Liquid Packaging Carton Market Size :

Consegic Business Intelligence analyzes that the liquid packaging carton market size is growing with a CAGR of 5.1% during the forecast period (2025-2032), and the market is projected to be valued at USD 32,039.51 million by 2032 and USD 22,295.46 million in 2025 from USD 21,587.77 million in 2024.

Liquid Packaging Carton Market Scope & Overview :

Liquid packaging cartons, also known as beverage cartons, are specialized containers designed for the efficient transportation and storage of liquid food products. They are typically made from a combination of paperboard, aluminum, and plastic, and are coated with a thin layer of polyethylene to prevent leakage. Also, the cartons have recyclability and eco-friendly attributes. As per the analysis, the key players in the market are focusing more on customized and attractive packaging to create major trends in the market. Furthermore, these cartons are lightweight and very economical. Moreover, the cartons are used mainly to package beverages and dairy goods for providing convenience, preservation, damage protection, and others. These cartons are ideal for transporting liquid food items such as juices, soft drinks, and others as they protect the liquid items from contamination and other hazards. Thus, these factors are creating trends for the growth of the market.

Liquid Packaging Carton Market Insights :

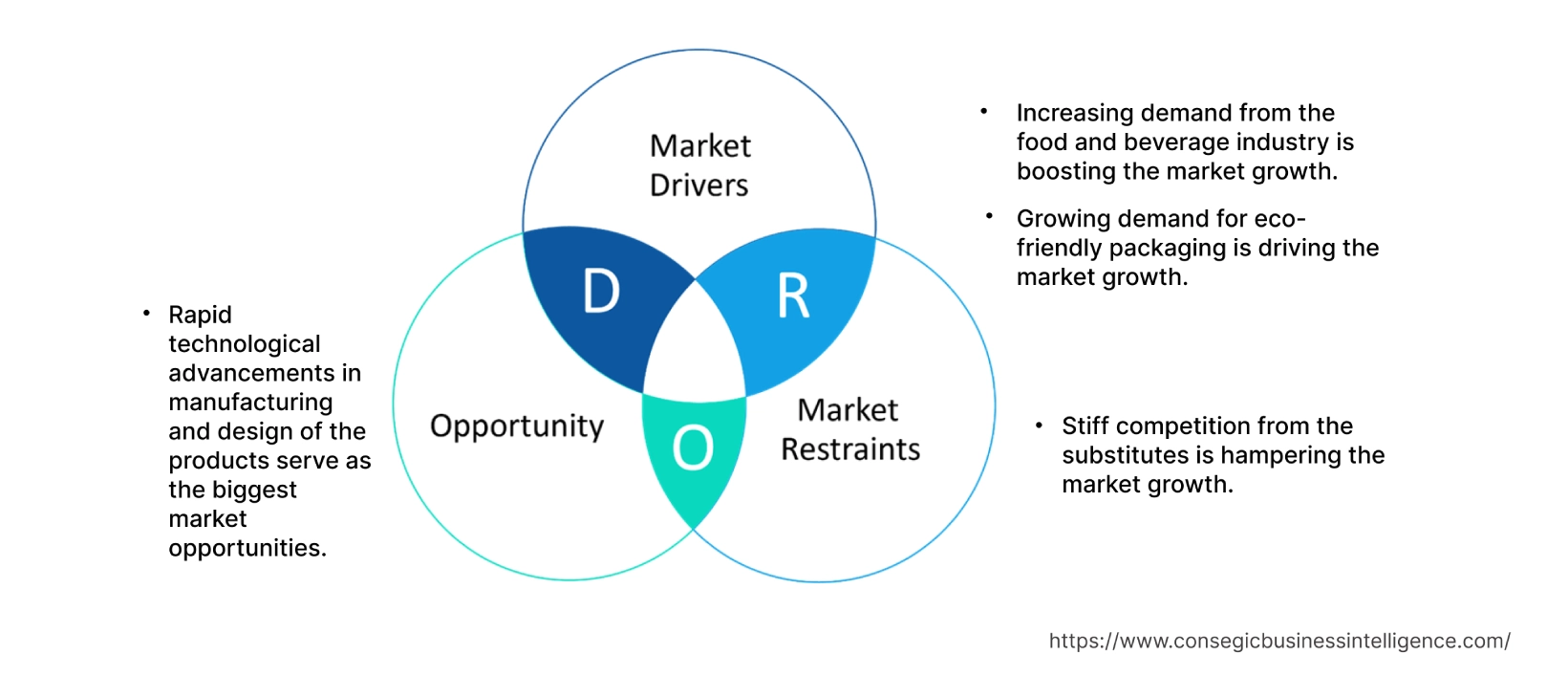

Liquid Packaging Carton Market Dynamics - (DRO) :

Key Driver :

Increasing demand from the food and beverage sector is boosting the market expansion.

