enable users to display products in the form of a video, poll, game, or quiz. Moreover, display ads offer various benefits including improved initial brand awareness & visibility, enhanced visuals, along the ability to target and retarget preferred audiences among others.

For instance, Google enables users to create display ads and campaigns to reach relevant audiences in multiple places or to boost leads, sales, and website traffic along with building awareness and consideration for a product, business, or service. Therefore, the segment trends analysis shows that the rising advancements associated with display ads are anticipated to drive interactive advertising market trends during the forecast period.

By End-User :

Based on the end-user, the market is segregated into media & entertainment, BFSI, retail & e-commerce, automotive, education, and others. The retail & e-commerce segment accounted for the largest revenue share in the year 2022 of the total interactive advertising market share. Factors including the growing consumer preference for online shopping, increasing investments in retail & e-commerce, and rising deployment of interactive marketing strategy by retail enterprises are driving the retail & e-commerce sector.

According to the U.S. Census Bureau of the Department of Commerce, the retail e-commerce sector in the United States was valued at USD 265.9 billion during the third quarter of 2022, witnessing a growth of 3% from the second quarter of 2022. Therefore, analysis of segment trends shows that the growing retail & e-commerce sector is driving the adoption of interactive advertising for expanding brand awareness and boosting conversion and sales, in turn proliferating the interactive advertising market demand.

The BFSI segment is expected to witness the fastest CAGR during the forecast period. This is attributed to several factors including rising investments in the development of banking & financial institutions, increasing trend of digitalization in BFSI, and rising adoption of digital services among financial institutions to enhance customer experience.

For instance, according to India Investment Grid, the BFSI sector in India consists of 22 private sector banks, 53 regional banks, 18 public sector banks, 1,542 urban cooperative banks, 46 foreign banks, along 94,384 rural cooperative banks as of 2019. Interactive advertising is primarily used by banking & financial organizations to target potential market segments and customers more definitively, increase brand awareness, and attract potential customers to click and end up on a landing page on the bank's website. Thus, the analysis of segment trends shows that the rising prevalence of banking & financial institutions is projected to drive the adoption of interactive advertising for aforementioned applications, in turn driving the interactive advertising market opportunities during the forecast period.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

