Isoprene Monomer Market Introduction :

Consegic Business Intelligence analyzes that the isoprene monomer market size is growing with a CAGR of 4.3% during the forecast period (2023-2031). The market accounted for USD 1,977.60 million in 2022 and USD 2,053.14 million in 2023, and the market is projected to be valued at USD 2,876.84 Million by 2031.

Isoprene Monomer Market Definition & Overview:

Isoprene monomer is a colorless, volatile liquid with the chemical formula C5H8. It is the basic building block of natural rubber and many other important polymers. It is produced both naturally by plants and synthetically by the petroleum sector. They are used in a wide range of applications such as production of synthetic rubber, production of styrene-isoprene-styrene block copolymers and others.

Moreover, according to the isoprene monomer market analysis, the monomer is being investigated for use in a variety of new applications and trends, such as biofuels, drug delivery systems, and tissue engineering. The successful development of these new applications could lead to a significant increase in the need for isoprene monomer industry.

Isoprene Monomer Market Insights :

Isoprene Monomer Market Dynamics - (DRO):

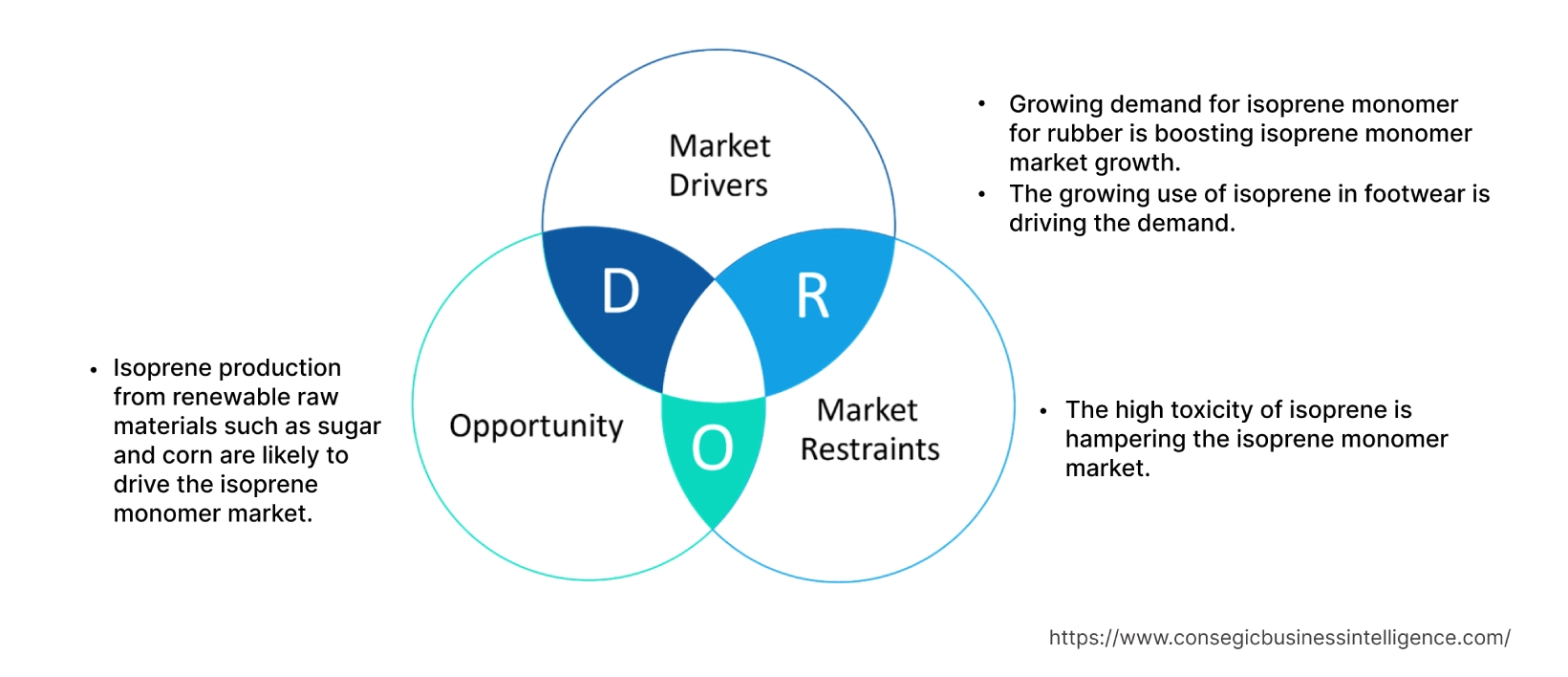

Key Drivers :

Growing demand for isoprene monomer for rubber is boosting the market growth.

Isoprene is used as a chemical raw material in the manufacturing of rubber, which is base material used in the production of natural and styrene butadiene rubber. Isoprene is a vital precursor to various industries owing to the widespread use of rubber. In the automotive sector, this monomer is used to make tires, adhesives, springs, bearings, shock absorbers, and others. Hence, the growing rubber and tire sector is driving the demand for these monomers. For instance, according to the International Organization of Motor Vehicle Manufacturers in 2023, the number of commercial vehicles in the U.S. will increase by 10% in 2022. They are widely used in the automotive sector due to their high elasticity and resilience. Moreover, they are also used in medical applications such as tubes, dental rubber dams, IV sets, and others. The high flexibility and low cost of isoprene appliances make it a vital component in the healthcare sector. As a result, the growing use of these monomers in the manufacturing sector is boosting the isoprene monomer market growth.

The growing use of isoprene in footwear is driving the demand for the market.

