Ethylene Glycol Market Size:

Ethylene Glycol Market size is estimated to reach over USD 67,130.84 Million by 2031 from a value of USD 43,917.84 Million in 2023 and is projected to grow by USD 45,527.86 Million in 2024, growing at a CAGR of 5.4% from 2024 to 2031.

Ethylene Glycol Market Scope & Overview:

Ethylene glycol, also known as ethane 1,2 diol, is a colorless, odorless liquid chemical compound utilized in many industries, as an antifreeze and coolant agent. This works by lowering the freezing point and raising the boiling point of liquids, hence, it is crucial in those situations where such properties are required. The advantages are that it prevents overheating and freezing of the engine and also participates in de-icing solutions. Typical key applications include antifreeze for automotive systems, polyester fiber, and a raw material for PET resin. It is used in various industries automotive, textile, and packaging for extending the life and functional properties of products at temperature-sensitive conditions.

How is AI Transforming the Ethylene Glycol Market?

AI is being utilized in the ethylene glycol market, primarily for manufacturing process optimization, automation, and enhanced supply chain management. AI-powered systems can analyze data from sensors to predict potential equipment failures in ethylene glycol plants, in turn facilitating proactive maintenance and minimizing downtime. Moreover, AI solutions can optimize chemical reactions in ethylene glycol production by precisely controlling variables such as temperature, pressure, and concentration, which contributes to higher yields and reduced waste.

Additionally, AI systems enable real-time monitoring of production processes, ensuring consistent product quality and enabling immediate adjustments to maintain optimum conditions. Thus, the above factors are expected to create lucrative prospects for market growth in upcoming years.

Ethylene Glycol Market Insights:

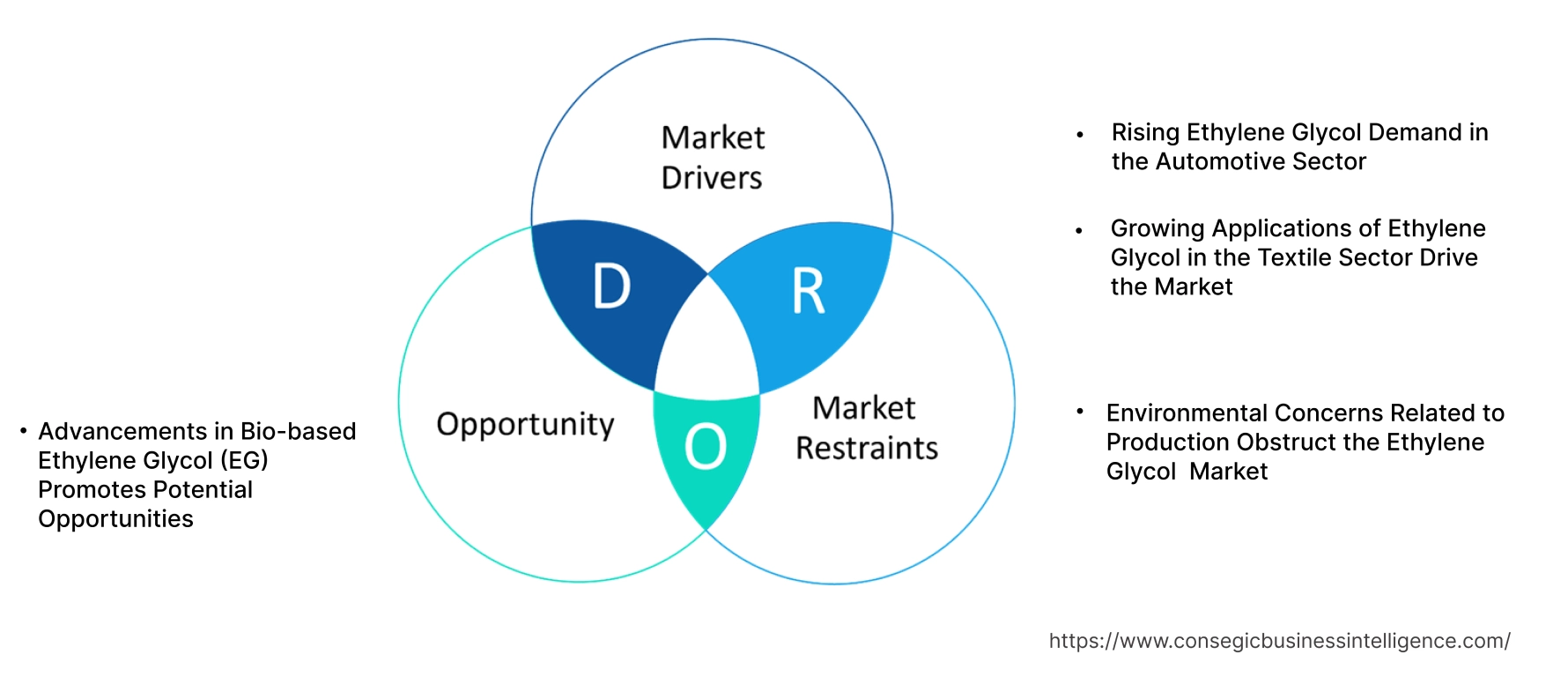

Ethylene Glycol Market Dynamics - (DRO) :

Key Drivers:

Rising Ethylene Glycol Demand in the Automotive Sector

Automotive is the major end-user of the compound for antifreeze and coolants. Ethane 1,2 diol maintains the operating range of the engine temperature since it prevents the freezing of coolant during extreme cold and boiling during hot conditions. The requirement for this compound has gone up with rising vehicle production and sales, specifically for electric and hybrid vehicles. Besides, the trend of lightweight vehicle construction to improve fuel efficiency also requires this compound in automotive materials such as plastics and composites.

- For instance, ethane 1,2 diol and its derivatives manufactured by BASF include MEG, DEG, and TEG. MEG is used in PET bottles, polyester fibers, and automotive coolants. DEG is used in printing inks, hydraulic fluids, and PU systems. TEG applications include plasticizers, water-soluble lubricants, and gas purification.

Therefore, the market analysis suggests that continuous technological advancements in the automotive sector are increasing ethylene glycol market demand.

Growing Applications of Ethylene Glycol in the Textile Sector Drive the Market

The ethylene glycol is used in the manufacturing of polyester fibers. Polyester fibers are tough, versatile, and chemically resistant. It is also wrinkle, shrink, and stretch-resistant. Due to these properties, there is a large consumer shift from natural fibers to synthetic fibers. This has led to a rise in the usage of this compound in production of the fibers.

- For instance, India Glycols Limited is a leading manufacturer of a broad spectrum of dry and wet textile-processing chemicals. It produces various kinds of glycols and ethoxylates, as emulsifiers, wetting agents, and lubricants.

According to the analysis, the growing textile sector combined with the growing need for polyester fibers continues to drive the ethylene glycol market trend.

Key Restraints :

Environmental Concerns Related to Production Obstruct the Ethylene Glycol Market

In the manufacturing of ethane 1,2 diol, there are major environmental concerns, such as toxicity and biodegradability. This compound is highly toxic to aquatic life, and improper disposition causes severe water pollution. Growing awareness of environmental sustainability and increased control of legislation in chemical disposal are the major variables that hold back the widespread utilization of this compound.

- The Department of Climate Change, Energy, the Environment and Water, Australia published a study that highlights the long-term and short-term effects on the environment. The report emphasized the chemical's harmful effects on aquatic ecosystems, noting that even small concentrations can cause significant environmental damage.

Hence, environmental considerations and their resultant regulatory challenges are one of the major obstacles to the flourishing of ethylene glycol market growth.