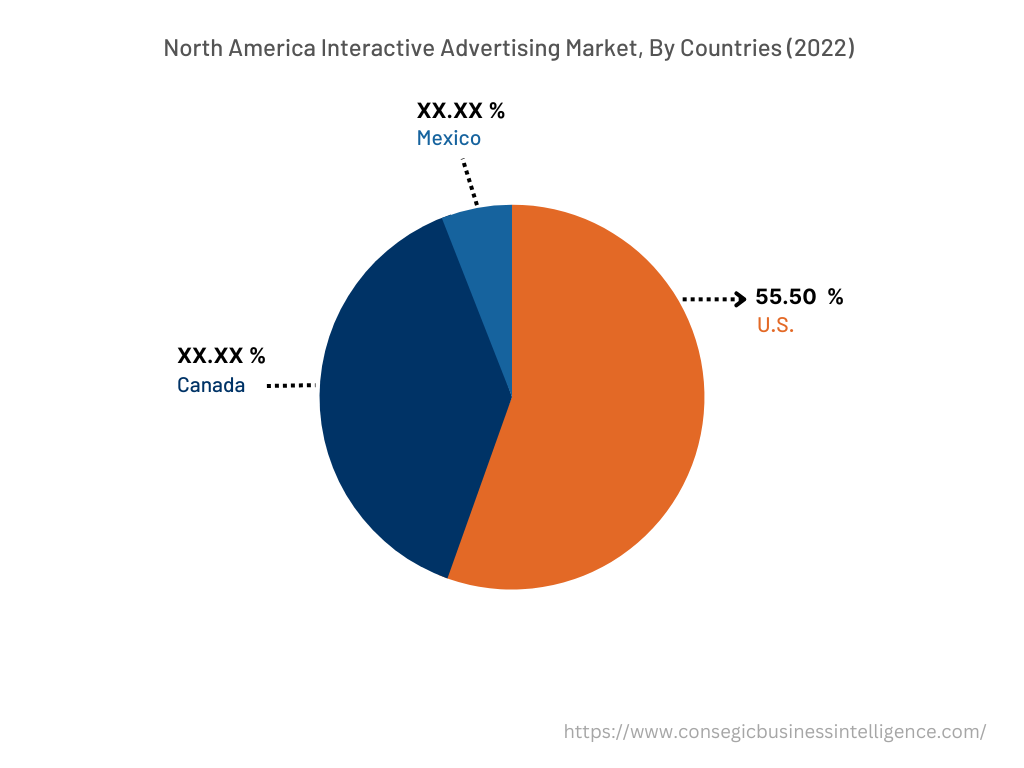

North America accounted for the largest revenue share of USD 13.87 Billion in 2022 and is expected to reach USD 42.32 Billion by 2030, registering a CAGR of 15.4% during the forecast period. In addition, in the region, the U.S. accounted for the maximum revenue share of 55.50% in the same year. As per the interactive advertising market analysis, the adoption of interactive advertising in the North American region is primarily driven by its usage in retail & e-commerce, automotive, media & entertainment, and other sectors. Moreover, the increasing application by automobile companies to raise brand awareness, reach location-specific and model-specific target customers, and engage in-market shoppers is among the significant factors driving the interactive advertising market in the region. For instance, according to the International Energy Agency, electric car sales in the United States reached 630 thousand units in 2021, depicting a substantial rise of over 100% in comparison to 295 thousand units in 2020. Hence, the growing automotive sector is propelling the deployment of advertising by automobile companies to increase brand awareness and reach target customers, in turn fostering an interactive advertising market in the North American region. Additionally, rising investments in the retail & e-commerce sector are anticipated to provide lucrative development aspects for the market in North America during the forecast period.

Asia-Pacific is expected to register fastest CAGR of 15.6% during the forecast period. The rising pace of industrialization and development is creating lucrative opportunities for the market in the region. Moreover, factors including the growth of multiple industries such as retail & e-commerce, BFSI, media & entertainment, and others are fostering the market growth for interactive advertising in the Asia-Pacific region.

For instance, according to Invest India, the media & entertainment sector in India is projected to grow by 10.5% annually and reach USD 35.4 billion by 2025. Therefore, the growing media & entertainment sector is projected to drive the utilization of interactive advertising by entertainment companies to reach a larger range of target audiences with its marketing content, thereby, boosting the interactive advertising market in the Asia-Pacific region during the forecast period.

Top Key Players & Market Share Insights:

The interactive advertising market is highly competitive with major players providing interactive advertising to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and application launches to hold a strong position in the interactive advertising market. Key players in the interactive advertising industry include-

- Grey Advertising

- Butler Branding

- Shine Interactive

- DEUTSCH

- MullenLowe Global

- Crispin Porter Bogusky

- Ogilvy

- BBDO

- Droga5

- Wieden Kennedy

- The Martin Agency

Recent Industry Developments :

- In June 2021, Butler/Till acquired Digital Hyve, a digital marketing firm headquartered in the United States. The acquisition enables the company to add Digital Hive's digital expertise and new services into its service offerings, including social media marketing, paid digital advertising, video marketing, retargeting, and others.

Key Questions Answered in the Report

What is interactive advertising? +

Interactive advertising is a type of advertising that utilizes offline or online interactive media for communicating with consumers and for promoting brands, products, services, or announcements.

What specific segmentation details are covered in the interactive advertising report, and how is the dominating segment impacting the market growth? +

For instance, by type segment has witnessed social media ads as the dominating segment in the year 2022, owing to its increasing utilization in media & entertainment, BFSI, retail & e-commerce sectors among others.

What specific segmentation details are covered in the interactive advertising market report, and how is the fastest segment anticipated to impact the market growth? +

For instance, by end-user segment has witnessed BFSI as the fastest-growing segment during the forecast period due to the rising adoption of interactive advertising by BFSI companies for targeting potential market segments and customers, increasing brand awareness, and attracting potential customers.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Asia-Pacific is anticipated to register fastest CAGR growth during the forecast period due to rapid pace of industrialization and growth of multiple industries such as retail & e-commerce, BFSI, media & entertainment, and others.