Static Random Access Memory Market Size :

Static Random Access Memory Market is estimated to reach over USD 703.15 Million by 2032 from a value of USD 507.53 Million in 2024 and is projected to grow by USD 519.6 Million in 2025, growing at a CAGR of 4.2% from 2025 to 2032.

Static Random Access Memory Market Scope & Overview:

Static random access memory (SRAM) refers to a type of random access memory that is designed to retain data bits in its memory and holds data in a static form as long as power is being supplied. Moreover, static random access memory offers a range of benefits including faster operations, low power consumption, fast access time, low latency, and improved performance among others. The above benefits of static random access memory are primary determinants for increasing its utilization in various industries including consumer electronics, automotive, telecommunication, aerospace & defense, and others.

Static Random Access Memory Market Insights :

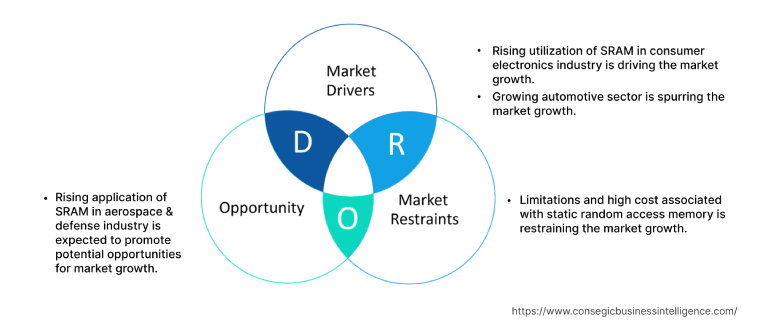

Static Random Access Memory Market Dynamics - (DRO) :

Key Drivers :

Rising utilization of SRAM in consumer electronics industry is driving the market growth

Static random access memory is primarily used in consumer electronics industry, particularly for applications in smartphones, wearables, cameras, and other consumer appliances. Static random access memory is integrated in consumer electronic devices for storing settings, operational data, along with facilitating quick data access and efficient performance in consumer devices.

Factors including the increasing penetration of smartphones, cameras, and other consumer devices, advances in consumer electronics including IoT and AI, increasing popularity of wearable devices are vital aspects driving the growth of the consumer electronics industry.

According to the Association of German Banks, the manufacturing and sales of electronics sector in Germany depicted a growth of 10% in 2021 as opposed to 2020. Further, according to the Brazilian Electrical and Electronics Industry Association (ABINEE), the value of electrical and electronics industry in Brazil reached up to USD 42.2 billion in 2022, observing an incline of 8% in contrast to USD 39.2 billion in 2021.

Hence, the growing consumer electronics sector is driving the utilization of static random access memory for facilitating quick data storage and access in consumer devices, in turn proliferating the market growth.

Growing automotive sector is spurring the market growth

Static random access memory is used in automotive sector for a range of applications including constant data transfer, data logging, buffering, along with supporting audio, video and other data-intensive functions required in advanced driver-assistance systems (ADAS), connected cars, and autonomous vehicles among others. Moreover, the characteristics of static random access memory including low power consumption, high performance, endurance, and zero write times make it ideal for deployment in aforementioned automobile applications.

Factors including the advancements in autonomous driving systems, rising adoption of electric vehicles, and increasing production of automobiles are major aspects fostering the growth of the automotive sector.

For instance, Boeing, a North American airline company, delivered approximately 99 commercial jets during the fourth quarter of 2021, depicting a substantial incline of 68% in contrast to 59 deliveries in the fourth quarter of 2020. Additionally, in December 2022, Dassault Aviation, a France-based manufacturer of military aircraft and business jets, launched its new Rafale fighter aircraft for deployment in the Directorate General of Armaments, a French military procurement agency.

Thus, the growth of automotive sector is increasing the adoption of static random access memory for supporting data-intensive functions required in advanced driver-assistance systems, connected cars, and autonomous vehicles among others, thereby, driving the growth of the market.