Future Opportunities :

Advancements in Bio-based Ethylene Glycol (EG) Promotes Potential Opportunities

The rapidly growing need for green and environment-friendly products has created an interest in bio-based EG derived from renewable sources such as plant biomass. The characteristics of this compound remain intact, matching its petroleum-based counterpart, while the environmental impact is considerably reduced. Moreover, with increasing efforts toward reduction in carbon footprint by corporates and governments, the development and adoption of bio-based EG is likely to create new frontiers of opportunities.

- In June 2024, Technip Energies officially announced its strategic alliance with Shell Catalysts & Technologies for the further commercialization of the Bio-2-Glycols™ technology. This technology enables the production of bio-based MEG from glucose, a first-of-its-kind sustainable production technology against traditional fossil-based MEG production.

According to the market analysis, the trends in the market present a promising opportunity that provides both sustainability and industrial advancement.

Ethylene Glycol Market Segmental Analysis :

By Product Type:

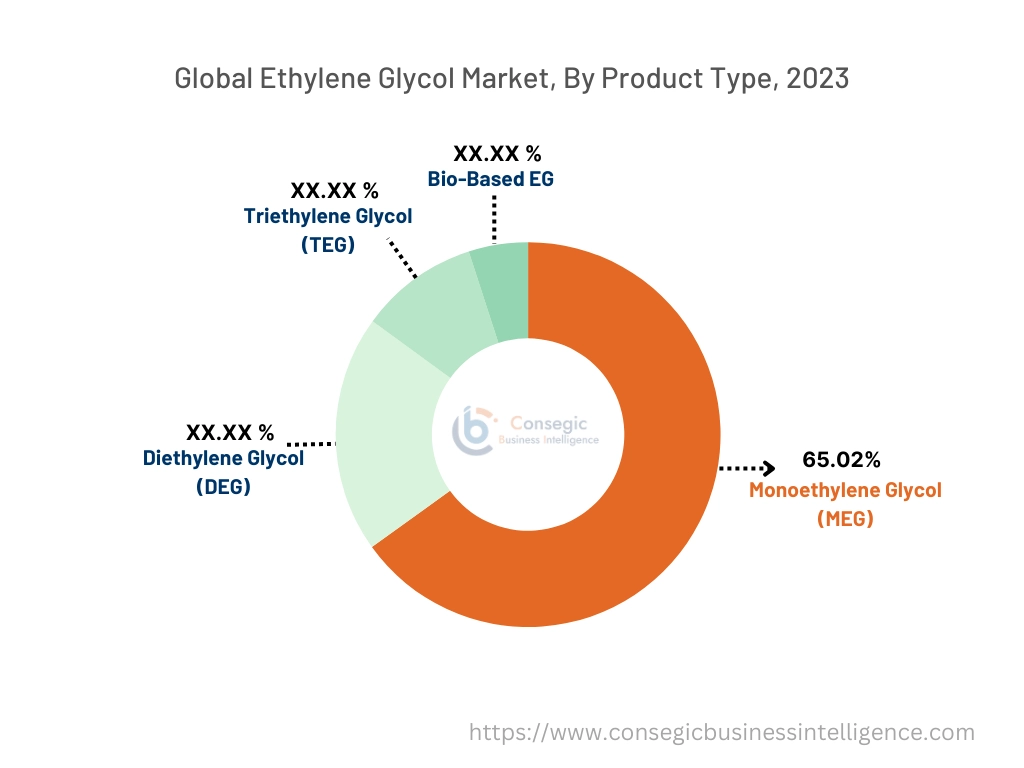

The ethylene glycol market is segmented into Monoethylene Glycol (MEG), Diethylene Glycol (DEG), Triethylene Glycol (TEG), and Bio-Based EG.

Trends in the Product Type:

- DEG is increasingly used in unsaturated polyester resins and plasticizers, both are used as raw materials in the production of durable and corrosion-resistant materials.

- TEG is used in various natural gas dehydration processes due to its better hygroscopic properties and finds its application in natural gas processing and systems of air conditioning.

The MEG accounted for the largest revenue share of 65.02% in 2023.