Liquid packaging cartons are largely utilized in the food and beverage sector for different purposes such as storage of liquid food items, conservation of the goods, and safe transport of the items. Also, based on the analysis, owing to increasing awareness regarding healthy lifestyles and consumer preference for protein shakes, fruit juices, dietary supplements, and others, the market is witnessing significant trends. Moreover, the cartons are largely demanded as they protect the liquid items from any form of contamination and other hazards. Furthermore, the increasing food and beverage sector globally is leading to the growing usage of these packaging cartons. For instance, according to a recent report by Invest India, in 2023, India's food processing sector is one of the largest in the world and its output is expected to reach around USD 535 billion by 2025-26. The report also mentions, that in the year 2021-22, the milk production in India has registered an annual expansion rate of 5.29%. Hence, due to the increasing food and beverage sector globally, there is an increase in the trends of the market.

Growing demand for eco-friendly packaging is driving the market expansion.

Liquid packaging cartons have eco-friendly packaging and a recyclable nature. There is a large requirement for sustainable products from consumers due to increasing awareness of the environmental impacts, which is driving the market further. Also, different eco-friendly packaging solutions by the key players in the market are driving the expansion of the market. For instance, Elopak, a Norwegian company producing cartons for liquids, provides these cartons that are environmentally friendly and 100% renewable. Also, different government initiatives for sustainable development are driving the market of packaging cartons for liquids. For instance, according to the Press Information Bureau of the Government of India in 2019, India has different policy initiatives for sustainable development such as the Swachh Bharat mission, Beti Bacho Beti Padhao, Pradhan Mantri AwasYojana, Smart Cities, Pradhan Mantri Jan Dhan Yojana, Deen Dayal Upadhyay Gram Jyoti Yojana, and others. Hence as per the analysis, increasing awareness and requirement for eco-friendly products is driving the liquid packaging carton market growth.

Key Restraint :

Stiff competition from the substitutes is hampering the market.

The growing usage of substitute goods such as glass and plastic is hampering the trends of the liquid packaging carton market. Glass bottles and flexible plastic pouches are used widely across the globe for the packaging of different liquids such as milk and other liquid items. Also, based on the analysis, the use of glass bottles for packaging organic juices and alcoholic drinks has been hampering the requirement for these cartons. Furthermore, plastic is ideal for corrosion resistance, is lightweight, and offers easy and hassle-free transportation. Hence, the wide availability and requirement of substitutes owing to their specific advantages is hampering the liquid packaging carton market demand.

Future Opportunities :

Rapid technological advancements in manufacturing and design of the products serve as the biggest liquid packaging carton market opportunities.

Different technological advancements in liquid packaging carton products such as design aesthetics, enhanced functionality, and others have been serving as the biggest opportunities for the liquid packaging carton market trends. Also, product development in cartons that offer extended shelf life, provide superior protection, better containment of the products, and others are driving the liquid packaging carton market opportunities. Furthermore, based on the analysis, different printing technologies providing high-quality graphics in the product designs have been improving the appeal of the product. Hence, due to the aforementioned factors, the wide technological advancement in these carton designs will boost the liquid packaging carton market trends in the forecast period.

Global Liquid Packaging Carton Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 202 | USD 32,039.51 Million |

| CAGR (2025-2032) | 5.1% |

| By Material Type | Uncoated Paperboard, LDPE Coated, Aluminum, and Others |

| By Carton Type | Brick Liquid Cartons, Shaped Liquid Cartons, and Gable Top Cartons |

| By Application | Dairy Products, Non-Carbonated Soft Drinks, Alcoholic Drinks, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Elopak AS, Nippon Paper Industries Co., Ltd, Greatview Aseptic Packaging, Refresco Group B.V., Evergreen Packaging LLC, Mondi plc, Adam Pack S.A, WestRock Company, Stora Enso, and Atlas Packaging |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Liquid Packaging Carton Market Segmental Analysis :

By Material Type :

The material type segment is categorized into uncoated paperboard, LDPE coated, aluminum, and others. In 2024, the uncoated paperboard segment accounted for the highest market share of the liquid packaging carton market share and is expected to grow at the fastest CAGR over the forecast period in the liquid packaging carton market. The uncoated paperboard cartons are widely popular and in trend due to the sustainable and recyclable attributes of the product. As per the analysis, the uncoated paperboard material is largely incorporated for packaging in the food and beverage industry. Furthermore, the product is ideal for custom packaging. The material is thick and sturdy and provides strength in packaging and thus is required for various applications. Also, increasing pollution levels globally have led to the need for eco-friendly and sustainable products, driving the requirement for uncoated paperboard cartons.