Key Restraints :

Limitations and high cost associated with static random access memory is restraining the market growth

The implementation of static random access memory is associated with certain limitations and high cost, which is a key factor limiting the market growth.

For instance, static random access memory is usually prone to loss of data in case SRAM is not powered and does not provide refresh programs. Additionally, other limitations associated with static random access memory include low storage capacity, reduced memory density, complex design, and requirement of more space in comparison to dynamic random access memory (DRAM).

Further, static dynamic access memory is relatively more expensive than dynamic random access memory. A gigabyte of SRAM cache typically costs approximately USD 5,000, while the average cost of a gigabyte of DRAM ranges from USD 20 to USD 75, making SRAM highly expensive. Hence, the above limitations and high costs associated with static random access memory are constraining the growth of the market.

Future Opportunities :

Rising application of SRAM in aerospace & defense industry is expected to promote potential opportunities for market growth

The rising application of SRAM in aerospace & defense industry is anticipated to promote potential opportunities for the growth of the static random access memory market. Static random access memory is often used in aerospace & defense industry for applications involving on-board image processing, satellite communications, and radar imaging payload applications among others. The characteristics of SRAM including high-speed, low latency, improved performance, and superior radiation and single event effects are significant prospects increasing its adoption in aerospace & defense industry.

Factors including increasing aircraft production, rising commercial flight activities, and growing investments in air defense platform are fostering the growth of the aerospace & defense sector.

For instance, Boeing, a North American airline company, delivered approximately 99 commercial jets during the fourth quarter of 2021, depicting a substantial incline of 68% in contrast to 59 deliveries in the fourth quarter of 2020. Additionally, in December 2022, Dassault Aviation, a France-based manufacturer of military aircraft and business jets, launched its new Rafale fighter aircraft for deployment in the Directorate General of Armaments, a French military procurement agency.

Therefore, the rising production from aerospace & defense sector is anticipated to increase the utilization of static random access memory in satellite communications, on-board image processing, and radar imaging payload applications, in turn promoting opportunities for market growth during the forecast period.

Static Random Access Memory Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 703.15 Million |

| CAGR (2025-2032) | 4.2% |

| By Type | Non-Volatile SRAM, Pseudo SRAM, and Others |

| By Functionality | Asynchronous SRAM and Synchronous SRAM |

| By Sales Channel | Direct Sales and Distributor Sales |

| By End-User | Consumer Electronics, Automotive, Telecommunication, Aerospace & Defense, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Infineon Technologies AG, Microchip Technology Inc., Integrated Silicon Solution Inc., Winbond, Toshiba Corporation, STMicroelectronics, Renesas Electronics Corporation, Semiconductor Components Industries LLC, Alliance Memory, Lyontek Inc. |

Static Random Access Memory Market Segmental Analysis :