Isoprene monomer is used to make soles, adhesives, and coatings in the footwear sector. Rubber soles made from this monomer provide a better grip on slippery surfaces. Also, these monomers are oil and water-resistant which reduces their wear and tear as well as provides safety in wet, muddy, and slippery environments. Therefore, footwear produced from this monomer provides better safety against slips and falls. According to a report by the National Safety Council in 2022, falls from slipping is the third leading preventable workplace injury accounting for 136 deaths and 127,680 injuries in 2022. As a result, footwear manufacturers are shifting towards isoprene rubber soles for their grip and low price. Hence, the growing use of isoprene in the footwear sector is driving the market.

Key Restraints :

The high toxicity of isoprene is hampering the market

Isoprene monomer is a versatile chemical with applications in many industries, however, its toxicity poses risks to human health and the environment. The National Institute of Health classifies isoprene as a carcinogen based on experimental studies, prolonged exposure to isoprene is associated with the risk of cancer, particularly for workers in the rubber and tire sector where it is the primary compound used in the production of this monomer. Also, minimal exposure to isoprene can cause irritation, headaches, dizziness, lightheadedness, and fainting. Furthermore, the emissions from isoprene factories affect atmospheric chemistry. Emissions from isoprene plants need to be filtered otherwise they can cause degradation of the ozone layer. As a result, there are strict regulations on the emission of isoprene plants. Hence, the toxicity of isoprene is hampering the isoprene monomer market.

Future Opportunities :

Isoprene production from renewable raw materials such as sugar and corn is likely to drive the market.

Isoprene monomer are primarily manufactured from oil refineries, as a by-product of processing coal tar or petroleum. However, the advancement of technology and newer methods have enabled renewable production of this monomer. Isoprene can be produced from organic feedstock from sugarcane, corn, peanuts, and others. Since these feed stocks are renewable through plants, it provides a renewable source of this monomer. Moreover, research is currently underway for isoprene production from sea algae and enzymes. As a result, isoprene production from renewable raw materials is likely to shape the i market in the forecast period.

Furthermore, many governments around the world are providing financial and other support for the development and production of bio-based products. For instance, In September 2021, the Department of Energy awarded USD 64 million to 22 projects focused on developing technologies and processes that produce low-cost, low-carbon products. This support is also helping to make bio-based isoprene more competitive with traditional petroleum-based isoprene. Thus, these growing initiatives are providing lucrative isoprene monomer market opportunities and influencing isoprene monomer market trends over the forecast period.