By Carton Type :

The carton type segment is categorized into brick liquid cartons, shaped liquid cartons, and gable top cartons. In 2024, the brick liquid cartons segment accounted for the highest market share and is expected to grow at the fastest CAGR over the forecast period in the liquid packaging carton market. The brick liquid cartons are known for being easy to handle and hassle-free transportation. They are largely preferred by retailers for a reduction in logistical costs. Also, the rectangular shape of the cartons allows for optimal usage of storage space, efficient stacking, and others. Hence, owing to the advantages of the brick liquid cartons, the product is being utilized largely for the packaging of milk, juices, and other liquid meals. Due to other benefits of the product such as the increase in the product's shell life and protection against the outside environment, brick liquid cartons are widely utilized for liquid packaging purposes. Also, the cost-effectiveness of the product is acting as a catalyst for the expansion of the brick liquid cartons. Thus, as per the segmental trends analysis this is due to the aforementioned factors, the brick liquid cartons segment is witnessing significant in liquid packaging carton market demand.

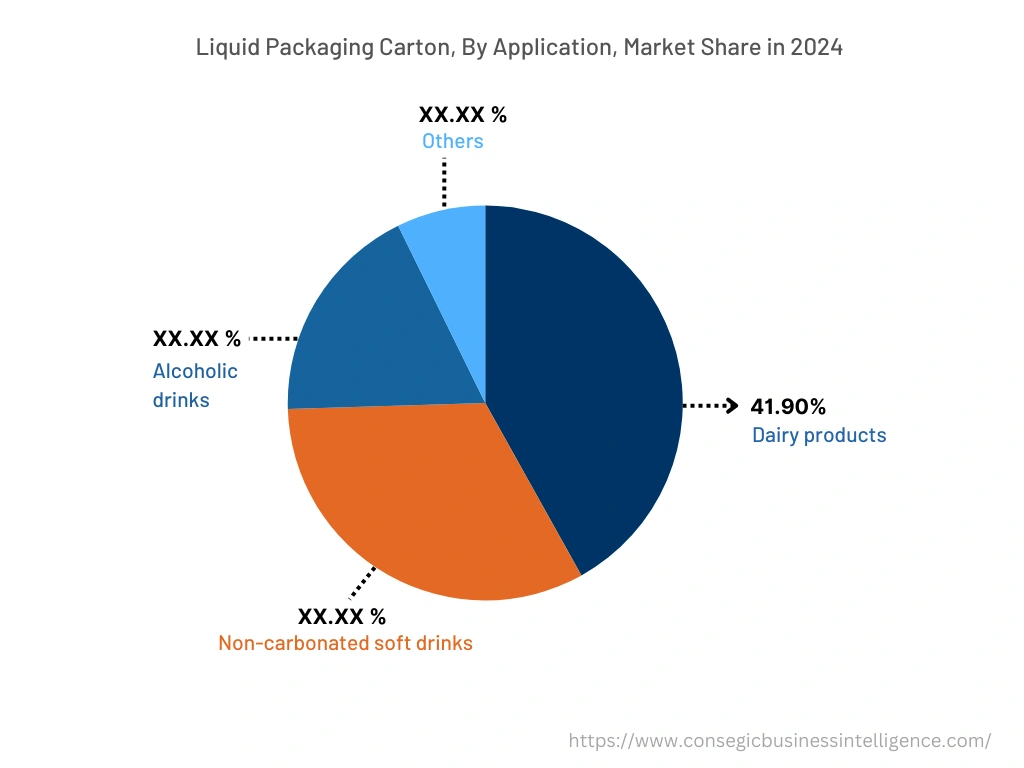

By Application :

The application segment is categorized into dairy products, non-carbonated soft drinks, alcoholic drinks, and others. In 2024, the dairy products segment accounted for the highest liquid packaging carton market share of 41.90%. Dairy products have wide utilization by consumers due to the health benefits of the product such as prevention of diabetes, enhancement of bone health, and others. The packaging cartons are ideal for preserving milk as they ensure a low risk of contamination and longer shell life. Also, the increasing dairy beverage industry is leading to the growing requirement for these cartons. For instance, according to the report by the Ministry of Fisheries, Animal Husbandry & Dairying, in 2022 milk production is growing at a rate of two percent in the whole world, whereas in India, its growth rate is more than six percent every year. Hence, the increasing dairy industry is leading to growing requirements for cartons. Thus, due to the aforementioned factors, dairy products are witnessing liquid packaging carton market growth.