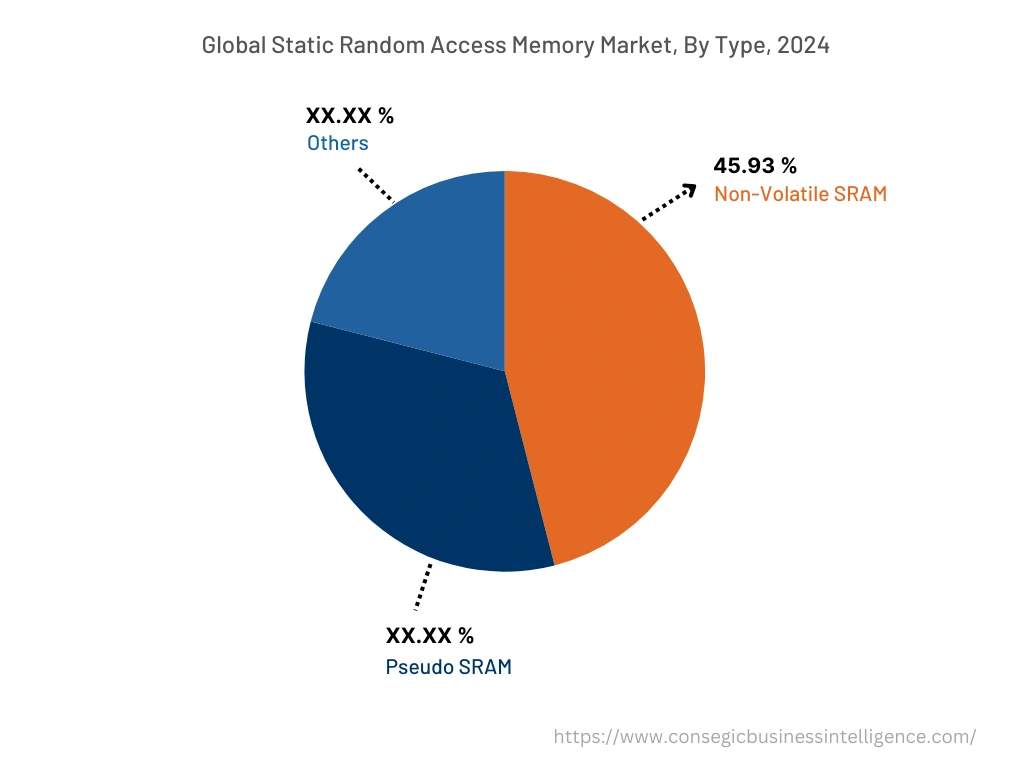

By Type :

Based on the type, the market is segmented into non-volatile SRAM, pseudo SRAM, and others. The non-volatile SRAM segment accounted for the largest revenue share of 45.93% in the year 2024. Non-volatile SRAM refers to a stand-alone non-volatile memory that enables users to instantly capture and preserve a copy of the SRAM data into non-volatile memory in case of power interruption and enables data to be recalled without power consumption. Moreover, non-volatile SRAM offers several benefits including faster data access, infinite endurance, space saving, and radiation tolerance among others. The above benefits of non-volatile SRAM are further increasing its utilization in consumer electronics, telecommunication, and other industrial applications.

For instance, Infineon Technologies AG is a manufacturer of static random access memory that offers a wide range of non-volatile SRAM in portfolio. Infineon Technologies AG offers non-volatile SRAM for consumer electronics, automotive, and other industrial applications. Thus, the rising advancements associated with non-volatile SRAM for use in consumer electronics and industrial applications is a significant factor driving the growth of the market.

The pseudo SRAM segment is anticipated to register fastest CAGR growth during the forecast period. Pseudo SRAM combines the best features of both static random access memory and dynamic random access memory computing units. Pseudo SRAMs are optimized for integrating a refresh feature, which eliminates the requirement of an externally enabled data rewrite onto its capacitor. The above features of pseudo SRAM make it ideal for main memory applications in several portable smart devices and wearable IoT devices among others.

For instance, Winbond offers multiple pseudo SRAM in its product portfolio designed for application in wearable and consumer devices. Winbond's pseudo SRAM features low-power performance, low-profile, and broad density offering from 32 Mb to 256 Mb. Thus, the rising increasing development of pseudo SRAM for consumer electronics and other applications is a prime factor anticipated to drive the growth of the market during the forecast period.

By Functionality :

Based on the functionality, the market is segregated into asynchronous SRAM and synchronous SRAM. The asynchronous SRAM segment accounted for the largest revenue share in the year 2024. Asynchronous SRAM refers to a type of volatile random-access memory that utilizes flip-flop based latching circuitry for storing each bit. The data bits are retained in memory as long as power is supplied. Moreover, asynchronous SRAM provides a range of benefits including low power consumption, high reliability, faster access time, and long term support among others. Additionally, asynchronous SRAM is primarily used in communication, automotive, defense, and industrial applications.