Isoprene Monomer Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 2,876.84 Million |

| CAGR (2023-2031) | 4.3% |

| Based on the Product | Polymer Grade and Chemical Grade |

| Based on the Application | Polyisoprene, Styrene Isoprene Monomer (SIR), Isobutylene Isoprene Rubber (IIR), Styrene Isoprene Styrene (SIS), and Others |

| Based on the End-user Industry | Tire and Rubber, Adhesives and Sealants, Construction, Sports Equipment, Medical, and Others |

| Based on the Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Braskem, China Petrochemical Corporation, Goodyear International Corporation, Kuraray. Co., Ltd., LOTTE Chemical CORPORATION, LyondellBasell Industries Holdings B.V., Mitsui & Co. Benelux S. A./N. V., Shandong Yuhuang Chemical Co., Shell, and ZEON CORPORATION |

Isoprene Monomer Market Segmental Analysis :

Based on the Product :

The product segment is categorized into polymer grade and chemical grade isoprene. In 2022, polymer grade segment accounted for the highest revenue in the market. Polymer-grade isoprene plays a pivotal role in monomer production, which is a versatile polymer used in a wide range of applications. According to the analysis, these compounds are a crucial component in the production of tires, as well as in many industrial and consumer products. The requirement for polymer-grade isoprene is closely tied to its use in various industries. The tire and rubber sector relies heavily on polymer-grade isoprene in the production of tires and anti-vibration mounts.

Polymer-grade isoprene is also used in the manufacture of bakelite, which is a high-resistance plastic used in the manufacture of non-conducting parts of electric devices such as sockets, wire insulation, and switches. Significant rise in the electronics sector is driving the rise of these monomer derivatives such as bakelight. For instance, according to the Ministry of External Affairs, India's electronic exports have almost tripled between 2015 and 2022 from USD 5.8 billion to USD 16 billion. As a result, increasing requirement from rubber and tire, and electronics sector is driving the polymer grade segment.

Based on the Application :

The application segment is categorized into polyisoprene, styrene-isoprene-styrene (SIS), styrene isoprene monomer (SIR), and isobutylene isoprene rubber (IIR), and others. In 2022, the polyisoprene segment accounted for the highest market revenue in the market as well as it is expected to hold the highest CAGR for the forecast year. Polyisoprene derived from isoprene has various applications in sector such as footwear, sponges, pipe gaskets, sports equipment, rubber bands, and others. The significant rise in requirement for polyisoprene monomer in the tire and rubber sector is driving the segment. For instance, according to a study by the U.S. Tire Manufacturers Association in 2023, the total U.S. tire shipments are projected to be 334.2 million units in 2023, compared to 332.0 million units in 2022 and 332.7 million units in 2019. Furthermore, polyisoprene is used in various industries such as adhesives, packaging, cosmetics, and others. Growing requirement for polyisoprene in the adhesives and packaging industry is driving the segment globally.

Moreover, the growing production of medicines is one of the profound factors expected to drive market in the upcoming years. For instance, according to the data published by the Association of the British Pharmaceutical Industry (ABPI) in January 2023, manufacturing of medicines in UK has the potential to drive the growth of UK over the next 10 years. Therefore, the above-mentioned factors are also expected to generate strong demand for these labels in the market over the forecast period.