- MEG is a chemical liquid that has no color or smell and is hygroscopic. It is represented by the formula C₂H₆O₂.

- It possesses a boiling point of 197.3° C and has very good solvent properties; hence, it is a useful compound for many industrial purposes.

- It is a raw material for manufacturing polyester fibers and PET resins that are used in textile and packaging industries.

- It is also utilized in antifreeze formulations, chiefly in the prevention of freezing in cold climates and overheating in warm ones.

- Hence, MEG plays an essential role in many industrial applications and secures its position as the largest segment in the ethylene glycol market share.

The bio-based EG is anticipated to register the fastest CAGR during the forecast period.

- Bio-based EG has the same chemical formula as conventional MEG, C₂H₆O₂, produced from renewable resources like biomass and agricultural waste.

- It possesses the same chemical properties as MEG: hygroscopic and soluble, hence equally effective in many industrial applications, particularly in the manufacture of bio-PET.

- It confers sustainability to meet the green chemistry standards that help reduce carbon footprints.

- The advances in biotechnology have made bio-based production quite efficient.

- In July 2021, new technology was developed to produce glycolic acid from EG through a novel process using biomass energy. Accordingly, in this method, the use of PtMn/MCM-41 nanocatalysts increased energy efficiency by 19.7%, while fossil energy requirement, greenhouse gas emissions, and water consumption were very significantly less when compared to coal-based processes.

- As per the analysis, the segment bio-based EG is fast-growing, with the change of trends toward sustainability combined with advancements in the production processes.

By Application:

The market is segmented into polyester fibers, polyethylene terephthalate (PET), antifreeze & coolants, chemical intermediates, and others.

Trends in the Application:

- Ethylene glycol is used as a raw material in the manufacture of surfactants and emulsifiers, particularly in personal care and cleaning products.

The polyester fibers sector accounted for the largest revenue share in 2023.

- Polyester fibers are in huge demand in the textile sector owing to their strength, resistance to stretching and shrinkage, and quick-drying properties.

- Due to their versatile chemical and physical properties, these fibers, produced are used to manufacture apparel, home textiles, and industrial textiles.

- With increased disposable income, the heightening in consumer spending on fashion has accelerated the polyester fibers growing need across the world.

- For instance, Eastman offers EG-Polyester Grade of utmost purity. It is used in the manufacture of polyester fibers and PET resins, which in turn are used in water bottles, textiles, and carpet fibers. It possesses specific properties, including good solvent properties, high boiling point, moderate viscosity, and noncorrosive nature, which make the product suitable for uses such as heat transfer fluids, antifreeze, and conditioning agents.

- Thereby, the growing need for this compound in the manufacturing of polyester fibers drives the global ethylene glycol market.

The antifreeze & coolants sector is anticipated to register the fastest CAGR during the forecast period.

- Antifreeze & coolants are mainly comprised of ethane 1,2 diol, possessing excellent thermal properties such as low freezing and high boiling points, hence, they are very suitable to retain the temperature of the engine.

- Such formulations have applications in the automotive and industrial fields, as they prevent the freezing of engines in cold countries and overheating in warm conditions.

- The electric vehicles are dependent on improved antifreeze/coolants that can maintain optimum thermal characteristics of the battery toward their effective performance.

- For instance, Chemtex manufactures glycol-based engine coolant antifreeze liquid, designed as an alternative to water-based coolants. These coolants, including Tropical Car Coolant and Extended Life Coolant (ELC), are inhibited with anti-corrosion, anti-scaling, and anti-microbial properties. They protect engines from extreme temperatures, prevent cracking, reduce pressure buildup, and avoid radiator contamination and blockage, ensuring optimal engine performance and longevity.

- Hence, the antifreeze and coolants segment will accelerate ethylene glycol market expansion due to the dynamic progress witnessed in the automotive industries.

By End Use Industry:

The market is segmented into textile, automotive, packaging, construction, healthcare, and others.