Moreover, the non-carbonated soft drinks segment is expected to grow at the fastest CAGR over the forecast period in the liquid packaging carton market. Increasing need for nutritious beverages such as fruit juices, protein shakes, and others owing to growing health awareness and changing consumer behavior for healthy beverages are driving the segment growth. These packaging cartons are widely utilized in the packaging of non-carbonated soft drinks as they maintain the freshness of the liquid items and prevent any sort of contamination.

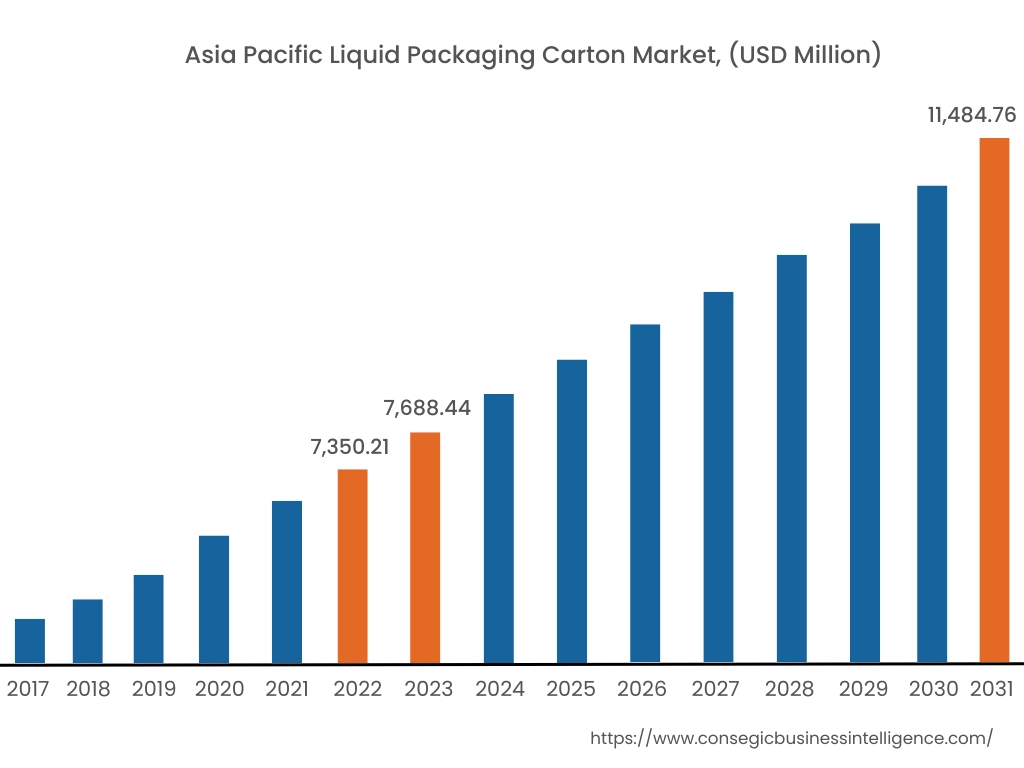

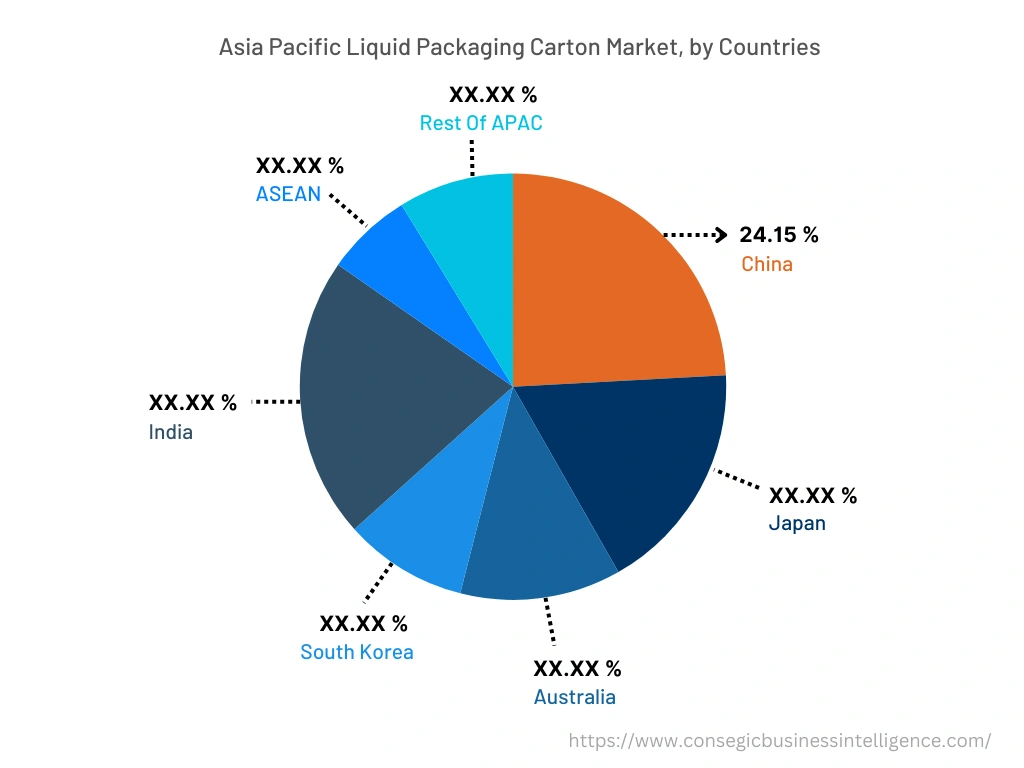

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, Asia Pacific accounted for the highest market share at 36.55%, valued at USD 6,357.78 million in 2024 and USD 6,584.76 million in 2025, it is expected to reach USD 9,756.03 million in 2032. In Asia Pacific, China accounted for the highest market share of 24.15% during the base year 2024. As per the liquid packaging carton market analysis, this is due to the leading beverage business in the region coupled with the high usage of packaged beverages such as soft drinks, dairy products, juices, and others in Asia Pacific. Also, favorable government initiatives for the reduction of carbon footprints and the development of sustainable packaging have been boosting the requirement in the region. For instance, according to a report by Invest India in 2022, different initiatives by the Indian Government such as Sanatan Bharat (Sustainable India), Swacch Bharat Mission (Clean India), Ayushmaan Bharat (Universal Health Coverage) and others have been showcasing execution of the broader sustainability agenda. Hence increasing awareness of sustainable goals and increasing government initiatives promoting a clean environment have been driving this market in the region.

Moreover, , North America is expected to witness significant growth over the forecast period, growing at a CAGR of 4.80% during 2025-2032. Based on the liquid packaging carton market analysis, increasing requirements for ready-to-transport and convenient goods and growing healthy lifestyle preferences have been driving major demand for liquid packaging cartons in the region. Also, different technological advancements in the packaging sector by the key players of the market in the region have been acting as catalysts for the growth of the product in the region. Hence, due to the aforementioned factors, the liquid packaging carton market is growing significantly in North America.