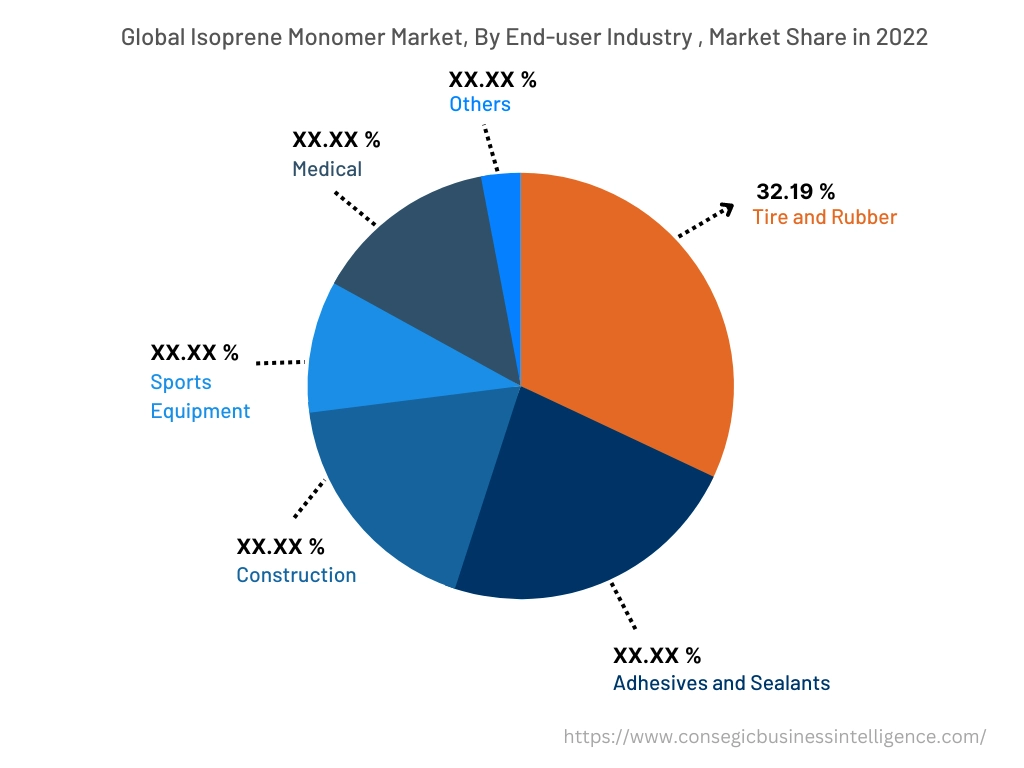

Based on the End-use Industry :

The end-user segment is categorized into tire and rubber, adhesives and sealants, medical equipment, construction, sports equipment, and cosmetics sector. In 2022, the tire and rubber segment accounted for the highest market revenue of 32.19% in the monomer market. The monomer is widely used in the tire and rubber sector due to its high tensile strength, resistance to wear and tear, vibration dampening, and low cost. Hence, this monomer is used in the manufacture of tires, springs, elastic bands, and conveyor belts along with other latex products including balloons and gloves in the tire and rubber sector. Furthermore, isoprene is used to make gaskets and seals for automotive parts owing to their consistency, fast cure rate, and low processing. Significant rise in the automotive sector is increasing the need for tires and rubbers, which is driving the segment across the globe. For instance, according to a report by the European Automobile Manufacturers Association (ACEA) in 2023, North American car production rose by 10.3% in 2022 to 10.4 million units, primarily driven by strong requirement in the US. Hence, increasing isoprene monomer market demand in the tire and rubber sector is driving the segment.

Moreover, the construction segment is expected to grow at the fastest CAGR over the forecast period in the market. The monomer in the construction sector to produce adhesives, butyl rubber, and seals. Also, there is a growing requirement in the construction sector for sustainable and high-performance materials. Hence, this monomer has proved to be a crucial part with distinct properties and advantages. Construction materials in combination with isoprene elastomer show durability and resilience to physical stress. Moreover, these applications are critical in roofing and sealing products where resilience and longevity are highly desirable. Hence, the growing construction sector is expected to drive the market segment in the forecast period.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