For instance, Integrated Silicon Solution Inc. is a manufacturer of static random access memory that offers a broad range of asynchronous SRAM in its product portfolio. The company's asynchronous SRAM is designed for deployment in automotive and industrial applications among others. Thus, rising innovations related to asynchronous SRAM for use in industrial applications is a key factor driving the growth of the segment.

Synchronous SRAM segment is expected to witness fastest CAGR growth during the forecast period. Synchronous SRAM is a type of random access memory that includes a clocked interface for control, address, and data. Moreover, synchronous SRAM provides several features including higher bandwidth capabilities, high speed, high random transaction rate, and others.

For instance, Renesas Electronics Corporation offers a range of static random access memory including synchronous SRAM with density ranging from 1M-bit to 18M-bit. Thus, the rising developments associated synchronous SRAM is projected to boost the growth of the segment during the forecast period.

By Sales Channel :

Based on the sales channel, the market is bifurcated into direct sales and distributor sales. The distributor sales segment accounted for the largest revenue share in the year 2024. The distributor sales channel of static random access memory comprises of both offline and online modes. In the online mode, the static random access memory can be bought from e-commerce websites such as eBay, Alibaba, Amazon, and others. The offline mode includes the distribution of static random access memory through specialist stores, and other regional distributors. In addition, buying from a distributor also benefits the consumer to select the best product available in the market.

For instance, Microchip Technology Inc. and Renesas Electronics Corporation are among few of the static random access memory manufacturers that offers a range of SRAMs through several regional distributors including DigiKey Corporation, Mouser Electronics Inc., Arrow Electronics Inc., and others. Hence, the increasing availability of static random access memory in distributor sales channel is a prime factor proliferating the growth of the segment.

The direct sales channel segment is anticipated to register fastest CAGR growth during the forecast period. In direct sales channel, products are sold directly to customers by the means of various physical outlets such as company outlets, and others. Additionally, direct sales channel also includes online mode, in which the manufacturers sell the products through company owned websites. Additionally, purchasing static random access memory from direct sales channel offers various benefits such as competitive pricing, higher product quality, higher return on investments, and faster response time, which are key factors for increasing the purchase of static random access memory from direct sales channel.

For instance, Infineon Technologies AG is among few of the static random access memory manufacturers that offer a broad range of static random access memory including asynchronous SRAM, synchronous SRAM, and others for direct purchase through company website. Therefore, the availability of static random access memory in direct sales channels, owing to its above benefits, is a crucial factor anticipated to drive the growth of the segment during the forecast period.

By End-User :

Based on the end-user, the market is segregated into consumer electronics, automotive, telecommunication, aerospace & defense, and others. The consumer electronics segment accounted for the largest revenue share in the year 2024. Factors including the increasing penetration of smartphones, cameras, and other consumer devices, advances in consumer electronics including IoT and AI, increasing popularity of wearable devices are crucial aspects driving the growth of the consumer electronics sector.

According to GSM Association, the adoption of smartphones in Italy is projected to reach 81% by 2025, witnessing an increase from 77% in 2021. Additionally, according to Atradius, the consumer electronics industry in Spain observed a growth of 3.5% in 2021 in contrast to 2020. Therefore, the growing consumer electronics sector is increasing the utilization of static random access memory for facilitating quick data storage and access in consumer devices, in turn driving the market growth.

Automotive segment is expected to witness fastest CAGR growth during the forecast period. The growth of automotive segment is primarily driven by multiple factors including advancements in autonomous driving systems, rising adoption of electric vehicles, and increasing production of automobiles among others.