Top Key Players & Market Share Insights:

The global liquid packaging carton market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The liquid packaging carton industry is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market stake through mergers, acquisitions, and partnerships. The key players in the market include-

- Elopak AS

- Nippon Paper Industries Co., Ltd

- WestRock Company

- Stora Enso

- Atlas Packaging

- Greatview Aseptic Packaging

- Refresco Group B.V.

- Evergreen Packaging LLC

- Mondi plc

- Adam Pack S.A

Recent Industry Developments :

- In April 2022, Elopak, one of the leading global suppliers of carton packaging and filling equipment, and GLS entered into a long-term strategic partnership to deliver sustainable packaging solutions to consumers across India. The joint venture aligns with Elopak's ambitions to expand geographically and meet the rising demand for sustainable packaging solutions.

- In June 2022, Nippon Paper Industries Co., Ltd. established a new local subsidiary in Australia to strengthen its liquid packaging carton business. The company is looking to transition toward sustainable packaging solutions and facilitate global business expansion.

Key Questions Answered in the Report

What was the market size of the liquid packaging carton industry in 2024? +

In 2024, the market size of liquid packaging carton was USD 21,587.77 million.

What will be the potential market valuation for the liquid packaging carton industry by 2032? +

In 2032, the market size of liquid packaging carton will be expected to reach USD 32,039.51 million.

What are the key factors driving the growth of the liquid packaging carton market? +

Increasing demand from the food and beverage industry is fueling market growth at the global level.

What is the dominating segment in the liquid packaging carton market by application? +

In 2024, the dairy products segment accounted for the highest market share of 41.90% in the overall liquid packaging carton market.

Based on current market trends and future predictions, which geographical region is the dominating region in the liquid packaging carton market? +

Asia Pacific accounted for the highest market share in the overall liquid packaging carton market.