Trends in the End Use Industry:

- Bio-based EG is increasingly being used to produce bio-PET, which finds its applications in new eco-friendly packaging materials.

The textile sector contributed the highest revenue share in the year 2023.

- The main application of ethylene glycol is in the textile sector, primarily for making polyester, which is a chemical-resistant, strong, and versatile synthetic fabric.

- This compound has wide applications in the fashion and home textile sector, as well as industrially in geotextiles and car upholstery.

- The sector of fast fashion is marked by an insatiable consumer appetite for cheap and fashionable clothes.

- For instance, MTROYAL COMPANY produces MEG, primarily used as a raw material in the production of polyester fibers used in the textile sector. MEG is crucial for manufacturing fabrics, clothing, and various packaging materials, making it a key component in the global textile markets.

- According to the analysis, the various applications of the compound in the textile sector are at the forefront of the ethylene glycol market.

The automotive sector is anticipated to exhibit the fastest growth in CAGR during the forecast period

- The automotive sector requires ethylene glycol to provide efficient cooling and lubrication for modern engines, which are required to be more efficient and perform better.

- The chemical nature of this compound maintains a uniform temperature and prevents corrosion, which makes it important in automotive cooling systems.

- Better fuel efficiency, along with increased regulation of emissions, has also given a boost to such formulations because these help bring down the temperature of the engine and reduce fuel consumption.

- For instance, EQUATE produces premium-quality MEG and DEG. This petrochemical product is essential in automotive applications, particularly in the manufacturing of antifreeze and coolant.

- Hence, the ethylene glycol market opportunities are very likely to be witnessed in the automotive sector due to the rising penetration of EVs, and advanced engine technologies.