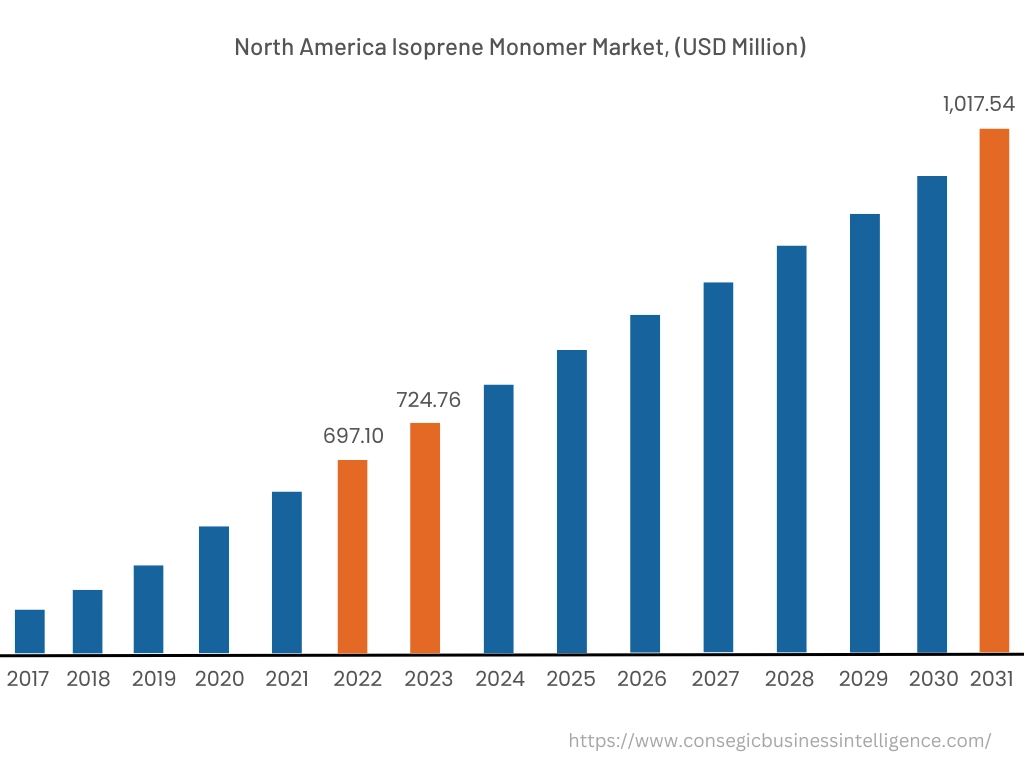

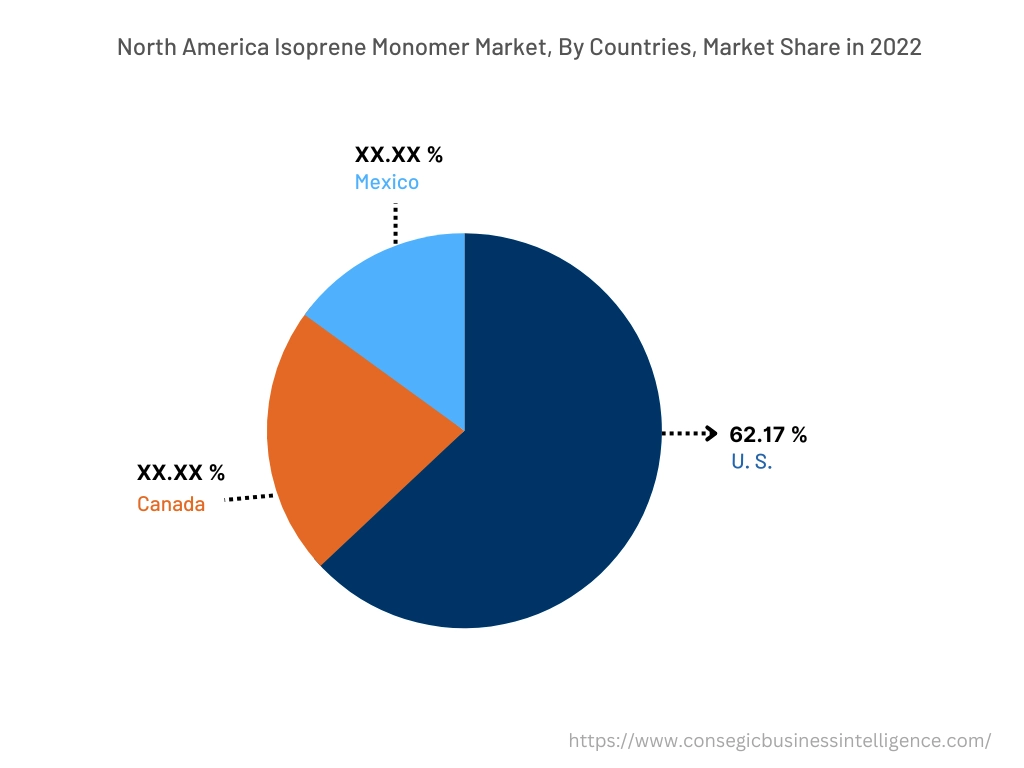

In 2022, North America accounted for the highest isoprene monomer market share at 35.25% valued at USD 697.10 Million in 2022 and USD 724.76 Million in 2023, it is expected to reach USD 1,017.54 Million in 2031. In North America, the U.S. accounted for the highest market share of 62.17% in the base year 2022. Based on the isoprene monomer analysis, the presence of a large automotive sector in the region and rapid industrialization is driving the demand for this monomer for the manufacturing sector. Also, the presence of a large manufacturing sector is propelling the demand for this monomer across the region. For instance, according to a study by the U.S. National Institute of Standards and Technology in 2021, manufacturing contributed USD 2.3 trillion to U.S. GDP amounting to 12.0 % of total U.S. GDP. Thus, the high presence of the large manufacturing sector in North America is driving the demand and trends from various end-user industry in North America.

Furthermore, the Asia Pacific region is expected to witness significant growth over the forecast period, growing at a CAGR of 4.9% during 2023-2031. The significant growth in construction and automotive industries across the region is increasing need for these monomer for elastomers and rubber applications. For instance, according to a study by the International Trade Administration of the U.S. in 2023, China continues to be the world's largest vehicle market by both annual sales and manufacturing output, with domestic production expected to reach 35 million vehicles by 2025. Thus, as per the analysis, the significant growth in automotive sector is expected to create opportunities, and trends for isoprene monomer market growth over the forecast period.

Top Key Players & Market Share Insights :

The isoprene monomer market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings, trends and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Braskem