For instance, Microchip Technology Inc. offers a wide product range of static random access memory in its product portfolio, particularly designed for use in automotive applications. Microchip Technology offers serial SRAMs featuring low power consumption, low pin count interface, and high speed capabilities for deployment in automotive sector. Thus, the rising development of static random access memory for application in automotive sector is a vital factor expected to drive the market growth during the forecast period.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

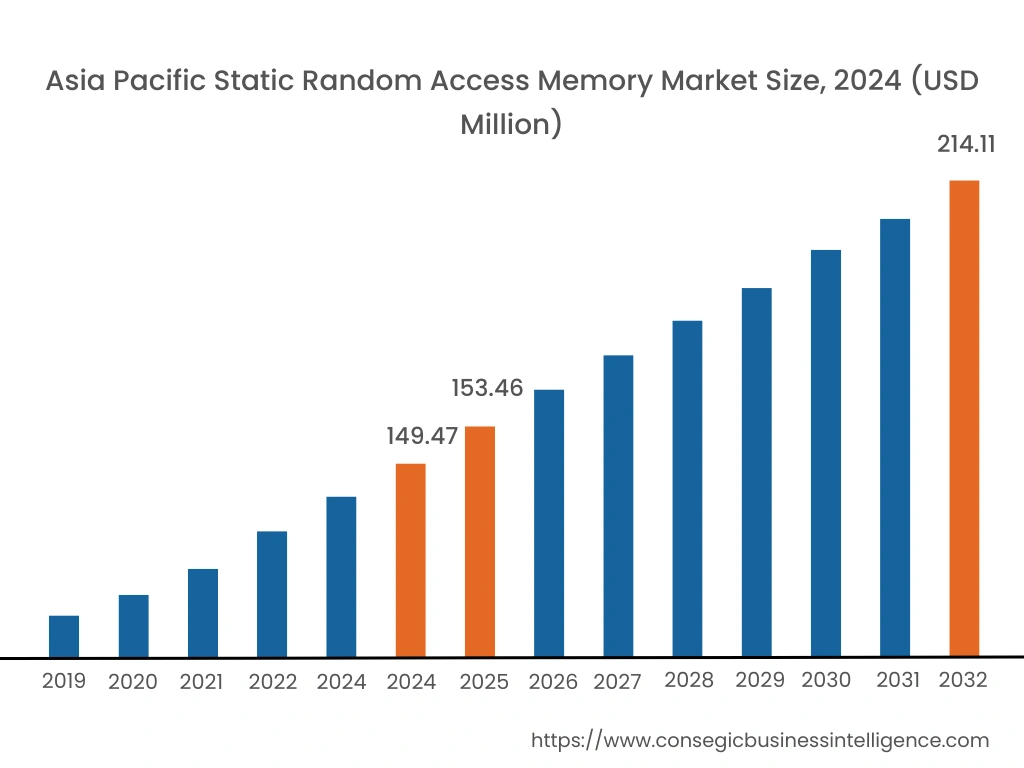

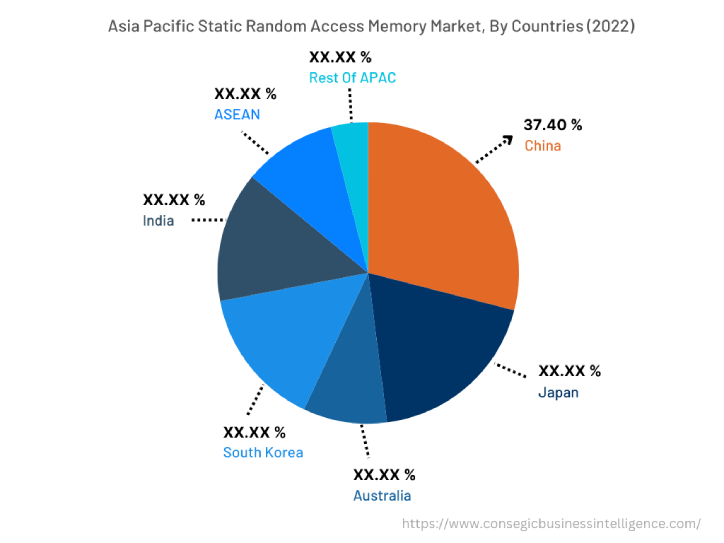

Asia-Pacific is expected to grow with a CAGR growth of 4.6% and is estimated to reach over USD 214.11 Million by 2032 from a value of USD 149.47 Million in 2024 and is projected to grow by USD 153.46 Million in 2025. In addition, in the region, the China accounted for the maximum revenue share of 37.40% in the same year.