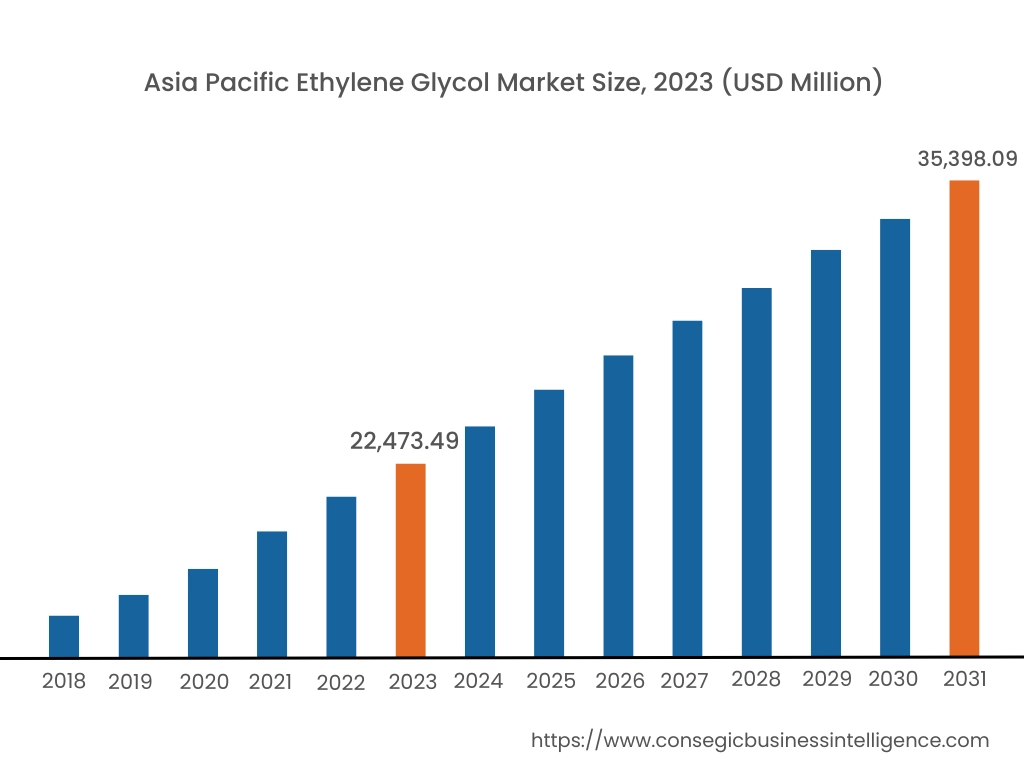

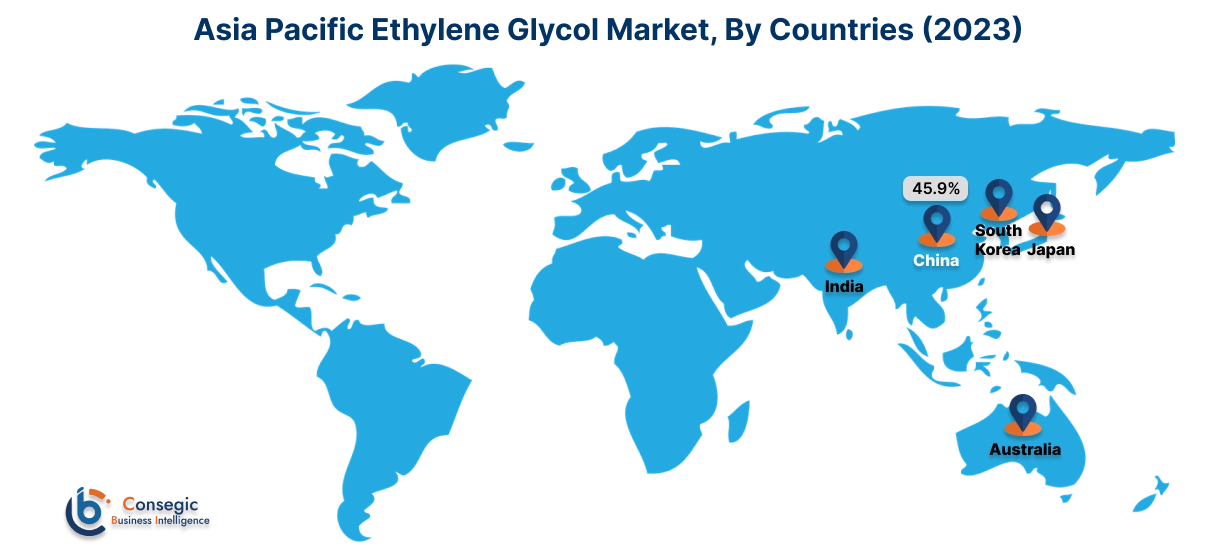

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 22,473.49 Million in 2023. Moreover, it is projected to grow by USD 23,356.49 Million in 2024 and reach over USD 35,398.09 Million by 2031. Out of this, China accounted for the maximum revenue share of 45.9%. This is due to the fast-growing automotive industries in major developing markets like China and India. The increased production of vehicles and growing demand for antifreeze and coolant applications are also some of the contributing factors. Besides, rapid urbanization and industrialization in the region drive the usage of the compound in various industries.

- For instance, BASF and SINOPEC celebrated the inauguration of a new, expanded chemical plant at the BASF-YPC Verbund site in Nanjing in November 2023. With this operation, the supply capacity is being increased with the joint effort between the two companies due to rising demand in China, leading to the ethylene glycol market expansion.

North America is estimated to reach over USD 13,956.50 Million by 2031 from a value of USD 9,194.93 Million in 2023 and is projected to grow by USD 9,526.45 Million in 2024. This could be attributed to this region's strong automotive and industrial sectors, which are considered key end-users for the product. Surging demand for antifreeze and coolant applications in vehicles and increased industrial production give further thrust to market growth.

Besides, manufacturers have been developing new technologies that push for increased efficiency and greener production processes.

- In May 2023, Dow and New Energy Blue, announced a collaboration to produce renewable EG from corn residue. This partnership in North America involves New Energy Blue creating bio-based ethylene from agricultural waste, which Dow will use to manufacture renewable plastics.