- China Petrochemical Corporation

- Shandong Yuhuang Chemical Co.

- Shell

- ZEON CORPORATION

- Goodyear International Corporation

- Kuraray. Co. Ltd.

- LOTTE Chemical CORPORATION

- LyondellBasell Industries Holdings B.V.

- Mitsui & Co. Benelux S. A./N. V.

Recent Industry Developments :

- In March 2022, China Petrochemical Corporation (Sinopec) announced plans to invest USD 2 billion in expanding its isoprene monomer production capacity in China. The expansion is expected to be completed in 2025 and will increase Sinopec's isoprene monomer production capacity by 50%.

- In August 2022, Liebherr launched new electric heavy lift 800 tonnes ship crane for lifting heavy components in the offshore wind industry.

- In August 2020, Hili Company launched ship-to-shore crane with a lifting capacity of 45t under spreader to increase the capacity and enhancing cargo-handling efficiency.

Key Questions Answered in the Report

What was the market size of the isoprene monomer market in 2022? +

In 2022, the market size of isoprene monomer was USD 1,977.60 million.

What will be the potential market valuation for the isoprene monomer industry by 2031? +

In 2031, the market size of isoprene monomer will be expected to reach USD 2,876.84 million.

What are the key factors driving the growth of the Isoprene Monomer market? +

Growing demand for isoprene monomer for rubber across the globe is fueling market growth at the global level.

What is the dominant segment in the isoprene monomer market for the end-user industry? +

In 2022, the tire and rubber segment accounted for the highest market share of 32.19% in the overall Isoprene Monomer market.

Based on current market trends and future predictions, which geographical region is the dominating region in the Isoprene Monomer market? +

North America accounted for the highest market share in the overall market.