The prevalence of significant number of static random access memory manufacturers in the Asia-Pacific region including Winbond, Renesas Electronics Corporation, Lyontek Inc., and others are contributing to market growth in the region. Moreover, the growth of consumer electronics, automotive, telecommunication, and other sectors is a vital factor driving the market demand for static random access memory in the region.

For instance, according to the India Brand Equity Foundation, the consumer electronics sector in India was valued at USD 9.84 billion in 2021, while it is estimated to grow at a significant rate to reach USD 21.18 billion by 2025. The growth of consumer electronics sector is driving the utilization of static random access memory for facilitating quick data storage and access in consumer devices, in turn driving the market growth in Asia-Pacific region. Further, rising investments in telecommunication infrastructure and growing adoption of electric vehicles are projected to promote opportunities for market growth in the Asia-Pacific region during the forecast period.

North America is expected to register a CAGR growth of 3.90% during the forecast period. The growing pace of industrialization and development is facilitating growth aspects for the market in the North American region. Further, factors including the growth of various industries including automotive, aerospace & defense, telecommunication, and others are driving the market growth for static random access memory in North America.

For instance, in March 2021, the Government of United States allotted approximately USD 752.9 billion budget for national defense for FY 2022, among which USD 715 billion was allocated for the U.S. Department of Defense. The FY 2022 Defense Budget submission aims at improving capabilities of the U.S. military and includes investments in various defense platforms including military aircrafts. Static random access memory is often used in aerospace & defense sector for applications involving on-board image processing, satellite communications, and radar imaging payload applications. Thus, rising investment in aerospace & defense sector is expected to drive the adoption of static random access memory, thereby proliferating market growth in North America during the forecast period.

Top Key Players & Market Share Insights:

The static random access memory market is highly competitive with major players providing static random access memory to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in static random access memory market. Key players in the static random access memory market include-

- Infineon Technologies AG

- Microchip Technology Inc.

- Semiconductor Components Industries LLC

- Alliance Memory

- Lyontek Inc.

- Integrated Silicon Solution Inc.

- Winbond

- Toshiba Corporation

- STMicroelectronics

- Renesas Electronics Corporation

Recent Industry Developments :

- In March 2021, Infineon Technologies AG introduced its new non-volatile static random access memory. The non-volatile SRAM is designed to provide high-reliability industrial specifications for facilitating data-logging and non-volatile code storage applications in aerospace and industrial sectors.

Key Questions Answered in the Report

What is static random access memory? +

Static random access memory (SRAM) refers to a type of random access memory that is designed to retain data bits in its memory and holds data in a static form as long as power is being supplied.

What specific segmentation details are covered in the static random access memory report, and how is the dominating segment impacting the market growth? +

For instance, by type segment has witnessed non-volatile SRAM as the dominating segment in the year 2024, owing to the increasing adoption of non-volatile SRAM in consumer electronics, telecommunication, and other industrial applications.

What specific segmentation details are covered in the static random access memory market report, and how is the fastest segment anticipated to impact the market growth? +

For instance, by end-user segment has witnessed automotive as the fastest-growing segment during the forecast period due to rising adoption of static random access memory in advanced driver-assistance systems (ADAS), connected cars, and autonomous vehicles among others.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2025-2032? +

North America is anticipated to register fastest CAGR growth during the forecast period due to rapid pace of industrialization and growth of multiple industries such as including automotive, aerospace & defense, telecommunication, and others.