The European market is driven by the region's prevalence of sustainable and energy-efficient technologies. Antifreeze and de-icing applications of this compound are gaining usage in the automotive and construction industries, respectively.

As per the ethylene glycol market analysis, the key driving factor in the Middle East and Africa is the growing industrial sector of the region that immensely needs the use of this compound in its manufacturing processes. Increasing investments in petrochemical infrastructures and expansion of industrial activities become some major growth contributors.

In Latin America, the developing automobile and industrial sectors are the primary causes of market growth. The growing automotive sector and increasing applications of this compound in antifreeze and coolants have grown the market in the region.

Top Key Players & Market Share Insights:

The ethylene glycol market is highly competitive with major players providing it to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the ethylene glycol market. Key players in the ethylene glycol industry include -

- Akzo Nobel N.V. (Netherland)

- Ashland (U.S)

- China Petrochemical Corporation (China)

- Dow (U.S)

- Formosa Plastics Group (Taiwan)

- Reliance Industries Limited (India)

- BASF (Germany)

- Huntsman International LLC (U.S)

- INEOS (UK)

- LOTTE Chemical Corporation (South Korea)

- LyondellBasell Industries Holdings B.V. (UK)

Recent Industry Developments :

Clinical Trials and Research:

- In October 2023, researchers Mee Kee Wong and colleagues reviewed the recent development in the synthesis of bio-based EG from renewable feedstock. It was observed that a bimetallic catalyst (W-Ni) gives a yield of up to 89% EG.

Mergers & Acquisitions:

- In December 2023, INOS acquired the Ethylene Oxide and Derivatives business from LyondellBasell for USD700 Million. This acquisition leads to the extension of its business to the US, adding to the pre-existing Ethanolamines facility in Louisiana.

- In May 2024, Loop Industries, Inc. and Ester Industries Ltd. announced a joint venture for a manufacturing facility in India focused on sustainable polymer production. The partnership brings together the expertise of Loop in producing recycled PET plastic and polyester fiber through its Infinite Loop™ technology with its experience in polymer production at Ester. The new facility will manufacture recycled MEG and recycled dimethyl terephthalate(rDMT), significantly lowering carbon emissions.

- In December 2023, SABIC collaborates with Scientific Design (SD) and Linde Engineering to achieve sustainable Ethylene Oxide and Glycol production and lower carbon footprint.

- In February 2023, UPM's Biochemicals and HAERTOL Chemie announced their partnership to develop carbon-neutral engines and battery coolants from renewable Bio-MEG. The collaboration aims to substantially reduce the CO2 footprint of electric vehicles and drive the replacement of fossil-based raw materials with sustainable alternatives in transport.

Ethylene Glycol Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 67,130.84 Million |

| CAGR (2024-2031) | 5.4% |

| By Product Type |

|

| By Application |

|

| By End Use Industry |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Ethylene Glycol Market? +

Ethylene Glycol Market size is estimated to reach over USD 67,130.84 Million by 2031 from a value of USD 43,917.84 Million in 2023 and is projected to grow by USD 45,527.86 Million in 2024, growing at a CAGR of 5.4% from 2024 to 2031.

What specific segmentation details are covered in the ethylene glycol market report? +

The ethylene glycol market report includes specific segmentation details for product type, application, end-use industry, and region.

Which is the fastest segment anticipated to impact the market growth? +

In the treatment type segment, Bio-Based Ethylene Glycols are the fastest-growing segment during the forecast period due to technological advancements and the move toward sustainability.

Who are the major players in the ethylene glycol market? +

The key participants in the ethylene glycol market are Akzo Nobel N.V. (Netherlands), Ashland (U.S.), BASF (Germany), China Petrochemical Corporation (China), Dow (U.S.), Formosa Plastics Group (Taiwan), Huntsman International LLC (U.S.), INEOS (UK), LOTTE Chemical Corporation (South Korea), LyondellBasell Industries Holdings B.V. (UK), Reliance Industries Limited (India).